TIPS spreads are a big problem

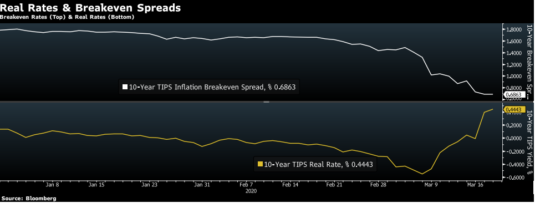

Michael Darda sent me a scary graph showing 10-year TIPS spreads (white line) and the (real) yield on 10-year TIPS (yellow line):

Notice the recent sharp increase in real interest rates in the US. This is exactly what happened in late 2008. Indeed almost everything that’s happened recently in the financial/commodity markets is a replay of what happened in late 2008.

But the rise in real interest rates is especially interesting. When I point out to economists that nominal interest rates don’t measure the stance of monetary policy, they sometimes say, “Yes, but real interest rates do.” Actually they don’t, as Ben Bernanke once explained.

But if real interest rates did measure the stance of monetary policy, then policy would have been getting much tighter. Do my colleagues in the economics community agree with me that monetary policy has been getting much tighter? No, of course not.

When I used to point out to people that real interest rates rose sharply between July and November 2008, they looked for 101 excuses to explain it all away. They say that TIPS didn’t accurately measure ex ante real interest rates. Really? TIPS are 100% default risk-free, and the real rate of return is locked in. In the entire investment universe there is no asset that measures risk free ex ante real interest rates more accurately than TIPS. But they just knew that money couldn’t possibly be getting tighter, so there had to be some other explanation.

Now it is true that the TIPS spread can get distorted during periods of high demand for liquidity, and that the current 0.62% 10-year TIPS spread may not accurately measure inflation expectations. (Note that the TIPS spread is for CPI inflation; it implies a PCE inflation rate of barely over 0.3% over the next 10 years!)

But even if the TIPS spread is distorted, it doesn’t mean money is not too tight, it just means that it’s too tight for a different reason. Both of the two possible reasons for low TIPS spreads (low inflation expectations and a mad rush for the more liquid conventional bonds) suggest that money is currently way too tight.

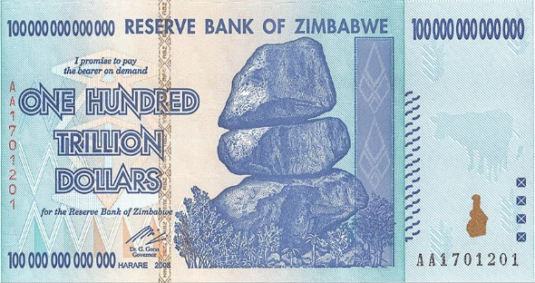

Some will insist that conventional Treasuries are the measure of all things, including real interest rates. That’s as nonsensical as someone in Zimbabwe in 2008 claiming “all asset values are soaring higher”, not recognizing that actually the value of one specific asset:

is plunging much lower.

Similarly, 99% of assets in the world are like TIPS, with rising real yields, not like Treasuries, with falling real yields. There in no meaningful sense in which one can deny that real interest rates in America are rising. That doesn’t prove that money is tight, but it suggests that people who view the stance of monetary policy through the lens of interest rates ought to view it as tight.

In my view, NGDP expectations over the next few years best measure the stance of monetary policy, and of course they are also falling.

PS. If you are in an investment area where liquidity doesn’t matter, say a company investing for insurance or pension obligations 10 years out, why wouldn’t you prefer TIPS over Treasuries right now? Isn’t PCE inflation likely to exceed 0.3% over 10 years? I’d be interested in responses from someone in the investment community.

PPS. George Selgin wrote an excellent post in response to Bob Murphy’s critique of market monetarism.

Bob wanted an example of where NGDP targeting would fail to stabilize NGDP. Suppose you are targeting 2-year forward NGDP expectations, and NGDP in Q2 and Q3 of this year fell sharply. Then the policy would fail to stabilize current NGDP. So there’s nothing tautological about our defining tight money as low expectations of future NGDP growth.

PPPS. David Beckworth has a new Mercatus Policy Brief discussing ideas for addressing the impact of the coronavirus on NGDP.

PPPPS. I have a new Mercatus Bridge post on the need for new Fed policy tools.

