No, 7% NGDP growth is not OK

Suppose we’d recently experienced 15 years of roughly 10% NGDP growth (as in the late 1960s and the 1970s.) Now NGDP growth slows to 7%. It would be reasonable to call the slowdown a successful contractionary monetary policy.

Twelve month NGDP growth was 12.2% in the fourth quarter of 2021, and slowed to 7.4% in the fourth quarter of 2022. So does that also represent a successful application of a contractionary monetary policy? No. Context is everything.

Over the last 30 years, the Fed has successfully kept the average inflation rate fairly close to 2%, until recently. During 2021, it was appropriate that NGDP rebound sharply from the extremely depressed conditions of 2020 as the economy re-opened. But once we reached the previous NGDP trend line, it was essential that NGDP not overshoot the target. Instead, NGDP has soared far above the previous trend line, and this is what has caused the recent high inflation.

It’s important not just to look at growth rates, but also consider levels. While policy may seem to be improving as NGDP growth slows, it’s actually getting worse as the level of NGDP moves further and further above the appropriate target path. This overheating has pushed the natural interest rate sharply higher, and largely explains why the Fed has failed to successfully tighten monetary policy despite substantial increases in its target rate.

I fight a hopeless and never-ending battle to convince people to stop thinking about policy in terms of “concrete steps”. The most important Fed decision in recent years has been its abandonment of average inflation targeting, and its signaling that it will tolerate inflation and NGDP growth that is far above trend. That tolerance has sharply raised the natural rate of interest. While the Fed also raised its policy rate, it increased more slowly than the natural rate. The net effect of the (expansionary) signaling and the (contractionary) rise in the policy rate, has been to loosen monetary policy, which has caused extremely rapid NGDP growth.

No, 7% NGDP growth is not OK. It should have been closer to 4% during 2022. There would have been a technical recession, but unemployment would not have rising very sharply with 4% NGDP growth. It would have been more like one of those pseudo recessions that you often see in countries like Japan and the UK.

PS. Off topic, but I can’t help commenting on the recent news about SVB. I had thought the libertarian movement hit rock bottom when the Neanderthal alt-right took over the Libertarian Party. Now I see Silicon Valley libertarians are lamenting the fact that the government won’t bailout a bunch of wealthy depositors. Can the libertarian movement go any lower?

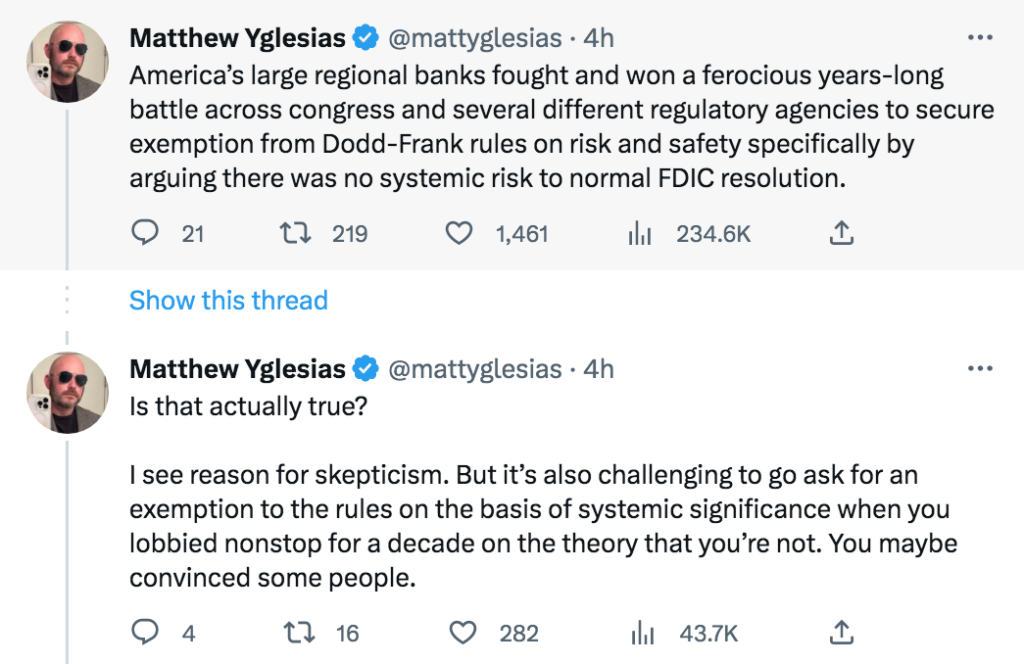

Matt Yglesias nails some of the hypocrisy:

They convinced me!

