Voluntary unemployment, voluntary uninsuredness?

People are unemployed for all sorts of reasons. Some people like to use terms like ‘involuntary unemployment’ and ‘voluntary unemployment’ to describe those reasons. In my view this is a big mistake. These terms are not helpful ways to summarize very complex and subtle distinctions. Indeed when I see people using these terms I generally tune them out, assuming they won’t have anything interesting to say about unemployment.

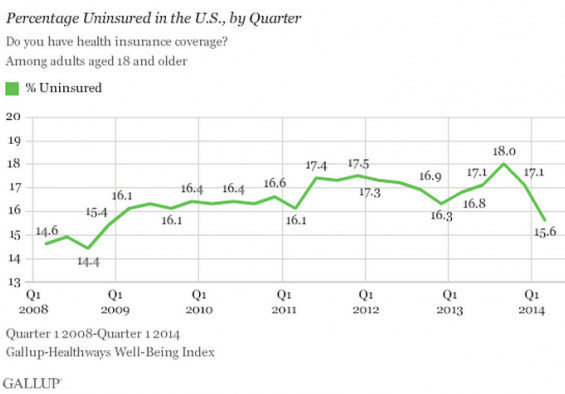

I know much less about health insurance than I do about unemployment, so the rest of the post is more of a “bleg” than a set of opinions. My first question is what is the goal of Obamacare? Here’s a graph showing the share of Americans who lack health insurance from 2008 to 2014.

The share of the population that is uninsured has dropped sharply since last summer. On the other hand the share of Americans lacking health insurance has risen in the 5 and 1/4 years since Obama was elected, from 15.4% to 15.6%. On the other, other hand 3 or 4 million more Americans will have health insurance by 2014:3. On the other, other, other hand that’s less than 2 percent of adults. So the share lacking health insurance will still be almost as high as in the summer of 2008. Or am I missing something?

The share of the population that is uninsured has dropped sharply since last summer. On the other hand the share of Americans lacking health insurance has risen in the 5 and 1/4 years since Obama was elected, from 15.4% to 15.6%. On the other, other hand 3 or 4 million more Americans will have health insurance by 2014:3. On the other, other, other hand that’s less than 2 percent of adults. So the share lacking health insurance will still be almost as high as in the summer of 2008. Or am I missing something?

Now let’s consider the goal of Obamacare. If the goal is to eliminate uninsuredness, then it seems to have failed. But perhaps the goal is to eliminate involuntary uninsuredness. After all, all of the sad stories we were told before the law was passed tended to focus on people who were unable to get treated for illness, or perhaps were financially devastated by the cost of treatment. If I’m not mistaken that will no longer occur, as no one can be turned down for having pre-existing conditions. Or is that assumption false? If there is no involuntary uninsuredness, can we consider the problem solved?

One objection might be that we need everyone covered, as otherwise the uninsured will tend to overuse emergency room services. But unless I’m mistaken there are studies showing exactly the opposite, that when given health insurance people tend to use the ER more often. Is that true? If so, why do we need to have everyone covered? Why isn’t it good enough to eliminate involuntary uninsuredness? Is the fear a “death spiral” that drives the insurance companies out of business?”

I’m sure this post contains many mistakes, and hope my commenters can educate me.

PS. In my view Obamacare did lots of bad things and two very good things. The good things were eliminating involuntary uninsuredness and the Cadillac plan tax. I opposed the program, but have an open mind on how it will pan out. We’ll know much more in 10 years. One key test is whether Congress will avoid “doc fixes” to the Cadillac plan tax.

PPS. Haven’t read Piketty’s new book yet, but a question for people who have. I’m told that he assumes the real rate of return on capital is about 5%, and that this is well above the real GDP growth rate. That assumption seems OK. But here’s what confuses me. Some of the reviews seem to imply that Piketty argues that real rate of return on capital represents the rate at which the wealth of the upper classes grow. Is that right? If so, what is the basis of that argument? I don’t think anyone seriously expects the grandchildren of a Bill Gates or a Warren Buffett to be 10 times as wealthy as they are. I’m pretty sure I’m misinterpreting his argument, so I hope someone can set me straight.

Tags:

8. April 2014 at 18:44

I haven’t read the Piketty book either, but the reviewers all seem confused. I can only conclude it must be a confusing book. I have the same question as you, plus other questions.

I wonder why in all this excitement about Piketty, nobody is referring the the seemingly relevant research of Kaplan and Rauh? Their research seems to show inheritance becoming less important, not more. Of course the importance of inheritance could increase in the future, which seems to be what Piketty is predicting, but we haven’t seen it yet. Ironically our two wealthiest people have pledged to will their entire fortunes to charity.

The best Piketty review I’ve seen is the one by Ryan Decker, which Yglesias oddly labeled as “from the right.”

http://updatedpriors.blogspot.com/2014/03/capital-in-partial-equilibrium.html

8. April 2014 at 19:08

Obamacare–yet another attempt to deal with the health care consequences of John Kenneth Galbraith … (One of whose subordinates in the Office of Price Administration was Richard Milhous Nixon: clearly, he had positive memories of the experience.)

As for involuntary and voluntary unemployment, I am reminded of My Fair Lady and the deserving and undeserving poor.

https://www.youtube.com/watch?v=aAQb_iGQmFo

8. April 2014 at 19:14

Ezra Klein interviews Ezekiel Emanuel in this new video:

http://www.vox.com/2014/4/8/5591314/how-obamacare-transforms-health-insurance

I don’t know how much of what Emanuel said is true but he’s a phenomenal salesman. He paints a very optimistic vision of our potential future healthcare system.

8. April 2014 at 20:10

You are just about right on ObamaCare, which had two goals:

1) Provide nearly free care to the 2% of the population that is uninsured and very sick.

2) Hide the cost of this from taxpayers, by utilizing mandates, moral suasion, accounting gimmickry, and most importantly, forcing self-employed Republicans to pick up a disproportionate share of the costs.

P.S.

My prediction on the Cadillac Tax: Employers will discover that the best way to avoid the Cadillac Tax is to reduce employment of older workers, sicker workers, and women. And this realization will cause the Cadillac Tax to be delayed indefinitely. Or maybe these people will be dumped on the exchanges, so that self-employed Republicans can pick up a disproportionate share of the costs in a de facto high risk pool.

