No, the eurozone doesn’t have a similar inflation problem

The US is currently experiencing 9.1% CPI inflation, while the eurozone has 8.6% inflation. That sounds pretty similar, doesn’t it?

In fact, the inflation in the eurozone is much different from inflation in the US. In the US, we have both stagflation and boomflation. The eurozone has mostly stagflation, as their NGDP growth rate since 2019 has not been particularly high (2.67%/year since 2019:Q4).

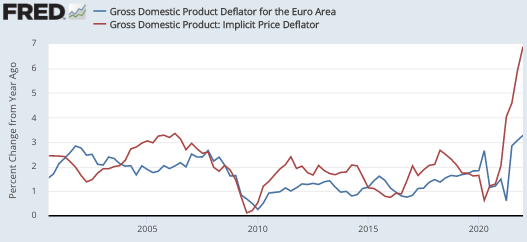

You can see the difference by looking at inflation as measured by the GDP deflator:

In the US, the inflation rate for final goods is 6.9%, whereas in the eurozone it is only 3.3%. Europe’s 8.6% consumer inflation is mostly imported goods.

Which inflation problem is worse? It depends what you mean by “worse”.

The eurozone is suffering more in terms of current living standards, as nominal income growth in the eurozone is far lower than in the US.

In terms of bad monetary policy and future macroeconomic instability, the US has a much worse inflation problem.

Tags:

17. July 2022 at 06:29

So the normative implication of this would be that the Fed should be stabilizing NGDP through contractionary policy whereas ECB should be laid off and treat their inflation as transitory.

I haven’t followed ECB policy much but something tells me they’re taking a similar course as the fed, perhaps to a different extent though.

17. July 2022 at 06:45

Sid, I think that’s mostly correct. But I’m not an expert on Europe, and I’ve read that they’ve had a big reduction in labor force participation for reasons that I don’t understand. If so, then somewhat below normal NGDP growth might be appropriate.

Do you know of any data on nominal wage growth in Europe?

17. July 2022 at 06:58

AD is going to fall after the current dissaving ends.

17. July 2022 at 09:01

Do you think the ECB will attempt to hit its 2% inflation target ? If so then the Eurozone will probably have the worse monetary policy.

17. July 2022 at 09:14

Powell May 4, 2022 WSJ: “We don’t have precision surgical tools. We have essentially interest rates, the balance sheet and forward guidance,” Mr. Powell said. “They are famously blunt tools, they are not capable of surgical precision.”

Policy went from sharp, to blunt, when Powell eliminated legal reserves (to appease the ABA). Jerome Powell thinks banks are financial intermediaries:

https://www.bis.org/review/r170309b.pdf

In 2010, the PBOC’s RRR went to 18.5% – “to sterilize over-liquidity and get the money supply under control in order to prevent inflation or over-heating”

Reserve bank credit (a blunt instrument):

2021-12-01 8678.115

2022-01-01 8780.344

2022-02-01 8852.336

2022-03-01 8891.820

2022-04-01 8910.015

2022-05-01 8907.146

2022-06-01 8888.579

17. July 2022 at 15:16

Market, I don’t see a problem with trying to hit the target, as long as they don’t try to get there too fast.

17. July 2022 at 15:21

“Which inflation problem is worse? It depends what you mean by “worse”.”

I would say the EU’s problem is worse, because it is harder to fix.

17. July 2022 at 15:23

Negation, I’d argue just the opposite. Supply side inflation is easier to bring down.

17. July 2022 at 17:46

Given that the US is not going to fix the inflation problem via a change in monetary regime (and even if the Fed did, how long until the market believed them?), aren’t the US attempts at fixing the problem clumsily, via just raising rates without forward guidance, going to keep pummeling the Euro, and make the EU problem bigger? It’s not as if their central bank is going to go with NGDP level targeting either.

When the US has a monetary policy problem, everyone else has a problem.

17. July 2022 at 18:07

‘Market, I don’t see a problem with trying to hit the target, as long as they don’t try to get there too fast.’

But isn’t there a danger that they won’t know what “too fast” is – and end up causing a recession by tightening in response to supply-side inflation ? I thought that was one of the reasons why NGDPT is better than IT.

17. July 2022 at 18:24

Bob, “When the US has a monetary policy problem, everyone else has a problem.”

I’m not sure that the Eurozone has a monetary policy problem. What is the evidence?

