“There is no debt crisis in Europe–it’s a monetary crisis”

I stole the title of this post from a PowerPoint slide that Lars Christensen sent me. Perhaps there’s a bit of hyperbole there, but it reminded me of my research on the Great Depression. During 1931 all the Very Serious People were obsessed with the debt crisis. In some mysterious way they believed this was a major cause of the Depression itself. I’m not sure why, I think it had something to do with “confidence.” Interestingly, the debt crisis never really got resolved. Instead it just gradually faded away as an issue, as by late 1932 it was becoming increasingly clear that intergovernmental debts were not going to be repaid. And as the debt crisis receded, people discovered that the Great Depression was still there.

Of course you all know the rest of the story. One by one countries discovered that the real problem was monetary, and recovery didn’t start in a country until it had abandoned the gold peg and started boosting NGDP rapidly.

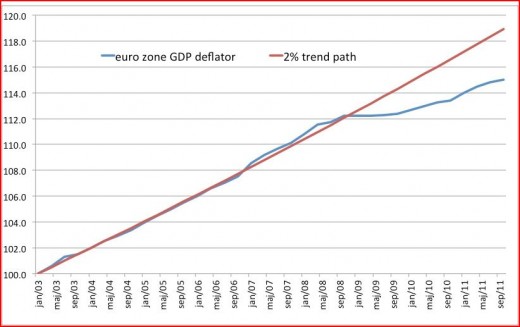

Some argue that the ECB cannot inflate, that it must keep targeting inflation at 2%, or else lose credibility. But they aren’t even doing a very good job in targeting inflation. You’d think that a central bank would be interested in the overall rate of inflation, not just those goods in the CPI. After all, no matter how dumb central bankers may seem, they certainly don’t believe that low and stable inflation is good because it holds down the cost of living to consumers. They actually do know about the circular flow of income/expenditure. The standard view among economists is that low and stable inflation reduces menu costs and helps stabilize output. Of course in both cases you’d do better with a price index that covered all goods, not just those in the CPI. And as Lars showed in this new post, they aren’t even coming close to hitting their 2% target for inflation, if we define inflation to include all goods. Indeed since September 2008 they aren’t even hitting a 1% inflation target.

Some might argue that the ECB is targeting a different index, and that they must stick with this failed policy in order to avoid losing credibility. It reminds me of how in the Vietnam War the US military would sometimes claim that they had to destroy a village in order to save it. The ECB will destroy much of the eurozone economy in order to save it. And in the end they’ll lose anyway, as politics always gets the last word.

PS. Just to be clear, there are debt problems in Europe. But Wall Street isn’t falling on Greek news because of the debt issue, rather it reflects a lack of confidence in the Fed’s willingness to keep NGDP growing at a healthy rate.

Tags:

14. May 2012 at 17:13

Even John Taylor, who should know much better came up with the idea that Friedman´s “Plucking Model” is not working because of “lack of confidence” (and regulation):

http://thefaintofheart.wordpress.com/2012/05/13/what%C2%B4s-cramping-the-pluck/

14. May 2012 at 17:45

It’s easy to see why The Very Serious People would want to use debt and credit as smokescreens for basically taking no action at all. But the reality is that debt and credit are placeholders on certain segments of the activity, rather than the activity itself. The real action is in what money does every day that does not get constrained by those preexisting obligations. That is the part that fascinates me, which I also see people in real conflict about. But people need money to do a million different things whether they have loans or not. That is too easily forgotten in the present.

14. May 2012 at 17:56

Scott,

re: this post and the last, on Greece’s chance to do better without the Euro.

Amongst all the gloating of especially UK based Eurozone permacritics: The UK _does_ have an independent currency and is oh so ready to point the finger at those benighted Euro countries in their monetary straightjacket and German-induced blindness to The Truth In Macroeconomics.

Where is the speedy UK recovery?

14. May 2012 at 18:38

Central banks are political entities. They came into being to finance governments, their leaders are appointed by heads of government, and to this day they insist on communicating in terms of interest rates and consumer price inflation in order to keep the public happy. The public doesn’t know what the macroeconomy is, they just see the Fed as some unreasoning god who is responsible for their cost of borrowing/living.

14. May 2012 at 18:44

It’s like what Breyer said about the Supreme Court – there’s no reason at all why the public should bend to the will of an arbitrary band of oligarchs, unless they do their best to grease the wheels of politics and are seen to ultimately cooperate with the volonte generale.

14. May 2012 at 19:49

Great. Sumner is now adopting Krugman speak.