9. April 2014 at 03:38

Just a quick note on the share of the population unemployed. Not 100% sure on my numbers but I believe that it would be 1-2% lower if the full medicare expansion had taken place. As it is right now there’s a large group of people who don’t qualify for medicare or exchange subsidies, which was explicitly not by design. Makes the numbers slightly more favourable for obamacare if that is taken into account.

9. April 2014 at 04:17

The 5% return gets reduced by:

– inheritors getting more numerous. Rockefeller has more than a hundred members. Du Pont, starting a century earlier, has more than a thousand. Because the rich marry other rich, by and large, this affects families more than it affects the class.

– consumption (philanthropic or otherwise). Some share of it is consumed, and only the remaining is invested. Only on average is the consumption share smaller than average MPC; some, like Carnegie or Rockefeller, may even consume more than their return on investment (i.e., running down the inheritance).

9. April 2014 at 04:43

Scott,

In my opinion, the very existence of the exchanges means we can consider the problem of “risk being caught uninsured” as being eliminated, regardless of the official uninsured percentage. I’m not saying Obamacare is perfect by any means, but like you I’m a pragmatist, and I think having a health insurance system with lots of holes for people to fall into and suddenly find themselves with an expensive condition and without insurance is a poorly functioning one to say the least. To the extent Obamacare fixes that, it’s a large improvement on the status quo.

In my view all of US healthcare policy evolved to just keep putting band-aids on holes. First you had the employer tax deductibility subsidy, but that created a huge hole for people once they retired, so we got Medicare. It also left a huge hole for the poor not covered by an employer, so we got Medicaid. Then you still had a big hole for people transitioning between jobs, so we got COBRA. Finally, until Obamacare we STILL had a hole for people who lost their jobs and couldn’t find new ones or who just otherwise were not covered privately but couldn’t buy an individual policy or get Medicaid. So I don’t say this with a whole lot of confidence, but I think Obamacare is the final band-aid, and to my knowledge there are no more glaring holes. I suppose the only one I can think of now is people who don’t buy on the exchanges and then get sick and rack up huge costs before they are eligible to buy into next year’s plan. But that’s not a big deal.

9. April 2014 at 04:58

Joseph, Can you be more specific? I thought Obamacare covered everyone.

David, I guess my real question is whether Piketty is assuming that a 5% real return on capital implies that wealth will rise by 5% per year. It clearly doesn’t imply that, but reviewers talk as if he is assuming that it does.

9. April 2014 at 05:02

Thanks Dan, So people have to wait a year to sign up? In that case I was wrong in assuming the uninsured were de facto insured. But the rest of your comments make sense.

I still think Obamacare is a bad program despite the two big gains that I cited, but that’s for entirely separate reasons.

9. April 2014 at 05:29

To my knowledge that’s right. You could still in principle be caught with your pants down mid-cycle, but keep in mind that you’d be paying the penalty for that and/or foregoing the subsidy that whole time anyway, so there are strong incentives to be enrolled while healthy regardless.

9. April 2014 at 06:06

To answer the question that you asked Joseph. The Exchange does not give subsidies to individuals under 100% of poverty. They were supposed to be covered by the expansion of Medicaid to 138% of poverty. However, since many states have refused to expand Medicaid, there is a subsidized coverage cap (i.e. individuals below 100% FPL who are not covered by Medicaid in their state).

9. April 2014 at 06:13

I was under the impression that the way the law was written it explicitly states that subsidies start at 133% of the federal poverty line and that medicare was supposed to be expanded up to that level. But some states haven’t done so which has caused there to be a group of people in some states which earn too much for Medicare but not enough for subsidies and that those people have been given a financial hardship waiver on the idvidual mandate. So yes they can still purchase insurance through exchanges or else where but the previous pre obamacare cost issue is still there. It’s mostly a technical issue which should be easy to resolve one way or another but which hasn’t due to politics.

9. April 2014 at 06:49

Scott,

This Forbes article summarizes the issue. I’m sure there’s better ones out there but this was the first one google threw up. According to that article the number is 4.8 million which would be covered by medicaid if all states had fully expanded. (I think I mistakenly referred to medicaid as medicare previously. My apologies.)Assuming some of those people have health insurance already the number of uninsured would be about 1% lower if medicaid was expanded as envisioned so not as big as an effect as I first stated but still noticeable.

http://www.forbes.com/sites/theapothecary/2014/02/12/what-to-do-about-millions-trapped-in-health-law-coverage-gap/

9. April 2014 at 06:56

Thank you BobG. I posted my follow up comments without seeing yours.

9. April 2014 at 07:18

r > g where r is 5 YOY

Is premised on DEBT based on historical atomic economy mindset. One where returns are “safe” – loans made against atomic collateral and labor is unrewarded.

Piketty says labor has gotten 2.5%, population grows at 1%, and capital earns 5%.

Now think about a equity based digital economy where we are winding down the capital in an orderly way. This is my NGDPLT grows at 2% until we are all consuming on electrons and calories.

Each digital newco:

1. Requires LITTLE OR NO CAPITAL.

2. Undermines current oldcos who have atomic debt that will not be able to be paid back.

3. Is structured to SELL / USE EQUITY (C Corp) from the beginning.

4. Rewards labor with equity PREFERABLY OVER TAKING ON CASH (via equity). Meaning newco founders offer labor the first right to take equity instead of salary at some kind of multiple.

5. Grows the pool of capital that sees the world in digital terms. It is more comfortable playing with equity. This is GEEKS get richer, not rich get richer.

Piketty says war destroys capital, as such we get good periods after them. If it helps, you should view DIGITAL DEFLATION AS A NON-STOP WAR, a war of attrition on atomic debt based systems.

BUT finally Piketty says Industrial Revolution grew income faster than capital.

And like Tyler Cowen, he makes mistake of not admitting that the Digital Revolutions DWARFS the Industrial Revolution, for the real growth gains it delivers.

All around us capital is freaking out if can’t find 5%. This is driving the valuations of the digital newcos higher and higher, BUT the cost of running them?

Still takes less and less capital.

As such, the capital is getting very small pieces of digital newcos, putting more equity into hands of founders / labor.

Each AQU-HIRE you read about?

That’s a transfer of $$$ from capital to labor.

This isn’t to say that we can’t do something about econ inequality, but it does mean that the answer is based on digitizing the safety net.

