Your job has never been safer

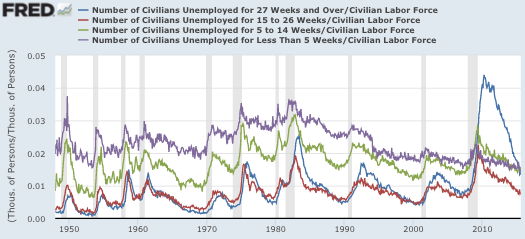

Commenter Matt directed me to some interesting data on unemployment by duration. The government looks at people unemployed less that 5 weeks, 5 to 14, 15 to 26, and 27 weeks or more. The most recent data is shocking, but first a bit of perspective.

The data is available back to 1948. For many years the low in the under 5 weeks category was in 1953, when it bottomed out at 1.5545% of the workforce. The low in the 60s boom was 1.802% in 1969, and the low in the tech boom was 1.751% in 2000. The low in the housing boom was 1.507% in 2007. In June of this year an all time record low was set; only 1.500% of the workforce was unemployed for less than 5 weeks. And yet the overall unemployment rate was 5.3%, compared to about 2.5% in 1953.

Very strange.

But today’s August data shattered all previous records. The less that 5 week unemployment fell to only 1.334% of the workforce, far lower than at any previous time in recorded history.

Basically almost no one is being laid off anymore.

Relax! Surf the net. Your job has never been safer.

Update: See Matt’s comments below, which make the recent numbers a bit less dramatic, but still very impressive.

PS. The total unemployment rate was higher in 1982 than 2009. But compare the over 27 weeks in those two bad recessions. Let’s see, which was the recession where they extended unemployment benefits to 99 weeks?

PS. The total unemployment rate was higher in 1982 than 2009. But compare the over 27 weeks in those two bad recessions. Let’s see, which was the recession where they extended unemployment benefits to 99 weeks?

PPS. Conversely, in May 1953, only 0.077% of the workforce was unemployed for more than 27 weeks. Essentially nobody. I guess if you couldn’t find a single job during the entire Korean War, you must have had some “issues.”

Tags:

4. September 2015 at 16:51

So the labor market is essentially ossified. Firms are neither firing at all except out of desperation and are hiring fairly modestly. And, yes, that graph looks impressive. I’ve never thought of it that way.

Also, is it just me, or is there a secular trend in which the long-term unemployed are constituting a larger and larger portion of the unemployed? Let me check…

4. September 2015 at 16:56

Interesting stats. I still say if we want to get labor force participation rates up…then let’s get wages up. Remember the old supply and demand? Increase the price of labor and we will get more labor.

Does it not seem odd that one of our macroeconomic policy-making bodies has a numerical target (evidently a ceiling) for inflation, but not a numerical target for labor force participation rates?

Imagine if there were hysteria, furrowed brows and pompous pettifogging everytime labor force participation rates sank below a certain floor.

4. September 2015 at 17:00

Yup. Change the chart type to “Area” and the stacking to either “percent” or “normal”. There is a long-term trend of over-27 week unemployment (the most cyclical kind) beginning to dominate the unemployment rate.

4. September 2015 at 18:04

One moderate caveat I should have mentioned: there was a Current Population Survey revision in 1994 that led to discontinuities in many of these measures, and it looks like there was a 0.4% or so fall in short-term unemployment at that time (confusingly, from Jan 1994 to Feb 1994 rather than Dec 1993 to Jan 1994, which is where I recall usually seeing the discontinuity).

If we “adjust” for this by moving the pre-1994 numbers down by 0.4%, then the basic message still holds: at the moment, we have historically low short-term unemployment. The only change is that the late Korean War period now looks better, and the late 60s (Vietnam War + extremely expansionary policy) is competitive with the current day. Since the late 60s had a famously tight job market, this still isn’t too bad!

(And I put “adjust” in scare quotes because it’s not clear that this is really appropriate: sure, the adjustment produced a noticeable discontinuity, but there are many other slow-moving changes in the mapping between a survey and reality, and sometimes the formal adjustments actually act to offset accumulated distortions in the other direction. I’m not an expert on this particular set of numbers, but for long-run comparisons it may be just as accurate to rely on the headline numbers as to make ad-hoc adjustments like these.)

