Tariffs can be deflationary

Tariffs are generally assumed to have an inflationary effect on the economy. I imagine that’s true in most cases, say a developing country with a newly elected populist government. But is it always true?

In my (still underrated) book on the Great Depression, I explained how the Smoot-Hawley tariff had a deflationary impact on the US economy. Stock and commodity prices fell sharply in April-June 1930, as the bill moved toward passage. The biggest stock market crash of 1930 occurred right after Hoover announced that he would sign the bill.

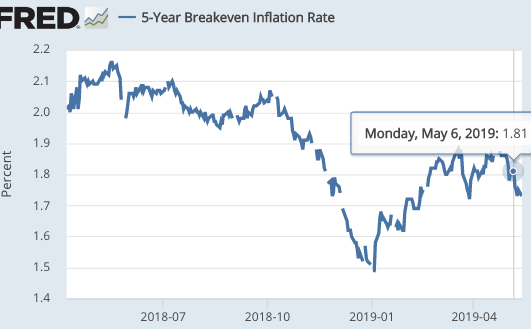

The same appears to be true of the recent trade war with China, which triggered a narrowing of the 5-year TIPS spread, down .08% to 1.73%:

In both 1930 and today, the Fed could have prevented a contractionary impact by an aggressive easing of policy. But in both cases they were reluctant to ease too rapidly, as that would make their previous rate increases look mistaken. (I’ve discussed this problem in previous posts, which is why I prefer daily rate adjustments, to the nearest basis point.)

I suppose that one could also point to the Fed being reluctant to look like they were being bullied by Trump, although that’s highly speculative.

The Fed funds futures now show one rate cut by year end, and another by mid-2020. That does not mean that money is currently too tight, as rates should move up and down with changes in economic growth. A better argument for money being too tight is that the newest Philly Fed forecast for 2020 inflation has dropped to 1.9%, and I suspect even that’s a bit too high, as market indicators suggest even lower inflation.

That doesn’t mean that everything is gloom and doom; the economy will probably do fine if inflation runs at 1.7% over the next 5 years. But if the Fed is going to have a 2% inflation target, it is better that they actually hit their target—if only to put them further from the zero bound.

Trump is arguing that the Fed needs to cut rates because of the trade war with China. Is Trump correct? The 5-year TIPS spread suggests that a rate cut would indeed be appropriate. But given my severe case of TDS, I’m reluctant to give him any credit. I hope readers won’t be offended if I point out that his argument makes no sense. Trump insists tariffs have an expansionary impact on the US economy. If that actually were the case (it isn’t), then Trump would be wrong in arguing that the trade war provides a rationale for the Fed to cut rates.

Trump is probably of two minds. His primitive understanding of trade theory leads him to view tariffs as expansionary, whereas the strongly negative view of stock investors toward tariff news triggers fear in the reptilian part of his brain. (And really, is there any other part?) And that fear leads him to call for the Fed to assist him in the trade war.

PS. Slightly off topic, but this David Beckworth tweet gets to the heart of the problem with monetary policy:

Here is my real critique: the Fed can get all the new tools in the world–neg rates, yield curve control, auto QE, etc.–but with a low inflation target regime they probably won’t matter much. IMHO, the past decade has shown us it is the monetary regime not the tools that is key.

I worry that the profession is focused too heavily on technical gimmicks, and is missing the bigger picture.

Tags:

15. May 2019 at 11:05

Would it be unreasonable to believe the tariffs are contractionary in the short term, but may lead to expansion if they successfully cause China to be more open to foreign investment and to enforce intellectual property rights?

15. May 2019 at 11:09

Very interesting. If you have time, can you lay out the mechanics or theories behind tariffs being deflationary? Thanks!

15. May 2019 at 11:21

Bill, Tariffs reduce the equilibrium interest rate, as they lead to slower expected economic growth. If the central bank does not reduce the policy rate, then monetary policy becomes tighter.

15. May 2019 at 12:06

Scott,

The analysis without TDS would probably go in quite a different direction (and would also abandon ad hominem): Trump seems to use tariffs mostly in order to reach a deal. He seems to be against long-term tariffs, he seems to regard them as leverage.

He also seems to have a keen sense of monetary policy because he recognizes the deflationary effects of tariffs by looking at market reactions, which is the smart thing to do.

I think TDS also prevents you from seeing the bigger picture. Trump is a simple populist, but surprisingly closer to a realistic monetary policy than most other politicians.

Most other Western politicians either demand very tight money, or they don’t even know what monetary policy is, or they want massive regulation and government spending in very questionable areas (as a major extension to monetary policy or even as a complete substitute). And not so infrequently even all three things together.

