Somebody should look into wage inflation targeting

That was the message at a recent Brookings conference, which looked at why inflation has remained lower that predicted in Phillips Curve models.

At one point (around 3:28), Olivier Blanchard suggested a wage inflation target made more sense, as the wage inflation Phillips curve is much more reliable than the price inflation Phillips curve. Then Blanchard said this about wage inflation targeting:

. . . which I think hasn’t been examined and should probably have been . . .

This made me smile, as back in 1995 I published a paper showing that wage inflation targeting might be superior to price inflation targeting. Mankiw and Reis (2002) also suggested that wage inflation targeting might be superior. And of course other economists like Earl Thompson did so even earlier.

In the end, I decided that wage inflation targeting was not politically feasible, as tightening money to slow wage growth would be too controversial.

Later in the session, Paul Krugman indicated that he also found the idea of wage inflation targeting to be appealing, but worried that wage inflation targeting was not politically feasible, as tightening money to slow wage growth would be too controversial.

As David Beckworth recently tweeted, seeing the advantages of wage targeting is the first step in convincing people that NGDP targeting is the way to go, as the ideas are related (albeit not identical.)

It’s interesting to see big names in the field coming around to ideas that George Selgin and I have been advocating for decades.

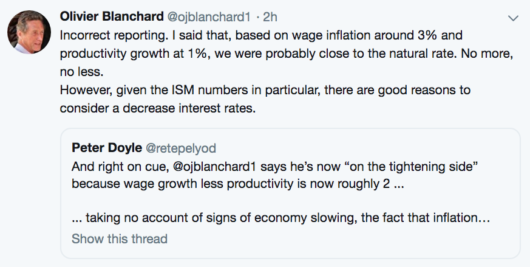

PS. Blanchard recently tweeted:

Actually Doyle’s tweet was accurate, and referred to comments Blanchard made between 3:29 and 3:30. Glad to see that Blanchard changed his mind. The Fed needs to be more expansionary.

Actually Doyle’s tweet was accurate, and referred to comments Blanchard made between 3:29 and 3:30. Glad to see that Blanchard changed his mind. The Fed needs to be more expansionary.

Tags:

3. October 2019 at 16:03

Slowly, slowly, then all at once. Hopefully. The ideal outcome is when people start acting as if they always believed that …

3. October 2019 at 16:43

It’s a shame that even top economists know so little history of thought. The idea of wage targeting, or of a stable money wage ideal, dates from the days of classical economics, when it sometimes was referred to as a “labor standard of value” (not be be confused with the labor _theory_ of value). Gunnar Myrdal one his Nobel prize, ostensibly at least, for a work in which he argued for stabilizing a wage index. I could name dozens of other pre-1936 sources.

3. October 2019 at 17:08

Still, this conversation appears to me a bit antique. I think the problem going forward will be maintaining aggregate demand and worrying less about inflation by this or that metric.

As the global population urbanizes, the ubiquitous problem appears now not wage inflation but inflation in property rents. Hong Kong has become the poster boy for the way a modern economy works, or doesn’t.

Yes, my comment might appear to be mixing apples and oranges, mixing a local structural impediment with a general macroeconomic concept.

But when a structural impediment becomes ubiquitous, it then requires recognition and treatment by the macroeconomic policy-making apparatus.

For the residents of Hong Kong, what good is the proper treatment of wage inflation?

3. October 2019 at 19:02

add on (sorry)

I sometimes think if you asked a globalist how to solve the problems of Hong Kong, they would answer, “More immigration, more free trade, and keep wage-inflation under control.”

So…does the globalist solution work for Hong Kongers?

Where else in the developed world does the globalist solution work or fail?

3. October 2019 at 19:07

Benjamin, I think you’re onto something. Nick Rowe has long been saying that land prices are a monetary variable. What point is there in stabilizing wages when land prices are free to oscillate as part of an international financial cycle? Wages are pretty sticky already, but housing is free to boom without much restraint. We should do something about that.

4. October 2019 at 02:02

Trigger warning: Please make sure Scott Sumner is comfortable and sitting down before he reads this.

—–

It Is Time for the United States to Stand Up to China in Hong Kong

Tweets aren’t enough. Washington must make clear that it expects Beijing to live up to its commitments—and it will respond when China does not.

BY ELIZABETH WARREN | OCTOBER 3, 2019, 1:30 PM

People hold signs reading “Don’t shoot our kids” as they gather in the Tsuen Wan area of Hong Kong on Oct. 2.

