Preaching to the choir

Brad DeLong has a long new post that offers a Keynesian take on recent events. To say I’m not buying would be an understatement. What I find most annoying about the post is that he doesn’t show any signs of even being aware of the criticisms of Keynesian economics made by outsiders, including market monetarists.

Unfortunately (or fortunately for Brad) he’s done his post in a type I cannot copy. But he basically starts out by claiming that under current conditions there is very little likelihood of monetary offset. And yet we’ve just seen an almost perfect example of monetary offset in 2013. Later he suggests that fiscal austerity will reduce GDP growth in 2013 by 1.5%. OK, the RGDP growth rate from 2011:4 to 2012:4 was 1.95%. I’ve gone on record predicting 2% for 2012:4 to 2013:4, despite higher income taxes, higher payroll taxes, and sequester. Who do you think will end up being closer to the truth?

Then he cites studies of the multiplier that ignore the monetary offset problem.

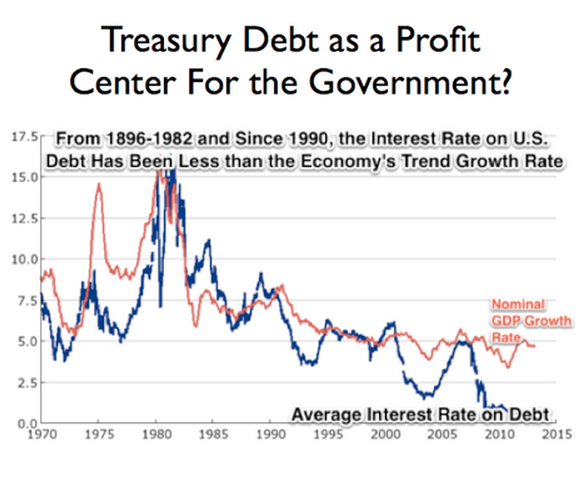

Then he presents this graph of NGDP growth:

Here’s a challenge. Come up with any sort of moving average for NGDP you wish, which makes those numbers accurate. Or even close to being accurate. The 1975 spike is clearly high frequency data, and the recent years clearly are not.

Then he claims that the BoE had only a “limited ability” to offset fiscal austerity. Oh really? What was the limit? Perhaps the fact that inflation was overshooting the target by a wide margin as British employment hit one record after another. But that can’t be right, as it would imply Britain’s huge output gap is mostly productivity, mostly supply-side.

Maybe Keynesians believe fiscal stimulus can also solve our productivity problems. After all, DeLong and Summers showed it has a Laffer curve-like ability to be self-financing.

Here’s DeLong:

Zero lower bound reached: Conventional monetary policy not powerful enough.

Translation: Keynesian economists talked the world’s central bankers into using a steering mechanism for nominal spending (interest rates) that locks ups just when you need it most, in a deep slump.

So how should the world respond to this Keynesian monetary policy incompetence? Switch to alternatives like QE and/or NGDPLT? No:

Worries about non-standard [read non-Keynesian] monetary policies on a large scale.

Instead of abandoning Keynesian monetary policy procedures, and switching to something that works, we need to adopt another failed Keynesian idea; fiscal stimulus. But that also failed. And how about worries about deficit spending on a large scale? Are those less of a problem for policymakers than monetary risks? Even worse, Obama can’t do anything about the Republicans who block fiscal stimulus, but he appointed the Fed Governors who worry about “risk.” Indeed he’s determined to appoint a Fed chair who thinks Bernanke’s QE is too risky. Someone to the right of Bernanke on monetary policy, and Bernanke’s a Republican!

BTW, the similarities between the austerity of 1937 and the austerity of 2013 are uncanny, right down to the 2% payroll tax increase in each case. Just one difference, the Keynesians told us that the 1937 austerity created one of the deepest depressions in US history, and the 2013 austerity (also at the zero bound), is leading to a carbon copy of 2012. It looks like we may need to go back and rewrite the history books for 1937.

It’s the tight money, stupid.

