The Fed cannot allow another lost decade

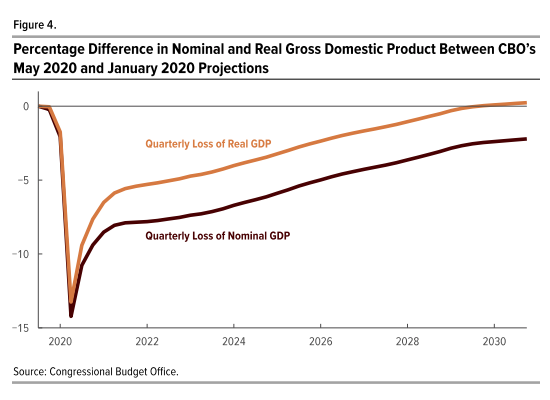

The CBO has a new report where they update their forecasts for real and nominal GDP growth during the 2020s:

Of course this is just one projection, but it’s in line with what I see elsewhere, both among forecasters and in the financial markets. The Fed should not allow this to happen.

You might argue that there’s nothing the Fed can do to prevent a big drop in RGDP. I agree, but the decline in NGDP, especially in the out years, is totally unacceptable. And this will make the fall in RGDP even worse than it needs to be.

It looks to me like they’ve lowered their forecast for 2030 prices by roughly 2.5%. There’s no reason why the Fed should allow the current pandemic to reduce inflation by 0.25%/year for the next 10 years. Yes, almost all of that shortfall is expected to occur in 2020 and 2021, but in that case the Fed needs to make up the shortfall with above 2% inflation in future years. The CBO does not expect this, nor do private forecasters (AFAIK), nor do the TIPS markets, nor do I.

I was appalled when in 2008 and 2009 the economics profession as a whole seemed complacent about Fed policy. It was obvious that NGDP would remained depressed for many years, and very few people were calling for a much more expansionary Fed policy. That’s why I got into blogging.

Now it’s widely expected that the Fed will again allow a lost decade, and I see no sense of urgency in the Fed, in the economics profession, in the government, in the media, or anywhere else to do anything about it. Where are the calls for level targeting?

Where’s the outrage?

Tags:

3. June 2020 at 15:49

Excellent blogging.

People confuse low interest rates with central bank aggressiveness. On almost any day one can read that the Bank of Japan has an ultra-easy monetary policy.

Central bankers themselves say the ball is in the Fiscal Court.

It is heretical to say so, but central banking is too important to be left to central bankers.

See 2009 and present day… would President Trump make a better central banker than Powell & Co.?

Curiously, yes.

3. June 2020 at 16:28

From where I’m sitting (a professional trader/investor), the Fed’s current actions are propping up uneconomical companies. New funds seem to make their way into the markets via bored retail traders who recently became unemployed or started working from home, and of course the bond markets where the Fed is a direct buyer of (high-yield) debt.

Robinhood provides good data on retail traders. They often buy very bad companies built on hype, stories, and top-line growth with widening losses. “Buy the dip” is so common, retail ends up buying companies like HTZ (https://robintrack.net/symbol/HTZ) after they declare bankruptcy! HTZ was probably a zero even before covid hit.

As a result of this influx of retail money, many nigh-worthless companies are able to do stock offerings at elevated prices.

Similarly, the debt buying seems to be propping up companies that took on irresponsible levels of debt during the post-GFC boom.

It all feels eerily Japanese. Or Cantillon, as the means by which the Fed’s newly printed dollars enter the economy seem to cause large distortions.

In the last thread on NGDP targeting, Scott said:

‘Grant, Under current policy, financial markets are impacted by real and monetary shocks. Under NGDP targeting it’s only real shocks. Hence financial markets are more stable under NGDP targeting, more reflective of “fundamentals”.’

As someone who focuses on smaller companies and hates having to constantly watch monetary policy, this sounds wonderful. But I wonder how the Fed could inject enough liquidity to keep NGDP flat without causing large distortions?

Thanks!

3. June 2020 at 17:16

Grant, Under NGDP targeting interest rates would probably be positive–at least most of the time (maybe not at the moment). This would lead to a smaller Fed balance sheets and fewer of the “Cantillon effects” distortions that we both worry about.

That may seem counterintuitive, but it’s actually the lowest inflation countries in the world (Japan, Switzerland, etc.) that have the largest central bank balance sheets, the biggest Cantillon effects.

3. June 2020 at 18:01

its in the mind of the sophists, where it well belongs.

