Stable NGDP growth is a public good

We (almost) all benefit from low and stable NGDP growth. But at an individual level we have no incentive to behave in such a way as to produce low and stable NGDP growth. It’s a public good.

Tyler Cowen recently pointed out (correctly) that if we hold the money supply constant, the private sector could manufacture more NGDP growth by acting in such a way as to boost velocity. That’s true. Whether it would actually work depends on how the Fed responds to a rise in velocity. That’s much more debatable, but I’m willing to entertain Tyler’s claim that we are in a place right now where expected NGDP growth is a bit less than the Fed would prefer. (Obviously if true that would also imply a role for fiscal stimulus.)

But I’d like to put aside the monetary offset issue and focus on the public good problem. It’s also true that it’s theoretically possible for everyone in the world to behave as if they are utilitarians, which (if they believe in global warming) would lead them to pretend that there is a carbon tax in effect, and base their consumption and production decisions on that assumption. We typically assume that people are not that altruistic, which is why most economists favor a carbon tax. (I am pretty sure that Tyler does as well.) If we have a NGDP problem, the private sector could solve it by manufacturing more NGDP. But they’d have no incentive to do so.

Clearly Tyler is aware of this public good problem, so he might be thinking about non-monetary policies that would encourage faster velocity, overcoming the public good problem. The easiest way to solve the NGDP public good problem is to print more money (or even better, have the Fed boost V by setting a higher NGDP target.) But there are other ways. You could do fiscal stimulus. You could replace the corporate income tax with a higher payroll tax on upper incomes, which would encourage more investment and boost V. You could reduce burdensome regulations.

But these other ways of boosting (or “manufacturing”) NGDP are completely unrelated to the sticky-wage issue. Perhaps I misread Tyler, but he seems to suggest that even if we need more NGDP, we might be better off thinking in terms of a lack of privately manufactured NGDP, not tight money. But if (as Tyler seems to suggest) wage stickiness is not the problem right now, then having more NGDP wouldn’t help at all. Rather we’d need supply-side policies that boosted RGDP, for any given level of NGDP. So I find a puzzling “mixed message” in a post that talks about how the private sector can manufacture NGDP, and also expresses skepticism about the sticky-wage problem.

I may well have misread Tyler’s argument, so let me suggest how I would have re-framed the argument I think he was making:

1. Suppose that the economy was subject to real shocks.

2. Suppose nominal shocks had no real effects.

3. Suppose the Fed successfully targeted inflation at 2%.

In that case movements in NGDP and RGDP would be perfectly correlated, even though there was no causal relation running from NGDP to RGDP. NGDP shocks would not be as important as they seem, and sticky wages would not be the problem.

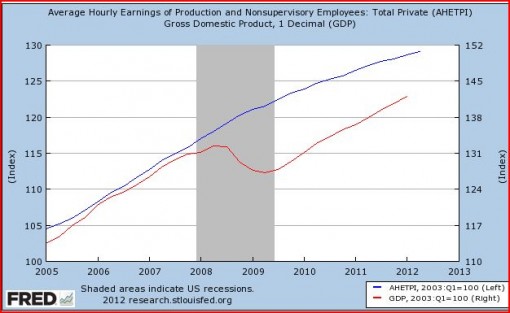

For quite some time I’ve suspected that my success in promoting NGDP targeting was partly undeserved. The famous L-shaped NGDP graph for the last 10 years is a very powerful visual persuader. Maybe too powerful. So you might ask why I believe NGDP is so important, given that assumptions 1 through 3 make the hypothesis highly questionable. Here’s why:

1. During periods when the Fed wasn’t targeting inflation, we had lots of natural experiments with wild and crazy monetary shocks. They seemed to have real effects.

2. I put a lot of weight on the stylized fact that wages and prices are sticky, which means nominal shocks should have real effects (on theoretical grounds.)

3. Asset markets behave in a way that seems consistent with the view that investors currently believe the real problem is (partly) nominal. Equity investors presumably favor monetary stimulus right now because they (correctly) believe that wages are pretty sticky right now.

Tyler agrees with me on some of this, which is why he’s argued in the past that while monetary stimulus is not a panacea, it’s worth shooting for at least a bit higher NGDP growth. We differ on the relative importance of real and nominal factors, and how long it takes for wages to adjust.

PS. The private sector can also “manufacture” lower NGDP, if the Fed is passive. For instance if the Fed had been passive (in terms of the monetary base) after the Soviet bloc broke up, then it’s very possible that the hoarding of dollars in that region would have led to a Great Depression in the US, comparable to the 1930s.

PPS. I agree with David Beckworth and George Selgin that NGDP is a 100% nominal variable. NGDP is “the real thing,” whereas P and Y are simply data points pulled out of the air by Washington bureaucrats. There’s no good theory to back up their efforts, as it’s not even clear what “inflation” is supposed to measure. (Suppose a $25,000 2012 Camry is just as good as a $25,000 Rolls-Royce sold in 1948. Does that mean there has been no nominal increase in car prices since 1948? What does “car price inflation” mean?) Tyler may have had in mind something like my example where despite the fact that NGDP and RGDP are highly correlated, there is no causal relationship.

PPPS. Commenters sometimes tell me that real world businessmen don’t care about NGDP. In fact they care a lot. I’m sure GM execs often sit around a table discussing how “the economy” will be next year, which actually means “how much consumers in aggregate will spend (in nominal terms) on cars next year.” The execs already know pretty much what it will cost to manufacture cars next year, even in nominal terms. So expected nominal spending on cars in 2013 is extremely important to GM execs when thinking about how much to invest in expanding their facilities. Undoubtedly they break the forecasts down into unit sales and average prices, but both of those variables are very important to them.