PS. Not to mention that there’s no discussion of the fact that the market monetarists were right about Switzerland and the Keynesians were wrong. No discussion of the fact that the market monetarists were right about Japan and the Keynesians were wrong. In both cases MMs said they could depreciate their currency. In both cases Keynesians said they couldn’t because they were at the zero bound. And in both cases the MMs were right.

The world is moving on. Keynesians need to recognize that monetary policy is where all the action is today. Fiscal stimulus is dead as a doornail. The Fed is about to “taper” because they are satisfied with the economy (here’s one area I agree with Brad–that’s nuts.) But does that sound like a central bank that is out of ammo?

PPS. I apologize if this post was too grouchy. I get more and more frustrated each day with what I read from my fellow economists.

Tags:

12. September 2013 at 09:21

Carney in Parliament (video): http://www.theguardian.com/business/2013/sep/12/bank-of-england-mark-carney-mps?CMP=twt_gu

12. September 2013 at 09:56

Preaching to the choir?

12. September 2013 at 10:08

I understand your frustration. As a millennial living in a region of north america that has above 10% unemployment, seeing a lot of his friends seemingly overeducated and underemployed this is infuriating. I am no economist, but I learned just enough macro to see that our problems used to be the fault of corrupt banks back in 2008-2009 but they are now clearly self inflicted by the timid central banks of the world.

12. September 2013 at 10:11

Best sentence I’ve read in a while:

“Keynesian economists talked the world’s central bankers into using a steering mechanism for nominal spending (interest rates) that locks ups just when you need it most, in a deep slump.”

12. September 2013 at 10:21

Amen.

http://www.youtube.com/watch?v=rn6w255CGkk

12. September 2013 at 10:41

PJ: Sumner had an even better quote on the same subject, in a (much) earlier post: “Our current monetary regime is roughly like a car with a steering wheel that works fine — except when driving on twisting mountain roads with no guard rail.“

12. September 2013 at 11:04

I don’t recall your position on Japan being all that different from some Keynesians. But with Switzerland there is more of a divergence, with either Krugman or Delong claiming the central bank was powerless to stop the rise of the Swiss franc, only to be proved wrong when it switched targets.

12. September 2013 at 11:23

Thanks everyone.

Wonks, I said Japan and Switzerland should simple devalue, and Krugman said I was wrong, as that’s really hard to do at the zero bound (albeit not impossible). It turned out to be really easy.

Lots of Keynesians claim its impossible–liquidity trap.

12. September 2013 at 11:29

Just the right amount of grouchy. Very well said.

12. September 2013 at 11:41

Scott,

Off topic but there’s a couple of interesting posts at Pragmatic Capitalism by Brett Fiebiger which are critical of Krugman’s “It’s Baaack: Japan’s Slump and the Return of the Liquidity Trap”:

http://pragcap.com/interest-rates-and-monetary-aggregates-during-the-lesser-depression-part-1

http://pragcap.com/interest-rates-monetary-aggregates-during-the-lesser-depression-part-2

I found myself agreeing with most what the Fiebiger said. But it left me with a delicious taste of “I told you so”.

Evidently Monetary Realism et al. are struggling to explain how QE has led to growth in broad money when their model of the economy (which essentially consists of balance sheets and accounting identities) has predicted over and over again that this is completely and utterly impossible. Naturally there’s no acknowledgment that they were totally wrong and that other people were right. In fact the on the contrary, Fiebiger takes the opportunity to take some swipes at old school Monetarists (e.g. Allan Meltzer) and members of the “exogenous money camp” who believe that the money multiplier is a constant. (Who exactly believes that? By the way, have they noticed there isn’t even an “exogenous money” Wikipedia page, so they are debating a straw man?)

I left comments on both posts but this is what I objected to the most.

Brett Fiebiger:

“During the current crisis the Fed seemingly managed to engineer non-trivial growth in bank deposits especially when bank credit was falling from late 2008 to early 2010. That development contrasts starkly with the 1930s Great Depression when the Fed was able to expand base money but was powerless to prevent a contraction in the broad money supply.

