Time to end the growth rate targeting experiment

In March 1968, the US began an experiment in pure growth rate targeting. The value of the dollar was no longer fixed by any “level” type variable. Prior to March 1968, the dollar had been at least loosely linked to gold (at $35/ounce during 1934-68, and $20.67/ounce during 1879-1933.) It’s time to bring this 52-year experiment in growth rate targeting to an end.

The experiment can be divided into three phases:

1. 1968 – 81

2. 1981 – 2008

3. 2009 – present

During the first period, the failure to set a price level target path resulted in excessively high inflation. This reflected a myriad of errors, including misjudging the stance of monetary policy, the politicization of monetary policy, and the misapplication of the Phillips Curve model. It was not caused by “supply shocks”, as the excessive growth of NGDP was just as appalling as the performance of inflation. RGDP growth during 1968-81 was just fine.

During the second period, monetary policy was relatively successful.

During the third period, the failure to set a price level path resulted in excessively low inflation. This reflected a myriad of errors, including misjudging the stance of monetary policy, anxiety about a large balance sheet at the Fed, and over-reliance on predicting inflation with Phillips curve models (and under-reliance on market forecasts.)

In retrospect, level targeting would have greatly improved the performance of policy during the first and third periods, and would have left the policy performance roughly the same during the middle period.

Right now, a switch to level targeting is a sort of “no-brainer” for the Fed. They’ve been discussing this idea for quite some time, so it wouldn’t be coming out of the blue. It would greatly improve policy during this crisis period, allowing a more rapid recovery from the recession. It would improve credibility, giving the markets more confidence that they would achieve their inflation target over time. It would eliminate the need for fiscal stimulus.

There’s no significant downside in committing to raise the PCE by 10.4% over the next 5 years (2% per year), and lots of downside for not setting this target.

I know that the Fed is a conservative institution that doesn’t like radical change, but that’s precisely why it’s the right time for level targeting. If they don’t do level targeting, the Fed will have to do far more of the sort of highly controversial “concrete steps” that Fed officials prefer not to do. Level targeting is a pragmatic solution, a solution that makes their job easier, not harder. It’s a failure to level target that would be risky and radical, opening the door to demands that the Fed get far more involved in bailing out the economy than is desirable.

So my message to the FOMC is, “Please, take the easy way out. Level target.”

My conspiratorial commenters will tell me that Fed officials view heavy involvement in running the economy as a feature, not a bug. I don’t believe that. I believe the FOMC wants to do the right thing.

Every expert from Michael Woodford to Ben Bernanke to Christina Romer will tell you that at the zero bound you need to level target.

So do it. Please.

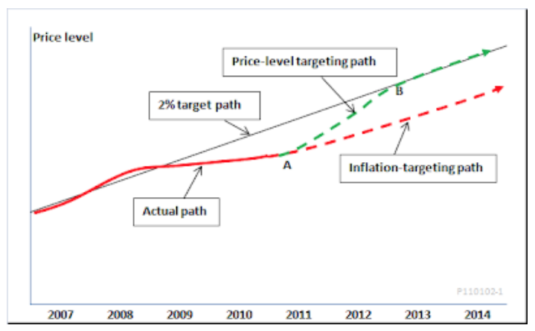

PS. Ed Dolan has a post that explains level targeting, and provides this nice graph:

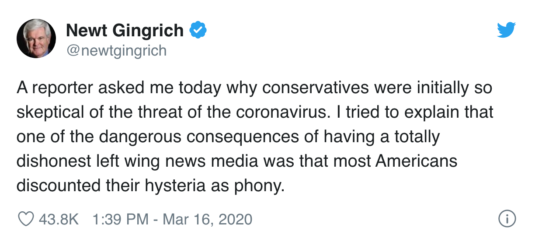

Update: Even in this crisis period, there’s always room for some comic relief:

Let me add that the left wing news media is also responsible for conservatives being wrong about global warming, evolution, and a host of other issues.

