The Chinese exchange rate puzzle

There are two possible correlations between currency values and exchange rates:

1. The SE Asian model (1997): The forex value of the domestic currency and the equity market are positively correlated. Financial crisis leads to both currency depreciation and plunging equity prices.

2. The Japanese model: The forex value of the domestic currency is negatively related to equity prices, as tight money leads to a rising exchange rate and a falling stock market.

The US followed the SE Asian model in the late 1990s, as the high tech boom pushed up both the dollar and stock prices. In late 2008 and in 1931-32, the US followed the Japan model, as tight money caused the dollar to appreciate and the stock market to fall. (Just one more example of NRFPC)

I’ve been puzzled about China’s exchange rate. In August 11-13, 2015, a 3% yuan devaluation seemed to depress stock prices, and a much smaller example of the same phenomenon occurred during January 6-8, 2016. That seems like the SE Asian model. But I would have expected China to follow the Japan model, as they currently need to stimulate AD in the economy. And other Chinese stimulus measures do seem to push stock prices higher.

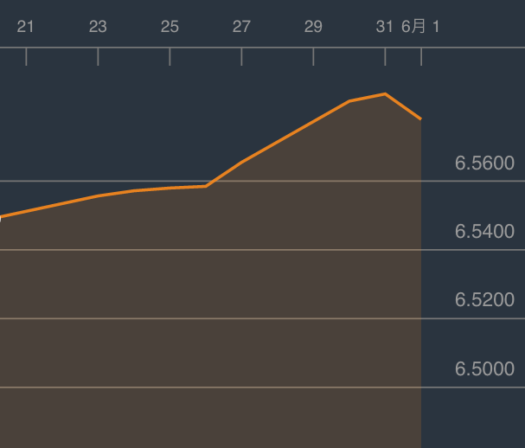

To make things even more confusing, in the past week China seems to have suddenly flipped to the Japanese model. Tyler Cowen reports that there’s been a lot of recent concern about the value of the yuan, which has recently plunged close to the lowest level in years. And yet Hong Kong stocks seem to be negatively correlated with the yuan, unlike August 2015 or early 2016 (graph actually shows inverse of yuan):

Not a large depreciation, but the yuan has been falling for several weeks, and this represents a pretty significant move, by Chinese standards.

Not a large depreciation, but the yuan has been falling for several weeks, and this represents a pretty significant move, by Chinese standards.

Notice that Hong Kong stocks show a “Japan type” correlation over the past week:

Here’s my best guess as to what’s going on here. If you look at the two previous currency moves, they occurred in the midst of a much longer and sharper fall in equity prices, suggesting that currency depreciation was not the only causal factor. More likely, equity markets were falling on fears of financial/macroeconomic problems in China, and the exchange rate was reacting to those fears. Admittedly the rate is controlled by the government, but markets may have seen the sudden move in August as a sign that things were worse in China than they thought. I actually don’t like that sort of (ad hoc) explanation, but I can’t think of anything better.

In contrast, over the past week markets may be reacting to the fall in the yuan as a much needed monetary stimulus. However I’m not at all confident that the correlation won’t revert back to the patter on late 2015. I’m still puzzled.

There are basically two ways to stimulate the Chinese economy:

1. Debt—which leads to major misallocation of resources and fiscal problems down the road when the Chinese government has to bail out the banks and or SOEs

2. Monetary stimulus, which helps the more efficient private sector in China.

The beauty of monetary stimulus is that it makes the process of creative destruction less painful. China is currently seeing a boom in tourism far beyond anything the world has ever seen. The Chinese government estimates that this will create another 12 million jobs for the Chinese poor. At the same time, millions of jobs will be lost in the old “rustbelt” of north China, where steel mills and coal mines will need to be shut down. Currency depreciation caused by monetary stimulus makes that transformation easier, whereas more debt simply causes the SOEs to double down on their failed policies of too much investment in heavy industry.

I’ve said it before and I’ll say it again. China needs easier money (more NGDP) and tighter credit (less moral hazard.) It’s that simple. But obviously hard to do in practice, given the political muscle of Chinese borrowers.

PS. I don’t know which stock market is best. The HK market is viewed as more efficient, and better correlated with macro conditions in China. The Shanghai market is occasionally manipulated by the government, and has lots of SOEs that might be hurt by a weaker yuan, as they have dollar denominated debts. On the other hand, a weaker yuan might hurt Hong Kong, as its currency would then become more overvalued.

PPS. Here’s the yuan over a longer period of time (again inverted):

Tags:

1. June 2016 at 06:44

When you fill in the boxes as to what “monetary stimulus” actually means in China, it’s not too different from what you are describing as debt…they do not live 1980 Eugene Fama.

1. June 2016 at 07:17

Tyler, It depends what “means” means. I agree that many people in and out of China confuse monetary stimulus with an easy debt policy. So in that sense you are right. However actual monetary stimulus as I would define the term, and as mainstream American academics have defined the term for decades, is actually radically different from an easy debt policy—indeed in some respects it might be viewed as an alternative.

