What if cherry pie could cure cancer?

[After reading this post, please check out my related Econlog post, an increasingly rare example (for me) of a post where I discuss a NEW IDEA for monetary policy. At least new to me.]

Imagine a world where eating lots of cherry pie was bad for healthy people. (Not hard to do.) Now imagine that for some strange reason the consumption of cherry pie improved the health of cancer sufferers. And the more you eat, the quicker you get over your cancer. A slice after every meal is good for cancer sufferers; adding an afternoon snack is even better. Sweet!

This scenario is fanciful, but actually does describe one important aspect of monetary policy.

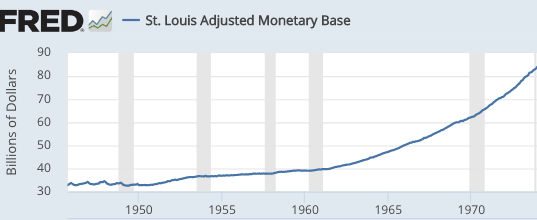

When LBJ became president in late 1963, the economy was in decent shape. It was three years into an expansion and inflation was less than 2%. But he couldn’t leave well enough alone, and a couple years later began pressuring the Fed to stimulate the economy. The Fed responded with a massive purchase of government debt, which led to a rapid increase in the money supply. The monetary base had risen from $33.4 billion to $44.3 billion between November 1945 and November 1963, but soared to $83 billion by November 1973—the Great Inflation was underway. BTW, these purchases reduced the value of US government bonds, for those worried about “Cantillon effects”.

Just as eating too much pie is bad for a healthy person, monetizing lots of debt is bad for a healthy economy. It causes high inflation, which discourages saving and investment.

Oddly, when the economy is so unhealthy that interest rates have fallen to zero, printing money to buy back the public debt becomes a healthy policy. The more you buy the better you feel. And it’s also highly profitable, at least in most cases. Of course it’s theoretically possible that you’d buy assets with a lower rate of return than cash, which earns zero. But that’s unlikely.

Because eating lots of cherry pie has a bad reputation, lots of doctors would discourage their cancer patients from eating too much for fear they might get diabetes. Even if consuming cherry pie worked miracles for cancer patients, some doctors would keep recommending chemo and radiation. As an analogy, certain mushrooms dramatically reduce depression in patients with terminal cancer, but many doctors refuse to recommend this enjoyable drug because . . . well . . . I’m not sure why. Perhaps it’s our puritan instincts.

Even though QE is a miracle drug that helps a zero bound economy get better and usually leads to big profits for the government, our economic doctors warn against taking too much of this delicious medicine. After all, QE is bad for healthy economies. In their view it’s better to rely on fiscal stimulus, which not only is not profitable, it imposes trillion dollar losses on the Treasury. We live in a world where the Very Serious People tell us we need economic equivalent of chemo, not cherry pie. Even though cherry pie is far tastier, and more effective.

Sad!

PS. Kevin Erdmann has a new piece in the Wall Street Journal. Also, please order his excellent new book on housing, it will lead you to completely rethink many of your views of what happened during the boom and bust.

Tags:

7. January 2019 at 14:06

Good post.

Standard GOP banker “sound money” theory is particularly reluctant to understand how cherry pie can help sometimes.

Europe could use some cherry pie right now. Maybe the US and China too.

My bigger worry, as you mention in your EconLog post, is that most people still think monetary policy is ineffective at the ZLB. This is a dangerous misunderstanding, as it leads to the “build up ammo” case for more rate increases. I was a big “build up ammo” guy in 2006.

Generals fight the last war, but the Fed, as far as I can tell, has been fighting the inflation war since 1982, and has beaten inflation to a pulp at this point.

7. January 2019 at 14:27

Scott,

Re your PS: Kevin Erdmann writes, “Those restrictions to access are the true source of a ‘bubble economy,’ pushing up asset prices which then collapse in a frenzy when the economy slows.”

