The American Dream lives (in Texas)

Back when I was young, America was an optimistic country that grew rapidly. Before NIMBYism got out of control, builders could build vast new housing developments, and the government would supply brand new expressways. Housing was cheap, and the workforce grew fairly briskly.

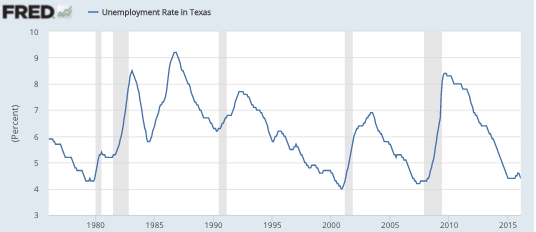

That America is mostly gone, except in Texas. Many liberals thought Texas would have a recession when oil prices collapsed last year. After all, back around 1986 Texas had a fairly steep recession, after a similar collapse in oil prices. But not this time; indeed unemployment just fell to 4.4% in February, which is only slightly above the all time low of 4.0%, which occurred during the boom year of 2000. Nor can this be attributed to people leaving the state; Texas continues to lead the US in population growth (total), and indeed growth actually picked up in the most recent 12 month period.

Of course Texas economic growth has slowed sharply due to the dramatic downturn in the fracking industry, but just look at how different the unemployment picture is compared to 1986:

I’d love to hear some thoughts as to why. I can think of three possible reasons:

1. In 1986 Texas was also suffering from the hangover effects of the S&L fiasco, but this time its banking system is in better shape.

2. Oil is now a smaller share of the Texas economy (but that can’t explain the entire difference).

3. The explanation I like most is that in 1986 the rest of the country was still doing sort of OK, so the the attraction of moving to Texas was less obvious than today. Now the rest of the US is stuck in The Great Stagnation, which makes Texas look good by comparison:

Liberal Governors, tired of looking bad next to Texas, may have hoped to catch a break as the full impact of cheap oil hit the Lone Star State in 2015. And Texas is creating jobs more slowly this year””1.1% growth through May versus 3.6% in the same period last year. Lower-paying positions in hospitality have substituted for higher-paying energy jobs.

But the overall economic resilience is a far cry from the Texas recessions that followed previous oil busts. Unemployment in the state, 4.3% in May [2015], was still well below the national average of 5.5% that month.

Some credit goes to the foresight of energy companies that made themselves less vulnerable with better balance sheets. In a report specifically focused on the energy capital of Houston, the Dallas Fed notes recent improvement in job growth and says that “refining, petrochemicals and service industries are managing to offset oil-producer woes.” Statewide, education and health services employment has also been strong.

Meanwhile in Austin, which has little exposure to the energy industry, business other than government is booming. May job growth surged at an annual rate of 6.6%, including “a significant increase in high-paying scientific and technical services jobs.” Texas is now America’s top technology exporter, surpassing long-time leader California.

Notice that the boom in Austin is helping to offset a slowdown in places like Houston, so that overall job growth continues to be positive. Back in 1986, Austin was not yet an important tech center.

Here, as in so many other recent cases, the pragmatic progressivism of Matt Yglesias (a Texas bull) and proved far more accurate that the ideological progressivism of Paul Krugman (a Texas bear). Progressives might not like the small government model of Texas, but wishful thinking won’t make the Texas miracle go away.

Tags:

22. April 2016 at 06:05

Texas also didn’t raise their minimum wage to $15/hr. In Seattle, Jacob Vigdor is documenting the effects of going from $9.50 to $11 (eventually to $15).

———–quote———-

Applying advanced statistical methods to census and other national data will let us examine how Seattle’s experience compares to a control group made up of cities and regions where wages stayed the same.

Another source of information comes from talking to those affected. University of Washington research staffers are calling and emailing more than 600 Seattle employers, asking about their current staffing, compensation scales and business models, and how they plan to adjust to the wage changes.

We chose participating businesses at random from all firms licensed to do business in the city. This ensures we get a representative group of employers, not just those who are politically active. We are focusing on employers most likely to be affected — restaurants, retailers, small manufacturers, immigrant-owned businesses and nonprofit human services.