Tags:

17. March 2020 at 09:38

I don’t think that the Fed could announce a level targeting regime tomorrow and be believed. The reason being that at some point in the not too distant future, the Fed will have to do things which many voting members are uncomfortable with in order to meet their target. Given that the next 12 months likely will see inflation lower than 2% (because that has been true for a decade), they are going to need to get inflation up above 2% for a while. Talk is cheap. If the Fed wants to do level targeting, they probably also need a plan to quickly cause serious losses to folks who bet against them. That kind of vigorous action just doesn’t seem in keeping with the Fed’s current voting members.

17. March 2020 at 10:05

Reading over the Fed site, it appears they do not believe short term 2% inflation is their job.

It would be a good idea for them to correct their dysfunction by acknowledging they must consider 2% short term inflation their job.

17. March 2020 at 10:52

And if a pandemic were to kill say 5% of the population? The rest of us then get to also suffer through inflation?

17. March 2020 at 11:27

I like Scott Sumner’s NGDPLT more than a price level target.

Some are estimating a 5% to 10% contraction in real GDP in the second quarter, US. Mainland China is showing retail sales down 20% year-over-year.

Is this really the time for central bankers to sit around and publicly hypothesize about divine 2% inflation rates, as measured?

Suppose we managed to get 2% real growth for the next five years and 3% annual inflation, as measured. I would consider that a terrific outcome, given the present circumstances.

Please preserve us from central bankers prissily discussing 2% inflation targets, when the economy is steaming towards an iceberg.

17. March 2020 at 11:37

Burgos, It’s very simple. If they intend to do it they will be believed. If not, then not. I want them to intend to do it.

Esteban, I agree with the Fed that short term 2% inflation is not their job, but level targeting is.

Effem, The Fed determines inflation. If they have a 2% target, then they should hit it. Not sure what losing 5% of the population has to do with anything.

17. March 2020 at 11:50

Sumner: “During the first period [1968-1981], the failure to set a price level target path resulted in excessively high inflation. … RGDP growth during 1968-81 was just fine.” – you can’t make this stuff up.

Folks, NGDP = RGDP + Inflation, an accounting identity. People only care about RGDP not NGDP. If RGDP is ‘fine’, then what’s the problem? Recall Brazil during the post WWII years had high inflation but also high real growth, and people were by and large happy. I really don’t see the problem here.

Bonus trivia: Arthur F. Burns, Fed chair for the 1970s, gets a bad rap. What’s wrong with the disco years? Real growth was higher than today. Bad hair and questionable music (though today’s electronic dance music is inferior IMO) but growth was solid. Who’s afraid of a little inflation? C’mon! Ben Cole you feel me?

PS–I doubt any of the ‘apt pupils’ here, and that includes C.L., will call Sumner on his B.S. on real growth as I did above. Not a single one.

17. March 2020 at 12:38

Trump is clearly a threat to everything I love.

I believe that he has the power under the National Emergency legislation, to order the Fed to GO BIG and buy corporate debt and equities at any scale. If he did that he could save the economy – and also get himself re-elected King.

17. March 2020 at 12:44

Wait—–you now want to target price level—not a nominal growth level? Are these just the same thing with a couple of simple equations in between? I thought target price was always part of what you want—combined with nominal growth—-just like that—by by NGDP? I am obviously missing something—just read Fackler/McMillin on this topic—–after 10 years trying to persuade the world—–and sort of half getting there and now its time to do something else? I do not know enough to disagree—-but it is a one big “Huh?”—got my mind off coronavirus

17. March 2020 at 12:53

They prefer Nominal path targeting over price path targeting—funny

17. March 2020 at 12:55

I.e NGDP path targeting over price path targeting

17. March 2020 at 13:03

https://pjmedia.com/trending/did-obama-botch-the-response-to-the-h1n1-outbreak-heres-what-media-fact-checks-arent-telling-you/

Did Obama Botch the response to the H1N1 Breakout?

Yes

17. March 2020 at 13:08

PS

In the United States alone there were over 60 million cases of H1N1, 274,304 hospitalizations, and 12,469 deaths between April 12, 2009 and April 10, 2010. As of March 17, 2020, the CDC reports there are 4,226 confirmed cases of the coronavirus in the United States and 75 deaths. When you compare these numbers, it makes no sense that the media is criticizing Trump’s response to the coronavirus pandemic while covering up the failures of Barack Obama during the H1N1 pandemic.

