You’re welcome

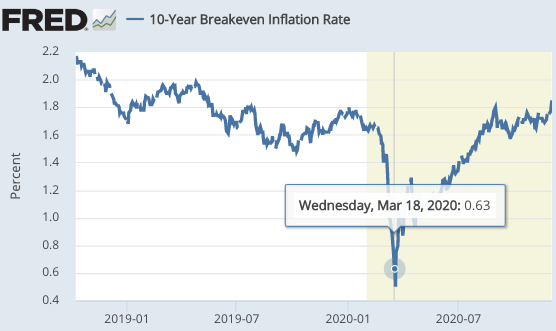

On March 18, I asked these questions:

PS. If you are in an investment area where liquidity doesn’t matter, say a company investing for insurance or pension obligations 10 years out, why wouldn’t you prefer TIPS over Treasuries right now? Isn’t PCE inflation likely to exceed 0.3% over 10 years? I’d be interested in responses from someone in the investment community.

Just to be clear, TIPS spread were 0.63% that day; I was referring to the implied prediction of roughly 0.3% PCE inflation, as PCE inflation runs a few tenths of a percent below the CPI inflation used for TIPS compensation.

Today, 10-year TIPS spreads are up to 1.88%.

To America’s insurance and pension industry I say, “You’re welcome”.

I’m trying to defend the EMH, and you financial market people are making it so hard for me.

Tags:

2. December 2020 at 18:57

Hey Scott

Off topic, but if you were entering college today, what would you study other than economics (or finance, accounting, business etc)?

2. December 2020 at 19:27

Right now, I’m moving money into the EU and the dollar is killing me (dropping relative to the Euro). Which was is the Euro going to go in the next few weeks, Dr. Sumner?

2. December 2020 at 19:34

You should be a money manager. You’re good at making predictions.

2. December 2020 at 19:59

There seems a similar recurrent opportunity in high-yield bond portfolios.

Every time there is serious financial stress, high-yield bond portfolio yields soar. Great time to buy.

2. December 2020 at 21:02

(I’ve been reading Scott for a decade and still aren’t sure when he is being ironic.) Ah, but wasn’t there a one in N chance of moving into a deflationary spiral, where N was a lot higher than it is now? What else could stocks have been pricing then, being a third lower than they are now?

2. December 2020 at 22:46

tpeach, Not sure. Using genetic data to examine the deep history of mankind seems kind of interesting.

So does studying the effect of psychedelic drugs.

Rajat, I’ve been writing this post for a decade and still aren’t sure when I am being ironic.

Recall that I don’t believe in the concept of personal identity, so it’s quite possible that one part of me is being playful and another part is serious.

3. December 2020 at 07:10

Scott,

I may not be the kind of member of the investment community you were referencing, but I did use my software briefly to come up with the macro risk factors for the 15 largest independent public US non-health insurance insurance companies. I use this macro risk factor approach to predict the movements in the prices of individual stocks with respect to hypothetical movements in the S&P 500 index. The predictive model yields pretty impressive fits to data.

The average macro risk factor for these 15 firms is 1.23. The formula is the r-squared value of changes in the prices of the individual stocks to changes in the S&P 500 index, multiplied by the ratio of the standard deviation of the individual stock price over that of the S&P 500 index. This is all for data trailing each data point by one year.

So, from this perspective, these mega insurance stocks present much higher average macro-related liquidity risk for investors than the market.

3. December 2020 at 07:11

I guess I perhaps should list the risk factors for each company here, while at it.

PFG: 1.48

PGR: 0.73

ALL: 1.02

MET: 1.46

AIG: 1.53

TRV: 1.06

CB: 1.04

HIG: 1.22

CNA: 1.09

AIZ: 1.02

LNC: 2.27

GCAAF: 0.57

EQH: 1.61

PRI: 1.26

Voya: 1.12

3. December 2020 at 08:52

Daniel, I don’t think I’m very good at making predictions, but I think I can spot times when the TIPS spread is distorted by risk, and doesn’t measure inflation expectations. At times like that, TIPS seem like an obvious choice for investors with a long time horizon.

