So what’s the forecast NOW?

Back in the early spring, we were told that without fiscal stimulus we would have an economic disaster. In fact, Congress produced by far the largest peacetime fiscal stimulus in history; indeed nothing else even comes close. And this was followed by what was by far the worst quarterly collapse in GDP ever.

In fairness, it’s quite possible that the Q2 collapse in GDP would have been even worse without the stimulus, although I suspect that some elements of the stimulus such as giving $2400 to upper middle class families that were terrified to go out shopping were mostly “wasted ammunition”.

In recent weeks there has been a drumbeat of hysteria on the internet claiming that without another massive fiscal package by August 1st, the economy will falter. So here’s my question. What is the conventional wisdom of Keynesian macroeconomists? What exactly are they predicting will happen if Congress doesn’t pass another package this month?

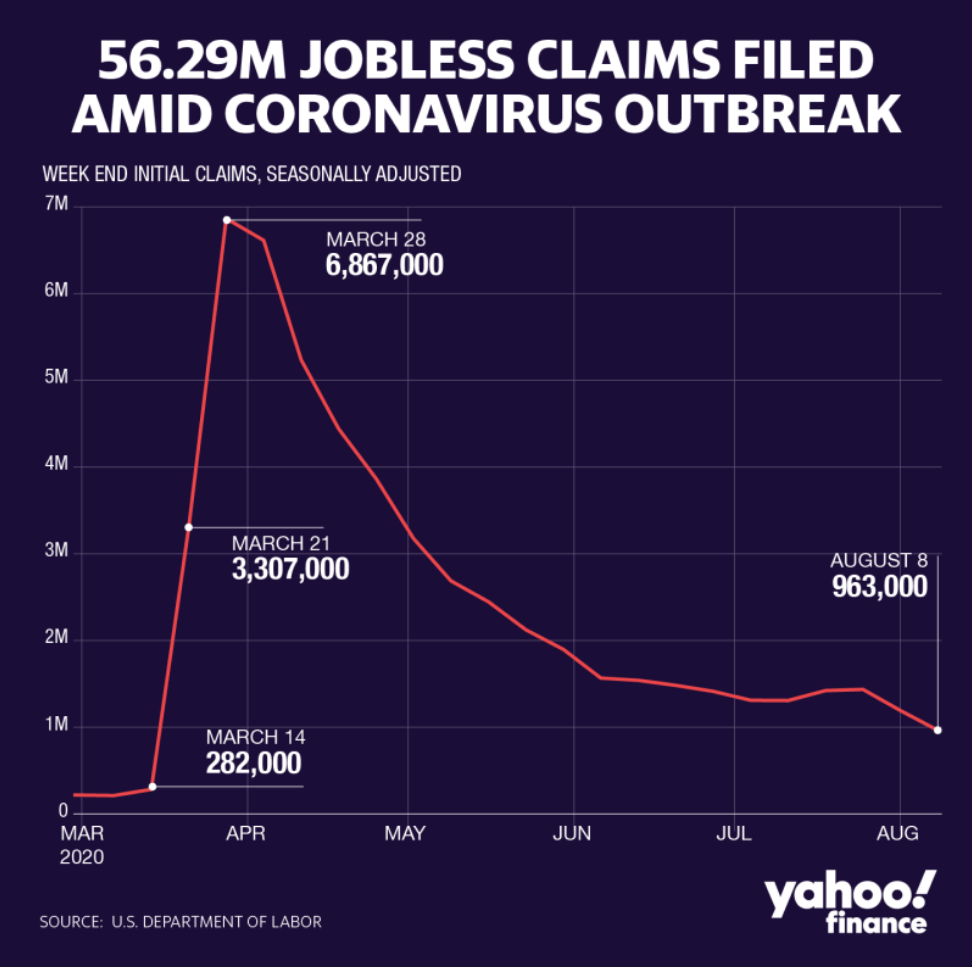

Here’s the latest data on new unemployment claims, which began edging upward in July with the second wave of Covid-19, but fell sharply below expectations in the week of August 8:

Too soon to draw any conclusions (and other data is weaker), but not too soon for Keynesians to make their predictions. It might also be fun to revisit 2014, when Keynesians predicted a slowdown in job growth after the end of extended unemployment compensation, and job growth actually accelerated by 700,000 (from 2.3 million to 3 million).

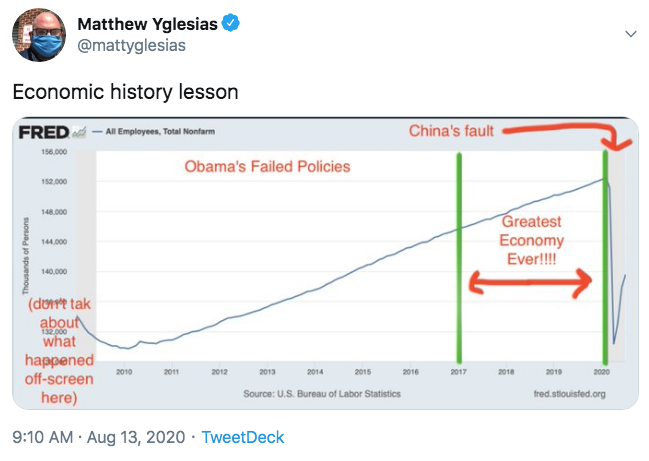

Matt Yglesias has a cute tweet showing the silliness of claims that Trump produced a great economy, but missed an opportunity to highlight the 2014 acceleration in employment, or the non-recession of 2013 after major fiscal austerity.