14. May 2012 at 20:03

I generally support the ECB, as they are displaying the best technical skill in hitting the CPI target, but this is the criticism I agree with.

14. May 2012 at 20:36

Hey check this out guys:

http://blogs.wsj.com/economics/2012/05/09/fed-foe-ron-paul-breakfasts-with-bernanke-at-central-bank/

14. May 2012 at 20:52

Regarding the p.s., though, doesn’t that contradict the idea that the central bank always uses monetary policy to keep NGDP growth right where it wants it, regardless of outside shocks?

14. May 2012 at 23:40

Now there is a convincing graph. Point, set, match.

15. May 2012 at 01:51

This is a bit disingenuous, Scott: “you’d do better with a price index that covered all goods, not just those in the CPI….they aren’t even coming close to hitting their 2% target for inflation, if we define inflation to include all goods.”

The GDP deflator that you show is the price of DOMESTICALLY PRODUCED goods (and services). That is neither inflation in terms of cost of living, nor my ideal concept of inflation for central banks to target, the weighted average price of all items (ie goods, services and assets) exchanged for the domestic money – a difficult concept I admit, but one that central banks could at least try to approach. I am afraid I think that we are stuck with the cost of living index though, partly for political reasons, and partly because it has to be produced anyway.

By the way, I already laid claim to the “burn the village” metaphor for eurozone monetary policy, although as you might expect, using it to criticise the ECB for selling out: http://reservedplace.blogspot.co.uk/2010/07/we-had-to-burn-euro-to-save-it.html

15. May 2012 at 03:14

RebelEconomist, but surely the GDP deflator is an improvement over the CPI?

15. May 2012 at 05:08

Sometimes I wonder if what we are seeing is an inversion of the 70s. Inflation from commodities. A passive central bank that tolerated it. Then inflation taming about the same time commodities start to crash back to earth in the 80s. Today commodities soar and we have tight money and low inflation but terrible labor markets (contrast with the 70s). I have to wonder if we will ever see a crash in commodities and if that will coincide with a better labor market.

15. May 2012 at 05:14

mbk,

The issue is not why the Bank of England has deviated from the ideal. The issue is how much WORSE the situation in Britain would be if we had had the same monetary medicine from the ECB that the rest of Europe has had. NGDP in the UK is well-off trend, but if we had had something close to 1% inflation in recent years then we would be in the same position as Spain or Italy.

The Bank of England has been much too timid, but at least it didn’t try a premature exit from the ZLB like the ECB.

15. May 2012 at 06:22

Saturos –

Interesting story. I read a story a little while ago about when Ron Paul showed up for Bernanke’s testimony and Ben joked about it being nice to see his old friend. He also said he’d be happy to discuss alternative currencies with Paul some time – maybe they discussed it over breakfast?

Anyway, it seems like yesterday was a bad day for the gold bugs, gold dropped again by 1.6%(it’s down 12% over the last 6 months). And the Presidential candidate who wanted to give them a federal bailout stopped actively campaigning. Or are those things related?

15. May 2012 at 06:23

A debt crisis is always and everywhere a monetary phenomenon.

15. May 2012 at 06:27

Do you have a laymen’s version of the downside of NGDP targeting?

15. May 2012 at 07:30

A monetary crisis is always and everywhere an illusion entertained by economists that don’t understand how constitutional democracies and their market economies work.

15. May 2012 at 09:10

If some economists were doctors, they would apply leeches to anemia patients.

15. May 2012 at 09:11

He who trades economic prosperity for price stability, will soon have neither.

15. May 2012 at 11:49

One thing this makes me wonder is why do the various central banks seem so dead set on undershooting their inflation targets when this will bring a lot more pain than if they had decided to overshoot a bit.

15. May 2012 at 14:59

Europe is undershooting because of German fears of inflation. As a currency union, the eurozone has one monetary policy. One size doesn’t fit all. The Germans brought the ball, so they get to choose the game.

15. May 2012 at 15:16

It’s hard for the ECB to run an expansionary policy while all the major European banks are running strongly contractionary policies (they’re undercapitalized, carry a lot more risk than their VAR calculations show and have to meet Basel III requirements). The ECB would have to add at least another 2 (probably closer to 3) trillion euros to its balance sheet.

Right now they are protected from speculative attack by their swap agreement with the Fed. They could easily fear that with a 6 trillion euro balance sheet, that might not be enough. And a lot of the ECB assets are trash.

15. May 2012 at 17:26

Marcus, I also lack confidence—in the Fed. And in the inflation hawks.

