Random observations

1. This confused me:

Renewed efforts by Congress to force TikTok to sell or face a ban in the US have the backing of the White House, even as President Joe Biden’s reelection campaign has started to use the platform to reach younger voters.

I’m confused. If using Tiktok endangers national security, then why is Biden using TikTok? I get that his specific tweets don’t endanger security, but doesn’t his use make TikTok more popular?

2. I’m confused. Why would Trump try to ban TikTok in 2020, and then suddenly support TikTok after meeting a GOP investor who own’s $21 billion worth of TikTok, right after losing some legal cases that threaten to bankrupt him?

3. A recent Hamilton Project report provides some pretty convincing evidence that recent population growth has been much higher than the Census estimates. Their findings would also explain the large divergence between the payroll jobs numbers and the household survey.

4. I’ve been pretty critical of white nationalists (and still am), which makes this recent Scott Alexander post on our insane identity politics all the more provocative:

In Bizarro-America, the only people who don’t think people’s value as human beings depends on their genetically-determined race are the white nationalists!

Read the whole thing, it’s great.

[FWIW, I’m completely opposed to all forms of “identity”, on both the left and the right. People are people. That’s all that matters. Gender, race, religion, ethnicity . . . who cares? That makes me far left on some issues and far right on others.]

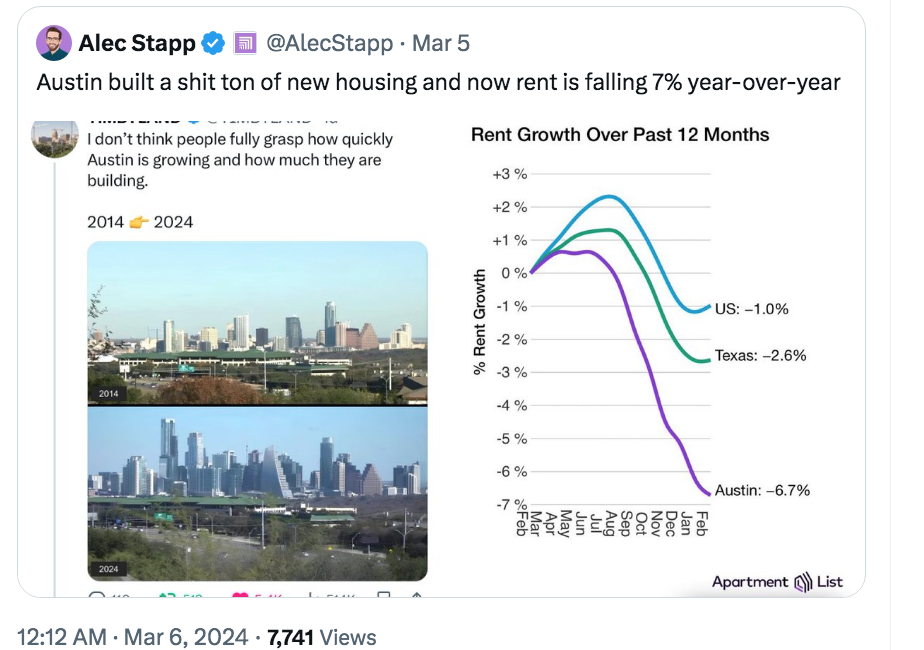

5. Speaking of Scott Alexander, this tweet reminded me of a recent debate we had over whether building more housing reduces housing prices:

The before and after skyline views makes Austin look like a Chinese city.

6. The NYT has an article discussing the strange new left-right coalition in support of YIMBYism:

Take, for instance, the YIMBY mantra of allowing taller buildings and reducing the permitting hurdles to build them. Is this, as many Democrats say, a way to create more affordable housing, reduce neighborhood segregation and give low-income households access to high-amenity areas and schools?

Or is it, as Republicans say, a pro-business means of reducing regulation and enhancing property rights by giving landowners the freedom to develop housing?

Is it, somehow, both?

7. This Cato headline caught my eye:

List of 120+ Biden Actions to Help Try To ‘Shut the Border’

Generally, it’s better to make more modest claims.

8. I see people suggesting that even if Trump wins, he’ll only be in office for 4 years. These people don’t understand that the Republican Party no longer exists. There’s the Democrats and the Trump Party. There is no Republican Party, so things will never go back to normal. Here’s the NYT:

Twenty-six Republican senators voted against the recent aid package for Ukraine, which a pre-Trump Republican Party would have overwhelmingly supported. And of the 17 Republican senators who were elected beginning in 2018 and who are age 55 or younger, 15 voted no.

Those Trumpistas are the future of America.

9. In a normal country like Canada or Australia, candidates debate issues on a roughly level playing field. In a banana republic like Venezuela, the entire election revolves around one larger than life figure, who has a personality cult. Issues don’t matter, other than the issue of what you think about the dominant politician. Which of the two better describes the US? You be the judge (from Edward Luce in the FT):

Here is a checklist of Donald Trump’s recent activity. He promised on day one of his presidency to let January 6 convicts out of jail, close the US-Mexico border and “drill baby drill” for gas and oil. He feted Viktor Orbán in Mar-a-Lago as the best leader in the world and assured Hungary’s strongman that he would not “give a penny” to Ukraine. He took out a $91.6mn surety bond to pay defamation damages to his sexual assault victim, E Jean Carroll.

He purged the Republican National Committee with 60 staff firings — the opening move by his daughter-in-law, Lara Trump, who he handpicked as RNC co-chair. . . . It seems almost trivial to add that new detail emerged about Trump’s apparent soft spot for Adolf Hitler.

All this happened since last Friday. . . . In another time, with a normal candidate, any single one would hijack the news cycle. Trump’s candidacy is so far off the charts it is almost paranormal. That is the essence of his political appeal. It means he is judged by a different standard to Biden, or any other politician, Democratic or Republican.

10. This is from an excellent Tyler Cowen post:

[I]f TikTok truly is breaking laws on a major scale, let us start a legal case with fact-finding and an adversarial process. Surely such a path would uncover the wrongdoing under consideration, or at least strongly hint at it. Alternately, how about some research, such as say RCTs, showing the extreme reach and harmful influence of TikTok? Is that asking for too much?

Now maybe all that has been done and I am just not aware of it. Alternatively, perhaps this is another of those bipartisan rushes to judgment that we are likely to regret in the longer run.

Funny how these “bipartisan rushes to judgment” so often involve China, not Russia. I wonder why?

11. Many commenters are under the mistaken impression that I’ve called Trump a Nazi. Not so. They are confusing me with Trump’s former aides. You know, the “best people” that Trump said he would hire to staff his administration. Those are the people that claim Trump is a Nazi sympathizer. Ohio senator JD Vance also suggested that he might be a Nazi. I just think he’s a borderline fascist, so don’t blame me for these wildly excessive accusations by his supporters and subordinates.

12. I always assumed that Trump plans to surrender to Putin, but it’s still sad to see it confirmed by Victor Orban. In the same article, this caught my eye:

JOE KERNEN: Have you changed your, your outlook on how to handle entitlements Social Security, Medicare, Medicaid, Mr. President? Seems like something has to be done, or else we’re going to be stuck at 120 percent of debt to GDP forever.

Or else? That’s the best plausible outcome, the one that occurs if we dramatically cut spending and/or raise taxes. The actual outcome will likely be far worse.

And check out Trump’s garbled response to Kernen’s question, which makes Biden seems like Daniel Webster in comparison.