Michael, What are the implications of that analysis for buying TIPS?

3. December 2020 at 09:20

Does anyone else find it odd and hypocritical that Sumner has the audacity to call Trump a “Megalomaniac” while titling his own blog post “You’re Welcome”?

There seems to be a great deal of irony there.

🙂 🙂

3. December 2020 at 10:24

Yes xu, that’s correct. Sumner is a vicious communist and he should be killed right away. Mainly for the crime of triggering “us”

3. December 2020 at 10:25

You are both correct, and true patriots like Lin Wood and Sydney Powell. The time is coming and Sumner and his evil fellow travellers will soon taste our rage!

3. December 2020 at 11:45

Your premise—i.e., a long term holder who does not care about mark to market, does not need to trade even for rebalancing etc., is probably what is required to make it a no brainer when implied inflation is so low. that is a boxload of “ifs”.

TIPs are illiquid, and only by holding to maturity does one really get inflation hedged. Actually, not really hedged just a known outcome.

I cannot believe that you think this is a counter argument to EMH—I think you are just thinking out loud. Any instrument which is illiquid and often trades against real expectations (How does one know that—I prefer forward rates as better estimate as expectations—probably empirical studies have been done—nothing is perfect—-).

again, the good part is your example—-but that is rarely the case for most investors.

3. December 2020 at 13:53

Hi Scott. You mean a trade of long tips and short duration matched treasuries? Because the specific trade is long breakevens, I think, from your writing, rather than just going long tips? I might be over interpreting just wanted to check.

3. December 2020 at 15:56

Michael, Who are you directing your comment to?

David, I’m just saying that in March I would have preferred to hold a 10-year TIPS to a 10-year T-bond, if I planned to hold the asset for 10 years. That’s all I’m saying.

But I suppose that does imply the long/short position you describe would be profitable.

3. December 2020 at 16:39

https://marginalrevolution.com/marginalrevolution/2020/12/canada-gamble-of-the-day.html

People are sniveling that Canada has built up a lot of debt, but the Bank of Canada has purchased much of that debt. The Canadians have kept millions employed, that the US chosen not to keep employed in the US.

The important question is, did the deficit spending, that is the fiscal stimulus work?

Looks like it did.

This would be a worthy topic for a Sumner blog.

Is deficit spending, in combination with QE the proper approach to an economic recession?

3. December 2020 at 22:44

Scott,

You asked:

“Michael, What are the implications of that analysis for buying TIPS?”

The implications were actually for insurance companies buying TIPS, which admittedly is only a narrow focus on your point, making my reply rather dumb. Sorry, but I looked at this earlier today on a short break.

Nonetheless, given the reaction of insurance company stock prices during the crisis, they would not seem to be big buyers of Treasuries of any kind. I didn’t know much about insurance company assets per say, but when I had more time I found this:

https://www.chicagofed.org/~/media/publications/chicago-fed-letter/2013/cflapril2013-309-pdf.pdf

Insurance companies, in this case, life insurance companies, generally want more yield than TIPS offer.

But, as to your broader point, as I think about it, it’s possible the oil price war between Saudi Arabia and Russia, which began earlier in March, was a factor in driving down TIPS spreads. Oil consumption is roughly between 1.5% and 2% of US GDP, and oil prices fell disproportionately during the crisis. I wouldn’t expect an oil price war to last 10 years, but markets could have been pricing in the risk of a less effective OPEC going forward.

I do admit though that there are quirks in the Treasury markets in general that I haven’t focused on and don’t understand, particularly during crises. I don’t necessarily think this undermines EMH though. The Fed buys TIPS and my gut tells me that part of the issue could be the infrastructure set up in that market. But, I really don’t know.