———-endquote———-

So far, restaurant meals are up about 9%!

This I also find encouraging;

‘We don’t yet know what the impact of today’s wage increase will ultimately be. As social scientists, our role is simply to report what happens and to leave it to the citizens and leaders of Seattle to decide whether the effects are good or bad.’

22. April 2016 at 06:32

The full Vigdor paper is here;

https://drive.google.com/file/d/0B-KBLMLLa7X9U0lsMXNsaWlkZms/view

22. April 2016 at 06:44

From the Vigdor et al. study;

‘Previous analyses of the minimum wage have focused on core labor market outcomes including employment and earnings. The UW study will evaluate the impact of the Seattle minimum wage ordinance on these outcomes using records collected by the Washington Employment Security Department (ESD), which administers the unemployment insurance program. The ESD, charged with determining eligibility for unemployment benefits, maintains quarterly records of employment and earnings for workers identified by name and social security number. Beyond these basic measures required to determine benefit eligibility, Washington is one of a small number of states that collects hours worked data at the level of the individual employee. It is thus possible to impute average hourly wages for workers in the ESD data, and thereby to identify low wage workers more reliably than in comparable data sources in other states. ***It is also possible to determine the impact of the minimum wage on hours worked***, both at the individual employee level and aggregated to an establishment level.

‘Records from ESD can be cross-referenced with other databases maintained by Washington state agencies. Of particular interest for this study, Washington’s Department of Social and Health Services (DSHS) maintains an Integrated Client Database with information on families receiving means-tested benefits including SNAP and Medicaid. This will permit us to focus attention on low-wage workers who belong to low-income households, and to examine the effects of higher minimum wages on means-tested program participation and benefits.’

My *** in the above.

22. April 2016 at 07:00

Why the Vigdor study will be different:

———–quote———–

To both broaden and deepen our understanding of the policy’s effects, we designed a longitudinal, qualitative study of 53 low-wage workers in Seattle with custodial children. We know of no prior qualitative studies of workers and their families during a minimum wage increase, but there is a long tradition of using qualitative methods to study low-wage work, and to uncover the process and meaning of program or policy impacts on low-income families …. For example, qualitative interview data collected from participants in an experimental housing mobility program in Baltimore helped

reveal the process by which the program changed families’ references for certain neighborhoods ….

Qualitative interviewing techniques, while not designed to produce generalizable or causal estimates, are unmatched in their ability to describe processes of change, to reveal the complex ways in which individuals and families react to and shape their own economic circumstances, and to provide an authentic voice for the subjects of research. In the context of the comprehensive evaluation of the City of Seattle minimum wage, the qualitative study of workers is designed to provide deep and longitudinal documentation of the subjective experiences of low-wage workers during this period of policy change. We have four research questions:

1. How do workers experience the wage increases in their monthly budgets, and through what mechanisms?

2. From the perspective of workers, how are their work schedules, compensation, and tasks determined? Are these job attributes changing as the wage mandate takes effect? If so, how do workers perceive these changes as being related to the minimum wage increases, if at all?

3. What are the trade-offs, according to workers, of packaging earnings with other financial and in-kind supports? Do these trade-offs change for the workers during the implementation of the law?

4. How do workers describe the influence of work conditions and budgets on day-to-day routines, family dynamics (including parenting), and parent and child well-being?

———–endquote———–

22. April 2016 at 07:02

I see I failed to include a link to Vigdor’s Seattle Times piece. It’s here;

http://www.seattletimes.com/opinion/digging-into-data-to-find-impact-of-seattles-15-minimum-wage/

22. April 2016 at 07:08

Patrick Sullivan

I see your paper and I raise you. Reid Wilson and H. Luke Shaefer of University of Michigan looked at the effects of the increases to the min wage in Seattle compared to surrounding metropolitan areas. Their conclusion?

