The Fed is behind the curve (as usual)

There’s a widespread impression that the Fed has recently tightened monetary policy. And it’s true that they have taken specific steps to signal an intention to raise rates and end QE earlier than had been expected six months ago. Nonetheless, monetary policy has effectively eased in the past six months, becoming more expansionary. The stance of monetary policy is not about Fed actions, it’s about market expectations of inflation/NGDP growth.

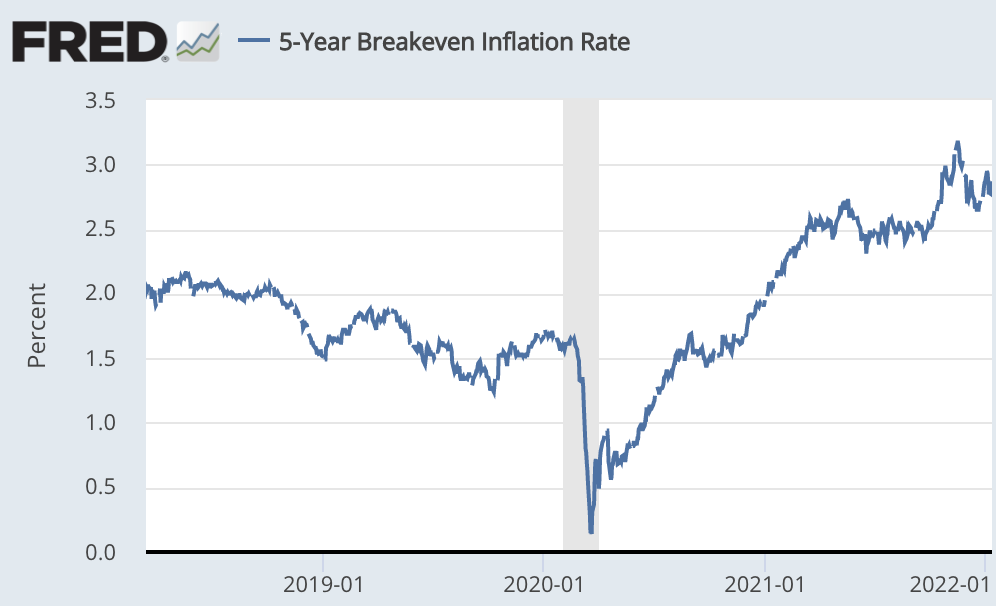

During the summer of 2021, 5-year TIPS spreads hovered around 2.5%. As of today, they are over 2.9%. The problem is that the equilibrium interest rate is rising faster than the Fed’s signals about future rate increases. This is actually the typical pattern over the business cycle. The Fed tends to raise rates too slowly during booms and cut them too slowly during recessions.

Actually, the situation is even worse than suggested by the rising TIPS spreads. The Fed isn’t targeting inflation; it’s targeting average inflation. That means a period of above target inflation should be followed by expectations of lower inflation going forward. Ideally, after the high inflation of the past 6 months, TIPS spreads should have declined, as markets anticipated a make-up period of below 2% inflation.

I still believe the Fed did a good job in promoting a rapid recovery in NGDP. Monetary policy is not binary situation of “success” and “failure”. All monetary policy ends in failure of some sort, it’s just a question of how bad. There’s still time for the Fed to remedy the situation and produce a soft landing. To do that, they need to aim for no more than 4% NGDP growth going forward, and no less than 3%. (In my view, trend RGDP growth is now below 2%) To do that the Fed needs to get ahead of the curve. Tighten policy enough to significantly reduce market inflation forecasts.

Tags:

12. January 2022 at 09:23

I still think that the Fed will sometime in the next two years announce an average target band for inflation between 2-3%, bring annual inflation down around to that level fitfully, and then declare victory. Isn’t something like that the prediction of markets? Stock prices seem happy with that outcome, so it doesn’t seem bad for RGDP.

12. January 2022 at 09:41

For capitalism to function properly, the economy must be permitted to reset itself without intervention from the state. Nobody voted to print more money, indebt posterity, and give that money to the banks (for the purpose of lending) to cash strapped businesses. Your group of tyrants at the Federal Reserve are unwanted and undeeded. I truly believe that your generation should be held personally liable, and morally culpable, for the debt it continues to rack up through unecessary QE. When big businesses fail, the price of real estate will plummet, wages will fall, and people will learn that reckless investing, along with hiring useless MBA paper pushers, is a BAD IDEA. New investment (competent and fiscally responsible investments) will open businesses that are more efficient & better managed. The government is not here to save you from personal risk and liability! Indeed, its only purpose is to secure the inalienable.

12. January 2022 at 10:08

1) If people are paying more, then people are being paid more. It’s not as if money spent on goods and services doesn’t land somewhere. There are of course friction and distributional issues.

2) If people owe money, people are owed money. It nets to zero. There are of course friction and distributional issues.

12. January 2022 at 10:54

What specific actions should the Fed take to tighten policy? And what effect will those actions have on the federal government’s ability to service its debt and implement its chosen fiscal policy?

12. January 2022 at 12:15

Scott,

I have read a few articles claiming that the fed is trapped between a rock and a hard place. It needs to raise rates to combat inflation but cannot do so without crushing the federal government’s ability to roll over its debt and causing the mother of all sovereign debt crises.