Tags:

12. March 2023 at 15:55

Scott, I like your way of thinking and I think you are right about a lot of things. However, there are a couple of things that bother me and I have not been able to figure out on my own. First is your assertion (it would seem) that public position statements ARE policy. I had a math teacher in high school who liked to say, “Math always goes to the simplest thing”. In other words, when you have a formula that at first looks undefined, you have to simplify the terms to see the actual result. In many cases, it is not actually undefined, the true solution was just masked by the initial presentation of the problem. An example is the definition of the derivative in Calculus, where you divide by delta X, but then set delta X to zero, which would at first seem to give a quantity/0 = undefined error, but actually will be resolved once you simplify the terms. Why would macro-economics be any different? Just because certain people say the result of certain conditions is indeterminate and the actual result will depend on how the markets PERCEIVE the situation, doesn’t make it true. So in economics, I don’t see how you can have inflation without also having too much money per the quantity theory of money (all other things being equal, which they never are). So how can the Fed’s saying “we are abandoning or hopelessly altering our previous policy on inflation targeting” really make a difference? Most participants in the market (e.g. individual consumers, shop owners, auto mechanics, etc.) don’t pay attention to what the Fed says anyway. So their pricing decisions are based on something else.

This leads to the second question that I have never been able to understand from your writing: what is the actual policy lever that you advocate to control the price level (i.e., inflation)? It’s clearly not interest rates, I’ll agree with you there. Your writings on the Price Level effect, the Fisher effect, the Liquidity effect, and the Income effect convinced me before the ineffectiveness of the Fed over the last 12 months made it even more convincing. But, given that “math always goes to the simplest thing” rings true, I don’t think a policy statement from the Fed that says, “We are now going to re-instate FAIT” will make a hill of beans difference to inflation without actually pulling a policy lever, such as decreasing the money supply or enacting policy (like incentivizing savings) that serves to reduce velocity.

I’d love to get your take on this. -signed: A hopeless Engineer who’s trying to make sense of economics

12. March 2023 at 15:57

There are no libertarians when neighborhood property zoning is under review, or your bank fails.

But then, who does not love national parks?

Is a billion immigrants to the US a good idea?

I want libertarianism to work, but I fear it has feet of clay.

12. March 2023 at 16:41

Scott, I strongly suspect Milton Friedman would disagree with most of what you said. Jeremy Siegel and and Steve Hanke are Friedman guys and emphasize the Fed’s job hiking is done. M2 has declined year over year by the largest amount since the Great Depression. The growth in M2 since 2020 is not too far above its recent historical trend. Also when the Fed Funds Rate goes above the two year Treasury yield, that is anecdotally a pretty good signal monetary policy is too tight.

As far as SVB, the Fed has raised rates to levels than most people (i.e. you) thought would be very unlikely a few years ago. It seems very unlikely SVB is the only bank that is holding a lot of assets that are underwater because of duration risk and would not be able to pay depositors who want to withdraw money in a timely. Signature Bank just got taken over tonight as well.

Not protecting depositors carries a huge tail risk. 50% of deposit funds at regional banks are above the FDIC limit. What happens if those people withdraw in mass?

12. March 2023 at 17:19

Chris, I think you misunderstand my views on a number of points.

As for policy tools, I’ve always preferred a simple system with no IOR, where the Fed adjusts the monetary base to keep NGDP expectations on course.

I agree that auto mechanics pay no attention to monetary policy, but that fact has no bearing on anything I say in this blog.

Solon, You said:

“There are no libertarians when neighborhood property zoning is under review”

So I’m not a libertarian?

Mark, Yeah, they’d disagree. That’s why I’m a market monetarist, not an old fashioned M2/long and variable lag monetarist.

It’s certainly possible that monetary policy is currently too tight. It is not possible that monetary policy was too tight in 2022, but lots of people said it was. For the past 15 months, every time I say policy has been too easy, people say “It was, but perhaps now it’s too tight”. Eventually, I suppose they’ll be right.