PS. Speaking of Yglesias, he also directed me to a article exposing that fact that the sexual witch hunt in Amherst had was motivated by political considerations. So does that mean I was wrong about stupidity in my recent post? No, because the bigger problem isn’t that there are a few nuts at Tulane and Amherst, it’s that they now control the universities. That means the administrators are stupid. And if they are controlled by trustees, then the trustees are stupid. The point is that someone is stupid. (And not just me.)

As an aside, I vaguely recall reading that the Salem witch hunt also had a hidden political agenda. Is that right?

PPS. By the way, I’m going to recommend Yglesias’s new book “One Billion Americans”. I have not actually read the book, but I know it’s good. How do I know? Because Yglesias is a very smart progressive who wrote a book with enormous appeal to national greatness conservatives (more people than China by 2100!), libertarians (Yimby! plus mass immigration) and religious conservatives (more babies!) How can such a book not be interesting? It’s as if Scott Alexander wrote a book on psychiatry or Tyler Cowen on the sociology of intellectuals in the 21st century. It literally cannot be bad.

Tags:

13. August 2020 at 12:17

One Billion Americans: The Case for Thinking Bigger

Not that Yglesias could change the title but “One Billion Americans” is a cool title by itself and doesn’t require a colon and elaboration.

13. August 2020 at 12:58

Not sure of what Sumner wants here. A prediction? OK, Keynesians predict that without another round of stimulus, the economy would be even worse. If in fact it improves without stimulus, the Keynesians would claim it would have improved even more with a stimulus. The Keynesians cannot logically be rebutted. Reminds me of Sumner’s NGDPLT, which literally is backward looking and cannot be rebutted either. Iron tight logic, like Marxism.

13. August 2020 at 16:25

Scott Sumner may be right or wrong in this post, and of course, in macroeconomics, no debater is ever right or wrong.

But it is not rabble-rousers in the peanut gallery who are calling for more fiscal stimulus. It is central bankers!

https://www.bloomberg.com/opinion/articles/2020-07-07/coronavirus-u-s-can-t-wait-half-a-decade-for-a-jobs-recovery

Mary Daly is just the most recent in a long line.

Some central bankers, such as Stanley Fischer, even call for the Federal Reserve to have a permanent fiscal facility ready to deploy when needed.

New totems are being erected in the Temple of Orthodox Macroeconomic Theology.

Dr. Ray Lopez is right, that the difference between theology and tautology is very thin.

13. August 2020 at 16:58

I think the worry is that the productive capacity of the economy is deeply depressed compared to 2014.

13. August 2020 at 17:13

One billion more people living in North America?

Milton Friedman said the US could have open borders, but in the real world then would have to eliminate the welfare state.

The US evidently cannot build more than 1 million net new housing units a year, largely due to property zoning.

The US can barely build infrastructure, and Scott Sumner has said the US is so bad at building infrastructure it should not even try.

—-

So, to wrap it up, in the real world the US has a welfare state and that will not change, the US will not build much housing and that will not change, and the increase in infrastructure will be minimal, and that will not change.

But the free-market theology call for more immigration!

Or, you can just move the Mumbai to get the same effect. Except Indians tend to be civil and pleasant people.

13. August 2020 at 17:18

Has it occurred to you that a Mayor should not be banging students at the local university? It doesn’t matter if they are consenting adults. You have to realize that people 31 year old incompetent mayors banging 20 year old girls is a bit creepy. It makes you wonder why he ran for office. Was it to help the community, or use his position of power to lure woman into his office for a blowjob? At some point, the man has to grow up and realize that even if HE CAN, he shouldn’t. Especially when you are a public official. He shouldn’t be reelected. And that is the type of news people should know about. I don’t want my Mayor banging teenage girls when his dick is hard 🙁

13. August 2020 at 17:57

With respect to 2013/2014 I think this Larry Summers quote is relevant:

Imagine a universal basic income could pay $10,000 per person—that would require nearly a doubling in the federal budget, or more than a doubling in federal tax collection, in order to finance it. That doesn’t seem to me to be remotely tenable. If you make it inexpensive, then you’re not going to be doing very much to help poor people.

I also think that contrary to economic theory, which supposes that leisure is good and work is bad, that many people derive satisfaction from work and from being a contributing part of the community. The idea that a fortunate minority of the economy should buy the peace from a majority that doesn’t work seems to me the basis for a very unhealthy society.

TAI: At least on that one point, then, you disagree with Keynes.

LHS: There’s a lot of empirical evidence since Keynes wrote, and for every non-employed middle-aged man who’s learning to play the harp or to appreciate the Impressionists, there are a hundred who are drinking beer, playing video games, and watching 10 hours of TV a day.

13. August 2020 at 18:11

Xu, You said:

“Has it occurred to you that a Mayor should not be banging students at the local university?”

Actually, that thought never occurred to me. Here’s what thought did occur to me. Mind your own &$#@&%* business and don’t interfere in the personal life of other people.

And what makes you think he’s dating “girls”?

13. August 2020 at 19:20

Q. And what makes you think he’s dating “girls”?

A. Those “girls” wore wigs.

Sorry, sorry, sorry, non-PC I know.

