There’s only one AD

Like any single currency area, the eurozone has only one AD. That’s true despite the fact that it contains 19 countries. In contrast, China has 4 ADs, for Mainland China, Hong Kong, Macao and Taiwan. (The Taiwanese constitution says they are part of China, who am I to argue?)

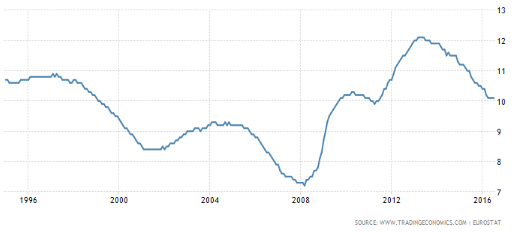

Here is the eurozone unemployment rate:

The disastrous policy tightening of 2011 pushed eurozone unemployment up from 10% to 12%. Then policy eased slightly, and NGDP started growing again. Unemployment fell back to 10%, about the rate of 1999, when the euro was created.

The disastrous policy tightening of 2011 pushed eurozone unemployment up from 10% to 12%. Then policy eased slightly, and NGDP started growing again. Unemployment fell back to 10%, about the rate of 1999, when the euro was created.

Unemployment is still very high in Greece and Spain, but that fact does not and should not matter to the ECB. There is only one AD for the eurozone, and it needs to be appropriate for the entire region, not any single country. By analogy, the unemployment rate in Nevada should have and does have no bearing on Fed policy, which looks at the national unemployment rate.

That doesn’t mean ECB policy is not too tight—after all, they target inflation, not unemployment. But here again I detect a weird pattern among pundits, to talk almost as if there are two ADs for the eurozone, one for inflation and one for unemployment. Consider the ECB’s recent action, or should I say non-action:

US and European equities are under pressure as disappointment over the European Central Bank’s decision to stand pat on monetary policy and uncertainty over the Federal Reserve’s interest rate trajectory force up borrowing costs. . . .

Ian Williams, economist at Peel Hunt, said investors appear “rather underwhelmed by the ECB announcement, both the absence of further policy action and the lack of guidance offered by Mr Draghi at his press conference about what may come next”.

Fixed income analysts at Citi said the ECB had introduced volatility by failing to even discuss QE. “The decision not to extend the timetable of QE from Mar-17 weakens forward guidance and is bearish.”

So the ECB tightened monetary policy yesterday—why does that matter? Here’s why it’s a big deal; roughly 90% of pundits, and even professional economists, don’t seem to have a clue as to what’s going on. If asked to explain the recent ECB non-action, most would say the ECB is satisfied with the pace of recovery, including the fall in the unemployment rate, and that it expects inflation to rise in the future. They may not agree with that outlook (I don’t think inflation will rise as much as the ECB expects) but that’s why the ECB effectively tightened yesterday, disappointing markets. So far, so good.

But when the discussion turns to inflation, these same pundits will insist that the ECB is trying and failing to hit its inflation target, and/or they are out of ammo. In other words, the implicit assumption is that a single monetary policy can target two different ADs, one for inflation and one for employment. On the employment front, the ECB still does normal monetary policy, tightening when they think the recovery needs no more juice. But on the inflation front the pundit class insists the ECB is out of ammo.

Of course none of this makes any sense. Obviously the ECB is not out of ammo, or markets would not have reacted negatively to their recent tightening of policy So why do so many economists think they are out of ammo for inflation, but not employment?

Maybe they are dumb.

More plausibly, pundits and economists are smart, but excessively deferential to the wizards behind the curtain of our central banks. People like Yellen, Bernanke, Draghi and Kuroda are deserving of our respect. They are more qualified than most pundits and most economists, including me. So if they are falling short on inflation, people assume that it must be because they do not have the tools to hit the inflation target.

What’s wrong with this view? I think it’s a mistake to judge the competence of central banks by the competence of their leaders. Central banks are complex and powerful institutions, embedded in even more complex and even more powerful political entities. Assuming that the performance of the central bank represents the competence of their leaders is a big mistake, even if the leaders voted in favor of the recent policy action. If the central bank heads had been assigned to the position of dictator of the world, we might be seeing an entirely different set of monetary policies.

PS. The ECB currently forecasts 1.6% inflation by 2018, which is close to its target of slightly below 2%. I think they are too optimistic. But excessive optimism and lack of ammo are two entirely different concepts, which most people don’t seem to be able to grasp.

Tags:

9. September 2016 at 08:45

” Assuming that the performance of the central bank represents the competence of their leaders is a big mistake, even if the leaders voted in favor of the recent policy action.”

