The Great Inflation

For God’s sake will people stop talking about inflation! Especially you inflation “truthers” who insist the BLS is lying and the actual inflation rate is between 7% and 10%. Those are the sorts of rates we averaged during the Great Inflation of 1965-81. For those too young to remember, a little history lesson:

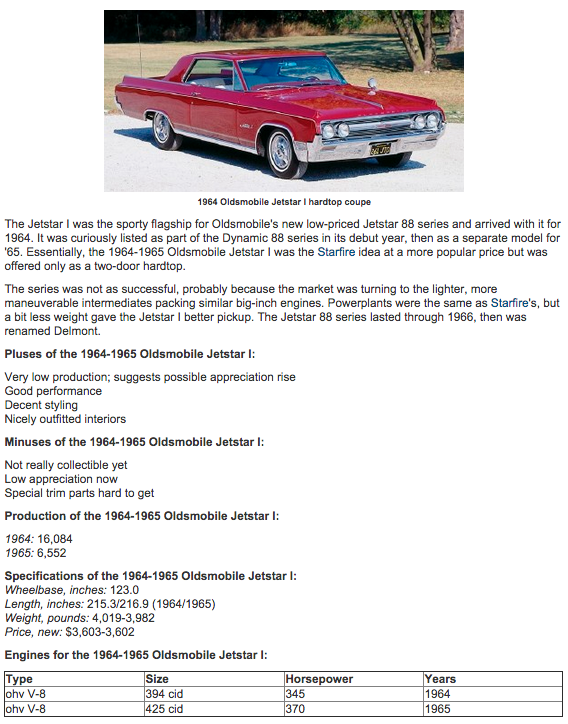

I was so excited when my dad came home with a red 1964 Oldsmobile 88. That was a car for upper middle class Americans. We were only middle class, but lived in an upper middle class house, because my dad was smart. The car was actually used, but almost new. He used to say a car lost 15% of it’s value the minute it was driven out the door of the dealer. Now when I go look for late model used cars the dealers ask more money than for a new model. Here’s the car (which sold for $3600):

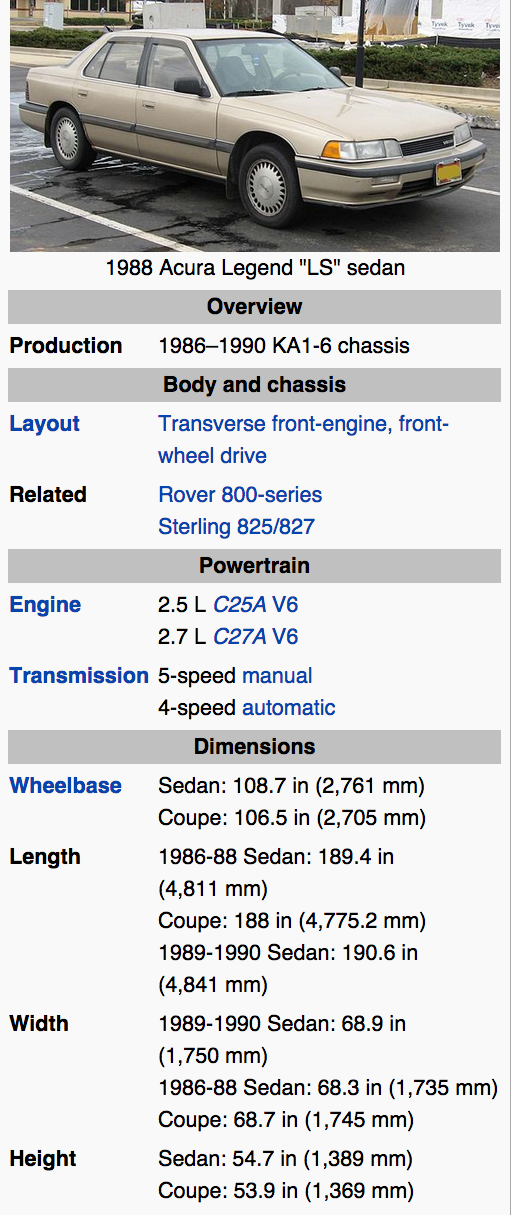

Now let’s flash forward to 1986. The Japanese cars are in style, and the first upper middle class Japanese car on the market is the Acura Legend, which sells for $22,500, more than a six-fold increase in 22 years. It was voted Car of the Year. That’s what high inflation feels like.