17. March 2020 at 13:36

Ray, Growth was also “fine” during the Vietnam and Iraq Wars. Obviously they were not a problem for the economy.

Michael, Glad to hear you think Obama was worse. Hopefully the other Trumpistas do as well. I wouldn’t want them using the coronavirus epidemic as an “excuse” for the recession we’re about to have. If H1N1 was worse, then obviously it wouldn’t be the cause of a recession.

And yes, I obviously still favor NGDPLT. One step at a time.

17. March 2020 at 14:09

@ssumner – “Growth was also “fine” during the Vietnam and Iraq Wars. Obviously they were not a problem for the economy.” – OK, you’re not being ironic are you? Or not? Double negative sorry. So, please tell us here or in a blog post exactly what your problem is? Do you like NGDP to increase at a constant rate? You like stable something something something? Let us kiss the Blarney Stone* of NGDP so we may flatter you with your brilliance.

*I wonder if in these Covid-19 days they’ve closed Blarney Castle, IRE? If they didn’t in the herpes days why now? Individual responsibility is the key phrase, a lost art in the modern nanny state.

17. March 2020 at 15:20

Michael Rulle, you write:

“When you compare these numbers, it makes no sense that the media is criticizing Trump’s response to the coronavirus pandemic while covering up the failures of Barack Obama during the H1N1 pandemic.”

“The media” is far from a monolith in the US and that’s been the case at least since Fox News and W. There is no shortage of pro-GOP media for anyone to choose from, literally at their finger tips. That was the case during the Obama administration too, of course.

In fact, since we choose our media, and we’ve had plenty of choices for decades now, it’s a complete myth that “the media” acted to “cover up” anything during the Obama years.

Based on the fact that Republicans get about half the votes during national elections I’ll go out on a limb and say that pro and anti GOP media likely get about equal numbers of people choosing them. Thus there’s no grand media conspiracy against the poor poor victimized GOP since GOP friendly media outlets are about as viewed as the others.

If H1N1 was the threat you say it was, then I have no doubt that GOP-friendly media would have tried exploiting it to the fullest extent possible.

Also, I don’t recall the WHOLE REST OF THE WORLD reacting to H1N1 the way they are to COVID-19. All a grand global conspiracy against the Republican party and Trump?

17. March 2020 at 15:43

Scott, you wrote:

“Let me add that the left wing news media is also responsible for conservatives being wrong about global warming, evolution, and a host of other issues.”

I saw that tweet from Newt too. You’re comment about it expresses my sentiments, but much more succinctly. Thanks.

17. March 2020 at 16:17

– Let the clown Gingrich join the circus. That’s where he better at his place.

17. March 2020 at 16:34

– Steve Keen made a video in which explained why “Monetary Policy” doesn’t work.

https://www.youtube.com/watch?v=WPIQnOdjoZk

17. March 2020 at 17:30

Ray, But you said that as long as RGDP growth is OK there are no economic problems worth worrying about. is that wrong?

Willy2, Unless you know what monetary policy is, how could you possibly know if it works?

17. March 2020 at 17:34

A 2% PL target is totally inappropriate when real GDP is suffering from a supply shock. The right way to go is guesstimate the size of the real hit and announce a higher than 2% PL target for each year through 2025, or whenever. Of course if they would create a NGDP futures market, they could intervene directly in it to keep it on a 5% track.

17. March 2020 at 18:59

“Let me add that the left wing news media is also responsible for conservatives being wrong about global warming, evolution, and a host of other issues.”

Scott, this kind of sneering is beneath you.

There is no conservative position on evolution. It is a live issue only to a few lunatics. It makes just as much sense to tar all liberals with the vacuous stupidity of the anti-vaccination crowd.

On global warming, most conservatives think there’s some evidence that temperatures have been rising, but it’s debatable how much of that is man-made, since it’s been going on for centuries. Ditto for rising sea levels. And there’s quite a bit of evidence that historical temperature data sets are being “adjusted” to exaggerate the upward trend.

