Price indices: constant utility or constant quantity?

Josh Hendrickson argues that an ideal price index should include asset prices. I am not going to address that issue, as I’m not sure what an ideal price index is. But it’s a good post—worth reading if you are interested in price indices.

Instead, I’d like to focus on a less controversial claim in the Hendrickson post:

From that description, one can easily understand why I called that “ideal.” How would one go about finding changes in the cost of a constant-utility basket of goods when utility isn’t really observable?

A practical solution to estimating a price index might be as follows. Consider two-period, two-good example. We observe the price of eggs and the price of milk each period. We also observe the quantity of eggs purchased and the quantity of milk purchased each period. If we want to track changes in prices over time, we could calculate expenditures for period 1 and period 2 using the quantities of eggs and milk purchased in the first period. Alternatively, we could calculate expenditures for period 1 and 2 using the quantities of eggs and milk purchased in the second period. In each case, the first period’s expenditure could be normalized to 100 and the second period price level could be calculated by multiplying 100 by the ratio of expenditures in period 2 to expenditures in period 1. Or, if we want to get really fancy, we could take the geometric average of the ratio of expenditures using both methods and multiply that by 100 to get the price level in the second period.

The purpose of doing any of these three options is that, since you are holding quantities constant across periods, your measures of expenditures are only capturing changes in prices. Effectively, what you are doing is constructing a weighted average of prices in which the weights are fixed quantities of the goods.

This is all pretty standard, similar to what you might find in an economics textbook. But this discussion implicitly assumes an equivalence between fixed quantities and fixed utilities. I will argue that this assumption is not justified, and then use my analysis to explain problems with the Michigan survey of inflation expectations.

To make things as simple as possible, imagine an economy with only one good and no quality changes over time. According to our textbooks, it should be easy to measure the rate of inflation in that sort of economy. But even in that case the inflation rate will differ depending on whether you assume constant utility or constant quantity.

Imagine an economy where the aggregate quantity of the only good increases at 5% per year, while the price of that good rises by 10%/year. You can think of that economy as having a 15% nominal growth rate. (I’ll ignore compounding for simplicity; technically it’s 15.5%). How much extra income would a person need each year in order to maintain a constant utility? I’m not sure, but I’m pretty confident the answer is not 10%, and it’s also not 15%.

1. A person that got a 15% raise would be able to buy 5% more real goods. So presumably their utility would be higher than before.

2. A person that got a 10% raise would be able to buy the same amount of goods, while that person’s acquaintances would be 5% ahead in real terms. So presumably that person would feel worse off in terms of utility.

This suggests that a measure of inflation that holds utility constant would be somewhere between 10% and 15%. You can think of utility as being a function of both absolute quantity of consumption and consumption relative to other people. Furthermore, it would vary by individual. A loner with no friends might be satisfied with a 10% raise, while a person that acutely feels any sort of “unfairness” in life might need almost 15% more income to maintain a constant utility. In other words, there’s a different ideal price index for each person.

Let’s assume that instead of holding utility constant, we hold quantity constant. Then it becomes easy to calculate inflation—which would be exactly 10% in this case. Unfortunately, our textbooks seem to conflate “constant quantity” and “constant utility” in a way that ignores the social aspect of consumption.

My thought experiment involves an economy where quantity grows over time. But the same problem occurs with quality improvements. Here again, a “hedonic” adjustment that attempts to account for quality changes will typically come up with a lower estimate of inflation than an index that holds utility constant. Thus the BLS says that the price of TVs has fallen by more than 99% since 1959 (due to quality improvements), but average people don’t think that way. They want to know how much more it costs to buy the sort of TV their neighbors have, not how much more it costs to buy the sort of TV their grandparents had.