Some people I have read have even claimed that the fed (and it would never openly say this) sees more inflation as a good thing in that it the only realistic way to lessen the real debt burden. They claim that federal spending cuts and tax raises are just not politically feasible in this country (perhaps because we are a banana republic now!)

Do you buy into any of this?

12. January 2022 at 14:55

Rinat: That talk is verbotin. “aS LoNg aS tHe FeD eXiStS, tHeN…” that’s how to properly speak and not offend anyone into having to admit they’re apologetic ‘advisors’ for a fiat system controlled by a satanic pedophile cult.

12. January 2022 at 15:21

Realizing they’d be changing their inflation metric, they should just peg the ten-year TIPS spread and be done with it.

12. January 2022 at 15:57

Professor,

How do you interpret the market reaction to the fed minutes being a bit more hawkish than expected? Was the market disappointed it was not hawkish enough? It seems that Powell walked back the fed’s hawkishness during his hearing and that resulted in a rally in the market. Surely you don’t believe the fed should increase rates to 2% tomorrow but what should Powell and company be doing to balance markets and the economy? Would it suffice for him to announce he plans on increasing rates until inflation expectations are below 2%? Even then the market reaction would probably be unpleasant.

12. January 2022 at 18:16

MikeDC, You said:

“What specific actions should the Fed take to tighten policy?”

The most important step would be to clearly explain what the Fed is trying to achieve with its FAIT policy. Does it want inflation to average 2% during the 2020s? If not, what is the target average inflation rate?

Once that’s clear, it will be easier to figure out how much rates need to rise.

MSS, You asked:

“Do you buy into any of this?”

No, the Fed doesn’t need to help the Treasury with debt servicing—which is not a major problem right now. Even a modest rate increase would be easy to handle.

Farrell, Not all pedophile cults are satanic. Are you certain that this particular pedophile cult is not one of the non-satanic ones?

Rodrigo, See my reply to Mike. I am not certain exactly where the Fed should set rates, but it should be a level expected to lead to 3% to 4% NGDP growth over the next year.

Sorry, I didn’t follow the market reaction very closely.

12. January 2022 at 19:06

We are past the point of the ordinary “behind the curve” scenario. Which begs the question of why. There is some unidentified force pulling the Fed from its own stated goals (FAIT). I don’t think we can diagnose the problem until we know what’s causing it.

Are they afraid of asset price declines? Captured by their own financial interests? Lacking the proper expertise to understand the labor market? Experiencing political pressure?

12. January 2022 at 19:26

Prof. Sumner,

You say US monetary policy has eased in the last 6 months. Could you kindly elaborate on the large rise in the dollar Vs most DM pairs over since june21?

Thanks

12. January 2022 at 20:01

Sumner: “I still believe the Fed did a good job in promoting a rapid recovery in NGDP.” – sorry I don’t read this blog much anymore, but can long-time readers inform me, whether Sumner has walked back his skepticism that the Fed had anything to do with the V-shaped recovery in March 2020? For the longest while, Sumner refused to acknowledge that the Fed had anything to do with it, notwithstanding their “QE-anything” speech just before the stock market rallied a few days after that speech and hasn’t looked back. I myself, who think money is neutral, say that perhaps, like FDR’s ‘fireside chats’, the Fed QE-anything announcement may have helped with animal spirits (not clear but sure seems that way).

12. January 2022 at 20:53

ssumner wrote: ” … they need to aim for no more than 4% NGDP growth going forward, and no less than 3%. (In my view, trend RGDP growth is now below 2%).”

The one year TIPS anticipates inflation at 3.5 percent, right at your NGDP target. How do you get inflation down while increasing RGDP? Higher interest rates should bring them all down.

13. January 2022 at 06:17

Producer Price inflation 9.7% as of December. Highest on record.

ssumner: I’m pretty sure yes. Perhaps you’re not ready for every truth yet. No worries, in time…’Epstein’ was highlighted for a reason. Will soften the blow and make the bigger pills easier to digest in the future.

13. January 2022 at 07:06

Biden Inflation numbers:

Gasoline up 56%

Heating oil up 42%

Used cars: 37.3%

Car rental: 36%

Natural gas up 31%

Hotels: 27.6%

Beef: 18.6%

Pork: 15.1%

Furniture: 13.8%

New cars: 12%

Chicken 10.4%

Fresh fish: 10.2%

Oranges: 9.9%

Jewelry: 8.8%

Dresses: 8%

Let’s Go Brandon!

13. January 2022 at 07:21

Kav, The real exchange rate moves around for many reasons, of which monetary policy is only one. Real economic growth is also a factor.

Vince, If NGDP growth slows to 3.5%, then obviously inflation would end up being well under 3.5%. That forecast assumes more like 5% or 6% NGDP growth.

Farrell, The fact that Trump used to be Epstein’s buddy doesn’t prove anything. Guilt by association?

13. January 2022 at 07:49

Epstein’s job was to hob nob with the wealthy and big politicians, to blackmail them with underage girls.

Trump banned him from Mar A Lago once he learned about what he was doing.

Trump’s name isn’t on the flight logs to Epstein’s pedo island, but Bill Clinton’s name is…24 times.

You’re right, mentioning people’s names together to smear them by ‘guilt by association’ is a terribly uncouth thing to do, but if that is how we roll, then we’ll roll that way.

