QE, or not QE?

To say the labor market is “strong” would be an understatement. The unemployment rate is now 4.2%. Only 3 of the previous 50 years saw lower unemployment rates (2000, 2018, 2019). Firms are desperately short of workers, despite fast rising wages. Service sucks almost everywhere I go.

Inflation is also above target, whether you look at a 1, 2, 3 4, or 5-year time frame.

So why is the Fed currently doing QE? What is the goal of this program?

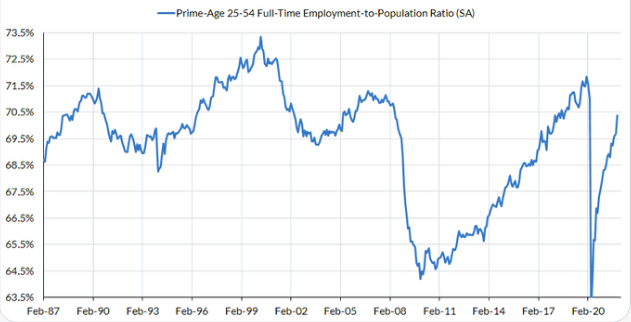

PS. David Beckworth directed me to a Skanda Amarnath tweet showing the amazingly quick recovery in the job market, compared to the Great Recession (for prime age workers):

PPS. Total employment in the US remains nearly 4 million below pre-Covid levels, while in Canada the previous peak has already been surpassed:

The unemployment rate fell to 6% — very near pre-pandemic levels — from 6.7% in October. Employment is now 186,000 jobs beyond where it was in February 2020. Hours worked rose 0.7%, fully recouping Covid losses for the first time.

Whatever factors are depressing US employment do not seem to be operative in Canada.

Tags:

4. December 2021 at 12:37

I can’t help but point out that this indicator suggests semi-recessionary labor trends in the previous recession that had started well before the official start of the recession.

4. December 2021 at 12:38

I’ll add: why aren’t more economists asking the same question?

4. December 2021 at 13:01

What do you think of what long term bond yields are saying? The 10yr is back below 1.5% (the same as September levels) and the 10yr minus 2yr yield spread has fallen steeply since omicron from 1% to 0.75% (the same as year-ago levels). David Beckworth recently had Matthew Klein on his program (recorded before the recent yield declines) and Klein said that the implied 25 year breakeven starting 5 years from now – when he says we could expect the effect of the pandemic to wash through – is the same as it’s been over the last 5-7 years, and lower than 2010-11. It’s about half-way through the discussion – see the transcript here: https://www.mercatus.org/bridge/podcasts/11292021/matthew-klein-recent-inflationary-trends-and-what-expect-future

4. December 2021 at 14:07

Kevin, Yes, but pretty mild until 2008.

Rajat, I think the bond market is saying that inflation is not a big problem. But I still don’t get the QE–what’s it supposed to be doing for the economy?

TIPS spreads still show excessive inflation over the next 5 years, albeit not as bad as a few weeks ago.

4. December 2021 at 14:13

You are simply taking figures provided to you by the government, without once questioning whether the figures themselves are accurate.

1. Millions have dropped out of the labor force (covid fear, horrible paying jobs, fear of crime, crt racism in the work place, etc. And as you know, the government miracously drops them from their database.

2. More people are on unemployment and government assistence today than ever before.

3. There is more crime (#1 indicator that unemployment is high) than ever before.

And service in America has always “sucked”.

By the way, why do you always use “teenage exlamations”. Is it because of your non exsistent vocabulary, or do you have the capacity to think of more intelligent adjectives?

Americans are known, worldwide, for providing some of the worst service imaginable – along with the Chinese – mostly because the culture continues to move to the left, and the left is filled with hate. Arrogant totalitarians suffering from excessive hubris, like yourself, are generally antisocial.

The most feared tourists for their disgusting manners and obnoxiousness.

1. Chinese (by a wide margin). Most feared. Most hated. By far!

2. American

3. U.K.

4. Everyone else.

Nobody travels to America and vacation and says the service was great. That is really funny.