13. August 2020 at 19:46

One problem I think is the framing: A Fiscal Cliff. That’s not what we’re facing. It’s more likely to start out slow and snowball, all the while being affected by other events (most notably Covid).

Under normal circumstances I am sympathetic to your view of monetary policy above all else. This is not a normal circumstance. We need a strong fiscal response to keep as many people afloat as possible until we come out on the other side. That fiscal response should be framed as disaster relief instead of stimulus, because that’s what it is.

14. August 2020 at 00:05

“We need a strong fiscal response to keep as many people afloat as possible until we come out on the other side.”

As long as it is financed by ‘new’ money?

“Equation (22) indicates that the change in government expenditure ∆g is countered by a change in private sector expenditure of equal size and opposite sign, as long as credit creation remains unaltered. In this framework, just as proposed in classical economics and by the early quantity theory literature, fiscal policy cannot affect nominal GDP growth, if it is not linked to the monetary side of the economy: an increase in credit creation is necessary (and sufficient) for nominal growth.

Notice that this conclusion is not dependent on the classical assumption of full employment. Instead of the employment constraint that was deployed by classical or monetarist economists, we observe that the economy can be held back by a lack of credit creation (see above). Fiscal policy can crowd out private demand even when there is less than full employment. Furthermore, our finding is in line with Fisher’s and Friedman’s argument that such crowding out does not occur via higher interest rates (which do not appear in our model). It is quantity crowding out due to a lack of money used for transactions (credit creation). Thus record fiscal stimulation in the Japan of the 1990s failed to trigger a significant or lasting recovery, while interest rates continued to decline. ”

http://eprints.soton.ac.uk/339271/1/Werner_IRFA_QTC_2012.pdf

14. August 2020 at 05:00

Scott – shouldn’t the focus be on how fast the unemployed come back into the workforce? New unemployment claims will bottom out eventually. Tyler Cowan talked with Nicholas Bloom this week and this quote is worth pondering, “…the stock market does not reflect the US economy. The stock market, for example — right now it’s 30 percent high tech, which has only 7 percent of US jobs. Also, when interest rates drop because the economy slows, it makes the stock market go up because it’s suddenly a relatively better investment. I think the stock market and the state of the US economy are only weakly linked.”

I continue to believe that a huge number of jobs lost to the pandemic are gone forever and there will be significant disruptions to the recovery in trying to find employment for these people.

14. August 2020 at 06:14

Re: “But velocity was actually increasing during late 2007 and early 2008, and more than 100 percent of the slowdown in NGDP growth was due to the Fed sharply slowing the growth of the monetary base”

Vi, income velocity is a contrived metric. It is Vt that matters. Vt fell. And the G.6 release was discontinued in 1996.

And your wrong about the monetary base. Friedman’s base has never been a base for the expansion of new money and currency. An increase in the currency component of the base is contractionary. It is always offset by an increase in FED credit. 90 percent of “MO” was currency prior to Oct. 6, 2008. There is no “expansion coefficient” assigned to the currency component.

see: “Quantitative Easing and Money Growth: Potential for Higher Inflation?

http://bit.ly/yUdRIZ

Dr. Daniel L. Thornton (former senior economist, FRB-STL)

D.L. Thornton Economics LLC

“the close relationship between the growth rates of required reserves and total checkable deposits reflects the fact that reserves requirements apply only to checkable deposits”

I.e., the monetary base contracted (less than zero) for 29 consecutive months, turning otherwise safe assets (MBS) into impaired assets. Ben Bernanke should be in Federal Prison.

14. August 2020 at 06:35

Re: “In late 2008 and 2009, declining velocity was the problem, as the monetary base increased sharply. Now the problem actually was errors of omission, as the Fed was too slow to respond to falling velocity with sufficiently aggressive monetary stimulus.”

You confused velocity (and the natural rate of interest) with the distributed lag effect of monetary flows, volume times transaction’s velocity. It was the distributed lag effect of short-term money flows, proxy for real output, that fell at its worst rate-of-change since the 1930’s.

This was predictable:

We knew in advance, the precise “Minsky Moment” of the GFC:

POSTED: Dec 13 2007 06:55 PM |

The Commerce Department said retail sales in Oct 2007 increased by 1.2% over Oct 2006, & up a huge 6.3% from Nov 2006.

10/1/2007,,,,,,,-0.47 * temporary bottom

11/1/2007,,,,,,, 0.14

12/1/2007,,,,,,, 0.44

01/1/2008,,,,,,, 0.59

02/1/2008,,,,,,, 0.45

03/1/2008,,,,,,, 0.06

04/1/2008,,,,,,, 0.04

05/1/2008,,,,,,, 0.09

06/1/2008,,,,,,, 0.20

07/1/2008,,,,,,, 0.32

08/1/2008,,,,,,, 0.15

09/1/2008,,,,,,, 0.00

10/1/2008,,,,,, -0.20 * possible recession

11/1/2008,,,,,, -0.10 * possible recession

12/1/2008,,,,,,, 0.10 * possible recession

RoC trajectory as predicted. Nothing has changed in > 100 + years

Milton Friedman, in the Journal of Political Economy: “The Lag in Effect of Monetary Policy”

Vol. 69, No. 5 (Oct., 1961), pp. 447-466 said:

“This would mean that effective monetary action requires an ability to forecast a year ahead, not an easy requirement in the present state of our knowledge.”

