The Swiss dodge two bullets

Back in January 2015, the SNB foolishly allowed the SF to suddenly appreciate against the euro (by roughly 14%), after capping its value at 1.2 for about 3 years. Soon after, the SNB realized its mistake, and now the SF is up by only about 8% compared to the period just before the revaluation (the graph shows the inverse of the SF’s value):

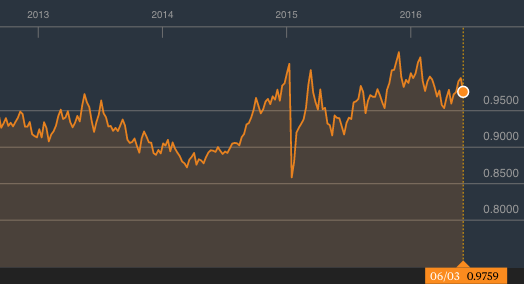

Another lucky break was that the euro weakened in 2015, and so the SF has actually been relatively weak against the dollar over the past year (again, graph shows the inverse of the SF’s value):

Switzerland fell into mild deflation, although that may have partly reflected falling oil prices:

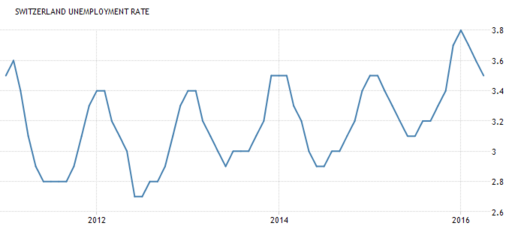

Fortunately, unemployment rose only modestly, as the Swiss economy has always been more flexible than other European economies:

Fortunately, unemployment rose only modestly, as the Swiss economy has always been more flexible than other European economies:

(Sorry, I could not find seasonally adjusted data, but you can see the mild upswing in unemployment.)

(Sorry, I could not find seasonally adjusted data, but you can see the mild upswing in unemployment.)

The other bullet dodged was a proposed Universal Basic Income, of roughly $30,000/year for each adult, and about $8000/year for each child. That is, about $76,000/year for a family of four. There may come a time when a UBI is appropriate, but this proposal was way too soon, and way too generous. It was rejected overwhelmingly:

Projections by the GFS polling outfit for Swiss broadcaster SRF showed nearly four out of five voters opposed the bold social experiment launched by Basel cafe owner Daniel Haeni and allies in a vote under the Swiss system of direct democracy.

Tags:

5. June 2016 at 08:53

Re the UBI proposal: Launched by a cafe owner! Wow.

5. June 2016 at 08:55

Becky, If my family could get $76,000/year without working, I think we’d be spending lots of time in cafes.

5. June 2016 at 10:40

The amounts in question for the UBI were speculative – the initiative itself didn’t specify any amount. It just says that the law should ” . . . enable the whole population to live in human dignity and participate in public life.”

In any case, I can’t see this ever happening in the US, and it probably won’t happen in Europe either beyond trial experiments and limited UBI (like a child subsidy payment) unless The Robots really do bring mass unemployment (I don’t think they will).

5. June 2016 at 10:43

I always thought the Swiss were insulated some. They sell high priced watches where prices is apparently no option. They entertain wealthy skiers which isn’t hurt by most currency fluctuations. They are skilled. Their chocolate is good but overrated. I like Italian milk chocolate and Belgium chocolate. Cheese from Switzerland is highly prized. A few pennies one way or another won’t hurt it.

I hope you saw this, Scott, regarding the last thread. I didn’t mean to imply that the economy as a whole declined because of NAFTA. I said this:

@Sumner:

“Gary, You do know that America’s unemployment rate fell sharply after Nafta was implemented, don’t you? And our job growth was much greater than most other developed countries.”

Yes, I agree, and I didn’t say that the US economy was greatly harmed. But there are two things NAFTA did to undermine things going forward. One is low wages for workers. Two is QE being needed which had the negative impact of making the rich far richer and causing the others to fall behind.

So, NAFTA was a mixed bag at best.