4. December 2021 at 14:32

Scott,

Perhaps the FED thinks there is a chance that something could happen within the next few years that cause inflation to go down, such as another outbreak, and are running up the score now so that if such a drop occurs, then they can hit their average inflation target.

When I listen to current Federal Reserve officials, I get the sense they are somewhat frustrated with the slow response to the Great Recession, and feel like they need to catch up to compensate with the slow growth of years past.

4. December 2021 at 15:17

There was an explosion of stimulus at the beginning of the outbreak, with good reason. But, with the the economy at full employment we do not need additional stimulus at this point.

I am actually surprised that inflation is not higher. So much news about “supply chains” as the reason for shortages. Classically, shortages do not exist. The market will always clear. It is just a matter of time before prices of goods in short supply adjust.

And, on the labor side, anecdotally, I hear stories of people walking off the job en-masse. Again, it seems like only a matter of time before this translates into wage inflation.

Inflation is high and, by all appearances, moving upward. While the Fed appears to be afraid to move. And the longer they hesitate, the more painful it will be when they finally react.

That was a nice rant.

Thanks.

4. December 2021 at 17:35

always clueless sumner ponders QE. it’s simple. shorten duration, chase the money out the risk curve looking for duration. that’s the why as to method. the why as to strategy: wealth effect, which is the real money illusion.

4. December 2021 at 17:48

Hi Scott, regarding why the Fed is still doing QE, didn’t you do a post sometime within the last few months about how, early at the onset of the pandemic, the Fed promised a certain amount of monetary stimulus, and now they are committed to following through on what they said they were going to do? I might be confusing one issue for another, and to be clear I didn’t try to search your archives for the post I’m thinking of.

4. December 2021 at 21:18

Ryan, Yes, they promised to do enough to bring the price level back to the 2% trend line. But they’ve already done more than enough, so what are they doing now?

5. December 2021 at 05:48

Keynesians are the real pandemic.

Yes, you can print your way out of trouble in the short term. It was selfish of you, but you did succeed in giving us your problems without having to deal with market corrections. All of which were created by your bad socialist policies.

So thank you for saddling us with 30-35 Trillion. That was very kind of you.

Your grandchildren will now grow up poor. Congratulations.

5. December 2021 at 07:50

The money stock can never be properly managed by any attempt to control the cost of credit. So, our money and banking system is being grossly mismanaged.

QE induces non-bank disintermediation. So, after QE ends, rates fall.

5. December 2021 at 08:26

I’m mostly in favor of an acceleration of the QE wind-down, but I don’t think that the pace change should happen until mid-January. My reasoning is that we need to see if the recent PCE & CPI spike was a one-off or the start of a bad trend.

Yglesias has been urging tightening by the Fed for a few weeks now. I don’t think he’s worried about inflation as much as he is about the political credibility of the Fed.

A worst case scenario would be a post-holiday consumption slowdown combined with Covid influenced stalling in the service sector AND inflation rates that matched this fall. We can call that “Stagflation-Lite” and I’ll eat some humble pie in February.

5. December 2021 at 08:29

Meta question: how much of the decline in service standards is due to:

1) The government having stimulated the recovery in this job market, i.e., currently low unemployment?

vs.

2) Increased belief that the government will always step in to stimulate a recovery in any poor job market, i.e., that there will never be another prolonged employment slowdown in our working lives?

5. December 2021 at 09:13

There seem to be a lot of reports on people retiring. Is this something you arent buying into? The numbers being reported seem to be in the range of about 3 million people retiring early which would seem to account for a lot of the missing workers. Just anecdotally, not seen that much data on this, it seems like a lot of 2 income homes figured out how to live on 1 income and are staying with it.

My wife makes most of her purchases online. As evidenced by the never-ending supply of boxes at out house that service is working too well. Service is generally fine at our local restaurants though some still have limited hours. I think that in general service got better after 2008 and the Great Recession. Restaurants and stores were happy to have you and no longer took you for granted. In my area that has persisted.

Steve

5. December 2021 at 09:44

Steve, Yes, retirement is definitely up this year.