I don’t judge the leaders by how they vote. I judge them by what comes out of their mouths. If they talk nonsense, like saying things about being out of ammo, then, it does say something about their competence.

9. September 2016 at 09:04

I think you are naive Scott, regarding the relentless decline of bond yields, and regarding the fact that the central bankers want negative bond yields and want slow growth. Why do you think they float discussions about negative rates? It is because they want them and they want people to have less access to cash so that one day they can implement a regime worldwide of digital money.

Look at Germany’s plan to weigh bonds from various nations. By weighing the German bund highly, yields go down even more! This is not random, it is a plan. It is a diabolical and totalitarian plan. In the US strength of the central bank is seen in its ability to raise rates. In the Eurozone, strength is seen in the ability to preside over the decline of yields.

http://www.talkmarkets.com/content/bonds/draghi-and-germany-have-a-secret-plan-to-save-the-eurozone?post=90083

From that article:

“Draghi, of the ECB, and Germany must have a secret plan to save the Eurozone. One cannot make sense of their actions without contemplating this plan…

…After all, Germany introduced a plan to weigh bonds, with bondholders potentially taking a haircut before bailout money can be approved for periphery banks. On the surface that would seem to indicate that Germany and the central bank are seeking to weaken bond prices in the weaker nations and destroy the Eurozone. This is causing a flight to safety, with German bonds being the primary beneficiary. See articles regarding this plan here and here. The chart is a bit out of date but trust me, yields are even lower after a short bump, and are going to go negative even on the long term bond…

…So, yields are even closer to negative now. Draghi is buying German bonds, making the scarcity of these bonds that are already in massive demand even more scarce. That will push yields down even more…

…So, what is going on? Surely Germany and the ECB do not want the Eurozone to fall apart. I believe that there is a plan, and that secret plan is the goal to fund Germany through getting people to buy German bonds for safety, even if they have to pay the ECB and ultimately the German government for those bonds…

…So, why would Germany and the ECB want to weaken the periphery? Well, it is all about discipline. The Germans want two things, 1) they want discipline in the periphery (formerly known as PIIGS), and 2) they want the ability to bail out nations with a large war chest of cash derived from getting people to pay them to hold their bonds!”

And Scott, if you don’t think I am telling the truth, look at Germany’s amazing budget surpluses partly derived from investors paying Germany to buy government bonds: http://www.ft.com/fastft/2016/08/24/german-budget-surplus-swells-to-e18-5bn/

9. September 2016 at 09:11

Bonnie, Good point. The top central bankers do not say they are out of ammo—because they aren’t.

9. September 2016 at 09:12

What is dumb, is the inflation obsession. Not that they cannot hit their higher than actual inflation target, it is that they seem worried higher inflation is indeed right around the corner. Sort of false expectations. CB’s need to react to actual inflation not imaginary inflation.

9. September 2016 at 10:31

“Then policy eased slightly, and NGDP started growing again.”

-It never fell after 2009.

9. September 2016 at 11:26

Speaking of smart economists–one with a Nobel Prize–who are clueless;

http://www.wsj.com/articles/hard-truths-about-easy-money-1473375861

‘Today, once more, some asset prices are very high—commercial real estate, for example. The S&P 500, which hit 17 times operating earnings in 2007, is 20 times this year. The unemployment rate is down to 4.9%. Yet the Fed hasn’t raised the near-zero fed-funds rate to more normal levels, let alone to abnormally high levels. Once again the Fed appears to see the steadiness of the inflation rate as evidence that the economy is in no danger of a financial crisis.

‘Besides the risk of easy money, one can question the policy objective. Fed governors observe that, though unemployment is low, male labor-force participation is extremely weak. In response, they advocate maintaining easy money to induce young working-age people to enter, and discouraged workers to re-enter, the labor force.’

Obviously, he is under the mistaken belief that interest rates are the price of money. Interest rates are low, thus money is easy!

The economics profession needs an intervention.

9. September 2016 at 14:04

Only the geniuses in Zimbabwe have cracked the inflation nut. To the rest of us, it’s a complete mystery. Zero ammo, sir.

Maddening. Central banks gearing up for another own goal.

9. September 2016 at 17:13

There is not only one AD.

There are local economies, and and each has a local AD. And the state of the local economy certainly matters to the people who live there, do business there and the politicians who represent them.

But the central banker has a crude tool. He can create more money, or he can create less money, but he cannot control where that money flows.