Which lead Friedman to conclude:

“The central empirical finding in dispute is my conclusion that monetary actions affect economic conditions only after a lag that is both long and variable”

Not so. I cracked the code in July 1979. The distributed lag effect of money flows have been mathematical constants for over 100 years.

14. August 2020 at 06:45

re: “The Fed acknowledged that the payment of interest on bank reserves was a contractionary policy, as it essentially sterilized the reserves that were then being injected into the banking system to provide liquidity”

Scott Fullwiler’s “Paying Interest on Reserve Balances: It’s More Significant than You Think” is blasphemy. The NBFIs are the DFI’s customers. Savings flowing through the nonbanks never leaves the payment’s system. The NBFIs are not in competition with the DFIs.

I.e., Bankrupt-u-Bernanke destroyed the nonbanks (just like the DIDMCA of March 31st 1980 did, caused the Savings and Loan Association crisis and the 1990-1991 economic recession.

14. August 2020 at 06:49

re: “Because the Fed was still fearful of inflation, it did not want these bank rescue operations to reduce interest rates and stimulate the broader economy”

You don’t know a debit from a credit. Banks don’t loan out deposits, they create deposits. All bank-held savings are frozen.

So you get FOMC schizophrenia: Do I stop because inflation is increasing? Or do I go because R-gDp is falling? — simply because, in the latter stages of an economic expansion, as interest rates rise, savings become increasingly impounded within the confines of the payment’s system, thereby destroying money velocity –and thus AD.

That’s why N-gDp level targeting won’t work, it is “money illusion”.

14. August 2020 at 06:54

Take Dr. Milton Friedman’s “The Lag in Effect of Monetary Policy.” Journal of Political Economy, October 1961, 69(5), pp. 447-66. or:

Friedman’s NBER 1971 restatement: “A Theoretical Framework for Monetary Analysis”

“, I believe, that full adjustment to monetary disturbances takes a very long time and affects many economic magnitudes. If adjustment were swift, immediate, and mechanical, as some earlier quantity theorists may have believed, or, more likely, as was attributed to them by their critics, the role of money would be *clearly and sharply etched even in the imperfect figures that have been available* (my figures were constants).

But, if the adjustment is slow, delayed, and sophisticated, then crude evidence may be misleading, and a more subtle examination of the record may be needed to disentangle what is systematic from what is random and erratic.”

The fact is that money flows are math constants. So we know the precise moment whether money is either robust (has a “sweet spot”), or neutral, or harmful. So instead of N-gDp targeting, the Central Bank must target R-gDp (the output gap).

14. August 2020 at 07:09

It should be remembered that the “administered” prices (oligopoly, monopsony, and monopoly elements) would not be the “asked” prices, were they not “validated” by M*Vt (money times transactions’ velocity), i.e., “validated” by the world’s Central Banks.

And that an increase in money products reduces the real rate of interest and has a negative economic multiplier, whereas an increase in savings products increases the real rate of interest and has a positive economic multiplier.

Thus, the solution to Alvin Hansen’s 1938 secular stagnation thesis is to drive the commercial banks out of the savings business (the opposite approach that has been taken since 1961). So we got stagflation up until 1981 (the end of the monetization of time deposits), and secular stagnation since (exacerbated by the payment of interest on interbank demand deposits beginning in 2008).

The regulatory release of savings in 1980-1981 produced 19.1 % N-gNp in the 1st qtr. of 1981. The implementation of legal reserve requirements in April 1981 on these new money products ended that expansion.

14. August 2020 at 08:24

rwperu, The aim of those $1200 checks to people with good jobs is not to keep people afloat. It’s stimulus. I’m all for expanding unemployment compensation at a time like this.

Alan, I agree about the stock market, but that’s not the topic of this post.

Everyone, Am I correct in saying that no one has come on here and said “With stimulus we get X and without stimulus we get Y”?

I don’t see evidence that people have confidence in Keynesian models. They seem faith-based.

14. August 2020 at 08:54

Yes, “It’s stimulus”. It’s the output gap, the “sweet spot” that should be expeditiously targeted.

Contrary to Nobel Laureates Dr. Milton Friedman and Dr. Anna Schwartz’s “A Program for Monetary Stability”: the distributed lag effects of monetary flows have been mathematical constants for > 100 years. Therefore, we have a modeling which gives an accurate economic trajectory.

“All analysis is a model” – Nobel Laureate in Economics Dr. Ken Arrow.

14. August 2020 at 09:01

The problem with economics is that people like Gene Frenkle try to apply micro-economics to macro-economic principles. They simply cannot see the forest through the trees.

14. August 2020 at 09:58

–“Not sure of what Sumner wants here. A prediction? OK, Keynesians predict that without another round of stimulus, the economy would be even worse. If in fact it improves without stimulus, the Keynesians would claim it would have improved even more with a stimulus. The Keynesians cannot logically be rebutted. Reminds me of Sumner’s NGDPLT, which literally is backward looking and cannot be rebutted either. Iron tight logic, like Marxism.”–

I think there are definitely experiments and predictions which even if they cannot prove, they can still convince a reasonable observer. For example, if the US performed a fiscal consolidation such that the budget was balanced in FY2021 (fiscal tightening of 15% of GDP) and yet unemployment a year from now had fallen from 10% to 7%, it would be very hard to argue from a Keynesian perspective any longer. In fairness, I think that such a tightening would have macroeconomic effects, but largely through destabilizing patterns of trade (or cementing in place trade patterns destabilized by COVID).