3. June 2020 at 18:14

Is it too cynical a take to say that Janet Yellen was trying to get more people to care about monetary policy by talking about an unemployment rate among blacks that was too high? I would assume that there is another chart or data set showing predicted employment to population ratio for the next decade, and that it is pretty low throughout the decade, and even worse for blacks.

3. June 2020 at 18:29

P Burgos—

Nations with “labor shortages” are happy countries.

Also, happy people have affordable housing.

The Fed, until recently, regarded any unemployment rate below 5% as an anathema. The Phillips Curve, NAIRU and other rubbish.

As of last year the SF Fed was still positing a “natural” rate of unemployment of 4.65%.

The US kept open borders to laborers from a Third World nation, but allowed state and local governments to criminalize new housing production.

Yet most orthodox monetary-policy types, and central bankers, have spent the last four decades jibber-jabbering and fear-mongering about inflation (not Scott Sumner).

Really–we should want central bank independence? Why?

3. June 2020 at 20:13

@B Cole

I know that the structure of the Fed is a bit different than that of the Supreme Court, but my impression is that both institutions are dominated by appointees of POTUS. That is to say, the Fed isn’t functionally much more independent of politicians than the Supreme Court, and the Supreme Court is quite partisan, with justices working to curry favor and prove their bona fides to the political parties over decades. I don’t see why the Fed should be any different, but that is a discretionary decision made by multiple presidents. Were I a first term president, I would try to pull every possible lever to goose employment and economic growth, consistent with not pissing off important constituencies of the party. For reasons I don’t understand, most presidents don’t seem to do this, though with Trump I think that it is mostly his laziness and incompetence to blame, not his theory of US politics.

3. June 2020 at 21:36

https://www.stlouisfed.org/on-the-economy/2020/may/achieve-shaped-recovery-covid19-pandemic

Wen of St Louis Fed says go big fiscal….

Burgos—

On the one hand what you say is true. On the other hand presidents Bush jr., Obama and now Trump have been undermined by an overly tight Federal Reserve policy. Only Trump seems aware of the problem.

What does it say when the Federal Reserve has 1,500 economists on staff, but Trump is a better central banker than the Fed?

3. June 2020 at 23:19

OT but…

“HSBC and StanChart publicly back China’s Hong Kong security law

UK lenders follow similar moves by Swire and Jardine Matheson”–FT

The question is raised: Does globalism solidify repressive regimes into place?

Certainly, the multinationals are backing Beijing….

4. June 2020 at 01:08

@ Benjamin Cole,

HSBC, Standard Chartered, Swire, and Jardine Matheson are not really ‘multinationals.’ They all were founded in Asia and still make the vast majority of their profits there, especially in Hong Kong and China. Some observers, including one former chairman of HSBC I’ve spoken to, think it was a mistake for them to have ever become incorporated in Britain in the first place.

I’d have been shocked if they pushed back against the new security law, to be honest, as they’d be out of business within the year.

4. June 2020 at 06:10

Scott,

I hope you’re prepared to go full Howard Beale on this for the next ten years. We know who some of your opponents will be:

-Republicans preaching deficit reduction and low inflation

-Democrats doing the same

-Strong dollar advocates

-Anti-Fed cranks in general

And does more immigration and international trade help? That seemed to have had a net positive effect on this country from 1783 through 2016.

4. June 2020 at 07:06

How exactly was the last decade lost? There has not been a recession, unemployment figures have never been lower, GDP has increased after all by 50% and the S&P 500 has tripled. If every decade were to happen like this, would it really be so bad? Or do you mean 2000-2009?

4. June 2020 at 08:54

Scott,

‘This would lead to a smaller Fed balance sheets and fewer of the “Cantillon effects” distortions that we both worry about.’

Do you have any suggestions on where to read more about this? Thank you.

4. June 2020 at 08:59

Christian, The decade ended well, but growth was far too slow for most of the decade.

BTW, more evidence of CCP cover-ups, this time in Spain?

https://www.ft.com/content/77eb7a13-cd26-41dd-9642-616708b43673

4. June 2020 at 09:10

I assume by “lost decade” Scott means opportunity cost and what was left on the table specifically beginning in 2008 (technically before the lost decade). The “one time” drop creates a permanent drop over the long run. He is fearing this will happen again now, with Covid playing the part of Housing crisis as the Fed refuses to go full NGDP

I am trying to understand how to intepret the chart to make sure it is not worse than it seems. For example, if RGDP is what it would have been before Covid by 2030, do we still lose all the RGDP we would have had prior to 2030? I am guessing the answer in “no”.

