What about the TIPS spread?

I’ve recently been asked about why I don’t put more weight on the TIPS spread, as compared to 3 to 5 years ago. I still consider the TIPS spread a useful indicator, but there are a bunch of reasons why I talk about it less frequently:

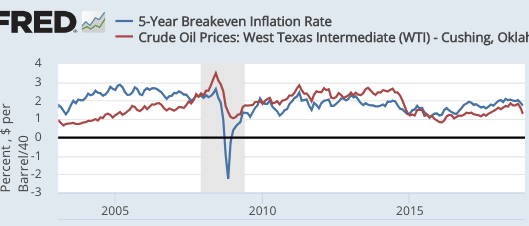

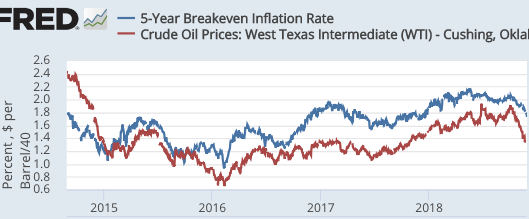

1. The TIPS spread does have a few biases, which need to be taken into account. One is the lag in the adjustment of inflation-indexed bonds to CPI inflation. In the short run, fluctuations in CPI inflation are caused by oil price fluctuations. This causes the TIPS spread to change in the same direction as the level of oil prices, without changing the actual expected rate of inflation at all. It’s an artifact of the lags, and this phenomenon has recently depressed the spread.

2. I’ve known about the preceding issue for quite some time, and always took it into account when making comments. But I’ve more recently become convinced that the risk premium is also an issue. It seems likely that the TIPS spread slightly understates the expected rate of CPI inflation, due to the fact that conventional bonds are viewed as more liquid, and thus offer a slighter lower expected yield. I don’t think this is a big issue, but it might bias the result by a couple tenths of a percent.

3. On the other hand, the Fed is targeting PCE inflation, which runs about 0.3% below the CPI inflation used to adjust TIPS returns. So the biases cut both ways.

A few years ago the problem with monetary policy was obvious. Actual PCE inflation had been running substantially below target, and the TIP spreads were also well below the target. In addition, unemployment was too high.

Today, unemployment is below the estimated natural rate, actual inflation has run roughly on target, and the TIPS spreads show only a small problem (at least when you adjust for the recent plunge in oil prices.) Furthermore, wage inflation is up to 3%, as compared to 2% a few years ago, indicating increased long run support for a core inflation rate at close to 2%. I suspect wage inflation will rise a bit more.

That’s not to say I’m completely sanguine about the situation. While the consensus of private sectors forecasters is for 2.1% PCE inflation going forward, I believe that there’s at least a 25% chance that we still haven’t gotten inflation up to 2%, and that the TIPS spreads are correct. So it’s something I’ll be watching. But don’t put too much weight on the next few months inflation numbers, as the recent oil price plunge will surely lower the rate for a while. (Back in July, the 12-month PCE inflation rate was running at 2.36%, whereas the actual underlying rate of PCE inflation was never that high–it was due to rising oil prices.)

Overall, I still believe monetary policy is roughly on target regarding inflation. But if the data proves otherwise over the next 24 months, I’ll change my view.

Tags:

29. November 2018 at 17:27

PCE core October out yesterday at 1.8% YOY.

I realize a central bank cannot dictate an exact rate of inflation, yet it still appears the Federal Reserve is treating 2% as a ceiling, not a target.

29. November 2018 at 17:37

I fully understand your point about the policy setting being appropriately right. Since market monetarism focuses on the wisdom of the market, however, wouldn’t it be a bit inconsistent to worry about risk premia issues creating a few basis points of divergence? The total size of the linker market is roughly 2 trillion, with the US issues accounting for roughly 40% of it. We have good price discovery in much thinner markets…Pricing for 10 year CPI should roughly move in tandem with pricing for 10 year core CPI because we are talking about long-term averages. If the ability of the market to price this correctly is questioned, then a potentially much, much more illiquid NGDP futures market might not be taken seriously at all.