Likewise, if the US pursued NGDPLT and we still had crashes like 2008, with the Fed losing control of NGDP, I think Scott would revisit his views, as long as there wasn’t some obvious failure from the Fed regarding implementation. For example, say there was a functioning prediction market which was stuck on a 4% level target path, TIPS expected inflation never really fell, and yet we still had a -2% NGDP recession with a slow recovery, Scott might reconsider his views.

14. August 2020 at 10:36

–“I continue to believe that a huge number of jobs lost to the pandemic are gone forever and there will be significant disruptions to the recovery in trying to find employment for these people.”–

This is really the primary justification for more stimulus: not to prop up aggregate demand, but maintain patterns of economic activity that work perfectly fine as long as there is no pandemic.

If a large number of small businesses employing (say) 5% of American workers close permanently, it will take a number of years for new businesses and existing business growth to absorb those workers.

14. August 2020 at 10:43

Also, the COVID-19 crisis was to a significant degree a supply shock.

The economy no longer can effectively provide as many restaurant meals, cruises, conferences, live sports, etc.

Giving people money won’t lead to increases in those sectors, and other sectors can’t really absorb all the extra demand. You’ll either get price hikes or shortages (I’ve mostly seen the latter so far).

Also a lot of people simply don’t want to spend all of the money freed up on the other sectors. If you end up saving $800/month on restaurants and buy an extra $150/month of groceries and $50/month on home entertainment, you may opt to just save/invest most of the difference.

14. August 2020 at 11:26

You can’t predict the outcome without knowing if and when there will be a vaccine.

But I must say, given N-gDp level targeting as a prescription to the GFC — would just have caused the economic recession to come at a much earlier date.

——-– Michel de Nostradame

14. August 2020 at 11:48

Justin, Yes, clearly the theories can be tested to some extent.

14. August 2020 at 11:58

Spencer Hall, I am guilty of applying physics to macroeconomics…the first law of thermodynamics applies to everything going on in reality no matter what macro models spit out.

14. August 2020 at 12:07

Justin, see stock market recovery and strong residential real estate market…and then throw in a side of record low mortgage rates and the rich and comfortable get richer and more comfortable.

14. August 2020 at 12:22

“(more people than China by 2100!), . . . ”

Unlikely?

“The IPCC report that the Paris agreement based its projections on considered over 1,000 possible scenarios. Of those, only 116 (about 10%) limited warming below 2C. Of those, only 6 kept global warming below 2C without using negative emissions. So roughly 1% of the IPCC’s projected scenarios kept warming below 2C without using negative emissions technology like BECCS. And Kevin Anderson, former head of the Tyndall Centre for Climate Change Research, has pointed out that those 6 lone scenarios showed global carbon emissions peaking in 2010. Which obviously hasn’t happened.

So from the IPCC’s own report in 2014, we basically have a 1% chance of staying below 2C global warming if we now invent time travel and go back to 2010 to peak our global emissions. And again, you have to stop all growth and go into decline to do that. And long term feedbacks the IPCC largely blows off were ongoing back then too.”

https://www.facebook.com/wxclimonews/posts/455366638536345

‘Limiting global warming to two degrees Celsius will not prevent destructive and deadly climate impacts, as once hoped, dozens of experts concluded in a score of scientific studies released Monday.

A world that heats up by 2C (3.6 degrees Fahrenheit)—long regarded as the temperature ceiling for a climate-safe planet—could see mass displacement due to rising seas, a drop in per capita income, regional shortages of food and fresh water, and the loss of animal and plant species at an accelerated speed.

Poor and emerging countries of Asia, Africa and Latin America will get hit hardest, according to the studies in the British Royal Society’s Philosophical Transactions A.

“We are detecting large changes in climate impacts for a 2C world, and so should take steps to avoid this,” said lead editor Dann Mitchell, an assistant professor at the University of Bristol.

The 197-nation Paris climate treaty, inked in 2015, vows to halt warming at “well under” 2C compared to mid-19th century levels, and “pursue efforts” to cap the rise at 1.5C.’

https://phys.org/news/2018-04-degrees-longer-global-guardrail.html#jCp

“Climate economics researchers have often underestimated – sometimes badly underestimated – the costs of damages resulting from climate change. Those underestimates occur particularly in scenarios where Earth’s temperature warms beyond the Paris climate target of 1.5 to 2 degrees C (2.7 to 3.6 degrees F).

That’s the conclusion of a new report written by a team of climate and Earth scientists and economists from the Earth Institute at Columbia University, the Potsdam Institute for Climate Impact Research, and the Grantham Research Institute on Climate Change and the Environment. It’s a conclusion consistent with the findings of numerous recent climate economics studies.

Once temperatures warm beyond those Paris targets, the risks of triggering unprecedented climate damages grow. However, because the rate and magnitude of climate change has entered uncharted territory in human history, the temperature thresholds and severity of future climate impacts remain highly uncertain, and thus difficult to capture in climate economics models. Put simply, it’s difficult to project the economic impacts resulting from circumstances which are themselves unprecedented.

https://www.yaleclimateconnections.org/2019/11/new-report-finds-costs-of-climate-change-impacts-often-underestimated/

Will there be change?

