The end of retail?

During the early stages of the recession there were all sorts of “structural” theories of unemployment. One popular theory claimed that housing had been overbuilt, and hence the job losses in home-building were due to “reallocation” of labor, not falling AD. That idea never made much sense as an overall theory of unemployment, as aggregate employment held up well during the great housing crash of January 2006 to April 2008.

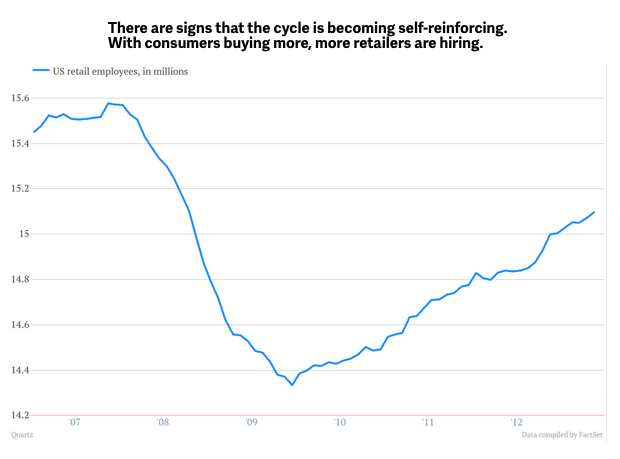

Another theory pointed to the “end of retail,” the idea that retailers like Border’s and Circuit City were becoming obsolete dinosaurs in the age of Amazon. It is possible that retailing will gradually decline over time, but we now know that the huge drop in retailing jobs during 2007-09 had nothing to do with the end of retailing:

A loss of 1.2 million retailing jobs during 2007-09. And it was mostly due to falling AD.

Not much blogging for the next few weeks.

Tags:

6. July 2013 at 08:56

Housing prices where I live are already back to near 2006 levels. I am ever more convinced that Andy Harless was right:

http://blog.andyharless.com/2010/08/what-housing-bubble.html

6. July 2013 at 09:30

The ‘end of retail’ has been predicted before, as Stan Liebowitz documented in 2002;

http://www.amazon.com/Rethinking-Network-Economy-Digital-Marketplace/dp/0814406491

In the chapter, ‘The (non) Ubiquity of E-Tailing’, there’s a blow by blow description of why bricks and mortar retail won’t ever go away.

6. July 2013 at 16:11

Chargercarl, Excellent Harless post.

Thanks Patrick.

6. July 2013 at 16:50

[…] See full story on themoneyillusion.com […]

6. July 2013 at 18:46

Huge fat guy sees gorgeous woman, wants to ask her out on a date. Shabbily attired, he goes to tie store and buys a new tie.

Then asks the gorgeous woman out on date. She says no.

“See, the tie is no good,” he says, returning it to the tie store.

See, structural unemployment is the problem. Not the lack of aggregate demand.

7. July 2013 at 06:33

Not sure if this is the place for it. But now that the Market Monetarists have started to have sway over the likes of Larry Kudlow, I was wondering if any of the blogging Market Monetarists might have replied to this attempted take down of Market Monetarism in Forbes. I don’t know enough about Market Monetarism to know where this guy is wrong.

http://www.forbes.com/sites/johntamny/2013/03/10/the-comical-central-planning-fantasy-that-is-nominal-gdp-targeting/?utm_source=customfollowed&utm_medium=rss&utm_campaign=20130310

7. July 2013 at 06:59

Casey Mulligan details the part-time jobs machinee that is Obamacare;

http://economix.blogs.nytimes.com/2013/07/03/the-new-economics-of-part-time-employment/#more-165204same

‘By taking a part-time position, the employee can have comprehensive health insurance coverage and make almost the money as he would in a full-time position. Thus the two traditional deterrents to part-time employment are disappearing. In effect, the new subsidies totaling almost $16,000 offset, from the point of view of employers and their employees, the loss of production that occurs from working 30 hours a week rather than 40.

‘None of the above relates to the employer penalties associated with the new law, because the employers covered by my example avoid the penalty by continuing to offer comprehensive insurance to full-time employees. Those penalties create yet another set of reasons that part-time employment will become more common next year.’

7. July 2013 at 09:06

– Eliezer Yudkowsky on Facebook.

