The map and the territory

I’m still seeing overwhelming confusion in the media about the definition of a recession, and more importantly, what a recession actually is. Here’s the BEA, which computes GDP:

Recession: how is that defined?

In general usage, the word recession connotes a marked slippage in economic activity. While gross domestic product (GDP) is the broadest measure of economic activity, the often-cited identification of a recession with two consecutive quarters of negative GDP growth is not an official designation. The designation of a recession is the province of a committee of experts at the National Bureau of Economic Research (NBER), a private non-profit research organization that focuses on understanding the U.S. economy. The NBER recession is a monthly concept that takes account of a number of monthly indicators””such as employment, personal income, and industrial production””as well as quarterly GDP growth. Therefore, while negative GDP growth and recessions closely track each other, the consideration by the NBER of the monthly indicators, especially employment, means that the identification of a recession with two consecutive quarters of negative GDP growth does not always hold.

And here is the NBER, the group that economists consider authoritative on all questions about definitions of recessions:

Q: The financial press often states the definition of a recession as two consecutive quarters of decline in real GDP. How does that relate to the NBER’s recession dating procedure?

A: Most of the recessions identified by our procedures do consist of two or more quarters of declining real GDP, but not all of them. In 2001, for example, the recession did not include two consecutive quarters of decline in real GDP. In the recession beginning in December 2007 and ending in June 2009, real GDP declined in the first, third, and fourth quarters of 2008 and in the first quarter of 2009. The committee places real Gross Domestic Income on an equal footing with real GDP; real GDI declined for six consecutive quarters in the recent recession.

Q: Why doesn’t the committee accept the two-quarter definition?

A: The committee’s procedure for identifying turning points differs from the two-quarter rule in a number of ways. First, we do not identify economic activity solely with real GDP and real GDI, but use a range of other indicators as well. Second, we place considerable emphasis on monthly indicators in arriving at a monthly chronology. Third, we consider the depth of the decline in economic activity. Recall that our definition includes the phrase, “a significant decline in activity.” Fourth, in examining the behavior of domestic production, we consider not only the conventional product-side GDP estimates, but also the conceptually equivalent income-side GDI estimates. The differences between these two sets of estimates were particularly evident in the recessions of 2001 and 2007-2009.

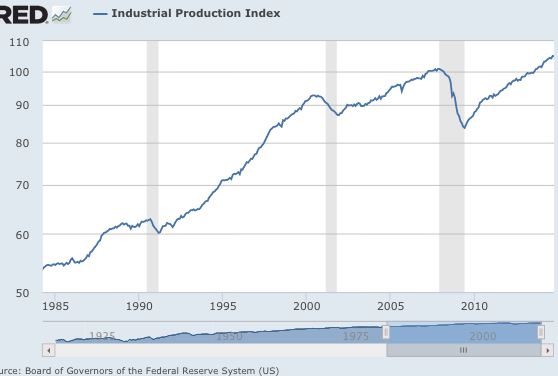

Fortunately, when you look at various monthly indicators, it is usually incredibly easy to date recessions—they look really, really different. Here’s industrial production over the past 30 years, how many recessions can you spot?

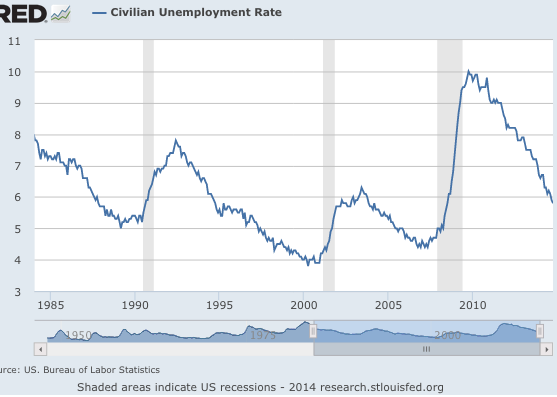

For those readers still struggling with the question, let’s try the unemployment rate:

Interesting how the answer “3” keeps popping up. But the “2 quarters of falling GDP” proponents insist that 2001 was not a recession (even though economists almost universally agree it was), and that Japan has recently experienced a recession, despite a falling unemployment rate.

Recessions really are distinct events. Why does this matter? Isn’t it just a question of semantics? By now it should be obvious that words matter. Many economists think in terms of words, not reality. The map, not the territory. Distinguished economists tell me to stop harping on the definition of “tight money.” But it’s precisely because most economists thought money was easy in 2008 that they don’t believe the recession was caused by a tight money policy of the Fed. If the Fed had suddenly raised the fed funds target to 8% in early 2008, they would have blamed the recession on the Fed. They wrongly exonerated monetary policy becasue they don’t understand the meaning of the term ‘tight money.’ In the same way, pundits who wrong believe Japan entered a recession this year are more likely to believe that monetary stimulus in Japan has not boosted AD, whereas it clearly has.

PS. One LA Times story claimed that Japan has had 4 recessions since 2008! And no, I’m not joking. When looking at the following graph keep in mind that sampling errors explain movements of a few tenths of percent. How many recessions can you spot?

PS. I have a new post on oil prices at Econlog.

Tags:

30. November 2014 at 09:40

Q: Regarding movements of income as an indicator of recessions, isn’t it true that real income has not fallen substantially during five of the past nine recessions?

A: That is why employment is probably the single most reliable indicator.

http://www.nber.org/newest.pdf

30. November 2014 at 09:40

Japan fools a lot of people. I think GDP per capita, rather than GDP or GDI, is a more useful measure in Japan. Though unemployment is good too. Both of those measures show that Japan is doing rather well, actually.