Tags:

18. March 2020 at 12:20

Interesting Scott,

So how much of this whole problem is demand vs supply shock. It seems from this post that this problem is a demand shock caused by the reaction to the coronavirus. Does that mean that the Federal Reserve needs to do a much larger QE immediately?

18. March 2020 at 12:25

Portfolios managers in insurance and pension functions are likely to be compensated for their performance versus strategic benchmarks decided by actuaries/consultants. These benchmarks probably don’t have an allocation to TIPS in them, and are instead a stock-bond mix that is basically S&P500/Barclays Agg (no TIPS in the Agg).

Buying TIPS over UST would be a significant out-of-benchmark bet that would add a lot of active risk (aka tracking error). The breakeven exposure would be tough to manage and you’d risk getting fired if you can’t explain it adequately if it goes against you in the short term if breakevens keep tightening.

18. March 2020 at 12:28

PS. If you are in an investment area where liquidity doesn’t matter

I would suggest this doesn’t describe any investment area right now. ymmv, but maybe you can find a real insurance guy to reaffirm this.

P.S. Investment grade corporate bonds are down close to 20% in the last week (measured by lqd etf). They are just as volatile as equities. I’m guessing there are colossal holes in insurer and pension fund balance sheets.

18. March 2020 at 12:35

Consider the whole Treasury inflation indexed curve versus the nominal Treasury curve. One take-a-way is that the part of the curve that has increased most is the short-term maturities. The one-year TIPs yield was above 2% last time I checked (yesterday or Monday I think, now working from home and no access to Bloomberg). There was a similar pattern in the 2008 crisis. Both periods have seen significant liquidity crises. Even in this current period, the Federal Reserve has agreed to buy TIPs, but I’m not sure it’s sufficient to offset the illiquidity in fixed income markets. This means that you should consider part of the yield to be a liquidity premium, which doesn’t mean that inflation expectations are as low as we would expect. Ideally, there would be a better way to measure inflation expectations in the market without these liquidity problems…

18. March 2020 at 13:14

In times of financial crisis, Tips are treated more like a risky asset than traditional Treasury bonds. It may have to do with the latter’s importance in hedging mortgages, futures, swaps and also just plain curve trading. The “need for speed” in Treasuries is important. Tips are a different animal. It is all relative of course—they are more liquid than Corporates for example—but yes, longer-term holders should find them appealing today I think—-unless, of course, they think we are about to head into 1930—which does not sound as crazy today as it did a few months ago!

18. March 2020 at 13:31

Hi Scott,

I have been a long time follower and, as a non-economist, I appreciate your explanation of monetary policy. In New Zealand, we haven’t had quite the same issues as the US/Europe etc as we were not anywhere near zero on our OCR (although despite that the RBNZ has failed to meet its inflation target for most of the last decade).

NZ finally hit effectively zero this week after 75 bp cut. The feckless RBNZ has said they cant cut further (negative) as our bank IT systems arent set up technically for it. Worse the RBNZ shows absolutely no inclination let alone a credible commitment to keep inflation expectations up. In recessions historically we have cut about 500bp. So I think we are a bit stuffed at this stage. Hope the Fed has more gumption.

18. March 2020 at 15:20

@ Sumner who says: “When I point out to economists that nominal interest rates don’t measure the stance of monetary policy, they sometimes say, “Yes, but real interest rates do.” Actually they don’t, as Ben Bernanke once explained….Similarly, 99% of assets in the world are like TIPS, with rising real yields, not like Treasuries, with falling real yields. There in no meaningful sense in which one can deny that real interest rates in America are rising. That doesn’t prove that money is tight, but it suggests that people who view the stance of monetary policy through the lens of interest rates ought to view it as tight.”

Please professor, can you ban me from posting here? I beg of you. What you wrote above–even for people who follow you–is nonsense. Clearly (or not) what you’re trying to say is interest rates don’t measure monetary policy tightness, but NGDP does. NGDP = RGDP + inflation, and real rates tie into RGDP and inflation (standard Hicks monetarism and Fisher equation). But then, assuming this is what you have in mind (a big assumption that I’m sure you disagree with), you then go off on a tangent and assume what others “ought” to view as tight, based on, as you said before, is their own faulty logic! What is the point of this nonsense? Like me saying: ‘If Sumner thinks money is neutral then he ought to view his blog as complete garbage’. So? Incredible. Ban me please. And Robert Murphy was spot on about you.