” Interestingly, the hike of the minimum wage in January corresponded to a faster percent growth in Seattle than in the MSA (metropolitan significant areas) in the most recent month.”

do any of these papers prove anything? No its way too early to tell so hold your horses.

http://static1.squarespace.com/static/551caca4e4b0a26ceeee87c5/t/5702ae13b6aa607cbb96f406/1459793428392/Shaefer-Wilson-Employment-Losses-Seattle.pdf

22. April 2016 at 07:15

It’s hard for me to think of Yglesias as a pragmatist with how bullish he’s been on Bernie Sanders.

Krugman on the other hand has been totally dismissive of the Bern-which makes me love Krug all the more as he drives the Berners crazy.

22. April 2016 at 07:18

“Miracle” is not the right word – “exception” is. The other southern states have been trying a similar model to Texas, without much success aside from Florida (which has some extra factors at work like tourism).

If Texas’ economic model is why it’s doing well, then you have to ask why similar policies haven’t done so well in culturally similar states.

22. April 2016 at 07:29

Scott

“I’d love to hear some thoughts as to why. I can think of three possible reasons:”

in 1986, I think Texas’s unemployment rate was 9% while nationally it was around 7%. Now the rates are 4.4% in Texas and 5% nationally. Cant we say that the unemployment in texas follows the national figures to an extent? Maybe we can say that Texas has a higher beta compared to the rest of country? I know texas did well in the recession but this should explain some of its employment numbers.

If Texas is the american dream we must have lowered our aspirations quite a bit. High poverty, Large numbers of uninsured, low investments in education. This is the dream? How does Texas stack against Massachusetts? If cheap housing and low wages is all Texas got then it aint got much.

And good for Texas they did well during the recession. It helps to restrict mortgage lending.

22. April 2016 at 07:33

Texas: “Dream to live in poverty”

22. April 2016 at 07:48

Worth pondering: Texas, like the nation, is in the eighth year of recovery and, until very recently also in an oil boom. Very little inflation in Texas.

It is among the most successful third-world regions in the world.

22. April 2016 at 08:07

Re: point 1)

Treating the S&L crisis and the oil bust as entirely exogenous is a bad assumption

– The oil crash was one factor exacerbating the S&L crisis- the drop in oil, consequent drop in employment, and consequent drop in real estate value (incl commercial real estate) played a big part in blowing up the S&L’s

– The differences today are twofold:

1) if there was a broad-based drop in real estate value (Houston office space may be very overbuilt soon), the impact will be much more dispersed- in 1986 most of those assets existed in concentrated form on the balance sheets of local, non-diversified S&Ls. Today that risk is distributed widely by large regional & national banks and capital markets via securitization.

2) There hasn’t been (at least so far) large drops in real estate value because the TX economy as a whole is much more diversified. Austin is a major tech hub that has benefitted greatly by silicon valley firms shifting some headcount to the Austin area. Practically ever major tech co has a sizable Austin outpost. Houston has the gargantuan medical center (total employment of ~125k) that’s pretty invariant to oil. Dallas has a number of industry clusters both glmourous (fashion/retail) and not (chain restaurant management). Dallas/Ft Worth punches way above its weight on corporate HQs (https://www.geolounge.com/geography-of-fortune-1000-companies-in-2015/)

22. April 2016 at 08:29

Brett, You said:

“Miracle” is not the right word – “exception” is. The other southern states have been trying a similar model to Texas, without much success aside from Florida (which has some extra factors at work like tourism).”

I don’t agree. One of the keys to the Texas success is the lack of income tax. Almost everywhere you look in America, the states with no income tax grow faster than neighboring states that have an income tax. I have a number of posts that explain that in detail. Most southern states have an income tax.

James, You said:

“In 1986, I think Texas’s unemployment rate was 9% while nationally it was around 7%. Now the rates are 4.4% in Texas and 5% nationally. Cant we say that the unemployment in texas follows the national figures to an extent?”

You missed the point. In 1986, unemployment in Texas surged higher while the US rate was falling. The reason? An oil bust. Now we have another oil bust, but no increase in the Texas unemployment rate. Some people say oil is less important today in Texas than in 1986. Let’s say it was just half as important today. Even in that case, why didn’t Texas unemployment rise sharply over the past year, albeit less sharply than in 1986? After all, we’ve been constantly told that the previous Texas boom was due to fracking.