Now a good right-wing / freshwater economist would say, and he shouldn’t care either. Let the market sort it out. If the economy of Germany is running hot, and Spain is running cold, then the policy makers should allow for some inflation in Germany, better than deflation in Spain, and given a little time, people will see that Spain is relatively cheap and invest in that country.

But the world isn’t run by freshwater economists. And very few of those that think that the market will sort it out it time don’t get up on their respective soap boxes to shout, “nothing to see here. Everything is under control. Keep moving along.”

The local politicians and the local press says, “its a crisis, we must do something.” Even if half the punditry argues for opposite actions.

The Germans say, “Poor people can barely afford the necessities as it is and you are going to let prices go higher? The rising cost of living is putting people on the street.”

And the Spaniards say, “There is no work. There has been no work for decades, and it is not getting better. Do something!” This is despite the fact that in recent history there were labor shortages in Madrid and Barcelona, and a glut of labor in other parts of the country, there was not much mobility of people to jobs.

9. September 2016 at 17:29

Yeah, well, I have been given, by Mish Shedlock, absolute proof that bonds are money, and bonds are gold:

http://www.talkmarkets.com/content/economics–politics/red-hot-junk-and-massive-bond-market-dislocations-equity-smash-coming-up?post=105791&uid=4798

Mish says:

“Buying bonds that allow interest to be paid back with still more bonds is crazy. Yet, there you have it. Can it get crazier? I don’t know.”

And Scott Sumner, you wonder why bonds are hoarded even when they pay negative rates? It is because they are gold, they are the best and cheapest collateral. How negative can they go before this stops or breaks? I don’t know.

9. September 2016 at 18:38

It is nearly universal: Independent fiat-money central banks will undershoot inflation targets, and engage in monetary asphyxiation.

Europe, Japan, Great Britain, Thailand, Australia, even China where the PBoC evidently has a degree of separation from the CCP. And the U.S.

Far from being inflationist-statist organizations, the world’s independent central banks are unaccountable, opaque and harmful to robust economic growth.

The right-wing (broadly speaking) has been out to lunch on this topic for a couple generations now. Even the alt-m crowd, with its never-dying premise that central banks are loose due to statist-inflationist goals, seems adrift.

But the real-world track record is obvious. How to explain global deflation and ZLB?

Central banks are way too tight.

9. September 2016 at 19:41

I think it’s a mistake to judge the competence of central banks by the competence of their leaders. […] Assuming that the performance of the central bank represents the competence of their leaders is a big mistake, even if the leaders voted in favor of the recent policy action.

So when an organization is failing and not doing its job it’s not the mistake of the leader but the mistake of his subordinates. What a weird form of denial and what a very lousy excuse. With this attitude we don’t even need leaders anymore. Accept your full responsibility or don’t be a leader, it’s as simple as that. A fish is always rotting from the head down, not the other way round.

9. September 2016 at 22:57

+1 Doug M who says: “There is not only one AD. There are local economies, and and each has a local AD. … But the central banker has a crude tool. He can create more money, or he can create less money, but he cannot control where that money flows.”

Doug M calls out Sumner’s bizarre monetarist prior, exposing Sumner as the emperor without clothes. Sumner confuses an accounting identity (GDP as measured by a single currency will give an aggregate demand with the mainstream economist’s conception of AD) with the underlying reality of aggregate demand. Though technically speaking, there’s no such thing as “aggregate demand” as any true Austrian will tell you, just a series of different demands for different industries that cannot be summed (Google “Cambridge Capital Controversy” and note this is NOT an Austrian concept, but adopted as such by most Austrians), in fact, as Doug M implies, the crude measure of money, which flows where it wants to, has no bearing on AD except as a counting tool (obviously it’s hard to count AD between regions with different currencies and compare the two, but it can and should be done).

Sumner is so backwards. On another note, as the Kids Want Cheese blogger wrote, Sumner confuses an accounting identity (quantity theory of money) with some sort of predictive tool for controlling GNP. Sumner is a joke, who is funny because he writes like he believes his own b.s.

10. September 2016 at 00:18

Gary,

Junk bond spreads are still 1-2 percentage points higher than their “normal” level.

https://fred.stlouisfed.org/series/BAMLH0A0HYM2

I see this all the time with financial press, media and blogs: Yields are nominated without regard to the basis of risk-free interest rates. The deplorable WSJ editorial above mentioned the S&P had a P/E of 20. Well yes, P/E goes up when interest rate goes down because the alternative investments have lower yields.

10. September 2016 at 00:26

“So when an organization is failing and not doing its job it’s not the mistake of the leader but the mistake of his subordinates. What a weird form of denial and what a very lousy excuse.”

