Why the Fed will raise rates

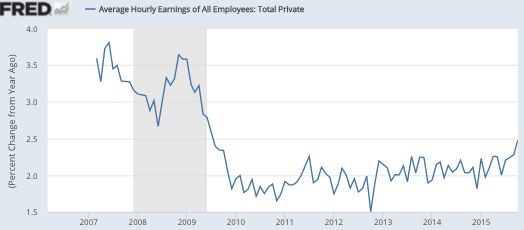

Of course the headline number is the 271,000 payroll jobs created last month. But the real reason the Fed is likely to raise rates in December (barring some unforeseen shock in the November jobs report, or international crisis) is the wage number:

With the October figures, year-over-year wage growth has risen to 2.5% (actually 2.48%). It does look like we are finally getting some faster wage growth.

With the October figures, year-over-year wage growth has risen to 2.5% (actually 2.48%). It does look like we are finally getting some faster wage growth.

Of course you also see lots of zigzagging. Nonetheless, I think the October data makes it likely that the underlying trend has finally moved above the roughly 2% rut we’d been in since 2009. Perhaps 2.4% is a reasonable guesstimate. That’s still less than the pre-recession wage trend line (around 3.5%), but I don’t expect us to get back to that rate of growth in wages. My hunch is that 2.5% to 3.0% will be the new normal, over the next 5 years.

Right now I’m a bit puzzled by the TIPS spreads. They’ve moved up slightly in recent weeks, but the 5-year spread (1.32%) still seems somewhat inconsistent with the underlying trend wage data, which suggests 1.5% to 2.0% inflation.

I seem to recall that Yellen is very interested in the wage data, which is why I think the Fed will raise rates in December. Rising wage growth suggests we are back at the natural rate of unemployment. The rising wage growth also makes it slightly more likely that the Fed is on target for 2% trend inflation, although the TIPS spread suggest otherwise. I can’t reconcile those two numbers, unless the TIPS market is pricing in another recession in the next 5 or 10 years, during which time inflation would slow once again.

If there is no recession in the next 5 years, then the current TIPS spread of 1.32% seems implausibly low, given rising trend wage growth. Perhaps some of the mystery is explained by a liquidity premium on conventional bonds, depressing TIPS prices and raising yields closer to conventional bond yields. Or maybe October’s wage growth was a fluke.

To conclude in my typical wishy-washy way, I still don’t see a compelling case for a rate increase in December, but I also don’t see much evidence that it would do significant harm to the economy. The recent data makes it a close call. The Fed’s real problem now is not next month’s fed funds target, it’s that it lacks a long run strategy for monetary policy. It still has not learned how to operate in a low NGDP growth environment—and better come up with a plan before the next recession.

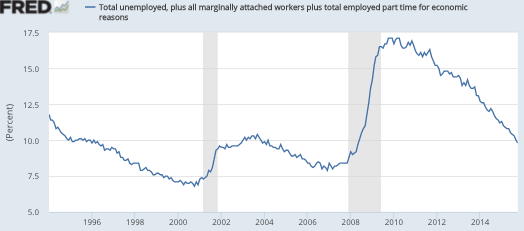

PS. No, the U6 unemployment rate (9.8%) is not horrible. It was 9.7% in October 2004, 15 months before the housing boom peaked. In was 9.7% in July 1996, almost half way through the Clinton boom. It’s not a great number, but it’s not horrible.

In other news, China’s bear market in stocks is officially over, as shares have risen more than 20% from August lows. There are lots of reports that the consumer sector in China is red hot:

More than 1m Chinese will go on a cruise holiday this year “” nearly five times as many as in 2012 “” a statistic that has whipped the global industry into a record expansion of ship orders and a collective decision to sail the world’s largest and most luxurious mega-vessels eastward.

The government also announced that the Hong Kong and Shenzhen markets will be linked later this year. The RGDP growth target for 2015 to 2020 was just announced at 6.5%. Apocalypse later?

Tags:

6. November 2015 at 08:05

Maybe markets don’t think wage growth in extended expansions is inflationary.

