Thank God the Bernanke/Woodford policy has failed!

There’s enough news here for a month’s worth of posts. Matt Yglesias has my general take on things, although my hunch is that we are a bit too little and too late to significantly affect this business cycle. However this is really good news for monetary policy going forward, especially for the next recession. It’s baby steps toward level targeting.

Now for the title of this post. Here’s what the Fed says it’s trying to do:

These actions, which together will increase the Committee’s holdings of longer-term securities by about $85 billion each month through the end of the year, should put downward pressure on longer-term interest rates, support mortgage markets, and help to make broader financial conditions more accommodative.

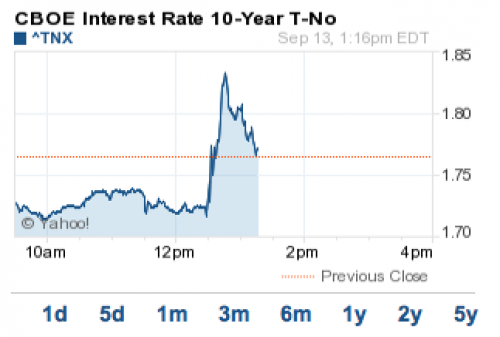

Nope. Long term yields increased on the news, just as market monetarist’s would have expected. And thank God they did! The higher yields are an indication that markets have (slightly) raised their NGDP forecasts going forward. The jump in equity markets suggests that RGDP growth will also rise (albeit modestly.) The bad news is that 100 points on the Dow is indicative of a really small change in the RGDP growth rate, basically within the margin or error. So we’ll never know any more than we know right now about whether the policy will “work.” Of course that won’t prevent hundreds of economists from making silly pronouncements a few months from now, based on actual changes in RGDP. I beg you to ignore them all.

One other thing. The rise is interest rates undercuts the Keynesian model (although I suppose the sophisticated version merely predicts that long rates would fall relative to the (rising) Walrasian equilibrium value.) But the markets are even more strongly rebuking John Cochrane’s claim that Bernanke’s promises would not be credible. Even a very vague and inadequate promise from the Fed was enough to boost markets significantly.

PS. I kind of regret the sarcastic tone of the title of this post. Bernanke deserves a lot of credit for what the Fed did today. It’s not as much as I’d like, but he’s way out in front of the median economist. It could be much worse.

Update: The one percent jump in stocks obviously just reflects the unexpected part of the announcement. Most observers expected the Fed to do something, and it seems likely that the rally over the last few weeks reflects (in part) hints from Bernanke that more would be done. So maybe it’s a 2%, 3%, or 4% jump. That’s not game-changing, but it’s also not chopped liver. (I see commenter O. nate beat me to it.)

Update#2: The jump in long term rates strongly supports David Beckworth’s argument in this excellent post.

Tags:

13. September 2012 at 09:47

Congrats Scott!

I think today is a culmination of almost 4 years of effort from you. My only regret is that this Woodford guy is stealing all the credit you should be getting.

If he ends up getting a Nobel prize for ending this depression over you it will be a travesty.

13. September 2012 at 09:50

I also agree with you that the jump in equity markets is disappointing. We are almost at the point where monetary policy is optimal and REAL problems are becoming the primary constraint to growth again.

13. September 2012 at 09:58

I go blind with rage when CNBC analysts say the Fed shouldn’t ease because stocks are near historic highs. Oh, you mean the market in 2012 just surpassed its historic high from 2008? How is that not terrible news?

13. September 2012 at 09:58

I’d imagine some would say this partially reflects market uncertainty over which asset would be purchased: Since it was MBS and not long term treasuries, treasuries fell on the news. Any way to prove or disprove this?

That being said, I join Liberal Roman is congratulating you for being about 10 ahead of the curve and right about everything. 🙂

13. September 2012 at 10:00

You can’t measure the success of QE3 by today’s equity price movement – because the market has been pricing in expectations of QE3 for some time. Today’s jump is only the difference between the expectation and the reality. What you’d have to measure is the difference between today’s jump and the fall that would have happened if expectations had been disappointed.

13. September 2012 at 10:00

I think markets basically expected something like this and the small jump in equity is due to the resolution of the tiny chance that the Fed would do nothing.

“… in a context of price stability” still sounds like they’ll change course the moment inflation inches above 2%. I hope I’m wrong.