You wouldn’t agree with that, would you? I thought the essence of a bubble is that it’s not based on fundamentals. But supply is a fundamental. So how can a restriction on supply that is not relaxed cause a bubble? It can cause price increases, but the increases are based on fundamentals. Then the slowing of the economy causes some prices to fall. That’s demand, which is a fundamental also.

7. January 2019 at 15:02

David, I suppose it depends how Kevin defines “bubble”. The underlying explanation is OK, but of course I don’t believe bubbles exist, so I wouldn’t call it a bubble. He may define ‘bubble’ as simply a sharp rise and fall in price, as do some other people.

7. January 2019 at 16:49

Excellent blogging.

Good!

7. January 2019 at 16:53

Mmmm cherry pie.

If you are starving a substantial injection of calories to your diet may be exactly what you need. If you are of healthy weight, perhaps not.

In the 1960’s economists seemed to be operating under several mistaken ideas.

1) Keynesian stimulus will always increase NGDP.

1a) Rising NGDP is always a good thing.

2) The Fed can trade inflation for unemployment.

3) There are no real consequences higher inflation.

4) The Fed should listen to the White House.

Politicians suffer from a need to appear to be doing something. If some of my constituents are jobless, better do something about that. Leave it up to the Fed? Then I won’t get the credit with my constituents! Leave the economy to self-correct!?! If the economy can self-correct, what do they need me for!

This stems from the delusion that the President steers the wave, when in fact the President (like the rest of us) rides the wave. Even worse, the president believes he is the wave.

7. January 2019 at 17:47

Scott, thanks.

David:

The use of quotation marks there was supposed to indicate that I was referring to the commonly heard refrain that high asset prices are somehow a result of Federal Reserve policies.

However, I think the term, as it is typically used, could apply in either case.

In Closed Access cities, the disconnect between unencumbered cost of building and market price makes price more purely a product of sentiment or local economic conditions, whereas in other cities, the cost of building acts to create a more stable long term market anchor. It is the lack of supply that causes it. But, because of the lack of supply, some of the operative “fundamentals” in home prices are things like what will local rent, property tax, and unusual income levels be in 15 or 30 years. At some point the distinction between fundamentals and sentiment becomes blurred in that context. It doesn’t match a stingy definition of the word – that at any point in time you could be guaranteed a short side profit – but, it matches a broader definition of a market unconnected to any fundamentals, like bitcoin, or say beanie-babies or baseball cards 20 years ago. I wouldn’t tend to refer to those markets as bubbles, because reasonable buyers would pay those prices based on persistence of recent rental values, but those rents are the product of arbitrary local constraints on competition.

In the Contagion cities, the idea that the markets experienced a bubble is more reasonable, since they experienced a demand spike, which included buyers with windfall capital, and inelastic short term supply with elastic long term supply. Those are fundamental reasons, I suppose, but the context is pretty peculiar and is highly likely to reverse. In some ways, a bubble is defined by the bust, and maybe the spike in demand could have persisted and those cities could have turned into Closed Access cities in a counterfactual. But, even though I generally fall with Scott on the idea of bubbles, I think there was a high probability that prices in the contagion cities were going to pull back at some point. Here, I think the framing of the issue as a refugee event is useful. In a refugee event, some things become expensive in the moment in a way that clearly will reverse when the moment passes. My distinction here from the conventional wisdom would be (1)the markets that might be described this way account for less than 10% of the US housing market and (2) the causes of bubble markets are quite peculiar and specific and bubbles don’t just appear everywhere at any time because people automatically become irrational when they get their hands on a little credit.

7. January 2019 at 18:01

Thank you for clarifying these points. I never got why the current system makes such a big difference between the Treasury and the FED.

Why aren’t they a single agency? Are there any sensible reasons for this, or is it just a matter of historical and formal legal reasons?

8. January 2019 at 06:53

Brilliant. Love it.