5. June 2016 at 10:44

Sorry, for watches prices are no problem. People pay for prized watches at almost any price.

5. June 2016 at 12:17

There’s a basic income in European countries like Switzerland already. It’s called social care and welfare and so on.

A family of four (2 parents, 2 kids) can make $68,000/year easily with this. And European politicians wonder why they get overrun by gypsies and people from Africa, the Near East and the Middle East. It’s a mystery.

More and more people are electing right-wing parties (and maybe even far-right wing parties) in Europe. Another mystery.

Even America goes for *you know who I mean* – at least in parts. Another mystery.

The world is full of mysteries these days.

5. June 2016 at 13:24

I wonder how long it will take Summer to realize that NGDPLT is a UBI for an economy of individuals.

5. June 2016 at 13:38

I wonder if Keynesians would acknowledge that a UBI like that could create inflation even at the ZLB?

5. June 2016 at 14:27

Gary, NAFTA led to QE? That’s one I never heard before.

5. June 2016 at 15:47

Uh, well, Scott, consider this: NAFTA led to low wages. Low wages led to the need for credit on the part of the middle class. The need for credit led to the housing bubble, and to bank instability, and ultimately to the liquidation by the Fed. And QE was the result.

Something like that, anyway.

5. June 2016 at 15:50

As far as the guaranteed income, it would have to be some form of helicopter money right? Or debt would possibly pile up.

Lonergan calls for a one time gift from the Fed with a 12 to 18 month time period to get us off the floor. It would be, in his system, debt free. I wrote about him at the link to my name. I believe he makes sense, and prosperity would increase. But, it is up to the economists to work out the nuts and bolts of it.

5. June 2016 at 16:33

You know, the Cavaliers are a good team and Golden State is threatening to pin them to the mat! GS is the most cohesive basketball team I have ever seen play since the old Celtics back in the 50’s and 60’s.

5. June 2016 at 19:02

The US would do well to replace the hundreds of welfare programs we have with a UBI. Subsidized food, food stamps, subsidized housing, TANF, EITC, etc: Just give people the money and let them make their own decisions about what to spend it on. Just imagine the huge administrative overhead that could be shed.

5. June 2016 at 20:07

Switzerland is another country where “low” unemployment is not generating inflation. See Japan and Thailand too.

NGDPLT targeting is best.

But when central bankers turn yellow at 5% unemployment, maybe we need a hard ceiling of 4% unemployment as a Federal Reserve target. Might work better than what we have now.

6. June 2016 at 00:59

Just give people the money and let them make their own decisions.

That’s not what most people/politicians want obviously.

6. June 2016 at 05:37

Scott, I like that you are softening your stance relative to UBI. Or so it seems to me.

Brett is correct above, the amount quoted was not what was being voted on and was likely an error in judgement by the proponents (imo).

I think UBI in the USA is inevitable b/c the ruling class will choose it over revolution.

Anywho, GiveDirectly is implementing a UBI experiment, which will be interesting to follow.

https://givedirectly.org/basic-income

6. June 2016 at 05:49

Very long Sumner post shorter: ‘I see that money is essentially neutral, and all the bad things I predicted about the Swiss franc appreciating did not come to pass; I guess Ray is right”. Exactly.

6. June 2016 at 06:08

Gary, No one can say you don’t have a sense of humor.

Philip, You said:

“I like that you are softening your stance relative to UBI. Or so it seems to me.”

Sorry to disappoint you, but my stance has not changed.

Ray, Actually the deflation and higher unemployment that I predicted did come to pass.

Have you figures out what an AS/AD model is yet, or are you still reading that old EC101 textbook, trying to figure it out?

6. June 2016 at 09:23

Lol, Scott. You mean when I said let the economists work out the details of helicopter money? Perhaps the concept of helicopter money is a joke to the bankers, who want more and more for themselves.

Certainly, the concept of GDP is a bit of a joke, since I would think that Gross Working Man’s Product(GWMP) minusthe cost of living totally sucks. I can say truthfully that I raised 4 kids in the 1980’s and 90’s, and it would be difficult to do so now. Hahaha.