Recent articles/tweets

1. I agree with 95% of the views in this Zvi Mowshowitz post, but not this one:

Andrew Biggs makes the case for eliminating the tax preference for retirement accounts. This mostly benefits the rich, does not obviously increase net savings values, causes lots of hoops to be jumped through, and we can use the money to shore up social security instead, or I would add to cut income tax rates. This would be obviously great on the pure economics, assuming it did not retroactively confiscate existing savings and only applied going forward. But as Matthew Yglesias says, political nonstarter, so much so that not even I support doing it.

For the umpteenth time, retirement accounts (401k, Roth, etc.) do not provide any tax preference for saving. They remove a tax penalty for saving, and make the system neutral between current and future consumption.

2. I strongly agree with this claim (in the same post.):

Most economics papers and other academic work is useless, everyone involved knows this, outside of the top quartile it is essentially a grift where nothing would survive critical review. Tyler Cowen retweeted and I too have come around to thinking this is basically correct.

So how can economics be a relatively successful field, given that most research is garbage? It seems that theory plus a few robust experiments are enough to provide a solid foundation. At this point, the difference between a good and bad economist is not the amount of research they’ve done, it’s whether or not they have good intuition about which theories and empirical work to rely upon.

3. I am increasingly depressed about the current state of macroeconomics. But Alex Salter provides a ray of hope:

The connection between government spending and inflation seems obvious. Fiscal policy affects aggregate demand by changing total dollar-valued spending in the economy. If the government ratchets up spending, financed by borrowing, that should inject a new flow of funds into the national income stream. This is standard income-expenditure Keynesianism — and it’s wrong. . .

The central bank, not the fiscal authorities, is the residual determiner of aggregate demand. . . .

Deficits are bad for the economy because they transfer resources from the productive private sector to the unproductive public sector. Deficits are bad for self-governance because they transgress a basic small-r republican commitment: not to saddle future generations with crippling debt before they are even old enough to vote.

That’s exactly my view. It’s sad that something that was conventional wisdom in the 1990s (the Fed determines inflation) is now a heterodox view. This is the new Dark Age of macro.

Suppose that in the late 1990s you had told a group of economists that in late 2021:

1. The economy would be booming.

2. The Fed would be rapidly increasing the money supply.

3. The Fed would be targeting interest rates at zero.

Then you told them that the profession would blame fiscal policy for the resulting inflation!!

(HT: David Levey)

4. Some people claim the world is getting dumber. I’m not convinced (recall the Flynn effect), but it’s an intriguing hypothesis. Of course we cannot extrapolate this model into the future, as embryo selection seems to be on the horizon.

5. In the past, I’ve discussed how the Chinese public uses funerals to voice their displeasure with the government. The same seems to be true in Russia.

6. For years, I’ve been telling you that presidents and former presidents are completely above the law. So this FT story should be no surprise:

Ever since Donald Trump was charged with seeking to overturn the 2020 presidential polls, his lawyers have argued a trial should not take place until after the 2024 election or risk tainting the vote.

The odds are now in Trump’s favour, after the US Supreme Court on Wednesday determined it would hear his appeal over claims that presidential immunity shields him from the Department of Justice’s indictment.

People who don’t understand how deeply corrupt our system has become were caught flat footed:

Analysts at Eurasia Group said the Supreme Court’s decision was “a surprise and is a massive break for [former] president Trump”, saying the expectation of a conviction was an “important component” of their forecast of Biden as a narrow favourite to win re-election.

What a surprise that Trump selected judges would throw him a lifeline!! (I doubt that Al Gore was surprised.)