8. January 2019 at 06:53

Kevin,

Congratulations on the WSJ article!

Excellent comment.

8. January 2019 at 09:33

Scott wrote: “BTW, these purchases reduced the value of US government bonds, for those worried about “Cantillon effects”.”

Scott would you mind elaborating? I think I know what you mean, but could you make it a bit more precise? E.g. suppose the Fed had instead bought shares of GM rather than Treasury securities during this period. Are you saying that would have hurt GM and helped the Treasury?

(Note: My first attempt at this comment got held up in moderation, so please delete it if this is a duplicate.)

8. January 2019 at 10:35

Erdmann responds to many comments about his thesis: https://www.econlib.org/archives/2018/06/kevin_erdmann_o_1.html

His responses reveal the many nuances of both the problem and the causes of it. I will mention one: preferential property tax treatment for long-time owners of residences. Some states (Florida included) restrict increases in property tax assessments as long as the owner owns it. This results in radically different taxes between long-time home owners and new home owners. Indeed, a long-time owner may pay only a few thousand dollars per year while his new neighbor pays tens of thousands per year. You can see how this would distort the housing market, not least the reliance on the disparity in tax treatment by local governments to fund increasing costs.

8. January 2019 at 10:37

Bob, If they had bought GM shares, I’d guess their price would have risen. If they had bought GM corporate bonds, I’m not sure what would have happened to the price.

8. January 2019 at 10:37

Sorry, I should have clarified that my link is to a short piece written by Sumner but with many responses to the comments by Erdmann himself.

8. January 2019 at 13:05

Nice post.

My younger brother has suffered migraines since he was little. When he feels one coming on, he basically has no option but to sleep it off. While visiting Columbia over this summer, he felt a migraine coming on and was advised to try a mild coca tea, and found it was 100% effective. He stayed for several days and confirmed the effect with a second trial. To your point, no doctor would advise their patients to regularly consume coca but, given the loss of both professional and recreational time due to headaches, a cup of tea every couple weeks seems like a very low price to pay to be fully functional.

Also, in case you’d missed this: the effects of psilocybin and LSD on cluster headaches:

https://thethirdwave.co/psychedelics-cluster-headaches/

8. January 2019 at 14:44

Randomize,

Cocaine is known to worsen headaches. With coca it won’t be much different in the long run.

I have seen it so often that people try questionable methods long before they even tried all the serious stuff from official medical guidelines properly. I doubt that the case of your brother is any different.

To return to the topic of the blog: Using coca is like doing helicopter drops and reckless fiscal policy, before even trying conventional and unconventional monetary policy.

8. January 2019 at 15:13

Christian,

You just assumed that my brother hadn’t tried conventional medicine before trying something else. As the old saying goes, when you assume…

8. January 2019 at 16:34

No I did not say that. He surely tried. I said he did not try all the serious stuff from official medical guidelines properly. That’s really save to assume. I never met a patient in my life who tried everything properly.

They might think they tried everything but the reality is similar to the huge proportion of people who think monetary policy is ineffective at the ZLB: „Oh no, we tried everything, now what???“

Let him do what he wants I won’t bother his coca consume any longer. Let’s just assume that he does not live in Colombia, then coca might be a bit hard to come by, but okay…

10. January 2019 at 09:25

Scott wrote: “BTW, these purchases reduced the value of US government bonds, for those worried about “Cantillon effects”.”

What about fees generated from those bond purchases?….where did those fees go? pretty sure those direct spends end up in the pockets of rich people at rich firms(primary dealers).

Also who benefits from the data flow of these transactions? again rich people…don’t think it has a lot of value? how about we auction off primary dealer licenses each year to 20 highest bidders? fees go to tax rebate for people with income tax payers with incomes below 200k. Ya that won’t be popular with the banks. I wonder why?

10. January 2019 at 15:48

Gabe, The Fed pays normal market fees for transactions. There is no windfall for anyone to pocket, rich or poor.