13. January 2022 at 10:27

Scott, readers. My latest blog post is about why the labor share has fallen post 2000 in the U.S. I make the argument that it is not because of more monopolies. I also make the connection between higher profits and greater excess capacity in the economy.

https://strangetidings.substack.com/p/the-reason-why-profits-are-high

13. January 2022 at 10:59

ssumner wrote: If NGDP growth slows to 3.5%, then obviously inflation would end up being well under 3.5%. That forecast assumes more like 5% or 6% NGDP growth.

Or NGDP growth 3.5%, inflation 3.5%, RGDP growth zero. If inflation is already anticipated at 3.5%, it must be lowered to accomodate any RGDP growth while achieving the 3.5 target NGDP. Lowering inflation would require even higher interest rates, which could push RGDP in the wrong direction.

13. January 2022 at 11:21

I think RGDP growth potential was at least 3% before the recession, and though it might be somewhat diminished now, due to damage caused by the pandemic, I doubt it is on net. I think we’re slowly entering a new era of higher and increasingly accelerating productivity growth, primarily facilitate by advances in AI. I don’t know if we’ll see much of that productivity acceleration in my lifetime, as we’re in the very early days of this technology, hype notwithstanding.

On the other hand, we may see enough evidence to begin to conclude that the AI revolution will dwarf the agricultural and industrial revolutions in terms of increased and increasing productivity, even within my lifetime. There is much uncertainty.

That said, I’m confident that the US will not become Japan, even with Japanese demographics. Yes, the aging population will be a drag on growth, but net forces of increasing productivity will prevail.

13. January 2022 at 17:08

@Ray Lopez

I remember that time differently. Scott immediately said it was from the Fed; you said for 2-3 weeks that Scott had now convinced you; and we all wondered if you had been abducted by aliens and replaced by a Scott-positive clone.

13. January 2022 at 17:18

Scott wrote (in the comments above): “No, the Fed doesn’t need to help the Treasury with debt servicing—which is not a major problem right now. Even a modest rate increase would be easy to handle.”

Scott, can you elaborate on what you have in mind? E.g. if the yield curve shifted up 1 percentage point, that would mean an extra $200 billion a year in interest service, right? So are you saying there’s no way that needs to happen anytime soon?

13. January 2022 at 19:37

Bob, No, I’m saying the Fed doesn’t need to change its policy to prevent the fiscal hit from interest costs from rising $200 billion/year. Thus it should focus on hitting its target. The Fed can and likely will ignore the fiscal impact of its actions.

14. January 2022 at 03:36

As I said:

The 4th qtr. 2019 is not the problem. The 1st qtr. 2020 will be negative.

Nov 26, 2019. 07:19 PMLink

Powell waited until March to counteract the deceleration in the economy.

No, it isn’t as FOX4 says: “Why is inflation so high?

The current rate of U.S. inflation stems from the robust economic recovery after the unforeseen economic downturn caused by the pandemic.”

You can blame the pundits:

(1) Thu 11/16/06 9:55 AM: But “no one in the Fed tracks reserves…” V.P., Fed’s technical economic staff…. & “There is general agreement that, for almost all banks throughout the world, statutory reserve requirements are not binding” (the conventional wisdom).

(2) “Reserves don’t even factor into my model, that’s not what causes inflation and not how the Fed stimulates the economy. It’s a side effect.” – Former Fed Governor Laurence Meyer, co-founder of Macroeconomic Advisers

(3) Donald Kohn “I know of no model that shows a transmission from bank reserves to inflation”

You can believe what you want, but the correct viewpoint is that Powell and the FED failed us.

It’s as Lawrence K. Roos said, Past President, Federal Reserve Bank of St. Louis & past member of the FOMC (the policy arm of the Fed) as cited in the WSJ April 10, 1986

“…I do not believe that the control of money growth ever became the primary priority of the Fed. I think that there was always & still is, a preoccupation with stabilization of interest rates”.

14. January 2022 at 03:40

re: “monetary policy has effectively eased in the past six months, becoming more expansionary”

Then inflation should accelerate, not decelerate.

But inflation peaks in January according to monetary flows, volume times transactions’ velocity.

Sumner not only doesn’t know a debit from a credit, but doesn’t know money from mud pie.

14. January 2022 at 03:47

The question is not where inflation goes. The question is where R-gDp goes. It’s been Powell’s experiment. Let inflation run its course.

The markets are largely dependent upon O/N RRPs. Any upsurge will stunt growth, any downswing will prevent growth from falling.

14. January 2022 at 04:03

You have to first be able to define money. For example, M2 isn’t money per se, money that is being spent, i.e., “means-of-payment” money, “medium-of-exchange” money. It doesn’t even represent pent-up demand, a “standard-of-deferred-payments” money supply.

The connection between money as a stock and money as a flow, is the velocity of its circulation. The velocity of money refers to the frequency of economic transactions, of physical exchanges between counterparties, in an economy.

One man’s spending is another man’s income (where the “demand for money” is the reciprocal of velocity).

M2 is posited by people trying to prove a point without the evidence. It’s not even correlation without causation. It is a fundamentally flawed analysis.