15. May 2019 at 12:17

So in some sense, the drop in the 5 year breakeven means that the market has some doubts that the Fed will fully offset.

15. May 2019 at 12:48

Christian, Lighten up, I was just pointing out that Trump’s comments make no sense. You suggest that Trump does not really believe what he says (you kept saying “seems” over and over and over again.) I suppose you can project whatever views you want, but I was merely pointing out that his public comments on monetary policy are nonsense. That’s all.

BTW, I suspect that Trump really does believe that tariffs help the US economy, although I can’t be certain. But the stock market will probably scare him into a deal.

Could you just once respond to what I actually wrote?

Bill, Yes, it does.

15. May 2019 at 13:53

Oh Scott,

That’s just because I’m careful with interpreting statements from other people. I know a bit Wittgenstein, and I can not peek into the brains of other people. I can only interpret what they say.

I continue to think that he looks at market responses, especially regarding monetary policy, and that he sees tariffs above all as leverage, because simply put, that’s just what he says and does. At most, it’s interesting that one can observe and present these things so differently.

It seems to me that you still have TDS, which means for example, that you always seem to use the most contradictory interpretations of his statements and actions. It seems you don’t even try to get them in line. I try to get his statements and actions in line, simply because I try this with all people, unless they are psychotic or something else (and even then you can get them in line). “Reptile brain” is kitchen sink psychology, by the way.

I don’t see the contradictions in his statements, at least not in the ones you mentioned. It seems to me it’s mostly TDS again.

I’m sorry if I made you upset.

15. May 2019 at 13:58

“Tariffs reduce the equilibrium interest rate, as they lead to slower expected economic growth. If the central bank does not reduce the policy rate, then monetary policy becomes tighter.”

Is Scott Sumner of all people suggesting monetary policy is really about interest rates?

Of course, I don’t think you are, Scott. I’m still just trying to gauge how this view fits in with your otherwise consistent view that NGDP is always under control of the CB. Perhaps it’s just because nobody can reliably estimate the natural rate, so it should be set by market forces (which is a principle I support).

15. May 2019 at 14:39

I’m just trying to get you on the FED board. Am I helping? I guess not.

15. May 2019 at 15:45

“IMHO, the past decade has shown us it is the monetary regime not the tools that is key.”

True that, as Australia has been demonstrating since 1993 …

15. May 2019 at 16:05

I hereby state for the record that Scott Sumner’s book on the US-European Great Depression is the best. Not underrated by me!

I hope Sumner’s next book is on the Great Depression that did not happen in Japan.

There are tools and regimes…but some tools work better than others.

15. May 2019 at 16:14

‘I was just pointing out that Trump’s comments make no sense.’

Neither did most of Obama’s about economics. Have we forgotten when he told us that he thought it a settled matter that fiscal policy is the way out of recession? That profits eat up overhead?

15. May 2019 at 20:09

Scott,

I’m glad there are economists like you who are so sound on the fundamentals. I’ve seen good economists recently saying that, because the tariffs represent real shocks, there’s nothing the Fed should do. And this was an economist who favors NGDP level-targeting! Monetary policy is very confusing, even to many economists.

16. May 2019 at 03:48

OT:

“Tackling Income Inequality Requires New Policies”

MAY 15, 2019

By IMFBlog

Español, Português

The hollowing out of the middle class, rising social and political tension, lack of education, globalization, and rapid technological change are just a few of the many drivers of growing income inequality. (more…)

—30—

Suddenly, there has been a Niagara of articles from frontline globalist organizations and people despairing of the vanquished middle class. The above is yet another.

The Fed’s Governor Lael Brainard just got into the act too.

Ray Dalio is saying MMT is coming.

Was some signal sent recently?

16. May 2019 at 13:31

Christian, It “seems” like you are not very good at reading comprehension. Here’s an idea, why not respond to what I actually say, not your preconceived ideas about my TDS. I said his statements on monetary policy are nonsense. You said it seems like he might have some understanding beyond the idiotic things he says. Maybe so, but that doesn’t invalidate what I said, does it?

You said:

“I don’t see the contradictions in his statements, at least not in the ones you mentioned.”

Well then you are not very perceptive.

Michael, You said:

“Is Scott Sumner of all people suggesting monetary policy is really about interest rates?”

No, but the central bank currently targets interest rates. I wrote an entire book about the interwar global gold market, when they targeted the price of gold.

I do think NGDP is under the control of central banks, but I also think they make mistakes on occasion.

16. May 2019 at 20:53

“I do think NGDP is under the control of central banks”

Ah yes, the cult of the omnipotent central bank, where the CB that can barely hit 2% inflation can somehow hit 3% inflation (5% NGDP growth) just through the magic of expectations! And prevent every recession/depression no matter how large the shock!