Becky, I agree that it’s not just about loans.

Saturos, Did Breyer really say that?

And yes, the PS does contradict that view. I think in late 2008 NGDP fell much more than the Fed wanted, and in another similar crisis it might undershoot again. My targeting assumption applies to “normal times” when the Fed seems to be steering the economy with more or less unconventional stimulus.

mbk, Where is the UK monetary stimulus?

Seriously, Britain devalued in 2008, which suggests it might very well be in with the PIIGS if not for the pound sterling.

Thanks Jon.

Rebeleconomist, But why have the Fed control the prices of goods produced in other countries, like Saudi Arabia? Doesn’t macro stability result from stabilizing the prices of the things produced with eurozone labor?

Benny, You said;

“I have to wonder if we will ever see a crash in commodities and if that will coincide with a better labor market.”

That was the late 1990s.

Negation, Exactly.

Andrew. Yes! There is no downside. That’s something any layman can understand.

Peter Anderson, I wonder that too.

Peter N, I don’t agree. Just setting a higher NGDP target, level targeting, would do wonders. Even w/o an extra penny added.

15. May 2012 at 20:09

Scott,

NGDP target or not, the banks won’t lend when doing so would violate their assets at risk to capital requirements.

I don’t know what Europe does, but the FDIC closes any American bank that is in violation. Since the new Basel III rules have toughened the capital requirements, the banks have to raise capital or dump assets. They’re dumping assets (cutting back on loans).

Even with the massive ECB life support (over 1 trillion euros), some of them are failing. Spain just bailed one out last week. There’ll be more.

15. May 2012 at 20:32

Scott wrote:

“Of course in both cases you’d do better with a price index that covered all goods, not just those in the CPI. And as Lars showed in this new post, they aren’t even coming close to hitting their 2% target for inflation, if we define inflation to include all goods. Indeed since September 2008 they aren’t even hitting a 1% inflation target.”

I was curious how the various major currency areas compared in terms of the pre and post trends. 2008Q3 seems to be the break in trend for all of the big four. Here are the results.

Average annual rate of change (%) 1998Q3-2008Q3

Currency Area-NGDP–RGDP-GDPDeflator-CPI-Difference

Euro-17——-4.09–2.04—2.02——2.26—0.24

US————4.99–2.48—2.45——2.97—0.52

Japan——-(-0.28)-1.09-(-1.35)—–0.00—1.35

UK————4.93–2.61—2.25——1.86-(-0.39)

Average annual rate of change (%) 2008Q3-2011Q4

Currency Area-NGDP—-RGDP–GDPDeflator-CPI-Difference

Euro-17——-0.57–(-0.38)—0.94——1.57—0.63

US————1.93—-0.56—-1.38——1.12-(-0.26)

Japan——-(-1.74)-(-0.41)-(-1.33)—(-0.87)–0.46

UK————2.03–(-0.30)—2.34——3.15—0.81

My big takeaways are:

1) The gap between the Japanese CPI and GDP deflator was huge and concealed a lot of deflation. But it is doing a whole lot better now. However the rate of deflation as measured by the deflator, although it has not gotten any worse, is still very bad. If literal price stability is the goal then the BOJ currently isn’t hitting it by any measure.

2) The UK CPI went from understating inflation relative to the GDP deflator to overstating it. This swing is by far the largest in either direction for the four currency areas. Note that British CPI currently makes things look much worse than the deflator does. These numbers in general seem to confirm the impression that the UK has undergone some kind of negative AS shock. UK is the only currency area currently overshooting its implicit target.

3) The US CPI moved in the opposite direction, going from overstating inflation to understating it relative to the deflator. Only Japan’s CPI moved in the same direction.

One final note. The US PCEPI over these two periods was 2.47% and 1.22% respectively. Thus the PCEPI has tracked the GDP deflator much more closely than CPI.

15. May 2012 at 20:39

@peter n,

i dont know what you are talking about banks dumping assets and BASEL III. BASEL 2.5 and the new market risk rule are not even finalized. commercial bank loans have been growing since about mid 2010, you can check in FRED. lots of US banks are well capitalized and well on their way to meeting (what is expected to be) the new rules.there are some banks growing by lendind (and not betting their excess deposits on red hehe).

ngdp targeting stabilizes and minimizes cyclical-unemployment related defaults. high delinquincies mean high demand for safe assets, large writedowns, and so on. my view is that had the Fed been ngdp targeting in 2004, 2005…2008 etc, the housing crisis would have remained contained as when we had the real estate bust in 1990s .the “financial accellerator” or classic fisher deflation cycle is arrested.