In the Great Depression, the supply of broad money fell initially due to debtors paying back debt (i.e. the liquidation phase), and was latter augmented by widespread bank failures (that thus wiped out deposit liabilities).”

This is both grossly simplistic and incorrect.

There were three distinct phases before during and after the Great Depression’s contraction: 1928-1930, 1931-1933 and 1934-1935. The following are the rate of change of the monetary base in blue, bank credit of Federal Reserve system member banks in red and broad money (M2) in green:

http://research.stlouisfed.org/fred2/graph/?graph_id=136889&category_id=0

During 1928-1930 the monetary base contracted at an average annual rate of 1.4%. Bank credit grew at an average annual rate of 3.8%. Broad money didn’t grow at all.

A series of bank panics started in October 1930 and didn’t really come to a conclusion until March 1933 with the inauguration of Franklin Delano Roosevelt. During this time about 4000 banks failed, or approximately one fifth of all banks. Bank failures had a direct effect on money supply of course when they rendered their deposits worthless. But they also had an indirect effect in that worried depositors began to withdraw their accounts causing the ratio of currency held by the public to deposits to rise.

The following graph shows the currency in circulation ratio in blue, the reserve ratio in red and the currency held by the public ratio in green:

http://thefaintofheart.files.wordpress.com/2013/06/sadowski_1.png

And so you don’t think this is just a story about increasing ratios, here is a graph of the quantities of the components of the monetary base:

http://thefaintofheart.files.wordpress.com/2013/06/sadowski_2.png

Currency in circulation is in blue, reserves in red, currency held by the public is in green and the monetary base including bank vault cash is in orange. Bank vault cash was more or less stable during this time period except for a temporary surge in March 1933 that coincided with a one month surge in the monetary base. Despite the increase in the reserve ratio the quantity of reserves actually fell from October 1929 to April 1933. But currency held by the public rose from $3.594 billion in October 1930, the month that the bank panics started, to $5.588 billion in February 1933, or by 55.7%.

From 1931 to 1933 the monetary base increased at an average annual rate of 6.5%. But bank credit declined at an average annual rate of 11.4% and broad money declined at an average annual rate of 12.0%.

In an act that was essentially the QE (and Price Level Targeting) of its day, FDR took the country off the gold standard in April 1933 and allowed the price of gold to rise from $20.67 an ounce to $35.00 an ounce by January 1934. This price was high enough to attract a large gold inflow from abroad which the Treasury monetized by issuing gold certificates to the Federal Reserve.

During 1934 to 1935 the monetary base skyrocketed upward growing at an average annual rate of 18.8%. Bank credit continued to shrink, declining at an average annual rate of 3.1%. Nevertheless broad money grew at an average annual rate of 14.2%.

In short, in the couple of years leading up to, and during the first year of the Great Depression, the monetary base declined. It was only after the bank panics started that the monetary base was expanded, but due to the soaring currency ratio this failed to increase broad money. Once the New Deal had reformed the banking system, including the institution of FDIC in June of 1933, and the devaluation of the dollar had led to vigorous growth in the monetary base, broad money rapidly expanded despite a continued decline in bank credit.

Shorter still: Money IS NOT Credit:

http://pragcap.com/credit-is-money

12. September 2013 at 12:40

Scott, not to swell your head when grouchy, but, as they say, first they ignore you, then they laugh at you, then they fight you, then you win.

Right now, you’re being ignored, and next they will misrepresent MM and laugh.

But don’t get grouchy — it’s unhealthy — if Keynesians cannot engage, you are clearly on the road to success!

12. September 2013 at 13:25

Reading this post makes me depressed.

Macro theory suffers from the problem of being not even wrong.

Tow economists can look at the same set of data and both see the data as vindicating their personal theory, even though the two theories are highly contradictory.

12. September 2013 at 14:30

Wow. Just had a go with the data. Can’t do it with 3, 5, 10, or even 20yr moving averages.