16. May 2019 at 21:30

Paul, You said:

“Ah yes, the cult of the omnipotent central bank, where the CB that can barely hit 2% inflation”

Yes, the Fed has raised rates 9 times since 2015, all because it is unable to raise inflation to 2%.

Sometimes the stupidity of my commenters makes my head spin.

17. May 2019 at 05:38

Regarding your excellent book—-why are the prices so high? It is not quite the price of forced purchased books by professors—but it is too high. I don’t know what control you have over prices—-but I would lower them if I could—-there should be great interest in it.

17. May 2019 at 05:50

If our Fed is “intimidated” by Trump, then they are the wrong people—but Trump’s attempt at a mini-stacking (Cain and Moore) has failed—-he is not relevant to Fed policy in my opinion. I have been “trained” to believe the Fed is always behind the 8 ball— always fearing 1980 will pop up out of nowhere and with an institutional bias toward tightening. No matter how many times in history this has caused problems, they seem unable to let go. On the other hand, I admit to not having a sense of how 25bps 8 months from now should impact the economy at all—except that “actors” (investors, companies, etc) believe it should. Re: Tips—-even as a market guy—for some reason I do not Trust Tips in the short run.

17. May 2019 at 15:27

Paul,

I don’t think your comments are stupid, although I do agree with the market monetarist perspective. I acknowledge that there is something that looks like handwaving going on when explaining why nominal rates stay near or even below zero for years on end. I think it’s understandable that some conclude that monetary policy has limits of effectiveness under such circumstances, given the sheer number of central banks that have struggled under these circumstances. Are they all just too dumb to realize they can just inflate their way out of trouble? It seems hard to believe.

That said, market monetarists generally favor a monetary regime change. Inflation-targeting has some well-known limitations that make it more subject to ineffectiveness. So, we need to see NGDP-level targeting in action before passing passing ultimate judgement on whether central banks really are omnipotent when it comes to spurring nominal spending. And in the pursuit of hitting NGDP-level targets, central banks must be willing to do whatever it takes, including helicopter drops, if necessary.

In reality, market monetarism is unproven. There’s not a tremendous amount of evidence to support any model, as there isn’t much relevant economic data available. I think market monetarism fits the data in a very limited sense better than other models of which I’m aware, but I’m also open to being wrong.

And, of course, NGDP targeting is unproven. There’ve been periods of time in which some central banks have seemed to effectively engage in NGDP targeting, with success, but I don’t claim those to be convincing tests. It’s not uncommon in economics for ideas that seem solid theoretically to fail miserably empirically. More often though, there isn’t enough convincing data to settle such questions for most.

To me, market reactions are the most convincing evidence market monetarism is correct. Even if you think markets are less rational than I do, it is markets that have to be convinced that a given stimulus will work.

17. May 2019 at 20:04

Michael Sandifer:

Yes, the central bank can do whatever it wants, but that stimulative monetary policy will necessarily need to, as Scott said, be conducted via interest rate changes. QE and helicopter money are fiscal policies designed to look like monetary policy.

Neither of those sound particularly appetizing to Friedmanite free-market warriors who want to implement monetarism in order to discredit fiscal policy and deregulate the financial system.

18. May 2019 at 01:31

Scott,

Off-topic, I wonder if you’ve seen this:

https://www.aier.org/article/sound-money-project/did-tight-monetary-policy-result-sluggish-recovery

The claim, by an NGDP targeting proponent, is that, while tight money was initially a problem that caused the Great Recession and the initial slow recovery, it has primarily been the Fed’s floor operating system responsible for sluggishness since 2014. The floor system is blamed for restricting bank lending.

18. May 2019 at 01:57

Paul,

But, as you may know, the market monetarist position is that interest rates are a result of monetary policy, not a cause. The Fed’s QE programs were moderately effective, despite nominal rates remaining above 0, clearly above the natural rate each time.

18. May 2019 at 01:59

Paul,

And I don’t see how QE can be considered fiscal policy.

18. May 2019 at 11:00

Michael Rulle, You said:

“I don’t know what control you have over prices”

Like most authors, I have zero control. The money cost of reading the book is small ($25 on Amazon, less for the ebook) compared to the time cost. I devoted many years of my life to the project, $25 doesn’t seem that out of line.

Paul, Helicopter money is combined fiscal/monetary policy. QE is monetary policy with a trivial fiscal component (like all monetary policy.)

Michael Sandifer, The floor system is part of the tight money. So it’s not either/or.

18. May 2019 at 11:10

Scott,

Thanks for clearing that up, because that was my impression, before I read the article.