5. December 2021 at 15:22

I was an early Tea Party supporter and ever since have wondered why we are able to maintain a reasonable national economy when our national debt is going up so much. I expected this increase in debt to drive inflation way up but it has not. I read this blog because I would really like to understand more about this and Prof Summer has helped me better understand it.

The light really went off in my head when I recently viewed a Cato panel discussion that included David Beckworth and John Cochrane (a link to the panel discussion can be found at https://johnhcochrane.blogspot.com/ ).

David made a strong argument that what is making the most impact is that investors have been willing to buy all the treasuries the US government wants to sell even in the face of dropping interest rates.

I did a quick ball park look at the numbers and found that our debt was $900B in 1980, $10,000B in 2010 and 22,000B in 2020 and that we were able to finance this and at the same time lower the interest cost in % terms from 11% in 1980 to 6% in 2000 to under 2% in 2020. The drop in interest rates resulted in an almost continuous reduction in our total national interest expense as a percent of GDP during this time of rising debt!!

The Cato panel had an interesting discussion about whether the world demand for our debt will continue to be strong in the face of all this new debt the Dems are likely to give us. Beckworth appeared to lean yes on this question and Cockrane seem to lean no. I would be interested to learn how Prof Summer would lean?

5. December 2021 at 16:36

Bob, My views are closer to David’s, as I expect somewhat higher interest rates, but nothing dramatic. Even so, I oppose the fiscal stimulus for other reasons.

5. December 2021 at 18:06

One operative factor is more covid cases, hospitalizations and deaths per capita in the US.

5. December 2021 at 20:12

Re: Canadian em.pop. ratio

I would guess that Canadians drink less and don’t use nearly as much drugs as folks in the US, though that could be wrong. Does Canada have a crazy opiod epidemic like the US?

Also, how does the em.pop. ratio account for prisoners and people in jail? I would assume that Canada has a much smaller percentage of its population locked up, and a much smaller percentage that has a criminal record, which I would think would make the labor market function more efficiently.

Another thing I would guess is that manufacturing, agriculture, mining, etc., make up a larger proportion of Canada’s economy than in the US, so the shift in demand towards goods would have a more stimulative impact on Canada.

Finally, doesn’t Canada have a higher proportion of immigrants in its population, and doesn’t it pretty ruthlessly select immigrants for both employability and their likelihood to be a net contributor to the fisc?

5. December 2021 at 20:50

Maybe, the Fed is doing more QE so that they can compensate for it by raising interest on reserves. It’s like a bus driver not wanting to ease up on the gas so that he can continue applying the brake.

5. December 2021 at 22:57

Lizard Man, There are lots of reasons why the E/Pop ratio might vary between the US and Canada, but those typically don’t explain the recent divergence. The factors you cite (like drug abuse, prison population, etc.) haven’t changed much since early 2020.

BC, Hopefully they aren’t as dumb as the bus driver you describe.

6. December 2021 at 00:49

Scott, can I expect your reaction to Krugman’s column today? https://www.nytimes.com/2021/12/03/opinion/inflation-friedman-money-supply.html?referringSource=articleShare

Oops, I think I have seen that already!!!

6. December 2021 at 03:53

Scott, completely agree with your concern about QE. In Europe the ECB shows no signs to winding its QE down soon and I guess a dramatic turn would also require international coordination (a bit like the sort of thing we had in the late 1980s). In Europe the consensus appears to be more and more that the condition of the Italian banking system (and the role of that system in the economy) make it hard to return to positive interest rates, let alone something that the Taylor rule would suggest. But it is now becoming (simplistically) German pensioners vs Italian (mismanaged) banks. Given that the Italians have no complains about EU largesse, maybe the ECB stance will change sooner than later. Of course the ECB policy tools and the FED’s nare not the same, if winding down asset purchases is accompanied by different treatment of deposits with the ECB, that might already do something for those german savers. But negative retail interest rates are not politically sustainable, not when CPI inflation is over 4%.

