How the Fed could simplify my life

The following suggestions are meant half-humorously and half-seriously. Some would make no substantive difference in policy; some would make only a slight substantive difference. But all would greatly simplify Monetary Economics–the course I usually teach:

1. Get rid of member bank deposits at the Fed. Make the monetary base 100% currency (including coins.)

2. Get rid of reserve requirements.

3. Get rid of the discount window.

4. Get rid of interest on reserves.

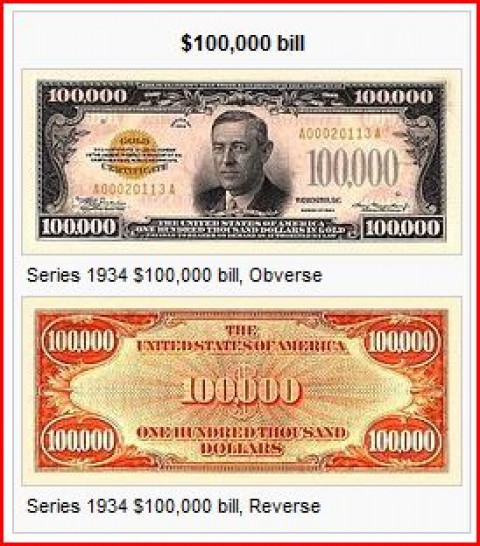

Now monetary policy will consist entirely of open market operations for cash. For that purpose, bring back the old high denomination currency, which used to be used for bank reserves:

First let’s consider normal times, when interest rates are positive. In normal times the base is about 95% currency, and open market operations completely dominate discount loans. Without reserve requirements the monetary base would have been 98% currency, or more. In any case, reserve requirements are rarely used as a tool of monetary policy, and the Fed got by just fine without IOR for nearly 100 years. Indeed the usual argument for IOR is that it offsets the efficiency loss caused by reserve requirements. But I plan to get rid of reserve requirements. Some countries have already done that.

Now for some possible objections:

1. Interbank transfers are done most efficiently via transfers between member bank deposits at the Fed. OK, but the Fed could keep safety deposit boxes for all the big banks, and small banks could have accounts at the largest banks. The balances would be adjusted by moving large denomination bills between various safety deposit boxes at the Fed.

[Let me point out parenthetically that this part of the plan might sound slightly insane, but in fact we used to do things roughly that way, and my real point is that nothing of importance would change. In December 2001 (according to Mishkin’s text) the Fed’s balance sheet was: Securities = $534.0 billion, Discount loans = $0.1 billion, currency = $580 billion, and member bank deposits = $24.9 billion. That means the plan I propose is actually not that different in substance from actual Fed policy circa 2001.]

2. Reserve requirements are needed to prevent bank runs, the 1930s prove that. No, we already had reserve requirements during the 1930s, that wasn’t the problem. Indeed in those days banks held way more reserves than required. If you are worried about bank safety, you should be looking at capital requirements, not reserve requirements.

3. Without reserve requirements the money multiplier would be infinite. No, it would be (C/D + 1)/(C/D + ER/D), which is far from infinite. Indeed it would be roughly what the multiplier was in 2001, little would change.

4. The discount window is needed for emergencies. No, financial crises need to be divided up into two components; falling NGDP and illiquidity. The Fed should address any NGDP and aggregate liquidity issues through OMPs, along with NGDP level targeting. They need to do that with or without discount loans. If NGDP is at trend, and you still have a failing bank, shut it down. If we are at trend NGDP, and you have banks that are solvent, but for some reason the interbank loan market freezes up, then have the Treasury do some sort of TARP program. I’m skeptical that this situation would ever occur, and I’m not sure it’s desirable to have a TARP program. All I’m saying is that bank solvency is not a monetary policy issue, we address it through Treasury bailouts, which is the appropriate way if we are going down that road. Again, with NGDP level targeting, I’d rather just shut down the problem banks, and let bank creditors take some losses.

Now let’s consider monetary policy at the zero bound. My first suggestion is that if the Fed is doing NGDP level targeting, then we probably wouldn’t be at the zero bound. But let’s say I’m wrong. Then there are two possibilities; either NGDP is where the Fed wants it, or it’s too low. If it’s where the Fed wants it, problem solved. If it’s too low, then keep buying T-securities. Come back to me when the entire national debt has been paid off with currency.

OK, some of you die-hard Keynesian are saying “what next?” Let’s say you’ve bought the entire national debt, and NGDP is still too low. There are several possibilities. You could raise the NGDP target path from 5% to 7%, if you really think this glut of currency is a big problem. Or, you can buy other assets, such as foreign government bonds. If you want to assume the problem is global, then I’d suggest buying the least distortionary assets, first GSE bonds, then relatively safe corporate index bond funds, and if necessary index stock funds. The EMH says your losses and gains would balance out over time, just as with T-security purchases. And no, that’s not “really fiscal policy” but go ahead and think so if you wish; a rose by any other . . .

Of course in the real world none of this would ever happen, indeed we would have stopped several stops back. I’m just pointing out some options for completeness. If you want to debate these options in the comment section that’s fine, but I won’t take your comments seriously as it’s not a hypothetical worth wasting time worrying about. We have actual problems in our economy to address.

The point of this exercise isn’t just to make my course easier to teach by making the base equal currency, and reducing the 4 monetary policy tools to one, but also to identify the essence of monetary policy. None of these changes would materially affect monetary policy as it was conducted in America before 2008. It was already 95% described by the simple operation of swapping bonds for cash. The interesting issues in policy aren’t the mechanical ones, but the policy target. We shouldn’t be debating “what the Fed can do” in a technical sense, that’s a completely boring problem. We should be debating where the Fed should be trying to steer the nominal economy, which is the only issue worth thinking about. Currency and NGDP; that’s what it all boils down to.

Banking and the broader aggregates don’t play an important role in the process, as the base is mostly currency and the currency/NGDP ratio isn’t strongly impacted by weird things going on in banking, except when rates are near zero. And with sound policy, they wouldn’t be near zero.

The Fed has a mystique because everyone thinks it controls the financial system. It actually (mostly) supplies currency for tax evasion and drug smuggling. The only non-boring thing about the Fed is that it has a monopoly on the medium of account (currency) and hence drives the nominal economy.

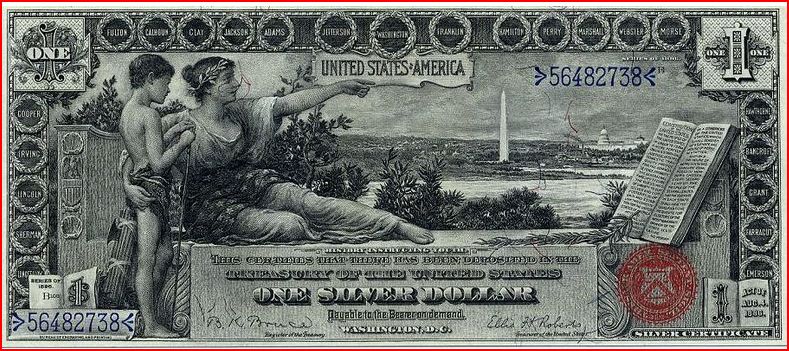

PS. Before the sex-phobic Puritans took over American culture, we used to have beautiful and artistic currency notes (in 1896):

Now I’d be fired for putting these pictures on my office wall.