You said:

“How does Texas stack against Massachusetts?”

Given that far more people are moving to Texas than to Massachusetts, or even to other states with equally low housing costs as Texas, I’d say there must be something especially attractive about Texas. Don’t you agree? Otherwise why would so many people move there? The climate is nicer in Florida or California, or even Arizona.

You said:

“low investments in education.”

Then why are their outcomes relatively good? Isn’t it outcomes that matter? AFAIK, Blacks, Whites and Hispanics all tend to score higher in Texas than most other states (Someone double-check that for me.)

Plucky, The lesser importance of oil certainly cannot explain such a dramatic difference.

22. April 2016 at 08:30

Patrick, Yes, the minimum wage difference may be a factor going forward. However I expect the GOP to go along with a higher national minimum wage after the election. So that will hurt Texas.

22. April 2016 at 08:41

Scott-

I did not mean to imply those differences were the only things going on, far from it. I mainly just wanted to point out that the S&L crises was in part an amplification of the oil bust rather than an entirely independent shock. I’m a Texan and a big TX booster (but I repeat myself) so I’m in full agreement with you on “there’s a lot more to it than oil”

22. April 2016 at 08:43

“If Texas is the american dream we must have lowered our aspirations quite a bit. High poverty, Large numbers of uninsured, low investments in education.”

-Pretty much all of this is due to the Blacks and Mexicans.

Also, Colorado and Utah are doing quite well, almost as well as Texas. Rhode Island, with far fewer Blacks and Mexicans than Texas, is doing especially poorly, with the contrast looking starker when it’s compared to its neighbors.

Russia is also doing a massive amount of construction, and has a fairly low unemployment rate for the degree of its real GDP drop:

http://www.forbes.com/sites/markadomanis/2016/01/11/moscow-just-set-a-record-for-residential-construction-is-a-housing-bust-on-the-way/

Rents and apartment prices in Russia are falling even in ruble terms. Compare Stockholm.

22. April 2016 at 09:10

I used to work in real estate equity finance. I have a vague recollection once about apartment (or housing?) starts in Dallas being something like 78,000 in 1983 at a time when there were only 300,000 units in existence at the start of the year. The numbers are so enormous as to be unbelievable (I’m even questioning my recollections now). Anyway, if there’s any truth to my recollection (which would be tied to S&L’s of course), it’s easy to imagine a very large fall off in the couple years after that. And if this happened in Dallas, it probably happened in Houston. And to their office markets too.

22. April 2016 at 09:27

@Benjamin Cole,

I think you are talking like a sausage.

https://mises.org/blog/if-sweden-and-germany-became-us-states-they-would-be-among-poorest-states

22. April 2016 at 10:05

James, Someone throwing darts at a wall covered in soundbites would be more convincing than you.

Still amazes me how often Krugman can be wrong and still have people that hang on his every word.

22. April 2016 at 10:27

Cool slideshow on how Houston is liberalizing land use codes to allow for more urbanism:

http://www.montgomeryplanning.org/events/rethink2011/documents/MakeoverMontgomeryConference_3A_Tennant.pdf

LA developed similarly in the postwar period before we clamped down on zoning in the 80’s. Now Texas cities are eating our lunch.

22. April 2016 at 11:00

This is extremely important:

http://www.nytimes.com/2016/04/23/us/governor-terry-mcauliffe-virginia-voting-rights-convicted-felons.html

Trump is now almost certainly unable to win Virginia. He must now win Pennsylvania to win the election. This is why the Pennsylvania primary will be so important.