6. December 2021 at 05:28

M-o-M or Y-o-Y comparisons in headline CPI or PCE deflator are misleading. The truistic “base effect” is determined by the distributed lag effect of long-term money flows, volume times transactions’ velocity. And the distributed lag effect has been a mathematical constant for > 100 years (not long and variable).

Neither the CPI nor the PCE deflator have peaked. But an accelerated reduction of monthly bond purchases would come at the wrong time. N-gDp then would undershoot its optimum growth path / optimal spending.

6. December 2021 at 06:26

QE is a Romulan cloaking device. If you swap duration for cash you destroy velocity. Can’t you hear the sucking sound?

https://phys.org/news/2021-02-stationary-hawking-analog-black-hole.html

Keynesian economists have achieved their objective: that there is no difference between money and liquid assets.

6. December 2021 at 06:58

As an empirical matter, QE (especially QE3) boosted long-term real rates, pretty much the opposite of the official narrative (Fed is holding rates “artificially” low).

30-year TIPS are currently -0.59% and have fallen 20 bps this year. That’s a real phenomenon, and it doesn’t augur well.

6. December 2021 at 08:24

Sumner’s democrats & commies won’t pass the forced labor act, which would prohibit the imporation of goods from Uigher concentration camps. Sumner thinks forced labor is free trade. It has been brought to my attention, through an investigative source, that Sumner’s great grandfather was a slave owner in Alabama.

He won’t talk about it in his blog, because his wife – and most of his families wealth – is derived from Chinese kickbacks. Same for Kerry, McConnell, and others.

Massive protests in Europe against the totalitarian covid passport, a passport that is wholly desgined to get names onto a world database that will be used to restrict movement, levy fines, centralize your data in one location, add or subtract points to your social credit score, etc, etc.

Sumner and Schwab are behind it.

6. December 2021 at 09:06

WSLee, I don’t agree with him. Friedman was right that tight money caused the Great Depression.

Rien, You said:

“But it is now becoming (simplistically) German pensioners vs Italian (mismanaged) banks.”

That’s why you need level targeting, to get rid of all the hawks and doves.

Brian, Nearly a decade ago I said slow growth was the new normal. Looks like I was correct.

6. December 2021 at 10:02

re: “Friedman was right that tight money caused the Great Depression.”

That’s not an accurate explanation. We needed a central bank that could and would pump IBDDs into the commercial banks in a volume sufficient to satisfy the public’s demand for currency, specifically paper money.

It was not until 1933 that we began to unshackle our paper money from the numerous and unnecessary restrictions pertaining to its issuance. With the numerous types of paper money in circulation at the time, this would seem to have been a non-problem.

Here is the list: gold certificates, silver certificates, national bank notes, United States notes, Treasury notes of 1890, Federal Reserve Bank notes, and Federal Reserve notes. With that array of paper money there should have been plenty to meet the liquidity demands placed on the banks by the public. But the volume of each type that could be issued was so circumscribed by restrictions that even the aggregate group could not begin to meet the panic demands of the public.

6. December 2021 at 10:05

re: “QE (especially QE3) boosted long-term real rates,”

Contrary forces are at work. QE reduces the supply of loan funds, duration for cash.

6. December 2021 at 12:27

Well, this morning the Fed has seemingly put forth the possibility that QE will end sooner than had been previously thought–perhaps unwinding 3 months earlier than prior expectations—- and there is also an expectation he will lighten his “transitory” language at next week’s meetings.

He has also stated that “almost all forecasters expect inflation to decline meaningfully” by the second half of next year (I had not noticed those forecasts–but he has— and “almost all” seems like a lot)_)—but the Fed “can’t act as if they are certain of that”. Well, of course, you cannot act as if they are “certain” of anything—so what was he communicating?

Omicron has seemed to have lost a bit of Mojo—so that is at least consistent with a good labor market looking forward. Less talk of supply chain problems—-which would take pressure off the inflation side of things if true–hence consistent with moving toward a less “loose” stance.