7. July 2013 at 12:44

Non-structural, AD-related explanations never made much sense as reasons for why unemployment changes tend to be so different across various industries:

http://research.stlouisfed.org/fredgraph.png?g=kn5

If aggregate spending is the main driver for recessions, we should not keep seeing this pattern where the most capital intensive, most interest rate sensitive industries (such as the construction sector) tend to suffer much more than the least capital intensive, least interest rate sensitive industries (such as the service sector).

————–

“A loss of 1.2 million retailing jobs during 2007-09. And it was mostly due to falling AD.”

No, the falling AD is mostly due to the loss of jobs. Wages precede AD, not the other way around. Wages are paid first, and then those who are paid wages go out and spend money on that which AD tracks. A good rule of thumb is that if AD falls, then we should inquire as to why wages fell.

http://research.stlouisfed.org/fredgraph.png?g=kne

Wages peaked before NGDP peaked. In other words, wages started to fall before NGDP started to fall.

If falling NGDP causes falling wages, we should have seen the reverse, or at least an overlap.

7. July 2013 at 12:50

Benjamin Cole:

Huge fat guy sees gorgeous woman, wants to ask her out on a date. Shabbily attired, he goes to tie store and buys a new tie.

Then asks the gorgeous woman out on date. She says no.

“See, the tie is no good,” he says, returning it to the tie store.

See, aggregate demand is the problem. Not structural unemployment.

———–

If you’re going to use (bad) analogies, at least try to make them in such a way that the conclusion follows from the premises, rather than being completely arbitrary.

Actually, nevermind. Since your belief on this score is arbitrary, it’s quite a fitting analogy.

7. July 2013 at 16:07

Before the Great Moderation, there was a lot of commentary on how high levels of unemployment would be a permanent condition which major social restructuring was required to deal with. Mistaking the cyclical for the structural is a recurring error.

7. July 2013 at 19:14

Major Freedom/Geoff,

still using that crappy chart? (I know you’re MF, he used the exact same chart) And your argument is wrong. There is always going to be differences in the degree to which spending fell across several sectors. It doesn’t mean anything in particular. Like Keynes in the second Keynes vs Hayek rap video, “you’re jumping for joy over one data point” . Besides, Housing isn’t a capital goods industry, Its consumer durables.

Actually, many goods can be dual-use depending on subjective preferences of people, so,….. never mind. Just another example of Austrian conclusions not following from austrian premises. Where does that leave ABCT, I wonder?

Benjamin Cole, that was funny. it figures that a humorless Randroid and Rothbard worshipper like Geoff, wouldn’t get it

7. July 2013 at 19:17

And wages are part of NGDI, which is just a more accurate picture of ngdp, so you’re totally clueless yet again Geoff.

7. July 2013 at 19:45

Lorenzo,

You’re absolutely right. And stupid ignorant people keep making the same mistake, over and over and over again

7. July 2013 at 23:54

LakeErieLiberal.

The excess of superlatives in the Forbes piece, which is more self-indulgent polemic than serious analysis, is not an encouraging indicator. And you can “prove” anything if you can just make stuff up.

Monetarism gained traction because of existing high unemployment and high inflation. Quantity monetarism did not prove enduring, but the notion that central banks could control inflation certainly did. Alas, that required gaining credibility, and that proved to be a painful process–hence central bankers current terror of losing that hard-won credibility.

As for calling targeting NGDP “central planning”, that is both an abuse of the language and massively wrong-headed, since managing such basic expectations both provide a much more stable framework for private agents to make their plans and undermines calls for more government intervention.

Gold was not a stable value measure, it was merely a shared one, it being vulnerable to, for example, the Bank of France driving up its price so driving down the gold zone price level. (How anyone can look at the contemporary gold market and say it is a stable value measure is beyond me.) Even in its 1873-1914 apotheosis, the apparent long-term stability incorporated periods of sustained deflation (1873-1896) and inflation (1896-1914). It was stable compared to the hyperinflation collapses that recurringly afflicted paper monies, but our monetary experience is now much richer than those stark choices.

