Why such low unemployment?

Economists have done a lot of head scratching about the fact that inflation has come down without a big rise in unemployment. This is seen as a violation of the Phillips curve model.

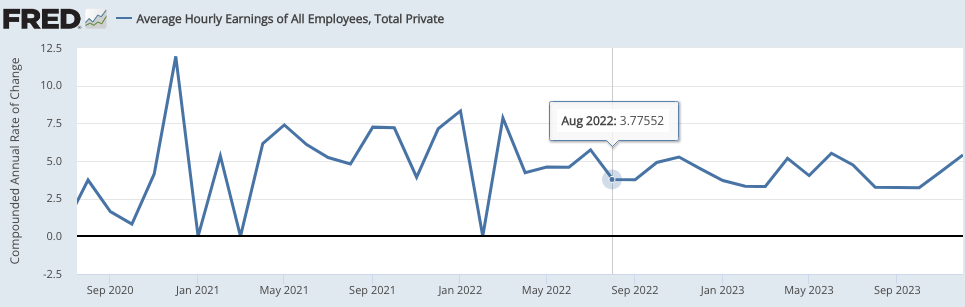

But Phillips did not look at the relationship between price inflation and unemployment; he looked at the relationship between wage inflation and unemployment. And wage inflation hasn’t come down very much since August 2022:

Wage inflation fell slightly between 2021 and 2022. But for the past 17 months, wage inflation has averaged about 4% at a compound annual rate. That’s about one percentage point above the level required to hit the Fed’s 2% price inflation target.

If you squint hard enough, it looks like there might have been a tiny downward trend since August 2022, but very, very gradual. Thus, there was absolutely no reason to expect significantly higher unemployment on the basis of falling inflation. Price inflation is not important, and the inflation that is important (wage inflation) has hardly fallen at all in recent months.

The good news is that we’ve avoided high unemployment so far, while the bad news is that we haven’t made much progress in reducing wage inflation. I hope 2024 brings slower nominal wage growth—the final step required for a soft landing.

On a related point, Gauti Eggertsson does a good job in making the case that (contra Yellen) we are still well short of a soft landing:

Tags:

5. January 2024 at 16:31

To avoid a recession, tolerating a couple more years of 3% inflation doesn’t strike me as the end of the world.

Productivity has looked pretty good lately.

5. January 2024 at 18:12

Sorry, Scott, I would benefit from some extra stepping-through here. My understanding has hitherto been is that you see wages growth as best reflecting the strength of aggregate demand. Therefore, 4% wages growth means that AD has not slowed by enough.

Another interpretation of your comments could be that ongoing nominal wages growth materially higher than prices growth – say, due to long lags in (or stickiness of) the response of wage changes to AD – is irrelevant to unemployment. I presume you do not mean that? It would mean that rising real wages do not affect employment whereas I thought you believed that unemployment was a function of the ratio of nominal wages to NGDP.

If my interpretation is correct, then how do we know that nominal wages growth is not on the verge of falling further in line with lower price inflation? Presumably that is what the markets currently believe?

5. January 2024 at 18:41

Rajat, You said:

“If my interpretation is correct, then how do we know that nominal wages growth is not on the verge of falling further in line with lower price inflation? Presumably that is what the markets currently believe?”

Yes, I think that’s very possible, maybe even probable. I’m just saying that we don’t yet have the soft landing.

6. January 2024 at 09:17

Scott how much of the wages not cracking due to smoothing effects and not more frequently updated wages. We had auto strikes a few months ago and then a new long term contract which above trend wage growth built in. Some of the gains in their wages were lagged since the old contract didn’t account for the new price level gap up from 2021-2022 so their wages had fallen below market.

Looking at the wage chart it doesn’t look like the peaks are as high and durable as the inflation data charts.

So my question is if we have a one time change in consumer prices of 10% but sticky wages would we not expect wages to be below 10% when the price shock occurs but then over a couple of years see above trend wage growth to catch up?

6. January 2024 at 09:35

Sean, Yes, that’s certainly the hope. The question is whether getting back to 3% wage growth will be painful. I don’t know the answer.

6. January 2024 at 15:01

Could we see a few years of high wage growth accompanied by changing ratios of wages and profits in NGDP?

7. January 2024 at 09:09

Atlanta Fed wage growth tracker shows some deceleration in wages since 2022

8. January 2024 at 09:34

Bill, Possible, but I wouldn’t expect any dramatic change.

Vaidas, I wish we had one reliable source for wages.

15. January 2024 at 01:06

Sumner’s thoughtful macro post gets 7 comments, while his political post about education gets 41. Shows what hoi polloi value, and it’s not macroeconomics.

BTW, it’s been known since the early 1980s that money is neutral, reference below [1]. So why are we even talking here? I sometimes wonder.

[1] MONEY, REAL INTEREST RATES, AND OUTPUT: A REINTERPRETATION OF POSTWAR U.S. DATA, Robert B. Litterman, Laurence Weiss Working Paper No. 1077, NATIONAL BUREAU OF ECONOMIC RESEARCH, February 1983, “Taken literally, our results imply that monetary policy has not discernably affected the real rate, although it has causally influenced nominal interest rates”

15. January 2024 at 08:59

“NATIONAL BUREAU OF ECONOMIC RESEARCH, February 1983”

Thanks for providing hot-off-the-press cutting edge research, that I might have missed.