“Today’s global consumption of fossil fuels now stands at roughly five times what it was in the 1950s, and one-and-half times that of the 1980s when the science of global warming had already been confirmed and accepted by governments with the implication that there was an urgent need to act. Tomes of scientific studies have been logged in the last several decades documenting the deteriorating biospheric health, yet nothing substantive has been done to curtail it. More CO2 has been emitted since the inception of the UN Climate Change Convention in 1992 than in all of human history. CO2 emissions are 55% higher today than in 1990. Despite 20 international conferences on fossil fuel use reduction and an international treaty that entered into force in 1994, wo/man made greenhouse gases have risen inexorably.”

https://medium.com/@xraymike79/the-inconvenient-truth-of-modern-civilizations-inevitable-collapse-8e83df6f3a57

However, ” . . . Yglesias is a very smart progressive . . . “

14. August 2020 at 15:50

Postkey, climate science is actually very similar to macroeconomics because it consists of professors developing models with a myriad of variables. Another similarity is that for some reason both are influenced by politics. A big difference is that the field of macroeconomics attracts people with much higher intelligence than climate science. So nobody in climate science is going to be as intelligent as Bernanke or Jason Furman or Larry Summers…and guess what?? Those guys all developed models that have been wrong because of the high number of variables. As Yogi Berra once said, “it’s tough to make predictions, especially about the future.”

14. August 2020 at 16:01

Scott,

You can call it hazard pay for people with jobs. So what if you send Jeff Bezos $1200? It’s far more important to get money out quickly to keep as many people afloat as possible. If you want to tax it back in the future, you can do that (I wouldn’t).

I am sympathetic to the argument by people who are making less working full time than those unemployed. To me the answer is not to cut back on unemployment, but to pay more to the people working. BTW, if you had a properly working market this is exactly what would happen…because it’s now higher risk to go to work.

You want a forecast? Well, it’s dependent on how far they let people fall. This is the most bizarre recession ever in that personal income and personal savings went up at the recession hit its nadir. That’s not uniform throughout the economy though. It’s 11% unemployed with the help. Once people eat through the savings they accrued they will cut back on spending further. It’s just not going to be a cliff.

14. August 2020 at 16:32

Scott,

2013 sequestration was the event that settled the Keynesian v MM debate for me. I suspect that a “stimulus” bill would help the economy to some degree, but I think that misses the point. The first round of stimulus averted a tremendous amount of suffering, whether it helped the economy or not. I expect that we will have large numbers of unemployed until we get through Covid, and I’m skeptical that economic policy will have much impact on that either way. I do think that stimulus can help us avert a lot of destruction. I don’t think it is in the long term interest to have people lose their homes, to have local governments go bankrupt, or to have small businesses close. When this is over, I want to have local restaurants and bars to go to, not to mention small shops and other small businesses. I choose to live where I live because I don’t like Applebees or Walmart. I think we need disaster relief in to help weather this storm. As a former Keynesian, I don’t think stimulus will have a signifiant impact on the economy, but I do think it will have a significant impact on the quality of life when this things are over. I prefer to dine and drink at places that don’t have the ability to issue corporate debt.

14. August 2020 at 16:56

From Brookings:

“FISCAL POLICY AND THE ECONOMY IN 2020 AND 2021

By Manuel Alcalá Kovalski and Louise Sheiner

The fiscal policy response to the pandemic had a massive impact on GDP growth in the second quarter, boosting it 14.6 percentage points at an annual rate, according to the latest reading of the Hutchins Center Fiscal Impact Measure (FIM). The FIM translates changes in taxes and spending at federal, state, and local levels into changes in aggregate demand.”

—30—

https://www.brookings.edu/interactives/hutchins-center-fiscal-impact-measure/

As my late, great Uncle Jerry used to say. “If you are not confused, then maybe you don’t understand the situation.”

14. August 2020 at 19:09

Spencer Hall, btw, I remember Greenspan on 60 Minutes saying every day he checks out the lumber market numbers. So microeconomics can inform macroeconomics.

14. August 2020 at 20:32

I’m in awe of how Yglesias managed to come up with such a brilliant idea and title for a book. And the way he lead into the announcement on Twitter was nothing short of genius. Can’t wait to read it, you can just sense he knew this one was good.

14. August 2020 at 23:33

“For climate change, there are many scientific organizations that study the climate. These alphabet soup of organizations include NASA, NOAA, JMA, WMO, NSIDC, IPCC, UK Met Office, and others. Click on the names for links to their climate-related sites. There are also climate research organizations associated with universities. These are all legitimate scientific sources.

If you have to dismiss all of these scientific organizations to reach your opinion, then you are by definition denying the science. If you have to believe that all of these organizations, and all of the climate scientists around the world, and all of the hundred thousand published research papers, and physics, are all somehow part of a global, multigenerational conspiracy to defraud the people, then you are, again, a denier by definition.

So if you deny all the above scientific organizations there are a lot of un-scientific web sites out there that pretend to be science. Many of these are run by lobbyists (e.g.., Climate Depot, run by a libertarian political lobbyist, CFACT), or supported by lobbyists (e.g., JoannaNova, WUWT, both of whom have received funding and otherwise substantial support by lobbying organizations like the Heartland Institute), or are actually paid by lobbyists to write Op-Eds and other blog posts that intentionally misrepresent the science.”

https://thedakepage.blogspot.co.uk/2016/12/how-to-assess-climate-change.html

15. August 2020 at 03:32

Gene Frenkle re: “Those guys all developed models that have been wrong because of the high number of variables.”