For example, If the S&P 500 had dropped 15%, then grew to where it would have been if had not dropped 15%, the investor is no worse off. Is that what this Chart is telling us about NGDP and RGDP?

Or is there a negative compounding effect due to the years that are below where NGDP/RGDP would have been? The latter is far worse obviously. I do not know how to interpret the Chart.

I thought that Powell had lost his bias against fear of out of control inflation. I thought his official position on inflation was 2%—-but no one believes him apparently

4. June 2020 at 11:26

scott –

please paint the narratives of what the world looks likes under these 2 different scenarios. jobs? wealth? wages? taxes? consumption? investment? health? mortality? what is it going to mean to the average worker?

4. June 2020 at 13:11

Scott,

Thank you for your answer about the lost decade, it’s much appreciated.

It’s also thoughtful of you to talk about Spain and the CCP, so I can answer this and you can’t blame me for being off-topic. In German we say: “Thank you for opening up that keg again.”

The FT wrote:

The Spanish government is breaking their practice, that’s for sure. They shouldn’t do that.

The CCP has to be praised briefly at this point, they have tended to become stricter and stricter, the Spanish government is now becoming looser and looser, which one might maybe understand a little bit, because they were very strict from the beginning, perhaps too strict, and now they want to become looser so that they get better results earlier in order to open up society earlier.

I think their lockdown is really strict, too strict in my opinion. But now simply changing the practice is trickery, that’s true, and it’s also a kind of cover-up, a pretty transparent cover-up but still.

But there is more:

That’s what I’m talking about, and here Spain has great transparency and CCP China, to my knowledge, has close to zero transparency.

Excess mortality is actually being followed quite closely, and funnily enough by the media you value most: The Economist and The Financial Times. But also the NYT and others.

https://ourworldindata.org/excess-mortality-covid

But none of these databases seem to have data on CCP China, we have almost the whole world, even Russia (!), but where is CCP China? Maybe you can help us out here Scott?? Where is the data?

I googled for quite some time, and found only one article from The Telegraph on the subject, and the article is so funny that I’d love to throw it at you some other day — when you are brave (and self-destructive) enough to open that keg once again.

4. June 2020 at 14:28

Won’t real GDP take a big hit this year no matter what happens in the second half?

To keep NGDP even slightly on track, wouldn’t you need close to double-digit inflation? Not to put too fine a point on it, but clearly even the 2% inflation target (likely missed) wouldn’t be nearly enough.

I can think of ‘concrete steps’ leading there, but I always found the ‘top-down’ argument from there not being enough spending to pay wages (and debts) the most convincing.

After reading your blog(s) for close to ten years I wonder— doesn’t depression follow with ‘arithmetic certainty’?

What am I missing?

4. June 2020 at 14:35

Grant, I’ve done some posts on Cantillon effects—some are at Econlog.

Michael, You said:

“I am trying to understand how to intepret the chart”

Did you read the report? It explains the graph.

kp, I’ve done that many, many times in previous posts.

Christian, LOL, Exactly the sort of double standard I expect from you. Spain reports numbers that make absolutely no sense, and you defend them. When it’s China . . .

4. June 2020 at 16:34

Scott,

Don’t worry. President Trump will get re-elected and will jawbone Powell into loosening up. Real estate developers are instinctively easy money advocates.

4. June 2020 at 18:16

@dtoh:

The problem is, there’s no way Trump understands that low rates might equal tight money. He wanted zero rates, here they are. To him, he already did the jawboning.

4. June 2020 at 18:59

Tacticus:

You are correct about the roots of HSBC.

But at bottom you agree with my observation: The multinationals are in the business if currying favor with the CCP. Once invested, multinationals have a stake in regime stability, not human rights.

The National Basketball Association, until recently, posited that freedom of speech was a core principle. “Shut up and dribble” was explicitly eschewed.

Now the NBA will not discuss Hong Kong or the CCP, or the 2 million Muslims in CCP concentration camps.

Gee, do you think we will see another Apple “1984” ad, but this time aimed at the CCP?

Money flows into the coffers of the CCP, strengthening the party. When the Panama Papers came out it sure looked like a lot of money flowed straight in the pockets of high CCP officials, including Xi Jinping.

It is not the result some academics foresaw, when they rhapsodized about globalism.