15. May 2012 at 23:01

ssumner:

Peter N, I don’t agree. Just setting a higher NGDP target, level targeting, would do wonders. Even w/o an extra penny added.

It will do “wonders” yes, for the money supply, in that it will cause it to accelerate, since a given dose of inflation has less and less of an effect in an increasingly distorted economy caused by inflation.

Continuous 5% NGDP targeting cannot be had by a constant growth in money supply. 5% NGDP targeting requires an increasing rate of money supply growth. Economic scarcity simply cannot be transcended. It will assert itself in presenting a perceived need for the Fed to continually increase the rate of monetary inflation.

16. May 2012 at 01:03

[…] Between the need for fiscal tightening and the need for increasing NGDP I have no doubt that it is much more important to increase NGDP. The public debt ratios in Europe has not primarily increased because fiscal policy has been eased, but because NGDP has collapsed. In that sense the crisis is not a debt crisis, but a monetary crisis. […]

16. May 2012 at 02:21

“Did Breyer really say that?”

Yeah, he did like two books and a dozen lectures. They’re all on YouTube. I made it sound worse than it was though, he didn’t actually say “grease the wheels”. But that was the upshot. See here: http://www.viddler.com/v/3c1f17a8

16. May 2012 at 02:52

Also, on the subject of Supreme Court Justices, this is priceless too: http://www.youtube.com/watch?v=FizspmIJbAw

16. May 2012 at 09:31

What happens if the ECB does decide to add trillions of euros to their balance sheet?

Peter N. wrote:

> The ECB would have to add at least another 2 (probably closer to 3) trillion euros to its balance sheet. Right now they are protected from speculative attack by their swap agreement with the Fed…

In Monday’s “Thoughts from the Frontline” http://ow.ly/1Mi5e2 John Mauldin wrote:

“Germany has two votes out of 23 on the ECB…Germany does not want inflation but wants to abandon the European Union even less. …the eurozone simply does not have enough money to keep itself together without massive ECB intervention. “

16. May 2012 at 09:35

Scott, W. Peden,

I don’t think it can be reduced to quite “it would have been worse”. There are two separate questions here. One is, how would the UK debt situation have evolved if it had been in the Eurozone. The other is, how would NGDP have done. The two are linked since it is claimed that the debt of many countries got out of control mainly because NGDP was failing and not primarily because of the severity of the debt.

Now the UK’s NGDP performance does not look particularly better than the Eurozone countries’. And this leads me to the question, would it really have been worse if the UK had been in the Eurozone. Same with debt, if the severity of the debt problem stems primarily from NGDP underperformance then the observed UK NGDP underperformance without the Euro should have had more or less the same effect on its debt than the similar expected underperformance it would have had within the Eurozone. I don’t see why the UK automatically would have been comparable to Italy or Greece. Why not France or the Netherlands? Hardly any European countries are doing great, with or without the Euro. Yes you can cite the odd outlier like Poland. But you could also cite Iceland where the primary motor for the fledgeling recovery was precisely to default on the bank debts and not any NGDP targeting. Iceland in fact would point to the opposite conclusion, that the debt is the primary issue.

The point I was trying to get at was, merely having a sovereign currency doth not solve all problems ipso facto. With UK financial commentary in the media there seems to be a lot of sovereign pride driving the arguments, not any particular macroeconomic genius. Exhibit A, Evans-Pritchard.

16. May 2012 at 12:16

Krugman had this to share about Very Serious People today (May 16, 2012) “Extremists and Enablers”

“When future historians write about the fall of the American Republic, they will of course lay primary blame on the extremists of the right, who set out deliberately to destroy it. But they will also lay heavy blame on all the ‘centrists’ and Serious People who not only refused to admit what was happening, but ostracized and silenced anyone who tried to point it out.”

Some days I’m glad I don’t have a lot to lose – I get to keep on pointing it out!

16. May 2012 at 18:45

@mbk :

the difference between the UK in or out of the Euro is clearly one of sovereignty :

the BoE can and will print any amounts of pounds, and the market knows it. Being in the euro means surrendering this extraordinary power to a supra-national entity less willing to act. The talk of possible default and no bailout policy is aggravating the speculative attacks against EZ sovereign debt.

Euros seem to be as difficult to print as gold is to dig from the ground. Political obstacles instead of rocks. The two systems are deflationary.