As Einstein said: “The deeper we penetrate and the more extensive our theories become the less empirical knowledge is needed to determine those theories.”

Take the “Marshmallow Test”: (1) banks create new money (macro-economics), and incongruously (2) banks loan out the savings that are placed with them (micro-economics).

As Luca Pacioli, a Renaissance man, “The Father of Accounting and Bookkeeping” famously quipped: “debits on the left and credits on the right, don’t go to sleep with an imbalance”.

You have to retain cognitive dissonance capacity, like Walter Isaacson described Albert Einstein’s ability: to hold two thoughts in your mind simultaneously – “to be puzzled when they conflicted, and to marvel when he could smell an underlying unity”.

It’s also like Athenian philosopher Plato — whose “first fruits of his youth infused with hard work and love of study” said: “We seem to find that the ideal of knowledge is irreconcilable with experience”.

In almost every instance in which John Maynard Keynes wrote the term bank in his bible: “The General Theory of Employment, Interest and Money”, it is necessary to substitute the term nonbank in order to make Keynes’ statement correct.

15. August 2020 at 03:40

Gene Frenkle. Yes, Greenspan was a colorful character. His book “The Map and the Territory” was insightful. The FRED database reports his figure:

Producer Price Index by Commodity for Lumber and Wood Products: Lumber (WPU081)

Such valuations generally depend upon Gresham’s law: “a statement of the least cost “principle of substitution” as applied to money: that a commodity (or service) will be devoted to those uses which are the most profitable (most widely viewed as promising).

15. August 2020 at 03:45

It’s no happenstance that money velocity fell following the FDIC’s hike in deposit insurance in 1980:

SAFE = FDIC deposit insurance. As @Danielle Dimartino Booth, in her book, gets backwards: “Fed Up”, pg. 218

“Before the financial crisis, accounts were insured up to the first $100,000 by the FDIC. That limit kept enormous sums *in the shadow banking system* (which was a good thing)

Historical FDIC’s insurance coverage deposit account limits (commercial banks):

• 1934 – $2,500

• 1935 – $5,000

• 1950 – $10,000

• 1966 – $15,000

• 1969 – $20,000

• 1974 – $40,000

• 1980 – $100,000

• 2008 – $unlimited

• 2013 – $250,000 (caused taper tantrum)

It’s stock vs. flow. The jump to $100,000 started the decline in money velocity.

As Dr. Philip George, in his E-Book “The Riddle of Money Finally Solved” diagnoses these recessions as a cash-imbalance phenomenon (which corroborates Dr. Pritchard’s thesis):

“When interest rates go up, flows into savings and time deposits increase” ( the ratio of M1 to the sum of 12 months savings ).

The “optical illusion” is that banks don’t loan out deposits. I.e., all bank-held savings are frozen.

The U.S. Golden Era in Capitalism was where 2/3 of GDP was financed by velocity (the thrifts), and 1/3 by money (the banks).

15. August 2020 at 04:44

Gene Frenkle re: “Those guys all developed models that have been wrong because of the high number of variables.”

MONETARY FLOWS { M*VT }

https://monetaryflows.blogspot.com/2010/07/monetary-flows-mvt-1921-1950.html

This time series (one variable), using the G.6 Debit and Demand Deposit Turnover release (discontinued by mistake in Sept. 1996), mirrored GDP.

So did my other time series, using one variable (albeit degraded due to the Treasury’s General Fund account expansion).

15. August 2020 at 05:28

Alan Goldhammer,

THE notion that the stock market doesn’t reflect the underlying economy well is simply wrong. People with such comments simply don’t understand how to interpret stock price movements and levels.

Stock prices are mostly determined by future expected cash flows with an infinite horizon. This year and next year have very little influence.

Also, people seem to get very confused when thinking about stock price levels. We’re still below the February high, all these months later. Given that we were due for quite a bit of appreciation in stock prices this year, sans crisis, it’s a big deal.

That’s primarily due to tight monetary policy. Cash-flows are very GDP growth dependent, on average.

To support my overall point, look at the log of the S&P 500 historical chart. Can you see the economic stagnation since the Great Recession, for example?

15. August 2020 at 08:14

Re: “February high”

Some people have never discovered the truth. They claim: “so the direct relationship between money supply and price level does not hold”.

It’s a matter of arithmetic. First, no economist compares absolutes. They compare rates of change. And no trader uses the first derivative, they use the second derivative.

But no money stock figure standing alone is adequate as a guide post for monetary policy. Vt has varied 3x that of M over a 50 year period. It’s stock vs. flow. Money is spent and re-spent.

Take the NBER’s recent dating.