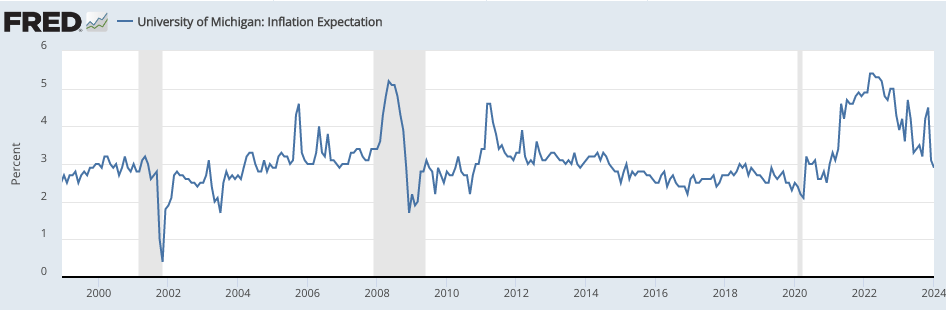

Notice that the Michigan survey of 12-month inflation expectations generally hovers close to 3% from 2000 to 2020, even as measured inflation averaged a bit under 2%. Economists might be inclined to write off the public’s estimate as being “biased”, or “uninformed”. The public doesn’t understand about substitution bias, or quality changes.

Or perhaps the public is taking seriously the “constant utility” definition of inflation. Perhaps they are saying they need about 3% more income to maintain their utility at a constant level. Notice that the public’s estimate of inflation is slightly below the average rise in per capita nominal incomes, and slightly above the inflation estimate you’d get using the economists’ preferred “constant quantity” approach. That’s the same qualitative result we derived in my thought experiment above. Coincidence?

Tags:

21. March 2024 at 21:37

I’m reminded a little bit of that Russian joke: “I’m not greedy, I just want the land that borders on mine.” In the context of the “average” American it’s reasonable to assign the following expectations:

-I want my salary to increase by 5% every year

-I want the value of my house to increase by 5% every year

-I want the price of all the goods and services I purchase to increase by 0% a year, unless I’m making the hedonic choice to spend my increased wealth on more expensive goods and services

I suppose that you could actually achieve that if you lived in the 19th century—although property values in those times weren’t protected by zoning regulations.

21. March 2024 at 23:52

People don’t want constant utlity; they want to increase their utility.

It’s not “greedy” as David says to want a better life for yourself and for your children. Of course, people want the land that borders there land. Why not? What’s what wrong buying land?

The Fed has been penalizing savers since 1913. Real incomes have declined. Nobody cares about their nominal income, or maintaining the status quo.

That’s precisely why bitcoin is so attractive. It rewards those who save. It doesn’t penalize them.

The next ten years will be a glorious revolution. Decentralization is on the horizon, and the centralized Sumner’s, and their monetary economists, are going to be run over by the decentralized, populist machine.

And there is nothing you can do to stop it. You cannot control Bitcoin without shutting off the electricity. And if you do that, you won’t befiguratively run over, you’ll be literally run over.

It’s game, set, match. And you lost.

22. March 2024 at 05:05

Why stop at 0% inflation?

Have a look at George Selgin’s ‘Less Than Zero’ for an exploration of falling prices (also in the 19th century).

22. March 2024 at 05:40

What is inflation trying to measure? It seems in the above examples it is being used as a part of an analysis of how productive an economy is in one time period versus another time period. I would assume that in real life that there are industries that produce undifferentiated commodities and that for those industries, you can compare output versus input during period one and period two. I don’t know if you can then use that info to look at other industries where you would make hedonic adjustments and get more useful information for decision making. And there are certainly economies, like say India’s, where you can tell the economy is getting more productive hedonically measured even if you can’t do so with precision. You can simply observe large swathes of the population going from frequent periods of caloric deficit and malnutrition to very little of the population facing those problems. Or you can observe the proportion of households with indoor plumbing and electricity versus those without. Likewise with motorized transportation.