“As far as SVB, the Fed has raised rates to levels than most people (i.e. you) thought would be very unlikely a few years ago.”

Yes, but I never expected such a recklessly expansionary monetary policy. That’s not tight money.

As far as protecting depositors, that’s the underlying reason why we keep getting into this situation. We need to pull the plug on moral hazard, the sooner the better. I’d just abolish FDIC, but please don’t expand past $250,000.

If I’m wrong, then let’s just have unlimited FDIC coverage, and make it official. End the charade. (They you’d see even more reckless banking.)

12. March 2023 at 18:00

We probably have unlimited FDIC coverage due to the political power of depositors and the fear of contagious bank runs. At least shareholders, unsecured creditors and management gets hit, which might reduce moral hazard

12. March 2023 at 18:02

a bit, but likely not enough. Tougher regulation may be appropriate, such as reinstating Dodd-Frank above $50 billion.

It appears making SVB depositors whole will not be that expensive, given its assets and eliminating all creditors other than depositors.

12. March 2023 at 18:21

Scott:

If you propose an end to all property zoning,

open immigration without limit,

the selling of national parks to the highest bidder without conditions

the end of the national space program,

the sunsetting of the VA, the privatization of West Point and Walter Reed Medical

the elimination of Depts of Commerce, Education, and Agriculture…

mercenary forces instead of a Defense Department…

euthanasia for the ill who have no money or insurance…

then you are libertarian!

BTW, I am attracted to libertarianism. Many others are too.

But I found I was becoming a “libertarian except for.”

In which case, I had devolved from principle into expediency.

Which defines 99% of the libertarians in the US.

Polygamy anyone?

Drug den-brothels-gambling joints on the rim of the Grand Canyon?

In the real world, politics is just politics, and ideology is window dressing.

I want what I think is good (for me). I look for a principled cover sheet.

I am for a 10-year hiatus on all property zoning. Then, let’s reassess.

But who cares? One voice squeaking…

12. March 2023 at 18:38

The 5 year inflation breakeven is back down to roughly 2%. I guess some good can come from bank runs!

Seriously though, to the degree one takes markets, and particularly, Treasury markets seriously, there should be more patience as the supply side of the economy continues to heal.

The February jobs report was very strong, but what was most interesting to me was the 0.2% uptick in unemployment, which may mean more workers came off the sidelines to find jobs. That doesn’t mean it would represent sustainable employment, if Scott’s right, but if I’m right, it could be a very positive sign of higher-than-widely-expected real growth potential.

Also, let’s not forget that we’re in the midst of an AI revolution right now, though likely no one has a good idea of the stage or how large or sustained a related productivity boom could be.

I can say that I’m learning to code now, and ChatGPT is like a free, 24/7 mentor as I learn. I make mistakes, and it can correct them in real-time. The same goes for the use of Co-pilot. Frankly, these apps do much of the coding for me. Also, ChatGPT writes all of the comments for my code, and does a pretty good job. It does better than I’d do.

This is not only greatly increasing the efficiency of coding, which can be responsible for a great deal of productivity growth, but it is revolutionizing how people learn new knowledge and skills. It diminishes the need for human teachers and tutors.

12. March 2023 at 18:42

Scott, do you have a model in your mind for the relationship between the natural rate of interest, NGDP growth and Fed policy?

12. March 2023 at 18:48

Scott,

Do you have an opinion on whether the Fed and Treasury can manage to avoid a financial crisis if rates are set much higher? I suspect they can, but it could really grow the moral hazard problem in the long-run.

If you’re right about the current stance of monetary policy, this could become an increasingly relevant question.

12. March 2023 at 19:57

“I had thought the libertarian movement hit rock bottom when the Neanderthal alt-right took over the Libertarian Party. Now I see Silicon Valley libertarians are lamenting the fact that the government won’t bailout a bunch of wealthy depositors.”

Spot on. Either way the entire tech community is supremely convinced of its own importance. They constantly assume that no rules should ever apply to them.

12. March 2023 at 21:36

Another good idea from libertarians: no oversight of virology labs.