PS. For some odd reason having to do with my computer, I’ve lost the ability to leave comments at most other blogs (at least non-Canadian blogs.) Here’s a comment I tried to leave at Karl Smith’s blog, in the remote chance anyone is still interested:

Karl, I’m claiming that it’s not even clear whether a forecast of higher interest rates should be regarded as bullish or bearish for the average business. We know that rates are strongly procyclical. I don’t see where you’ve addressed this issue.

I do agree that if one combines low interest commitments with various specified NGDP paths, it could be bullish.

When I try to leave comments it doesn’t appear, even days later. If I try again it says “you’ve already said that.” When I contact the blogger they say my comment isn’t even in the queue. Anyone know what’s wrong?

Tags:

2. March 2012 at 05:53

It might be your browser. Or maybe you were banned. Haha. That happened to me over at DeLong’s blog. I don’t know what I could have said but my posts never go through.

2. March 2012 at 06:17

Benny, No, it occurs at most blogs, even friendly ones.

2. March 2012 at 06:30

The plan would certainly reinvigorate our moribund bank heist movie and con game movie industries.

Also, if you haven’t seen “The Trouble with Trillions,” it’s pretty funny.

http://en.wikipedia.org/wiki/The_Trouble_with_Trillions

2. March 2012 at 06:30

try another browser. if it works there, delete your cache on your regular browser. if it still doesn’t work, delete your cookies.

2. March 2012 at 06:38

absolutely right on reserve requirements, they are antiquated.

i’ve also had an issue on Delong’s blog, comments seem to be eaten. I don’t know why they appear sometimes and not others. I started to think it was censorship but then they magically started to appear again. if clearing your browser cache and deleting cookies does not do the trick, check for stealth popup blockers (on some toolbars) or reset your browser security settings (could be antivirus software too).

2. March 2012 at 07:15

Scott, given that it’s unlikely puritans will change their mind on aesthetics within our lifetimes, what’s the purpose with introducing large denomination bills? Couldn’t you just get rid of the reserve requirement but at the same time let banks keep accounts with the fed for the purpose of transferring money to one another while charging them something like libor-500 for the privilege of parking their money at a risk free account?

2. March 2012 at 07:15

Scott, no objections from me on these proposals. However, you fail to mention George Selgin’s new proposal for Money Market reform. I think George’s ideas make a lot of sense. Furthermore, George have some very valid points regarding the primary dealers system and how that played an important role in the collapse in 2008. Because of the institutional construction the Fed failed to expanded the money base enough and fast enough.

http://marketmonetarist.com/2012/02/05/l-street-selgins-prescription-for-money-market-reform/

Anyway, great to see you getting on board in terms of discussing the institutional set-up at the Fed. It seems to me that the entire way the way Fed is controlling the money base is seriously outdated…

2. March 2012 at 07:17

…and regarding your “missing” comments still no sight of the ones that you left at my blog…and to everybody else – I guess it is pretty clear that my blog is a “friendly one”;-)

2. March 2012 at 07:37

J Mann, Yes, but actually banks wouldn’t hold any more cash in their vaults, and it’s pretty hard to rob the Fed. Still a Fed heist would make a great “Oceans 14” or whatever film is next.

Vincent, Thanks but I just tried my other browser, and no luck.

dwb, I think DeLong does ban some people. He once deleted one of my comments.

orionorbit, Reread my first sentence of the post. You are of course correct, but it would make teaching easier if I could just refer to ‘currency’ which everyone understands, instead of “monetary base” which is a confusing abstraction to most students. KISS.

BTW, no interest would be needed on Fed accounts.

Thanks Lars, That’s a very interesting post on Selgin. I agree about opening up the OMO process to anyone who wants to play.

I’ve been shutout of yours, Hawtreyblog, MR, and lots of other friendly places, so I know it’s not aimed at me. I have some sort of computer bug.

I plan to switch to an iMac this summer–hopefully that helps.

2. March 2012 at 07:55

Krugman is back at it again:

“the Reagan recession was brought on by very high interest rates, and a quick recovery took place when the Fed loosened up, whereas the 2007-2009 slump was a financial crisis that occurred despite low rates, leaving little room for Fed action.”

http://krugman.blogs.nytimes.com/2012/03/02/austerity-american-style/

2. March 2012 at 07:56

I’m surprised none of your Austrian followers have posted this yet:

http://twittface.net/wp-content/uploads/2010/12/zimbabwe_100_trillion_dollar_bill1.jpg

2. March 2012 at 08:02

Of course if Richard Fisher were Fed Chair, we might use these instead:

http://www.blogcdn.com/www.luxist.com/media/2011/01/may-1-1843-25-cent-texas-exchequer-note.jpg

2. March 2012 at 08:16

Scott, go all in on Apple…wonderful product that works;-)

2. March 2012 at 08:31

Scott, thank you for this post, as I had been curious about your views about the relationship between monetary policy and financial crises.

Am I correct in saying that you believe that it’s an NGDP shortfall that’s ultimately responsible for causing market-wide disruption in the financial sector?

When I look at a graph of NGDP and the TED spread (difference between treasury rates and interbank lending rates), it seems to me that serious problems in the financial sector cropped up well before the disastrous late 2008 drop in NGDP. Or would you say that it’s merely the slow growth of NGDP beginning in late 2007 that caused the financial turmoil of that time? Or would you also cite other factors?

In other words, how much regulation do you believe we should impose on the financial system, or do you think stable monetary policy is enough?

2. March 2012 at 08:44

I think DeLong does ban some people. He once deleted one of my comments.

ironic on so many levels. as flattered as i would be that someone took the time to delete my comments, honestly, i think its a technology issue. i have issues with all the typepad-based blogs mostly to do with the way it wants me to log in.

2. March 2012 at 09:00

I disagree totally.

Interest on reserves is a good policy. Just peg it at less than the interest rate on short T-bills. The opportunity cost on holding reserves is equal to that difference and is not impacted by changes in the interest rates on short and safe assets.`

The purpose of interest isn’t to avoid the inefficiency of reserves requirements.

The purpose is to avoid wasteful transactions costs. Zero interest reserves means banks are motivated to hold minimal reserve balances and trade funds overnight or trade T-bill as they develop favorable or adverse clearings.

But, in reality, whatever reserves banks choose to hold allows the clearinghouse to hold interest bearing assets. Keeping the interest rate on reserves at zero is a way to exploit the banks.

The Fed, as clearinghouse, gets a zero interest loan.

If the Fed pays interest on reserves, and keeps the interest rate on those reserves less than the interest rate on T-bills, then it covers its costs, including the liquidty cost of borrowing at a zero term to maturity.

The Fed borrowers from the banks that deposit with it, and then it lends the money out. It earns interst on the loans it makes (to the Treasury) and it pays interest on the reserve balances.

Scott, how much of your thinking is still tied to the old arguments that velocity is stable because interest rates don’t impact the demand for money much? Why hold money when you can own interest bearing securities. So people just hold as little money as they must to fund transactions.

But most money pays interest.

Efficiency requires that it all pay interest.

Basing everything on paper currency is a horrible mistake. Paper currency should be treated like the trivial appendedge to the monetary order that it is.

Make it expensive and beautiful? No, make it like cheap wastepaper.

There is no need to convince people that they should hold the government’s currency rather than gold coin.

Let currency be used to make change. For small face to face transactions.

Of course, my answer is to privatize it. Don’t think of currency as the basis of the banking system, the payments system, and the monetary order. That is all about deposits. The currency is trivial.

Don’t try to build it up to be paper gold.

2. March 2012 at 09:04

Thank you for the pictures of pre puritan currency – very striking.