9. April 2014 at 08:00

Lorenzo from Oz:

“Obamacare-yet another attempt to deal with the health care consequences of John Kenneth Galbraith … (One of whose subordinates in the Office of Price Administration was Richard Milhous Nixon: clearly, he had positive memories of the experience.)”

Government fixing of spending also has adverse long term consequences.

—————————

Sumner:

“I still think Obamacare is a bad program despite the two big gains that I cited, but that’s for entirely separate reasons.”

Can’t be that bad, for if spending on all things not Obamacare fell by $50 billion for whatever reason, then NGDPLT will ensure that Obamacare spending rises by at least $50 billion.

9. April 2014 at 08:02

* The employer mandate has been waived, possibly indefinitely

* The individual mandate has been waived for “hardships”, a definition that will likely be tweaked and audited after the fact. This is a joke since the insurance was supposed to be “affordable” there should be no such thing as a “hardship.”

* The “penalty” will likely never be enforced except against politically disenfranchised groups, i.e., self-employed folks earning over $45K individually and $90 family. Enforcing the penalty would be an electoral disaster.

* The reinsurance fee was waived for union plans.

* HHS ruled that hospitals can enroll patients in Obamacare. In fact hospitals are allowed to pay patient premiums, too, which they will do only if the claims the hospital can collect exceed said premium costs.

What do all of these rulings have in common? They jack up the cost of insurance in the individual market, by increasing adverse selection.

Meanwhile, even in the above comments, you have people talking about coverage “gaps”, i.e., the person who chose to be uninsured and then got sick in the narrow 10 month period between open enrollments. Come on, IF YOU WANT FREE CATASTROPHIC AND EMERGENCY CARE, RAISE TAXES AND PAY FOR THE G**D*** THING! Stop with all the deceptive cost shifting and dumping of the bill on people in the unsubsidized individual market.

9. April 2014 at 08:14

There are two things that are obvious about Obamacare:

* People want FREE emergency/catastrophic/high-risk health care.

* No one wants to PAY for that.

The current situation is one where people in the unsubsidized individual market are pulling their weight thrice over, and everyone else is a morally hypocritical free-rider.

9. April 2014 at 08:35

Scott, in Piketty’s book capital=wealth. He uses these words interchangeably and defines them as stocks, bonds, real estate and anything in between. He does exclude human capital.

9. April 2014 at 09:18

Steve,

if you are healthy, and make good money, you can just pay the fine and use US Healthgroup http://www.ushealthgroup.com/

This lets you buy into the highest end Cigna network – which is all the famous top shelf hospitals.

The overall cost including penalty will be lower than Obamacare.

This is bc the people in plan are using HSA, smart upwardly mobile (healthy), and the plan doesn’t conform, so mental health, drug, pregnancy, etc. – you don’t pay for.

9. April 2014 at 10:09

No, he does not. He introduces the savings rate in chapter 5, which is what drives the accumulation or disaccumulation of the capital stock (no need to read that chapter: it’s just the Solow model simplified for the layman).

Piketty posted it here too, as part of module notes: http://piketty.pse.ens.fr/fr/teaching/10/25

His “second fundamental law of capitalism” in the book is what is labelled “Harrod-Domar-Solow formula” in the notes.

9. April 2014 at 10:12

Also note that the entire book’s thesis is essentially just Section 6, Note (i) in the linked course notes. Plus, admittedly, quite a lot of interesting but not rigorous historical narrative.

9. April 2014 at 10:20

“Stocks Rise After Fed Minutes”

http://www.businessinsider.com/stocks-rally-2014-4

9. April 2014 at 10:20

Dan, So is your prediction that when the penalty kicks in the number of uninsured will fall close to zero?

Bob and Joseph, Thanks for that info. It seems there are not enough people in that gap to explain the high uninsuredness rate.

Thanks David, So what is the key assumption that allows him to claim that wealth will rise faster than labor income in the steady state? Or is he simply postulating a once and for all rise in the wealth/income ratio, to a higher plateau than in the 1960s?

9. April 2014 at 10:34

David, Now that I’ve looked at his link I see that there is a steady state wealth/income ratio. So either the reviews were wrong or else I misunderstood what they were saying about “r.”

9. April 2014 at 11:00

Observes r* greater than g in the empirics aside from a postwar aberration, asserts it will continue to hold in the future, and then works backwards to derive that the result that wealth will rise faster than income. Raises the theoretical possibility of r* then falling when the capital stock increases, but argues that it will not fall “fast enough” because capital-labour substitution in the production function rises even faster, elasticity greater than one (again based on loose observation). Conclusion: wealth-income ratio rises essentially indefinitely, rather than plateauing.

However, the specter of gainful employment being worse than playing dynastic marriage games only occurs when some additional conditions are met: wealth-income ratio must be already quite high, and inheritance of that wealth must be much larger than inheritance of labour income (e.g., genetic lottery), by several multiples. Otherwise, intuitively, CEOs will out-earn trust fund kids sitting on investment returns, and no horrifying return to the 19th century occurs. Piketty argues that these conditions hold in chapters 9 to 11 and therefore argues against pure progressive income taxes in chapter 14 and, on practical grounds, against pure taxes on realized capital gains and inheritances in chapter 15. Instead advocates broad-based inheritance/wealth/income taxes.

9. April 2014 at 11:05

Heck, let me just copy and paste the relevant section from Ch6

9. April 2014 at 11:09

Dan S,

I think the big weakness with the system pre-ACA, which has not been corrected post ACA is the association between coverage and employment.

There is a big hole for the self-employed. And a smaller hole for the employed by an employer too small to be covered by the ACA employer mandate.

There is also a gap for the willfully unemployed — those either believe they are immortal, too distracted to seek insurance or who are gaming the system.

9. April 2014 at 11:13

The Medicare Advantage cuts received a “doc fix” of their own (administratively. not legislatively) for one year. This may be a sign.

9. April 2014 at 12:59

Dear Commenters,

Does this news indicate that the Fed is reluctant to overrule Janet Yellen????

“Fed Minutes Lift the Market”

http://www.crossingwallstreet.com/archives/2014/04/fed-minutes-lift-the-market.html

9. April 2014 at 14:03

Thanks David, Am I correct in assuming that the mere fact that r exceeds g does not prove that the wealth/income ratio will increase?