Now let’s go up to the present. I’m not quite sure what model would be comparable to the Legend, but the Accord is made by the same company, and is slightly larger. Here’s a picture of the Accord:

I’m pretty sure the Accord LX is better than the Legend LS in almost every way you could imagine. It’s price? Brace yourself, because 28 years is even more than 22 years. Surely the price of cars has risen more than 6-fold in the last 28 years. I’d say around $200,000. Nope.

I’m pretty sure the Accord LX is better than the Legend LS in almost every way you could imagine. It’s price? Brace yourself, because 28 years is even more than 22 years. Surely the price of cars has risen more than 6-fold in the last 28 years. I’d say around $200,000. Nope.

OK, $100,000. No.

$50,000?

Actually it’s $22,105. (The link has all the specs.)

Cars have gotten cheaper over the past 28 years.

In nominal terms.

(The CPI says car prices have risen about 35% in the past 28 years–I don’t believe that.)

BTW, wages of factory workers rose from just over $2.50 an hour in 1964, to about $8.90 in 1986, to $20.68 today. Put away the tissue paper, the middle class is doing fine.

My favorite car was a 1976 powder blue Olds Cutlass with a T-bar roof, whitewall tires and white bucket seats:

It was a $6000 dollar car, but I bought it used for $3500 in 1981. That’s actually a 1977, I don’t have a picture of my car.

Hmmm, I thought they were a bit better looking than that.

And no, I did not have a “Landau roof.” I do have standards.

PS. OK, I cheated a bit by using a Wikipedia photo of the Legend, which isn’t too flattering, and a very pretty official Honda web site photo of the Accord. But I’m not kidding, I’d rather have the Accord, even for the same price.

Millennials have no idea how lucky they are that they can just go out and buy a Honda Accord, brand new. On a middle class income.

That BMW you always dreamed of? Back in 1970 they looked like something made in a Soviet factory.

PPS. Labor intensive service prices have risen much more than car prices, and high tech goods have fallen dramatically in price. There is no such thing as a “true rate of inflation,” but there’s also no reason to assume that inflation has not averaged 2% in recent decades. It’s just as reasonable as any other number the BLS might pull out of the air.

Tags:

10. September 2014 at 19:15

Great – now let’s do this for housing. Could this guy afford an upper-middle class house today? Can *anyone* who isn’t already in the game now that prices have detached from wages thanks to banks lending against combined incomes at insane multiples? That’s where the inflation is.

10. September 2014 at 19:18

http://research.stlouisfed.org/fred2/graph/?g=IIl

10. September 2014 at 19:49

Man, the 1988 Accord was much better looking than the Acura Legend …

http://img2.netcarshow.com/Honda-Accord_Coupe_1988_800x600_wallpaper_02.jpg

I should be so lucky. I had to drive around one of these …

http://carphotos.cardomain.com/ride_images/3/1950/1481/29873240001_large.jpg

10. September 2014 at 20:49

Ben, what sources are you using for mortgage lending to income? The Federal Reserve releases mortgage debt service payments and disposable personal income as a ratio. By that metric, households are at three decade lows.

10. September 2014 at 20:58

Ben,

Average mortgage payments are lower, relative to rent, than they have been since the Owners Equivalent Rent level has been tracked by the BLS. Don’t get me wrong – you have lots of company. But if you think that, right now, there is a problem of banks being too generous with real estate lending, your point of view is simply unattached to empirical reality. Real estate lending has been DOA for more than 5 years. Home prices, relative to rent, got so low that the market has been dominated by institutional and all-cash buyers for the past several years. See the 2nd graph in this post for the mortgage-to-rent comparison:

http://idiosyncraticwhisk.blogspot.com/2014/09/speculative-position-in-housing.html

Scott,

You know, if inflation has been 5% or more, that means that banks have been paying us for the privilege of lending us money for much of the past decade! All these inflation phobes should be carrying bankers around on their shoulders, cheering them as heroes.

So, when those supposedly evil bankers were tricking us all into buying homes in the 2000’s, they were actually losing money on the deal, if you adjust for “real” inflation. Follow the money. The fraud ends up at you & me. It’s all of us who should be thrown in jail. Maybe there should be a trial with Goldman Sachs and JP Morgan Chase as the plaintiffs, where we will have to confess that when we financed our houses, we didn’t make it clear to them that at real inflation rates, we were making deals with them that they couldn’t possibly make money on.