4. June 2020 at 19:21

@msgkings

I don’t think business people are constrained in their thinking by the contortionist models created by monetary economists. Their thinking is much more primitive, i.e. the banking system needs to extend more credit (i.e. buy more assets.)

4. June 2020 at 21:22

How does one properly understand the importance of nGDP level targeting? I must admit as a lay person I don’t entirely get it, other than it presumably helps firms make better plans for the future because it’s a predictable macro environment or something. It seems like more could be done on the marketing side to help communicate it, especially the magnitudes involved. Why might some hypothetical firm make better decisions under a policy of nGDP targeting? I was on the FED-is-an-evil-wealth-transfer-machine side of things, but now I’m realizing I was quite wrong in my thinking. There are many people in the software/cripto space getting into economics who are receptive to good arguments, but often can’t quite digest it. I’ll have to do some more reading.

5. June 2020 at 01:21

Interesting question: In terms of scale, the US fiscal-monetary response to the 2020 recession has been larger, and perhaps more-immediate, than the 2008 response.

If US fiscal and monetary authorities had reacted on 2008 as they did in 2020…would the US have obtained better results. I think so, but a big sloppy topic…

5. June 2020 at 02:02

“Of course this is just one projection, but it’s in line with what I see elsewhere, both among forecasters and in the financial markets. The Fed should not allow this to happen.”

The Fed may be able to ‘manage’ demand, but is supply that is the problem?

” Planet Earth, though, does not work that way. To have what humans call wealth, you have to have resources and you have to have the means to extract, transport and utilise these resources in order to create the goods and services that are bought and sold in the global marketplace. But before you can do any of that, you have to have energy. And while the new currency being borrowed into existence in the financialised economy was a claim on energy, it was not energy itself. . . .

With oil extraction already past peak, any attempt to return the global economy to its pre-pandemic level via the fabled “V-shaped recovery” is likely to generate oil shortages which could see prices temporarily rise above a depression-inducing $100 per barrel. No amount of central bank financial alchemy is going to add oil to depleted fields or remove the gunk from shutdown wells, pipelines and refineries. And so a black new deal can only occur by diverting a large part of the energy previously used in the wider economy to the extraction of the last of the accessible fossil fuels – in its way, essentially the same imperialism as the green new deal, in which a handful of people in a handful of wealthy states enjoy one last energy-consuming blowout before industrial civilisation crumbles to dust; except in this version we incinerate what remains of planet Earth through runaway global warming.”

https://consciousnessofsheep.co.uk/2020/06/04/a-brown-new-deal/

5. June 2020 at 02:04

. . . but it is supply . . .

5. June 2020 at 04:29

Benjamin Cole,

Erm, no, I’m not agreeing with you. I am saying that all four of the companies you mentioned are more like Chinese companies than multinationals, and therefore one should not draw conclusions from them about whether or not globalism solidifies repressive regimes.

5. June 2020 at 06:52

Scott—-I obviously did read it, which is why I asked the question. The end point difference is lower than the sum of the annual interim period differences ——-which is higher than the unexplained “total difference” given in the statement—-such “total difference” being closer to the the end point difference.

That was the question I was asking—-how in general are these calculated. I assume you also have no idea how those numbers are actually calculated. A simple “I don’t know” would have been sufficient.

I am sure there are all sorts of plugs and degrees of freedom manipulation——just thought there might have been a simpler answer.

But I truly appreciate your response.

5. June 2020 at 07:46

Scott,

Arnold Kling posted two articles on Econlog today, one describing Aggregate Supply and another on Aggregate Demand. I’d be interested in your thoughts on his articles, in particular what you disagree with.

5. June 2020 at 09:09

“A barrel of conventional crude oil contains the equivalent of roughly 4.5 years of continuous human labour; or around 11 years at 35 hours per week, 48 weeks of the year. But the capitalist doesn’t pay for the value of the fuel, merely the cost of extracting it. For a mere £49 (at pre-pandemic prices) the capitalist purchases £330,000 worth of work (at the current UK median wage). It is the exploitation of fossil fuels rather than the exploitation of labour which generates the vast majority of the surplus value in an industrial economy. . . .