Re blog software problems

software doesn’t work very well for two reasons:

1) people think google or apple produces good software because they have no std of comparision (what should a good search engine look like) or are bought into some status symbol (eg, for many years an apple laptop was 2-3X the cost of a wintel box)

2) software is a wierd combination of monopoly (we are the phone company, we don’t have to be human [ L Tomlin]) and cut throat lasseiz faire race to the bottom capitilism

2. March 2012 at 09:35

What a great post.

Yes, we have become sex-phobic—I think the Bush Administration covered a statue of Justice in the Justice Department as she had bare boobs.

(And people forget that all through the Midwest and South, girls got married at 14 and 15 and had babies, right up through the 1960s. Now we say teenagers are not ready for sex).

Another change in currency: There used to be a Native American on the Buffalo nickel, and the “Indian Head” penny. There were bills with Native Americans too. I think this was because for a period of time it was believed that a Native American could not tell a lie–ergo, as pillars of integrity their images were used to suggest the currency was not bogus either.

I guess there is a Sacagawea coin out there somewhere, but basically we have wiped out the Native Americans–again.

2. March 2012 at 09:37

‘ironic on so many levels. as flattered as i would be that someone took the time to delete my comments, honestly, i think its a technology issue.’

Sorry, DeLong has a long history of deleting comments of people who too often win arguments against him (or his acolytes, where I think the real problem originated; they lobbied him to keep some people out of the conversation).

I might be the world’s number one expert on Brad DeLong’s blogging idiosyncracies.

2. March 2012 at 10:04

Why ever have a TARP type program? If you have to intervene, why not let failing banks fail and create new banks with the same or less money than you’d put into the TARP program. That way you avoid the moral hazard and have a healthier lending market instead of one full of banks slowly clawing their way back from failure.

2. March 2012 at 10:39

We used to have beautiful coins as well as beautiful paper currency, and the designs changed every few years, too. The country is going to the dogs(TM).

2. March 2012 at 10:45

I have Milton Friedman’s book, A Program for Monetary Stability, in which he advocates the exact opposite. He proposed raising the reserve requirement to 100% and paying interest on those reserves. Irving Fisher’s book “100% Money” does the same without the interest component. Friedman’s way makes more sense so the banks wouldn’t have to charge people for accounts. As long as the interest paid is less than the T-bill rate (as Bill Woolsey noted) then the government is making a profit.

Keep in mind, this has nothing to do with banning fractional reserve lending, as some advocate. If people want to loan out money at interest and assume the risk (default and liquidity) associated with it, that’s fine. There would be a thriving market for investment accounts. But people need a place where they can put US dollars, make payments with it and have it guaranteed to be there just like paper cash. Deposits within the Federal Reserve System fill that role for us. Every bank deposit is currently a government liability just like a Federal Reserve Note.

If you combine Friedman’s plan with the Sumner plan for the Fed to target NGDP, you wouldn’t have any change in inflation or deflation. The Fed would simply offset any changes in velocity. The Fed’s balance sheet would be much larger and the dividend to the Treasury would also be much larger, lowering the tax burden on the citizens.

2. March 2012 at 11:10

For deposit safety (and removing the distortionary FDIC subsidy), you can require banks to hold t-bills. This is equivalent to requiring banks to hold interest-earning reserves (provided that the national debt > deposits, which is the case for the U.S.)

2. March 2012 at 11:30

How about capital requirements?

2. March 2012 at 11:57

Have you tried commenting from other computers? Do you have multiple computers in your home? They are probably all behind the same router – maybe your IP was banned?

If other computers outside your home work – we know it’s not you. If other computers inside your home work – we know it is your computer. Try deleting all your cookies and temporary internet files, then try again.

2. March 2012 at 12:14

“If you want to assume the problem is global, then I’d suggest buying the least distortionary assets, first GSE bonds, then relatively safe corporate index bond funds, and if necessary index stock funds. … I’m just pointing out some options for completeness. If you want to debate these options in the comment section that’s fine, but I won’t take your comments seriously as it’s not a hypothetical worth wasting time worrying about.”

Well, the ECB is buying bank loans that are 5X overcollateralized with loans to Italian small businesses. This is both serious, very safe and non-distortionary. The founding fathers of Euro feared the distortions that are caused by purchases of T-bills.

2. March 2012 at 12:22

I won’t notify the folks at mises.org that you have called for the return of the $100,000 GOLD certificate…

2. March 2012 at 12:44

ssumner:

1. Interbank transfers are done most efficiently via transfers between member bank deposits at the Fed. OK, but the Fed could keep safety deposit boxes for all the big banks, and small banks could have accounts at the largest banks. The balances would be adjusted by moving large denomination bills between various safety deposit boxes at the Fed.

It’s more efficient to transfer digital money than paper money.

2. Reserve requirements are needed to prevent bank runs, the 1930s prove that. No, we already had reserve requirements during the 1930s, that wasn’t the problem. Indeed in those days banks held way more reserves than required. If you are worried about bank safety, you should be looking at capital requirements, not reserve requirements.

Reserves in the 1930s was not 100%, which is why bank runs occurred. It wasn’t a lack of capital requirements. Capital itself is dependent on continued fractional reserve credit expansion and the resulting increased price level. If credit expansion collapses, and the defaults decrease the quantity of money and volume of spending, then the prices of capital assets will fall as well, making them improper “backstops” for fractional reserve banks.

3. Without reserve requirements the money multiplier would be infinite. No, it would be (C/D + 1)/(C/D + ER/D), which is far from infinite. Indeed it would be roughly what the multiplier was in 2001, little would change.

Capital prices would themselves be dependent on the height of credit.

4. The discount window is needed for emergencies. No, financial crises need to be divided up into two components; falling NGDP and illiquidity. The Fed should address any NGDP and aggregate liquidity issues through OMPs, along with NGDP level targeting. They need to do that with or without discount loans. If NGDP is at trend, and you still have a failing bank, shut it down. If we are at trend NGDP, and you have banks that are solvent, but for some reason the interbank loan market freezes up, then have the Treasury do some sort of TARP program. I’m skeptical that this situation would ever occur, and I’m not sure it’s desirable to have a TARP program. All I’m saying is that bank solvency is not a monetary policy issue, we address it through Treasury bailouts, which is the appropriate way if we are going down that road. Again, with NGDP level targeting, I’d rather just shut down the problem banks, and let bank creditors take some losses.

So NGDP targeting is only applicable at the national level? Not the state or city level? Why shouldn’t the Fed print money and spend it on assets to increase state or city level NGDP? Why only national?

Now let’s consider monetary policy at the zero bound. My first suggestion is that if the Fed is doing NGDP level targeting, then we probably wouldn’t be at the zero bound. But let’s say I’m wrong. Then there are two possibilities; either NGDP is where the Fed wants it, or it’s too low. If it’s where the Fed wants it, problem solved. If it’s too low, then keep buying T-securities. Come back to me when the entire national debt has been paid off with currency.

You’re resting the “correct” NGDP on nothing but the Fed’s subjective desire? And you want the state to continue to grow by way of borrowing inflated money from the Fed? This is madness.

OK, some of you die-hard Keynesian are saying “what next?” Let’s say you’ve bought the entire national debt, and NGDP is still too low. There are several possibilities. You could raise the NGDP target path from 5% to 7%, if you really think this glut of currency is a big problem. Or, you can buy other assets, such as foreign government bonds. If you want to assume the problem is global, then I’d suggest buying the least distortionary assets, first GSE bonds, then relatively safe corporate index bond funds, and if necessary index stock funds. The EMH says your losses and gains would balance out over time, just as with T-security purchases. And no, that’s not “really fiscal policy” but go ahead and think so if you wish; a rose by any other…

So you want there to be those who receive the new money first and those who receive it last. You want arbitrary wealth transfers away from most people, and towards the owners of GSE debt, corporate debt, and stocks that get bought by inflation.

