The monetary hawks are wrong, again.

As always occurs in this sort of situation, you have monetary hawks telling us that interest rate cuts won’t do any good. These monetary hawks have been consistently wrong, wrong, wrong about monetary policy for the last 12 years. They’ve complained that policy is too easy, and that it would lead to higher inflation, even as inflation has almost consistently undershot the Fed’s 2% inflation target.

Even worse, they seem to show no contrition, no interest in learning why they were wrong, and no interest in reading the analysis of those of us who have been consistently right. I don’t believe we should ignore those who we disagree with, but when I read their analyses and see stupidity like “rate cuts don’t cure a disease”, it makes me want to pull my hair out. Show me a single economist who claims that rate cuts cure disease, or even who claim rate cuts make supply-side problems go away.

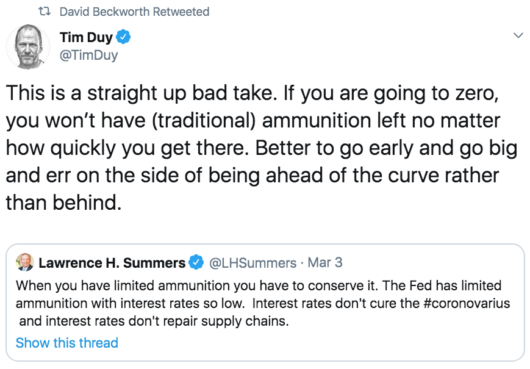

That’s not to say that all is well in monetary dove-land. Tim Duy correctly calls out a tweet by Larry Summer:

Summers manages to make not one but two bonehead errors in one tweet. First, the fact the interest rate cuts don’t cure disease is completely irrelevant to everything, including the question of whether rates should be cut. Summer seems to think otherwise. (It’s about like saying cutting rates won’t cure my toothache. So what?)

Even worse, Summers seems to suggest that monetary stimulus uses up ammunition, whereas it actually creates ammunition. Indeed that’s why many economists favor raising the inflation target to 4%—precisely to give the Fed more “ammunition” (i.e. a higher equilibrium rate of interest.). Summers is making the basic error of confusing a cut in the policy rate (which adds to ammunition) with a cut in the equilibrium interest rate (which reduces ammunition.)

PS. Over at Econlog I discuss the recent “saving shock”.

PPS. I’m quoted in this recent article, as is Larry Summers.

HT: David Beckworth

Tags:

6. March 2020 at 12:53

Shocked that Summers falls in so easily with what I think of as “the Wall Street Consensus” view on monetary policy. Is he too old to keep up?

6. March 2020 at 13:08

Any chance your S&P video interview is up? I search but couldn’t find anything so far…

6. March 2020 at 13:08

Whats the FED’s best ammunition here with the 30 year treasury trading 1.2%?

I think that might be the most concerning thing going on.

Maybe the markets just making a mistake pricing the 30 year at 1.2%. Even if you factor in 24 months of 0% interest rates you would get with carry an imputed long term yield sub 1.4%. Thats very concerning to me.

QE like in the past would seem to not be a great policy here especially with IOER.

Two fed officials are already musing about seeking permission for expanding asset purchases outside treasuries/agencies.

That would seem ok. Promising to stay at 0% until inflation expectations reach 2% might work too. Directly printing currency and giving to people?

Market often overreacts, but crushing these long-term expectations seems extremely important.

6. March 2020 at 15:36

@Brian Donohue – I thought you said Sumner but I see you say Summers. Saying Sumner has turned senile is not cool on this blog (unless I say it). As to who to believe, Summers > Sumner and “consensus” > lone wolf with a crazy theory that printing infinite money will not cause hyperinflation (never mind that money is largely neutral).

@Sumner – “First, the fact the interest rate cuts don’t cure disease is completely irrelevant to everything, including the question of whether rates should be cut.” – Not. R u senile? Unless you concede money is short-term neutral, in which case indeed it’s irrelevant.

@Sumner – “Even worse, Summers seems to suggest that monetary stimulus uses up ammunition, whereas it actually creates ammunition.’ – well, this is more sound. You should do a column explaining why the Fed buying junk paper (say C or D rated paper) is a good idea. You once implied this (if I’m not mistaken). The only way to inflate the money supply is in fact for the Fed to bloat their balance sheet with such junk paper. Buying the limited paper that is dealt by (issued by) the US government doesn’t seem to be inflationary enough for NGDP (correct me if I’m wrong). In fact they once cancelled the 30 year US govt bond for this very issue (limited supply).

6. March 2020 at 16:05

“These monetary hawks have been consistently wrong, wrong, wrong about monetary policy for the last 12 years”—Scott Sumner. Perhaps there was a typo in this sentence. Substitute 32 for 12.

Perhaps the S&P Global interviewers caught Larry Summers on his back foot so to speak. I suspect Summers advocates an aggressive fiscal response to a supply and demand shock. I disagree with Summer and think interest rates should be dropped to zero yesterday.

There is a camp with in macroeconomics circles that holds that conventional monetary policy, which now includes conventional quantitative-easing, lacks firepower against a coronavirus recession.

You see Stanley Fischer calling for the Federal Reserve to operate a fiscal facility to stimulate aggregate demand.

Of course, it does not have to be an either-or. We can increase fiscal stimulus and cut interest rates. And raise the inflation target.