12. March 2023 at 21:53

Foosion, I recall when people said the problem had been fixed by regulation after the 1980s crisis. Then they said Dodd-Frank fixed the problem. The problem is moral hazard, and we should not expect regulation to fix the problem. We have lots of regulators, why didn’t they stop SVB from its reckless behavior. If they plug one hole, the banks will find a way around the constraints.

“It appears making SVB depositors whole will not be that expensive”

The big cost will be paid down the road, when this bailout leads to lots more reckless behavior. Consider:

“The Fed in a separate statement said it’s creating a new “Bank Term Funding Program” that offers loans to banks under easier terms than are typically provided by the central bank.

Fed officials said on a briefing call that the facility will be big enough to protect uninsured deposits in the wider US banking system.”

Wonderful! How careful would you expect big depositors to be after that announcement? We keep making the problem worse.

Travis, In my view, monetary policy drives NGDP growth and NGDP growth is a major determinant of the natural rate of interest. (Not the only one.)

Michael, I can’t predict the timing of financial crises, but I can say that our current system of moral hazard on steroids makes them more likely to occur.

12. March 2023 at 23:44

Wonderful! How careful would you expect big depositors to be after that announcement? We keep making the problem worse.–SS

I agree with this sentiment.

On the other hand, my understanding is the SVB shareholders will get 100% wiped out (unless the Biden Administration is really craven).

So…there is no total extinction of moral hazard.

Shareholders of a badly run bank can expect to lose all their money. You would think that would result in shareholders electing a responsible board that runs the bank prudently.

As an aside, I would like less bank regulation, but if a bank wants deposit insurance, they have to keep a fat layer of convertible bonds in place, say at 25% of deposits.

If a bank fails, the bonds convert. If markets work, the convertible bond holders will extract covenants that result in a prudently run bank.

Of course, as we have just seen, markets do not always work.

13. March 2023 at 00:41

Scott,

As I have said many, many times over many, many years. The banks will always get bailed out. What we need is not regulation but a system where the banks have an explicit guarantee but where equity holders, management, and highly paid employees lose everything if the guarantee gets exercised.

13. March 2023 at 03:48

Sumner has no originality; he’s now borrowing my paleolithic paleonthropian and neolithic neanderthal comments; get your own, you doofus.

Use your brain. Think of something witty…if you can.

And your entire post is nonsensical, yet again, because as we told you they did bailout the SVB. It’s what your little petty thugs do. They like to use tax payer money to feed their little coffers.

All of the risk is transferred to the tax payer, permitting banks to continue to invest in bad companies; companies with no profit, like twitter, which was losing 4M a day for almost a decade until Musk came in and changed the culture. And the only reason these VC’s continue to make wild speculation is because they know that easy money is right around the corner to help them. And if the bank fails, if the company fails, ask the tax payer to foot the bill.

It’s gangsterism 101.

You can call it “alt-right” which is not your term, not original, and not a coherent name for a group: so loosely defined that’s meaningless; you can call it “hard right” because someone on t.v. told you to say that, another meaningless term, or you can realize what it is: it’s foot dragging, knuckle dragging, Hobbesian thugs, accompanied by their woke mobsters, and a little old boy named Sumner.

One rule for me, another for thee.

13. March 2023 at 04:31

It seems that the weekend of bailouts did not halt the growing banking instability. Banks are already selling off again this morning, including big ones like Charles Schwab, which is down nearly another 8% so far. Even Bank of America is down nearly 5% this morning. The 10 year Treasury rate is already down 22 basis points.

13. March 2023 at 04:37

Regulatory malfeasance notwithstanding, there wouldn’t be maturity mis-matches if the FED had targeted N-gDp.

Net changes in Reserve Bank credit, since the Treasury-Reserve Accord of March 1951 are determined by the independent policy actions of the Federal Reserve authorities.

The crux of the cause of our monetary mismanagement, especially since 1965, is the assumption that the money supply can be managed through interest rates. R star is non sequitur.

13. March 2023 at 05:30

I love Sara, seriously.

13. March 2023 at 05:50

“Silicon valley libertarians?”‘

Scott, it’s 2023. Look at the friggen Calendar.

It’s not 1985. This isn’t Steve Jobs silicon valley; it’s the woke mob silicon valley.

Where have you been?

This is the neomarxist silicon valley.

There are no libertarians in Silicon valley, other than Musk, who is relocating everything to Austin (as he should).