We’re through the looking glass, here, people. This fraud is big.

10. September 2014 at 21:05

Ben: depends where you are. Texas, not so much. California, absolutely. But that is about how restricted (land-approved for housing) is.

http://www.demographia.com/dhi.pdf

10. September 2014 at 21:11

Was this article a joke? Economics professor compares different cars and concludes inflation isn’t real and people should stop whining.

10. September 2014 at 21:30

Inflation’s too useful as a way of examining whether an economy is flexible enough at adding extra capacity for goods and services with increases in the money. If you have major expansion in the money supply and prices skyrocket, then you’ve got structural problems with your economy. If they stay the same or only slightly increase overall, then your economy is really flexible and has a lot of room for growth.

10. September 2014 at 23:19

It would be interesting to see the various hedonic adjustments to CPI made over those time periods for these cars. I’m sure the price increases as reflected in the CPI would be much different (lower) than the sticker prices. For the last 28 years, they would probably show deflation for this component.

Taking literally, “hedonic” means relating to pleasure. Did you get more or less pleasure from that 1964 Olds with all its trunk and leg space, steel and chrome and its muscular engine than you would from the Accord? What would it cost today, even with our advances in manufacturing technology, to reproduce that 1964 Olds with the same specs? Are hedonic adjustments confusing functionality with price (or even pleasure)?

These are all debatable questions, and for this reason I doubt the statement “there is no such thing as true inflation rate” is debatable.

11. September 2014 at 01:29

Good grief, old cars were ugly. I know very little about cars in general, but the aesthetics of cars have improved tremendously. It’s like comparing old mobile phones to modern mobile phones.

I’m inclined to agree with Vivian Darkbloom.

11. September 2014 at 01:31

The data that A is referring to-

http://research.stlouisfed.org/fred2/series/MDSP

11. September 2014 at 02:18

how does that one thing prove anything? sure cars and other things like computers got cheaper, but what about groceries and rent?

11. September 2014 at 03:58

How about the gas the car burns? Bought tires lately? How does the property tax you pay compare? Lame analysis like this shows why our kids are getting a lousy education. Maybe this prof needs to do an inflation analysis of the cost of higher education.

11. September 2014 at 04:01

Quick on housing: If a nation urbanizes (and the USA still is) and incomes rise, you have people paying more for housing.

That counts as inflation, but is also real estate appreciation. People are getting a better house, maybe not physically, but in terms of where they want to live, perceived neighborhood value etc.

The CPI overstates inflation. Maybe the PCE deflator too. Don’t even get smartphone….

11. September 2014 at 04:08

The Jetstar was a variant on the Olds 88 platform. Oldsmobile, of course, exists no more. Nor does GM have any offerings in this class today. The nearest I could find is a Buick Regal (Premium I) which would run you around $35,000, depending on how you kit it out.

The Accord is from Honda, Honda’s mass market brand. The Acura Legend is from Honda’s premium brand, Acura. Acura discontinued the Legend and replaced it with the RL, which has since been superseded by the RLX. The RLX is not exactly comparable to the Legend, but fills the same slot in the Acura line-up. A typical sales prices is $52,000. My mother’s Legend cost $29,000 in 1991.

11. September 2014 at 04:41

Good article. It speaks well to the idea of perceived inflation. Regular folks judge inflation based on simple things: gallon of gas, gallon of milk, ounce of gold, movie ticket, first car, first house,… Nobody can wrap their heads around the inflation measurement for a 6th generation Iphone. Then there is a selection bias, where people dwell on things that have gotten more pricey and forget the cheap stuff. Between the intuitive perception of inflation and the doom-sayers in media, it is little surprise that people think inflation is higher than it really is. Just remember the price of an encyclopedia.

11. September 2014 at 04:56

@Steven Kopits,

I think that is Scott’s point. The “mass market” Honda of today is probably a better car than the “luxury model” of yesteryear. And cheaper.

11. September 2014 at 05:49

I wasn’t arguing that, Brian. But for goodness sake, if you’re going to blog on Accords versus Olds, spend the 15 minutes to actually determine what models are comparable and what their current and historical prices are. It’s all out there on the internet.

If you’re interested in the perception of prices, compare median wages to CPI. That will give you a pretty good idea of how people are perceiving their purchasing power.

11. September 2014 at 05:53

Ben, Yes, housing has rising much faster than cars. I wonder why?

Kevin, Good point.

