Why you should believe the Chinese GDP data

[There’s a much better China post just put up at Econlog.]

Here’s a typical news story about China:

Red-handed: China province admits faking economic data

A Chinese official has admitted his province falsified its economic data for years, state media said Wednesday, vindicating long-held suspicions that China has been cooking the books.

So why do I believe the Chinese GDP data? Lots of reasons:

1. This headline refers to provincial data. For years, if not decades, the Chinese central government has admitted the provincial data is inflated. For any given year, if you take an average of provincial GDP growth rates you end up with a figure that is substantially above the national growth rate. How is that even possible? The answer is simple; the national government knows the provincial data is inflated (as provincial officials are given promotions based on success in boosting GDP) and hence the national figures are developed using a completely different data set.

2. How plausible is it that Chinese GDP would keep growing at the same astronomical rate, year after year? Not very, but that’s not what the data shows. RGDP growth has slowed from over 14% in 2007, to 10.6% in 2010, to about 6.7% today. In contrast, US GDP growth has stayed right around 2% every single year since 2010. It’s true that quarter-to-quarter changes in China are small, but that’s partly an artifact of their smoothing technique (reporting year over year figures) and partly due to China’s size and high degree of diversification. Also keep in mind that if the level of Chinese growth were inflated by, say, 13.7% every single year, due to reporting biases, then the growth rate would not be distorted at all. You need increasing distortions to consistently inflate growth.

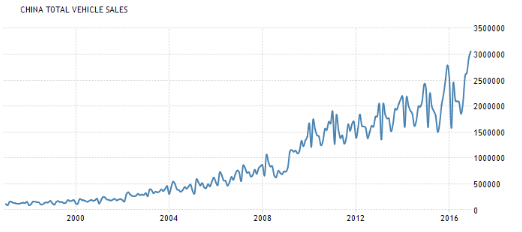

3. Everywhere you look, you see micro level data that tells a story of extraordinary growth. China going from a trivial part of the global economy, to a place that absorbs almost 1/2 of global output of key commodities. A place where auto sales have exploded:

Note that these figures would be almost impossible to fake, as they are also available broken down by company. Would Ford, GM and VW be telling their stockholders completely phony stories of massive auto sales growth in China?

Note that these figures would be almost impossible to fake, as they are also available broken down by company. Would Ford, GM and VW be telling their stockholders completely phony stories of massive auto sales growth in China?

Everywhere you look you see a similar story, an explosion of urbanization. Infrastructure built at a phenomenal rate. The China I visited in 2009 was a completely different country from the China of 2002. Here’s an example:

To appreciate the extent of China’s high-speed rail ambitions, take Mr Gu’s dreams and multiply them many times over. Less than a decade ago China had yet to connect any of its cities by bullet train. Today, it has 20,000km (12,500 miles) of high-speed rail lines, more than the rest of the world combined. It is planning to lay another 15,000km by 2025 (see map). Just as astonishing is urban growth alongside the tracks. At regular intervals—almost wherever there are stations, even if seemingly in the middle of nowhere—thickets of newly built offices and residential blocks rise from the ground.

Ditto for the world’s largest expressway system, built almost overnight. Enormous growth in subways, airports and other types of infrastructure.

Yes, there are sectors like steel and coal that have recently struggled, but there are also sectors growing faster than average, such as services, which is now more than 1/2 of GDP.

Obviously I don’t know that RGDP growth in China is exactly 6.7%, but I also don’t know the exact growth rate in India, the US, and especially in Ireland. All GDP data is flawed. But when you look at the spectacular changes occurring in China, a figure of 6.7% seems very reasonable.

PS. The Economist article on China’s high-speed rail is excellent, with the first half devoted to its successes and the second half to its wasteful excesses. They consistently have some of the most balanced pieces on China. If you simply read China bulls or China bears, you will have no idea what’s actually going on in the country.

Tags:

18. January 2017 at 13:29

“GDP is the total market value of all final goods and services produced in a country in a given year. To make meaningful comparison, PPP is used to compare economies and incomes of people by adjusting for differences in prices in different countries.