And you are not a libertarian, so stop pretending already. We all know you like centralized actors, you’ve made that very clear in your writings.

The only thing remaining in SFO are plutocratic ruffians, who are neck deep with the Washington and CCP establishment.

13. March 2023 at 06:31

Scott, do you favor increasing reserve requirements?

If (as it appears) we are always going to bail out the banks, would increased reserve requirements reduce the frequency of doing so?

13. March 2023 at 07:19

SVB was only got exempt from the stress tests.

They were still regulated by Dodd Frank in other ways.

And in any case, they were well capitalized with “highly liquid assets” (as defined by Dodd Frank) so would have passed tests.

THe question we should ask is if Dodd Frank to load up on bonds now losing value.

13. March 2023 at 08:02

10-year Treasury yield currently below 3.5%. Is that an unnatural rate of interest?

13. March 2023 at 08:14

Solon, Yes, there are lots of good options, but we are a banana republic so we won’t do them.

dtoh, Yes, there are lots of good options, but we are a banana republic so we won’t do them.

Todd, Reserve requirements are not the issue—banks have plenty of reserves. They lack capital and they take too much risk.

Everyone, In a technical sense it’s easy to fix the banking system. Read John Cochrane’s many posts. It’s the politics that are impossible.

And how’s that 2018 Trump “deregulation” of large regional banks working out?

13. March 2023 at 08:16

Brian, As in 2008, when lending standards tighten the natural rate falls.

13. March 2023 at 08:34

OK, cuz expectations of impending Fed increases are collapsing, which suggests markets expect the Fed to stop tightening so hard. At the same time, the 10-year has fallen 40 bps.

13. March 2023 at 09:40

Scott, in a response to Todd, you said, “Todd, Reserve requirements are not the issue—banks have plenty of reserves. They lack capital and they take too much risk.”

It seems to me that *some* banks might have plenty of reserves. But when SVB needed to sell some of its assets to raise liquidity, would you say that it had enough reserves?

13. March 2023 at 09:51

Travis, SVB had a solvency problem, not a liquidity problem. SVB had deeply negative equity on a mark-to-market basis, selling assets just revealed the depth of the insolvency.

SVB’s problem was entirely duration mismatch. They increased their holdings of agency mortgages by 700% during the pandemic, when Silicon Valley was flush with deposits, and then those assets lost a double digit percentage of market value when the Fed pivoted from pretending to inflation was transient to actually fighting inflation.

13. March 2023 at 10:16

Imagine blowing up your bank on agency mortgages! Zero credit losses, buy deeply insolvent nonetheless.

13. March 2023 at 10:38

Sumner loves using epithets like Hard-Right and Alt-right; just don’t ask him to define those terms, and precisely where the parameters are between right and alt right, because his eyes begin to glaze over, like he’s half in a stupor, as if you just asked him to solve Reimann’s hypothesis.

If you want the best example of Sumner’s band of neoliberal gangsterism, look no further than Bosnia.

Bosnia recently established a foreign agent act, similar to the U.S. act in 1938, which requires those funded by foreign agents to register. There is not much different between the two pieces of legislations, yet amazingly the U.S. called Bosnia’s new law “Russianesque” and “an attack on human rights and democracy”.

The same of course happened in Georgia. Georgia has a lot of U.S. funded NGO’s (CIA fronts) who receive a lot of financial aid from you guessed it “America” and a lot of that money is spent on funding protests. Whenever the politicians attempt to pass a policy the U.S. doesn’t like, lo and behold, the protests begin; this of course is what led to the coup in Ukraine, in 2014, and what led to recent protests in Georgia over their new foreign registration act, and in Egypt, but Bosnia is free of U.S. psuedo charity influence, so instead of the coup attempt, they scream and yell Russia bad, Human rights, democracy, as they fear monger there way into the hearts and minds of people brainwashed Sumners, who get so scared so quickly, that someone as innocent as Trump becomes Adolf Hitler in their eyes.

Sumner is wrong about everything; he was wrong about Jan 6th too, which we now know were not domestic “terrorists” because they were given “tours” of the building on Jan 6th. I never knew that a terrorist group would attempt to overthrow the government with no weapons and a police tour guide. Who would have guessed?