When you are talking about advanced economies, it does seem more difficult. Everyone already has enough to eat, has antibiotics and vaccines, has electricity and indoor plumbing in their dwellings, and the vast majority has access to motorized transportation. So it seems that in the case where you aren’t getting changes to the economy that make life vastly easier and vastly healthier, the utility derived from consumption is going to be more about consumption relative to one’s peers. I doubt people who don’t have enough to eat feel worse about getting enough to eat if their hungry neighbors also start getting enough to eat. Though I don’t know, maybe people do get upset if lower castes get enough to eat when you, a person of higher caste, also go from being hungry to only just having enough food to get because it violates your sense of the divinely ordered hierarchy of human beings?

22. March 2024 at 06:47

Fisher already explained this. He used all transactions, not just final goods and services. Financial transactions aren’t random as the 1st qtr. of 1981’s time bomb showed.

22. March 2024 at 08:14

Sara, You said:

“People don’t want constant utlity; they want to increase their utility.”

One of those moments where I realize that Sara is a complete idiot. You really think this is an interesting observation? Something we all want to read?

22. March 2024 at 09:07

Actually, targeting N-gDp solves the problem.

22. March 2024 at 10:30

It would be interesting to see a price index over time of a “healthy diet” as recommended by the USDA MyPlate website. The average American male is 5’9″ and 37 years old. Middle of normal range BMI is 22 so that’s 150 lbs. Calorie counter with moderate exercise says that guy should eat 2300 calories per day. How much is that guy spending per year at the grocery store over time and as a % of his income?

I think something like that is one aspect of “utility”

22. March 2024 at 15:33

I liked this post.

Add in chronically worsening housing shortages and wildly escalating housing prices and costs…

23. March 2024 at 02:27

Scott,

if the public uses another, slightly higher, value for inflation as it seems to care more about utility, doesn‘t this mean that real GDP is overstated? I assume the GDP deflator is impacted all the same…

23. March 2024 at 14:42

viennacapitalist, Not necessarily, as real GDP is trying to measure output, not utility.

I think what you mean to ask is whether this means RGDP doesn’t measure utility, and that is clearly true.

25. March 2024 at 08:28

As Solon notes housing is huge. Renting a house is fundamentally different from owning one. How can you compare a situation where someone can uproot you with 30 or 60 days notice, for no reason in most jurisdictions, with one where you get a grace period of months or years before the bank or state forces you out even after you’ve fallen behind? Especially with children the former situation is highly undesirable. It is completely nuts to think that you can measure housing inflation solely with rent and quasi-rent/OER indices.

28. March 2024 at 13:53

Always been somewhat confused by this point.

I was trying to explain to my brother, who was studying economics, how it was incorrect to say that GDP is an inaccurate measurement because of this example: Say you have 3 towns, A, B, and C, which is in between A and B, and you build a highway between A and B cutting off C. This is great for the drivers who don’t have to spend money at C and can get to their destination faster. It is not good for C because they get less money, but they were providing an inefficient service, and the highway increases efficiency. Nevertheless, GDP goes down as less spending at C.

And I gave the counter argument that look, the people who would have spent money at C, now they have funds to spend elsewhere, or invest, and ultimately they are better off, and so NGDP is constant and RGDP goes up, and even if you construct this such that NGDP goes down, RGDP does not decrease.

And while I think that is theoretically correct, I realized I am totally unconvinced our metrics actually capture this.

It is also totally unclear to what extent inflation captures hedonics and quality improvements, when studying monetary policy in college we just sort of acted like those thing do not exist. I also don’t understand how the relationship between M2 money supply and “price level” can be understood in the context of quality. You can keep it constant for the analysis, but yeah I do not think people actually think that way.

29. March 2024 at 05:56

Sorry for this being somewhat off topic but here is Larry Summers saying there are other reasons to think that the public experience of inflation differs from official inflation indices.

https://www.forbes.com/sites/theapothecary/2024/03/23/summers-inflation-reached-18-in-2022-using-the-governments-previous-formula/?sh=97ac7a720929

30. March 2024 at 08:40

Jerry, Yes, but that pre-1983 method was clearly misleading.