13. September 2012 at 10:05

o. nate, Yes, I realized that even before I read your comment, and added an update. That partly answers Liberal Roman’s disappointment.

Thanks everyone.

13. September 2012 at 10:15

[…] Sumner has two comments (here and here) on the FOMC decision. Share this:Email Pin ItLike this:LikeBe the first to like this. […]

13. September 2012 at 10:33

[…] wait. I should have read Scott Sumner first: …my hunch is that we are a bit too little and too late to significantly affect this […]

13. September 2012 at 10:37

This is good. The Fed has adopted one part of the market monetarist agenda.

The only real problem is that inflation is still a constraint. Assets will be purchased until the real economy recovers and inflation doesn’t rise above 2% (I guess.) With nominal GDP targeting, it would be asset purchases until nominal GDP recovers, and whether it is inflation or real output would have no impact on the policy (though we really hope it is real output and not an increase in the price level above its 2% growth path.

13. September 2012 at 10:40

Higher long term bond rates is consistent with both higher growth expectations, and higher inflation expectations. Isn’t the thing to watch for higher REAL long term rates? (using TIPS)

13. September 2012 at 10:48

[…] Scott Sumner isn’t so sure that the latest news will actually impact the economy, though interest on reserves and the lack of a very specific target seem tertiary when you are dumping half a trillion dollars on the banking system per year. Instead of predicting the path of the economy, this is how I predict economists will react given different outcomes. […]

13. September 2012 at 11:11

> It could be much worse.

Exhibit A. The ECB

Signed,

An envious European

13. September 2012 at 11:25

I’d be happier if TIPS rates were going up. Nominal treasury yields are approximately flat, TIPS rates are down and equities are up.

13. September 2012 at 11:28

Steve, TIPS are ambiguous. The yields fall on the liquidity effect and rise on the expected growth effect.

13. September 2012 at 11:29

I dunno, Scott. Market reaction was very strong just now.

http://www.marketwatch.com/story/stocks-surge-to-session-high-after-fed-bond-plan-2012-09-13

http://www.businessinsider.com/fomc-stock-market-update-2012-9

And of course, here’s the clincher: http://twitter.com/esoltas/status/246303958749040640/photo/1

13. September 2012 at 11:46

[…] Sumner, an economist at Bentley University who has long argued for more aggressive Fed action, says the market rally proves that the Fed can boost the economy merely by shifting expectations: […]

13. September 2012 at 12:06

Scott wrote:

The jump in equity markets suggests that RGDP growth will also rise (albeit modestly.) The bad news is that 100 points on the Dow is indicative of a really small change in the RGDP growth rate, basically within the margin or error. So we’ll never know any more than we know right now about whether the policy will “work.”

Once again, now I’m flummoxed Scott. If you don’t mind, please clarify: I thought your position would be that even if the equity markets had reason 1,000 points on the Dow, then “we’ll never know any more than we know right now about whether the policy will ‘work.'” What does the size of the move have to do with it? I thought you said that *in principle*, waiting for x months and then looking back was a nonsense way to evaluate Fed policy.

13. September 2012 at 12:08

I think he meant “now” as in “just prior to the jump”.

13. September 2012 at 12:23

Scott

By 3:46 pm pixel time, the 10 year rate was back down to 1.74%.

With a drop of water, you have deduced the Niagra. 🙂

13. September 2012 at 12:44

My congratulations as well Scott. Laypeople like me would never have heard about NGDP targeting without you and to the extent we plebs are like the median economist, your influence has been huge.

But one concern: “my hunch is that we are a bit too little and too late to significantly affect this business cycle”. The ECRI thinks so too, arguing that the US is already in recession, which will only become clear over the next few months as the data are revised. Isn’t the danger here that a recession is declared in late 2012/early 2013 and ‘unlimited QE’ gets the blame?

13. September 2012 at 13:50

Bob, That’s right, but I meant that comment for those who don’t believe the EMH, and who take a wait and see approach. The move wasn’t big enough to have a dramatic effect on growth. I think the effect will be positive, but it might be overwhelmed by other factors. If the Dow had jumped 1000 points, it’s unlikely the effect would be overwhelmed by other factors. Hence even those who didn’t believe the EMH would clearly see the effect in the macro data.

Ritwik, The point is that the markets think easy money raises rates. Bernanke said the goal was to lower them. By that criterion he failed.

