Spain’s other depression

Paul Krugman has a new post comparing Spain and Florida. He notes (correctly in my view) that one reason Florida has recovered more rapidly is that they are part of a fiscal union.

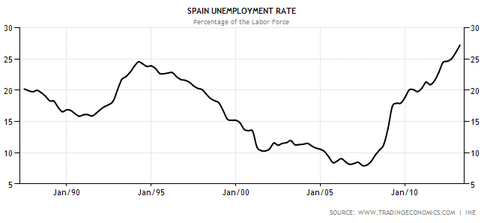

However we should not lose sight of the fact that the supply-side also matters, even in depressions. Here’s the Spanish unemployment rate since 1987:

Note that during the depression of the early 1990s (when Spain still had its own currency) their unemployment rate rose from 16% to 24%. I don’t recall if they devalued during that cycle, but they certainly had the ability to devalue. And of course what’s striking about that period is not so much that Spain’s unemployment rate rose by 8 percentage points, but rather that it only fell to 16% at the peak of the previous boom!

To say Spain has structural problems with its labor market would be an understatement.

I would encourage people to avoid either/or debates in this area. Yes, Spain has a really, really high natural rate of unemployment, due to poor labor market policies. And yes, Spain had a really, really big increase in cyclical unemployment during this depression, due to sharply falling NGDP. Both hypotheses are true.

Tags:

26. June 2013 at 12:12

It’s charts like these that highlight that, hey, maybe Spain really should stay on the Euro. Not because it’s good monetary policy by any means. But because Spain is not really capable of ‘good’ monetary and fiscal management on their own anyways and there are benefits to being in the monetary union. Although as unemployment heads upwards, they may wish to revisit this approach.

26. June 2013 at 12:23

The Peseta fell about 15% at the time of the Europen currency crisis, and drifted another 15% over the next few months.

26. June 2013 at 14:37

Thanks Doug.

26. June 2013 at 20:23

Yes—I think Krugman missed it.

The USA has had tight money, but the EU has had even tighter money. And Spain has ossified labor markets.

That explanation strikes me as the most powerful.

26. June 2013 at 23:56

What you don’t see in the numbers is the black market employment which (depending on who you ask) is worth at least 5 – 7 % of employment on top (and probably more as times get harder).

if you trust the numbers blindly, you dont know what you’re looking at

27. June 2013 at 01:57

A more interesting question would be how did they manage to get unemployment below 10% between 2005-08 with such terrible structural problems?

27. June 2013 at 04:37

Does anyone have information on the relative performance of Spains co-operative large sector? This is pure bias, but I can’t imagine it helped.

27. June 2013 at 04:43

My bias betrayed me. Is wage stickiness less of a problem for co-ops? Or, another way of looking at it: in recessions does the “employment stickiness” of co-ops pay off? Would be an interesting area of research.

“And as Spain struggles through double-dip recession, fierce austerity and 26% unemployment, this is one company that is not about to collapse. Nor has it shed many jobs, with the workforce remaining steady at around 84,000 people worldwide – about a sixth of them outside Spain.

The reason? “We are more flexible,” said Emilio Cebrián, the social director at Mondragon’s biggest individual unit – the Eroski supermarket-based group. “When times are bad, we cut wage costs by deciding it among ourselves.” And, as owners, they also forsake dividends.

Exposed to a Spanish economy shrinking at an annual 1.9%, Eroski has just agreed a fresh round of wage reductions. Workers’ incomes will drop by 5%-10%.”

http://www.guardian.co.uk/world/2013/mar/07/mondragon-spains-giant-cooperative

27. June 2013 at 10:44

Steve, I agree, and certainly didn’t suggest that I trust the numbers.

Rob, They had a huge housing boom. A normal country would have had 2% unemployment.

Sam, Interesting, but wage stickiness is only part of their labor market problems.

29. June 2013 at 06:54

Yeah, Spain’s labor problems are huge. Still, I don’t think that you could wave a magic wand, bring in employment at will into the country, and get any significant improvement.

Spain is just stuck in a different equilibrium due to their low trust society. A firm is most competitive there not by giving you the best bid, but by being owned by your uncle’s brother in law. Then you know that the job will be shoddy, or more expensive than it should be, but at least you won’t get completely shafted. Want a government contract? Befriend a politician!

Until an entrepreneur can focus on running a lean business, and a good worker can expect payment that is commensurate with his contribution, Spain will not be competitive.

29. June 2013 at 07:48

I hear – anecdotically – that Spanish engineers are shipped by the plane loads to Germany for employment interviews these

days. Germany is still in need of more engineers.

3. July 2013 at 07:22

bob, I agree that Spain could benefit from many different reforms.

mbk, That doesn’t surprise me.