Wonderful.

Of course in the real world none of this would ever happen, indeed we would have stopped several stops back. I’m just pointing out some options for completeness. If you want to debate these options in the comment section that’s fine, but I won’t take your comments seriously as it’s not a hypothetical worth wasting time worrying about. We have actual problems in our economy to address.

And you’re doing everything you can to destroy the economy even more by ignoring economic calculation and only focusing on aggregates.

The Fed has a mystique because everyone thinks it controls the financial system. It actually (mostly) supplies currency for tax evasion and drug smuggling. The only non-boring thing about the Fed is that it has a monopoly on the medium of account (currency) and hence drives the nominal economy.

There is no such thing as “the nominal economy” divorced from “the economy.” Money is enshrined into personal valuations in exchanges. The totality of these personal valuations is what drives monetary aggregates.

No individual cares if NGDP rises or falls. He only cares if HIS income rises and falls.

2. March 2012 at 14:18

“‘I think DeLong does ban some people. He once deleted one of my comments.'”

“ironic on so many levels. as flattered as i would be that someone took the time to delete my comments, honestly, i think its a technology issue.”

Sorry, DeLong has a long history of deleting comments of people who too often win arguments against him

DeLong is maybe the most notorious comment-deleter around, certainly in the econo-blogs by far. Patrick understates it. You don’t have to be someone who “wins” against him to get cut — any non site-correct opinion will do.

He admits it to mass comment cutting — but says, of course, only to maintain order and block abusive troublemakers.

I ran a test of that once when he was on a comment-cutting rampage: In a thread under one of his posts about Social Security every couple of hours I posted a link to a different NBER paper about SS, with no opinion comment from me at all, only just a few words quoting the abstract to show how it related to the issue in the thread. *Whap, cut* … *Whap, cut* … *Whap, cut* … every one, from immediately to within half an hour. Those NBER abusive trouble-makers!

He actually got worse after that. He reached a point where he was opening peoples’ comments, insulting them with their own comment, then deleting the rest of the comment. That was when I finally, totally stopped reading him.

But the *extraordinary* thing about DeLong is how he *changed* over the years.

I was one of the first commenters on his site (as was Patrick) and back then at the very beginning DeLong said the reason for his blog was to have a place of polite discussion without all the partisanship and name calling and enmity on usenet (such as in sci.econ). And in the beginning that’s how it was.

I actually have e-mails from DeLong in my files congratulating me and saying “touché” for making an effective point contrary to his. But then … wow, what a turn-around! I mean, Krugman was always Krugman, he’s been assuming evil on the part of his opponents forever, from the beginning, since way back before 2000 when they were all on the Left. He was born that way. But DeLong made himself DeLong.

It’s maybe really the greatest example of political partisanship becoming *literally* addicting, via endorphin behavior, as the brain scientists now say it does — “this is your brain on politics” — that I’ve ever seen.

A warning example for us all.

So if one wants to feel flattered that DeLong thought enough of one’s opinion to purge it, that’s legit — just don’t be *too* flattered.

🙂

2. March 2012 at 14:43

Measuring Worth says that $100,000 bill was worth $22 million in today’s terms, relative to GDP.

Maybe Mr Burns really does have a $1 Trillion bill — with naked women on it!

2. March 2012 at 14:46

Keep IOR, but just make sure it never rises above the rate on T-bills–or whatever is the next most safe and liquid asset. If you have to, let IOR go negative. Among other things, this ought to silence all the nonsense about liquidity traps.

2. March 2012 at 15:04

I remember an experience as a new visitor at Karl Smith’s blog, several years ago. DeLong entered the thread with a really nasty remark for Karl and I replied something along the lines of “Who are you and why are you insulting my friend?” The only time I went to Delong’s blog after that was for referenced links.

2. March 2012 at 16:08

Major_Freedom: Reserves in the 1930s was not 100%, which is why bank runs occurred. I am betting there were plenty of times when reserves were not 100% but bank runs failed to occur.

No individual cares if NGDP rises or falls. He only cares if HIS income rises and falls. But one person’s income is dependent on other folks’ income. No economic agent is an island. (Or, for that matter, only of one gender.) Self-interest drives folk to be also concerned about general expectations about income, which means expectations about spending. And spending=income is another way of saying transactions matter.

You continually seem to think that the only economic calculation that matters is price. But people only care about price because of its effect on income (either getting it or using it). Reducing income paths to flatten average prices is not a net social benefit. Which is also another way of saying transactions matter.

2. March 2012 at 16:26

Lorenzo,

I’m sure that MOST economic agents have only one gender, excluding a small portion of the population who are consumers of the sartorial apparatuses of both genders.

2. March 2012 at 17:02

1. For bank transfers, better yet put all the big bills in a single safety deposit box and have an application on Bernanke’s iPhone track which serial number belongs to which bank. Or better yet, just get rid of the physical bills and maintain them in electronic form….oh… that’s the system we already have.

2. Yes you do need a system to provide liquidity to the banks if they get in trouble, you might be able to eliminate excessive risk taking, but you can’t eliminate extremely bad luck, i.e. the black swan. I would totally eliminate the discount window and instead implement a system where banks have an option/ requirement (bank put/Fed call) to sell equity to the Fed at a price set solely at Fed discretion if the bank got in trouble.

3. It would be easier to understand if you wrote the multiplier as (C+D)/(C+ER)

4. Monetary Policy – You still don’t solve the problem with OMP where the banks sell bonds out of their portfolio and put the cash in their vault (or the Fed Safety Deposit Box), or where they buy from non-banks (bank deposits up/bank cash up) and the non-banks sit on deposits (drop in V). You still have the problem of the No-Nothings complaining about the Fed printing money.

2. March 2012 at 17:14

Scott,

When I was recently discharged of my responsibilities at Rowan University one of the complaints delivered (by several students) was I was pushing a Monetarist agenda. I don’t blame you at all. I was all too eager to follow your prodding.

http://www.youtube.com/watch?v=HseaM9b_tIQ&feature=player_embedded

P.S. Naughty, naughty, naughty Professor.

P.P.S. I agree with your advice on simplification.

2. March 2012 at 17:39

Mark, I think it is weird students would care.

Were you a small government for the sheer force of 4% level targeted NGDP monetarist?

2. March 2012 at 17:55

Morgan,

Honestly I never understood my students. (A sufficient number apparently hated me that I lost my job.) They seemingly had no understanding of history. They had a really weird view of the weight of debt (IMO) in causing the current recession. (And frankly I thought they were idiots, given they could not beat the average performance of a UD student on a standard multiple choice question bank.)

You should know I think falling below a 2% inflation rate is really bad given the flatness of the AS curve below that rate.

P.S. New Jeersy is a strange state, especially given that big old Chris Christie is governor. And the roads are really bad.

2. March 2012 at 18:32

Scott,

I’m having amazing trouble retracing simple grief sticken comments that I made here yesterday concerning Andrew Breitbart. Am I sane in assuming this is pure paranoia rather than an effort by you to erase it down the memory hole?

2. March 2012 at 19:22

The BoE do something similar with internal high denomination notes for the Scottish banks who issue their own sterling notes.

