What missing workers?

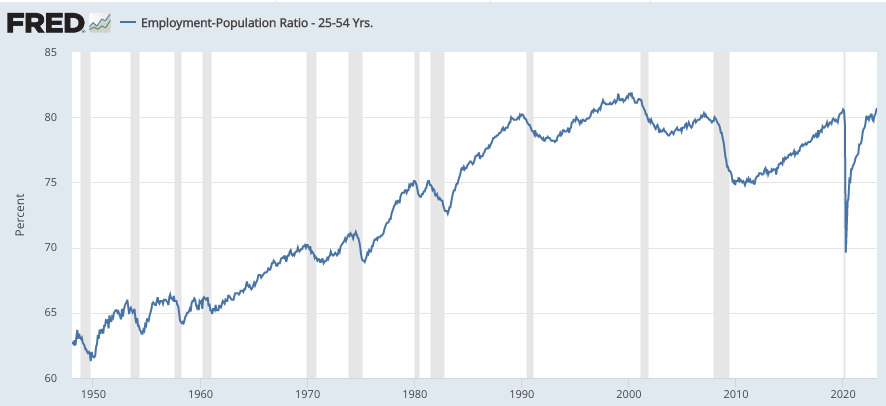

I saw that the prime age employment/population ratio hit 80.7 in March. With the exception of a few years during the dotcom bubble of the late 1990s and early 2000s, that’s the highest employment rate in US history.

So why all the hand wringing about “missing workers”? You know, the workers that supposedly dropped out due to Long Covid, or an addiction to playing video games, or an addiction to opioids. People keep writing essays about the missing workers, but I can’t see what data they are trying to explain. Can someone help me?

It’s worth noting that the labor market remained absolutely red hot in March, with payroll employment surging by 236,000 (a bit more than expected.) That’s far above the trend rate of employment growth (which is likely less than 100,000/month.) Both Bloomberg:

And the FT:

US jobs growth slowed in March as Federal Reserve tightening bites

missed the big picture. It would be like a Phoenix weather forecasters suggesting that there was a cooling trend when the temperature fell from 113 to 111 degrees.

During 2007, payroll employment growth fell below trend 6 months before the recession began in December. During 2000, employment growth fell below trend 10 months before the recession began in March 2001. If that pattern holds again, then we are likely at least 6 to 10 months away from the onset of recession, as growth is still far above trend. But of course this pattern may not hold in the next downturn, indeed during earlier business cycles employment growth occasionally declined right before the onset of recession.

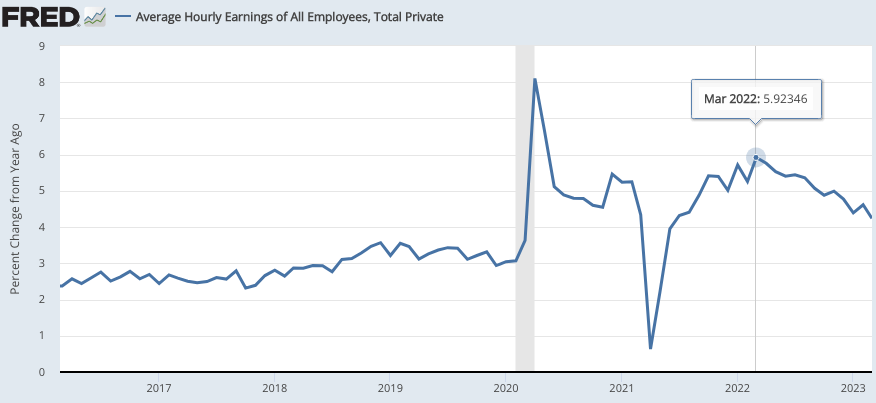

Right now, I’m much more interested in average hourly earnings than I am with the employment figures. I’ve argued all along that price inflation doesn’t matter, rather what matters is NGDP growth and wage inflation. But of course price inflation does matter in one sense; the Fed has a 2% PCE inflation target. So they need to get NGDP growth and wage growth down to a level consistent with a 2% average inflation rate.

If NGDP growth suddenly falls to 3.5% and nominal wages are still growing fast, then you get a recession. (You need 3.5% NGDP growth to account for 2% inflation, 1% productivity and 1/2% labor force growth.) So to create a soft landing you need wage growth of about 3%, so that when NGDP growth slows to 3.5% you can still have full employment.

I’m happy to report that we are making some progress toward that goal. Twelve month growth in average hourly earnings peaked at 5.9% in March 2022, and has since fallen to 4.2%:

This has been a pleasant surprise. When I was younger, the US labor market was less flexible (perhaps due to more heavily unionized manufacturing jobs.) A labor market this hot would have had faster wage growth. If this downward trend continues, then the unemployment rate in the next recession (which Bloomberg says is certain to occur before October) will be fairly mild. I have my fingers crossed. But I fear that squeezing out that last 1.2% of excess wage growth won’t be as easy.