Anon, I concluded inflation is real. I concluded truthers were wrong. Do you know how to read?

Vivian, Very good comment.

James and Charles, Some other things got more expensive. I think you missed the whole point of the post. Try reading it again.

Steven, Around 1970 my dad bought a calculator that did plus/minus/times/divide for $300. It was viewed as a luxury home computer. Indeed the most luxurious home computer you could buy at the time . Recently I paid almost $2000 for a iMac. Luxurious home computers have sharply increased in price. Sound absurd? That’s why I keep claiming that inflation is a meaningless concept. No one knows what the hell it is supposed to be measuring.

FWIW. the CPI tries to hold actual physical quality constant. But as Vivian points out that is almost impossible. In this post I tried to do what the CPI tries to do.

11. September 2014 at 06:27

I really like this post … So I’m sorry to snark … But:

‘I concluded inflation is real.’

And

‘That’s why I keep claiming that inflation is a meaningless concept.’

Me think Econ no fit words good sometime.

11. September 2014 at 06:30

Off-topic,

Does anyone know if there’s any official US stats on the sectoral holdings of M2 in the USA? The Bank of England reports a broad money aggregate less financial deposits, as does the ECB and some other central banks. You can construct a non-financial M3-type aggregate using FRED, but not one that excludes large time deposits. The closest I could do was this-

http://research.stlouisfed.org/fred2/graph/?g=JYm

– but there are still a fair few problems with doing it that way.

11. September 2014 at 06:55

It’s a good thing those car payments are easier to afford now, because there ain’t much left over after the student loan payments.

11. September 2014 at 07:00

I really like your blog but I just don’t get why housing prices and other asset prices are not considered when people talk about inflation. The S&P 500 doubled in just 5 years, there are regions in Europa where housing price tripled or quadrupled in just 3-4 years, so why is this not considered when economists talk about inflation?

11. September 2014 at 07:53

Scott –

Let me tell you what I often remind myself: If you don’t know the answer, look it up on the internet. An Accord and a Legend, while materially similar cars, are at different price points for different customer segments. And they were back in 1986, too.

We have owned all of Honda Accords, Oldsmobiles and Acura Legends. An Olds sedan never competed with an Acura Legend, and its nearest successor, the Buick Regal, is still $20,000 cheaper than the comparable Acura. Therefore, confusing an Olds with a Legend, and a Legend with an Accord, is an easily avoidable error.

A quick survey of the internet would have precluded this mistake. What’s the successor to the Acura Legend? Do you suppose there’s a Wikipedia page with that information? Of course there is.

And what does the very first paragraph of the Wiki entry say?

“The Acura Legend is a full-size luxury car manufactured by Honda sold in the U.S., Canada, and parts of China, under Honda’s luxury brand, Acura from 1986 to 1996 as both a sedan and coupe. It was the first flagship sedan sold under the Acura nameplate, until being renamed in 1996 as the Acura 3.5RL. The 3.5RL was North American version of the KA9 series Honda Legend.”

And click through that, and you’ll find the successor to the RL is the RLX.

http://en.wikipedia.org/wiki/Acura_Legend

You could have easily chosen, say, a Volkswagen Beetle (with minor reservations), Ford Mustang, BMW 2002 / 328i, Audi 100 / A6, or Porsche 911, for example. All of these have been in production for a long time (some with market segmentation / price point changes over time). The BMWs, Audis and Porsches sell to the same segment they sold to in 1970, ie, the value proposition is essentially unchanged, and therefore an apples-to-apples comparison is largely defensible. (For example, you can find Porsche 911 prices back to the 1960s here: http://auto.howstuffworks.com/porsche-911.htm)

Or you could have stayed with the Buick Regal, GM’s closest equivalent to the Jetstar / 88 today. That works, too.

But mixing Olds apple and Acura oranges is just sloppy and gives away credibility points for free.

11. September 2014 at 07:55

And as for perceived inflation:

Run the CPI against median wages back to 2005, and you’ll see how the median family perceives price levels.

11. September 2014 at 08:19

OK, median earnings are out there, too.

In nominal terms, US weekly earnings, in current dollars, are at $859, just off recent highs of $868.

In real terms, weekly earnings peaked in Q1 2009 at $345 (1982-1984 dollars), and for Q2 2014 stood at $330, down 4.5% over a five year period.