2. April 2024 at 08:43

I’m a bit late to this, but this is a very good post.

I’ve thought of this in somewhat different terms, not so much from the perspective of social comparison specifically, but in terms of what money you’d actually need to keep living the way you’ve been living.

Suppose your household buys a new BMW 3-series every five years, with you and your wife each driving one for 10 years and then buying a new one. This may not be a social status thing: the both of you may just enjoy how they drive while finding sedans practical. In 1999, your wife’s BMW 323i might have cost $28,000. In 2004, a BMW 325i (which took over the 323i’s spot in BMW’s lineup) cost you $31,000. Your wife then replaced her 1999 323i with a 2009 328i for $37,000 in 2009. Your 2004 325i was replaced by a 2014 328i for $40,000, and your wife’s 2019 330i cost $44,000. Over the twenty year period, the price of the model at that point in BMW’s line up went up almost 60%, yet new car CPI was barely changed over that time period due to quality improvements.

The same thing with smartphones. Say every four years, you buy Apple’s flagship smartphone with base storage, starting with iPhone4S in 2011 for $649. In 2015, you then buy iPhone 6S Plus for $749, iPhone 11 Pro Max in 2019 for $1,099, and iPhone 15 Pro Max in 2023 for $1,199. From a CPI perspective, the price of a smartphone likely fell a lot (say 70%) over this time period, but actual dollar outlays nearly doubled.

You can make the case that you truly can find cheaper options and be better off (e.g. in 2023 you can buy an iPhone SE for $429 and that SE is way better than your iPhone4S), just as a $28,000 2019 Honda Accord has many features the 1999 BMW doesn’t have. However, this is a downgrade of lifestyle, and if it continues you’ll eventually be buying used iPhones and used Honda Civics if your income only follows the CPI for cars and phones. Also, quality is subjective: not only would I pay 1999 prices for a new 1999 BMW over 2019 prices for a new 2019 BMW, but I would pay 2019 prices for a new 1999 BMW instead of for the 2019 BMW, without hesitation. Some of the ‘added features’, such as electronic power steering, made the driving experience subjectively worse.

2. April 2024 at 09:09

Justin, I used to use the example of the 1986 Acura Legend, which sold for $22,500. The cost of “entry level luxury” rose over the next few decades, but there was no increase in the price of that physical quality car, as a 2006 Honda Accord was just as good as the 1986 Acura—indeed better.

It’s all subjective.

2. April 2024 at 09:11

There is an inconsistency with how cars and houses are treated in the CPI.

Both are long-term assets, but cars are captured using hedonically-adjusted cost of new cars while houses have been converted into some intangible owners equivalent rent which is silly because it’s a price no one pays. The price of houses should be captured the same way as with cars.

Agreed that financing costs should be carved out as what we really care about the is the underlying commodity or service price. If those prices are stable, then high rates should be a short-lived aberration.

2. April 2024 at 09:18

It all depends on what is the purpose of the price index. Thus a GDP deflator looks at “output”, which would include the cost of newly built homes and the rental equivalent of existing homes.

The CPI is supposed to measure “cost of living”, but that’s a pretty meaningless concept. How do you define it?

I saw Larry Summers indicate that by one definition inflation recently reached 22%. But if that were true, then the US would have been in a major depression, which seems unlikely, given that we are sort of booming. I try to ignore inflation, and focus on what really matters.

2. April 2024 at 09:33

Scott, I agree it’s subjective but I think a price index will be more useful for regular people if it lets them better understand how much money they will need to maintain their current spending patterns.

For most people, they believe they are advancing economically when they are able to do & buy more or step up to higher brands. You’ll have trouble selling someone on the notion that they’ve had real income growth but all of it went to make his Honda minivan, Apple iPhone and HDTV, and he still can’t afford a sports car, or to take more vacations, nor build an addition to his house, etc.