According to data provided by IMF Outlook (April-2015), China overtook United States as the world’s largest economy in terms of purchasing power parity (PPP). GDP of China stands at $17.6 trillion international dollor {sic}.”

http://statisticstimes.com/economy/world-gdp-ranking-ppp.php

18. January 2017 at 15:31

Sumner: “For years, if not decades, the Chinese central government has admitted the provincial data is inflated….the national government knows the provincial data is inflated … and hence the national figures are developed using a completely different data set” – with ‘logic’ like this, it’s understandable why Sumner believes in the unproved metaphysics known as monetarism. Question for Sumner: who collects the ‘completely different data set’? Why, the provinces do…duh.

As for private sector auto sales, keep in mind such projects are joint ventures with the Chinese “Red Army” hosts. Of course Volkswagen et al are going to fake the data, if they know what’s good for them. What matters however is how much money these joint ventures repatriate back home, and I bet it’s not that much.

18. January 2017 at 15:32

“How is that even possible? The answer is simple; the national government knows the provincial data is inflated (as provincial officials are given promotions based on success in boosting GDP) and hence the national figures are developed using a completely different data set.”

Or, the national figures are ALSO inflated, and the provincial figures are massively inflated, which makes it superficially appear the national figures are accurate.

18. January 2017 at 15:37

Scott,

These are very good points, especially #2. I would make a more general statement that, as you also point out, it is very difficult to fake any economic data, because it is hard to fake all economic data, and all economic data must be faked and deemed credible in order for any single number to be faked credibly.

I don’t just mean that such a vast conspiracy would be hard to maintain for any length of time, but that governments don’t know enough economics to fake all numbers and make them seem realistic for very long. There’s no reason to believe anyone does.

This is especially true since private entities construct their own metrics, based in part on government data. Absurd contradictions would quickly begin to show up in many places, beginning to bring the data reporting and processing into serious question.

This is why the Venezuelan government, for example, doesn’t publish false inflation numbers. They just stop publishing the numbers altogether.

18. January 2017 at 16:14

Scott Sumner has been right and the China Bears have been wrong for years in a row now.

Sumner raises a key point about Western investors. Why are such investors as Blackstone buying real estate in China? Cruise lines building ships to ply the China coast? Japan is being flooded with China tourists (President Xi is trying to limit that business.)

I think it is impossible that the China banking system will collapse. The People’s Bank of China buys sour loans. End of problem.

Perhaps there are things we can learn from China.

18. January 2017 at 20:41

Scott if you get really bored you can round up all those ghost cities of China articles and post a little follow up if they are still boondoggles or actually full of people. I think everyone from the economist to Vice has written an article or two about it.

Very few have covered what I think is massively under reported: China’s investment in Africa. They just completed a new rail line in Ethiopia. They are electrifying and developing Africa like no one before. Fascinating.

https://www.google.com/amp/www.bbc.co.uk/news/amp/37562177?client=safari

18. January 2017 at 20:55

Ray sees conspiracies everywhere . . .

who is behind that grassy knoll, Ray?

Benny, Some of the ghost cities are filling up, some remain a problem. Two to watch are Binhai and Ordos

18. January 2017 at 22:58

I’m persuaded that GDP is more misleading (as a useful measure) the larger the government share is. (For laymen like myself, a yuan of government spending is a yuan of GDP even if it’s wasted on a no-show job, because that’s how we calculate GDP.) Is it possible that the shrinking growth rate is composed of two parts: 1) the dynamic private sector falling apart, and 2) the government sector growing?

19. January 2017 at 02:50

I believe they will buy a lot of Mazda

CX?

19. January 2017 at 04:48

OT but…

http://asia.nikkei.com/Politics-Economy/Economy/New-housing-may-stand-in-way-of-Japan-s-inflation-target

Mercy me, see above.

While Yellen plots to keep unemployed one in 20 Americans who want to work, Japan is building apartments and holding inflation way down.

I like the Tokyo approach better.

American orthodox macroeconomists seem to have ossified into uselessness.

19. January 2017 at 08:00

Ray Lopez,

Why would foreign car makers inflate their sales number in China? To pay more taxes?