He also does not understand that it is income expectations which need to be revived, not “inflation”. The Great Depression involved great confidence in the value of money (it massively appreciated in value), it was income expectations which collapsed. The Great Recession similarly saw confidence in the value of money remain strong, it was income expectations which collapsed (though not as badly as in the 1930s). Australia avoided the Great Recession because income expectations did not collapse.

The notion that market monetarism seeks to devalue income streams is showing how much he does not understand the argument. It wants to revive them. Income is price times quantity, so demand has to revive if incomes are going to revive.

He is that weird beast, a “free marketer” who does not take market information seriously. Markets clearly expect continuing low inflation and rise on any evidence that central banks are going to let Py (i.e. NGDP) increase. Despite hysteria in certain quarters about QE. David Beckworth has a nice post on the US v Eurozone QE “natural experiment”.

http://macromarketmusings.blogspot.com.au/2013/06/what-great-natural-experiment-reveals.html

The problem was the collapse of NGDP due to a collapse in income expectations. Until that is fixed, performance will continue to be below par.

8. July 2013 at 03:14

“And your argument is wrong. There is always going to be differences in the degree to which spending fell across several sectors. It doesn’t mean anything in particular.”

This position you have vis a vis the date is a direct consequence of a lacking in theory that is otherwise necessary to be able to understand the data.

There is a huge difference between “differences in the degree of problems between sectors”, which would seem to suggest a random distribution, and “differences according to temporal lives, capital intensiveness, and interest rate sensitivity”, which would suggest a non-random distribution.

If you go back to all the recessions throughout history, a similar pattern emerges as to which particular sectors suffer the most, and which suffer the least. This is not random.

“Like Keynes in the second Keynes vs Hayek rap video, “you’re jumping for joy over one data point”.”

It’s not just one data point.

“Besides, Housing isn’t a capital goods industry, Its consumer durables.”

According to Austrian theory, capital goods and durable consumer goods “react” similarly to artificially low interest rates.

….

Is that it? What a weak rebuttal.

8. July 2013 at 03:18

Edward:

“And wages are part of NGDI, which is just a more accurate picture of ngdp, so you’re totally clueless yet again Geoff.”

I see you’re confused as to how to PARSE information from statistical figures.

If you want to try to parrot Dr. Sumner and argue that NGDI is “more accurate” than NGDP, then it makes no difference to my argument that wages precede spending on goods and services, and hence precede NGDP.

The actual argument Dr. Sumner is making is that NGDI is a closer measurement of NGDP than the official NGDP statistic. Just because he argues that NGDI is closer, it does not mean you are entitled to argue that since wages are a part of NGDI, that wages are a part of NGDP as well.

Edward, I don’t know what your problem is, but every time you post something in response to me, it’s filled with errors and attitude. I suspect it has something to do with the lack of enthusiasm you have in your own theory.

8. July 2013 at 03:41

That graph is entirely driven by changes in the working age population. Adjusted for population, retail employment has been in secular decline since the dotcom days. It contracts in recessions, but stays relatively flat (but still declining somewhat) during the boom.

8. July 2013 at 04:03

[…] The end of retail? – Money Illusion Five Takeaways From the Jobs Report – WSJ Jobless to Take a Big Hit […]

8. July 2013 at 06:52

We need Scott to weigh in on this: http://marginalrevolution.com/marginalrevolution/2013/07/immaculate-conception-theories-of-real-interest-rate-changes.html

8. July 2013 at 08:28

Geoff,

Yes it does. It means exactly that. Aggregate income equals aggregate spending, so total wages is equal to corporate spending on laborso wages don’t precede ngdp at all.

Consumer durables equals capital goods in terms of interest rate sensitivity? Nice going. Keep adding epicycles to classical ABCT and someday it will probably make sense.

And my tone is a example of my frustration at the enormous, COMPLETELY UNECESSARY suffering that comes from the deliberate, willfull ignorance of structuralists like yourself, hard money freaks like John Taylor and Allan Meltzer. This is not a game. Economic beliefs and their resultant policies have consequences in the real world

8. July 2013 at 11:19

Geoff,

You said: “If aggregate spending is the main driver for recessions, we should not keep seeing this pattern where the most capital intensive, most interest rate sensitive industries (such as the construction sector) tend to suffer much more than the least capital intensive, least interest rate sensitive industries (such as the service sector).”