22. April 2016 at 11:03

having lived in Texas for about or more years, i really havent seen that we are exceptional (unless you think that most people should live on less than 20,000 a year. which is a lot more prevalent here that any where else i have lived, including Arkansas). the only reason the state didnt end up in the ditch in the great recession, is that most if not all of the state’s spending is from the oil taxes collected, which basically has replaced the need for an income tax, plus for some reason we get a lot of federal spending too (probably due to a lot of federal facilities, like military bases, etc) . course we have been a one party state for over 100 years now, and its really hard to tell the current political bosses from the previous ones, seems that it was just a change in label, not much else. course when companies come to Texas, its usually just top bring their low wage jobs to the state. or for a new low cost facility. course we have had low cost homes (have to or no one could buy them) for a long time now, probably has to do with the fact we have a lot of land, almost all of it flat. course we do have down sides. low education levels, those whirly winds (Tornadoes) and hail, plus through in drought and flooding (odd huh?). and while we might have a ‘mild’ climate, we can hit 100+ for 3-5 months of a year, and hit the teens and below some of a year too.

22. April 2016 at 11:06

Brett, the only other states in the south with no state income tax are Florida and Tennessee, both of which seem to be doing relatively well from what I’ve seen.

James Elizondo, The median household income in Texas was slightly higher than the national median in 2014, even without any sort of purchasing power adjustments (in 2000, it was about 8% below). Their poverty rate doesn’t look bad at all when you break it down by demographics. The rates for whites, blacks, and hispanics look like they were all either even with or a little below the national rates for those groups.

http://kff.org/other/state-indicator/poverty-rate-by-raceethnicity/

22. April 2016 at 11:11

Scott, This is just for fourth and eighth grade reading and math scores, but it seem to back up what you are saying.

http://www.nytimes.com/2015/10/27/upshot/surprise-florida-and-texas-excel-in-math-and-reading-scores.html?_r=0

22. April 2016 at 11:20

A.H

you may have a point actually. I prob do rely on p.k, vox, economist view a little too much without doing in depth research. But Texas def has it’s problems and I think its reasonable to point to poverty rates, lack of health insurance and low investments in education to support my view. Scott counters that minorities do pretty well despite low investments in schools. That’s something to consider. Zack points out that poverty rates dont look so bad once you break down by demographics.

But you sir contribute nothing.

22. April 2016 at 12:38

Yeah, and it’s great to live in North Korea because they’ve got that universal health insurance there.

I never realized that honestly analyzing the Texas economy would turn out to be such an emotional issue for people.

I recall a Krugman blog post that deconstructed the Texas “Miracle” to expose that it was not, in fact, an actual divine intervention that is causing the Texas economy to do relatively better than its peers. Sometimes Dr. K is hilarious.

22. April 2016 at 13:05

define well? from a long time Texan, not sue i have seen it since 2000?

22. April 2016 at 13:21

@scott

You said, “One of the keys to the Texas success is the lack of income tax. Almost everywhere you look in America, the states with no income tax grow faster than neighboring states that have an income tax. I have a number of posts that explain that in detail. Most southern states have an income tax.”

Not to mention no capital gains tax.

22. April 2016 at 13:29

From a Yankee… Texas is awesome!!! It has everything you need in abundance, plus great people, good food, enough sports, warm winters, central time zone is nice, centralized airports as well, and most importantly – a ton of hot chicks that actually prefer to carry themselves like women.

22. April 2016 at 14:13

“But Texas def has it’s problems and I think its reasonable to point to poverty rates, lack of health insurance and low investments in education to support my view.”

-Every single state in the Union overinvests in education. America has way higher education spending per student than Korea or Finland, and it’s not getting much out of it. It’s in the top 10 in education spending per student. That’s ridiculous. Teacher’s unions need to be crushed, education spending should be cut in half, if not more. Lack of health insurance may simply be because people don’t want it. Again, poverty rates are just due to the Blacks and Mexicans.

@Dervis

-You’re overrating Texas. Its health regulatory system is extremely ineffective. I wouldn’t want to live there. Pennsylvania and Oregon have better scenery, Michigan is less hot in the summer.

22. April 2016 at 14:26

E. Harding

Poverty rates cuz of the Blacks and Mexicans huh? Ya cuz no poor ppl are white. You’re an idiot.