12. September 2013 at 14:46

Is that DeLong graph using the measure of “potential NGDP” which the CBO produce? I’m guessing from the reference to “trend growth rate”; it is a closer match than actual NGDP but still not perfect.

http://research.stlouisfed.org/fred2/graph/?chart_type=line&s%5B1%5D%5Bid%5D=NGDPPOT&s%5B1%5D%5Btransformation%5D=pc1

12. September 2013 at 15:02

Three month rates look like last year’s NGDP.

http://research.stlouisfed.org/fred2/graph/?g=mlF

12. September 2013 at 16:09

Here

http://www.project-syndicate.org/commentary/why-us-inflation-remains-low-by-allan-h–meltzer

Allan Meltzer cries how the evil QE is taking us to the path of inflation.

Why you don´t open a post saying that the old monetarism is dead?

12. September 2013 at 16:50

Mark, Yes, I had to chuckle when commenters started coming over here and telling me that “textbooks claim the multiplier is a constant.”

Robert, I’m not surprised, I can usually spot bad data from a mile away. I slipped up in my debate with Andolfatto, but that was a rare case.

Britmouse, Interesting, given there is no such thing as “potential NGDP”

Kira, I’ve bashed old monetarism many times. I pointed out back in 2009 or 2010 that Meltzer’s predictions would be wrong.

12. September 2013 at 17:42

We don’t know enough about the underlying AD to say that the apparent non-impact of US austerity is due to monetary offset. How do we know that there wasn’t positive fluctuation in AD that was offset by austerity leading to a “carbon copy” of 2012 (changing 2013 from yay to meh)?

I don’t think it is so cut and dried.

Imagine a scenario where all the markets believe in the power of monetary policy (evidence is in the response to Fed statements!), but the true underlying economic theory says it isn’t effective and “austerity” is bad. What would we get? Markets would fall when tapering is mentioned and rise when it is taken off the table. The yen will fall against the dollar with Abenomics. Businesses that think austerity is good will invest. Then what? Do we continue at growth path given by the expectations of the “incorrect theory” (contradicting the idea there is a correct theory of macroeconomics) or do we revert to the growth path given by the underlying theory (expectations don’t matter in the long run)?

12. September 2013 at 18:18

That is a very, very strange chart. Maybe NGDP growth has a different, unlabelled Y-axis?

Anyways, by BDL’s standards your post is a model of civility, so don’t beat yourself up too badly.

12. September 2013 at 18:54

Scott, for future reference when Brad Delong embeds a pdf file into his website like that, you can save off the pdf to your hard drive and open it up in Adobe Reader. You’ll be able to copy the text from that.

12. September 2013 at 21:26

PPS. I apologize if this post was too grouchy. I get more and more frustrated each day with what I read from my fellow economists.–Scott Sumner.

Not grouchy enough.

13. September 2013 at 00:05

Can someone enlighten me as to what is the basic argument Keynesians make for saying (wrongly) that you cannot devalue because of the zero lower bound? I just can’t get my head around this one

13. September 2013 at 04:54

Jason, Why didn’t the Keynesians tell us that when they complained that austerity was slowing growth in the EU?

MFFA, In their view banks will simply hoard the monetary injections, and asset prices won’t change.

13. September 2013 at 13:38

Scott, they probably should have — at least initially — but there has been more data in that case:

http://krugman.blogs.nytimes.com/2012/04/24/austerity-and-growth-again-wonkish/

The US “austerity package” point and would not be inconsistent with the fluctuations around the regression line in the linked graph.

14. September 2013 at 06:11

Jason, Those studies don’t account for monetary offset, and hence are worthless. Many of those countries are in the euro, so obviously the fiscal multiplier will be positive at a country level.

16. September 2013 at 13:38

Why should the ZLB make it difficult for a country to devalue? I do not know if this is it, but there are two possible indirect/theoritical paths, either through inflation or nominal interest rates, or simply directly by unloading reserves. So what could the issue be? I now that is not your line of thought and you also disagree with that, but I would be really pleased if you could explain to me why they could eventually in someone’s mind be right.