Why supply shocks look like demand shocks

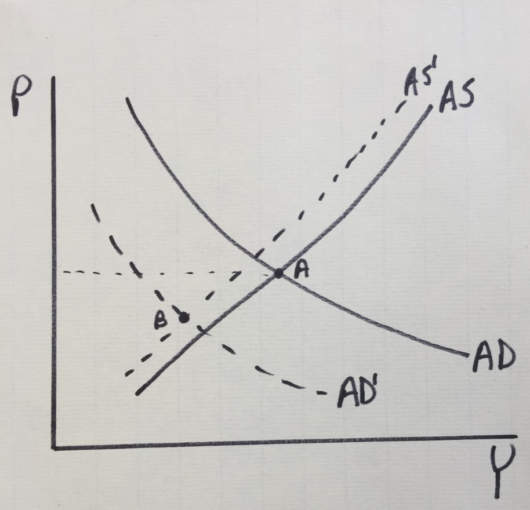

Over at Econlog I have a new post that I wrote last night, before the recent market crash. It occurred to me that it might be useful to present a graph explaining the argument I’m making.

[The original post had a graph with a typo]

You’d expect a negative supply shock to be inflationary. But lots of recent supply shocks in the global economy have reduced the equilibrium interest rate, and central banks have inadvertently tightened policy by not cutting their policy rate fast enough. Markets clearly fear another example of this in response to the Covid-19 outbreak, especially as it spreads to other countries such as Italy and South Korea.

Adverse supply shocks are inflationary. But a bad monetary policy response can be even more deflationary. That’s what the markets currently fear.

To be sure, markets are often wrong, indeed in a sense they are always wrong—events are almost never exactly as they predicted. A few weeks ago, markets were too complacent about Covid-19 becoming a global pandemic. Who knows, perhaps today they are too fearful. But markets do provide the best guess as to what’s likely to happen, and today the best guess is that the odds of recession just increased, albeit still remain below 50%.

The Fed would prefer not to cut rates. But they also need to understand that the longer they wait, the deeper they will have to cut them. Don’t slowly wade into that cold lake—jump in!

PS. Americans are increasingly “risk averse” (i.e. scaredy cats). I worry that an outbreak in the US could lead to panic.

PPS. If I don’t respond to comments immediately, that’s because I’m at the store stocking up on toilet paper.

PPPS. I’m 28 days into one of those colds where you can’t stop from coughing. I developed it the day after returning on a long flight from the Eastern hemisphere.

PPPPS. Fortunately, it was a flight from New Zealand!

Tags:

24. February 2020 at 09:32

The Fed would likely be more willing to respond to the crisis than the ECB or BoJ. The ECB may increase asset purchases, but I would be skeptical that they would do enough. The market has even less confidence than I do.

24. February 2020 at 09:37

Hah, that joke has a very similar structure to Justine Sacco’s unfortunate tweet. Hope you don’t get cancelled!

24. February 2020 at 10:02

“The Fed would prefer not to cut rates.”

The Fed has a legal mandate to keep prices steady and employment full. It has discretion in what those terms mean (although it’s hard to understand how they can have thought that allowing the price level to drift ever farther from what their supposed target of 2% average inflation since 2008 would imply meets the steady criterion) and which instruments to use to go about achieving their mandate. It’s not supposed to have “preferences” about the values of the instruments it uses to achieve its targets. It’s hard enough for markets to know how the Fed will go about achieving it’s targets; they should not have to have to guess about it’s possibly shifting preferences.

Re PP..PPPPs: Ha Ha

Re PS: “Risk averse” depends on framing. One can be afraid of doing “too much” or “not enough” about Covid 19, ACC, GMO’s, opiods, or whatever. Personally I’m more afraid of overreaction to Covid 19 and GMOs and underreaction to ACC and opiods. Others’ mileage may differ

24. February 2020 at 10:19

I love this new graph, and it does make the argument in your Econlog post more clear.

But: Shouldn’t the point labelled “B” be on the AS’ line, not the AS line?

(I’d also label the intersection of AS’ and the original AD as point C — the place you could choose to be, with an NGDPLT monetary policy!)

24. February 2020 at 11:59

I no longer understand the market reactions; it has been clear for a few weeks now that the virus will spread, at least to Europe. And yet they are now reacting relatively surprised.

Personally, I am far less worried than I was a few weeks ago, when they did not know exactly what the mortality rates are, how the virus spreads and what the mutation rate is.

I also don’t fully understand the quarantine measures anymore. Either way, the virus will spread. It is too late for extreme quarantine measures.

There is no reason for panic, children do not get seriously ill, it mainly affects very old, very sick people and the mortality rate is currently “only” 0.75%.