But I often forget that it’s a balance of inflation and employment the Fed seeks—perhaps because on the one hand “2%” is stuck in my mind—but there is no employment rate that is “fixed” in my mind. I assume the target should be as low as possible consistent with 2% inflation–which is presumably a judgment call. What was the low before the virus showed up? 3.5%. I like that better than 4.2

Personally, I fear premature tightening more than slightly extended inflation. Net, he seems to be signaling a tightening–which began right when he was reappointed. I hope he is smarter politically than those who appoint him—and that he sticks to what he really believes–whatever that is.

It hope he is not “selling the low” (market analogy) as suggested might be the case by Tyler Cowen today. I always think the Fed is biased toward the tight side—which I felt Powell was not.

I still think there is a bit of politcs going on—but he should not be signaling too strongly in one direction if he himself is still unclear—which I fear he may have already done.

6. December 2021 at 12:44

4.2% unemployment victory lap seems a bit premature given there are 3.9 million fewer people working in the USA than 21 months ago.

6. December 2021 at 13:38

Brian, Why is it premature? Total employment is a completely unrelated issue. Monetary policy cannot put a gun to people’s head and force them back to work.

7. December 2021 at 05:54

Maybe total employment is a “completely unrelated issue” —-but one needs a reason considering it happened on the heels of Covid——median age of workers has risen 3 months —-that has some impact. But, I can also seeing it having a longer term impact that is not negative—we have learned something positive from Covid that was unintended.

Does 4.2% matter versus pre-Covid 3.5%? Is that also a completely unrelated issue? It’s related—-although maybe that is the right number. If inflation needs restraint——-maybe 4.5% is the right number.

That is the issue.

7. December 2021 at 06:32

Mainstream always sees inflation as demand pull with a wage/price spiral. It’s their standard doom loop mantra. And the only solution is to suppress demand so that the existing production and its financing can continue to extract rent.

The actual solution is to see every price rise as an anti-trust issue, which requires competitive intervention, break up, funding new start ups and training of competitors.

Or at the very least removal of supply from the failed market incumbents and the imposition of rationing by quantity, not price.

MMT is the true supply side economics, because we tend to see the problem as a supply bottleneck that needs uncorking.

7. December 2021 at 08:19

The economic theories that have garnered interest are backasswards. Interest is the price of loan funds. The price of money is the reciprocal of the price level.

There is no such thing as a neutral rate of interest – “the rate consistent with the economy operating at full strength and with stable inflation”

Velocity is a function of interest rates. As the demand for money increases, velocity falls. Demographics has nothing to do with it.

These fallacious ideas are vitiated on largely false premises on which deregulation, laissez-faire economics is based (“abstention by governments from interferingV in the workings of the free market”), viz., that demand deposits in commercial banks constitute the “savings’ of the depositors, that these are “lent” to the banks, and that the commercial banks are only a “medium” through which this end is affected.

The utilization of bank credit to finance real investment or government deficits does not constitute a utilization of savings, since bank financing is accomplished through the creation of new money.

7. December 2021 at 15:30

The academics have never understood the difference between banks and nonbanks:

The FED’s definitions have long been a joke:

MSB’s balances in the DFIs were designated as interbank demand deposits (IBDDs-balances maintained by respondent banks in their correspondent), presumably because MSBs were called banks and were insured by the FDIC and not the FSLIC (and not counted in M1).

At the same time the Savings and Loan Associations’ deposits were insured by the FSLIC and their balances held in a member bank were not designated as IBDDs (and their deposits were counted in M1); neither institutions had the right to hold deposits: transferrable on demand, without notice, and without income penalty prior to the DIDMCA of March 31st 1980 (the legal basis for becoming a DFI); both were the customers of the DFIs; and neither had Reg. Q restrictions prior to July 1966.

9. December 2021 at 05:44

If you back out O/N RRPs from the money stock, then R-gDp is taking such a hit that the FED must ease monetary policy:

01/1/2021 ,,,,, 0.645

02/1/2021 ,,,,, 0.659

03/1/2021 ,,,,, 0.697

04/1/2021 ,,,,, 0.671

05/1/2021 ,,,,, 0.646

06/1/2021 ,,,,, 0.518

07/1/2021 ,,,,, 0.475

08/1/2021 ,,,,, 0.252

09/1/2021 ,,,,, -0.014

10/1/2021 ,,,,, -0.042

11/1/2021 ,,,,, -0.040

9. December 2021 at 06:27

There was no economist more prescient than Leland Pritchard, Ph.D., Economics, Chicago 1933, M.S. Statistics, Syracuse.