6. November 2015 at 08:06

‘In was 9.7% in July 1996, almost half way through the Clinton boom.’

You mean the Bush-Clinton boom that started in 1991?

But, as for the Fed ‘raising interest rates’, if we do get higher inflation we’ll get higher interest rates even if the Fed does nothing new.

6. November 2015 at 08:07

If there is no recession in the next 5 years, then the current TIPS spread of 1.32% seems implausibly low

Credit spreads are widening again and the general consensus is that we are approaching the end of the cycle. So with the market implying low predicted inflation, risky credit, and a higher predicted FF rate, I think that you can make a story that is consistent with all that and quite plausible, too; namely, the Fed is going to raise rates too much, too quickly, and throw the economy into a recession. You are probably correct that the December decision doesn’t matter much in the long run, but the market doesn’t have much faith in how gradual the later increases will be.

6. November 2015 at 08:41

You know, if you brought an economist from the 1960s and had him read this blog, he would say “Inflation at 1.32% and you guys are cutting the engines? Are you nuts?”

“No,” some would answer. “It is worth it to wipe out a couple trillion dollars of output in order that the PCE read at 1.5% instead of say, horrors, 2.5%.”

6. November 2015 at 09:19

Off topic: I got my copy of The Midas Paradox! Tyler Cowen says that it is “highly recommended”.

6. November 2015 at 09:26

Prof. Sumner, what do you think will happen after the Fed raises rates? Is it possible that the markets will crash and the Fed will be forced to lower rates back, possibly into negative territory?

Another question: suppose it becomes apparent that, in order to avoid a crisis, the Fed needs to set rates lower and lower each year. E.g. in 2016 it needs -1%, in 2017 it needs -2%, in 2018 it needs -3%. Is this theoretically possible? What would you advocate in such a situation? Thanks

6. November 2015 at 10:02

Much ado over nothing. Experts agree, see below. – RL

Bradford-delong.com – Nov. 5, 2015 post:

And then there is fourth view, one that I associate with Larry Summers and Paul Krugman, that we have no warrant for believing that monetary policy can restore full prosperity not only not in the short-run, but not in the medium-run and probably not even in the long-run. As Krugman put it most recently:

In 1998… I envisaged an economy in which the… natural rate of interest… would return to a normal, positive level… [and so] the liquidity trap became a [monetary-]expectations problem… monetary policy would be effective if it had the right kind of credibility…. [But if] a negative Wicksellian [natural] rate… permanent… [then] if nobody believes that inflation will rise, it won’t. The only way to be at all sure… [is] with a burst of fiscal stimulus…

Their position is, after a long detour through the post-World War II neoclassical-Keynesian synthesis, a return to a position set out by John Maynard Keynes in 1936…

6. November 2015 at 11:02

Scott, what are the market signals you reference (tips spreads, nominal long yields, NGDP) telling you about the tightness of money?

6. November 2015 at 11:58

The five-year breakeven inflation rate on FRED has been trending higher lately. Does anyone think it will head significantly lower as a result of today’s monetary tightening?

6. November 2015 at 12:50

This new analysis by James Alexander and Mark Sadowski deserves more attention:

https://thefaintofheart.wordpress.com/2015/11/05/the-us-is-going-to-fall-behind-the-euro-19

“The US is going to fall behind the Euro 19”

6. November 2015 at 14:17

Kevin, Yes, but I’d expect a bit higher inflation if wage growth speeds up.

Patrick, Good point.

Njnnja, That’s possible, I’m agnostic on US growth prospects. Stocks are doing well.

Ben, Yes, we’ve become pretty obsessive about inflation.

Don, Not just highly recommended, “self-recommending.”

Ray, If we’ve returned to 1936 then we are even worse off than I thought.

David, There are different ways of thinking about the tightness of money. If you look at NGDP growth, it’s slowing a bit. But the labor market seems to be reaching equilibrium. No big problems there. If you look at the Fed’s inflation target, they seem to be falling short, and I would look at TIPS spreads for that issue.

