Yes, QE2 did happen, and it (sort of) worked

I say “sort of” because it was obviously too little, too late. But it’s now pretty clear that it did have an expansionary impact on both nominal and real aggregates. Let’s start with the “did it happen” question. Here’s Arnold Kling:

In the current setting, it appears that economic activity is expanding and inflation is higher than it had been. One may choose to interpret this as resulting from the Fed’s quantitative easing. However, I am not signing onto that one. I recall reading recently that QE 2 was basically canceled out by offsetting changes in Treasury funding operations. That is, as the Fed bought more long-term bonds, the Treasury issued more long-term bonds relative to short-term securities. So we are left with the channel that the Fed announced a higher intended path for nominal GDP, and this was self-fulfilling. Strikes me as a very difficult proposition to prove or disprove.

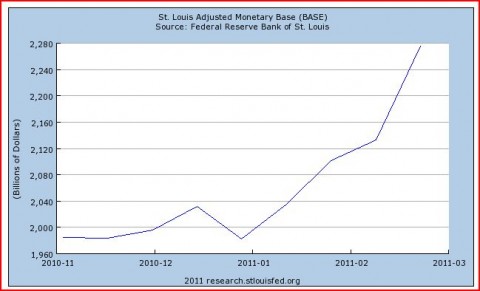

I also recall reading that QE2 was cancelled out, but as the following graph shows the base is up $300 billion since November:

Of course switching long and short term bonds does almost nothing (this was once called operation twist.) QE is all about increasing the base.

As far as the effects being “difficult to prove,” nothing could be further from the truth. Asset markets of all kinds responded very strongly to Fed rumors of QE2 in September and October 2010. Those sorts of event studies aren’t proof, but they’re the closest we get in macro—far more significant than most econometric studies published in elite journals.

I’m constantly surprised by people’s reluctance to accept the efficacy of monetary stimulus. When a (fiat) central bank is bound and determined to raise NGDP, it will never fail.

Everyone from Jim Hamilton to Paul Krugman to Martin Feldstein is talking about the recent acceleration of growth. But when I suggested this was evidence that QE2 might be working, Mark Thoma insisted that this couldn’t be true, as modern macroeconomics has established that monetary policy operates with significant lags. My initial reaction was “that’s what’s wrong with modern macro.”

Yes, I’m out of the mainstream. But it’s hard to find a more mainstream economist than Martin Feldstein, and he insists that QE2 is responsible for the recent upswing. We had a huge stock market rally triggered by rumors of QE2, and then in 2010:4 we saw the most rapid growth in real final sales in more than 2 decades. (Nominal final sales was also very strong, and is actually the better indicator–but everyone else seems to want to look at real variables. Note the focus on weak real GDP in the UK during Q4.)

In fact, Feldstein underplays the impact of QE2, as he only considers the impact of higher wealth on consumption. But the increase in asset prices produced by QE2 also raises investment. The depreciation of the dollar caused by QE2 raises exports. Indeed if QE2 produces economic growth, it also slightly reduces cutbacks of state and local government spending. BTW, it’s now obvious that S&L spending is so endogenous that it might as well be lumped in with the private sector, not treated as a sort of “fiscal policy” that can be waved around like a magic wand.

In addition, Feldstein actually underestimates the evidence in favor of QE2 being the cause of the recent acceleration in growth. It’s not just that stocks rose at roughly the same time. As I already noted, stocks clearly were rising in response to specific rumors of QE2 in September and October 2010.

In Kling’s post it’s a bit hard to figure out whether he is skeptical that monetary stimulus can boost nominal variables, or real variables. He provides this quotation from a Reinhart and Reinhart paper:

Second, changes in monetary policy can only change real interest rates temporarily.

Yes, some people argue that real interest rates are an important transmission mechanism. I doubt they matter much, but even if they did, note that 5 year TIPS yields have fallen into negative territory. In my view monetary policy works by raising expected future NGDP, and current asset prices. Kling then argues:

The point of the Reinhart and Reinhart paper is to demonstrate empirically that central bankers can only make a big difference if they make really big policy changes.

The important difference isn’t between big and small changes, but between temporary and permanent effects. We know (from asset market responses) that even quarter point changes in the fed funds target can have a huge impact on the stock market. These big effects occur precisely when the policy shocks lead to a change in the expected future path of policy. When they don’t, they have little effect.

In the first Kling quotation I provided he expresses skepticism about merely psychological aspects of Fed policy. In fact, we know that expectations are far more important than actual changes. I’ll finish with a couple easy thought experiments that demonstrate why expected future policy matters:

1. The central banks doubles the monetary base, and the change is expected to be permanent. Assume it occurred because a new populist government takes power in Bolivia.