In the worst case it will be a severe, relatively deadly “flu wave”, which happens every few years without anyone taking extreme quarantine measures.

I suspect that the economic damage caused by flawed monetary policy (and excessive quarantine measures) will far outweigh the damage caused by the virus. Humans in panic mode are quite strange animals. Do we ever learn?

24. February 2020 at 12:36

Don, Yes, thanks. I fixed it.

24. February 2020 at 12:38

Another confused and confusing Sumner post. Let me count the ways.

1) Since Sumner believes in money non-neutrality, he tends to frame simple economic concepts like shifting supply and demand curves in a idiosyncratic way. Simple analogy: instead of saying “the victim was stabbed”, Sumner will say “the victim backed into the knife”. Regarding Sumner’s Econ 101 graph showing shifting AS and AD curves, Ockham’s razor says it’s easier to simply say: “in response to a supply shock, where AS shifts to the left, AD dropped even more, so both prices and output were lower”. Instead, Sumner resorts to an ‘alternative universe’ where AD is influenced by monetary policy, when in fact monetary policy simply responds to AD. Thus Sumner states: “Adverse supply shocks are inflationary. But a bad monetary policy response can be even more deflationary.” – bizarre! Much easier to simply say “AD shifted even more to the left”. Period. No need for fancy answers.

2) Aside from 1), since we’ll never agree on money non-neutrality (since the evidence for it is so tenuous) I think we can all agree that whenever we see charts like Sumner’s you notice AD *always* drops or rises much greater than AS. This is intuitively correct, since changes in demand (as Keynes rightfully put it, aka “animal spirits”) is what determines what an economy will do. If people panic over a mere 5% shortage in toilet paper, arguably this panic will translate to panic buying and shortages along the lines of 1970s gasoline lines (where supply imbalances are also razor thin) and plunge the economy into a recession (AD induced from tiny AS shocks). If the above didn’t make sense, read this: https://awealthofcommonsense.com/2020/02/market-have-always-been-rigged-broken-manipulated/ (“economic prosperity is a state of mind” aka AD is what matters)

3. I’m not a doctor except perhaps a failed Juris Doctor, but this seems medically wrong and likely to induce a heart attack: “Don’t slowly wade into that cold lake—jump in!”. In fact, gradual acclimation is what doctors usually counsel for stuff like altitude climbing, and I suspect cold baths. But since Sumner is from originally Scandinavian stock, he’s probably a fan of those crazy cold water plunges (which BTW the Romans did not practice, they had cold, warm and hot baths that you gradually entered, not all at once).

Markets down today, exactly as I’ve predicted for weeks at MishTalk and elsewhere. Who to believe? An esteemed blogger who was once on a long list for Fed Reserve candidate, or some anonymous seeming troll who claims to be in the 1%? It’s pretty clear to me what the answer should be.

24. February 2020 at 14:52

Is the coronavirus a supply shock? Sick and dead people, and the scaredy cats Sumner mentions, don’t demand. It’s fear of falling demand, and falling demand and prices for financial assets, that will trigger a crisis. This is a supply shock in the sense that a shut-down China economy can’t produce supply, but more importantly, it’s a demand shock.

24. February 2020 at 14:59

Ray, You said:

“Instead, Sumner resorts to an ‘alternative universe’ where AD is influenced by monetary policy”

Except that AD responds to monetary policy when money is neutral.

Rayward, No, aggregate demand is determined by monetary policy. The Black Death killed 1/3 of Europe, but didn’t reduce aggregate demand. You are confusing aggregate demand and quantity. Every few years I do a post on that.

24. February 2020 at 15:06

Of course, the demand for safe financial assets has spiked. Those aren’t the assets I was referring to.

24. February 2020 at 16:16

Rather than engage in a pointless argument about rising/falling asset prices, I will mention the paralysis that seems to have hit the Trump administration today, as the coronavirus spread around the globe and with it panic spread to markets. Trump is in India for reasons I don’t understand, and those he left behind are offering nothing in the way of reassurance. This is the first crisis during the Trump administration that Trump himself didn’t create, and we are getting nothing other than complaints by the folks at DHS and CDC about under-funding and under-staffing since Trump took office. Trump’s visit to India notwithstanding, Trump’s overpriced condos in India aren’t going to recover while the Indian population is recovering from coronavirus once it spreads to India. Indeed, coronavirus will likely spread everywhere, a real pandemic, here too according to this article. https://www.theatlantic.com/health/archive/2020/02/covid-vaccine/607000/ Maybe we are better off if Trump stays in India. That would be a supply shock.