Travis, I don’t think money got tighter today. Rates rose, but mostly due to the income effect, not tighter money.

6. November 2015 at 14:42

Scott, you said, “If you look at NGDP growth, it’s slowing a bit.” How do you reconcile the increase in wages with the slowing of NGDP growth? I’ve been assuming that the low wage growth over the last few years was just a reflection of the relatively low NGDP growth when compared to pre-recession levels. Was that a bad assumption?

6. November 2015 at 15:05

“Right now I’m a bit puzzled by the TIPS spreads. They’ve moved up slightly in recent weeks, but the 5-year spread (1.32%) still seems somewhat inconsistent with the underlying trend wage data, which suggests 1.5% to 2.0% inflation.”

Does Sumner purposeful bask in writing ignorant statements? As I explained repeatedly on this blog, the level of TIPSs spreads are not a one for one estimate of the market’s inflation expectations. TIPS bonds have an implicit call option. TIPSs spreads can decline in the face of higher inflation expectations.

6. November 2015 at 15:45

A rare voice of good sense in UK macroeconomic policymaking-

http://www.bbc.co.uk/news/business-34741331

6. November 2015 at 16:26

If Fed policy was NPLT, we’d have QE4.

6. November 2015 at 16:50

Scott, did you climb into the “hole in the hull” wage-inflation boat?

https://thefaintofheart.wordpress.com/2015/11/02/why-have-such-a-large-research-staff-if-their-results-are-ignored/

6. November 2015 at 17:45

@Sumner, who says: “Ray, If we’ve returned to 1936 then we are even worse off than I thought.” – reeding comprehension professor. Your colleague DeLong is referring to economic theory in 1936, not the state of the economy in 1936. But of interest to me re-reading the passage I quoted is that DeLong states his prior belief that monetary policy probably worked in the long run (“we have no warrant for believing that monetary policy can restore full prosperity not only not in the short-run, but not in the medium-run and probably not even in the long-run”) which is the opposite of what textbooks (and you) say, that it only works, at best, in the short-run. I think it’s a DeLong typo, but he does have some eccentric views.

6. November 2015 at 17:58

@marcus nunes – educate yourself here:

https://www.timeshighereducation.com/blog/news-blog-economics-based-shaky-statistics (“This makes it particularly concerning that researchers working for the United States Federal Reserve and the US Treasury have found that more than half of economics papers aren’t replicable”)

Presumably this half of bogus papers includes the Fed’s own work.

6. November 2015 at 19:04

Can we mark this week as a beginning of a test? The advocates for monetary easing appear to have gone on record that a rate hike will be bad for the economy. So if in 6 months rates have been raised what economic performance would prove this assertion correct? What economic performance would prove this assertion wrong?

If in 12 months the funds rate is at 2% and unemployment is below 5% will that prove Sumner wrong? Clearly it would show his calls against a rate hike were wrong. For he has said a rate hike now would be wrong. I suppose it will come down to his definition of wrong.

6. November 2015 at 20:03

Here’s a “dry powder” theory: maybe the Fed is talking about raising rates (without actually intending to raise rates) so they can, if needed, stop talking about raising rates as means of loosening policy while still at zero.

6. November 2015 at 20:16

‘Patrick, Good point. ‘

Here’s another; if the Fed sells bonds thinking that will reduce liquidity to the economy and thus raise interest rates, it could actually lower rates by inducing a recession.

7. November 2015 at 01:00

At least Caroline Baum thinks NGDP growth not good enough to think of raising rates.

http://www.marketwatch.com/story/maybe-the-fed-needs-a-growth-target-like-chinas-2015-11-05?mod=mw_share_twitter

7. November 2015 at 04:33

For your average hourly earnings chart, the production and non-supervisory chart goes back to 1965 rather than just 2007 – puts things in a different light.

https://research.stlouisfed.org/fred2/graph/?graph_id=266632

7. November 2015 at 05:54

Gordon. Good question. Wage growth depends on two factors, current NGDP growth, and the lagged response to past NGDP growth. During 2010-15, wage growth was slower than would have been justified by NGDP at the time, because it was responding slowly to the huge negative NGDP shock of 2008-09. Now that lagged response seems to be roughly concluded, and thus wage growth should track NGDP growth, as long as they are smooth.