2. The Fed doubles the monetary base right before Y2K hits, and announces that the money will be withdrawn from circulation 4 weeks later. Their intention is to make sure enough liquidity is available in case ATM machines break down on 1/1/00.

In case 1, nominal asset prices double, in case 2 they hardly budge. Yet in both cases the monetary base doubles. Why the difference? Purely psychological factors; different expectations about future monetary policy.

Case 2 is sort of like what happened in the 2008 crisis. In this case the Fed could leave this extra money in circulation for quite some time, because of a combination of IOR and near zero rates. But if Bernanke announced that the Fed was going to permanently abandon IOR, and planned to leave the base at twice its normal level even when T-bill yields rose back up to normal levels, inflation would explode almost immediately.

Commenters: I beg you not to ask me one more time to explain in a “mechanical” way how QE2 causes NGDP to rise. Hint: it has nothing to do with banks.

PS. Just to be clear, I am not expecting miracles from QE2. At the time I guesstimated that the markets had raised their 2011 NGDP growth forecasts from about 3.5% to 4.0% in the dog days of summer, to about 5.0% to 5.5% after QE2 was announced in early November. I still think we are in that ballpark, but obviously a collapse of the House of Saud or another euro crisis would shake things up. I’d still like to see about twice the monetary stimulus that we got, even though (paradoxically) I think we are gradually transitioning from an aggregate demand shortfall to an aggregate supply shortfall. But I continue to believe that more AD would boost the supply-side of the economy, mostly by speeding the removal of 99 week UI.

PPS. And no, $1200 billion in QE would not have provided “twice the stimulus.” It’s all about expectations.

Tags: QE 2

3. March 2011 at 14:05

Hi, I’m a business owner that operates as per Scott Sumner’s model of the economy. I follow NGDP very closely, and when I expect that this measure is going to increase, I increase my output, irrespective of the actual demand for the stuff I produce. And that of course means buying more inputs to my business, regardless of how sustainable my business model is.

When people feel wealthy because of unsustainable purchases like that and then go spend that phantom wealth, I immediately recognize that as an enhancement of economic health — the ability of market transactions to provide the goods people want in the most efficient way. And if people don’t buy cars at the rate they did in 2005 — well, that’s a bad economy. And that’s not what I want. Because it means smaller nominal GDP numbers, after all.

Since NGDP is a great measure of my well-being, I always believe we’re doing better off on average when it goes up.

3. March 2011 at 15:15

If it didn’t happen then how does Kling explain this?:

http://www.bloomberg.com/apps/quote?ticker=USSWIT2:IND#chart

The two year inflation zero coupon swap rose from 0.92% on 8/26/2010 to 2.37% on 3/2/2011. Since the implosion of inflation expectations in late 2008 the highest it had closed prior to QE2 was 1.74% on 4/30/2010. In fact this is the highest level that 2-year inflation expecations has been since 8/28/2008.

It didn’t happen, and yet, there it is. Time for Kling to clean his glasses and get a new model of economic reality.

3. March 2011 at 15:29

“At the time I guesstimated that the markets had raised their 2011 NGDP growth forecasts from about 3.5% to 4.0% in the dog days of summer, to about 5.0% to 5.5% after QE2 was announced in early November. ”

—–

Scott, how do you do this? What do you use to guesstimate the market’s forecast for NGDP growth? If you’re using some sort of market expectation for inflation, how do you go from there to NGDP?

3. March 2011 at 17:27

“Worked” might be defined as, “returned NGDP expectations back to trend levels in a reasonable time frame.” Did it accomplish this?

In other words, if we had an NGDP level targeting regime, would the Fed be correct in signaling that QE2 will end as scheduled (June 30)? If not, then shouldn’t the markets be selling off on the expectation of that premature policy tightening?

It strikes me that if QE works through the wealth channel, that stopping it prematurely should have a “reverse wealth effect”. After all, it would send a strong message about the path of future policy.

BTW, I’m not sure where we are on meeting a level target, but I would note that 5yr TIPS spreads ended the day at 2.69%. (Using the duration-adjusted 4/15/15 TIPS bond for the TIPS real yield.) Are we still falling short?