So if you’re telling us that things are great, and that inflation is just in our heads, well, BLS is confirming what people are feeling on the ground. Inflation has been comfortably outpacing wage gains.

http://www.bls.gov/news.release/pdf/wkyeng.pdf

11. September 2014 at 08:49

I’m with you on inflation being low.

But:

“BTW, wages of factory workers rose from just over $2.50 an hour in 1964, to about $8.90 in 1986, to $20.68 today. Put away the tissue paper, the middle class is doing fine.”

The fraction of all workers (in nonfarm payroll) who were in manufacturing in 1986 was about 20%. Today it is around 9%. Many of yesterday’s factory workers work for Walmart, UPS, or Target today. And those jobs just don’t pay as well.

11. September 2014 at 10:05

The portion of our paychecks that go toward products is smaller and smaller and the portion that go toward services are larger and larger. I remember going to the vet when I was a kid with by dog…and after the vet checking him over for 10 minutes and telling us what the problem was.. my dad asked what the bill was…and he said…”oh $2 is good and here is his medicine”

Try getting out of the vet’s office for less than $100 today…

11. September 2014 at 12:12

@Steven Kopits,

I think you need to look at this longitudinally. Every year, old higher paid people retire and young, lower paid people enter the workforce.

Consequently, wage increase for an individual will outpace ‘average’ or ‘median’ pay figures, quite possibly by enough to erase or reverse the shortfall you identified.

That’s how it looks on the ground.

11. September 2014 at 12:26

What is also interesting is that a luxury vehicle in 1775 would get less than half the MPG’s that a recent model with get. So even thought gasoline prices have risen considerably gasoline cost per mile, which is what we should really care about, has risen by less that half as much.

11. September 2014 at 15:53

Christian, Housing costs are 29% of the CPI, 39% of the core CPI. But the government does a lousy job measuring them. Stocks should not be included because you’d be double counting assets. The underlying physical capital is already part of the GDP deflator.

Steven, You said:

“Let me tell you what I often remind myself: If you don’t know the answer, look it up on the internet. An Accord and a Legend, while materially similar cars, are at different price points for different customer segments. And they were back in 1986, too.”

I know that, and it has absolutely no bearing on anything I said in the post. That’s not what price indices are about. The people who construct the CPI don’t care about “price points” and “customer segments” and “luxury brands” etc., etc. They care about the physical characteristics of the car. A 1986 Acura is nothing like a 2014 Acura.

And I’m saying the CPI is overstating inflation. Even so, I’m not claiming the recent recession didn’t hurt the middle class, obviously it did. But there’s no secular decline in living standards. It’s a myth.

maxk, I could not find a wage series for all workers, but I believe it’s gone up about as fast.

mikef, The sums that Americans spend on “vet” services pretty much tell you all you need to know about how rich we are today. When I was young the dog was “put to sleep” when he got sick. Now they treat dogs for cancer, depression, all sorts of nonsense.

Floccina, Actually a luxury buggy in 1775 was only one or two “horsepower.” Seriously, I get your point. 🙂

11. September 2014 at 18:18

Scott, not to mention the emissions were awful….

11. September 2014 at 23:33

Scott, you wrote:

“Steven, Around 1970 my dad bought a calculator that did plus/minus/times/divide for $300. It was viewed as a luxury home computer. Indeed the most luxurious home computer you could buy at the time . Recently I paid almost $2000 for a iMac. Luxurious home computers have sharply increased in price. Sound absurd? That’s why I keep claiming that inflation is a meaningless concept. No one knows what the hell it is supposed to be measuring.”

If I recall correctly, back in the 1980s, Apple put out the Lisa computer in the same luxury home computer that was priced at nearly $10,000. So I don’t really buy this claim that “luxurious home computers have sharply increased in price,” at least not without further context.

12. September 2014 at 08:05

Brian –

As a population ages–and the median age in the US is now around 37–hourly wages should increase, at least until the median is beyond peak earning years (which I believe is around 50-55 years old). So median weekly earnings should increase with an aging population, all other things equal.

Again, as I understand it, earnings have nothing to do with the unemployed or retired. These are the weekly earnings of people who work. And these are 4.5% below their 2008 level in real terms.

And that’s not household data, which is much worse. Households do include the retired and the unemployed, and that data is commensurately worse than the earnings data. That’s 7% below peak, although it is recovering. (http://www.advisorperspectives.com/dshort/charts/census/monthly-household-income.html?household-income-monthly-median-since-2000.gif)

Now, Scott can argue that the US government does not know how to do deflators, and that might be worth a post of its own. But to trot out a poorly conceived comparison between three not really comparable car types as justification for this is not really a good approach. At best it is anecdotal.