This implies that profits will grow more slowly than during 2009-15.

Marcus, I don’t think wages predict changes in inflation, but they may be helpful in figuring out the underlying trend rate of core inflation.

Ray, That’s what I meant, economic theory circa 1936, which was horrible.

Dan, I said:

“To conclude in my typical wishy-washy way, I still don’t see a compelling case for a rate increase in December, but I also don’t see much evidence that it would do significant harm to the economy.”

Does that answer your question? Or do I need to explain the meaning of each individual word to you?

7. November 2015 at 06:16

Scott,

While visiting Econlog refresh yourself on Bastiat’s essay on the “seen and unseen”

http://www.econlib.org/library/Bastiat/basEss1.html

You claim you don’t see the benefits of higher rates. At the same time you bemoan the existence of low rates. Yet you then say lacking clear evidence you would prefer to keep rates low. I think you have it backwards! All things being equal and lacking strong evidence to the contrary it would be better to raise rates.

(1) When the next crisis comes would it not be better for the central banks to have flexibility in lowering rates? Changing the funds rate is proven to be a much simpler mechanism for the central bank to operate than QE and other unconventional forms of stimulus. But in order for the bank to have the ability to lower rates in times of financial turbulence rates needs to be higher!

(2) Tens of millions of people will be made richer by an increase in interest rates. Their benefit may be “unseen” by you but it is real.

Lacking a compelling case to keep rates low the policy bias should be to return rates to a more normal level, which historically is above 1%.

7. November 2015 at 06:55

@Dan W. – Sumner is saying, at the present, money is largely neutral. He of course would never admit this, but in practice that’s what he’s saying at the moment, that rates are irrelevant to the present economy.

Sumner has great flexibility, and to try and pin him down is like spearing a jellyfish. Just when you thought you had nailed the spineless critter, he morphs and slips away. Nothing Sumner ever says is falsifiable, and never will be. Sumner is immortal, his theory pristine, internally consistent to the mind of Sumner, and, like MF, he don’t let facts get in the way of his ideology.

But times are bypassing Sumner; he is yesterday’s man. Note:

Editorial by a certain David Brown in South China Post: “Monetarism’s demise paving the way for a Keynesian revival ”

Forbes, guest columnist: In July 2015, Paul Krugman wrote that “Gold bugs have taken over the GOP.” The Financial Times reported that “Republicans eye return to gold standard.” The realization is dawning, in conservative circles, that the Milton Friedman Monetarism popular during the 1980s is really just another flavor of seat-of-the-pants funny-money manipulation, not much different than what Krugman himself advocates. The real monetary alternative is the approach that the United States embraced for most of its history….In 2014, we began to see a new stirring of intellectual capability, which will serve as the foundation of the epic task of global monetary reconstruction. Last year, the Cato Institute established the Center for Monetary and Financial Alternatives, headed by the excellent George Selgin. Over the past year, the discussions they have hosted at their website Alt-M.org have been of very high quality. This sort of thing didn’t really exist before.

In 2014 the Atlas Network established the Sound Money Project, headed by Judy Shelton. Again, the level of discussion at their website this year is exemplary. They recently released a book, Roads to Sound Money. More excellent material is found at the Lehrman Institute (thegoldstandardnow.org). Also in 2014, the American Principles Project, which I sometimes call the “Tea Party’s think tank,” started the Fix the Dollar Project, headed by Steve Lonegan.

George Gilder [LOL, A TREND FOLLOWER NOT A SETTER IMO, BUT HE DOES HAVE A REPUTATION–RL], the deep thinker of capitalism who was not a gold-standard advocate in the past, publicly changed his mind with the 2015 publication of The 21st Century Case for Gold: A New Information Theory of Money.”