4. September 2015 at 18:10

Also, see Abraham and Shimer (2001) for some discussion of the 1994 redesign and long-term downward trend in short-term unemployment. Aside from the component attributable to the redesign, they attribute part of the fall to demographics (the aging of the baby boomers) and part to social changes (women’s increased labor force attachment): http://www.nber.org/papers/w8513.pdf

Of course, short-term unemployment has now fallen even below its circa-2000 low — and looks like it might continue to fall a little — so the remarkable trend documented a decade and a half ago by Abraham and Shimer has pushed even further…

4. September 2015 at 18:20

Matt, Interesting. Is your sense that it’s a level shift of 0.4%, or a given percentage decline (say 20%), where the absolute number would be less when rates are low, and more when rates are high? (I hope that makes sense)

4. September 2015 at 19:04

Scott, great question — honestly I have no idea whether it’s an additive or proportional shift, or some mix of the two. If it’s the latter, of course, then the decline relative to the high levels of the 70s and 80s is even more dramatic.

On the other hand, if unemployment status is being measured correctly and the shift in 1994 reflects some misclassification of duration (either before or after the redesign), then the magnitude of the shift may be proportional to the number of unemployed overall, particularly those in nearby categories like 5 to 14 weeks where mild misreporting could really be an issue. This would still mean that the shift is probably less relevant now than it was in 1994, since unemployment in all categories except the long term is currently quite low.

—-

It’s notable that a similar, even more dramatic secular decline is visible in the initial unemployment claims data, where the ratio of claims to covered employment is barely a third of its level in the 70s. This may partly reflect a decline in UI takeup due to other factors, but it also suggests that the labor market has gotten a whole lot less frictional — and that this trend, for whatever reason, has received a surprisingly small amount of attention. https://research.stlouisfed.org/fred2/graph/?g=1LzG

(On a related note, I’ve generally been skeptical of the view that unemployment insurance has played a key role in the evolution of the unemployment rate during the recent recession, given that uninsured unemployment is also high and insured unemployment hasn’t stayed especially elevated: https://research.stlouisfed.org/fred2/graph/?g=1LzN

But this interpretation is weakened a little by the long-term downward trend in initial unemployment claims, since it might be that this decline in short-term UI is partly offsetting the effect of medium-term and long-term UI. I’d need to be much more familiar with the numbers to say more and avoid embarrassing myself here…)

4. September 2015 at 19:50

Matt, the insured unemployment numbers don’t include extended unemployment insurance past 26 weeks.

Scott, since old workers have more frictions they tend to have longer durations. But they also have much lower churn. That’s why unemployment could easily fall to 4% or less if we work off the remaining hysteresis.

But I think this only adds a few tenths of a percent of the labor force to 27+ week unemployment. It was dwarfed by the additional extended ue that appears to have been related to eui.

4. September 2015 at 19:53

And yet employment ratio is still near record lows. How can both be true? Returns to leisure are ridiculously high today so this is now rational behavior, especially for older people with savings who have little fear of inflation.

This trend has been around a while — the whole concept of “retirement age” is relatively modern, only recently replacing the ancient standard of “too old to work.”

And the returns will continue to get higher as long as we maintain some semblance of a free market system.

4. September 2015 at 22:03

Very interesting post and comments. Now if I just knew what Ray Lopez thought about all of this…

4. September 2015 at 22:25

Kevin, thanks — you’re right, of course, since there would be a huge fall in 2014 if the numbers did include EUI, and there isn’t. Since extended claims were (at their peak) comparable to regular continued claims, this insured unemployment rate is obviously a vast understatement, then… (Do you know if there’s an easily available rate that includes extended claims too?)

4. September 2015 at 23:31

Matt, the department of labor has data you can download to figure it manually.

Here is the site. It looks like they have changed some things since the last time I was poking around there.

http://ows.doleta.gov/unemploy/data.asp

5. September 2015 at 02:15

On an anecdotal personal report, I’ve been semi-retired for years from my field, which is very sensitive to growth, and recently I had some feelers put to me for a new job in the USA in the tech field. I declined them, as it would require me moving back to the States, but it’s suggestive that the tough times in hiring are over.

5. September 2015 at 05:53

Matt, Yes, I’ve done many posts on new claims falling to record lows, starting a couple years ago.

Early in the recession I suggested that up to 0.5% of the unemployment might be due to the extended benefits. Since then there has been research that has supported that claim. At the beginning of 2014 Krugman suggested that 2014 would be an interesting test, as the extended benefits expired. Strangely, he never followed up on that “test,” as 2014 had significantly more payroll job creation then the years before (or 2015 so far.)