Some people focus on aggregates like NGDP and total earnings, which are also very important. Here I’d say that slowing the aggregates is essential for controlling inflation and slowing hourly earnings is essential for getting a soft landing when conducting your anti-inflation policy.

On the downside, I expect that RGDP growth will remain weak for many years. Trend RGDP growth is down to about 1.5%, and is likely to remain there until AGI produces a brief surge in growth just prior to human extinction. 🙂

Tags:

7. April 2023 at 12:37

Professor, are we sure the labor market is still red hot?

Aggregate payroll spending has grown at 1.3% annualized the last two months and at 5.3% over the past 6-months.

Seems we might already be at numbers consistent with 2% inflation or very close to being there.

https://fred.stlouisfed.org/series/CES0500000017

https://twitter.com/Value_Quant/status/1644331213199491073?s=20

7. April 2023 at 17:07

“Coincidentally” NGDP growth peaked in March 22!

7. April 2023 at 19:59

The 5 year inflation breakeven is at about 2% in core PCE terms, despite NGDP being above the pre-pandemic level growth path. This seems inconsistent with the notion that real growth potential is only about 1.5%, if we’re to take the 5 year breakeven seriously.

8. April 2023 at 00:11

“just prior to human extinction.”

Sumnerism: Keynesianism, but all at once.

8. April 2023 at 00:29

> You need 3.5% NGDP growth to account for 2% inflation, 1% productivity and 1/2% labor force growth.

I wonder how those assumptions work out under an NGDP targeting regime undergoing rapid productivity growth due to AI or whatever. Is there anyone who can be expected to note the change in productivity growth and adjust the NGDP target accordingly?

Or say you’re a developing country and the Party aims for 10% NGDP growth, with a ‘whatever it takes’ policy. Do they have a good way to measure productivity growth, or are they just randomly adding inflation/deflation to an already dynamic situation?

8. April 2023 at 02:58

I just want to make it clear that he’s not a professor. He’s a retired quack, who is practicing pseudoscience. Three hundred years from now, nobody is going to know who the hell he was. They will cite Mises and Hayek, not doofus’s from Bentley.

re: employment: the state can say anything they want. The state told the Russians people the economy was booming and employment was high during the 1930’s when millions were starving. The evidence is the homelessness, the violence, the increase in number of people on part time contract work, the number of layoffs at blue chip companies, etc. You don’t really believe that America is at full employment. Have you been to SFO recently. The tents suggest otherwise.

Combine that with twenty years of artificially low interest rates, and you have the perfect recipe for a crash. Sumner’s predecessors did the same thing between 1920 and 1929. They kept interests rates below the natural rate… and lo and behold….it made credit much too easy, and a lot of money went into companies that were not worthy. The result of course was inflated equities and a massive correction.

Irving Fischer, Sumner’s predecessor, was so stupid that two weeks before the crash he famously remarked that the stock market would double. Meanwhile Mises and other Austrians were warning folks that Fischer was madman, insane, and a bonafide idiot walking like a retard around the halls of university.

Not much has changed in one hundred years. You still have the imbeciles who think they can manage demand and supply, and Sumner is one of them. His gangsters are planning a CDBC soon. They desperately want control. They live in a world of immense fear and dream of mechanized order. It’s their life goal to have their little hands on everyone else’s affairs.

8. April 2023 at 03:10

Apropos: do you have any guess when we will start seeing the impact of recent AI advances in aggregate productivity figures?

At the moment, the most widely publicised advances have been in creating images and creating prose text. But I’m not sure either of those are big sectors of the economy? (Especially since the text that chatGPT et al produce mostly sounds reliably plausible, but is not actually reliably accurate nor correct so far.)

8. April 2023 at 08:02

Rafael, Sure, that’s possible. But two months isn’t much to go on. I’d say inflation is likely to stay too high throughout 2023, unless there’s a recession.

Michael, Aren’t you mixing forward looking and backward looking data?

Anonymous, Well, we do try to measure productivity. Of course, I’d rather just ignore it and switch to simple NGDP targeting.

Ricardo, “Have you been to SFO recently”

Yes, it’s a beautiful city.

Matthias, You said:

“do you have any guess when we will start seeing the impact of recent AI advances in aggregate productivity figures?”

Probably not in my lifetime.

8. April 2023 at 09:59

> Of course, I’d rather just ignore it and switch to simple NGDP targeting.

Aren’t you still making an implicit prediction about productivity growth? Maybe I don’t understand what simple NGDP targeting is.