@John Arthur- there are no dumb questions, but a lot of inquisitive idiots…your question is so basic, so dumb, and your suggested relief is so painfully clueless, that I am firmly convinced you are trolling Sumner when you say: “Does that mean that the Federal Reserve needs to do a much larger QE immediately?”. Dumb de dumb dumb. But I bet that I, not you, get labeled as a troll, and I bet Sumner answers your post rather than my post. Sigh.

18. March 2020 at 15:45

One thought I had re: yields, maybe the price of bonds is sinking because of the new greater expectations of a massive, massive deficit increase (ie a supply shock)? That doesn’t explain the low TIPS spread though. This is something that has been on my mind.

Real yield on the 10 went from basically zero at the start of the year to a little below zero then really started plunging on Feb 20. It bottomed at -0.57 on March 6 and now 12 days later is +0.56.

18. March 2020 at 15:52

That’s just gold. You have counter-trolled R. so much that he now demands his own ban to be put out of his misery.

18. March 2020 at 16:04

I am glad to see elements of the macroeconomics profession, even if belatedly, finally consent to the usefulness of money-financed fiscal programs, aka helicopter drops.

Or should we say the profession is finally relenting on helicopter drops on Main Street. I would say most economists. have embraced the idea of helicopter drops for Wall Street already.

There is many a fable, hagiography, and totem in the Temple of Orthodox Macroeconomic Theology.

I prefer that helicopter drops be implemented through tax cuts, such as a payroll tax holiday or radical reduction in withholding rates on income taxes.

Let people keep the money they earn, instead of confiscating it.

Both these adjustments can be made immediately.

18. March 2020 at 16:07

John, First, they need a new policy target. A distant second is to do much more QE. But the target is the number one issue.

It’s mostly a supply problem right now, but by 2021 it may be mostly a demand problem. Actually “real shock” is a better term than “supply shock” as its partly about fear of shopping.

Garrett, Interesting. If I read you correctly, you are saying that we have a stupid way of monitoring performance. I say that because if you have an obligation to pay money in 10 years, it’s not really very risky to buy a TIPS instead of a T-bond. The perception that it’s more risky must come from flawed metrics.

John Hall, Yes, but as I said there are liquidity issues in all markets, so it doesn’t mean the TIPS yields are in any sense misleading. But the conventional T-bond yields are certainly misleading for liquidity reasons, as are the inflation spreads.

Michael, I agree, as I said in the post.

Matthew, Central bankers tend to think alike, and all screw up in similar ways.

Ray, LOL. You do know that you just made my argument, don’t you? You are claiming that high nominal interest rates mean easy money. Wait, I guess you don’t realize that.

18. March 2020 at 16:57

If people do not agree with you, maybe it’s because you continue to try to characterize the monetary stance as “tight” or “loose.” I’d stick to recommending what to DO rather than define where we ARE.

“Tight/Schmite”–“Loose/Moose.” Whatever people call policy today, the Fed should be telling markets that it will be doing what it takes to get the price level up to X1 is six months, x2 in 12 months x3 in 18 mo, etc (where the x’s are what is consistent with NGDP growth of 5% p.a) If it wants to announce the specific transactions it plans in the next few day to execute it’s policy, that’s OK, but is probably should not announce transactions too far in advance.

18. March 2020 at 17:06

@ B Cole

I think a “helicopter drop” is when the check is signed by the President of the Federal Reserve instead of the Secretary of the Treasury. They are equivalent but nomenclature is nomenclature. I, too, favor a capped tax on wages holiday in the hopes that it will become permanent and we can get SS/Medicare on a sound consumption tax basis.

18. March 2020 at 18:06

Hi Scott,

“PS. If you are in an investment area where liquidity doesn’t matter, say a company investing for insurance or pension obligations 10 years out, why wouldn’t you prefer TIPS over Treasuries right now? Isn’t PCE inflation likely to exceed 0.3% over 10 years? I’d be interested in responses from someone in the investment community.”

Even for insurance companies (I was in one of the insurance companies’ investment department), short term returns (we’re talking about YoY or even MoM) matter. With plummeting UST yields, you can realize a lot of return out of it over the short term. TIPS on the other hand gives negative return because of higher real yield (higher yield means lower price). For me, I would continue to hold UST, until around the time I think things are about to trough or starting to improve, that is when TIPS is still relatively undervalued and will likely outperform UST.

18. March 2020 at 18:16

Thaomas:

Well, perhaps you are right on the semantics.

I mean for the Fed to print money and send it to the Treasury and the Social Security/Medicare trust funds for the rest of this year.