According to the Business Cycle Dating Committee of the National Bureau for Economic Research (NBER), the U.S. entered recession in February:

The committee has determined that a peak in monthly economic activity occurred in the U.S. economy in February 2020. The peak marks the end of the expansion that began in June 2009 and the beginning of a recession.

https://www.nber.org/cycles/june2020.html

As money flows pointed out:

Feb 28, 2020 at 9:08am

Parse date: real-output; inflation

05/1/2019,,,,, 0.06 ,,,,, 0.10

06/1/2019,,,,, 0.05 ,,,,, 0.09

07/1/2019,,,,, 0.06 ,,,,, 0.09

08/1/2019,,,,, 0.04 ,,,,, 0.09

09/1/2019,,,,, 0.04 ,,,,, 0.10

10/1/2019,,,,, 0.01 ,,,,, 0.07

11/1/2019 ,,,,, 0.07 ,,,,, 0.09

12/1/2019,,,,, 0.07 ,,,,, 0.07

01/1/2020,,,,, 0.10 ,,,,, 0.13 *

02/1/2020,,,,, 0.04 ,,,,, 0.13

03/1/2020,,,,, 0.04 ,,,,, 0.09

04/1/2020,,,,, 0.04 ,,,,, 0.08

05/1/2020,,,,, 0.03 ,,,,, 0.09

06/1/2020,,,,, 0.04 ,,,,, 0.09

* = sharp drop in money flows, volume X’s velocity

15. August 2020 at 08:21

rwperu, I don’t think you understand what’s going on. Disposable income has recently soared higher at record rates. Spending is NOT being held back by a lack of income. It’s the Covid-19 fear that is slowing spending.

bb, You underestimate the extent to which companies will supply what consumers want, even after Covid-19. We need adequate monetary policy, not wasteful fiscal stimulus. But I do agree that more spending on the unemployed was justified on humanitarian grounds.

15. August 2020 at 08:40

What you notice from long-term money flows is that the BLS’s CPI acceleration has now peaked:

“In July, the Consumer Price Index for All Urban Consumers rose 0.6 percent on a seasonally adjusted basis; rising 1.0 percent over the last 12 months, not seasonally adjusted. The index for all items less food and energy rose 0.6 percent in July (SA); up 1.6 percent over the year (NSA).”

I.e., forecasts are ex-ante extrapolations. You cannot run a regression test against the historical data. The fact is that Alan Greenspan was directly responsible for what happened on October 19, 1987 or “Black Monday”.

15. August 2020 at 10:13

Postkey, the more variables the more real world testing is necessary. So historically NASA scientists were far more impressive than the current crop of climate scientists and unfortunately several astronauts have died because the real world has so many variables that the models can’t account for. So a big problem with climate science is simply the lack of negative consequences when their models are inevitably incorrect…along with the unimpressive scientists attracted to the field of climate science. So right now scientists and engineers are working on autonomous vehicles and the problem they are encountering is the huge number of variables in real world driving. One way to get to autonomous vehicles more quickly would be to build roads specifically for autonomous vehicles and reduce variables.

15. August 2020 at 12:10

Science denier.

15. August 2020 at 17:16

Scott,

For a period of time my Twitter handle was “A Spending Shortfall Caused By Coronavirus”. I understand fully what is happening. I thought it was understood by this blog that the best form of federal spending and actions would be to suppress the virus. I also thought it was understood that isn’t going to happen.

Disposable income may be up, but there is serious asymmetry in those who have and those who don’t have. The biggest group of haves is people who lost their job! There are plenty of people working who have taken serious pay cuts!

I’m surprised you’re advocating going back to normal given that you’ve said many times that you don’t expect monetary policy to keep NGDP on target during the pandemic. I suppose the biggest difference in our views is I see the fiscal response as something to keep people afloat in a world of falling NGDP. I think they should just pump as much money as they can in any way possible (ie both monetary and fiscal) and deal with the fallout once the crisis is over.

Put another way. I think the Fed is doing a fantastic job. The problem is in a world where spending is constrained by something other than monetary policy, something else needs to be done (ie fiscal policy).

16. August 2020 at 08:15

rwperu, You said:

“Disposable income may be up, but there is serious asymmetry in those who have and those who don’t have. The biggest group of haves is people who lost their job!”

Most on the people collecting unemployment comp. are being paid more than they earned on their jobs. Lack of disposable income is NOT the problem.

16. August 2020 at 17:02

Scott,

I agree with you. Disposable income is not the problem. The problem is people who don’t have disposable income! Most of the population has rising disposable income (so it’s up in the aggregate), but there is a large portion (and rising due to expiration of enhanced UI) of the country that does not have enough income to cover their basic living expenses. An added problem is the normal indicators don’t tell us who is in what group.

My position is you don’t worry about rising disposable income and just get money to everybody. The benefit of this is the money gets out fast. The cost is some people get a little extra disposable income for the future. There is a such a huge asymmetry between not having enough money to cover basic expenses and having too much disposable income I’m willing to give the money to everybody.

16. August 2020 at 17:48

rwperu, the problem with that is in the fastest growing cities with the best job markets housing prices were too high in February 2020 before record low mortgage rates. I don’t think it is a good idea to give well off people working comfortably at home even more money when lower class hourly workers are the ones risking getting coronavirus and spreading it to their family members. We need to be funneling money to fast food workers and grocery store workers and truck drivers and others doing the grunt work to keep everyone else comfortable and safe.

16. August 2020 at 19:02

But while Congress was trying to get very badly targeted relief to people who had lost income from the recession (I think it is silly to call it “stimulus” unless you think that it pushes the Fed to purchase more of something that they would have without the “stimulus”), the Fed was presiding over a FALL in expected inflation when they should have been producing a an increase assuming that there was at least SOME supply shock from forced closures.