In recent years, China’s run a tight money/easy credit policy, which supports my claim that the two policies are quite distinct.

Currency depreciation is the easiest way for them to make monetary policy easier, indeed perhaps the only way.

1. June 2016 at 07:42

re: recent devaluations in China, I seem to remember that the immediate reaction was one of disappointment (“too little too late”), a bit like the Fed moving its rate by just 0.25% where 0.5% was possible

1. June 2016 at 08:24

Speaking of (un)easy debt policies;

http://www.wsj.com/articles/nuns-with-guns-the-strange-day-to-day-struggles-between-bankers-and-regulators-1464627601

———-quote———-

The sobering reality of banking in 2016 is that lenders are awash in new regulations, and growing armies of rule-interpreters and enforcers—for good or ill—are bringing striking changes to banks’ internal cultures.

The 2010 Dodd-Frank law, passed in the wake of the financial crisis and designed to prevent another, is one of the most complex pieces of legislation ever. At more than 22,200 pages of rules, it is equivalent to roughly 15 copies of “War and Peace” and covers matters from how much capital banks must set aside to how they can advertise.

Those rules and others have spawned a regulatory apparatus that is the fastest-growing component of the financial sector, with banks hiring tens of thousands of new staff whose job is to keep their employers right with the new regime. Federal agencies have dispatched thousands of their own minders to set watch at banks.

The regulatory tightening has helped change the profile of a big bank in the postcrisis era. It now looks more like a utility, subject to complex rules about how it can do business and answering to government watchers whose careers depend on enforcing those rules with vigor.

—————endquote————-

Actually getting loans made to people with promising ideas, will be an afterthought.

1. June 2016 at 08:27

More from the WSJ article;

————quote————

… there are trade-offs. Banks pulled back from financing areas ranging from student lending to certain types of mortgages. They no longer make bets with their own money, known as proprietary trading, and have collectively ceased working with hundreds of thousands of individual or company accounts.

The heightened regulatory environment led 46% of banks to pare back their offerings for loan accounts, deposit accounts or other services, according to an American Bankers Association survey of compliance officers last year.

It is also costly. The six largest U.S. banks by assets in 2013 together spent at least $70.2 billion that year on regulatory compliance, up from $34.7 billion in 2007, according to the most recent study by policy-analysis firm Federal Financial Analytics Inc., which said costs have continued to mount since then.

————-endquote———–

1. June 2016 at 09:33

I’m impressed by your new Econlog post, Sumner. The best advice here would be asking the traders what they think.

1. June 2016 at 09:50

I’ve been arguing that a weaker RMB is a positive – sign of stimulus. Most people I talk to, however, fear that RMB devaluation = deflation, as in Asian Crisis 1997. I think that is misreading history but the fear is there. (The Chinese deval pre 1097 was end of dual cutrency system and deflation was deliberate policy choice independent of FX)

1. June 2016 at 10:07

Korea first had rapid inflation than a rapid fall in inflation in 1997-8. Indonesia had just inflation in 1997. Not sure about Thailand.

1. June 2016 at 10:30

Japanese Model: Currency depreciation.

SE Asian Model: Capital flows.

1. June 2016 at 11:08

Michael, I wondered about that at the time, but I’m not convinced the data matches that theory.

Patrick, Thanks for the link–that’s depressing. Just one piece of the puzzle explaining slow productivity growth. (Of course there are many other pieces).

1. June 2016 at 11:10

Scott,

“The beauty of monetary stimulus is that it makes the process of creative destruction less painful.”

Right. It doesn’t artificially reduce the amount of creative destruction that will take place, AND it makes it less painful.

“I don’t know which stock market is best.”

For most purposes, SEHK. It isn’t just more efficient. The main issue with SHSE is not even manipulation, as it’s usually explicit, but that it’s dominated on the listing side by SOEs, and on the investor side by a HUGE number of inexperienced individual investors. It’s best to treat it as uncorrelated.

On debt, there’s a lot of talk now in China about shifting from debt to equity financing, in general.

1. June 2016 at 11:37

Scott – I think the reason for the seemingly odd behavior of yuan weakness correlating with falling risk assets is b/c yuan weakness comes at the hands of a rising dollar and a lot of PBoC intervention to subvert a much larger fall in the yuan.

This is sort of similar to the gold standard phenomenon you described in the Midas Paradox of expected devaluations being deflationary and actual devaluations reflationary. China’s devals have been ‘guided’ by a pboc that has had to sell reserves and contract it’s balance sheet, much like an expected deval under a gold standard. And that ain’t monetary stimulus.

1. June 2016 at 11:50

Except for the minor depreciations you mention, the Chinese have chosen to peg the yuan to the dollar, effectively outsourcing their monetary policy to the Federal Reserve. Tying the yuan to an dollar that is overvalued both by tight money and the safe asset shortage David Beckworth has been talking about is a disaster for Chinese net exports, albeit one partially obscured by cheap oil. The Chinese devaluations have not been nearly enough, and they should let the yuan float.