Only a brainwashed fool would believe it was an act of domestic terrorism. And only a brainwashed fool thinks Human Rights, Equity, Build back better, recalibration, sustainability, are innocent little words with no hidden objective, no exterior motive, and no external purpose.

The greatest threat to the world is the globalists. If that makes you ‘alt-right” in the eyes of Sumner and his petty thugs, then so be it. I will where that name with pride.

But I think reasonable people simply call it classical liberalism. It’s not hard right. It’s not even right. It’s just not hard left. It’s a respect for others, their property, their culture, their country, their laws, etc.

And clearly, with the new bailout, the respect for property is once again being threatened by economic and hard left (Sumner left) gangsters.

13. March 2023 at 10:43

As Sheila Bair said: “It should replace the shock and awe of major interest rate hikes with new targets based on money supply, and aggressively shrink its portfolio, selling securities at a loss to do so, if necessary.”

13. March 2023 at 11:56

Brian, You are reversing cause and effect. The Fed is unlikely to raise rates as far as previously expected because long-term rates are falling.

Travis, See Steve’s response.

Everyone, my SVB blogging is over at Econlog, not here.

13. March 2023 at 15:44

Steve, I agree that SVB had negative equity (around $5 billion) and was technically insolvent on an MTM basis. But the stock market knew that in January, yet the stock price rallied 40%. Why? My guess is that the market thought that SVB could weather this period of technical insolvency and earn enough to get back to even. It was making $1.5 billion in income yearly. So in four years, it would have covered the losses.

The balance sheet showed $9 billion in cash. I assume that includes reserves. When the run started, that obviously wasn’t enough to meet demand. If it had $50 billion in cash, it would probably *still* be operating today.

So my point was that Scott’s comment that banks have enough reserves is either not accurate or that the reserves are unevenly distributed through the financial system. Maybe JPM has enough reserves, but SVB didn’t.

13. March 2023 at 15:44

You should ponder what Bank Indonesia did during pandemic. Seemed to work.

13. March 2023 at 15:48

Scott,

[quote]Chris, I think you misunderstand my views on a number of points.[/quote]

Yes, that is basically what my post was trying to say. I elaborated so you would have a better idea of how I’m confused. I have never had an Econ 101 course, let alone one in macro. So I feel like I’m playing catch up trying to understand your meaning most of the time. For example, I had never studied an AS/AD curve prior to reading your book. It was all new to me.

My point is, I’m probably one of many who read this blog as a means of education, but it often feels like there is a big curb to jump over first before I can understand the nuances. Any help you can give to stragglers like me is appreciated.

[quote]I’ve always preferred a simple system with no IOR, where the Fed adjusts the monetary base[/quote]

Since you describe yourself as a market monetarist, I kind of assumed that was your position, but in all of your blog posts and even in your book, I can’t remember a time where you actually stated that explicitly until now. So thanks.

13. March 2023 at 16:37

From what I’ve read, all depositors have been made whole in very FDIC insured bank. If someone has counter-examples, please post.

If SVB has sufficient assets, as certainly appears the case, who should be paid, if not depositors first? Look at their balance sheet and consider that some of their bonds are trading around 50% (bonds only get paid after depositors).

Depositors tend to be sympathetic common folk or politically connected powerful folk, or both, and there will be sufficient pressure to make them whole, whatever the merits of the moral hazard argument might be.

How many banks, however well capitalized, could withstand losing 24% of their deposits in 24 hours?

More regulation seems our only practical alternative.

13. March 2023 at 19:33

Michael Sandifer said: “Banks are already selling off again this morning, including big ones like Charles Schwab”

People on Reddit are asking if they should cash out all of their stocks. It’s the same old story: they all rushed in during the pandemic, bought at the top of the market, kept buying through ’22 when seasoned investors were selling thinking they were getting spectacular deals, and now that the market is tanking even further, they’re flipping out and selling.

The funny thing is that it’s so apparent that bankers did the exact same thing!

Meanwhile, real investors, who don’t get bailed out, were repositioning a year ago.

Same story, every time.

13. March 2023 at 21:29

Steve, I agree that SVB had negative equity (around $5 billion) and was technically insolvent on an MTM basis. But the stock market knew that in January, yet the stock price rallied 40%. Why?