Economists don’t know a debit from a credit. See e-mail:

Re: My comment: Savings are not a source of “financing” for the commercial bankers

Dan Thornton

Thu 3/9, 2:47 PMYou

See the graph below.

http://bit.ly/2n03HJ8

Daniel L. Thornton

D.L. Thornton Economics LLC

It is hard for the average person to believe that banks do not loan out savings or existing deposits – demand or time. But the DFIs always create money, somewhere in the system, by making loans to, or buying securities from, the non-bank public.

This results in a double-bind for the Fed (FOMC schizophrenia: Do I stop because inflation is increasing? Or do I go because R-gDp is falling?). If it pursues a rather restrictive monetary policy, e.g., QT, interest rates tend to rise.

This places a damper on the creation of new money but, paradoxically drives existing money (savings) out of circulation into frozen deposits (un-used and un-spent, lost to both consumption and investment). In a twinkling, the economy begins to suffer.

People can choose to hide their heads in the sand. It’s as Dr. Philip George says. “When interest rates go up, flows into savings and time deposits increase” (thereby destroying money velocity)

9. December 2021 at 06:44

In Alfred Marshall’s “Cash Balances Approach” (demand for money), K = “the length of the period over whose transactions purchasing power in the form of money is held”. K is related to Vt; it is the reciprocal.

Money is a paradox, by wanting more the public ends up with less, and by wanting less it ends up with more.

9. December 2021 at 06:47

@spencer

You always like to make the point that savings does not create lending power— as an intro to some other issue. I was not aware economists thought it did. Maybe I am wrong. But I don’t think so. Why make that point?

9. December 2021 at 09:06

@Michael Rulle: Because others keep advertising it:

Alt-M: “Although there is a natural (sometimes justified) tendency to associate inflation with “printing” additional money, the historical relationship between annual changes in money and inflation (using the M2 aggregate measure for money and the overall PCE index for inflation) shows that inflation has been low and stable for decades even following large increases in money. In fact, dating to 1960, annual changes in the core PCE display very little correlation with M2 growth.”

We’re not in a contraction, subtracting O/N RRPs from our means-of-payment money is wrong. Different classification.

Money matters. If prices don’t fall in FEB and MAR next year there’s a new paradigm.

9. December 2021 at 15:59

Sumners communist thugs at CNN were once again wrong.

Jussie “mega loser” Smollet found guilty today of pretending to be harrassed by Trump supporters. For weeks, CNN and Sumner wrote about this case. For weeks they told us Trump was “inciting hate”. For weeks, they spoke of nothing about “hate crimes” and “hate speech” and how we should all crack down on those “trump supporters” because they are all racist.

None of those Trump supporters voted because they were tired of open borders, or to end one sided trade policies that enrich the MNC’s and consolidate industry while destroying the lives of the majority. Nope. They only voted because they are all racist. Every single one of them.

Sumner needs to say “I’m a dotard”, apologize, and then crawl back into whatever hole he emerged from. The quicker he does, the faster America returns to prosperity and rids itself of communist fleas.

All that talk of “net gain” while completely ingoring the losers. Yes, globally tade is a net gain. It’s not a net gain for the American worker.

And your chicago thugs are disgusting. What kind of sicko pretends he gets attacked.

That is deranged. Derangement syndrome. Sound familiar sumtard?

10. December 2021 at 05:29

@nick

While Scott has a mild to medium case of TDS, which has held constant, I have not seen him translate that into supporting the Cuomo boys, let alone Jesse Mollet (or whatever his name is). One of the issues supporters of Pols like Trump and DeSantis have is these imaginary ideas. Then again, so does the left.