In spite of the Ph.Ds. in economics trying to prove otherwise, nothing has change in > 100 years. Un-like what Alan Greenspan tried to communicate:

“CHAIRMAN GREENSPAN. I must say that I have not changed my view that inflation is fundamentally a monetary phenomenon. But I am becoming far more skeptical that we can define a proxy that actually captures what money is, either in terms of transaction balances or those elements in the economic decision-making process which represent money. We are struggling here. I think we have to be careful not to assume by definition that M1, M2, or M3 or anything is money. They are all proxies for the underlying conceptual variable that we all employ in our generic evaluation of the impact of money on the economy. Now, what this suggests to me is that money is hiding itself very well.”

AD = money times transactions’ velocity, not N-gDp as the Keynesian economists claim. “Money” = the measure of liquidity; the yardstick by which the liquidity of all other assets is measured.

Vi is a “residual calculation, or mathematically fabricated – not a real physical observable and measurable statistic.” Income velocity may be a “fudge factor,” but the transactions velocity of circulation is a tangible figure.

I.e., income velocity, Vi, is endogenously derived and therefore contrived (N-gDp divided by M) whereas Vt, the transactions’ velocity of circulation, is an “independent” exogenous force acting on prices.

Money demand is viewed as a function of its opportunity cost – the foregone interest income of holding lower-yielding returns on money balances (Keynes’ liquidity preference curve). As this cost of holding money falls (or “K” — the length of the period over whose transactions purchasing power in the form of money is held), in Alfred Marshalls’ cash balances approach, the demand for money rises (and velocity decreases).

As Dr. Philip George says: “The velocity of money is a function of interest rates”

As Dr. Philip George puts it: “Changes in velocity have nothing to do with the speed at which money moves from hand to hand but are entirely the result of movements between demand deposits and other kinds of deposits”.

It’s the transactions velocity (bank debits to deposit accounts – Vt) that’s statistically significant (i.e., financial transactions and non-GDP transactions are not random, and can be filtered).

14. January 2022 at 04:08

Powell: “stressing supply side constraints have been “very persistent” and “durable.”

LOL. Dodging the bullet again. Overall supply has increased, not decreased. R-gDp in the 4th qtr. of 2019 was 21694.458T. R-gDp (non-inflationary growth or supply) in the 3rd qtr. 2021 was 23,202.344T. up + 1507.886T.

14. January 2022 at 06:41

pharma fascist Scott Sumner has arrested and detained total stud and tennis legend Novak Djokovich because his ugly and fat American losers can’t beat him.

Stop commie Sumner!!!!!!!! Detain him at the univeristy for crimes against humanity and crimes against posterity and crimes against tennis superstar and total stud – without the loser vaccine – Novak Djokovich.

Let him play dictate sumtard

14. January 2022 at 06:45

Bernanke, Laubach, Mishkin, and Posen (1999, pp. 315–20) describe a two-year lag between policy actions and their main effect on inflation as “a common estimate.”

https://www.lancaster.ac.uk/staff/ecajt/inflation%20lags%20money%20supply.pdf

14. January 2022 at 08:34

The standard line is this from the Bank of England

when we raise Bank Rate, banks will usually increase how much they charge on loans and the interest they offer on savings. This tends to discourage businesses from taking out loans to finance investment, and to encourage people to save rather than spend.

Like all propaganda The Myth sounds very reasonable at first glance. However even a cursory institutional analysis reveals a glaring problem. MMT shows us that The Myth is not compatible with how banks work. Loans create deposits. So if there are fewer loans then there will be fewer deposits. For you to save financially, there has to be a corresponding outstanding loan somewhere.

That’s not a matter of opinion. That’s a matter of accounting fact. Even the Bank of England Agrees.

Overall if loans go down, financial savings must go down by exactly the same amount.

If you want the stock of bank loans to come down, while the stock of bank deposits goes up, then, unfortunately, reality won’t let you do that.

14. January 2022 at 12:19

nick,

Have you noticed that many who are ‘defending Australia’s sovereignty’ to decide who can enter into the borders, are the same who say defending the US/Mexico border is ‘xenophobic’?

Another craziness:

Many hospitals fired nurses and doctors for being unvaccinated, even though most had NATURAL immunity from having caught a variant of the common cold in the last two years, covid negative, and ready to help patients safely and securely.

That caused a shortage of staff.

Now those same hospitals are hiring vaccinated nurses and doctors, many of whom are covid positive and don’t have natural immunity.

Yet more craziness:

UK government has just admitted that double vaccinations cause permanent damage to the immune system.

Yet Biden admin and many other ‘puppet’ admins worldwide are calling for triple vaccinations and boosters.

Even more craziness:

Germany just imposed a ban from restaurants and other places of business anyone who is ‘only’ double vaccinated. German health minister calling for mandatory vaccinations on entire population. Reason he gave: “It is necessary because it is necessary.”

The entire narrative of the corrupt leftist media is collapsing. Good riddance!

14. January 2022 at 15:21

@Christian List- thanks, but I don’t recall Scott saying the Fed helped turn around the economy in March 2019 (sic, not 2020, my bad). In fact he said the opposite, that it was not the Fed. Perhaps I missed a column but I’ve read Sumner’s works pretty frequently, and even posed the question to him by email which did not get a reply. If Sumner is reading this, a column clearly explaining why or why not he feels the Fed may have turned the economy around in March 2019 is kindly requested.