13. September 2012 at 14:03

[…] US Federal Reserve really delivered today. Its chairman Ben Bernanke announced QE3, but with very big differences to other QE operations. […]

13. September 2012 at 16:38

Long term yields increased on the news, just as market monetarist’s would have expected. And thank God they did! The higher yields are an indication that markets have (slightly) raised their NGDP forecasts going forward

Or, it could mean that the market expected more long term bond QE than what was announced, which increased the demand for, and hence lowered the yields of, long term bonds, but then after the announcement was made, yields rose.

NEVER REASON FROM INTEREST RATES.

13. September 2012 at 16:51

MF, so on that basis, halting QE altogether would cause the stock market to boom?

13. September 2012 at 17:09

Rajat:

No, it would cause it to collapse, because the market priced in QE (actually inflation in general), which raises equity prices.

When bond yields rise, the prices fall.

————–

My arguments is that we cannot infer from rising bond yields that the market is necessarily pricing in additional NGDP. It COULD mean that the market overshot the extent of QE, which raised bond prices “too much”. Then, once the announcement was made, the market repriced the bonds back down to the actual QE. In other words, if the Fed announced a larger QE, then bond yields may have remained stable because the market correctly predicted the Fed’s ACTUAL QE.

On a related note, for the 10 year yield chart that was posted here, if you check it out now, the yield has fallen back down. This fact casts even further doubt on Sumner’s theory, because if the market is actually raising the yields on the bonds because of rising NGDP expectations, then those yields would not have come back down. They would have stayed higher. My suspicion is that the initial spike was the market temporarily being disappointed in the announcement, but then investors quickly realized that the prices went too low given the fact that the Fed is going to give them a risk free profit via QE, so new entrants to the Ponzi scheme came into the fore.

13. September 2012 at 17:25

Eventually, at some point, market monetarists are going to have to get it through their heads that investors, particularly bond investors, don’t give a rat’s ass about “NGDP”. Not in this market when the game is now buy bonds before flipping them to an institution that doesn’t care if it buys bonds that will lose 5 or 10 years from now, because it can print money.

Market monetarists are delayed in their ability of understanding existing market conditions. They actually believe that the recent low yields on 10 and 30 year bonds means that the market is expecting low inflation for the next 10 to 30 years. I spit out my coffee when I first saw that claim being made.

Market monetarists treat NGDP like a hammer for every job.

13. September 2012 at 17:33

Haha, Liberal Roman wants Nobel Prizes to be handed out like coupons.

“you mean those who inflate are inflating more like this man wanted? Give this man a prize!”

What original contribution to economic science are those who want more inflation making? Other than of course more evidence of the state of the quality of the economics profession?

13. September 2012 at 17:37

Hang on MF, if QE causes inflation – and this boosts stocks – why wouldn’t it also cause bonds yields to rise? This is what we have seen. But according to your theory, if bonds are reacting to less QE than expected, it should have caused stocks to fall because there would be less inflation than expected.

13. September 2012 at 17:39

ssumner:

Ritwik, The point is that the markets think easy money raises rates. Bernanke said the goal was to lower them. By that criterion he failed.

The market may think that easy money through bond purchases presents an excellent opportunity to make a profit: buy bonds and flip them to the Fed.

This raises bond prices and lowers their yields.

13. September 2012 at 17:47

Rajat:

Bond yields don’t work exactly like stock prices, not when the Fed is buying bonds.

When the Fed buys bonds, this is done by creating new money yes, but it makes bonds more attractive to buy, because investors can buy bonds and flip them to the Fed. This LOWERS bond yields.

Inflation does not necessarily raise bond yields. What you learned in class, about inflation adding a “premium return” to bonds, is not correct. It presumes that inflation occurs on the side of rising consumer prices only. This model does not take into account the Fed buying bonds and thus adding ann arbitrage like premium to bond PRICES. This lowers bond yields.

Suppose I promised to buy any bonds you offer to sell to me, at whatever price you paid for them. Suppose the money I use to pay you, is money I created in my basement. My actions are inflationary, yes? Do you think that my offer would make bonds more attractive or less attractive to you? More right? Well, what happens to bond prices when bonds become more attractive? They rise in price! Despite future inflation. You don’t plan on holding the bonds until maturity do you? Why would you? You can make a profit by selling the bonds to me!