Also, he seems to assume savings is zero for labor and positive for capital. Is that right?

You said;

“However, the specter of gainful employment being worse than playing dynastic marriage games only occurs when some additional conditions are met: wealth-income ratio must be already quite high, and inheritance of that wealth must be much larger than inheritance of labour income (e.g., genetic lottery), by several multiples. Otherwise, intuitively, CEOs will out-earn trust fund kids sitting on investment returns, and no horrifying return to the 19th century occurs. Piketty argues that these conditions hold in chapters 9 to 11 and therefore argues against pure progressive income taxes in chapter 14 and, on practical grounds, against pure taxes on realized capital gains and inheritances in chapter 15. Instead advocates broad-based inheritance/wealth/income taxes.”

I’d add that lots of businesses become essentially worthless when the owner dies, and also that people like Gates and Buffett plan to give away almost their entire stock of wealth. In Europe that would be illegal, as rich people are forced to give at least 50% of their estate to children, even lazy, worthless, no good children. Perhaps Piketty’s work reflects a European perspective.

9. April 2014 at 14:35

Well – r exceeding g would imply that the wealth-income ratio would increase (but if wealth increases, then normally we would say that r would fall. Eventually, r will no longer exceed g; then the economy equilibrates around the new wealth-income ratio).

r exceeding g leading to an increase in the wealth-income ratio is ‘proven’ to the extent that one has faith in the Solow model of exogenous growth – you can throw a spanner in the works with something as undergraduate as human capital (a point which is acknowledged in chapter 6). I am not sure if this is what you are asking, though.

The book seems to assume a homogenous savings rate, i.e., equal for labour and capital income (net of capital depreciation).

Gates and Buffet are not new, of course – Carnegie gave away a lot of his wealth. But I question that this is broadly representative. It should show up in the annual inheritance flows that Piketty cites, for one thing.

The bigger killer of family fortunes, from a casual perusal, seems to be a lack of diversification away from the founding business. Even if the company is healthy after the founder dies, technology changes and bad luck eventually kill it. But contemporary attitudes toward long-term wealth management should suppress this habit.

9. April 2014 at 14:39

Piketty is a macro-scammer the same way Henry Blodget was a wall st analyst scammer.

The Blodget stock analysis methodology goes as follows:

Company XYZ will grow 25% annually for a DECADE.

Company XYZ will then have 8% terminal growth.

Apply a 10% discount rate….

And we project a target P/E ratio of 200! STRONG BUY!!!

It seems Piketty (and Krugman who parrots him) has adopted the same fallacious growth rate extrapolation methodology.

What’s wrong with this methodology? Reflexivity.

For the company, eventually the growth rate will go down once the addressable market is addressed, and go down even more when new businesses take cheap capital and build competitors.

For the macro argument, eventually returns will go down, or the economic growth rate will accelerate. And the wealthy will spend money on themselves as well as on taxes. g and r and both highly variable.

So Thomas Piketty is now the Henry Blodget of macro. Congratulations.

9. April 2014 at 14:56

@Steve –

There is no actual equilibration mechanism that obliges the production function to actually have a capital-labour elasticity of less than one, as Piketty (correctly) points out. Without this, there is no mechanism by which ‘reflexivity’ would occur.

9. April 2014 at 15:28

Big thanks to david for linking to these notes. You can’t understand Piketty by reading the reviews, that’s for sure.

9. April 2014 at 15:43

Just anecdotally – I have observed that for the very wealthy, they tend to be concerned more with preservation of capital. To the extent that they try to achieve high long-term real returns on capital, that tends to be seen in their foundations, which have a lifespan greater than their own and are used to benefit others.

9. April 2014 at 15:46

I believe Henry Blodget argued that eToys had a permanent first mover advantage. In other words, there was no mechanism by which ‘reflexivity’ could bring eToys back to earth — they had a first mover advantage so the game was up for all future toy retailers.

So it still sounds like Piketty is making the Blodgett argument.

You could sum up Piketty in one sentence: “I think capital share of national income could forever rise.”

That statement is, perhaps, possibly true. But it doesn’t sound so smart as an eleborate wonkish model saying the same thing.

In order for capital share to swallow the entire economy by defying reflexivity, there must be some subset of businesses swallowing the entire economy by virtue of defying reflexivity.

9. April 2014 at 15:50

It is difficult to understand Piketty even by reading Piketty, because the book is carefully equation-free, even when he is bandying around rates of changes of flows (i.e., rates of change of rates of change!) which may or may not balance each other.

9. April 2014 at 16:02

david, I don’t understand when you say “r exceeding g would imply that the wealth-income ratio would increase.”

From the notes, section 1.2 notes 4 and 5 seem to give a Cobb-Douglas example where you have steady state with r* and beta* constant, with r*>G. (For example you could have r*=5%, s=6%, g=1%, beta*=600%, and alpha=30%.) What am I missing?

9. April 2014 at 16:08

(aside from equations of the multiplicative form A = B * C * …, which I don’t really think count)

@Steve –

This is nonsensical; the success of individual businesses does not change the capital share of income one whit. A ferociously competitive economy can be entirely coexistent with a high, or rising, capital share of income; the only requirement is that each individual entrepreneur pays the surplus from economic activity mostly to the suppliers of the capital rather than the suppliers of the labour. A nation of small shopkeepers can still paying high interest rates.

9. April 2014 at 16:42

@ed

Y’know, on a careful re-glance through the book, I’ve just realized you’re right. r > g actually holds only as an approximation when g is close to zero, then the fact that s is less than one matters less and less in the limit. This is made explicit in Ch6 and also the notes linked. Whoooops. Now I understand where Sumner’s remark was coming from…

9. April 2014 at 16:47

(alternatively you can assume that all income from capital is saved, but that’s not really plausible)

9. April 2014 at 17:31

Mark A. Sadowski,

Do you think that Jason Smith is overly critical of the concept of expectations. Here are some examples:

http://tinyurl.com/mrpmq2w

9. April 2014 at 18:16

david wrote: “A ferociously competitive economy can be entirely coexistent with a high, or rising, capital share of income…A nation of small shopkeepers can still paying high interest rates.”

Yes, but only if they live in the Eurozone.