Market, Sure, that’s why I prefer NGDPLT. I’m just saying that over the past year the ECB has done better than the Fed, a reversal of the usual rankings. But yes, they might make a mistake.

18. July 2022 at 06:53

BEA: “Real gross domestic product (GDP) decreased at an annual rate of 1.4 percent in the first quarter of 2022.” GDPnow’s latest estimate: -1.5 percent — July 15, 2022

That can only be true if O/N RRPs drain liquidity, i.e., reduce the money stock. A change in the “demand for money” is insufficient. The FED’s economists are contradictory.

Link: “Understanding Bank Deposit Growth during the COVID-19 Pandemic”

https://www.federalreserve.gov/econres/notes/feds-notes/understanding-bank-deposit-growth-during-the-covid-19-pandemic-20220603.htm

“According to Greg Ip, money supply had a poor record of predicting US inflation because of conceptual and definitional problems that haven’t gone away.”

“since the early 1980s, correlations between various definitions of money and national income have broken down” – Frank Shostak of The Mises Institute

That’s not how the economy worked. The rate-of-change in legal reserves determined national income. “Black Monday” was due to the largest swing in RRs since the GD. And it’s not something you can run a regression test against. The FED covered its Elephant Tracks.

That’s why the stock market bottomed in October 2002 and in March 2009.

18. July 2022 at 07:19

Some people think Feb 27, 2007 started across the ocean. “On Feb. 28, Bernanke told the House Budget Committee he could see no single factor that caused the market’s pullback a day earlier”.

In fact, it was home grown. It was the seventh biggest one-day point drop ever for the Dow. On a percentage basis, the Dow lost about 3.3 percent – its biggest one-day percentage loss since March 2003. It was due to the large drop in RRs.

Money and central banking is a ruse. It has been driven by the profit proclivities of the commercial bankers.

The deregulation of interest caps/ceilings on saver-holder’s accounts by the BOG and FDIC for Ron Chernow’s “go-for-broke bankers” (represented by the most powerful lobby influencing legislation in Congress, the ABA), was vitiated on the largely false premises on which deregulation is based, viz., that bank deposits in commercial banks constitute the “savings’ of the depositors, that these are “lent” to the banks, and that the commercial banks are only a “medium” through which this end is affected

18. July 2022 at 11:03

I would think good/bad problems are mostly judged based on how difficult to get out of the problem. And in that respect, I’m guessing the USA has the less bad problem.

18. July 2022 at 12:13

U.S. MMFs’ repos with the Federal Reserve

https://www.financialresearch.gov/money-market-funds/us-mmfs-repos-with-the-federal-reserve/

18. July 2022 at 14:39

Philip, I think the US will have a more difficult time bringing inflation down.

19. July 2022 at 08:06

re: “more difficult time bringing inflation down”

Sounds right.

Link: “Nonfarm Business Sector: Labor Productivity (Output per Hour) for All Employed Persons (PRS85006092)

Q1 2022: -7.3

19. July 2022 at 09:55

Hi Scott, this was recently linked on MarginalRevolution, https://www.cfr.org/blog/how-fed-bond-binge-predictably-stoked-inflation. They claim the central bank-holding / bank reserve gap is a good indicator of inflation, which by eyeballing the graph is not that obvious except for recently. I also think it’s kind of cheating to say something is an indicator without giving a timeframe. Do you have any thoughts.

19. July 2022 at 10:00

Interesting post. I’m still trying to decide whether I agree and so let me ask a question.

Isn’t most of the increase in the price of European imports a consequence of increases in the price of imported energy? The US doesn’t import much oil and so energy inflation shows up in our GDP deflator. But since energy prices are set on a world market should we point to the difference as marking some important difference between euro and dollar inflation?

19. July 2022 at 12:15

Based on TIPS spreads, the Fed is fairly close to a reasonable policy (5-year is around 2.6%-2.7%), would like to see 1-year and 2-year however. If anyone has a Bloomberg terminal, please post those figures.

Copper prices are way down, stocks are down. Makes me think we’ll see more reasonable NGDP figures soon, but could be reflecting a German depression too.

How quickly should they correct NGDP expectations, conditional on being too high? If NGDPE is too low, it’s easy, get back on target ASAP. But too high? Maybe lower from 7% to 4.5% over a year or so. Or maybe you move quickly, eat the recession. A little more market pain and I think we’ll be where we need to be.