PS–it’s a shame how ignorant America is, and with SARS-CoV-2-omicron having an R0=16 that requires an H.I.T. of over 95%, measles-like, and with 33% of the population refusing to take a vaccine, and with the US Sup. Ct. ignorantly leaving it to states to decide (a bad decision, Google “affectation doctrine 14th Amendment” on why if you wish to delve into US constitutional law, e.g., the Civil Rights act was pushed through on this doctrine, and pandemic is as equally important IMO), it’s clear we’ll have the probable WIV-lab release Covid-19 illness with us for the foreseeable future, in fact perhaps forever unless they require, German police style, strict vaccine mandates. Sumner should be beating the drum on this but his libertarian bias prevents him from doing so.

14. January 2022 at 15:30

It´s not so much that the “fed is behind the curve”. It´s more the case that it has not yet decided which curve it wants to be on!

https://marcusnunes.substack.com/p/an-inflation-chart-book

15. January 2022 at 08:37

re: “The Myth is not compatible with how banks work. Loans create deposits”

That’s not exactly how prior cycles have previously worked. When interest rates rise, bank deposits are shifted into savings (largely interest-bearing accounts). That destroys velocity (not necessarily slowing bank credit as loan growth is supplanted with government securities growth).

So, the FED tries to offset the decline in AD, which typically results in higher inflation. Thus, the prior cycle’s collapse was almost inevitable.

Dr. Philip George describes this as an offshoot of the demand for money. Actually, it is an accounting problem. Banks don’t lend deposits, so all bank-held savings are frozen.

And there’s an historical demarcation. Prior to 1981 (during the “monetization” of time deposits), the remaining demand deposit turnover offset the shifting of bank deposits. All of this was explained in

“Should Commercial Banks Accept Savings Deposits?” Conference on Savings and Residential Financing 1961 Proceedings, United States Savings and loan league, Chicago, 1961, 42, 43.

“Profit or Loss from Time Deposit Banking”, Banking and Monetary Studies, Comptroller of the Currency, United States Treasury Department, Irwin, 1963, pp. 369-386

Link: The riddle of money, finally solved BY PHILIP GEORGE

http://www.philipji.com/riddle-of-money/

15. January 2022 at 08:43

re: “So if there are fewer loans then there will be fewer deposits”

How could that be a problem if the FED controls the money stock?

15. January 2022 at 12:14

Supreme Court just destroyed the Biden/Sumner tryannical executive mandate, which attempted to force a large percentage of the population to get jabbed against their will, or stop getting paid. Now it’s up to individual businesses.

Considering twitter is losing users after their tyrannical cancelation, shadow banning, and other totalitarian assaults on speech, I’m confident businesses that force innoculate their workers will soon be struggling to compete!

The Supreme Court ‘s ruling once again proves the genius of the framers who sought checks and balances on a possibly corrupt executive and legislative branch.

And lastly, there is nothing more sweet than beautiful commie tears. So keep crying Sumner, and remember to collect those tears for me. There is no crown waiting for you. No totalitarian chair to sit on. American patriots will stop you.

16. January 2022 at 08:49

Dr. Oz destroying Sumner’s bio pharma fascism.

https://twitter.com/DrOz/status/1482491032692473857?cxt=HHwWgoCypavv7pIpAAAA

To summarize, Sumner is concerned his old and wrinkly body might catch the disease from a young and robust teen, so he wants to force vaccinate children, shut their schools, and lock them inside, despite the fact that they are more likely to die from the vaccine than from the virus.

This is probably the first time in human history, in which old men and woman – mostly the wrinkly old men – are selfish enough to sacrifice children to save themselves. Talk about a wimpy baby boomer generation. Why can’t you just “man up” and realize that you are old and are going to die soon. Literally “anything” can kill you at your age. Sorry, but it’s reality. Time to face the truth; and it is time to stop living in a fantasy world.

16. January 2022 at 11:16

>We are past the point of the ordinary “behind the curve” scenario. Which begs the question of why. There is some unidentified force pulling the Fed from its own stated goals (FAIT). I don’t think we can diagnose the problem until we know what’s causing it.

I’m reminded of things Krugman kept harping on on his blog during the financial crisis 1) QE works at the zero lower bound only if policymakers “credibly promise to be irresponsible” and 2) only WWII truly ended the Depression.

Earlier in 2021, in February, I was listening to an interview with someone (Mester, I think), and the interviewer said, basically, markets are soaring to well above pre-COVID highs, more fiscal stimulus is about to drop, is it about time to start worrying about inflation? And her response was basically “LA LA LA LA inflation? Why would we care about that??” Which made me think of the “promise to be irresponsible” line.

Then in November 2021 I heard another interview, this time with Mary Daly. And the interviewer was asking her to explain the Fed’s inaction, noting that real interest rates were even more negative than in the 70s, at negative six percent. And her immediate retort was “But we’re still dealing with COVID!” Which rang extremely hollow, 20 months into the pandemic. She was obviously attempting to make the claim that COVID is somehow an excuse for financial repression and confiscation of the savings of private individuals, as might be case in wartime. I thought of Krugman’s “only WWII cured the Depression” line, and started wondering if they are trying to use COVID as the “new” WWII, to finally put an end to the financial crisis.

17. January 2022 at 06:13

Scott,

You are right and I believe this is pretty urgent. But how much discretion do they really have?