The excess job growth in 2014 (600,000) was pretty close to my estimate of the unemployment caused by extended UI. Also, prior to the recession there was a lot of solid research suggesting it raised unemployment. Indeed when Bush extended the benefits just slightly around June 2008, Brad DeLong predicted it would lead to an extra 0.5% unemployment by election day. I’ve also heard many anecdotal stories from people I know about the effects of extended UI, FWIW. (Too many to simply dismiss)

To summarize, I’m pretty confident that an extra 0.5% is a reasonable guesstimate.

Kevin, I absolutely agree that unemployment could fall to 4%, but that would not prove that the natural rate is 4%, it could well be 4.5% or 5.0%. The natural rate is not the lowest rate to which unemployment falls in an expansion.

5. September 2015 at 10:23

Your disability check has never been safer.

5. September 2015 at 16:53

In 2010-2011, nearly 4% of the labor force was on EUI, and the number of workers unemployed for more than 26 weeks was more than 2% higher than a linear model based on short term unemployment that estimated long term unemployment within a few tenths of a percent for the entire history of available data. The employment behavior here was stark and unique.

By the end of 2013, less than 1% of the labor forces was on EUI.

So, I would say that in terms of the effect of EUI during the heart of the cycle, 2% is a reasonable estimate. Possibly, a range of 0.5% to 2% is the possible effect.

This has been hidden by the low levels of inflation, but inflation adjusted wage growth in the 2009-2010 period was very high- way outside the past range of the relationship between real wage growth and the unemployment rate, which strikes me as a sort of confirmation of the strong effect of EUI on labor markets at the time.

Unemployment would never have topped 9% (or maybe even 8%) without EUI.

6. September 2015 at 04:53

Kevin, What’s your counterfactual on NGDP growth, are you holding that constant?

6. September 2015 at 05:05

Kevin and Prof. Sumner,

Interesting new article in the latest Barron’s: “As Stocks Fall, Real Estate May Be the Best Defense”

http://www.barrons.com/articles/as-stocks-fall-real-estate-may-be-the-best-defense-1441437287

Robert Shiller: “Overall there just isn’t much correlation of home prices with the stock market. So [what happened in 2007-2009] looks like just chance.”

6. September 2015 at 12:12

Scott,

To what do you attribute the volatility of the unemployment rate? The chart of the rate since 1948 shows the unemployment is rarely steady. Rather once a low in unemployment is reached there is a very large and swift increase in unemployment. And once a high in unemployment is reached there is a multi-year period of declining unemployment rates. What causes these inflection points? Why are reversals in the rate so abrupt?

To me this data gives credibility to the Austrian theory of capital, the business cycle and booms and busts. What is your explanation?

6. September 2015 at 15:19

Despite all the data and our office has not had a lay-off since 2011, nobody believes this reality. (Sort like the dropping crime rates in 1993 & 1994, it was impossible to believe.) Living through 2008 and 2009 nobody in our office really never feels their job is ever safe.

I do think some of the drop in the work force are older workers in decent financial shape not wanting to return to the corporate rate race.

7. September 2015 at 05:08

Thanks Travis.

Dan, All business cycle theories predict that pattern, including market monetarism. We attribute it to variation in NGDP growth.

Collin, Belief is one thing, reality another.

7. September 2015 at 07:29

Collin, Belief is one thing, reality another.

However, there can be a long term impact. In our office, our HR department is always complaining because skilled middle workers are leaving for smaller premiums (10% salary increase) versus 20% during the 1990s and 2000s. And HR department has spend a lot to find new workers as the big 2008/2009 decrease has completely knock out our ‘minor league’ talent bench.

Has 2008 & 2009 effected the labor supply? Practically every group in the US workforce has had a drop in labor supply. (I believe the 60-65 is about the same and over-65 has increased.) I hear a lot of complaining about this drop but I hear very little why this is occurring.

8. September 2015 at 08:13

“Basically almost no one is being laid off anymore.”

Perhaps its a throwaway line, but this conclusion only follows if the only place you can go after being laid off is on the UE line (and that everyone qualifies). There are multiple options.

1. Firms have gotten better at avoiding UE claims against them, either through managing hiring practices or documenting fire able offenses and so fewer layoffs are classified as eligible.

2. Layoffs lead to people dropping out of the labor force (LFPR has seen a decline in the past two recoveries, and those two plus a small drop (over a short time frame) in the late 50s.

3. Layoffs are ending up on other roles, such as disability roles.

9. September 2015 at 07:16

Bacon, Good points. And yes, it was a throwaway line—hyperbole.