What is the common thread here? Either a shift to the left (return of Keynesian fiscal policy), or, a shift to the right (gold standard return) but Sumner’s 3.2% – 13.2% remedy of monetarism is increasingly seen as worthless, impotent, a waste of time, yesterday’s medicine. Yet Sumner continues to preach it, simply because he’s invested so much time learning it (in his own mind, though he can’t articulate his worldview very well) that he refuses to change his tune, even when the evidence shows money is largely neutral.

7. November 2015 at 07:59

Are there any good reviews / ripostes of Eric Rauchway’s “Money Makers” yet?

7. November 2015 at 08:28

David Stockman on 2% inflation targets:

http://davidstockmanscontracorner.com/the-central-bankers-death-wish

“Folks, Mario Draghi’s central banker view of consumer inflation is just brain dead ritual incantation. Self-evidently, the rate of change does not need to be smooth as the skin on a baby’s butt for optimum economic performance.

In fact, 2% inflation is a purely religious proposition that is unrelated to the prosperity of main street; it is no more relevant to gains in real wealth than the rite of full immersion baptism.

…….

This is just plain rubbish. These half-baked propositions would have received a falling grade in even a junior college introductory economics course just 20 years ago……”

7. November 2015 at 09:06

will they raise rates ? of course, cant have low rates. will it matter? depends. how long will they last and how much will they raise them. many seem to think the Feds rates basically sets interest. they dont. all you have to do verify that is look at any credit card statement for the interest rate. might be some thing like fed rate + 10% or some thing like that. and its doesnt set the rate that banks pay either. if they wanted the money they would pay for it. and it doesnt set the rates for binds., that depends on what business wants to pay for money. long and the short of it, there really isnt much demand for money, since there isnt much demand for much of any thing. because consumers arernt doing much to demand goods (see business reports for sales, almost without exception they are stagnant, or dropping), without growing sales, business has no need for money, which leads to lower interest rates

7. November 2015 at 09:31

[…] Scott Sumner, like many, was very taken with the latest average hourly earnings figures. The tick-up seemed to be breaking a very dull trend and taking the growth rate back up to the heady heights of 2007. […]

7. November 2015 at 09:34

Ray, you said:

“like MF, he don’t let facts get in the way of his ideology.”

Look in the mirror Ray, you’re so blinded by your ideology that you want others to believe 13.2% is equal to zero.

Hahaha, such a hypocrite.

7. November 2015 at 09:59

“Tens of millions of people will be made richer by an increase in interest rates. Their benefit may be “unseen” by you but it is real.”

How be that? And how bout all-o-dem peoples with credit cards and adjustable rate payment loans…

7. November 2015 at 13:18

Dan, You said:

“When the next crisis comes would it not be better for the central banks to have flexibility in lowering rates? Changing the funds rate is proven to be a much simpler mechanism for the central bank to operate than QE and other unconventional forms of stimulus. But in order for the bank to have the ability to lower rates in times of financial turbulence rates needs to be higher!”

All I can say is I hope you are joking. As far as your socialist ideas that the government should try to artificially raise interest rates above the equilibrium level, all I can say is check out what happened when Trichet tried that in 2011.

7. November 2015 at 17:02

Scott,

I picture you as a fitness trainer. Your client is lifting weights. He has lifted 50 pounds and asks to do more. But you say no. By your observation a weight greater than 50 pounds would exceed the client’s”equilibrium level”. Time passes and it finally occurs to your client that all his friends are showing a lot more muscle than he is. And why? Because their trainers actually have their clients test the limits of their strength. And you? You are afraid to ever have your client try.

Maurizio’s question (posted above) is a relevant one. If one is reluctant to raise rates from zero when unemployment is 5%, wages are increasing at 2+% and stock markets are at record levels then when would one ever raise rates? If rates never go up it follows they will go negative. What distortion to the economy will negative interest rates cause? Under what scenario would interest rates, once negative, ever go positive? How far negative will they go until the whole apparatus falls apart?