17. January 2022 at 09:01

[…] la clase media – Tyler Cowen Here’s Why Inflation Numbers Are About To Get Worse – Gene Marks The Fed Is Behind The Curve… As Usual – Scott Sumner When Higher Prices Are Not Inflation – Doug French Stop Pretending Price […]

17. January 2022 at 10:33

This seems a bit overwrought. 5-year breakeven back to 2.79% (was 3.17% in November). 10- and 30-year breakevens are 2.44% and 2.22% respectively.

The idea that creditors, recently burned by 7% inflation, will think in terms of Fed now tightening, rather than accounting for the comparatively novel risk of serious devaluation, is silly.

18. January 2022 at 01:19

The ‘argument’ does not go ‘like this’!

“Exactly the same error can be seen in the Keynesian idea of liquidity preference. The argument goes somewhat like this. When interest rates are very low, everyone expects interest rates to rise and therefore bond prices to fall. Therefore everyone gets out of bonds and prefers to hold cash, whence the phrase ‘liquidity preference’. But it is impossible for any one individual to exit bonds and accumulate a larger cash balance without at the same time increasing someone else’s supply of bonds and reducing his cash balance. The economy as a whole cannot change its liquidity preference by disposing of bonds.”

http://www.philipji.com/riddle-of-money/

18. January 2022 at 12:24

Just like in AA, you can take what you need and leave the rest.

The argument starts with this: “The error we are talking about is the error of regarding money as cash balances, and the demand for money as the demand for cash balances. The idea dates back to the early part of the 20th century in Cambridge, UK, and has appeared so obvious it has held unquestioning sway over all schools of economics.”

No matter. George doesn’t entirely get it. Banks don’t lend deposits, so all bank-held savings, demand deposits shifted into time deposits, are lost to both consumption and investment.

1966 Interest Rate Adjustment Act

https://seekingalpha.com/instablog/7143701-salmo-trutta/5265714-1966-interest-rate-adjustment-act

1966 Interest Rate Adjustment Act II

https://seekingalpha.com/instablog/7143701-salmo-trutta/5265717-1966-interest-rate-adjustment-act-ii

18. January 2022 at 14:35

It was 2020, my bad. What I want is a showing that the Fed announcement of March 15, 2020 had the effect of reversing the US stock market, keeping in mind the DJ-30 index bottomed in March 23, 2020. Note the DJ-30 had started to crash on March 4, 2020. The Fed, if you believe in expectations, may have panicked or crashed the market, since on “3 March [2020] the Federal Open Market Committee (FOMC) lowered the federal funds rate target by 50 basis points” (Wikipedia on the 2020 stock market crash). Likewise the Fed may no doubt was responding to the market crash in the March 15, “QE anything” announcement.

In short, the Fed responds to the market, and, like the Plaza Accord of 1985 (when the dollar was already depreciating in Forex) and, like Volcker’s interest rate flip-flops in the early 1980s (which did not ‘break’ inflation, the recession did that), it’s not clear that the Fed really does anything much, not even affect expectations. Money = neutral.

18. January 2022 at 15:19

https://www.theguardian.com/sport/2022/jan/18/warriors-part-owner-backtracks-after-saying-he-doesnt-care-about-uyghur-abuse

This is simply more proof that economists are wrong. You want free capital flow, and free trade, on the basis that it will increase efficiency, but none of your models account for instability, difference of values, future effects on America’s ability to manufacture (generational brain drain), the growing number of industries that are not “free”, but are now globalist oligopolies with tremendous entry barriers, etc, etc.

When Germans were investing in the United States, they brought with them the same protestant work ethic and values of America’s founders. When the Italians, Jews, Ghanians, Armenians and Irish arrived, they adopted those same values.

But some groups don’t fit in, and never will.There culture is simply too different. The Chinese, for example, STILL, after three to four generations, fail to adopt any of the same values. Indeed, they set themselves up in China town ghetto’s and engage in black market transactions with their mother country. Many hispanics continue to reject “learning english”, and demand that corporations provide them with a “spanish language” option. I’ve done my fair share of traveling in South America and I can assure you that they don’t have an “english option”. If you don’t speak Spanish, you won’t survive long. Middle Easterns are another group that refuse to abide by American values, because American values are in direct violation with Sharia law.

If you let foriegners who share different values buy up your companies and land (the U.S. is the only country in the world that permits foreigners to buy up property without any investment visas), you will soon find that your culture is under attack.

And this isn’t just a problem in the U.S.. It’s a MAJOR problem in Australia, France, UK and elsewhere. There is a clear correlation between Asian investment, and the silencing of speech, the funding of radical political candidates that oppose traditional American values, etc.

In Summary, your globalist game is a death sentence for freedom worldwide.

19. January 2022 at 07:04

re: “In short, the Fed responds to the market”

On the day the market bottomed, I repeated myself 3 times:

That’s B.S.

Bottom’s in.

Mar 23, 2020. 10:34 AM

Link

Margin Call: The Story Of A Historic Week – The Heisenberg

Bottom for stocks, not the economy. It will decouple.

Mar 23, 2020. 10:33 AM

Link

We Likely Saw The Bottom – Michael A. Gayed, CFA

The bottom’s in.

Mar 23, 2020. 10:28 AM

———————–

I bought on the basis of money flows.

