There’s nothing special about zero growth

The FT has a new piece on the growth prospects for Europe:

The eurozone will avoid a recession this year according to a widely-watched survey of economists which illustrates the sharp about-turn in global economic sentiment in the past couple of weeks.

As recently as last month, analysts surveyed by Consensus Economics were predicting the bloc would plunge into recession this year. But this month’s survey found that they now expect it to log growth of 0.1 per cent over the course of 2023.

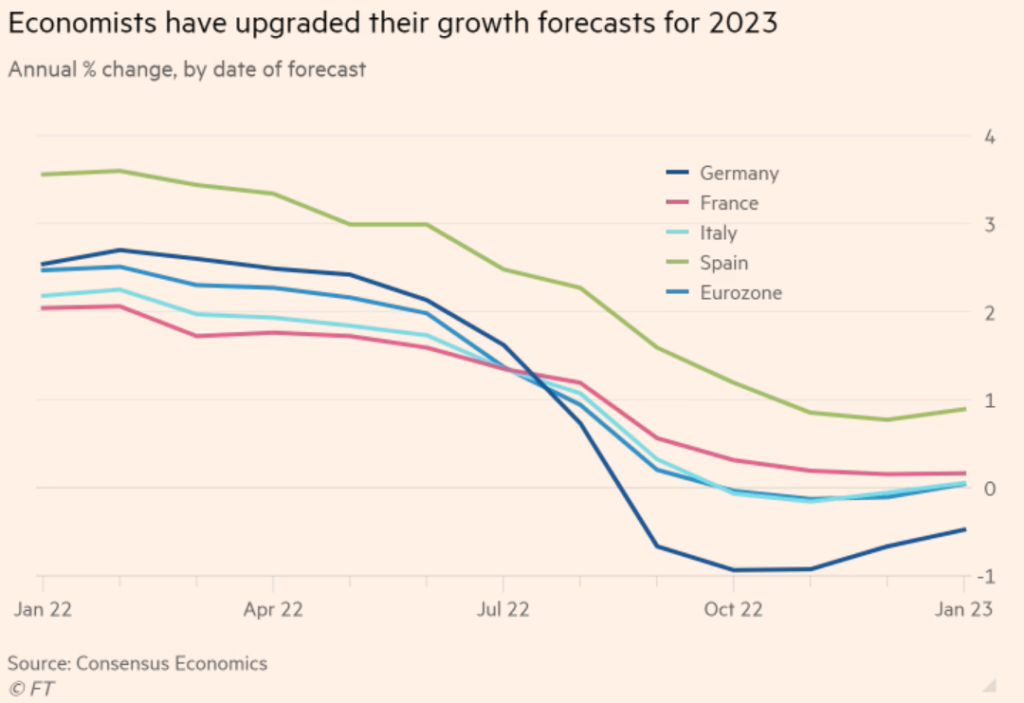

But the accompanying graph doesn’t show any sort of “sharp about-turn”:

Unfortunately, the graph is a bit hard to read. But notice that projected eurozone growth has merely edged up from about negative 0.1% to positive 0.1% over the past month or two.

AFAIK, the eurozone has no NBER to make an official recession call. (Is that right?) In addition, whereas the US has no borderline recessions, Europe does. In that case, I think it’s a mistake to focus on whether or not Europe experiences a recession this year. There’s no meaningful difference between minus 0.1% and positive 0.1%. For business cycle purposes, we should focus on the eurozone unemployment rate, not RGDP. Will there be a sharp increase in unemployment?

The US case is far more interesting. We’ve never had a mini-recession. So in 2023, we’ll either have no recession, our first ever mini-recession, or a significant recession. Any of those three outcomes would be quite interesting.

It’s better for the world if macro is boring, but it’s better for me if it’s interesting. And 2023 will be quite interesting.

PS. I define mini-recession as a rise in the unemployment rate of between 100 and 200 basis points. In the past, it either rose by more than 2% or less than 1%. Never in between 1.0% and 2.0%.

PPS. There’s a lot of talk about how inflation is coming down. But the inflation rate that matters is wage inflation, and progress there has been much more modest. A soft landing is still possible, but it won’t be easy.

Tags:

23. January 2023 at 20:05

“ PPS. There’s a lot of talk about how inflation is coming down. But the inflation rate that matters is wage inflation, and progress there has been much more modest. A soft landing is still possible, but it won’t be easy.”

Why, aren’t wages simply catching up to prices in lagged reaction to the demand shock!

23. January 2023 at 21:19

Brian, They are, but it’s still true that wage growth needs to slow sharply. Hopefully it can be done painlessly.

24. January 2023 at 03:38

“AFAIK, the eurozone has no NBER to make an official recession call. (Is that right?)”