Besides, a somewhat warmer planet might not be such a horrible thing. Why do you think the climate of fifty years ago was ideal? If more CO2 means higher crop yields and increased photosynthesis, is that so horrible? Many more people die from cold weather than from hot weather.

Finally, even if you do believe that warming is anthropogenic and a problem, there’s still the question of whether or not there are good ways to address it. Most proposals we see involve trying to make the US and maybe Europe burn fewer fossil fuels via fiat (unlikely to work very well) or carbon taxes. But if this is not done world wide, it’s mostly useless. If the US burns less oil, the price of oil falls and the Chinese and Indians are thereby led to burn more. We will effectively subsidize the rest of the world’s use of fossil fuels, and the global net reduction is likely to be pretty small. But the cost to Americans will not be.

Pretending that everyone who disagrees with you on some issues is some sort of drooling knuckle dragger with no teeth is not how your blog became so influential, and it hurts your effectiveness in persuading people on monetary policy issues where you really do have something important to say.

18. March 2020 at 07:52

Inflation should be 0% you maniacs.

18. March 2020 at 09:30

Scott, I would like to see your response to Ben Cole and Thaomas. It really does seem that this is an inopportune time to be advocating price-level targeting.

18. March 2020 at 10:30

Long-time NGDPLT fan, here. But honestly, I’ve never felt more like the phrase “pushing on a string” is valid until today. Right now the Fed and federal government are doing close to what we would have wished for in 2008. $1,000 checks to households (i consider that a helicopter drop), at least signaling that inflation isn’t a concern or constraint on the Fed’s willingness to stimulate the economy (how I’ve interpreted Powell’s actions), etc. but what good does it do when people have to stay home and can’t spend it? You can’t even order things online if they’re not being made. As the population dies, borders close, trade shrinks, and demand dies with it. I’m currently stuck overseas, a $1,000 check to me will go nowhere as there are no international flights that can bring me what I order. There is no hand sanitizer left in my country. Businesses can’t expand when they can’t employ more than 5 workers in an office space or factory floor under emergency declarations. I’ll spend it eventually, but I don’t expect to spend it anytime soon. Sending me money is like pushing on a string.

18. March 2020 at 16:14

Jeff, It was a joke. If you can’t see the silliness of Gingrich’s comment then there’s no way I can help you.

Philo, I consistently favor NGDPLT. But it’s not going to happen this week. Maybe we get PLT, which is a close second.

JTapp, There’s nothing that will save us from the massive real shock over the next few months; the goal is to boost NGDP expectations for 2021 and 2022.

19. March 2020 at 13:37

I watched all the Democratic debates back in Jan/Feb time frame…I don’t recall the topic of the Coronavirus never came up….the only consistent concern I heard from the left was the “stigma” that the travel band would have on Asian Americans….

Gotta love what AOC said just last week…”Um Honestly, it sounds almost so silly to say, but um there’s a lot of restaurants that are feeling the pain of racism,” the New York Democrat said Tuesday night on Instagram Live. “People are um literally not patroning Chinese restaurants. They’re not patroning um Asian restaurants because of just straight-up um racism around the coronavirus.”

20. March 2020 at 12:51

[…] Significantly, as Bernanke also notes, advantages (1) and (2) would also be achieved by a debt-financed government spending program. Benefit (3) can, in turn, be achieved through other sorts of unconventional monetary policy, including either ordinary or expanded-asset quantitative easing (QE), aided perhaps by a Fed commitment to temporarily raise its inflation target, or by its agreeing to switch to NGDP level targeting. […]

21. March 2020 at 05:34

[…] Significantly, as Bernanke also notes, advantages (1) and (2) would also be achieved by a debt-financed government spending program. Benefit (3) can, in turn, be achieved through other sorts of unconventional monetary policy, including either ordinary or expanded-asset quantitative easing (QE), aided perhaps by a Fed commitment to temporarily raise its inflation target, or by its agreeing to switch to NGDP level targeting. […]