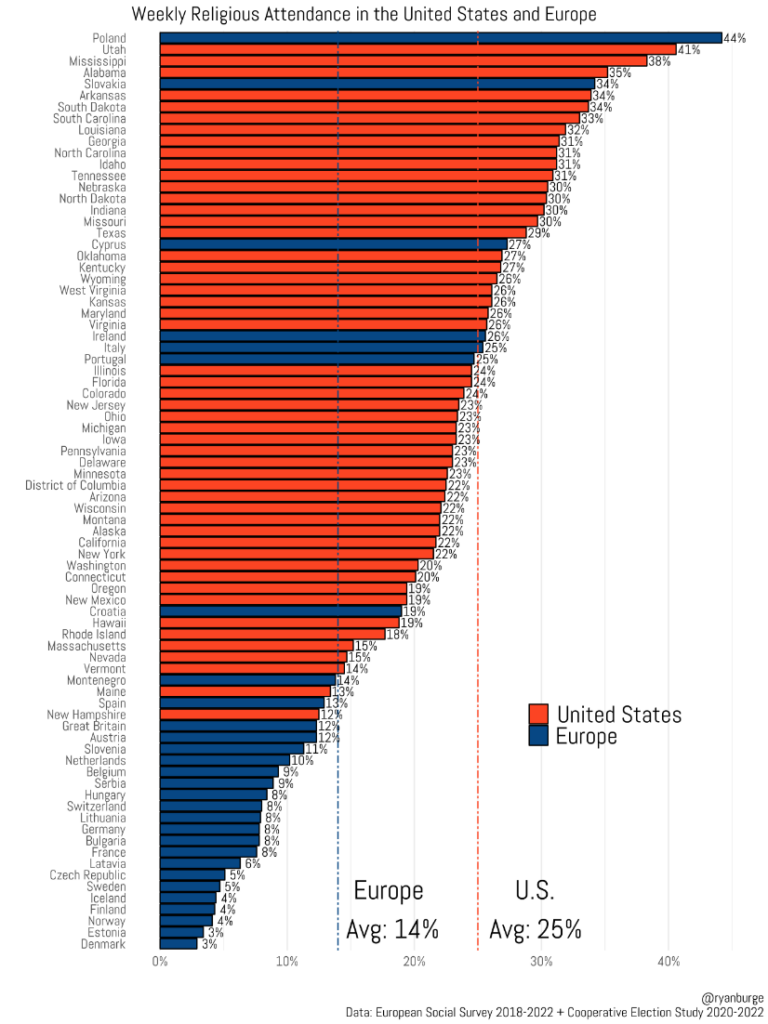

7. Denmark shows up at the top (or bottom) of all sorts of lists. It’s arguably the country with the highest level of civic virtue, the most free market economy, and the most egalitarian society, which is an odd mix of attributes. Now we can add in least religious. (BTW, I understand “religious” can be define many ways, such as belief in God. The following is religious attendance.) The other odd result is the vast difference between Slovakia and the Czech Republic—no wonder they split up! The following graph is from a Ryan Burge tweet:

Tags:

2. March 2024 at 09:37

What does Denmark’s immigration policy look like? I suspect that there is a strong correlation between countries whose publics like or believe they control the nations immigration policies and countries with more economic freedom. Switzerland and Singapore also come to mind.

2. March 2024 at 10:11

So Trump was correct with his “Mexican judge” comment!

2. March 2024 at 12:26

6. I hope — and there’s a decent chance — that SCOTUS took the case so that they can unanimously rule against Trump. It’s an important case and seems reasonable they would take it in order to send a strong message.

2. March 2024 at 12:36

Lizard, Both Singapore and Switzerland have extremely high rates of immigration.

Raja, By correct do you mean “racist”?

Dirk, The Supreme Court just guaranteed that he’ll be able to run out the clock. Then Trump will force the DOJ to drop the case. They know what they did. I’m sure that Trump is celebrating.

2. March 2024 at 15:41

“That’s exactly my view. It’s sad that something that was conventional wisdom in the 1990s (the Fed determines inflation) is now a heterodox view. This is the new Dark Age of macro.”

As you’ve said, Sumner, it’s trivial to double nominal GDP (or halve it) via monetary policy, and either impossible or reckless to do so via fiscal policy. You should use this line more often.

“Some people claim the world is getting dumber.”

Two possible reasons here (for rich countries): the first is the less use of television and traffic lights among the youth, the second is increasing lumbar flexion due to smartphones. For the world as a whole, differential fertility is obvious.