Scott is not of the left. He is far more negative about the state of the world. He sees the world as heading in the direction of dangerous nationalism. What he calls Banana Republic. I must admit, when I quietly reflect on the state of things, I may be more negative than him. As in—- when has it ever been different?

10. December 2021 at 05:39

To answer my own question It is a matter of degrees.

As writing this the 6.8 number printed. I now give up. This inflation has been unexpected for far too long, hence no longer unexpected. Well, I have thought tightening in 81-82 was good. Of course I do not know if COVID alters the internal mechanics of implementing monetary policy. So I fear over doing it. Maybe we should pull a mini Volcker. Scott thinks it will prevent recession. I have no idea. But we are likely to find out

10. December 2021 at 05:49

I learned early that I was not capable of directionally trading. I think my belief in EMH was the reason. So I rarely trade. Very long term buy and hold. Years and years. But I have from time to time. In reality —-while I was never good—-my entries were not bad. Never knew how to exit. So, the Fed’s equivalent of an exit is to lower inflation, which I assume is to tighten. I think that will happen. I hope Powell knows how to exit.

10. December 2021 at 06:48

re: ” Why make that point?”

Economists think banks are intermediaries. Just google it. It’s universal. Economists have the system backwards. Loans create deposits, not the other way around. The implications are profound. It means from the standpoint of the system, the banks should store their liquidity, and not buy their liquidity. It means all bank-held savings are frozen, lost to both consumption and investment. That’s what has caused the deceleration in velocity since 1981. That’s what causes secular stagnation.

The increased lending capacity of the financial intermediaries is comparable to the increased credit creating capacity of the commercial banks in only one instance; namely, the situation involving a single bank which has received a primary deposit. But this comparison is superficial, since any expansion of credit by a commercial bank enlarges the money supply, whereas any extension of credit by an intermediary simply transfers the ownership of existing money.

10. December 2021 at 07:02

CPI numbers this morning say we have the highest year-over-year inflation rate in nearly forty years. And the Fed is thinking about tapering a bit faster, and oh, yes, perhaps a quarter-percent rise in the funds rate may happen four months from now.

The 1970’s Fed had nothing on these guys.

We apparently learned nothing from the early 70’s experience. Stimulating aggregate demand is not the correct way to deal with adverse supply shocks.

10. December 2021 at 07:13

The inflation print was no happenstance. The distributed lag effect of money flows, volume times transaction’s velocity, has been a mathematical constant for > 100 years. The peak is in January.

What’s notable is that: “real-wages shrank for the 8th straight month in November…and with it, Americans’ standard of living dwindles.”

N-gDp level targeting, a “total dollar make up policy”, is backwards. Lending by the Reserve and commercial banks is inflationary, whereas lending by the nonbanks is noninflationary.

The FOMC’s monetary policy objectives should be formulated in terms of desired rates-of-change, roc’s, in monetary flows, volume times transaction’s velocity, relative to roc’s in the real-output of final goods and services -> R-gDp.

The solution to secular stagnation is to gradually drive the banks out of the savings business.

10. December 2021 at 07:24

An attempt to understand, not to criticize the post or the comments. Your input is welcomed.

It appears to me that the Fed has bought about 60% of the increase in Federal Debt since 1/1/20: $3.3 trillion increase in Fed Treasury Securities held outright, out of a $5.1 trillion increase in Total Public Debt.

https://fred.stlouisfed.org/series/TREAST

https://fred.stlouisfed.org/series/GFDEBTN

1. Do these purchases drive up the prices of Treasury securities, and therefore drive the rates down?

2. If so, should we expect Treasury securities prices to fall (and rates to rise) as the Fed’s purchases decline as a fraction of total new Public Debt?

3. If so, are there any credible estimates of the magnitude of this effect: how much Treasury rates will rise as the Fed buys decreasing percentages of new Public Debt? Where might I look?

Thank you!

10. December 2021 at 10:34

Michael, You are replying to nick like he’s some sort of normal human being? Hello, it’s nick.

Todd, It’s hard to predict the impact of bond purchases on bond prices, because these purchases have both a liquidity and a Fisher effect, which work at cross purposes.