3. March 2011 at 17:57

This just in:

Thanks to David Andolfatto of the FRBSL (and MacroMania) and his colleague Kevin Kleisen I’ve been able to find data on 2-year inflation expecations estimated from the 2-year TIPS. These numbers come from the data file of a Finance and Economics Discussion Series Working Paper called “The TIPS Yield Curve and Inflation Compensation” by Refet S. Gurkaynak, Brian Sack, and Jonathan H. Wright:

http://www.federalreserve.gov/econresdata/researchdata.htm

The estimated 2-year TIPS spread rose from 0.65% on 8/26/2010 to 2.21% on 3/01/2011. Since the collapse of inflation expectations in late 2008 (it stood at -4.9% on 12/10/2008) the highest it was estimated to be prior to QE2 was 1.67% on 5/3/2010. This is the highest level that 2-year inflation expectations has been by this measure since 7/22/2008. These results suggest a much stronger rise in AD than even those by the 2-year inflation zero coupon swaps.

3. March 2011 at 18:20

Scott

You´re inside the “he said I said…I didn´t say what he said I said…” “game”.

http://economistsview.typepad.com/economistsview/2011/03/long-and-vairable-lags-in-monetary-policy.html?utm_source=feedburner&utm_medium=feed&utm_campaign=Feed%3A+typepad%2FKupd+%28Economist%27s+View+%28typepad%2FKupd%29%29

3. March 2011 at 19:33

I’ll agree that QE2 worked, but not that it happened.

The increase in reserves is irrelevant because:

1. Since banks are not currently bound by reserve requirements, reserves and T-bills are perfect substitutes. If swapping short-term for long-term bonds is ineffective, than swapping bank reserves for long-term bonds will be equally ineffective.

2. With or without QE2, it is widely expected that the Fed will eventually be draining reserves from the system, or at least raising IOR and/or reserve requirements so that those reserves lose their power. Whether reserves go up or down today has no obvious relevance to the question of where they will be several years from now, which is what really matters.

AFAICT QE2 was basically the Fed’s way of saying, “Hey, look at us, we’re doing something! We’re not sitting idly by while the inflation rate continues to fall and the economy fails to recover.” Substantively, the Fed’s actions were offset by the Treasury’s actions, so there was no net QE2, but what matters is that the Fed was perceived to be taking action.

3. March 2011 at 23:04

“AFAICT QE2 was basically the Fed’s way of saying, “Hey, look at us, we’re doing something! We’re not sitting idly by while the inflation rate continues to fall and the economy fails to recover.”

bingo. “look reserves! so, so many!”

4. March 2011 at 05:48

Harless: “Substantively, the Fed’s actions were offset by the Treasury’s actions, so there was no net QE2, but what matters is that the Fed was perceived to be taking action.”

I hereby nominate Tinkerbell for the next open Fed seat, and Obi-wan Kenobe for the Chair.

So one question I have is do market actors need to believe in the connection between nominal and real effects for them to be transmitted, or can that connection break down? For example, if market actors in the UK expect stagflation wouldn’t the stock market-investment and asset price-wealth effect be disrupted?

4. March 2011 at 06:33

Andy,

The problem with the “Tinkerbell” effect lies in the nature of the original concept in the Peter Pan story: what happens if, while you are flying, you stop believing?

4. March 2011 at 08:33

David,

That’s certainly an issue, but it’s important to note that (since there are many agents involved, most of whom are uncertain about their outlook) “belief” is not a binary variable. I think QE2 has robustly improved the aggregate state of belief, but not as much as one would hope. There may be some backsliding, but we’ll almost certainly still end up somewhere between where we should be and where we would be without QE2.

Also, it’s not strictly a matter of belief, because the Fed can still make good on the implied promise to provide yet more stimulus if it should become necessary. It’s like flying with a parachute attached in case you stop believing. The remaining question is whether the parachute really works: is the Fed really as committed to its stimulus as the market originally thought? Of course one hopes not to have to find out the answer.

I’d also note that, even though QE2 “didn’t happen” in aggregate, it did happen from the point of view of one who is watching only the Fed. Since what matters most is the Fed’s future action, the Fed’s current action may provide a valid signal even if it is offset by the Treasury’s action.

4. March 2011 at 09:08

OGT: “…do market actors need to believe in the connection between nominal and real effects for them to be transmitted, or can that connection break down?”

I don’t think it can break down completely, but it can certainly weaken (as it did during the 1970’s). There would still be menu costs, and some nominal shocks would still be unanticipated and therefore have real effects. Plus we still don’t really have a very good economic explanation of why wages are so downward sticky: psychologically, I’m inclined to believe that this stickiness would continue even if market actors stopped believing in it. So I think, when the inflation rate is very low, you can still get substantial real effects from nominal shocks no matter what people believe.

In your UK example, though, the stock market mechanism wouldn’t just prevent the real effect; it would increase money demand and thereby offset the original nominal action. But it would probably be countered by the exchange rate effect, which would get stronger if people expected stagflation.