24. February 2020 at 16:39

The Federal Reserve’s two tools, that is lower interest rates or quantitative easing, are woefully inadequate in the face of a large downward demand shock. Especially today when interest rates are already low.

On the fiscal side, the automatic stabilizers come into play too slowly and after the fact.

When one ponders the situation, it is hard to believe that advanced nations have not yet developed a method for rapidly increasing aggregate demand.

The obvious solution is something along the lines of a payroll tax holiday. Such a policy can be implemented immediately, and would have immediate impact on wages and business costs.

Contrast the payroll tax-cut policy to the Federal Reserve buying more assets on globalized capital markets. Which would be more effective in increasing aggregate demand within the United States?

Orthodox macroeconomics is in a discredited shambles, a profession in which willful ignorance is praised as prudence.

24. February 2020 at 20:11

Mortality rate in Wuhan was 4.9%.

Mortality rate in the Hubei Province was 3.1%.

Mortality rate nationwide was 2.1%.

Fatality rate in other provinces was 0.16%.

The above figures are from the China National Health commission.

In other words, people are only dying much in Hubei. Moreover, the mortality rate is highly speculative as no one knows how many people contracted the virus and are asymptomatic and never even approached the doctor.

Along with Trump’s trade tariffs, the coronavirus is likely the most overblown story of our time. The media has gone into a full-fledged fear-mongering mode. Evidently, Western leadership does not know how to responsibly describe the situation to their own populations.

The Federal Reserve lacks the tools to counteract the demand shock and the fiscal response is too slow. This could be an ugly year.

25. February 2020 at 13:37

@ssumner – I was referring to the below, real variables, not nominal variables as apparently you are.

Internet screen scrape: “Neutrality of money is the idea that a change in the stock of money affects only nominal variables in the economy such as prices, wages, and exchange rates, with no effect on real variables, like employment, real GDP, and real consumption.”

25. February 2020 at 15:19

@Ray: “I was referring to the below, real variables, not nominal variables as apparently you are.”

No, alas, you’re even wrong about your own words. You originally wrote: “Instead, Sumner resorts to an ‘alternative universe’ where AD is influenced by monetary policy, when in fact monetary policy simply responds to AD.”

You were clearly referencing aggregate demand, which is a nominal concept, not a real concept.

And, just to save us all some time, since your next thoughts are so obvious: there is no such economic concept as “real demand”. That isn’t a possible thing.

26. February 2020 at 00:49

@Don Geddis – thanks for your reply, it will be a good ‘teaching moment’. Since you are the teacher’s pet, you can substitute for professor Sumner.

Given that we all know the Hicks-Hansen interpretation of Keynes’ Cross (IS-LM curves) and given we all know the AD-AS curves (refresh yourself in Econ 101 if necessary), the question then becomes: what factors will shift AD? From the textbook (I’m using Mishkin’s but they’re all the same): G (govt spending), T (Taxes), NX (net exports), C (consumer spending), B (business spending). That’s it! Agree with this Don? Then we’re in violent agreement my fiend. You will notice however that one variable is deliberately omitted: M (money supply). That’s because money is neutral (has no effect on the real economy). Money supply will increase or decrease according the aforementioned variables. You don’t increase or decrease M and affect anything (that’s putting the cart before the horse and saying the cart pulls the horse). Sorry Don, but I can’t dumb it down any more for you.

PS–Ssumner to RL re the IS-LM curves once: ” Ray, You still don’t know? Really? I think the IS curve often slopes upward. ” (that was a shock, to this day I don’t know if our host was trolling me, but it was a good teaching moment as it forced me to restudy IS-LM)

26. February 2020 at 05:55

Talking about inflation in this context confuses people. It’s a red herring.

When there is a negative NGDP shock, the neutral interest rate will fall, in absence of monetary offset. Doesn’t matter whether the shock is real, meaning a supply shock, or nominal, meaning a money demand shock, for example.

26. February 2020 at 20:53

@Ray Lopez: You don’t seem to even know the basic difference between nominal and real concepts, and which things are which. And you keep shouting “money is neutral” as a kind of mantra, but you don’t seem to know what that means either!

Aggregate demand is a nominal concept.

G+T+NX+C+B=NGDP is a nominal number. (And, BTW, you made an additional mistake in thinking that an accounting identity will tell you anything about how the economy will react to changes.)

“You don’t increase or decrease M and affect anything”

No. We can argue about whether money is neutral or not … but your opinions here are not even wrong.

Even if money were neutral (as you claim), that would only mean that it would not affect real concepts. But it still would affect nominal concepts — such as aggregate demand.

You aren’t even making a coherent argument. Whether or not money is neutral, has nothing to do with whether changes in M also then change NGDP.