16. May 2012 at 19:25

mbk,

Not only would the UK’s NGDP performance be worse if we were in the eurozone, but we would also (1) be seen as liable for much of the peripheral debts, (2) be seen as unable to exercise control over our economy, and (3) we would have had tighter monetary policy measures (e.g. a rise in interest rates and less QE) which would have made a difference within the context of the eurozone.

I agree that having a sovereign currency doesn’t solve all problems. What it does mean is that we don’t have to convince the Germans in order to get higher NGDP and accountability for the failed macroeconomic policies of 2008-2012 lie with the governments we’ve had in that time. (Not the Bank of England, who are restricted by their CPI target and have been admirably flexible given the situation they are in.)

16. May 2012 at 22:08

Amarito, W. Peden,

I don’t deny that the UK has that sovereignty. But empirically the situation oddly reminds me of the childless protestant couple in that Monty Python sketch in The Meaning of Life. The husband pontificates about how they’re so much better off in their love life than those wretched catholics with dozens of kids who by the pope are not allowed to use contraception. Because as protestants, you know, no pope: they’re allowed to do whatever they want. Sadly, they’re never actually doing anything. But yea, no pope: they could, if they only wanted.

17. May 2012 at 00:17

mbk,

Not only have the Bank of England done more to help than the ECB: they’ve also done less directly to hinder.

17. May 2012 at 08:49

Peter N, We don’t need more bank lending, just more NGDP.

Mark, That data is quite interesting. The BOJ did succeed in their goal of a stable CPI for almost two decades. This is why it’s silly to see all these articles trying to explain why the BOJ failed. They didn’t fail, they just had the wrong target.

MF, You said;

“5% NGDP targeting requires an increasing rate of money supply growth.”

If only this were true we’d be very lucky. But alas, it’s false.

Saturos, That’s cute.

Kevin, That’s hopeful.

mbk, You said;

“Now the UK’s NGDP performance does not look particularly better than the Eurozone countries’. And this leads me to the question, would it really have been worse if the UK had been in the Eurozone.”

I can’t believe you are even saying this. The pound has depreciated considerably against the euro. Show me a model where NGDP would be just as high if they were attached to the euro.

Becky, He forgets people on the left who opposed monetary stimulus, like Stiglitz.

17. May 2012 at 09:18

ssumner:

“5% NGDP targeting requires an increasing rate of money supply growth.”

If only this were true we’d be very lucky. But alas, it’s false.

No, it’s true. You continue to ignore the fact that inflation brings about a changes to relative spending and prices, and hence brings about changes to the real structure of the economy. The same absolute doses of inflation have less and less of an ability to sustain the increasingly stressed capital structure, and thus status quo inflation of the money supply has less and less of an ability to sustain status quo nominal spending on that structure.

Therefore, inflation of the money supply has to accelerate in order to bring about a constant nominal growth in spending. Real factors increasingly counter-act the inflation, as inflation doesn’t affect everything equally.

And what does that mean “if only this were true we’d be very lucky”? How is accelerating inflation, which inevitably results in destruction of the currency, “lucky”?

18. May 2012 at 00:32

Scott, what I am interested in is, empirically how well is the UK doing with its sovereign currency (and devaluation or whetever other measures have been taken independently). And that includes all of politics and why things weren’t done that could have been done etc. All this compared to Eurozone countries with their currency “straitjacket”.

Cursory reading of Eurostat tables comparing GDP since 2008 shows that in spite of this independent currency, year on year UK GDP growth or decline pretty well matched Italy’s (eyeballing best match with a large Eurozone country). Picking at random, Austria, Germany, even Belgium, consistently did better than the UK in 2008, 9, 10, 11 and 12 forecast (Eurostat data). France did better too than the UK except in 2010 and 2012 (tie).

That was the UK _with_ the benefit of one’s own sovereign currency and devaluation. So you are telling me that inside the Eurozone the UK would have done worse than Italy. OK. But my point remains, if one didn’t _know_ the UK has an independent currency one sure wouldn’t have guessed from the GDP data.

18. May 2012 at 09:34

[…] basic logic is one which I adhere to. The European Central bank has caused a debt problem to be seriously exacerbated by an aggregate demand problem, a new national central bank in control […]

19. May 2012 at 17:30

mbk, Britain is doing better than some and worse than some. Which proves nothing, right? But suppose it hadn’t devalued?

17. April 2015 at 02:59

My brother suggested We would probably similar to this web-site.. breaking news Your dog was entirely proper. This kind of distribute definitely made my own evening. An individual cann’t think just just how a whole lot time frame I did put in because of this details! Thank you!