19. January 2017 at 10:07

“Ray sees conspiracies everywhere . . .

who is behind that grassy knoll, Ray?”

Ted Cruz’s father, of course. At least according to Trump…

19. January 2017 at 13:26

China may produce much less stuff than official numbers indicate, but what cannot be denied is the amount of chatter it generates in the Western media.

The (maybe not so) mighty Chinese economy can sway everything from stock markets to presidential elections!

19. January 2017 at 17:33

Before this report, Sumner would have called it a conspiracy theory.

19. January 2017 at 18:20

@chu – “chu”, a Chinese nym; I wonder, are you part of the Fifty Cent Army? Educate yourself chu: “GM and Ford Hope for Extension of Tax Break in China as Sales Jump” (Dec 2016 story) – GM, Ford, others, pay no tax on Chinese cars, for now. So of course they will ‘play ball’ (play ball: do you know what that passcode phrase means? If not, you’re a spy).

@ChargerCarl – of course Ted Cruz’s father was at the grassy knoll…just Google it: ‘Ted Cruz: “Yes My Dad Killed JFK”‘

20. January 2017 at 08:09

@Scott,

I thought you’d enjoy this sentence from Bernanke’s post on Jan 13.

*Developments that push the forecasted path of the economy away from the Fed’s employment and inflation objectives require a compensating policy response; other changes do not.*

20. January 2017 at 10:39

I think it is perfectly reasonable to claim that Chinese data will not be reliable in identifying a big crash in China if it comes. But to think this data can be falsified indefinitely is ridiculous. The level overstatement you would need at this point is simply absurd. Of course, China is just now ripping past Mexico in GDP/capita. It will be interesting to see how they do as they move up the pyramid. I’m guessing they can get to $15K per capita per annum with their current model. But their massive investment in infrastructure will definitely be beneficial. Based on observing the biggest problems for growth in the United States, if a state is rapidly urbanizing, I think it is literally impossible to over-invest in infrastructure (unless your planning is truly terrible).

20. January 2017 at 11:03

Hey….ChargerCarl… congrats on getting our Chargers… It really makes waaaay more sense for them to move to LA then to stay here…

I was against spending a dime in welfare for billionaires…and I’m proud that my city agreed…

I had zero hard feelings about them moving….But what really hurt was that New logo..

Dude….I’m not an LA hater at all…I love LA… And I could have worn the bolt…

But I can’t wear that new logo…it’s feels like they went out of their way to give San Diego fans a parting FU…

20. January 2017 at 11:14

Ray Lopez,

You need to improve your reading skill. First, my name is not chu. Second, foreign car MAKERS does pay taxes in China, although taxes for CONSUMERS can be reduced from time to time.

20. January 2017 at 11:36

@cbu – thanks chu, I stand corrected. I was looking at several articles online and assumed GM had a tax treaty with China; guess I was wrong. Anyway, unless somebody breaks down the sale of units reported by GM, BMW, Ford, etc for China, and compares this data to the officially reported China data for car sales, I doubt the official number is 100% accurate. After all, who are you going to sue if the number is propaganda? Sue in the World Court at the Hague?

20. January 2017 at 14:33

Ray Lopez,

I think you are right in the sense that foreign car makers do not really have to pay tax for a car until they actually sell the car on the Chinese market. They probably do not have to pay tax by just bringing in a car to China or manufacturing the car in a joint venture in China.

21. January 2017 at 10:46

@cbu – see this story, fake China numbers acknowledged: http://www.bbc.com/news/business-38686570

20/1/2017- Some analysts turn to electricity consumption or seaborne cargo believing that these are actual measurable indicators of activity expanding or contracting.

Other potential yardsticks could include building construction per square metre or domestic freight volumes.

Using these measures there are those who think that, in recent years, China’s actual GDP growth should have dropped much more dramatically from 8% down to more like around 4% rather than just below 7%.

22. January 2017 at 11:10

bill, I will do a post at Econlog, in a few days.

Ray, I’ve been hearing those claims for 30 years. If true, China should be dirt poor, not a middle income country.