As Nicole Foss once put it – if conventional oil was like drinking draught beer from a glass, fracking was the equivalent of sucking the spilled dregs from the carpet.”

https://consciousnessofsheep.co.uk/2020/05/26/two-money-tricks/?fbclid=IwAR1rOz0jexO2dIIldSlseh-8-EqES4oYZcBTvHMtW-JyBgMHB6xgfOOsbBI

5. June 2020 at 10:15

dtoh, You said:

“Don’t worry. President Trump will get re-elected and will jawbone Powell into loosening up.”

And it will be equally successful to his jawboning in 2017-19.

“Their thinking is much more primitive, i.e. the banking system needs to extend more credit (i.e. buy more assets.)”

That’s the problem; they confuse credit policy with monetary policy.

Cartesian, I’ll have a book on this next year, but the basic idea is that stable NGDP avoids shocks that disrupt two key markets—labor and credit. NGDP shocks screw up the labor market and credit market, where contracts are negotiated in nominal terms. That’s why we need stable money.

Michael, I thought you were asking what the numbers represent, not the model used to calculate them. The graph shows deviation from the previous forecast.

5. June 2020 at 11:36

@Ben Cole: Agreed, the 2020 Fed response was swifter and larger. That’s because we learned a lot from 2008, and to Powell’s credit he didn’t mess around, and went full bazooka. The results seem to show he did a great job.

5. June 2020 at 11:51

This is what Fed Chair Jerome Powell says:

“it interferes with the

03:19 process of credit intermediation that

03:22 banks undergo they take in deposits they

03:24 lend it out “ ?

This what the Bank of England says:

“Saving does not by itself increase the deposits or ‘funds available’ for banks to lend. Indeed, viewing banks simply as intermediaries ignores the fact that, in reality in the modern economy, commercial banks are the creators of deposit money. This article explains how, rather than banks lending out deposits that are placed with them, the act of lending creates deposits — the reverse of the sequence typically described in textbooks.”

http://www.bankofengland.co.uk/publications/Documents/quarterlybulletin/2014/qb14q102.pdf

5. June 2020 at 14:01

Scott, LOL, Your point wouldn’t even make sense if it were true. So you want me to defend the CCP when their numbers don’t make sense, just to make it even? LOL, what a great point.

Not to mention that your point is not true at all, I didn’t write what you want to misread. Same goes for the FT article, you didn’t get their subtle points either. Is this intentional malicious misreading or just a lack of reading comprehension? When it comes to these issues, you always get crazy, you are no longer able to make neutral judgments.

And when do we get the excess mortality from CCP China? I bet it’s coming any day now.

@Benjamin Cole

Good observations about the Fed, it is reacting better than in 2008.

I also think your observations on Hong Kong and CCP China are convincing. But it’s not just the multinationals. It’s generally a Western problem. In Europe there were certainly several thousand people protesting for George Floyd, which is nice, but also pointless, the US democracy can solve its problems alone, they certainly don’t need any history lessons from Europe.

Have you seen any of these hypocrites protesting for Hong Kong? Is the freedom of millions of people in Hong Kong worth nothing? Not even the European politicians have expressed any relevant criticism. You can’t suck up any more than they do. I don’t want to hear any more moral lectures from those mendacious bastards ever again.

5. June 2020 at 15:31

Christian List—

Good points. A couple of generations ago the multinationals had no influence in China, as they had no business in China.

Today, if multinationals acted in concert, they could have a great deal of influence. But instead, they have chosen to enable the CCP.

The purpose of US foreign policy is to provide a global card service for multinationals. The erratic Donald Trump is an occasional thorn in the side of this relationship.

5. June 2020 at 16:28

Scott,

> That’s the problem; they confuse credit policy with monetary policy.

No that’s the solution. They believe that the Fed should extend credit to the economy by issuing money in exchange for financial assets.

5. June 2020 at 23:16

“Some Empirical Evidence {?}

The framework can account for the anomalies identified. In addition, there is a growing body of empirical evidence in its support. Examples will be reviewed briefly.

Credit and growth Werner (1992, 1997, 2005, 2011b), using Japanese data, shows that credit for GDP transactions explains nominal GDP well over several decades, while alternative explanatory variables (including interest rates and money supply) are eliminated in a reduction from a general to the parsimonious specific model.

https://eprints.soton.ac.uk/339271/1/Werner_IRFA_QTC_2012.pdf

6. June 2020 at 19:10

Christian, I want you to admit that when China suddenly adjusted its Covid death data it was no different from what lots of other countries do.

doth, Money isn’t credit.

7. June 2020 at 03:47

Scott,

Correct. Money is not credit. But generally, it’s created in an exchange for credit instruments.