30. November 2014 at 09:56

Sometimes, there are jobless recoveries. And at others, there are full-employment “recessions” (as in Russia and Japan today).

30. November 2014 at 10:10

Unemployment rates EU-28, EA-18, US and Japan, seasonally adjusted, January 2000 – October 2014

http://tinyurl.com/pjadt33

30. November 2014 at 10:29

E. Harding, Yes, Nick Rowe often talks about unemployment as being the key variable–that’s what we are trying to explain with demand-side models.

Frances, I agree.

Richard, Interesting. You can really see the eurozone double-dip in that data. My take on 2002 is that the EU 28 is affected by Britain not having a recession at all. It looks to me like the eurozone (18) had a mild recession, but I suppose it might have varied country by country. Japan traditionally has smaller increases in unemployment during recessions, but nonetheless there clearly are increases.

30. November 2014 at 10:31

@Frances Coppola

-Compared with which countries? It’s definitely doing better than Italy, but I can’t say it’s doing better than the Tigers, Australia, and Germany.

http://www.google.com/publicdata/explore?ds=d5bncppjof8f9_&ctype=l&met_y=ny_gdp_pcap_pp_kd#!ctype=l&strail=false&bcs=d&nselm=h&met_y=ny_gdp_pcap_pp_kd&scale_y=log&ind_y=false&rdim=region&idim=country:KOR:JPN:HKG:SGP:AUS:CAN:USA:MAC:DEU:ITA&ifdim=region&hl=en_US&dl=en_US&ind=false

Japan’s full-employment stagnation reminds me a little of the U.S.S.R., which had no unemployment and a serious slowdown in the mid-70s.

30. November 2014 at 10:36

E. Harding, I agree. I meant it is doing fine in a business cycle context. Japan has seen slower growth in per capita income than in the boom years, but so have most other developed countries. Certainly they could use some supply side reforms, as the level of their per capita GDP is a bit low for such a highly educated, orderly, and well-functioning society. German per capita GDP would be a reasonable goal for Japan.

30. November 2014 at 15:09

Scott, I know you’ve said that your blog is not intended for a general audience when a commenter suggested that you try to extend your reach via social media. But that does not mean all your posts are only suitable for a narrow audience. As a lay person, I’ve learned a great deal by being a regular reader and the post above is a perfect example.

Perhaps one of your students would be willing to take select posts such as this one and copy them to a place like Facebook where it could reach more of the general public.

30. November 2014 at 15:37

The literature of the Fed, which 700 or so PhDs on staff, does not represent the Fed ss having tightened to the Great Recession in 2008, nor extending the recession since then with overly tight money.

Why does Scott Sumner say the Fed caused the recession?

30. November 2014 at 17:10

Macro-econ is a confusing subject right from the start. Does anyone know what anyone else is talking about?

Tight or Loose money: I have seen no definition that can be used in the present. People look back and say that money must have been tight or loose 4+ years ago. I used to think it was slang for too high or low a FedReserve interest rate, but now understand tentatively that we can’t tell from interest rates.

Recession: Two quarters of declining GDP, or something else? Whatever the NBER says it is? Per Frances Coppola above, why isn’t a recession defined on GDP/(working age person)? Recession seems to be defined in the most politically favorable way possible, hard to have an official recession.

GDP: This quantity strangely includes all government spending as productive. That is outrageous. Again, this is the most politically favorable interpretation for a quantity which can not be determined in government spending. How do economists avoid double counting the production of the US and also the amounts spent by government to buy that production?

Unemployment Rate: U3 People who looked for work in the last 4 weeks, or U6 every able bodied adult not working at his potential. Something in between?

Discussions which use undefined, il-defined, or multiply-defined terms may sound good but they mean nothing. How can one make any sense of macro-econ discussions?

30. November 2014 at 19:10

-I’m confident the correlation between these is high.

http://research.stlouisfed.org/fred2/graph/?g=SK9

-People don’t like division.

-WWII was not a recession.

30. November 2014 at 21:12

Hmmmmm……….

Bob Murphy: Krugman: “Sticky Wages I Win, Flexible Wages You Lose”

http://mises.ca/posts/blog/krugman-sticky-wages-i-win

30. November 2014 at 22:05

@benjamin cole: “…700 or so PhDs on staff…”

In 1931, the book “A Hundred Authors Against Einstein” was published, “disproving” his Theory of Relativity. Einstein’s response: “If I were wrong, then one would have been enough!”

Scientific truth is not a matter of popular vote.

1. December 2014 at 02:22

Travis,

Bob Murphy is an embarrassment. The fact that Krugman is dishonest doesn’t make it less so.

1. December 2014 at 10:30

Gordon, Let me talk to some other bloggers to get the pros and cons. Do blogs like MR do that?

Andrew, Many of your questions have answers (for instance government output is not double counted), but unfortunately I don’t have time to answer all of them.

1. December 2014 at 14:47

“Do blogs like MR do that?” I did a quick check and MR is on both Twitter and Facebook. Though I was thinking that the best thing would be to have select posts replicated to a Facebook account rather than the usual practice in social media of linking to the post to your blog here. That way any comments about those posts would remain in Facebook rather than the comments section here getting inundated with a lay audience. The other advantage is that there would be no expectations that you would read or reply to those comments. And it would be good for your time and your sanity to avoid them.

1. December 2014 at 17:49

Gordon, Thanks for the tips, I’ll consider them over the break.