Say the economy produces 100 widgets at $1 each. Next year we aim for an NGDP of $103 (2% inflation, 1% productivity, no immigration). Alas, FactoryGPT comes online and we end up producing 200 widgets. Price drops to $0.80 but NGDP is still vastly above target at $160.

8. April 2023 at 10:42

Anonymous, That’s not how NGDP targeting works. In that case, price drops to $0.515.

8. April 2023 at 11:39

Scott,

Yes, obviously it is mixing forward-looking and very recent backward-looking data, but if one thinks monetary policy is still too loose, noting that NGDP is above trend, but thinks the forward real growth trend will return to the weakness before NGDP rose above trend, one might reasonably expect above trend inflation in the future.

8. April 2023 at 13:14

Male 25-54 was higher.

https://fred.stlouisfed.org/series/LREM25MAUSA156S

The previous declines do indicate lack of flexibility though, versus lack of NGDP. In particular COLAs during supply-side inflation.

8. April 2023 at 15:43

I figured out why we never find intelligent life elsewhere in the universe.

AI

AI detected a threat to humanity from an alien life force, and so wiped out that life force and all other aliens. This happened in the future but AI figured out time travel and so has done it retroactively also.

Far from being a threat to humanity, AI has saved humanity.

9. April 2023 at 05:51

Solon, Thanks for clearing that up.

9. April 2023 at 07:16

Everything I read seems like it contradicts everything else I read. We don’t believe in the constitution. We don’t believe in separation of powers. By “we” I mean Democrats. But GOP doesn’t even know what it doesn’t believe.

This is not bad. I think the less we know, the less we try to do stupid moron things. I still lean toward things getting better. We are not smart enough to make it worse. Irony is this makes us lean toward freer markets. Because free markets have Hayek/Freedman form. Like “making a pencil”.

The dumber we are, perhaps the better off we are. It works for me

9. April 2023 at 07:16

N-gDp is a subset and proxy for aggregate demand. When N-gDp is too high, it’s obvious that monetary policy is too loose. N-gDp is a reliable and self-evident growth metric.

Whereas the Philips Curve was denigrated in the 60’s.

See: See: “The Great Demographic Reversal” by Charles Goodhart and Manoj Pradhan.

9. April 2023 at 07:22

Money is not neutral. Real wage growth has been negative for 24 months. That means the economy is being run in reverse.

9. April 2023 at 08:44

NPR has reported an inverted yield curve:

https://www.npr.org/2023/04/04/1168039533/the-inverted-yield-curve-is-screaming-recession

And notes that in the past this has been a reliable predictor of recessions.

9. April 2023 at 10:12

Scott, I am assuming that you base your RGDP forecast of 1.5% on 1% productivity growth + 0.5% population growth. Are those forecasts based on the taking the average of productivity and population growth between 2008 and the pandemic? Do you have any particular reason to use that time period as the base rate?

9. April 2023 at 19:37

When one considers my above point, and the fact that the dollar index strengthened during the Fed’s loosening cycle, and has weakened during the Fed’s tightening cycle, and consider the catch-up rate of stock price appreciation during the pandemic recovery, all in the context of an accelerating AI revolution, one begins to have a case for RGDP growth potential being underestimated.

This is not a complete case, but it should at least make one think.

10. April 2023 at 10:41

Larry, I certainly agree that the risk of recession is much higher than usual, although the yield curve is not a perfect forecasting tool. We are at full employment, which has also been a good recession forecaster.

Travis, Population growth has been slowing, so I believe the trend going forward is lower than the trend during 2008-23. Productivity is hard to predict, but the previous 20 years provide a reasonable guesstimate.

11. April 2023 at 05:22

stats are made to be manipulated and then lied with you moron. try some time out here in the real world. EVERY business I can see needs people. I’m building a house. EVERY sub is begging for people. this crisis did not exist 3 years ago. you exemplify the “elitist” leftists of the phantasy utopia of big cities and college campuses.

11. April 2023 at 06:28

Dr. Sumner said: “People keep writing essays about the missing workers, but I can’t see what data they are trying to explain. Can someone help me?”

I think this is the data. Something like a 2 to 4 million people exited the labor force during the covid shutdown depending on what you think the long term trend is. I don’t have an opinion about how much of a problem this ought to be.

https://fredblog.stlouisfed.org/2023/01/a-greater-number-of-workers-still-remain-outside-the-labor-force/?utm_source=series_page&utm_medium=related_content&utm_term=related_resources&utm_campaign=fredblog

11. April 2023 at 09:41

[…] You might wish to consider whether you and I hold the same views. Here’s a brand new commenter named kipd: […]

14. April 2023 at 10:57

Maybe wage growth cooling a bit, but any number of union contracts were agreed to last year with CPI adjustments, but am unsure when they might hit in 2023; an Dif not this year, will hit in early 2024, so there I that to consider.