“As the Chinese Communist Party commemorates 70 years of the People’s Republic of China by parading its military hardware in Beijing, the people of Hong Kong are struggling for their rights. For months, the world has watched as protesters in Hong Kong stood bravely in the face of police and state violence. They deserve our support….

China’s economic policies undercut American workers. Its military ambitions and coercive diplomacy threaten peace in Asia and beyond. Its repression at home, including its treatment of the Uighur minority, and attacks on norms abroad risk eroding liberal values around the world.”

===30===

There is much more. Foregin Policy magazine, sort of a centrist outfit. I think.

https://foreignpolicy.com/2019/10/03/it-is-time-for-the-united-states-to-stand-up-to-china-in-hong-kong/

4. October 2019 at 03:46

@ B Cole

Rents are only really high in a few cities (looking only at US and Canada). For what it is worth, rent is included in price baskets used to determine inflation, so rising rents would be reflected in wage data as lower real wages, ceteris paribus.

As far as globalism is concerned, well, the only connection I can seen between the issues of cities like HK (or Sydney or SF) is that they don’t have policy regimes that result in enough new units of housing being built. In HK it appears to be the result of collusion by the property tycoons who run the government. In Sydney and SF it is the fact that ordinary residents don’t want developers to tear down short buildings to put up the thousands of skyscrapers that are needed to make housing affordable (and those buildings likely would be profitable). The only connection I see to globalism is that building all those homes would require a lot of workers, and probably a lot of immigrants.

4. October 2019 at 07:29

Ben, Trump told Xi that he would not criticize China over Hong Kong. I agree with people like Warren who say Trump should criticize Xi over Hong Kong. I presume you agree with Trump? Always hard to tell with your comments.

4. October 2019 at 15:28

Just for amusement value: I keep getting ads warning about Australia’s impending recession when I look at this blog. I believe I have been seeing these ads for at least 5 years, maybe considerably longer.

Reminds me of The Economist predicting the collapse of the Australian housing bubble…

4. October 2019 at 16:36

Scott Sumner:

Regarding Hong Kong, I am not sure what the right thing to do is, from the perspective of American foreign policy. It looks like a no-win situation, from both the perspective of national interest and from an altruistic position.

However, if you read past the headline, Elizabeth Warren has all but declared China the enemy, arguably even exceeding Trump in his perspective of China.

I would say Elizabeth Warren has placed herself to the right of Don Trump, from the perspective of old Cold War politics.

4. October 2019 at 16:49

Anwer Khan:

Indeed, the obsession with wage inflation and the fleeting interest in rent inflation is another feature of the Temple of Orthodox Mcroeconomic Theology.

The solution to rent inflation is of course free markets, that is the elimination of property zoning.

In Hong Kong, a propertied-financial class colludes with government to make sure property development is limited, thus keeping prices high and loans on property safe.

As property zoning is ubiquitous in developed nations, and control of property zoning by the propertied-financial class also ubiquitous, this raises a serious question for students of macroeconomics and living standards.

If you want an honest take on Hong Kong, embarrassingly enough you have to go to Beijing. While Western economists ballyhoo the freedom of the Hong Kong economy, Beijing has correctly pointed out the role of artificially restricted real estate development in undercutting Hong Kong living standards.

4. October 2019 at 19:24

Lorenzo, There’s a commenter who comes here once a year telling me the recession has already started. Haven’t seen him in a few months.

Ben, You said:

“While Western economists ballyhoo the freedom of the Hong Kong economy, Beijing has correctly pointed out the role of artificially restricted real estate development in undercutting Hong Kong living standards.

Yeah, “Western economists” are just completely unaware of the housing market problem.

(Yes, I’m being sarcastic.)

4. October 2019 at 21:41

Benjamin I am definitely with you on the problems of adequate housing supply, especially in hot markets, after reading commentary from many economists that I respect. As Scott notes above, the problem is well-known and we all wish we could influence the politics somehow to make progress on this issue. But I’m also attracted to measures that deter foreign buyers looking for safe places to park their cash, and not actually using these properties for housing. Here in Canada we used a tax on foreign buyers, which seemed to help cool off the Vancouver market. I don’t know if is or will be tried here in Toronto, which I just saw listed as the second-highest inflated market in the world. In Australia the problem of foreign buyers driving up property values comes up often in public policy discussions. Hopefully we can find good ways to deal with this problem of “capital” flowing uphill, or at least implement the most obvious deterrents.