7. November 2015 at 20:14

@Dan W: “all his friends are showing a lot more muscle”

Sorry, can you point to the specific economies that you have in mind, that raised rates prematurely and were rewarded with stronger economic growth? Where are they?

“when would one ever raise rates?”

When inflation is well above target, of course. If there’s no need to dampen inflation (or NGDP, which would be a better target), then there’s no need to raise rates.

“If rates never go up it follows they will go negative.”

No, it doesn’t. You need to get over your obsession with interest rates. There is no zero lower bound on increasing the monetary base. The central bank can easily provide additional monetary stimulus, regardless of what interest rates are (and even if they stay at zero throughout the stimulus). The bank lending channel is not a significant part of the monetary policy transmission mechanism.

7. November 2015 at 22:58

Charles Evans on CNBC:

http://www.cnbc.com/2015/11/06/feds-evans-strong-jobs-growth-will-help-push-up-inflation.html

http://www.reuters.com/article/2015/11/06/usa-fed-evans-idUSL1N13116G20151106

7. November 2015 at 23:09

Prof. Sumner, you wrote:

“Travis, I don’t think money got tighter today. Rates rose, but mostly due to the income effect, not tighter money.”

Hmmm, it’s challenging for me to understand how one could look at the data below and conclude “I don’t think money got tighter today.”

http://www.bloomberg.com/news/articles/2015-11-06/bond-traders-see-70-chance-of-fed-rate-increase-in-december#media-1

http://www.businessinsider.com/federal-reserve-december-rate-hike-odds-2015-11

“Chance of December Rate Hike Skyrockets”

8. November 2015 at 09:07

“Perhaps some of the mystery is explained by a liquidity premium on conventional bonds, depressing TIPS prices and raising yields closer to conventional bond yields.”

Do you mean a liquidity premium on TIPS? (meaning that because TIPS are less liquid than conventional Treasuries, their prices are lower and yields higher) than they would otherwise be). Conventional bonds actually carry an “inflation risk” premium (which is why Larry Summers thought the government could save money by recapturing the inflation risk premia by issuing TIPS).

8. November 2015 at 18:29

Dan, Why not let markets decide?

Travis, Rising rates don’t tell us if money is tight. At least not if the Wicksellian rate is also rising. And the strong jobs report did push the Wicksellian rate higher.

Maynard, Yeah, I always get confused by bond terminology? Why isn’t it called the “lack of liquidity yield premium?”

9. November 2015 at 06:12

It seems to me like the markets have made their peace with a December rate hike.

9. November 2015 at 07:34

I am starting to wonder if the difference in subjective inflation between TIPS buyers and wage earners is significant enough to create measurable discrepancies.

10. November 2015 at 14:54

Brian Donohue,

Great point, the same thing is on my mind!

10. November 2015 at 14:54

Does anyone have a theory for why 5-year and 10-year inflation breakevens have shrugged off the negative Fed news and moved higher?

11. November 2015 at 15:35

via Calculated Risk:

http://www.calculatedriskblog.com/2015/11/goldman-health-inflation-should-soon.html

The CPI is higher than PCEPI because negative supply shocks in housing push it higher. But, good news! Now that we have taxes and transfers pushing money into health care – another sector with supply constraints that is weighted more in the PCEPI, it will catch up with CPI inflation and make it easier for the Fed to meet its 2% mandate! Wages in the rest of the economy will be stagnant, but taking more money out of those wages to inflate the incomes of landlords and hospitals will help meet the inflation target while they raise rates. What could go wrong?

from Goldman Sachs:

“If our estimated equation is accurate and prices begin to catch up with rising wages in the sector, health inflation could potentially rise by a bit more.”

As of September, the core PCE index has risen 1.3 percent year-over-year, well shy of the Fed’s 2-percent target. A major challenge for the U.S. central bank, which has strongly hinted at liftoff for interest rates in December, will be proving that core PCE inflation can rise along with policy rate.

According to Goldman’s analysis, this key segment looks likely to cooperate in this regard, helping the central bank move closer to meeting its dual mandate.