El-Erian at the Fed?

The Wall Street Journal has a new piece discussing rumors that Mohamed El-Erian might be chosen for the position of vice chair of the Board of Governors:

In recent years, Mr. El-Erian has voiced somewhat hawkish critiques of the Fed’s policy stance, including decisions to hold interest rates at ultralow levels despite signaling plans to raise them. In recent months, he has suggested that the Fed’s inflation target of 2% might be too high given structural forces holding down consumer prices.

A few comments:

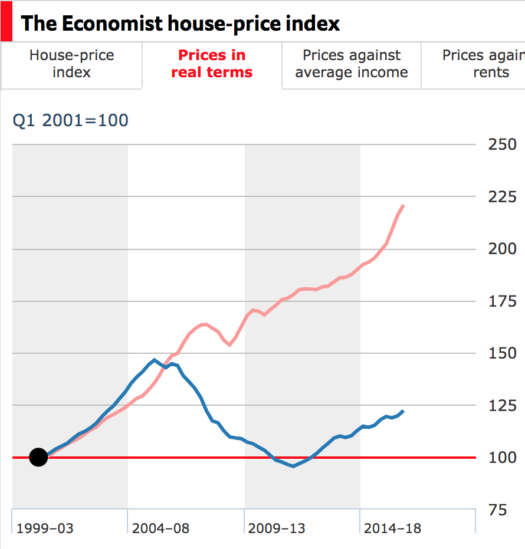

1. We now know that those who offered hawkish critiques of Fed policy a few years ago were wrong. Inflation has continued to undershoot the Fed’s target.

2. When “structural forces” hold down inflation, they do so by boosting RGDP growth. There is no other way by which structural forces can hold down (GDP deflator) inflation. None. RGDP growth has actually been at unusually low levels over the past decade. Thus we now know that structural forces are not holding down inflation. It was slow NGDP growth. Those who think otherwise are confusing microeconomic factors (Amazon, China, etc.) with macroeconomic factors. Yes, Amazon and China hold down specific prices, but only by boosting GDP growth. And this mistake cannot be excused by pointing to mismeasurement of inflation. Maybe tech is causing actual inflation to be lower than measured inflation, but the puzzle being discussed is why measured inflation is so low.

Confusion over these sorts of basic macro issues is exactly why we need to appoint world class experts on monetary economics to the Fed. People like El-Erian tend to assume that a tighter monetary policy would allow the Fed to have a higher path of interest rates going forward. In truth a tighter monetary policy would result in slower growth and a lower path of the natural rate of interest over time. (See Trichet, ECB.) If the Fed didn’t realize this and persevered with their plan to raise rates, they would create a depression. I’m not predicting a depression because I don’t expect the Fed to do this, just pointing to the logical consequence of this sort of mistaken reasoning.

Higher interest rates should not be a goal of monetary policy, but if it is a goal then you get there by making monetary policy more expansionary, and boosting the trend rate of NGDP growth.

PS. I have a cameo role in a new MRU video.

PPS. I was interviewed for this piece in the Commercial Observer.

HT: Patrick Horan, Vaidas Urba