9. April 2014 at 18:20

Another fine graph from Saez showing my point that the 1/3 who spend part of earning life in the 80-99% are the hegemony in America.

http://www.zerohedge.com/news/2014-04-09/richest-rich-have-never-been-richer-rest-us

Only a true idiot on the left, hoping to help the bottom 2/3 wouldn’t ask the hegemony what deal they want to GUT the oligarchs.

Game theory isn’t a strong suit of liberals.

9. April 2014 at 18:34

David, This subject isn’t my speciality, but your last few comments make more sense to me. My intuition was that the rich can’t be assumed to get richer if they consume (or donate) their wealth. So it has to be more than just r and g. Savings rates, taxes, bequests, etc, also had to factor into the model somehow.

9. April 2014 at 19:21

From Governor Daniel K. Tarullo.

http://www.federalreserve.gov/newsevents/speech/tarullo20140409a.htm

Fed-policy-driven recovery has “benefited high-earners disproportionately.”

Tarullo seems to understand that it really, really, REALLY matters who gets the new money first.

10. April 2014 at 03:04

Krugman just put out these slides on QE: https://webspace.princeton.edu/users/pkrugman/Quantitative%20easing.pdf

10. April 2014 at 05:54

“Lowest Initial Claims Report in Seven Years”

http://www.crossingwallstreet.com/archives/2014/04/lowest-initial-claims-report-in-seven-years.html

10. April 2014 at 07:13

Mark A. Sadowski, I think I found a discrepancy on the Wikipedia money supply page regarding their description of M0 in the US:

http://en.wikipedia.org/wiki/Money_supply

I left the following comment on their “talk” page for the article:

Discrepancy in description of M0 in the US

In the 1st table, the only check mark in the M0 column corresponds to the 1st row:

“Notes and coins in circulation (outside Federal Reserve Banks and the vaults of depository institutions) (currency)”

Directly underneath the table you note:

“M0: In some countries, such as the United Kingdom, M0 includes bank reserves, so M0 is referred to as the monetary base, or narrow money.”

Which implies that perhaps in the US (which is what the preceding table was about) M0 does NOT include “bank reserves.”

And then later in the this section:

http://en.wikipedia.org/wiki/Money_supply#United_States

You write about MO the following:

“M0: The total of all physical currency including coinage. M0 = Federal Reserve Notes + US Notes + Coins. It is not relevant whether the currency is held inside or outside of the private banking system as reserves.”

So here it’s clear that being inside or outside the private banking system as reserves is “not relevant” to its status as M0, but in the table you clearly state that it’s ONLY the currency OUTSIDE depository institutions. This seems to be a direct contradiction.

10. April 2014 at 07:18

Mark A. Sadowski,

As I noted earlier:

http://www.themoneyillusion.com/?p=26552&cpage=1#comment-328689

Jason Smith has a different view of expectations. He seems to imply that empirical evidence is not always supportive.

Jason also writes this:

“I find expectations to either be like phlogiston or way too powerful.”

http://informationtransfereconomics.blogspot.com/2014/04/inflation-predictions-are-hard.html?showComment=1397101892546#c1584940641137386799

What do you think the empirical evidence is for the power and/or phlogiston-likeness of expectations?

10. April 2014 at 08:04

Marcus Nunes notes an AWFUL argument from Edward Lambert (a liberal economist?):

http://thefaintofheart.wordpress.com/2014/04/10/on-breaking-bones

“I would love to support continued aggressive policy to bring the economy back to full employment, but the social cost of inequality is sickening. And if stopping this disease means putting the economy back into a recession, then so be it.

………

It is like re-breaking a bone to set it straight. If the re-breaking of a bone is not done, the bone won’t work correctly in the future. It is proper medicine. You will be better off going through the moment of extra pain.

My prescription is to re-break the economic bone which has not set correctly, and this time let’s be aggressive in setting straight better wages and labor share from the start…..”

10. April 2014 at 08:24

W-O-W!!!!

Bob Murphy promotes Paul Craig Roberts!!

http://consultingbyrpm.com/blog/2014/04/paul-craig-roberts-doesnt-expect-a-happy-new-year.html

“The evidence of massive amounts of naked shorts being dumped into the paper gold futures market at times of day when trading is thin is unequivocal. It has become obvious that the price of gold is being rigged in the futures market in order to protect the dollar’s value from QE.

…………

Nothing worked on 9/11. Airport security failed four times in one hour, more failures in one hour than have occurred during the other 116,232 hours of the 21st century combined. For the first time in history the US Air Force could not get interceptor fighters off the ground and into the sky. For the first time in history Air Traffic Control lost airliners for up to one hour and did not report it. For the first time in history low temperature, short-lived, fires on a few floors caused massive steel structures to weaken and collapse. For the first time in history 3 skyscrapers fell at essentially free fall acceleration without the benefit of controlled demolition removing resistance from below.

Two-thirds of Americans fell for this crackpot story…

But no one else believed it, least of all the Italians.”

10. April 2014 at 08:30

Mark A. Sadowski,

This definition doesn’t match either of the ones on Wikipedia for M0:

http://www.investopedia.com/terms/m/m0.asp

I tried leaving a comment but it didn’t stick for some reason.

What is the proper definition in the US? How about Canada? I know the UK is different.

10. April 2014 at 08:38

Mark A. Sadowski, O/T: I did find a guy with a copy of Jurg Niehans book: commentator HJC at Nick Rowe’s site. We went through a few examples, but it was inconclusive. What he said seemed to me to indicate that what I called “the definition” and what JP Koning called the “Tom Brown Multiple” was more likely attached to the MOA than the UOA, however, HJC thought that you were correct and Marcus was wrong in his post in which he referred to the “MOA.” HJC and you … and Marcus later, all thought that he should have used UOA there. HJC gave as a reason that there was no good associated with the URV over the months in question in 1994.

So, although I was happy to have some feedback from HJC and he quoted the book at least once, he concluded that the definitions in Niehans’ book left something to be desired. I’m left thinking the issue is still unresolved. Here’s the start of the thread:

http://worthwhile.typepad.com/worthwhile_canadian_initi/2014/04/temporary-vs-permanent-money-multipliers.html?cid=6a00d83451688169e201a73da21569970d#comment-6a00d83451688169e201a73da21569970d

10. April 2014 at 09:08

Tom Brown,

“I think I found a discrepancy on the Wikipedia money supply page regarding their description of M0 in the US:…”

You only found one? Then that means it’s pretty good for a Wikipedia entry. Keep in mind that Wikipedia is an encylopedia written by *anybody*.

