You might wonder how I can sleep at night knowing my policy proposal, if enacted, might simply lead to higher inflation, without creating any jobs at all. My answer is very simple. Even if I knew that dismal outcome would occur, I’d still favor monetary stimulus. I believe steady growth in NGDP is optimal, even if fluctuations in NGDP don’t affect employment. But let me explain my reasoning using the more familiar inflation targeting criteria.

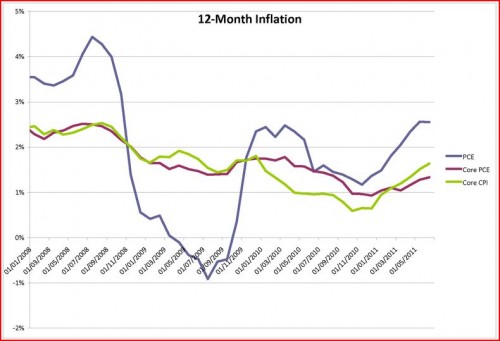

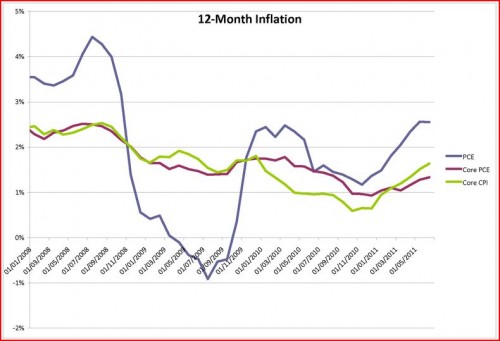

As you know, the Fed has a dual mandate, stable prices and high employment. They’ve generally assumed that stable prices mean roughly 2% core inflation, for complicated reasons. And core inflation has been around 2% during recent decades. If you favor inflation targeting, you’d like it to stay at that level, as inflation instability can cause problems for the economy. So how’s the Fed doing? Here’s a graph I found at Stephen Gordon’s web site:

So both measures of core inflation have run below 2% since the end of 2008. I also tried to estimate inflation expectations from the TIPS market, which isn’t easy. I found a TIPS yielding negative 1.05%, due January 2014. Regular T-notes due at that time yield about 0.25%. So 1.3% seems a ballpark estimate of inflation over the next 2 and 1/2 years.

This, or course, would be what you’d expect if the Fed’s dual mandate were stable prices and high unemployment, not high employment. If the Fed didn’t care a bit about the suffering of the unemployed, and was a strict inflation targeter, we’d have 2% inflation. Instead we are in the middle of five years of sub-2% inflation. Why is that? One theory is the Fed is sadistic. It’s willing to miss its inflation target on the low side if it can inflict suffering on the unemployed. I admit it’s acting as if this were true, but we all know it’s not true. Another theory is that the Fed is helping the bankers. But as we saw in recent weeks, slower NGDP growth hurts the banks too. My theory is that this big, highly sophisticated institution employing many of the brightest monetary economists on the planet, made a big boo boo. Needless to say I’m the only one who believes this theory.

But whatever your views, the Fed is in a position where if it does more monetary stimulus in an attempt to speed the recovery, and totally fails to create a single new job, the policy will still be smashing success. It will still move core inflation closer to its 2% target.

And that, my friends, is why I can sleep comfortably at night. I am proposing a policy that literally cannot fail.

When there are $100 bills on the sidewalk, they should be picked up. And when printing $100 bills (for 5 cents) and injecting them into the economy might create lots of jobs, and will not increase the national debt, and might reduce the budget deficit, and will definitely move us closer to the Fed’s definition of price stability, why would we not want to print those $100 bills? Are we a bunch of masochists?