There is a Eurostat Business Cycle Clock nobody knows about: https://ec.europa.eu/eurostat/cache/bcc/bcc.html

Here’s some information about the tool: https://ec.europa.eu/eurostat/statistics-explained/index.php?title=Business_Cycle_Clock

24. January 2023 at 03:40

I realise you don’t think RGDP growth is important to defining a recession, but just so I understand a possible implication of what you’re saying: The Eurozone might not experience a significant rise in unemployment even if RGDP is modestly negative; if the US experiences a mini-recession, would that mean RGDP growth had almost certainly been negative, or could a rise in unemployment happen even with rising RGDP?

24. January 2023 at 09:00

John, Thanks for that info.

Rajat, In theory, rising unemployment could accompany rising RGDP. In earlier decades, that would not have been uncommon. Today, unemployment is not likely to rise SIGNIFICANTLY if RGDP is rising.

24. January 2023 at 12:29

Hey scott,

Not related at all to this blog post but I was wondering if you could do a post about the moneyillusion as applied to stock prices during a high inflation regime (Modigliani-Cohn Hypothesis). Do you think it applies or not to the current situation?

24. January 2023 at 18:42

OT mostly, but in the large ballpark:

In India, by one estimate, the top 20% income class consumes maybe 60% of discretionary items.

“The pandemic has not impacted affluent consumers’ income levels in the country is clear from the fact that the top 20 per cent of the population account for the bulk of discretionary consumption — 59 per cent in rural areas and 66 per cent in urban areas, Tanvee Gupta-Jain, chief economist at UBS Securities India, said in a report”

Anybody know the US numbers? I cannot find.

We read about “labor shortages” in the US. Is it strong consumption demand from the top 20% that is driving “labor shortages”? The top 20% want to eat in restaurants, stay in hotels, spend at retail in greater dollar volumes than the market is providing at present wages?

Of course, old school profs will tell you there is no such thing as a economic “shortage”. Only where supply and demand lines cross. I can remember being crossly corrected for speaking of a shortage in Econ 101 (or 102?).

Also, “labor shortages” on the West Coast also strike as a variation on “housing shortages.” $2,000 a month for small apartment in Los Angeles? And you expect wages to stay stable?

Except we know the supply of housing is sharply constrained.

Something is misfiring in the world of orthodox macroeconomics….

24. January 2023 at 23:09

KG, I’m very skeptical of that theory.

25. January 2023 at 08:28

re: “rising unemployment could accompany rising RGDP”

It’s called dis-savings; a fall in money demand. There are cross-currents in the economy.

25. January 2023 at 08:58

“Money demand” has fallen. Thus, velocity has increased.

Banks don’t lend deposits. Deposits are the result of lending/investing. If you hold your money in a bank, the bank can’t use it, and if you aren’t using it, then it is not being used. The banks pay for their earning assets with new money, not existing deposits.

The only way to activate monetary savings (and all monetary savings originate within the payment’s system), put savings back to work (complete the circular flow of income), is for the saver-holder to invest/spend directly/indirectly outside of the payment’s system.

And saver-holders never transfer their funds outside the banks unless they’re hoarding currency or converting to other national currencies, e.g., FDI, FPI.

25. January 2023 at 15:11

Scott,

This post reminds me of a financial media favorite phrase. The economy has reached “stall speed”. Somehow we will fall out of the sky if real growth is zero.

26. January 2023 at 11:56

TF, Good example.

27. January 2023 at 01:57

Sumner says, “It’s better for the world if macro is boring, but it’s better for me if it’s interesting. And 2023 will be quite interesting.”

I think this summarizes Sumner and his thugs well.

1. Create massive credit expansion through artificially low interest rates.

2. Encourage risk taking beyond means, ratchet up the fiscal debt, and watch with glee as inflation kicks in.

3. laugh as the market collapses, the dollar tanks, civil unrest and confidence wanes as debt becomes unsustainable.

4. Sweep in at the last minute, pretending to be the hero, and propose a socialist/communist alternative to your manafuctured thuggery.

Folks, the preenlightenment, dogmatic, ruffians are on the march. They are moving swiftly across the intellectual battlefield With their watered down degrees and outworn slogans.

Montesquie and Jefferson, Locke and Kant, are all rolling in their graves as the tyrant Sumner reemerges under the banner of the common good.

Only a lunatic finds pleasure in other people’s suffering. Only a crazed imbecile thinks it’s “interesting.”

29. January 2023 at 10:08

Why so pessimistic Prof Sumner? Things aren’t so bad. Look at the parking lot Larry! Would you look at that parking lot.

30. January 2023 at 11:51

Aladdin, I am not “so pessimistic”. I’m in the middle.