My own experience from editing the pages on automobiles is that there is an army of determined idiots who are intent that Wikipedia express their opinion no matter how wrong it may be. The only way to correct these errors is by engaging in “edit wars” which usually get resolved by somebody getting blocked from editing that page. If we’re lucky it’s the person who is correct, but that’s up the judgement of the people who manage Wikipedia.

Now to the matter in question.

The section is titled “Empirical measures in the United States Federal Reserve System” so it’s referring to US specific measures and moreover supposedly official ones used by the Federal Reserve. The only problem is that *there is no M0 money supply aggregate in the US, and there never has been one*.

As far as I can figure out, the Federal Reserve only started to use the term “M1” informally around 1960. It wasn’t until 1971 that it started giving money supply official names such as M1, M2 and M3. At one time there was even an M4, an M5, and an L measure. But there’s never been an M0. See this short history for example:

http://richmondfed.org/publications/research/economic_review/1989/pdf/er750102.pdf

Note that the Wikipedia article cites DollarDaze Economic Commentary Blog by Mike Hewitt as the source of its information on M0.

Who is Mike Hewitt? Damned if I know.

So, who uses M0? The BOJ uses M0 to denote currency in circulation. The BOE used M0 to denote the monetary base until May 2006, but no longer. The World Bank and the IMF uses M0 inconsistently but usually they use it to denote the monetary base. Canada does not have an M0 measure. Other than that I don’t know offhand.

But note that of the central banks or international organizations I mentioned only the BOJ consistently uses M0 the way that Wikipedia and Mike Hewitt use the term.

And this means Wkipedia is wrong. (So what else is new?)

10. April 2014 at 09:23

Mark, thanks for your help. I too looked on the fed’s websites and found little mentioning M0. So the thought did cross my mind that it wasn’t actually used in the US, but I thought I’d ask you since I’ve used that Wikipedia table as a reference in many conversations (and as I recall the table used to be consistent with the text below it). Sure I know you can’t trust it but in this instance I was surprised since nobody ever pointed out to me that M0 was never used. Thanks again for the sanity check!

10. April 2014 at 09:45

Tom Brown,

“Jason Smith has a different view of expectations. He seems to imply that empirical evidence is not always supportive.”

Well, evidently this is why he is a physicist and not an economist.

Economics is a social science, so by its very nature is interested in the behavior of people. People are not inanimate objects. The beliefs of people about the future matter a great deal, unlike frictionless gliders and cue balls:

http://i85.photobucket.com/albums/k46/gcapot8462/CueBall_Close_Up.jpg

I’ve heard people question rational expectations, or argue the virtue of adaptive expectations, or even come up with alternative theories of expectation formation (e.g. Akerloff and Yellen’s “near-rational expectations”) but I’ve never heard anyone question the value of considering expectations in the context of economics.

I came across the following paper the other day courtesy of Simon Wren-Lewis:

http://andy.egge.rs/papers/Eggers_Fouirnaies_Recessions.pdf

It shows that there is a significant effect of the announcement of a recession on personal consumption, but not on physical investment. Wren-Lewis points out that this is not very “rational”:

http://mainlymacro.blogspot.com/2014/04/when-definition-of-recession-matters.html

This actually supports theories of expectation formation such as Akerlof and Yellen’s, in which some agents (i.e. households) act with incomplete information because there is some cost or impediment to their gaining a more complete comprehension of what is most likely to happen.

And one implication of the paper is that *expectations matter*.

Incidentally…

Granger causality tests using data in monthly frequency from December 2008 to September 2012 show that household nominal income expectations, as measured by the University of Michigan Survey, cause 10-year T-Note yields at the 10% significance level. Furthermore the impulse response results show that household nominal income expectations have a significant *positive* effect on 10-year T-Note yields which is exactly what term structure theory predicts. (And try and find an explanation of term structure theory that does not refer to “expectations”.)

Furthermore, I find that inflation expectations Granger causes Nondefense Capital Goods Excluding Aircraft Industries (ANXAVS) spending at the 5% significance level over the period from December 2008 to present.

So you’ll have a hard time convincing me that expectations don’t matter.

10. April 2014 at 09:52

Mark thanks for the information on expectations. I have yet to read all of those articles on Jason’s blog. But I was curious about other evidence. Appreciate it.

10. April 2014 at 10:00

Tom Brown,

“So, although I was happy to have some feedback from HJC and he quoted the book at least once, he concluded that the definitions in Niehans’ book left something to be desired. I’m left thinking the issue is still unresolved. Here’s the start of the thread:…”

Yes, I read the conversation. I agree the issue is unresolved from the standpoint of Niehans’ opinion.

But I still think the UOA doesn’t make much sense unless it includes the “definition”, and the MOA obviously includes only the commodity and not the “definition”, as the definition can be changed without changing the commodity.

In other words, the UOA is the measuring unit, the MOA is the commodity that you are measuring. I really don’t understand how anyone can see it any other way.

10. April 2014 at 10:16

Mark A. Sadowski,

Re: economics being a social science, well now that we’re beginning to peer into people’s brains and see what they’re dreaming or imagining (…and also beginning to upload false memories into mice!):

http://sbstatesman.com/2014/03/27/physicist-dr-michio-kaku-captivates-student-audience/

…perhaps it won’t be long until economics becomes a hard science too. 😀

BTW, that false memory thing has got to have Madison Avenue salivating, right? Yeah, I remember that Coke I had… it was good and well worth the money!

Re: UOA vs MOA: I agree it makes more sense to have the definition as part of the UOA, but his talk of how Niehans described it, with the Roman coin example, etc, made me think that Niehans might not be completely on board. Oh well.

10. April 2014 at 10:59

… maybe an enterprising Google-like company in the future will offer to upload false memories of how to do advanced mathematics or speak French or something, in exchange for “ad space” in your brain! 😀

10. April 2014 at 11:02

[…] Source […]

10. April 2014 at 11:31

Tom Brown

“Re: UOA vs MOA: I agree it makes more sense to have the definition as part of the UOA, but his talk of how Niehans described it, with the Roman coin example, etc, made me think that Niehans might not be completely on board. Oh well.”