4. March 2011 at 09:47

Andy,

Point taken on the non-binary nature of belief. I would argue, however, that the Fed has to over-commit in order to provide a parachute. That is, if the Fed targets an 9% NGDP rate and falls short, there is a parachute there. If it targets a 5% rate and falls short, we are back in recession risk — no parachute.

In other words, for the Tinkerbell effect to work, there has to be a trade off between inflation risk and stimulus. The fact that the Fed pussyfoots around this trade off means that its stimulus is unlikely to change expectations. If you keep threatening “we have the tools to contain inflation”, why should markets believe you will deliver on the promise of a strong NGDP recovery?

4. March 2011 at 14:23

I was surprised your response to Thoma didn’t focus on the logic of the expectations trap. As I understand it he claimed that with rates above 0 he believed that monetary policy dominated as described by Woodford but that he wasn’t sure the fed could “credibly commit” to raising inflation at the 0 bound. I think QEII pretty much blew that up and he’s basically shopping the same conclusions without the plausible causation he used to have. I actually think theres probably some truth to the god in the gaps argument but its a second best policy that is actually harder than the first best of having the fed hit its target.

5. March 2011 at 07:28

Silas, You must be the only business owner who thinks the near to medium term outlook for “the economy” has no impact on your business decision. I suppose you think GM would go ahead with plans to build three new auto manufacturing plants if they saw a steep depression on the way.

Mark, Yes, although I’d say the first part of that increase was QE, and the later part was partly factors like Libya.

Dustin, It’s very subjective. A mixture of higher inflation forecasts from TIPS markets, and higher RGDP forecasts from leading private sector and Fed forecasters. I know that’s not scientific, but its the best I can do. Last summer the 2011 RGDP forecasts had slipped to about 2.5%, and I added on 1 to 1.5% inflation.

David, With NGDP targeting the fed would have done much more. You said;

“In other words, if we had an NGDP level targeting regime, would the Fed be correct in signaling that QE2 will end as scheduled (June 30)? If not, then shouldn’t the markets be selling off on the expectation of that premature policy tightening?”

That’s not a problem, as QE2 works mostly through higher NGDP growth expectations, and the mechanical aspects are much less important.

That TIPS spread is plenty of inflation if it were core inflation, but it’s driven by high commodity prices, especially oil. That’s a supply shock. That’s why I continue to insist that NGDP is better than inflation. The Fed uses core inflation, and that clearly won’t get back to trend for many years, if ever.

Mark, Thanks, but these data just make me think how much we need a NGDP futures market, or at the very least a core inflation futures market. Both AD and AS affect headline inflation.

Marcus, That’s a lot of huffing and puffing about a tiny distinction in language. He clearly thinks the lags are too long for the effects to occur so soon. I guess I overstated his certainty on that point–I’ll try to be more careful next time.

BTW, I recall Friedman talking about a “distributed lag,” with some effects occurring immediately, but the peak effects occurring in about 18 months. Surely Friedman would acknowledge that if QE causes the dollar to depreciate, oil prices rise immediately. Does anyone know of a Friedman quotation that talks about distributed lags?

Andy, I agree with everything you say except the first sentence. I’d say, it did happen, it should have been nearly irrelevant, but it was highly relevant as a signal of future changes in the monetary base (relative to demand). But that’s always true. Even if rates are 5%, a temporary doubling of the monetary base (for one week) has almost no effect.

OGT, You are right about the wealth effect, but I don’t see that as very important. There are other effects if nominal asset prices rise but nominal wages are sticky.

I just saw Andy had a similar answer.

e, Good point, I think QE2 blows the credibility problem right out of the water.

6. March 2011 at 20:31

Arnold Kling wrote: “I recall reading recently that QE 2 was basically canceled out by offsetting changes in Treasury funding operations. That is, as the Fed bought more long-term bonds, the Treasury issued more long-term bonds relative to short-term securities.” Why would this be “canceling out”? By buying bonds, the Fed is injecting money into the economy. If the people who receive this money–the former bondholders–immediately use it to buy similar bonds newly issued by the Treasury the effect will have been to put new money in the hands of the government. But this should be just as stimulative as putting it in private hands–unless the government planned to hold it rather than spending it, which is manifestly not the case.

The point of quantitative easing is to get more money in circulation. The amount of treasury securities, whatever the maturity, is irrelevant.

7. March 2011 at 06:45

Philo, I agree, but there is a (Keynesian) argument that monetary policy works by changing interest rates. If so, and if short rates are near zero, it must reduce long rates. If the Treasury creates now long term bonds just as fast as the Fed buys them, it may do nothing. I think this argument is wrong on almost every level, but it’s out there.