22. April 2016 at 14:39

Poking around the internet for info, I found the BLS data for employment by sector in Texas for the last 6 months. And it shows the year over year changes in each sector:

http://www.bls.gov/eag/eag.tx.htm

Mining and logging shows double digit declines. Manufacturing shows declines as well. And I’m not certain but I believe tech employment by the likes of Dell, HP, IBM, and Intel is counted under manufacturing. As someone pointed out earlier in the comments, it’s services that are doing well.

22. April 2016 at 15:20

Have you read “Big, Hot, Cheap, and Right: What America Can Learn from the Strange Genius of Texas” by Erica Grieder?

http://www.amazon.com/Big-Hot-Cheap-Right-America/dp/1610393759

22. April 2016 at 15:36

@james

-Gr8 strawman burning.

22. April 2016 at 15:40

James, Posters like you appear all the time. No interest in learning anything and full of a dogmatic confidence that only an education from the esteemed New York Times columnist can give. You’ll forgive me if I find it boring.

22. April 2016 at 16:34

Brian Donahue–

I am not a sausage. I am an astute observer of the passing economic scene.

In general, I agree free markets work better than socialism.

However, international comparisons are always treacherous, and remember that the typical Swede or German works six weeks less a year than the typical American and gets free healthcare. Once you comp those facts in, there is not too much daylight in the results between one nation or another. They have the advantage, after all, being Swedes and Germans,

extraordinarily productive ethnic groups.

BTW per capita incomes in Ireland probably this year will exceed those of the United States— Drink Guinness Stout!

22. April 2016 at 16:37

One caveat I have about Texas is its relatively low life expectancy, which is below the national average (and US life expectancy wasn’t that high compared to other OECD countries to begin with!). This even though the state has a larger share of Hispanics, who push up the average. The life expectancy for non-Hispanic whites is 1 year below that of the national average, ranking 38th. And yes, Massachusetts does much better.

http://kff.org/other/state-indicator/life-expectancy-by-re/

And the midlife mortality rate for whites is increasing faster in Texas than the nation as a whole (I’ve covered that on my blog) whereas it is falling in Mass (from a much lower level).

22. April 2016 at 16:55

https://www.washingtonpost.com/news/wonk/wp/2016/04/22/on-this-issue-donald-trump-knows-a-lot-more-than-other-republicans-sad/

Warning to the Trump=Hitler crowd (especially those who follow monetary policy): do not read the above link, which in addition to being really annoying is largely true.

22. April 2016 at 19:26

In 1986 Texas was hit by the same forces that hit the global economy in 2008. So in both the S&L Crisis/2008 Financial Meltdown were the result of a dysfunctional energy market that produced dysfunctional capital markets. So oil prices were high but oil production failed to increase which resulted in oil profits wreaking havoc in the capital markets. The major difference was that capital markets had advanced to global markets by the 2000s so the impact of the dysfunctional oil market was felt on a global scale. The oil profits of the 1980s stayed near the oil so cities like Houston experienced real estate bubbles.

*One way we know the oil market was dysfunctional in the 2000s is because oil was the only major commodity that increased in price while production failed to increase. We know the oil market was dysfunctional in the 1980s because of the behavior of the Saudis.

23. April 2016 at 05:12

Plucky, In that case I agree.

Bill, I do recall a real estate boom and bust.

ChargerCarl, Thanks for that link.

dw, I don’t agree with your “facts” I believe that lots of people are moving to Texas because living conditions are better than elsewhere (apart from the weather, which I agree is very hot in the summer. The lack of income taxes is not explained by federal spending (Texas does not do particularly well in that area), or oil.

Zack, Thanks for that info. I recall a post I did earlier pointing out that when the Census bureau adjusts for cost of living, Texas has a relatively low poverty rate, much lower than California or New York.

James, You say:

“Texas def has it’s problems and I think its reasonable to point to poverty rates,”

No it isn’t, see my reply to Zack

Steve, Haven’t read that.

HW, I think that’s because Texans live with more gusto. We Massachusetts residents live rather boring lives.