The “denarius” is a coin which ceased to exist as a medium of exchange. But the denarius was itself defined in terms of asses. A denarius was equal to ten, and later 16, asses. An “as” was a Roman coin made of bronze or copper, and the weight of the as was changed several times.

So I would argue that the UOA was the as, and the MOA was bronze or copper. Thus, with respect to the denarius, I really don’t know what HJC was talking about.

The Niehans passage that HJC quoted failed to resolve the issue precisely because HJC only quoted a passage that expressed what we already know (i.e. the medium of account is the commodity that defines the unit of account).

I think part of the confusion stems from the fact that in a modern purely fiat system there is no way to separate the UOA from its MOA. But this has not always been the case. At the time that Niehans wrote his book the US had only had a purely fiat system for five years.

10. April 2014 at 11:45

“But the denarius was itself defined in terms of asses” ??? Really? 😀

10. April 2014 at 11:48

ECB’s Constancio: “We Will Do Something” About Low Inflation

http://blogs.wsj.com/economics/2014/04/10/ecbs-constancio-we-will-do-something-about-low-inflation

10. April 2014 at 11:52

The Romans greatly appreciated asses, Tom.

10. April 2014 at 11:56

Philippe, I’d never heard of a “as” before. You? Well I learn something everyday.

10. April 2014 at 12:19

Bernanke SMASHES Raghuram Rajan!

http://blogs.wsj.com/economics/2014/04/10/bernanke-settles-back-into-research-world-2

“I do want to take you to task as a professor at the University of Chicago, ignoring money. You made a very clever equivalence … between exchange intervention and unconventional monetary policies,” he said.

“There’s one very important difference which is that exchange rate intervention sterilized the effects on monetary policy or on the money supply. So you’re ignoring the money supply,” Mr. Bernanke continued.

What that means, he said, is that unconventional monetary policies like going off the gold standard in the 1930s “increase the total demand in the global economy,” whereas exchange rate interventions, like the tariffs of the 1930s are “demand-diverting, they take from a fixed amount of demand and move it from one country to another. There is a very important difference between those two policies.”

To which Mr. Rajan responded, “The underlying assumption is debt overhang and a variety of other constraints in the economy prevent the demand-augmenting side of monetary policy, creating more of these adverse global effects.”

10. April 2014 at 12:30

Hey Scott,

First of all, it’s worth remembering that Medicaid expansion in the Affordable Care Act was a major part of the ACA and it was shot down by the SCOTUS, and now over a third of the United States population are not living in states that accepted the Medicaid expansion. Especially of note is that a lot of these states without the expansion have high poverty rates; out of the ten states with the highest poverty rates (excluding DC), only New Mexico and Arizona opted for the Medicaid expansion.

I wish I could find some data on state-by-state uninsured percentages going into 2014. The Medicaid expansion is really a perfect natural experiment. A difference-in-difference analysis looking at the number of uninsured living below the poverty line would be a surefire way to test how the Medicaid expansion affected insurance rates, and I expect to see a lot of DID models on Medicaid expansion popping up in the next year.

You wrote: “One objection might be that we need everyone covered, as otherwise the uninsured will tend to overuse emergency room services.”

I’m not sure that’s the argument most (or even any) Obamacare/universal health care proponents use. The argument is about adverse selection, and a mandate is necessary to mitigate adverse selection in a system where companies cannot deny people for having pre-existing conditions.

In one respect you can say that people “should” have the right to be voluntarily uninsured, but there’s really no guarantee that voluntarily uninsured person will not apply for insurance the minute they get sick. Of course if everyone did that, by Akerlof (1970)’s model, the market for health insurance would cease to exist, even though a risk averse population would much rather have health insurance than no health insurance.

10. April 2014 at 12:35

Ah, I just read the previous discussions about the Medicaid expansion. I didn’t realize how few people are actually eligible for the expansion! Still, it would be interesting to see the effects on state budgets and insurance rates from the expansion.

10. April 2014 at 12:52

Tom, it’s where the term ‘booty’ originates from.

When the Romans brought back plundered treasure that was worth a lot of asses, it was referred to as booty.

10. April 2014 at 12:54

Philippe… Lol… you’ve GOT to be pulling my leg with that one!

10. April 2014 at 13:14

TravisV,

“To which Mr. Rajan responded, “The underlying assumption is debt overhang and a variety of other constraints in the economy prevent the demand-augmenting side of monetary policy, creating more of these adverse global effects.””

If this is true, then how come, between 2009 and 2013, where they have done QE, namely the US, the UK and Japan, the trade balance has decreased due to demand augmentation, whereas in the Euro Area, where they have done no QE, the trade surplus has nearly tripled?

http://appsso.eurostat.ec.europa.eu/nui/show.do?query=BOOKMARK_DS-055480_QID_-1A2F7BB4_UID_-3F171EB0&layout=TIME,C,X,0;GEO,L,Y,0;UNIT,L,Z,0;INDIC_NA,L,Z,1;INDICATORS,C,Z,2;&zSelection=DS-055480INDIC_NA,B11;DS-055480INDICATORS,OBS_FLAG;DS-055480UNIT,PC_GDP;&rankName1=INDIC-NA_1_2_-1_2&rankName2=INDICATORS_1_2_-1_2&rankName3=UNIT_1_2_-1_2&rankName4=TIME_1_0_0_0&rankName5=GEO_1_2_0_1&sortC=ASC_-1_FIRST&rStp=&cStp=&rDCh=&cDCh=&rDM=true&cDM=true&footnes=false&empty=false&wai=false&time_mode=NONE&time_most_recent=false&lang=EN&cfo=%23%23%23%2C%23%23%23.%23%23%23

The Euro Area is sucking the aggregate demand out of the global economy. Does Rajan ever consider the facts before he makes the assertions?

10. April 2014 at 14:33

Scott,

Off Topic.

Heard somewhere in the econblogosphere:

“My research shows that hyperinflation tends to be more than a monetary phenomenon. In fact, the “money printing” that is generally associated with a hyperinflation tends to occur for OTHER reasons. The primary factors leading to hyperinflation include:

War

Production collapse

Regime change

Lack of sovereignty…”

Yes, these factors are often present during hyperinflation.

But I want to specifically address the “production collapse” factor to put this in some perspective.