13. September 2012 at 17:54

This is incidentally one of the reasons I suspect the bond market to be in a bubble. Bond investors are investing in bonds not to hold to maturity, but to flip them, similar to how home buyers during the mature stage of the housing boom purchased houses not to live in, but to flip them.

The housing boom did not last past 2008 because the final holder of the hot potatoes don’t print their own money.

But with the bond market, the final holder of the hot potato is an institution that can print money. The bond market is thus free to bid up bond prices to sky high levels.

13. September 2012 at 18:02

The Fed buys at the market price. If the market expects inflation, the market price will fall and yields will rise. What you’re suggesting is that I could sell bonds to you at a higher price despite the fact that you expect higher inflation in the future because you know you could sell to the Fed. Sounds a bit crazy to me. Also doesn’t explain why yields rose after QE1 and 2 – did the market also underestimate QE then too?

13. September 2012 at 19:03

Is it just me or is MF getting smarter? Still wrong, of course, but smarter. Perhaps I should dress him down for his obliviousness to reason more often?

13. September 2012 at 19:13

Rajah:

The Fed buys at the market price. If the market expects inflation, the market price will fall and yields will rise. What you’re suggesting is that I could sell bonds to you at a higher price despite the fact that you expect higher inflation in the future because you know you could sell to the Fed. Sounds a bit crazy to me. Also doesn’t explain why yields rose after QE1 and 2 – did the market also underestimate QE then too?

No, you’re still insisting that bond prices should fall when the Fed buys bonds. You’re divorcing the concept of inflation from the MEANS by which such inflation enters the market. If consumer prices rose, without the Fed buying bonds, then this may increase bond yields and make bond prices fall. But when you include the means by which the Fed inflates, in this case bond purchases, then this action itself, apart from future consumer prices, makes bonds more attractive as temporarily owned securities.

You have to stop trying to force feed the typical “inflation premium” pedagogical model into real world bond prices. Yes, in another world, inflation will raise bond yields all else equal. But we don’t live in at world. We live in a world where inflation enters the market via conspicuous bond purchases. This makes the bonds more attractive for flipping purposes. This raises their prices. Investors don’t plan on holding these bonds until maturity. They plan to hold them until they can sell them either to the Fed, or to another investor who will sell them to the Fed.

Bond interest rates are no longer anywhere close to traditional market pricing models.

13. September 2012 at 19:17

Saturos:

I’ve corrected you so many times that your claim I am “still wrong of course” actually made me chuckle out loud. Really, if only you did actually show me how I am wrong, I would take your empty boasting more seriously.

You don’t even grasp the concept of economic calculation and catallactics.

How about you actu

13. September 2012 at 19:18

ally try to “dress me down”? Teach me something.

13. September 2012 at 19:20

Rajan:

The Fed does not buy bonds at market prices. The very fact that the Fed is buying bonds with non-market created money generates non-market prices of bonds.

The Fed’s inflation has raised bond prices above their market levels.

14. September 2012 at 00:16

Oh dear. The squatter’s back on the property.

14. September 2012 at 00:43

This could represent a movement from debt to commodities? Lets see what commodities did:

GLD shot up immediately. ~2%

SLV shot up immediately ~3%

Both had been flat for a while.

HAP went up ~8%

DBO (oil etf) was flat. (It should be falling a lot at this time of year)

Now stocks:

S&P was up 1.63%

Since commodities rose on the news more than stocks, I fear the real news from today is mostly inflationary.

14. September 2012 at 02:40

Doc Merlin, commodity spikes reflect real growth as well as inflation expectations. So do stocks. Inflation expectations can only cause current asset spikes through portfolio rebalancing.

14. September 2012 at 10:24

[…] to output… that’s a big step. That’s a good step. And, by the way, that’s a pretty solidly and radically anti-Keynesian step. If you dislike big government and Keynesian economics, then QE3 is a good thing for you. I just […]

15. September 2012 at 06:27

Hmmm, SoberLook says that the 10yr T-yield spike is all inflation: http://soberlook.com/2012/09/longer-dated-treasuries-touch-another.html

So any real growth effect is cancelled by the liquidity effect?

16. September 2012 at 06:52

Saturos–looks that way.

19. September 2013 at 05:13

[…] Here’s what I said minutes after QE3 was announced last […]

2. February 2017 at 08:40

[…] http://www.themoneyillusion.com/?p=16202 […]