19. January 2022 at 07:06

@Postkey

“The fact that the earning assets held by the commercial banks are approximately equal to their demand and time deposits liabilities is often cited to prove that demand and time deposits are actually being invested. It bears reiteration that no investment can take place unless money is turning over. The turnover of money involves the transfer in the ownership of demand-deposits, and this is the exclusive prerogative of the nonbank owners of these deposits.”

19. January 2022 at 15:02

Since closing at its all time high on January 3rd, the S&P 500 is down 5.82%, which my model translates into a decline in the expected NGDP growth path of 0.23%. Over that same period, the 10 year Treasury yield has risen a bit over 0.22%.

I’ve refined my model to the point that this sort of consistency has become routine. Exact Macro, indeed, though there is still much work to be done.

I’m increasingly confident that the traditional macroeconomics is in a relative dark ages, with fundamental misunderstandings about the relationship between savings and investment, GDP growth and liquid asset prices, and what it means for an economy to be in equilibrium.

Many outstanding mysteries in economics, such as the paradox of capital and the equity premium puzzle are naturally explained by the new approach. Future generations will shake their heads at the level of ignorance and confusion that exists today.

19. January 2022 at 15:48

rinat wrote: (quite a bit).

powerful, very powerful commentary.

19. January 2022 at 16:02

I should also add that the 10 year inflation breakeven has fallen 0.20% since January 3rd.

One thing that disturbs me though, is that the more I look at the evidence, the more certain it seems that the mean expected NGDP growth rate is around 4%, which is more consistent with Scott’s view of likely long-run US RGDP growth than my own.

20. January 2022 at 01:22

The ‘argument’ does not go ‘like this’!

20. January 2022 at 06:44

http://www.philipji.com/

20. January 2022 at 13:56

rinat wrote: “If you let foriegners who share different values buy up your companies and land (the U.S. is the only country in the world that permits foreigners to buy up property without any investment visas), you will soon find that your culture is under attack.”

Interesting possibilities for socio-economic warfare against the US. Much worse than Russian Bots fooling (willing) voters.

21. January 2022 at 09:27

Spencer,

“How could that be a problem if the FED controls the money stock?”

They can control the price – not the stock.

http://bilbo.economicoutlook.net/blog/?p=1623

“t is clear that the central bank then is unable to control the volume of money in the system although it can control the price through its monetary policy settings. The money multiplier is a flawed conception of how things work. The monetary base does not drive the money supply. In fact, the reverse is true. So the reserves at any point in time will be determined by the loans that the banks make independent of their reserve positions.

So when you consider this in the light of the current policy debate you have to wonder what half the commentators are on! For example, it makes no sense to say that the credit crunch is because banks have no money to lend and that Quantitative Easing will provide them with “printed money” that they can then lend. Banks will always lend when a credit-worthy customer walks through the door and the terms are to the bank’s favour.”

“One of the hard-core parts of mainstream macroeconomic theory that gets rammed into students early on in their studies, often to their eternal disadvantage, is the concept of the money multiplier. It is a highly damaging concept because it lingers on in the students’ memories forever, or so it seems. It is also not even a slightly accurate depiction of the way banks operate in a modern monetary economy characterised by a fiat currency and a flexible exchange rate. “

21. January 2022 at 11:01

@Kester Pembroke:

It’s a disgustingly biased argument. No time periods are represented. Things have changed a lot over time. These commentators simply want to paint themselves as being “right”.

And there still is a money multiplier. It is represented by the FRB-NY trading desk purchases and sales between counterparties, between the banks and the nonbanks (which is unpublished).

Link: Charles Hugh Smith

https://seekingalpha.com/article/3152196-bank-reserves-and-loans-the-fed-is-pushing-on-a-string

“one in 1960, where the ratio was 10:1, and the other in 2008, where the ratio was 219:1”

The banks began to usurp the FED’s open market power in 1965. Legal reserves ceased to be “binding” in 1995. But banks remained liquidity constrained up until Powell discontinued required reserves in March 2020.

21. January 2022 at 11:21

re: “The monetary base does not drive the money supply.”

That’s an idiotic statement. You cannot derive the outcome from a supposition while ignoring the evidence. Bill Mitchell simply doesn’t trade the markets.

Some people think Feb 27, 2007 started across the ocean. “On Feb. 28, Bernanke told the House Budget Committee he could see no single factor that caused the market’s pullback a day earlier”.

In fact, it was home grown. It was the seventh biggest one-day point drop ever for the Dow. On a percentage basis, the Dow lost about 3.3 percent – its biggest one-day percentage loss since March 2003.

ME -flow5 (2/26/07; 14:34:35MT – usagold.com msg#: 152672)

Suckers Rally. If gold doesn’t fall, then there’s a new paradigm

You can’t run a regression test against the figures. Because the FED covers UP its “ELEPHANT TRACKS”.

21. January 2022 at 13:16

RE: “What about open market operations? These are allegedly how the central bank increases or decreases the money supply.”

Once again, we’re talking two different time periods. Bank reserves are “Manna from Heaven”, they are costless and are showered on the payment’s system.

Between 1942 and Oct 1, 2008, the DFIs remained fully “lent up”, the DFIs minimized their non-earning assets, their excess reserve balances (not a tax but “Manna from Heaven”).