I’ve seen arguments that recessions are changing as we move toward a more service-oriented economy because of inventory differences between goods providers and services providers. It makes sense that, even if aggregate spending is the main driver for recessions, certain industries will continue to be hit harder during recessions. Service-providing firms will not have inventory to draw down when demand for their services falls, so they will not slow production by as much. Yet, they will also not speed up production as quickly when tomorrow’s expected demand for their services rises because they don’t have an inventory to build up.

My point is simply that different types of firms will, time and time again, react differently to demand shortfalls.

8. July 2013 at 11:22

Edward,

You said: “This is not a game. Economic beliefs and their resultant policies have consequences in the real world”

Unless you are secretly an important economic policymaker, your opinion and Geoff’s opinion don’t matter and will not have consequences in the real world. Although, it is possible that Geoff is secretly Ron Paul and we should exert as much effort as possible to persuade him to change his views.

8. July 2013 at 11:44

[…] a recent post – The End of Retail – Scott Sumner […]

8. July 2013 at 11:49

Excuses to allow a Fed induced cyclical downturn to become the ‘new normal’:

http://thefaintofheart.wordpress.com/2013/07/08/excuses-galore/

8. July 2013 at 13:21

LakeErie, Tamny is the guy who claimed inflation targeting means the Fed is trying to stabilize the price of every single good. Enough said?

Patrick, It will be interesting to watch all the unintended side effects of Obamacare.

Fredrik, Even if true, the drop in 2009 would have been almost entirely cyclical.

Saturos, Tyler really needs to include a discussion of NGDP growth expectations in that post.

I’d add that no one should be surprised by any of this, long rates have always reacted erratically to monetary announcements.

8. July 2013 at 18:44

Query: Okay, we keep hearing. “Well, retail sales are too strong given the employment figs.”

Also, “banks have huge amounts of inert excess reserves.”

That means deposits.

So maybe people are spending the money they have in the bank accounts. They have waited, the economy looks a little better now.

“Time to take the wife out to a new dinner for her birthday, some new clothes, buy a new car..we waited for along, time to start living again.”

So…maybe QE is working? Time to pour it on, go to heavier QE?

8. July 2013 at 18:53

Scott,

You should really check out this John Taylor post:

http://economicsone.com/2013/07/03/toward-a-rule-for-all-seasons/

He says “This rule would allow for the possibility that bank rate would be extra low in periods following a stint at the zero lower bound, but by a measurable rules-based amount that depends in a consistent way on the degree to which the desired bank rate has fallen below zero bound.”

Wow, that sounds a lot like…

9. July 2013 at 16:00

Edward:

“Yes it does. It means exactly that. Aggregate income equals aggregate spending, so total wages is equal to corporate spending on laborso wages don’t precede ngdp at all.”

That’s not what NGDP means. The context is NGDP. Aggregate income and NGDP are different animals.

NGDP is the total spending on “final” goods and services, which excludes (of course) wages (and stock/bond/derivative spending).

“Consumer durables equals capital goods in terms of interest rate sensitivity? Nice going. Keep adding epicycles to classical ABCT and someday it will probably make sense.”

If you had bothered to read that which you choose to criticize, you would have known that this has been a core component of ABCT for quite a long time.

Please don’t mistake your not knowing X, with X not existing. You’re not an ostrich.

“And my tone is a example of my frustration at the enormous, COMPLETELY UNECESSARY suffering that comes from the deliberate, willfull ignorance of structuralists like yourself, hard money freaks like John Taylor and Allan Meltzer.”

Except it is precisely you who is willfully ignorant, as well as socially dangerous to whatever extent your destructive advocacies have any impact on others who are then misled.

The suffering we are facing now is due to the embarrassingly wrong worldviews that have been attempted at being put into effect over many years, where we are all now facing the consequences of it. While you and your ilk can’t see more than 2 inches in front of your faces, blaming what happened last week for all the problems faced the next week, actual economists, rather than political strategists and pundits, have made such a convincing case for a more long term description of the causes, that there is no excuse for you to remain uninformed, especially when all the literature is available FREE for your perusal.