” Most of the notes issued by the note-issuing banks in Scotland and Northern Ireland have to be backed by Bank of England notes held by the issuing bank. The combined size of these banknote issues is well over a billion pounds. To make it possible for the note-issuing banks to hold equivalent values in Bank of England notes, the Bank of England issues special notes with denominations of one million pounds (“Giants”) and one hundred million pounds (“Titans”) for internal use by the other banks. ”

http://en.wikipedia.org/wiki/Banknotes_of_the_pound_sterling

2. March 2012 at 20:04

For how we can solve he long run debt I turn to the CBPP:

“Tax Cuts, War Costs Do Lasting Harm to Budget Outlook

Some commentators blame major legislation adopted in 2008-2010 “” the stimulus bill and other recovery measures and the financial rescues “” for today’s record deficits. Yet those costs pale next to other policies enacted since 2001 that have swollen the deficit. Those other policies may be less conspicuous now, because many were enacted some years ago and they have long since been absorbed into CBO’s and other organizations’ budget projections.

Just two policies dating from the Bush Administration “” tax cuts and the wars in Iraq and Afghanistan “” accounted for over $500 billion of the deficit in 2009 and will account for $7 trillion in deficits in 2009 through 2019, including the associated debt-service costs. [7] By 2019, we estimate that these two policies will account for almost half “” nearly $10 trillion “” of the $20 trillion in debt that will be owed under current policies.[8] (The Medicare prescription drug benefit enacted in 2003 also will substantially increase deficits and debt, but we are unable to quantify these impacts due to data limitations.) These impacts easily dwarf the stimulus and financial rescues, which will account for less than $2 trillion (less than 10 percent) of the debt at that time. Furthermore, unlike those temporary costs, these inherited policies (especially the tax cuts and the drug benefit) do not fade away as the economy recovers.

Without the economic downturn and the fiscal policies of the previous Administration, the budget would be roughly in balance over the next decade. That would have put the nation on a much sounder footing to address the demographic challenges and the cost pressures in health care that darken the long-run fiscal outlook.[9]”

http://www.cbpp.org/cms/index.cfm?fa=view&id=3490

The solution is simple. Bring the tax rates back up to the level they were under the Clinton prosperity. And then, bring the boys (and girls) back home.

“Bring the boys back home

Bring the boys back home

Don’t leave the children on their own

Bring the boys back home”

http://www.youtube.com/watch?feature=player_embedded&v=xIecEEv8kIo

2. March 2012 at 20:29

Oh Gosh,

I thought I had gone mad. I never though you would have erased comments I just couldn’t find them.

Thank You

2. March 2012 at 22:51

W. Peden: Well spotted. “Nor do they only come in one gender” would have been better 🙂

2. March 2012 at 23:13

Personally I have an “outie” as opposed to an “innie.” But it makes no real difference to me.

2. March 2012 at 23:39

On the other hand, as much as Physiognomy means no difference, I still have a personal preference (guess).

3. March 2012 at 00:00

OK,

I’m being cruel. I’m totally straight. But my best friend in high school was gay and my best land lady in college was a lesbian.

And maybe that’s my point. I really loved these people.

3. March 2012 at 07:30

Steve, There are two Paul Krugmans. The one who demands that the Fed do more, and the one that sounds like he’s giving them a pass.

Morgan sent me one of those $100 trillion bills.

Thanks for the tip Lars.

SG, You said;

“Am I correct in saying that you believe that it’s an NGDP shortfall that’s ultimately responsible for causing market-wide disruption in the financial sector?

When I look at a graph of NGDP and the TED spread (difference between treasury rates and interbank lending rates), it seems to me that serious problems in the financial sector cropped up well before the disastrous late 2008 drop in NGDP. Or would you say that it’s merely the slow growth of NGDP beginning in late 2007 that caused the financial turmoil of that time?”

Yes, it was mostly the NGDP shortfall. I can’t emphasize enough how misleading the quarterly numbers really are. Monthly NGDP estimates show almost the entire fall in NGDP occurring between June and December, with the financial crisis getting much worse about half way through that plunge. As you say, there had already been a mild recession in early 2008, and that probably also had a slight effect. But I see June to September as the key problem.

We also need to completely revamp our regulation of banking. Not more regulation, but more effective regulation. Banning sub-prime mortgages with FDIC insured funds. Eliminating the mortgage interest deduction. Abolishing the GSEs. Getting rid of TBTF. Getting rid of non-recourse mortgages, and many other changes. Be more like Canada.

Bill, You said;

“Scott, how much of your thinking is still tied to the old arguments that velocity is stable because interest rates don’t impact the demand for money much? Why hold money when you can own interest bearing securities. So people just hold as little money as they must to fund transactions.

But most money pays interest.

Efficiency requires that it all pay interest.

Basing everything on paper currency is a horrible mistake. Paper currency should be treated like the trivial appendedge to the monetary order that it is.”

I think you misunderstood my argument. I define money as the base. So 95% of money is currency during normal times. Currency is what drives the nominal economy. Double currency and you roughly double NGDP. I see other definitions of money as mostly being financial assets. I’d combine bank deposits with things like stocks and bonds, which the Fed doesn’t directly control, but influences via changes in NGDP.

So causation runs from the base (i.e mostly currency) to NGDP to the nominal value of all goods, services and financial assets.

If you don’t like my definition of money as the base, just mentally think “base” every time I say “money.”

I once published a paper on “Privatizing the Mint” so I’m with you there.

With no reserve requirements, the level of reserves would be so low that the welfare cost of no IOR would be negligible. Indeed the tax on money might be no worse (in welfare terms) than the tax on income. So raising income taxes to pay for more IOR is probably a wash.

Ezra, Thanks for that info–I know little about computers.

Ben, Yes I used to collect old coins when I was young.

Patrick, I’ve heard the same thing.

John, I agree about TARP.

Pct, I agree.

Negation, Friedman moved closer to my views late in his life.

Max, I see that as a sort of capital requirement, not a reserve requirement, but it may be a good idea.

Floccina. They probably need to be raised, but we already have seen how easily banks evade them.

Jason, Thanks for the tip.

123, I don’t see that current ECB policy has any bearing on the optimal monetary policy regime. I also don’t see how your comment relates to the previous point. Just because the ECB thinks T-bills are distortionary doesn’t make it true.

But I’d add that my comments were focused on the Fed, which can assume T-bills have no default risk.

DF Linton, Please don’t tell them!

Major Freedom. You said:

“It’s more efficient to transfer digital money than paper money.”

Use your imagination for God’s sake. Make them digital safety deposit boxes, and transfer cash digitally between them. The actual box just holds the aggregate currency holdings of the Fed. Surely that would be efficient.

In any case it was a joke, as I clearly implied.

Your other comments are either wrong or silly.

It’s wrong to think that reserves were the main problem in the Depression, it was solvency.

It’s silly to think the Fed can target regional economies with a single currency.

Jim Glass. That’s an interesting take on DeLong’s “evolution.”

Jim Glass, That’s off by about a factor of 10. It’d be closer to 2.2 million.

Lee Kelly, Except I’ve found that even that doesn’t silence the “liquidity trap” proponents.

Becky, Interesting.

dtoh, You said;

.”For bank transfers, better yet put all the big bills in a single safety deposit box and have an application on Bernanke’s iPhone track which serial number belongs to which bank.”

Ha! We think alike, I just had the same thought in a reply to Major.

You said;

“Yes you do need a system to provide liquidity to the banks if they get in trouble, you might be able to eliminate excessive risk taking, but you can’t eliminate extremely bad luck, i.e. the black swan.”