They held no excessive amount of excess legal lending capacity to finance business, consumers, or the Federal Government. They utilized their excess reserves to immediately acquire a piece of the national debt, or other short-term creditor-ship obligations that were eligible for bank investment, whenever there was a paucity of credit worthy borrowers; pending a longer-term, and presumably more profitable disposition of their legal and economic lending capacity.

In contrast to today, bank reserves have been made earning assets based on the remuneration rate on IBDDs. Why should the banks be given a “free lunch”?

21. January 2022 at 14:36

re; “it makes no sense to say that the credit crunch is because banks have no money to lend and that Quantitative Easing will provide them with “printed money” that they can then lend”

That’s as crazy as it gets. A “credit crunch” only applies to the nonbanks since 1933. That’s what I point out, Bill Mitchell doesn’t know a credit from a debit.

The banks weren’t “reserve bound”. The credit creating capacity of the banks is determined by monetary policy. The credit creating capacity of the nonbanks is determined by savers willing to entrust their savings with the nonbanks.

I.e., bank credit is endogenous, nonbank credit is exogenous. A credit crunch originates with a flight-to-safety back to the banks, back to the payment’s system, albeit the funds never left the commercial banking system in the first place. The nonbanks suffered disintermediation in large part because the FDIC increased deposit insurance from $100,000 to unlimited.

Remunerating IBDDs destroyed the nonbanks, where the size of the shadow banks fell by $6.2 trillion – while the banks grew by $3.6 trillion.

It was a gargantuan monetary policy blunder. Most of the nonbanks’ funding was from the money market (short-term liabilities — shorter than one year which fund longer duration assets). And the remuneration rate exceeded all money market rates > 1 year, even up to 2 years in 2011. The remuneration rate directly induced an asset liability mismatch.

21. January 2022 at 14:54

Bill Mitchell: “The important point though is that all transactions at the non-government level balance out – they “net to zero”.

Nothing could be further from the truth. All bank-held savings are lost to both consumption and investment, indeed to any type of payment or expenditure. They are an unrecognized “leakage” in Keynesian National Income accounting.

22. January 2022 at 11:21

SBH please read this paper from Bank of England. Money multiplier is a myth. Please read through the WHOLE paper before replying.

https://www.bankofengland.co.uk/-/media/boe/files/quarterly-bulletin/2014/money-creation-in-the-modern-economy.pdf

“The reality of how money is created today differs from the description found in some economics textbooks:

• Rather than banks receiving deposits when households save and then lending them out, bank lending creates deposits.

• In normal times, the central bank does not fix the amount of money in circulation, nor is central bank money ‘multiplied up’ into more loans and deposits.

”

“While the money multiplier theory can be a useful way of

introducing money and banking in economic textbooks, it is

not an accurate description of how money is created in reality.

Rather than controlling the quantity of reserves, central banks

today typically implement monetary policy by setting the

price of reserves — that is, interest rates.

In reality, neither are reserves a binding constraint on lending,

nor does the central bank fix the amount of reserves that are

available. As with the relationship between deposits and

loans, the relationship between reserves and loans typically

operates in the reverse way to that described in some

economics textbooks. “

23. January 2022 at 08:19

I can’t get by the first few sentences. RE: “In normal times, this is carried out by setting interest rates”

Interest is the price of loan funds. The price of money is the reciprocal of the price level.

Interest rates are still used as the FED’s monetary transmission mechanism. Open market operations are being supplanted by the FED’s new funding facilities [sic].

JANUARY 11, 2022 — “How the Fed’s Overnight Reverse Repo Facility Works”

https://libertystreeteconomics.newyorkfed.org/2022/01/how-the-feds-overnight-reverse-repo-facility-works/

JANUARY 13, 2022 — “The Fed’s Latest Tool: A Standing Repo Facility”

https://libertystreeteconomics.newyorkfed.org/2022/01/the-feds-latest-tool-a-standing-repo-facility/

How the Federal Reserve’s Monetary Policy Implementation Framework Has Evolved

https://libertystreeteconomics.newyorkfed.org/2022/01/how-the-feds-overnight-reverse-repo-facility-works/

It’s a blatant error. Contrary to the accountants at the Board of Governors of the Federal Reserve System (in contradiction to the presupposed GAAP), the sale of securities by the FRB-NY’s trading desk decreases both the assets and liabilities of the Reserve Bank. It is not just an “exchange in liabilities”.

Otherwise how would the funding facilities even work?

23. January 2022 at 08:22

I.e., the FED is not “behind the curve”

O/N RRPs are an unrecognized subtraction from the broad money stock:

Apr ,,,,, 0069

May ,,,,, 0290

Jun ,,,,, 0673

Jul ,,,,, 0848

Aug ,,,,, 1053

Sep ,,,,, 1211

Oct ,,,,, 1425

Nov ,,,,, 1445

Dec ,,,,, 1600

Surreptitious tightening.

23. January 2022 at 08:43

Yes, I agree with a lot of what the article says. RE: “typically implement monetary policy by setting the price of reserves — that is, interest rates.”

and: “In no way does the aggregate quantity of reserves directly constrain the amount of bank lending or deposit creation.”

There’s something that is missing here. If reserves are removed, then bank deposits are removed.

24. January 2022 at 07:53

The authors that wrote that piece had an IQ of about 3.