For some incredible reason, you willfully choose to not educate yourself on that which could/may/possibly challenge your convictions. For myself, I ONLY travel and post and debate on websites and blogs that challenge my worldview, because I WANT it challenged. I desperately want someone, anyone, to conclusively demolish it. So far, I have not seen any serious critic even grasp the principles of the Austrians, error-free, let alone actually engage those principles with strong rebuttals.

You talk about frustration? Here’s looking at you kid.

“This is not a game. Economic beliefs and their resultant policies have consequences in the real world”

That’s why you ought to be among the first in line to hold your tongue until you understand how the market works and what destroys it. You can’t possibly know what ails the market unless you know how it works.

Yet as far as I can tell, all you really know is NGDPLT and every stretched apology for it. I strongly doubt you even know how a free market would operate without any intervention whatsoever. How capital is structured, and what makes it grow and what makes it struggle. I find myself asking you, how in the world can you possibly claim to know that NGDPLT is a “solution”, if you don’t even know the problem?

Much like the Keynesians, your worldview more or less treates capital and consumer goods interchangeably, and I know for a fact that you don’t even treat capital to any detailed degree, especially temporally. Too many things are lumped up into single aggregates in your treatment.

You focus almost exclusively on money spending, and you believe you have a sufficient set of tools to understand the real economy.

——————–

J:

“I’ve seen arguments that recessions are changing as we move toward a more service-oriented economy because of inventory differences between goods providers and services providers. It makes sense that, even if aggregate spending is the main driver for recessions, certain industries will continue to be hit harder during recessions. Service-providing firms will not have inventory to draw down when demand for their services falls, so they will not slow production by as much. Yet, they will also not speed up production as quickly when tomorrow’s expected demand for their services rises because they don’t have an inventory to build up.”

What about retail, goods selling businesses? They aren’t hit as hard relative to the more capital intensive industries either. I am afraid your theory isn’t rigorous enough to explain the data.

Plus, service providers still have “fixed” costs, built on a foundation of required return (competitive profit) vis a vis demand, so if there is a fall in demand in the service sector, they’ll still have to cut costs, lay workers off, etc. While the problem of excess inventory is less acute, if a specific, service oriented sector experiences a falling demand, that would still make it harder to pay wages going forward.

In other words, your explanation would actually lead to concluding that service sector industries should be hit relatively harder, precisely because they have less/no inventory to draw down to keep afloat in the face of a falling demand.

Your initial claim “even if aggregate spending is the main driver for recessions” remains an ad hoc explanation in the face of the facts.

“My point is simply that different types of firms will, time and time again, react differently to demand shortfalls.”

It’s not just “different” firms though. It’s differences according to lengths of production, capital intensiveness, and so on. You are going to have to explain why businessmen and investors in the higher order, capital intensive stages tend to always make more costly errors than those in the retail and service sectors. More accurately, you’re going to have to explain why the demand for higher order goods collapses relatively more than the demand for final goods during recessions. You can’t explain this by way of inventory.

I will agree with one thing you said though. Should an economy move towards a more service oriented production, and what you didn’t mention: as consumer debt markets expand, it may not necessarily be the case that we see a boom and bust concentrated in the higher order stages like we usually do. It is possible for the credit expansion to enlarge the consumer goods industry unduly as well, leaving the “middle” stages inadequately supported via real savings, and thus the “whole” capital structure is left unsound.

10. July 2013 at 03:08

SG, A couple years ago I suggested the Fed go ahead and set the fed funds rate target at negative levels if they thought that was optimal, but the actual fed funds rate would stay at zero. Then a cut from negative two percent to negative three percent would be expansionary, because it would signal a longer period until rates became positive again (delayed exit)

10. July 2013 at 03:09

SG, On second though my idea is weaker, unless combined with level targeting.

10. July 2013 at 04:25

Scott,

Taylor obviously believes, contra most Republicans, that monetary policy is properly used to stabilize the macroeconomy. But he never comes right out and says it. In fact he’s criticized the Fed for being too loose (which I guess is a purely political position), when in fact he’s implicitly acknowleging that it has been too tight. I guess he can always claim that what he really hates is that the Fed has been acting without conveying to the market its reaction function. It’s just frustrating to see someone who could be an intellectual ally coyly acknowledge the validity of your position while publicly joining the hard money types on the WSJ editorial page.

11. July 2013 at 04:34

SG, Yes, he does seem a bit conflicted.