Interest rates and inflation have been falling for 40 years. Now, with each shock, we tumble to an even lower plateaus of interest rates and inflation. This has happened all through the developed world. Yet this reality has surprised the macroeconomics community for decade after decade.

Times change, and that calls her changes in policies.

The Federal Reserve can no longer consider its primary mission “to fight inflation.” Due to the coronavirus, the Federal Reserve’s primary mission for the next year should be to keep the economy running very hot. It may need some fiscal authority to accomplish that necessary goal.

Why tweetybird around? Send in the choppers.

6. March 2020 at 16:08

What I have noticed is it seems one thinks like a MM person or they don’t. You seem to know what the Summers of the world are saying, but they rarely seem to know what people like you are saying. You make arguments that one can attempt to judge, they do not—-it’s as if they never even learned enough to disagree. They just think a different way. I find that strange. At least Hayek and Keynes could argue and Hayek could jokingly call Friedman “just another central planner”

6. March 2020 at 16:24

PS. Although many critiques perceived the same things I did in the beginning. Tautological thinking. I have not perceived that of late. Based on an implementation that is assumed but which is not possible, or not possible to the degree it needs to be. But you have been right. You are still the only guy all in

6. March 2020 at 17:36

Why stop at zero? Why not go to -5%? Is there some sort of law or regulation against that? I mean, if what you want is to go beyond what markets are expecting.

6. March 2020 at 17:42

I would assume that negative interest rates in practice are basically a way of giving the central bank a way to print money via banks that can borrow from it. Were that the case, why wouldn’t banks just borrow trillions of dollars and then just sit on those “loans” and pay out the interest they receive to shareholders? Wouldn’t that just be a taxpayer financed bailout of banks? Does QE work the same way?

6. March 2020 at 19:29

Jim, There’s no video interview. I was interviewed over the phone for a story. The link is above.

Sean, Abolish IOER.

Ray, It’s sad when someone trying to be a troll doesn’t even know how.

Michael, Summers’ claim isn’t even defensible. Tim Duy is not a MM, but he called him out on it immediately.

6. March 2020 at 21:21

To potentially abuse the metaphor:

If a guy is running at you with a gun you shoot right away, you don’t wait a while to conserve bullets before you shoot. Your gonna use them away, best do it before your dead.

6. March 2020 at 21:53

“Abolish ioer”

This may be right.

I’m a trader. Semi-successful. Powell gets pushed around. He’s gotten better since the 2018 stuff but he’s clearly not respected by markets to stabilize things. I don’t know if abolish ioer is the best but definitely seems better than status quo. The fed is in a bad spot right now. 2 fed guys today talked about buying non risks free assets because they knew buying qe wouldn’t work now.

You need to get loud unless you think the virus disappears. But I think it’s clear fed doesn’t know what to do now.

6. March 2020 at 23:13

@Sumner – ad hominem attack noted. I’m not a troll as much as I want you to say it’s OK for the Fed to buy C/D rated commercial paper. Please tell us how NGDP LT will work if there’s a limited supply of government bonds and if NGDP doesn’t respond as you anticipate. Of course I will get a kick reading you say that, so indeed I’m baiting you, but it’s a legitimate question given that there’s a worldwide high demand for US govt bonds and the supply is rather limited.

7. March 2020 at 07:14

Scott, my go-to explainer for rate hikes/cuts is to ask someone to imagine the plank of a teeter totter sitting completely balanced, and imagine the natural rate of interest as a marble sitting on top of that teeter-totter, directly above the fulcrum. The fed funds rate is the fulcrum and you can shift the fulcrum point from left to right. If the marble (natural rate) gets blown or pushed to the left of the fulcrum it will continue to move that way, which represents a continued fall in the natural rate (and thus falling NGDP), unless the fulcrum is moved to the left in lock-step with the marble. If the fulcrum is shifted with any delay, then it may need to be shifted further to the left than the marble to arrest the marble’s momentum and stabilize the system again. Of course, if the fulcrum is moved left but less so than the marble, then the marble will continue to fall to the left. I guess the ZLB is the edge of the plank!

Of course this is wrong in some ways, but would you critique it so that I can use the most accurate version of this analogy as possible?

7. March 2020 at 07:53

I’m getting the impression that science is only skin deep for people of action, even those like Larry Summers

7. March 2020 at 09:00

Prof Sumner-

I feel like you get hooked in to discussing interest rates because you are responding to what appears in the popular press.

As I understand your ideas, you favor direct creation of money as a better tool than interest rate manipulation. Although it’s appropriate to respond to hawks as they comment on interest rates, don’t forget to keep advocating for your better ideas, to help new readers understand.

You are changing the world for the better. Keep your eyes on the prize!

7. March 2020 at 09:20

Tjnel, Great comment, I’ll add it to a future post.

Thanks Todd

9. March 2020 at 09:30

Wow, even Summers. But Sumner is right this time. But not in 2018.

Interest is the price of loan funds. The price of money is the reciprocal of the price level.

#1 Gibson’s Paradox: “observation that lower prices were accompanied by a drop—rather than a rise—in interest rates”

#2 Interest Rate Fallacy: “monetary policy is easy when interest rates are low and monetary policy is tight when interest rates are high”

# 3 Paradox of Thrift: “The paradox states that an increase in autonomous saving leads to a decrease in aggregate demand and thus a decrease in gross output which will in turn lower total saving.”

The “Paradox of Thrift’s” far-reaching impact is characterized by savers reactions to absolute changes in interest rates, either up (yield chasing) or down (locking in yields).