“Of course we cannot extrapolate this model into the future, as embryo selection seems to be on the horizon.”

Sad, but very true.

“recall the Flynn effect”

Since ~2000 there has been a reverse Flynn effect -see “What causes the anti-Flynn effect? A data synthesis and analysis of predictors”.

“It’s arguably the country with the highest level of civic virtue, the most free market economy, and the most egalitarian society, which is an odd mix of attributes.”

Also the best COVID response (other than perhaps New Zealand and Mongolia).

2. March 2024 at 15:59

Switzerland and Singapore do have high rates of immigration. They seem not to have had populist backlash against those high levels of immigration unlike other nations. My point was that countries where the public believes that immigration is orderly and under their control tend to support more economic freedom.

2. March 2024 at 20:11

“Andrew Biggs makes the case for eliminating the tax preference for retirement accounts.”

‘For the umpteenth time, retirement accounts (401k, Roth, etc.) do not provide any tax preference for saving.’

I don’t understand your upset over this. “Tax preference” is not any claim of economic substance, it is a fiscal accounting term applied to specified items defined in the Internal Revenue Code. Tax preference items are included in the Tax Expenditure Budget, mandated by Congress and published by the Treasury annually.

By the same token there are people over at Econlog who argue that “tax expenditures” themselves aren’t really expenditures. Merits aside, who cares? Tax expenditures are accounting items — with zero claim of economic merit made or implied on their behalf. The same with the “tax preferences” among them. These terms are accounting definitions, that is all.

Years ago I umpteen times over objected that “public goods are not goods that are good for the public!”. Yet economists have given public goods the definition they have, whether it is misleading in my opinion or not.

2. March 2024 at 20:18

I strongly agree with this claim … ‘Most economics papers and other academic work is useless, everyone involved knows this’ … So how can economics be a relatively successful field, given that most research is garbage?

The same way the same thing is true in most all other academic fields. See the famous paper, “Why Most Published Research Findings Are False”, by John Ioannidis of Stanford School of Medicine. Believe me, it’s a lot worse in medicine and health care, which he focused on. (Ponder this while in the waiting room before your next check-up.)

3. March 2024 at 12:56

Jim, Isn’t it obvious that most of these pundits oppose the provision precisely because they wrongly believe it’s a tax preference that favors savers?

3. March 2024 at 13:25

“Most economics papers and other academic work is useless, everyone involved knows this, outside of the top quartile it is essentially a grift where nothing would survive critical review.”

It’s such a shame too, because more people (not just the occasional Sumner) could be doing truly useful work, but useful work doesn’t necessarily generate immediate results.

But at least publishing is somewhat objective, maybe? You’re making people put in some effort, of a sort?

At least Econ isn’t one of those fields where you can pick up a journal and immediately see that everything published in the journal is meaningless.

4. March 2024 at 05:34

“At this point, the difference between a good and bad economist is not the amount of research they’ve done, it’s whether or not they have good intuition about which theories and empirical work to rely upon.”

I often wonder how much even highly ranked people have thought about the “interest rate problem” – i.e. why should we think about monetary policy in terms of interest rates. If you were to suggest that “interest rates are not monetary policy” to the average economist chances are you would be met with a blank stare. The case in point is how they teach the gold standard, a confused mix of the price specie flow mechanism and the bank rate.

4. March 2024 at 06:04

I think one of the problems is that economists have very little actual experience in their field…. especially on the production side.

4. March 2024 at 10:08

anon/portly, I also think a lot about all this wasted effort in “research”—not just in econ, but in dozens of other fields, including science. Perhaps it’s a necessary side effect of the truly useful research that is done? Maybe it’s driven by government subsidy? I don’t know.

Iskander, Good analogy.

dtoh, Um, production isn’t actually “their field”. In 50 years, I’ve yet to see a cogent critique of economics written by a non-economist–even though they are absolutely right to be skeptical. It’s hard to evaluate a field unless you know it from the inside.