23. April 2016 at 05:39

well, how many states do you know that dont stop a business from blowing up a city? Texas does that. and that isnt an old ancient event, its with the the last 2 years. and we still dont know which cities are still at risk. nor can we as residents know that we are at risk. i suspect that people move here because there are jobs (in some areas, usually in the large metro areas). we can get away with paying less, because housing is less than most states. and considering we have the largest army base (Fort Hood) and a lot of military bases in Texas, lost of them. we get a lot federal spending, and that doesnt include the mint, NASA, and others that are in the state. the 2nd largest city if the state, is home to more military bases, than some states have.

23. April 2016 at 06:01

ChargerCarl, I did a new post on the slideshow, over at Econlog.

23. April 2016 at 09:26

The lack of income taxes can, I think, be explained by oil; Texas gets a lot of its revenue from that.

23. April 2016 at 10:23

Harding, Not unless you consider 2.6% of revenue “a lot”

Texas spends less, that’s the key.

23. April 2016 at 11:12

@Benjamin Cole,

I never thought you were a sausage, merely that you were talking like a sausage.

Which you were, in comparing Texas to a third world country.

Sláinte!

And, on your Trump link, it sounds like Trump is right for the wrong reasons. What is clear is that Matt O’Brien (the author) himself has little understanding of monetary policy, equating low rates with easy money, a mistake our estimable host has spent many pixels trying to correct. I find it hilarious that O’Brien anoints himself as the arbiter of who has the best position on monetary policy. Blind squirrel.

23. April 2016 at 13:21

Texas: “Dream to live in poverty”

Personal income per capita is about 2.5% below national means.

Worth pondering: Texas, like the nation, is in the eighth year of recovery and, until very recently also in an oil boom. Very little inflation in Texas. It is among the most successful third-world regions in the world.

Value added attributable to the oil and gas sector amounts to 10.6% of the total, give or take.

23. April 2016 at 13:25

if the state, is home to more military bases, than some states have.

Military spending in Texas accounts for 1.3% of value-added.

23. April 2016 at 13:27

the typical Swede or German works six weeks less a year than the typical American and gets free healthcare.

No, the cost of medical care is socialized according to different methods.

23. April 2016 at 13:41

The lack of income taxes can, I think, be explained by oil; Texas gets a lot of its revenue from that.

IIRC, about 21% of state and local tax revenue is accounted for by income levies. Given the difference in the size of the oil and gas sector relative to national means, severance taxes might substitute for perhaps 1/3 of what others get from income levies were the rates assessed on extraction similar to those other states assess on production and imports.

23. April 2016 at 15:55

Texas is rewarded by big government contracts by the NWO for taking out JFK. Read up on LBJ’s mistress comments sometime.

I like Texas, it wasn’t the masses that did the evil for the military industrial complex. Don’t say Ike didn’t warn us.

23. April 2016 at 16:54

Scott and Partrick Sullivan

Most employers surveyed in a university of Washington said that expected to raise prices on goods in order to compensate for the 15 dollar an hour raise to min wage.

But after a year after implementation of the law said study indicates such increases aren’t happening.

Bottom line it’s too early to tell.

http://www.washington.edu/news/2016/04/18/early-analysis-of-seattles-15-wage-law-effect-on-prices-minimal-one-year-after-implementation/

23. April 2016 at 17:01

Texas is rewarded by big government contracts by the NWO for taking out JFK. Read up on LBJ’s mistress comments sometime.

I like Texas, it wasn’t the masses that did the evil for the military industrial complex. Don’t say Ike didn’t warn us.

Do you ever get tired of the act?

24. April 2016 at 06:24

‘Most employers surveyed in a university of Washington said that expected to raise prices on goods in order to compensate for the 15 dollar an hour raise to min wage.’

James, it’s usually a bad idea to take journalistic reports of economics studies seriously. Vigdor himself has said–I heard him, myself–say that restaurant meals in Seattle are up 9%. And Seattle’s minimum wage has only been forced up to $11 from $9.50.

Vigdor went on to explain that you’d expect to find rising prices in industries that are comparatively LABOR INTENSIVE, like restaurants. That’s what his study has found.