My plan has that system, it’s called “open market purchases.” If the problem is solvency, not liquidity, that’s where TARP comes in (although I’d rather not.)

3. I prefer to write the ratios, as they show the underlying behavioral determinants of the multiplier.

4. I don’t think banks would hoard cash under my plan, but if they did then so much the better–no national debt!

Mark, Market monetarism is best ingested in small doses.

Your comment is still there, in the previous post.

Richard, Thanks for that interesting info.

3. March 2012 at 08:06

Scott:”I don’t see that current ECB policy has any bearing on the optimal monetary policy regime. I also don’t see how your comment relates to the previous point. Just because the ECB thinks T-bills are distortionary doesn’t make it true.

But I’d add that my comments were focused on the Fed, which can assume T-bills have no default risk.”

My point applies to the Fed too. Suppose the NGDP targeting is implemented. If the total stock of government is low, or if the money demand is elevated, according to your logic there comes the time when even the Fed has to buy 10 year treasury bonds. I am saying this is too risky, the interest rate risk is too high. The right solution is to make a three year loan collateralized with a 10-year treasury bond with an appropriate haircut.

My message to you (and Nick Rowe) is: never say that the time might come when the Fed has to buy index stock funds. Please say the Fed might have to make a three year loan collateralized with index stock funds (with a huge haircut applied).

How is Bernanke supposed to know that he is not overpaying for 10 year bonds? Draghi is a much better risk manager…

“So 95% of money is currency during normal times. Currency is what drives the nominal economy.”

No, currency does not drive the nominal economy. Currency drives the drug dealing sector. The nominal economy depends on banking transactions that are facilitated by the remaining 5% of the base.

3. March 2012 at 12:12

Scott, The shortage of safe assets is a non-issue. There is no reason to scare people with “relatively safe corporate index bond funds” or “index stock funds”. There is no reason to scare people with the operation Twist.

It is easy to find safe assets with a reasonable yield if you want to expand the monetary base. Bundesbank representative has voted yes for the ECB purchase of 3 year commercial bank loans that are 5X overcollateralized with loans to Italian small businesses, and all this has happened during a financial panic.

3. March 2012 at 12:51

Jim Glass, That’s off by about a factor of 10. It’d be closer to 2.2 million.

I’ll let Measuringworth speak for itself:

“In 2010, the relative value of $100 from 1934 ranges from $1,340.00 to $22,000.00. ”

It gives seven different measures: CPI is $1,630, relative to GDP is $22,000.

This is an excellent historic data site, via EH.net, including data for China among other countries.

In my mind CPI is meaningless going more than 25 years back (you don’t like it even currently?). This gives multiple ways to find equivalent value going back in time, so one can choose the method that best fits one’s purpose, back to 1790 for the USA.

3. March 2012 at 13:14

“Just because the ECB thinks T-bills are distortionary doesn’t make it true.”

If the 3month first 10% tranche of Barclays US corporate investment grade index yields more than a T-bill and is safer than a T-bill, the Fed should hold such a tranche instead of T-bills.

3. March 2012 at 17:13

123, No, banking (and food, clothing, shelter, and machines) drive the real economy, currency drives the nominal economy.

Since the stock index fund purchases will never happen anyway, I’m fine with any alternative you want. but I’d rather focus on real issues, like where to set the NGDP growth target.

I still think long term T-bonds are safe (the EMH says losses balance out and the government can easily self insure.)

Jim Glass, That means I’m right, any price index would be closer to 22 times than 220 times.

GDP isn’t a good comparison for relative value. But I agree the CPI is very arbitrary.

123, I doubt they are safer.

3. March 2012 at 19:40

Hi Scott:

Regarding monetary policy easing (or tightening), how do you think about the distributional effects of the way you choose to do it? Assuming that the Fed does it through OMO, presumably the ones who benefit the most are the ones who hold the assets that the Fed is buying (let’s assume that the Fed can buy any asset but the market doesn’t know which they’re going to buy). Aren’t you concerned about the political economy effects of this skewed distribution (or what some people call “distortions”)? Naturally you can argue that with the right monetary policy everybody is better off even if some more than others, as opposed to the wrong monetary policy where everybody is equally worse off. Anyways, how do you think about this problem? Btw, I assuming that the Fed has to do SOMETHING to keep NGDP at trend, i.e., expectations by itself don’t take care of it.

3. March 2012 at 20:52

Scott:

“I don’t think banks would hoard cash under my plan, but if they did then so much the better-no national debt!”

If things were really bad (time to lower the lifeboats bad), then very likely the banks would hoard cash rather than buy other assets (e.g. make new loans).

Another way to think of this is to assume there is only one counter-party to the Fed OMPs. Let call him Mr. Market. What would induce Mr. Market to do the trade from Tbills into cash. The one and only thing would be if the Fed offered a high enough price on the Tbills so that the yield was negative and therefore holding cash was preferable. With the banks, they will only do the trade if they can lend out the cash at a better risk adjusted return than what they can get on Tbills. When it’s time to lower the life boats the risk thing gets to be a big issue. Then even when the Fed creates money through OMP, you have the economic actors just sitting on money (be it time deposits, checkable deposits, ER, or cash). When all you are doing is substituting Tbills for money, the drop in V exactly offsets the increase in M and there is no impact on NGDP. It’s only when the money is spent that you get an impact.

To the extent you make holding money less attractive (e.g. eliminate IOER) you ameliorate the problem but you don’t elminate it, and the problem gets worse in low interest rate environments and after hitting icebergs. On the other hand, if you force the banks to create new assets (loans, etc.), there is a much higher likelihood the money will be spent thereby increasing MV. You also elminate the political rhetoric about the Fed printing money. Which is why I keep saying the Fed should be able to flexibly set minimum and maximum asset/equity ratios by asset class. This gives the Fed the power to force the banks to create new assets and will more effectively increase MV.

Your solution (do OMP till you hit the target) works if you could convince people to do it, but my solution works better and it would be a much easier sell.

4. March 2012 at 00:01

Scott: “No, banking (and food, clothing, shelter, and machines) drive the real economy, currency drives the nominal economy.”

Transaction services drive the nominal economy. These services are provided by the banks (credit cards, checking accounts), and by currency. Other stuff done by banks is a part of real economy, but of course we need to focus on transaction services. These transactions services depend on the 5% of monetary base that is not cash.

And please see the the recent post by Tabarrok:

http://marginalrevolution.com/marginalrevolution/2012/02/excess-reserves-and-intraday-credit.html

You were measuring the monetary base at midnight when you said that it is 95% cash during normal times. During business hours the non-cash monetary base was much higher than you think.

“Since the stock index fund purchases will never happen anyway, I’m fine with any alternative you want. but I’d rather focus on real issues, like where to set the NGDP growth target.”

Of course, the NGDP level targeting is the most important problem. But the question of what assets to buy when you need to expand the monetary base is the second most important problem. Bank of Japan has bought stock market ETFs. Three days ago the Bank of Israel has started buying US stocks. Bernanke has bought toxic financial products that are more dangerous than stocks in 2008.

During the financial panics, the public starts reducing their M2 holdings and increasing their T-bill holdings, so much higher increase in the monetary base is needed if the Fed does not sell T-bills during panics (as it did in September 2008). And of course there is a question of subsidy – the markets that Fed operates in become more liquid. This subsidy is usually tiny, but during financial panics it is both substantial and important.

“I still think long term T-bonds are safe (the EMH says losses balance out and the government can easily self insure.)”

On the level of consolidated government balance sheet you are right. But please think about those libertarians who think that all banks, including the central banks, should be private 🙂

“123, I doubt they are safer.”