Let me give you two reverse anecdotes on standard of living so you can see what I mean.

This morning, I brought my now vintage mother home from the hospital from getting her cast off from a fracture associated with osteoporosis in older women. The osteo was exacerbated by her breast cancer treatment three years ago and probably also contributed to her broken hip two years ago (which was replaced). (Not Mom’s best four years in terms of health.)

Now, my mother is part of an aging cohort of Americans, and all that work on her is counted as part of GDP, probably $150,000 over the course of her treatments (maybe much more), that is, the equivalent of three annual household incomes or five Buick Regals. Here’s the question: Is the US wealthier for her treatments? In fact, no. That money was entirely spent on “maintenance capex”, that is, on maintaining her earlier standard of living, not enhancing it. But that spend counted as increased GDP, as incremental prosperity! But it wasn’t. So, as we age, we spent more and more money on healthcare, but it’s not making us healthier. It’s just preventing us from getting less healthy–which is something entirely different if we’re considering substantive measures of prosperity.

And that’s also true for so all those folks calling for spending on our “crumbling infrastructure.” Replacing infrastructure is, in some sense, no different from transfer payments. Repaving an existing road does not increase GDP over the long run. It provides current income to laborers and construction firms, but it does not increase GDP over the longer term. It just prevents the road from deteriorating, that is, it prevents GDP from declining. Thus, fixing aging infrastructure, whether for fixed assets or our senior citizens, does not make us wealthier. It prevents us from getting poorer.

(If we had a national balance sheet, all this would be readily visible because we would be calculating depreciation and amortization, including the depreciation of well-being of our population and our physical infrastructure as it ages.)

So, for every calculator, backup camera or iPhone Scott cares to bring up, I’m happy to offset it with 30 seconds of chemotherapy for an incremental 85 year old woman. Anecdotes are not analysis. You can use them to illustrate or clarify a point. But they are not a substitute for a long-standing BLS survey, the years of experience with various deflators in the government, or on-going efforts of the Census Bureau.

If you’re going to argue deflators, argue deflators like an economist. If you’re not going to do that, but expect us to take NGDP targeting seriously…well, Krugman may be a hack, but he’s a very careful hack. If you give him a nice clean shot at you or your credibility, you should expect that he’ll take it.

12. September 2014 at 08:19

Steven,

I understand and agree with much of what you said, and I don’t want to minimize the struggles many people have experienced over the past several years- I know a lot of these people.

On the other hand, I don’t want to exaggerate them either. The word Depression is thrown around a lot these days, and I can’t help but wonder what these people would think if they were thrown back into the world of 1933.

My point is a simple mathematical one. If everyone’s pay was frozen at current levels, we would see a decline in median wages from year to year as older people retired and younger people joined the work force. That is all. Individuals move through time in a way that medians don’t.

12. September 2014 at 17:37

psoun, I agree that home computers have not increased in price, I was being sarcastic. A calculator is not an iMac, just as a 1986 Acura is not a 2014 Acura.

Steven, There are plenty more reasons to be skeptical of the CPI. They claim housing costs rose 10% between 2006 and 2012, while Case-Shiller says they fell by 35%. I don’t trust either number.

Regarding my car example, I’m happy to admit the Olds is worse than the 1986 Acura–so let’s say prices rose 4- or 5-fold. Not 6-fold. That changes almost nothing. You can’t seriously claim that the 1986 Acura is better than a 2014 Accord—so my point stands. Car prices have fallen since 1986, not risen 35%.

I agree there is massive waste in the health care system. But anyone my age with two eyes and a head can see that living standards are much higher than in the 1970s. It’s obvious. You wouldn’t find one millennial in a 100 that wanted to live a 1970s lifestyle-including healthcare.

12. September 2014 at 18:29

Sorry, I’m still on the “middle class is doing fine” issue.

Scott quoted hourly factory wages:

1964: 2.50

1986: 8.90

today: 20.68

And concludes that the middle class is doing fine. That’s a pretty poor set of data to draw any conclusions from. As I pointed out, factory wages apply to a shrinking part of the workforce. More importantly, these are *nominal* wages! Are we supposed to correct for inflation in our heads?

The US census gives household income numbers by quintile from 1967 to 2012 (https://www.census.gov/hhes/www/income/data/historical/household/).