Using the Hanke-Krus list of hyperinflations as a guide, what is the largest decline in RGDP from peak to the last year of hyperinflation, and what is the largest decline during from the year before the hyperinflation to the last year of hyperinflation?

http://upload.wikimedia.org/wikipedia/en/8/88/The_Hanke_Krus_Hyperinflation_Table.pdf

According to the Angus Maddison database, the largest decline from peak was in Greece (1941-45). RGDP was 64.4% lower in 1945 than it was in 1937. Greece is also the largest decline that can be found during the actual hyperinflation itself, by 57.6% from 1940 to 1945.

Assuming NGDP had remained constant from 1937 to 1945, Greece’s price level would have increased just under 3-fold, ceteris paribus. Instead we know that in the worst month of the hyperinflation alone, October 1944, the price level increased 139-fold.

We have no way of knowing how much real output rose or fell that month, but it’s a safe guess, given that RGDP had already fallen nearly 50% from peak by the previous year, and fell about 16% year on year in 1944, that NGDP probably went up over 100-fold in that single month of October 1944.

The point is, although the decline in real output was severe, it was a relatively minor factor in contributing to the hyperinflation. Rather, more likely, with prices doubling every four days, the hyperinflation contributed to holding down the real output level.

What about the flip side of things? Are there any cases of real output rising during the years of hyperinflation, or indeed rising to record levels? Yes and yes.

Here’s a list of countries where RGDP rose from the year before the hyperinflation to the last year of the hyperinflation:

Country-years-RGDP

1.Taiwan-1947-49-(+56.2%)

2.Angola-1993-97-(+34.2%)

3.Austria-1920-22-(+20.6%)

4.Germany-1919-20-(+8.7%)

5.Zaire-1990-92-(+5.1%)

6.D.R.Congo-1997-98-(+3.7%)

7.Bolivia-1983-85-(+0.03%)

The Hanke-Krus list contains 54 incidents of hyperinflation. This means in 13% of hyperinflation cases, RGDP was higher in the last year of the hyperinflation than in the year preceding the hyperinflation.

However, despite these increases in RGDP, real output was still below record levels in the last year of hyperinflation in all but one these incidents: the D.R.Congo in 1998. Nevertheless, D.R. Congo *is* an example of a country that attained a record high level of RGDP during a hyperinflation.

Lots of generalizations are made about hyperinflation. But only one thing is really true of all of them: it is a monetary phenomenon.

10. April 2014 at 14:35

“…and what is the largest decline during from the year before the hyperinflation to the last year of hyperinflation?”

should read

“…and what is the largest decline from the year before the hyperinflation to the last year of hyperinflation?”

10. April 2014 at 14:56

Tom Brown:

“Philippe, I’d never heard of a “as” before. You? Well I learn something everyday.”

Phillippe:

“Tom, it’s where the term ‘booty’ originates from.”

Reminds me of these guys:

http://cdn.memegenerator.net/instances/500x/43540250.jpg

10. April 2014 at 14:57

Ha!

10. April 2014 at 15:03

No, not “Ha!” I mean:

https://www.youtube.com/watch?v=1OvMZT2zfy0

10. April 2014 at 15:17

Scott,

Off Topic.

Thomas Palley has a paper in which he suggests something he terms an “asset based reserve requirement” (ABRR):

http://www.thomaspalley.com/docs/articles/macro_policy/monetary_policy_and_qe.pdf

I just skimmed the paper but it seems straight out of la-la land.

Hitherto reserve requirements have only applied to liabilities, not assets. Furthermore his suggestion is to apply ABRRs to non-bank financial intermediaries as well as to banks. And, on top of that, he proposes setting the ABRR by asset type in a highly discretionary manner.

Normally I think of Thomas Palley as being relatively thoughtful for a Post Keynesian economist. However, on first pass, the suggestion in this paper seems Colonel Bat Guano crazy:

http://moviegoings.files.wordpress.com/2009/04/batguano.jpg

10. April 2014 at 17:13

” In Europe that would be illegal, as rich people are forced to give at least 50% of their estate to children, even lazy, worthless, no good children.”

How so? Scott?

10. April 2014 at 17:32

Mark, I thought my comment was a notch above beavis and butthead, even if it was ass related.

10. April 2014 at 20:27

You can watch Bernanke school Raghuram Rajan 1 hr 15 min into this video:

http://www.youtube.com/watch?v=VBmiq_yB8aI

11. April 2014 at 05:12

Mark and Travis, Rajan is a very good economist, but his forte is not macro–which makes it ironic that he’s been put in charge of macro policy for a nation of 1.3 billion people. I’d guess he’s not aware of the literature demolishing the beggar-thy-neighbor argument.

Daniel, Yes, a DID study would be very interesting. Regarding health insurance, I favor a system of mandatory HSAs done via payroll tax deductions, combined with government catastrophic insurance.

Mark, They also seem to be confusing the direct cause of hyperinflation, with factors that might lead a central bank to print a lot of money.

Edward, Check this out:

http://www.themoneyillusion.com/?p=2734

11. April 2014 at 05:14

“Sweden: The New Laboratory for a Six-Hour Work Day”

http://www.theatlantic.com/international/archive/2014/04/sweden-the-new-laboratory-for-a-six-hour-work-day/360402

11. April 2014 at 05:36

Scott,

How has Rajan done in his role of setting macro policy?

TravisV, thanks for the link. Rajan sounds more conciliatory after that first bit he gives in response to Ben.

https://www.youtube.com/watch?feature=player_detailpage&v=VBmiq_yB8aI#t=4507

11. April 2014 at 07:26

Prof. Sumner,

I can’t link to Arnold Kling’s blog. However, he just wrote a post on charter schools that you might be interested in.

He argues that libertarians should view charter schools as a mostly-good thing.

12. April 2014 at 11:08

Tom, Sorry, I haven’t followed that issue closely.

Travis, I agree on the charter schools.

13. April 2014 at 18:30

Prof. Sumner,

I’m curious what exchange rate interventions Rajan was referring to. Were they really just tariffs?

I’m curious which exchange rate interventions are sterilizing and which ones aren’t. For example, if the Fed printed a ton of new U.S. dollars and bought lots of foreign currencies with them, that wouldn’t be sterilizing…..

9. October 2014 at 11:21

Kevin M. Kerekes

TheMoneyIllusion » Voluntary unemployment, voluntary uninsuredness?