3 month first 10% tranche of Barclays US corporate investment grade bond index is safer than a T-bill. Of course, both are very safe. But a T-bill is more likely to default, for example due to the debt ceiling glitch – this has already happened 30+ years ago. On the other hand, US corporate investment grade bonds have never fallen by 90% during a period of three months.

4. March 2012 at 00:13

Scott: “Since the stock index fund purchases will never happen anyway, I’m fine with any alternative you want. but I’d rather focus on real issues, like where to set the NGDP growth target”

…and there are all those fiscal stimulus advocates like DeLong and Krugman, who argue that bridges in Alaska and teaching services in California should be financed via the expansion of monetary base. The proper monetarist response to fiscal stimulus advocates involves showing that there are plenty of safe asset tranches for the central banks to buy, and there is no need to finance bridges and schooling services.

4. March 2012 at 07:39

“Negation, Friedman moved closer to my views late in his life.”

I knew he changed his views on a constant rate of growth in M2, but I wasn’t aware that he ever changed his view on 100% reserves. In my edition, he writes in the preface (written in May 1992) that he still favors the idea, and says that it would have avoided the S&L crisis. I suspect it would have avoided the last round of bailouts, because the choice was either bailout Fannie, Freddie and the banks, or do the same thing though FDIC.

Friedman says he thinks it is unlikely to be adopted, because “The vested political interests are too strong, and the citizens who would benefit both as taxpayers and as participants in economic activity are too unaware of its benefits and too diffuse to have any influence.”

Of course, he lived another 14 years after he wrote that, so he very well could have changed his mind. He correctly believed you should always be open to changing your mind due to the data.

4. March 2012 at 17:24

ssumner:

“It’s more efficient to transfer digital money than paper money.”

Use your imagination for God’s sake. Make them digital safety deposit boxes, and transfer cash digitally between them. The actual box just holds the aggregate currency holdings of the Fed. Surely that would be efficient.

That’s exactly what the Fed is doing now, the very thing that you said is not needed in 1.

In any case it was a joke, as I clearly implied.

I thought you said half joke.

Your other comments are either wrong or silly.

It’s wrong to think that reserves were the main problem in the Depression, it was solvency.

The solvency problems were brought about by fractional reserve banks not having adequate reserves to satisfy withdrawal and transfer demands. That’s the major reason so many went bankrupt.

It’s silly to think the Fed can target regional economies with a single currency.

Hahahaha

If you’re consistent then you must also conclude that NGDP targeting of the regional economy called “America” is “silly.” That’s what NGDP targeting is, isn’t it? Targeting the NGDP of a regional economy called the US?

Your nationalist mercantilist dogma rears its ugly head once again. It’s allegedly silly to target NGDP for X square miles and Y Americans, yet it’s not only not silly to target NGDP for X-x square miles and Y-y Americans, but it’s the solution to depressions.

4. March 2012 at 21:02

Fredico, Any distributional effects of 5% NGDP targeting aren’t an order of magnitude lower than the efficiency effects, they are 3 orders of magnitude lower. Not even worth thinking about when we have these massive problems on our hands. I wouldn’t even have a clue as to who gains (and no, it’s not necessarily bond holders–how would they feel about hyperinflation, for instance?)

dtoh, I don’t think that problem would ever occur, but if it did:

1. Print lots of money.

2. Or if you don’t want to do that, raise the NGDP target growth path.

123, You said;

“You were measuring the monetary base at midnight when you said that it is 95% cash during normal times. During business hours the non-cash monetary base was much higher than you think.”

Not back in the 1920s.

You said;

“Of course, the NGDP level targeting is the most important problem. But the question of what assets to buy when you need to expand the monetary base is the second most important problem.”

To me it’s not even in the top 100.

And I don’t care at all about what libertarians think about the Fed. My concern is trying to get my fellow economists to have more sensible opinions. Libertarians will always be a fringe, with no impact on Fed policy. The problem now is most mainstream economists think Bernanke has it about right.

Negation, I had thought he moved away form 100% banking, but am not certain.

Major, You’re still wrong. Word’s like “regional” are meaningless, take a look at the optimal currency area literature.

4. March 2012 at 21:48

Scott wrote:

“Mark,

Market monetarism is best ingested in small doses.”

Yes, I know. It will truly blow your mind.

5. March 2012 at 00:06

Scott:”To me it’s not even in the top 100.

And I don’t care at all about what libertarians think about the Fed. My concern is trying to get my fellow economists to have more sensible opinions. Libertarians will always be a fringe, with no impact on Fed policy. The problem now is most mainstream economists think Bernanke has it about right.”

Here are four reasons why it should be the #2 problem:

1. Your fellow economists like Krugman and Delong want to put bridges and schooling services on the asset side of the central bank. As it is the monetary policy all the way down, they are in effect saying that the cause of the slow recovery is the lack of illiquid and risky assets on the asset side of the central bank. Bernanke partially agrees, hence the Operation Twist that did not expand the monetary base. Fortunately, Draghi has done the proper QE.

2. Central bankers themselves including the Fed are very concerned about the solvency of the Fed. Your fellow economists like S. Williamson are criticizing the Fed for the risk the Fed is taking. Here is S. Williamson: “Further, the Fed has locked itself into a portfolio of long-maturity assets which will drop in value if short-term interest rates go up substantially. Ultimately, the Fed may not have the stomach to fight the inflation, in which case the higher anticipated inflation becomes self-fulfilling.” The influence of such economists has delayed the recovery.

3. Ron Paul and republicans are influenced by the fringe austrian goldbug nonsense. It would be better if they read George Selgin instead. Selgin spends quite a lot of time on the issue of neutrality of Fed’s assets.

4. You have argued that NGDP futures should be put on the asset and the liability sides of Fed’s balance sheet.

“Not back in the 1920s.”

Yes, the return to 1920s would simplify our life. I myself use almost exclusively cash anyway. 🙂

And credit cards discourage saving.

5. March 2012 at 00:33

123,

1) Draghi did the proper Twist although it was not noted.

2) Inflation? What inflation?

3) I have no quarrel with George Selgin.

4) Huh?

The 1920s sucked. Especially if you were a farmer.

5. March 2012 at 05:50

ssumner:

Major, You’re still wrong. Word’s like “regional” are meaningless, take a look at the optimal currency area literature.

I am fully aware of OCA theory. First off, it is regional!

Monetarists believe the Fed should target NGDP for a REGION called “America.” Every time you post charts and data, it is for the region called US. You’re just uttering “optimal currency area” as an escape, as if your belief in NGDP targeting for the US just so happens to exactly overlap the area that optimal currency theory would predict and that it’s OK for you to go on yammering about “American NGDP.”

Too bad for you market monetarists, but the optimal currency area theory that you rely on to defend market monetarism is riddled with so many flaws as to make it fallacious. It is really just an ex post attempt to defend indefensible state fiat money regimes.

You and your supportive readers should learn that OCA theory is non-operational and internally inconsistent; it contradicts well established economic principles.

1. It is non-operational because of its many imaginary assumptions that have no counter-part in reality, such as “factor immobility.” There is no such thing as an “immobile” factor in a free market. All scarce resources are objects of individual human action, and only individuals determine what resources they will use to further their ends. The fact that I don’t sell my dirty socks does not mean that my underwear is an “immobile factor.” Every good is tradeable. The only issue is what price sellers are willing to accept, and what price buyers are willing to pay. There is no geographical region in which a factor is “mobile”, beyond which it is “immobile.” These considerations alone collapse the entire “optimal currency area” doctrine.