The places where prices aren’t rising, such as grocery stores and retail outlets like Target, don’t have labor inputs as large a factor.

The news stories are, as usual, missing the point of Vigdor’s work.

24. April 2016 at 16:41

Patrick

Just thought you should know that there’s studies out there ( I listed two) by credible professionals who came to different conclusions than Vigdor

25. April 2016 at 05:34

You only listed one, from the U of Michigan–though it credits TWO AUTHORS. It is about jobs, not price increases, and it ends:

‘…we suggest caution in regard to declaring anything about the minimum wage hikes until more and better data become available and more

sophisticated analyses are conducted.’

Which advice the Vigdor study agrees with. HOWEVER, Vigdor does find price increases (substantial) in a comparatively labor intensive industry; restaurants. At only $11/hr.

I”ll also point out that a study that does not find an effect does not trump one that does. ‘The absence of evidence….’

25. April 2016 at 06:18

Patrick

I listed two. The second one you discredited simple because it was reported by a journalist. So the link to actual paper is below. I like this part that goes directly against what Vigdor says

“Results, derived from repeated price collection in a range of retail outlets including grocery stores, drugstores, and small businesses, show no significant impact of the minimum wage ordinance

on price levels, though estimates are imprecise enough to be consistent with small increases on

the order of 1%.”

Bottom line its too early to tell about the impact on both jobs and prices.

https://evans.uw.edu/sites/default/files/HOvIV%201-27-16.pdf

25. April 2016 at 06:20

and you’re absolutely right that one study doesnt trump another my main point is that concrete conclusions should be avoid until enough time has passed for more research.

25. April 2016 at 06:29

Patrick

you have some explaining to do as we’ve both cited the same paper yet have interpreted their conclusions differently.

25. April 2016 at 07:49

Maybe that’s because I’ve actually read the Vigdor study (and have listened to a radio interview he did on it).

25. April 2016 at 07:58

are you sure you read it? cuz you would have seen this in your own link

“On the basis of all the evidence collected, then, any price increase brought about by Seattle’s increase to a $11 minimum wage on April 1, 2015 led to at most small positive effects on prices, not detectable even in our largest samples.”

Not detectable. what am I missing? I guess all you got is the radio interview but the link you provided does not support your view at all.

25. April 2016 at 08:01

Its ironic. you start off by saying

“Texas also didn’t raise their minimum wage to $15/hr. In Seattle, Jacob Vigdor is documenting the effects of going from $9.50 to $11 (eventually to $15).”

then provide a quote from Vigdor that pretty much says nothing.

then you say

“So far, restaurant meals are up about 9%!”

The horror! Yet the very paper you cite says the impact of in the increase on prices is not significant.

amazing.

25. April 2016 at 12:54

Amazing isn’t the half of it. Get back to me when you’ve actually read Vigdor’s paper.

25. April 2016 at 13:27

I did. perhaps you didnt or you’re being dishonest.

25. April 2016 at 15:39

Patrick I owe you an apology. I didnt focus as much as I should have on the restaurant business. Although the paper says they’re not sure if they can attribute the price increase to the min wage.

“The exception to this pattern is the restaurant industry, where prices appear to be roughly 8% higher than they were before the minimum wage increase, although it is unclear whether this increase can be fully or even partially attributed to the minimum wage itself.”

25. April 2016 at 16:49

Yes, as I said, the price increases are found in the comparatively labor intensive restaurant industry. Here’s a podcast with Vigdor spelling out why, from just last week;

http://kvi.com/podcast/carlsoncast-april21-2016-hour3

27. April 2016 at 12:04

far more accurate that the ideological progressivism of Paul Krugman

People really should wait before making such announcements. For example, I expect a modest employment effect in California due to the $15 minimum wage but I am willing to wait and see before I pronounce “The Golden State Stumble”. He looks pretty foolish.

27. April 2016 at 12:27

@James Elizondo, I do not have Texas verses Massachusetts but here is <a href=http://iowahawk.typepad.com/iowahawk/2011/03/longhorns-17-badgers-1.html)Texas verses Wisconsin or Longhorns 17, Badgers 1