1. June 2016 at 15:29

Slightly unsatisfactory explanations might be:

(1) August 2015: The unexpected transition from (6 month long) hard peg to more flexible arrangement, in response to domestic market turmoil, created very high exchange rate risk for H-shares (HSCEI, not Hang Seng) whose RMB dividends need to be converted into HKD.

(2a) May 2016: Having slogged through five months of new crawling peg regime, markets are more comfortable with modest depreciation in the bilateral exchange rate. Or

(2b) …markets actually believe that the end of nigh for the relentless downward trend in the benchmark RMB index (vs. basket of 13 currencies), as temporary depreciation in the RMB has been more muted than it has been in the USDJPY or EURUSD pair. Implied volatility for USDCNY / USDCNH has been actually declining in recent weeks.

(2b) would be consistent with the hawkish rhetoric from “authoritative person” featured in the odd People’s Daily article a few weeks ago. Or modest (albeit pork price driven) pick-up in domestic inflation toward the NPC annual target in recent months.

Just some quick theories.

There is also the “Window dressing” possibility for A-share inclusion in global MSCI benchmark. But not sure if that mattered.

1. June 2016 at 15:44

Excellent blogging.

Moreover, The People’s Bank of China is below their inflation target, so they have plenty of room for monetary stimulus.

A bit ironically, the risk to China is that their central bankers become westernized.

1. June 2016 at 16:45

Absolutezero. Thanks for that info.

Tommy, That’s possible, although the analogy to gold can’t be exact, as less demand for yuan would be inflationary. Still, some analogous process may be at work.

Jeff, I agree, except I’m not sure about “not nearly enough”. The yuan is down almost 10% from the peak—it’s not clear how much more is needed, as China still has lots of strengths, and the yuan is probably on a long term upwards trend.

HL, Yes, perhaps people do feel the end is approaching, for yuan devaluation. The switch to a basket of currencies is another factor I had not considered.

2. June 2016 at 05:09

Related to my earlier comments about banks and curtailed lending, how about the proposed Loan Shark Enabling Act of 2016;

http://www.nytimes.com/2016/06/02/business/dealbook/payday-borrowings-debt-spiral-to-be-curtailed.html?ref=todayspaper&_r=0

———quote———-

Mainstream banks are generally barred from this kind of [Payday] lending. More than a dozen states have set their own rate caps and other rules that essentially prohibit payday loans, but the market is flourishing in at least 30 states. Some 16,000 lenders run online and storefront operations that thrive on the hefty profits.

Under the guidelines from the Consumer Financial Protection Bureau — the watchdog agency set up in the wake of 2010 banking legislation — lenders will be required in many cases to verify their customers’ income and to confirm that they can afford to repay the money they borrow. The number of times that people could roll over their loans into newer and pricier ones would be curtailed.

The new guidelines do not need congressional or other approval to take effect, which could happen as soon as next year.

The Obama administration has said such curbs are needed to protect consumers from taking on more debt than they can handle. The consumer agency — which many Republicans, including Donald J. Trump, have said they would like to eliminate — indicated last year that it intended to crack down on the payday lending market.

———–endquote——–

And thus deprive poor people of an option now open to them.

————quote———-

Both sides agree that the proposed rules would radically reshape the market. Loan volume could fall at least 55 percent, according to the consumer agency’s estimates, and the $7 billion a year that lenders collect in fees would drop significantly.

That will push many small stores out of business, lenders say. The $37,000 annual profit generated by the average storefront lender would instead become a $28,000 loss, according to an economic study paid for by the trade association.

———-endquote——–

Of course, The Poor’s Party is all in favor of depriving the poor;

————quote———–

The Democratic presidential candidates generally support stricter lending rules. Senator Bernie Sanders has called for a 15 percent rate cap on all consumer loans and for post offices to become basic banking centers, a change that could “stop payday lenders from ripping off millions of Americans,” he said in a January speech.

Hillary Clinton praised the payday lending proposals that the consumer agency released last year and urged her fellow Democrats to fight Republican efforts to “defang and defund” the agency.

————endquote———-

3. June 2016 at 10:14

Patrick, Will progressives ever learn?

8. June 2016 at 08:58

The problem with currency depreciation as a vehicle for stabilizing aggregate demand is that everyone wants to do it and no one wants to take the absorption. China is already running a healthy CA surplus. Who is going to absorb the excess demand of the world’s largest economy? The US can’t do it by itself.

While I am sympathetic to your arguments, NGDP is not enough if the 40% of the production gains are captured by the top 1%. I have read your interesting post on whether the poor can save. Your points are valid but it is relative wealth that drives social outcomes, not absolute wealth. That applies on a state-by-state level in the US as well.

https://www.ted.com/talks/richard_wilkinson?language=en

NGDP targeting with progressive taxes, closing tax havens, GMI, and EITC, are what is needed.