29. November 2018 at 18:38

HL, I think you missed my points, none of which have anything to do with the size or efficiency of the market. I’m not saying that the market is inefficient, I’m saying that TIPS spreads do not even try to measure CPI inflation going forward. They are systematically biased due to the lag in adjusting TIPS bonds for actual CPI changes, not because the market is inefficient. It’s a feature, not a bug.

If I were wrong then the red and blue lines in the graphs above should not be correlated, as one is a level and one is a rate of change.

As far as the risk spread, I don’t think that would create any problem if the Fed were targeting the spread, as it’s likely to be fairly stable over time. But the Fed is targeting actual inflation, not the TIPS spread.

29. November 2018 at 18:39

HL, I don’t care if no one except me takes the NGDP futures market seriously. In that case I’ll get rich trading against the Fed—which I consider a very desirable result.

30. November 2018 at 12:00

5 years is a long time, long enough for short run effects from oil price changes to fade. The association implied by those charts, is more likely due to NGDP expectations driving both oil prices and inflation, rather than a blip in the oil price hitting the TIPS spreads. Markets are saying that the Fed will undershoot its arbitrary inflation target by quite a lot over a half decade, maybe 0.4 points. Not that anyone should care much about inflation as long as it’s under 5%.

Oil prices are going to stay reasonably low. These new drilling methods can be deployed across the globe on long depeted fields. All the more reason to let ‘er rip and have a period of prosperity on the back of sustained 5% NGDP growth.

30. November 2018 at 12:47

It seems to me like these 0.1-0.3 percentage points fluctuations are well within measurement/predictive errors for this system. And they probably do not matter much from a macroeconomic standpoint.

I also think that this highlights an advantage of NGDP or total wages targeting over inflation targeting: when the economy is too cold or too hot, ngdp and total wages provide a better signal-to-noise ratio than inflation.

30. November 2018 at 15:35

Justin, I don’t agree. A 1% change in the CPI is 0.2%/year when spread out over 5 years.

There’s no evidence in the Hypermind market that NGDP expectations have recently fallen, and even oil prices changes that are clearly unrelated to NGDP (say Iran sanctions, or a Saudi decision to change output) affect TIPS spreads. Recall that oil doesn’t correlate that well with stock indices, and any fall in NGDP expectations would clearly impact stocks.

1. December 2018 at 07:50

Thank you for the responses! I think my only qualm is that we don’t know if that sharp decline in crude oil price is simply due to better supplies (i.e. of course consequence to the medium-term cycle) or widespread worries about the future. In past few months, we got a non-negligible uptick in ex-ante real yield for 10 years (after nearly 4 years of stubborn range-bound move) and significant simultaneous declines in 10 year breakeven rate and oil prices alongside equity market adjustment. This is of course a mosquito bite relative to, say, pre-GFC situation, so I share your view that we are not on the cusp of some major recession or deflation. Still, I wouldn’t dismiss the move completely either…but you’ve already said similar things in the post, so my bad.

I think the major difference here is that I take the combination of linker, currency, and equity market moves as a decent indication of NGDP and policy stance whereas you might feel that we already have a superior signal from the Hypermind (as it gives you a direct indication on future NGDP instead of more misleading headline CPI inflation). I respect / understand your view of course. I guess I am a bit more brittle to 10~20 bps movements as an actual participant in the market.

Meanwhile, I need to think harder and more precisely about your earlier posts / work on actual mechanics of NGDP futures…I think those are probably as important as the NGDPLT idea itself.

1. December 2018 at 07:52

(i.e. of course consequence to the medium-term cycle)…

-> (i.e. of little consequence to the medium-term business cycle)

1. December 2018 at 07:53

Sorry one more correction: as an actual participant -> as an active participant.