After years of unconditioned yammering on about “stickiness”, “immobility”, and other rigid conceptualizations, market monetarists should realize that the state, the very institution that enforces the fiat money regime, is the only source of “factor immobility.” From imposing regulations, technical specifications, customs duties, tariffs, quotas, capital movement laws, immigration laws, the state is the barrier to trade integration. The North Korean state is the most obvious example of imposing “factor immobility.”

Much of the price and wage “stickiness” that we observe in modern economies around the world is a result of economic actors overestimating future drops in the purchasing power of the dollar.

Far from being “exogenous”, factor “immobility” is in fact a part of the political process. Of course one would therefore observe some positive correlation between immobility/stickiness and national boundaries.

Then there is the further critical flaw that OCA rests on the assumption that one can compare interpersonal utility. There is no scientific method of comparing such a subjective thing. Rather, monetary union/disunion should be based on property rights. This is the only way to make a consistent argument of monetary union/disunion. Any monetary regime that fails to respect property rights necessarily decreases the welfare of society, and benefits only some actors. Monetary union only increases social welfare if it is based on individual choice to integrate. To merely make the claim that monetary union and a smaller number of currencies “increases trade” and “increases welfare”, is to view humans as robots, rather than purposeful beings.

Since economies constantly change, in terms of technology, labor, as well as political problems created by trying to convince inhabitants to change the optimal currency area every time market monetarists say so, makes optimal currency area theory itself uncertain and hence a policy of OCA is a policy of making uncertainty in money a permanent phenomenon.

2. Most importantly of all, OCA theory is not even internally consistent.

A. If local demand decreases, then in a non-independent fiat regime world, that locality would be able to compete on price. In an independent fiat regime world, inflation in that region will just raise domestic prices, and eventually wages, and competition will be lost. Monetary independence is therefore not positively correlated with specialization.

B. Countries with different production structures are not, contrary to OCA theory, candidates for monetary disunion and independent currencies. For in reality they can join together in a wider division of labor. A raw material producing country and a finished goods producing country can form a monetary union.

C. The criteria for establishing OCA are themselves dependent on the existence of the OCA itself. They are self-forcing. Krugman (1993) argues that as trade develops and as division of labor increases, it leads to countries becoming more specialized, and as this reduces correlation of incomes between countries, it leads to the case for monetary nationalism. But if specialization makes the case for monetary independence, then by that logic, the process of monetary disunion should keep going to the individual human level, which is the unit of specialization in a market economy based on division of labor. But if monetary disunion and monetary independence were to proceed to the individual level, then money would no longer exist, and we’d be all on barter again. Only if an OCA is already considered then, will the criteria used to establish OCA be apparent, which of course begs the question.

I don’t take into account the “optimal currency area” doctrine not because I don’t know about it, such that you in your smugness believe you can just hand wave the criticisms away (this is one of the most annoying habits you have, and I think it is a defense mechanism used to hide the emptiness of your worldview), but because I REJECT it. It is fallacious.

Now that this is out of the way, now try to address what I said again:

Why do you advocate for NGDP targeting at the national level only, and not at the level that you tacitly claimed characterized your position, which is OCA theory? Many economists believe the US is not an OCA, and that there should be competing currencies within the US. Why do you believe the Fed should target “America” NGDP only? Don’t worry about answering, because what I said above can make your readers know why you advocate for national NGDP targeting. It’s because you need an arbitrarily (politically) established existing currency area first. The US state forces a national fiat money union, and so you follow and play along in the monetarist sandbox.

5. March 2012 at 17:42

Mark, But in a good way.

123, I don’t agree about DeLong and Krugman, it seems to me they want to put government debt on the asset side of the balance sheet, and have the government run big deficits, but maybe I missed something.

You said;

“2. Central bankers themselves including the Fed are very concerned about the solvency of the Fed. Your fellow economists like S. Williamson are criticizing the Fed for the risk the Fed is taking.”

Then they should favor an Australian-style monetary policy that keeps rates above zero and keeps the monetary base nice and small (it’s tiny in Australia.) I think I’m still being misunderstood. I don’t fear a big Fed balance sheet, but those that do should advocate faster NGDP growth, that would shrink it real fast. Is Williamson advocating faster NGDP growth? I might do a post on that.

You said;

“4. You have argued that NGDP futures should be put on the asset and the liability sides of Fed’s balance sheet.”

Yes, but these would be trivial in comparison to other assets and liabilities. And the Fed wouldn’t be taking a significant net position, it would just be a market-maker.

Major, I think the USA is an OCA. One fiscal policy, one language, labor mobility, etc.

5. March 2012 at 22:42

Scott, I was talking about the consolidated balance sheet when I discussed bridges on the asset side.

Williamson has got some very sophisticated views about the size of the balance sheet. If small balance sheets are preferred with a low inflation, williamson has got a recipe somewhere, I cannot find the link on the Iphone, I could send it when I return back home from my vacation.

Btw You have left my comment on the soros post unanswered when you switched to your new comment policy.

@Mark: #4 please google “scott sumner ngdp futures”. Greetings from Bialystok.

6. March 2012 at 06:44

ssumner:

Major, I think the USA is an OCA. One fiscal policy, one language, labor mobility, etc.

One fiscal policy is the catch, isn’t it? That is what you NEED to force the nationalistic foundation of the Fed. The US has to be an OCA, because if it isn’t, then it would make your nationalistic mercantilism a giant waste of time.

Labor mobility? It’s less costly for a laborer in Detroit to move to Windsor, Ontario, than it is for a laborer in California to move to Maine. Does that mean the Michigan/Ontario area should have their own currency, but California should have a separate currency from that of Maine? You’d say of course not. But why? Because the country of Canada is not the country of the US, of course!

And fiscal policy often targets individual states (typically those which contain the most voters of the party/politicians doing the spending), so it’s not necessarily the case that there is “one” fiscal policy that affects all states equally that would justify a common currency across all states. Some states also tend to be net gainers of spending versus taxation, while other states tend to be net losers.

Then there is the fact that WITHIN the US there is a different states, each with their own fiscal policy, where labor is even more mobile, and where language becomes even more distinct (for example those in Alabama have a language that is distinctly different from those in New Hampshire). Thus, according to your reasoning, each state in the US is also an OCA that leads to independent state currencies being optimal.

Then we can even identify differences within states as well, for example southern California and Northern California, Upstate New York and Lower Manhattan, and so on. Here we can look at city level fiscal policy, city level labor mobility, and city level language differences, and we’d of course see more justifications for independent currencies at more localized levels.

If you actually understood the OCA literature that you so cavalierly hand waved before, then you would have known that OCA theory can show that the US is diverse enough to warrant a removal of a common US currency. The economy of Alabama for example is as different to the economy of New York, as is the economy of Canada different from the US.

In fact, taken to its logical conclusions, OCA would justify independent currencies all the way to the individual human level. Shouldn’t the individual decide what currency they will use? At the individual level, there is MAXIMUM language similarity (an individual speaks their own language exactly!), MAXIMUM mobility (the individual can get where they are cost free and instantaneously!), and MAXIMUM “fiscal policy” (the individual spends exactly in their own way!).

Then there’s Europe, what with its many different languages and many different fiscal policies. But it’s still an OCA, isn’t it?

Just admit it. US level NGDP targeting is arbitrary, it is a product of the Fed already having control over the US money supply, you add a flavor of nationalism to it, and out pops the crude “5% annual NGDP growth in the US”.