Interesting counter-factural: What if the Fed, and ECB, and BoJ had gone heavy and hard on helicopter drops in 2008?

I suspect the Great Recession would have been a blip. (The PBoC may have gone to chopper-drops, hard to say, and the Sino economy kept growing through 2008-9).

Remember, the 2008 Great Recession was a “fictional recession.” That is, there was not cause, such as a plague, or massive earthquakes nationwide, or huge crop busts. It was story written by man, and certain demented economic quacks.

2008 was all about the invisible, blips on computer chips representing assets and debts and money. The 2008 Great Recession was entirely fabricated by mismanagement our financial “system.” So, we threw millions out of work for no good reason.

This time is different. I still contend the reaction to COVID-19 is hysterical, but the recession this time is caused by something real. People are afraid and hiding indoors.

Send in the choppers—no, send in the B-52s.

BTW, do yo know 600,000 Americans die every year from cancer, and cancer is often caused by carcinogens released into the environment or in products? Should we immediately ban the use of plastics? Outlaw any type of air or water pollution? And next year another 600,000 Americans will die from cancer, and into perpetuity.

COViD-19, if handled properly, will come around in big form but once.

18. March 2020 at 19:22

Scott it seems as commented above that this is mostly a supply problem. Even if the fed doubled or tripled its QE program that the released last weekend, would it really change anything? Long term it would help, but I feel there is not much the fed can do to help the markets in the next 60-90 days.

18. March 2020 at 19:48

Are we in “pull your cash from the bank” territory here?

19. March 2020 at 01:48

China reports no new COVID-19 cases today. Japan never had many, and the new infection rates is stalling there too.

Housing in rural Japan is cheap. If you can become Japanese, I recommend it.

19. March 2020 at 04:36

@The Tin-Foil Hat Mastermind Economist

Now you are praising China and Japan???

These silly morons made the rookie mistake of not following your brilliant strategy at all but the opposite.

They might have reached the beginning of herd immunity and a few million fatalities by now, if they only had listened.

You should move over there asap and tell them how it’s really done.

19. March 2020 at 05:03

Markets are saying CPI won’t budge much in the next five years, and only 1% per year over the long haul. Powell should accept this challenge. Mugabe laughs.

19. March 2020 at 07:26

In February 1957, a new influenza A (H2N2) virus emerged in East Asia, triggering a pandemic (“Asian Flu”). This H2N2 virus was comprised of three different genes from an H2N2 virus that originated from an avian influenza A virus, including the H2 hemagglutinin and the N2 neuraminidase genes. It was first reported in Singapore in February 1957, Hong Kong in April 1957, and in coastal cities in the United States in summer 1957. The estimated number of deaths was 1.1 million worldwide and 116,000 in the United States.

—30—

The US population in 1957 was a little more than half what it is today. A remembrance…

Say Your Prayers and Take Your Chances

Remembering the 1957 Asian flu pandemic

Clark Whelton

It’s not that Asian flu—the second influenza pandemic of the twentieth century—wasn’t a serious disease. Worldwide, this flu strain killed somewhere between 1 and 2 million people. More than 100,000 died in the U.S. alone. And yet, to the best of my knowledge, governors did not call out the National Guard, and political panic-mongers did not blame it all on President Eisenhower. College sports events were not cancelled, planes and trains continued to run, and Americans did not regard one another with fear and suspicion, touching elbows instead of hands. We took the Asian flu in stride. We said our prayers and took our chances.

—30—

Have public health agencies learned to mimic the strategies of us global security agencies?

We must not take any risks, not any risks at all! A single terrorist attack is too much to tolerate! Danger, Will Robinson, Danger!

Let’s waste a few trillion dollars fighting phantasms in the deserts of the Mideast. Then let us reduce GDP by a few trillion dollars too.

19. March 2020 at 07:34

Some fun math.

Let is suppose we forego about $9 trillion in US output over the next three years due to contractions caused by government reaction to COVID-19. I hope this is a little high but it may be a little low.

Suppose we save 90,000 lives as a result of these disruptions, Mostly old people.

A bargain! That’s only $100 million per life!