19. July 2022 at 13:00

5-year, 5-year breakeven is down to 2.11:

https://fred.stlouisfed.org/series/T5YIFR

But Fed Funds futures are implying rate hikes up to 350-375

https://www.cmegroup.com/trading/interest-rates/countdown-to-fomc.html

(click on “Probabilities”).

So market is betting that they’ll tackle inflation if they continue on their likely path.

BTW: the implied Sept rate hike is bizarre.

19. July 2022 at 13:26

Mike, I’m skeptical of that sort of approach to predicting inflation.

Mike Davis, Good question. This post might be helpful:

https://www.econlib.org/how-do-you-know-if-ad-is-too-high/

Justin, It’s always tough to give advice when it’s not clear what the Fed is trying to do. Under NGDPLT the answer is simple—aim for the trend line. But given from where they are today, it’s not clear what they should be doing.

I do see some progress in the past month, so perhaps they are slowly getting back on track. But what is the track? IT? FAIT?

19. July 2022 at 14:06

Scott – somewhat related, what would your “explain it like I’m a dummy” reasoning be for why the U.S. dollar has strengthen so much vs. other currencies?

I assume you don’t agree with the “simple” answer you hear everywhere (Fed is tightening while other central banks are not).

19. July 2022 at 14:36

sd0000, First I need someone to explain it to me like I’m a dummy. Seriously, it may be partly related to the strength of the US economy relative to the ROW. But I don’t have a complete explanation.

19. July 2022 at 16:10

I believe the strong dollar is related to oil prices. US oil production is still within sight of pre-Covid record, and trending up. We bleed a lot less currency than Japan or Europe now that we are a/the major oil producer. If EMU and Japan see a weaker currency, then USD index will go up.

20. July 2022 at 08:22

probably largely because the forces driving secular contraction were already stronger across the rest of the OECD until last year

i.e. it was easier to make Americans poorer since they were already richer — low hanging fruit

but even Japan is seeing high inflation now

rapid inflation can certainly have a lot of different sources, but tends to have rather similar primary causes… Sri Lanka certainly collapsed for entirely different reasons than Venezuela, but eco-socialists and petro-socialists start from similar assumptions and ended up in the same place

20. July 2022 at 09:56

Justin, Yes, good point. And that also correlates with economic growth.

20. July 2022 at 14:54

Sorry if this is a dumb question, but in your linked article:

“Boomflation occurs when aggregate demand shifts to the right, boosting real output and real income (in the short run)”

If consumers choose to save less and instead spend more, would that look like boomflation but really, real income is the same?

20. July 2022 at 15:24

Mike, AD isn’t about consumer spending, it’s about total spending—including investment. (Recall that saving equals investment in a closed economy.)

When total spending rises, that tends to raise real output and real income in the short run. Saving is a sideshow.

21. July 2022 at 06:42

“The M2 Inflation Myth”

http://dlthornton.com/images/services/The%20M2%20Inflation%20Myth.pdf

AD = M*Vt

Money has no significant impact on prices unless it is being exchanged.

Link: The G.6 Debit and Demand Deposit Turnover Release

https://fraser.stlouisfed.org/files/docs/releases/g6comm/g6_19961023.pdf

Non-transaction deposits have very little turnover. 95:5 at best.

That leaves DDs and currency:

https://fred.stlouisfed.org/series/DEMDEPNS

Link:

https://marcusnunes.substack.com/p/misleading-monetarist-views

“Clearly, it´s not “all about money”. In fact it is, but not only about money supply. We must take into account money demand (or its inverse, Velocity).”

21. July 2022 at 22:23

Scott,

Euro zone NGDP growth was 9% in Q1. There are no signs that it is coming down dramatically.

Yes, there is ALSO a negative supply shock on top of that, but it doesn’t change the fact that there has been very robust NGDP growth so far.

The real risk is that the ECB believes that because there is a negative supply that slows REAL gdp growth (that has happened yet!) it should not slow NGDP growth.

22. July 2022 at 07:58

Lars, Yes, but one quarter’s NGDP growth is not very important. What is important is:

1. Longer run NGDP growth, which has been appropriate.

2. Expected NGDP growth going forward.

The expected future NGDP growth may be appropriate or excessive. Maybe money is currently a bit too easy. I suspect it should be tightened somewhat, based on other indicators such as wages. But thus far, the eurozone inflation problem has been almost entirely supply-side.