Here are some values from about the same years that Scott quotes, plus 2000.

Household incomes for 20th percentile, 40th percentile, 60th percentile, 80th percentile, and 95th percentile (all in 2012 dollars):

1967: $18,032 $35,163 $49,907 $71,167 $114,203

1986: $20,482 $39,177 $60,802 $91,909 $154,121

2000: $23,893 $44,000 $69,565 $109,021 $193,627

2012: $20,599 $39,764 $64,582 $104,096 $191,156

What I find most remarkable is how little gain from 1986 to 2012 (26 years!) at the 20th percentile and 40th percentile of the income distribution. And at both percentiles, incomes have fallen by more than 10% since 2000. While at the higher percentiles, the income drops since 2000 are much smaller.

Seems crystal clear that in the last 25 years the income distribution has spread to the right as total GDP has gone up, rather than shifted to the right.

Not saying that there is a clear remedy to this. But can’t we at least admit that there is something going on here, that the lower middle class has been squeezed in the last 25 years and especially in the last 10?

The other argument is that most people move substantially between quintiles in their lives, so this doesn’t matter. We’ll all get our fraction of years when we are in one of the top 2 or 3 quintiles, and we get to cash in then. Honestly, I don’t buy it. For one thing, I’ve spent all my years since grad school up in the top two quintiles. So have all the professionals that I work with. Same I’m sure with Scott and his colleagues. If we’re not falling out, there have to be lots of people who aren’t moving in.

13. September 2014 at 09:12

maxk, You said;

“Honestly, I don’t buy it. For one thing, I’ve spent all my years since grad school up in the top two quintiles. So have all the professionals that I work with. Same I’m sure with Scott and his colleagues.”

Amazing how you can be “sure” of things that are not true. Since leaving grad school I’ve spent time in all 5 quintiles. But why exclude grad school from your argument? Does the data in your post exclude grad school?

I have many posts explaining why income distribution data is almost worthless, for lots of reasons.

13. September 2014 at 20:14

My bad! I wasn’t “sure” – I was just guessing. And of course you’re right – for the 5 years that I spent in grad school my household (such as it was) was in the first quintile. But for the 25 years since then I’ve been comfortably in the top half. And I believe that is the usual experience for most professionals. That is, a few years in the bottom quintiles while building human capital and many years out of them. Do you think I’m wrong about that?

Yes, of course our grad school years are in the first quintile. But do you really think that is a significant part of the statistics? Quick internet search finds 1.74M grad students in US in 2012, of a population of 250M adults. That’s about 0.7%, and some of those grad students are people with pretty good jobs who are doing Masters degrees in the evening.

It’s like you want to look at the $20K threshold and say, ‘That’s me in grad school. In fact I made a lot less than that.’ But it’s not. It’s a guy working for $10 an hour at Walmart, whose father made $20 an hour (adjusted for inflation) working for GM.

Do you really think the income stats are nearly worthless and tell us nothing? Do you not believe that the wage distribution has widened considerably in the last 25 years (fewer $40K – $60K jobs, more $25K jobs and more +$100K jobs)? What stats tell you that it’s not happening, or if it is happening, it isn’t a problem?

13. September 2014 at 23:00

maxk:

You are too obsessed by money. Think quality of the spend, even if we were to agree the deflator was at all accurate, which it isn’t.

14. September 2014 at 05:40

maxk, Very few people are in grad school, but the income figures are dominated by age factors. Lots of people are young and old, making low incomes. Many of these people are economically “poor” but functionally middle class.

The second poorest town in America is a college town in Ohio full of middle class college students. That’s according to the NYT.

The NYT also says that 73% of Americans spend some time in the top 20%. That doesn’t seem at all consistent with your claims that most people don’t move around.

Then there is the fact that income data mixes labor and capital income, which should never be combined in the same data set. It’s a logical monstrosity. You are essentially counting the same income twice.

And of course capital income isn’t even measured correctly–it reports realized gains unadjusted for inflation, not actual gains adjusted for inflation (as it should report.) For instance, real income on Treasury bonds, after tax, is now negative. Lots of that “income” goes to rich people. If a middle class person sells their house they might suddenly be “rich.”

Yes wage inequality has widened, but it’s also true that the cost of living for the rich has risen faster than for the poor, so living standards are not becoming more unequal.

Think of the lifestyle of the poor in America today, compared to the 1960s–it’s day and night.