19. March 2020 at 07:43

Re: Random comments on Coronavirus

1) Abbot Labs says it will be producing 1,000,000 tests a week within 2weeks—-they already have imbedded tech in place at many hospitals —-so a lot will be “plug and Play”

2) The Governors of the two largest left leaning states, Cuomo and Newsom, have had only very positive things to say about Trump himself

3) Korea does produce stats by age (why don’t we?)—see R. Epstein at Hoover Inst. Fascinating results. A) only 10% of cases are from people over 70——but 70`% of deaths are from this same group. B) 78% of cases are people under 60, with death rate of .13%. Fauci strongly believes letting “the young” roam and the “old” self isolate won’t work. He does not explain why this would be the case—-just that it would be.

4) we seem to have all forgotten about the Diamond Princess—-fascinating—-the overall mortality rate in Korea is basically the same as Diamond Princess. (Between .9 and 1%) Diamond Princess provides no age categories

5) “Never let a crisis go to waste”. One cannot but wonder what the various, unintended consequences of our actions will be. Some could be good——for example we keep “waiving” restrictions——makes one wonder why we have them—-Abbot, for example, required a “waiver”. Others could be bad——Government getting used to declaring emergencies, spending to offset “Lockdown”——I wonder what the negative spread is on the that “trade”

6) Fauci is clearly calling the shots. He will turn 80 this year—-looks pretty good! I do not know if his judgment is sound or not—-but he is the guy. So no one can say the scientist is not in charge! But, he reminds me of the “risk manager” in a trading firm. They are there to answer “what if” questions, and their role is very important. But they provide input to decision makers——And should not be the de facto decision maker. I would like to know why—we focus more explicitly on the elderly. He asserts it won’t work—-but he does not explain why.

19. March 2020 at 07:45

“Garrett, Interesting. If I read you correctly, you are saying that we have a stupid way of monitoring performance. I say that because if you have an obligation to pay money in 10 years, it’s not really very risky to buy a TIPS instead of a T-bond. The perception that it’s more risky must come from flawed metrics.”

I think “stupid” is harsh. It’s a result of agency costs in asset management. The pension board wants to be able to pay pensioners without the company needing to increase contributions more than planned. The board hires an independent consultant who tells them the asset allocation that is likely to achieve this result based on research. This asset allocation is basically weights to different indices.

The board then hires asset managers to implement the asset allocation. The managers invest as agents for the board. Their performance is benchmarked to the indices they manage against so the board can ensure they’re delivering the expected performance.

If the consultant’s asset allocation doesn’t include TIPS then it’s out-of-benchmark. At what point in this process can an OOB asset class be inserted? The asset manager could take benchmark risk because they think TIPS will outperform their benchmark (say the Barclays US Aggregate). But why would you expect your Agg manager to be a TIPS expert? And if his bet is wrong he’ll have to explain to the board why he underperformed. That discussion is a lot tougher if the reason is unexpected.

Alternatively the board could hire a TIPS manager. But why would they go against the consultant’s recommendation? They aren’t TIPS experts either.

Or maybe the asset allocation does include TIPS. The asset allocations are held constant over a year+, so it’s not going to change after a volatile month like this. If the board has an overlay manager who oversees the allocations to the different asset classes then he might make a tactical bet towards TIPS, but he needs to manage benchmark risk too because if he underperforms the strategic asset allocation he’ll have to explain that. So any bet he makes will be small.

19. March 2020 at 07:46

—meant to say “I would like to know why we DON’T focus more explicitly on the elderly

19. March 2020 at 08:01

@garrett

You vastly overrate how the major institutions (specifically state and local pension funds) care about benchmarks. You may already know this, but the range of returns across pension funds are remarkably wide. Hundreds of basis points between low and high with a normal distribution for any given year is typical. So much is wrong with state pension funds——but no need to get into that now, Re-look at Cliffwater, NASRA, Callan and a ton. My own opinion on Tips is they have a lot of “basis risk” relative to what they are predicting——ergo, assuming one likes inflation protection in a risk free form ——buying them cheap is okay. They never worked quite like they were mean to.

19. March 2020 at 08:20

Mark, Good luck trying to predict interest rates. No one has ever been able to do that consistently.

Stephen, I agree that the immediate problem is supply, I think everyone agrees. I agree that doubling or tripling the QE program would do almost nothing. If you thought I didn’t agree, you are not following my argument.

As for markets, they can be helped immediately by a much more expansionary monetary policy. And tripling QE is not “much more expansionary.” The real problem is NGDP expectations for 2021 and 2022. If those are addressed, markets will do somewhat better RIGHT NOW. But more money can’t paper over a real shock in the short run.

Liberal, Probably not.