To make a weaker point, did anyone really think that the S&P 500 would remain down 35% for years, as it was in March? That would represent a roughly 2.4% lower GDP growth path. Should anyone have thought that was permanent? My answer is, perhaps, because perhaps Japanification is a non-trivial risk.

4. December 2020 at 01:13

‘The fundamental weakness of the Temporary Equilibrium method is the assumption, which it is obliged to make, that the market is in equilibrium—actual demand equals desired demand, actual supply equals desired supply—even in the very short period.’ (76) Hence we have to look for another method of dynamic analysis. To find it we must move nearer to Keynes and his successors who are here given credit for having understood, earlier than others, that a fixprice world requires a fixprice method of analysis.” (Lachmann 1977: 238–239).’

4. December 2020 at 01:20

From: socialdemocracy21stcentury blogspot

4. December 2020 at 05:41

Scott – we were in a classic liquidity squeeze mid-March. The TIPS spread was not pricing off of expected inflation but off of fear that funding costs on TIPS would rise significantly above those on treasuries. Buy and hold, fully funded entities can take advantage of the pricing in small size, but levered players and those who must mark their books to market with the potential for loss of capital such as active money managers and bank trading desks can easily be crushed by pursuing a strategy which bets on the liquidity squeeze not getting worse. Further, the buy and hold unlevered investors which do exist are generally not organizationally capable of pivoting their asset allocation quickly.

This is a well-understood phenomenon among bond market participants. It is a less severe repeat of TIPS pricing during 2008-2009.

4. December 2020 at 07:20

@ Michael Rulle,

‘TIPs are illiquid, and only by holding to maturity does one really get inflation hedged. Actually, not really hedged just a known outcome.’

I’m not sure I agree. I know traders handling hundreds of millions of TIPS per week for clients moving in and out of TIPS.

And pension funds have huge amounts of capital, so there’s not exactly a ‘small’ amount of people interested in these things.

TIPS are obviously not as good a hedge as an inflation swap, but I don’t think the spread should be disregarded. Especially as a lot of people pay attention to it, which leads to

Personally, I moved my personal Treasury allocation into TIPS in June – very glad I did.

4. December 2020 at 07:20

Seem to have lost part of my post there, odd. ‘Especially as a lot of people pay attention to it, which leads to its own consequences.’

4. December 2020 at 10:33

TIPSter, What I don’t understand is that there is “potential for loss” for either investment, and it seems like in March the potential for loss was higher for T-bonds.

4. December 2020 at 11:50

@Ray Lopez re: “the U.S. $”

It’s driven by FED policy. It’s about to take a big dive. It’s the same old, same old, reason. When long-term monetary flows rise, volume times transaction’s velocity, the exchange rate falls.

And that’s something that N-gDp targeting neglects to encompass.

4. December 2020 at 11:53

Right now, April 2021 is the bottom.

4. December 2020 at 20:45

Here is a practical question.

Unit labor costs.

The index on Q4 2008 stood at 101.45.

Then, latest, Q3 2020 at 114.04.

You are looking at unit labor costs rising at less than 1%, annually compounded.

https://fred.stlouisfed.org/series/ULCNFB

I cherry picked a little bit, but not too bad. Less so than most academic studies.

If unit labor costs, over a pretty long and very recent stretch, are rising at less than 1%…

Does this mean the Fed should engage in more QE?

Is there a reason to allow unemployment? What is that reason?

6. December 2020 at 13:30

Scott – the potential for loss was there for both investments. On a short term basis the volatility in the TIPS investment was higher. On a long term basis the positive alpha trade was to buy the TIPS, which “everybody” knew at the time. But the number of people who can move many billions of dollars, unlevered, not mark-to-market on 2 weeks’ notice is very very small. The levered or mark to market people who can move quickly and were not scared of getting squeezed in their other investments had already sold all their treasuries.

Providing liquidity during liquidity squeezes is a reliable but infrequent way of earning money. I do it myself personally every few years when it happens, but I’m not a big enough player to move pricing, unfortunately. Take the money and be happy for the small deviations from the EMH when they happen.