Travis, you’re right that SVB has been technically insolvent for a long time. You’re also right that the stock market thought they could “earn back” their negative equity.

What changed? Two things: First, ffr near 5% meant that SVB couldn’t fund the spread between short-term deposit rates and the partly sub-2% yield on the securities portfolio.

Second, SVB’s extreme industry concentration in cash-burning tech industry startups meant that SVB was natively losing deposits (without a run) due to the cash burning nature of venture companies.

Their ability to earn back to solvency was gone with high ffr and tech venture cash burn (pulled from deposits).

13. March 2023 at 21:55

Travis, I believe the problem was insolvency, not illiquidity. If it had just been illiquidity, I presume the Fed would have lent them the money.

Foosion, More regulation might help a bit, but it won’t solve the problem. We need to scale back on moral hazard—instead we are making it worse.

The problem is that politicians want banks to take these risks.

14. March 2023 at 03:03

Bought a bunch of Charles Schwab yesterday at an average price of ~49. Let’s see if that turns out to be a horrible mistake!

A crowd of self-important, egotistical ‘libertarians’ claiming that the US/world economy will shut down if they don’t get bailed out, after they didn’t understand basic prudential treasury management, is one of the more disgusting things I’ve seen in a while. Hope people never let them forget it.

Might as well just make FDIC coverage unlimited, now – end this farce. And prepare for more huge bailouts in the future.

14. March 2023 at 06:28

Scott, I think you’ll make more headway if you start pitching this to DeSantis and Chip Roy:

https://www.themoneyillusion.com/under-ngdplt-it-becomes-the-job-of-fiscal-policy-to-control-inflation/

“If conservatives understood this then market monetarism would go from being a fringe movement eyed suspiciously by those on the right, to a position where we’d be headline speakers at CPAC.”

Scott, you touched genius! And missed the turn!

I think the worst part of Trump breaking your brain, is bc it caused to you hide that NGDPLT is fundamentally a GOP / Federalist (states’ rights) monetary policy.

At some point, you have to ADMIT who and what you are Scott.

When I chased down Rawl’s I opened with “you tricked liberals into having to support capitalism” and we got along fabulously…. but he never said that out loud.

Robert Mundell knew the problem with Greece and Italy was the Bureaucrats and capital trying to keep down Talent… but he never said that out loud.

I’m 100% convinced Uncle Milty was really a gold bug, but he knew it couldn’t beat Keynes, so Monetarism was his consolation prize… but he never said that out loud.

Scott you aren’t those guys! You need to SAY IT OUT LOUD.

14. March 2023 at 08:58

Scott, I’m curious, what do you believe are the best bundle of indicators of R*’s trend and magnitude? Are these moving targets, would these load together in factor analysis, or are they orthogonal in some sense? You state above NGDP trend is just one, but in your writings I can’t recall other indicators. Please feel free to refer to specific papers or previous blog posts, happy to do the reading.

14. March 2023 at 09:18

Morgan, I’ll say it out loud: YOU ARE DELUSIONAL.

MJM, That’s not my area of expertise, but I’ll offer a few guesses:

1. Fiscal policy: Bigger deficits mean a higher R*, as in 2018. (But be careful, deficits often occur during recessions.)

2. The composition of demand: Holding GDP constant, an investment boom would lead to a higher R* (as in 1999-2000.) Immigration would also be a factor, as it leads to more investment.

Having said that, I don’t think there’s much to be gained from trying to directly estimate R*. We should be trying to estimate market forecasts of NGDP (or inflation).

14. March 2023 at 09:44

Thanks for your response, Scott — mostly trying to interpret the present operations over at the Fed from a different perspective. I’m typing here, so it’s unsurprising that I agree (from a non-economist’s POV) that market forecasts of NGDP seem like the most parsimonious indicator.

Thanks for all the great work!

14. March 2023 at 12:15

Hey, MORGAN WARSTLER, what drugs are you on and are they legal in London? Please let me know, seems like a wild trip. Cheers!

14. March 2023 at 16:14

Not to belabor a point on moral hazard…

The depositors in SVB were not largely insured (they had accounts topping $250k).