Christian,

Keep in mind that Janet Yellen does not have the same control of subordinates that a CEO would. At the end of the day, the Fed chair is only one seat on the FOMC. It’s actually not clear what powers the Fed chair really has compared to other FOMC seats. The Fed chair is the one grilled before Congress and has some executive powers over the branches. The ECB probably has a similar board structure.

Some of the FOMC seats are local branch presidents, who are elected by the branch’s board of directors. 6 of the 9 board seats are bankers (3 for big banks and 3 for small banks). The other 3 represent the “community.” When I looked up these directors for the Atlanta Fed branch, two were CEO’s and one was a McKinsey consultant.

The local branch presidents are also the ones with tighter views of monetary policy and pretty nutty justifications for this tighter policy.

10. September 2016 at 02:45

Scott

How do you know the ECB tightened policy on Thursday? Some comments from market participants may suggest that but actual market price movements were very muted around the statement and press conference. The EUR rose vs the USD around the time of the announcement and fell back, ie weakened, subsequently. German Government bond yields rose, or became less negative after the announcement and press conference. The Euro Stoxx 50 equity index fell about 0.5% after the announcement and then recovered that fall after the press conference.

The most speculation on Thursday and especially Friday is over the intentions of your Fed, not the ECB. Euro Area NGDP and RGDP growth has moved ahead of the US. The ECB has a expansionary monetary policy, the US a tightening one. Where do you think these trends will go?

https://thefaintofheart.wordpress.com/2016/09/09/europe-overtakes-us-growth/

10. September 2016 at 08:04

I think Doug M. makes some very good points in his comment. There are local economies, especially in an area like the Eurozone where people are divided by nationality and language. Monetary policy at the level of the ECB is probably too blunt a tool to address economic problems within different countries. Especially monetary policy within its current goals and restrictions that are imposed by the Euro agreements. At some point people in some area will have to say “Look, we have to make sure the economy works for us also.” Maybe they will get the ECB to do NGDPLT, or maybe they will institute fiscal transfers, or maybe they will leave the Euro. Or maybe they will do worse. Or nothing.

10. September 2016 at 10:57

Harding, You said:

“It never fell after 2009”

If you keep wasting my tame, I will stop responded. You’ve been warned.

Doug, Every family is a tiny economy. Is my family’s expenditure usefully called “local AD”

James, Thanks for that information. In any case, we both agree they did not ease policy.

10. September 2016 at 13:15

“I think it’s a mistake to judge the competence of central banks by the competence of their leaders.”

Scott, sorry to say it but that’s just an utterly ridiculous statement. Quit beating around the bush. The central banks and their leaders are incredibly incompetent. Future economic historians will look back and view their actions as the monetary equivalent of blood letting.

11. September 2016 at 00:28

Scott,

The graph shows merely that the EU is blessed with a large reserve army of people willing to work and ready to keep wages from rising. Or maybe that those unemployed are not willing to move to places where there is a shortage, or that leisure is too attractive (benefits, lifestyles), tec But we are reverting to the mean and that is pretty good. I doubt it could be pushed below 7% long term without structural changes.

11. September 2016 at 15:43

As a heap of sand contains finitely many grains. And a heap of sand less one grain is still heap.

What the smallest collection of people where we can still talk about aggregate demand.

12. September 2016 at 13:23

Doug, You can use the concept anywhere you like, but if not for a currency zone, the concept is not very useful.

12. September 2016 at 14:25

dtoh, It’s not as easy as it looks from the outside.

Rien, Yes, I think the natural rate over there is higher than in the US, for some of the reasons you cite. I’d guess around 8%.

13. September 2016 at 04:12

@Scott

“It’s not as easy as it looks from the outside.”

Yes it is. You tell your trading desk to keep buying until you hit the target and you tell the public that’s what you are doing. With all due respect, when did you become an apologist for these incompetents?

13. September 2016 at 13:44

dtoh, My views on the Fed have not changed, maybe you misread them.

I certainly believe Fed policy has been wrong, as they’ve followed the consensus view of economists. But that’s an entirely different issue from whether Bernanke was a good Fed chair. When he retired I did a post suggesting that he was better than average.

13. September 2016 at 13:44

Look at the ECB and BOJ, for example.

14. September 2016 at 03:22

“When he retired I did a post suggesting that he was better than average. Look at the ECB and BOJ, for example.”

Scott, in this case, the difference between average and better than average is the difference between being an utter failure and a complete failure. Come on. Maybe there is a legitimate debate about targets, but when you completely and consistently miss your target, it’s just pure incompetence. Bernanke was a disaster as Fed Chair.