Christian, No, Ben is not praising China, he’s criticizing it. Ben wants millions of dead people. China’s not doing what he suggested.

Michael, Epstein says fewer than 500 people will die in the US. That’s the guy you want to cite?

And the Diamond Princess does provide age categories, all 7 dead were over 70.

Garrett, Here’s how I think about it. If I was Warren Buffett and owned an insurance company, I’d tell them to substitute TIPS for Treasuries right now. Does anyone think PCE inflation will average less than 0.3% over the next 10 years? A smart insurance company will beat its competition. These are $100 bills on the sidewalk.

19. March 2020 at 09:15

Predictably the permabears and internet Austrians are out in force, boasting of how they ‘knew it was all a bubble’. I’m not sure how much influence these people really have, probably not enough to be too dangerous. One good thing about the recent freak out among that set at the UBI and monetary policy moves (which are insufficient as you point out, Scott), is that we finally have a definition of a “bubble”.

After all these years, I think we now know that a bubble is present whenever any system is set up which can collapse under exogenous stress. If you think about it, an individual human life is really a “bubble”, and all these interventions we make in it: eating, sleeping, going to the doctor, are just prolonging the inevitable collapse!

Anyway, keeping beating the Level Targeting drum. This is not 2008, you and your peers can push the Fed to do the right thing.

19. March 2020 at 15:23

Scott, what do you think the chances are that the Tea Party people are RIGHT NOW dusting off their tri-corner hats, grabbing their pitchforks and headed for the capital because they’re enraged about this new round of QE, talk of bailouts, the gov sending checks to people, the skyrocketing debt and deficit, and just generally all this socialism rearing it’s ugly pinko head? Because I’m 100% sure those folks really believed all that then (and now) and aren’t at all complete frauds who pretended to care about those things as a cover for what really frightened them.

19. March 2020 at 15:31

Okay, now I stand accused of “wanting” millions of dead people.

I guess I could posit that Scott Sumner “wants” to crush the GDP, cut the stock market in half and collapse our financial system.

But an interesting point is raised. How much lost GDP is Scott Sumner willing to tolerate in exchange for saving one life?

I have suggested we will lose about $9 trillion of GDP over the next several years and save about 90,000 lives, which comes out to about $100 million dollars per life. By the way, these are lives of old people.

20. March 2020 at 06:15

@Scott

Re: Epstein

C’mon Scott—-read more carefully. I was quoting where I got the Korea info from—-that is it. And the Diamond Princess numbers confirm (or consistent with) the Korea numbers. If you are only commenting to be polite—-don’t. Comment on what is trying to be said. I write too long and ramble—I will shorten. Easier to get real responses.

My short view.

1. Our ONLY COVID-19 objective should be to keep the healthcare system functioning—-Period. That is hard and we do not have a path

2. Korea and DP ship indicate the overwhelming proportion of danger is to the elderly and I suggest their stats point toward the answer. Don’t yet know how flattening curve really works

3) if we attempt to do more it will cause long term economic damage

20. March 2020 at 08:08

@ Scott

“And tripling QE is not “much more expansionary.” The real problem is NGDP expectations for 2021 and 2022. If those are addressed, markets will do somewhat better RIGHT NOW. But more money can’t paper over a real shock in the short run.”

I agree that the POLICY is GDP targeting (in practice meaning PL targeting at >2% p.a.) but would that be believed if the INSTRUMENT of that policy were not a massive increase in QE? Or are you assuming that on the Fed making the announcement speculators would do the rest?

20. March 2020 at 10:01

Justin, Yes, bubbles are almost tautological to believers.

Tom, Good point.

Michael, I agree on the proportions. But if 1.7 million Americans were to die, the absolute numbers of deaths among those under 70 would be large.

Thaomas, I have no idea how much QE would be necessary, if any. But QE without LT is pretty weak tea. Look at QE1, QE2, QE3.

21. March 2020 at 02:52

Scott. Responding to your PS. TIPS have been bought at the margin by leveraged funds over the last 3-4yrs. Positioning was horribly offside and given margin calls from banks, forced selling to cover portfolio losses elsewhere and/or redemptions, these securities have been dumped into a super illiquid market where real money buyers have been timid to take up the slack. I think positioning now is mostly clear and real money buyers are starting to come back, Friday’s price action confirms this and I suspect we will see further outperformance in coming weeks. You couldn’t have had a worse set up for TIPS and they’re still not pricing deflation so I’d say the Fed has won so far. Happy to chat more via email