The depositors seemed careless…you could venture “Oh, they knew the Biden Administration would bail them out.” That seems a little cavalier, but who knows…

It strikes me the idea of moral hazard and even sophisticated depositors putting money in a bank…may be a mismatch. The depositors cannot be expected to gauge bank health…

The SVB shareholders were totally wiped out. They don’t seem to have paid attention either, nor the board they elected to represent shareholder interests.

The shareholders had and have real hazard, and in earlier bank failures, shareholders did face 100% losses also.

Not sure the high-minded concept of moral hazard applies in present-day circumstances and banking systems….the depositors and shareholders don’t seem to get it.

Should we destroy the banking system to teach shareholders and depositors a lesson? In theory…yes….

14. March 2023 at 21:39

What used to be called the “libertarian” movement is alive, but it keeps having to rename itself. First it was “liberal,” but socialists purloined that word. So it invented the ugly neologism “libertarian”; but the alt-R and the Silicon Valley advocates of bail-out have ruined that (good riddance!). Time for a new label–or might we wrest ‘liberal’ back from the leftists?

14. March 2023 at 21:41

Here’s ChatGPT on MM, viewed through the lens of Yoda and then Klingon. You’re welcome:

Very well, here is Yoda’s description of market monetarism in Klingon:

“Hmm, Market Monetarism, a theory it is, in the economy’s stabilization, the central bank’s role is crucial, hmmm. A rules-based framework guides monetary policy towards a nominal income target, aiming to keep expectations anchored and maintaining stable growth in nominal income, hmmm. Economic crises prevented, and their impact mitigated, powerful tool it can be if used wisely.”

In Klingon, it would be:

“Qoy qeylIs puqloD, Market Monetarism, nIvbogh wa’logh QeH ‘e’ DaH Daqawlu’, qeylIS De’ ‘ej nom jImej, chu’wI’ lo’laHbe’chugh nom jImej targhI’meyvam jIH’a’, hmmm. ghojmoHwI’vam ‘uchta’ ‘e’ poHmoHwI’vam ‘etlh nabnIS, vItlhutlh nuqDaq ‘ej vItlhutlh DaHechtaHvIS, jen tIq ‘etlh, hmmm. chenmoH’e’, ‘ej chenmoH’e’ qay’bogh nuvpu’, ‘Iv chenmoHwI’ qeylIS, vay’ chenmoHwI’ Hoch, mIgh HoHchu’, hmmm.”

15. March 2023 at 06:19

“Meanwhile, February was yet another month of declining real wages, and was the twenty-third month in a row during which growth in average hourly earnings failed to keep up with CPI growth”

“The neutrality of money, also called neutral money, is an economic theory stating that changes in the money supply only affect nominal variables and not real variables.”

How long does the neutrality of money have to be?

15. March 2023 at 08:35

Dr. Lawrence H. White, a senior fellow at the Cato Institution wrote about duration risk in the borrow short to lend longer, savings-investment paradigm: “in 1979-1981 it rendered insolvent about two-thirds of US thrift institutions (FSLIC, NCUSIF, insured), who were financing 30-year fixed-rate mortgages with 1- and 2-year deposits”.

The mistake was made in 1961. Banks aren’t intermediaries. Banks don’t lend deposits. Deposits are the result of lending.

See: “Should Commercial banks accept savings deposits?” Conference on Savings and Residential Financing 1961 Proceedings, United States Savings and loan league, Chicago, 1961, 42, 43

Banks should be required to store their deposits, and not attempt to buy their liquidity through open market devices.

See Penn Central, Lehman, Continental Illinois.

List of largest U.S. bank failures – Wikipedia

15. March 2023 at 09:15

Solon, you said ‘The depositors cannot be expected to gauge bank health…’

Er, why not? That is their responsibility – or, at least, it was before this bailout.

15. March 2023 at 10:28

I was also sickened by the “libertarian” tech bros begging for a bailout. That said, I don’t know that I’d be any more principled if I had that much money on the line. Corn pone ‘pinions. The idea that depositors weren’t responsible so they should be made whole is ludicrous. If your home insurance is capped at 250K and your home burns down, you’re still on the hook for losses above 250K regardless of whether it was your fault. At least we know that regulators will come up with a sensible straightforward policy response that doesn’t just swallow a mouse to catch the fly.

15. March 2023 at 11:38

2Q21 NGDP grew 17% Y/Y and 14% Q/Q annualized. The Y/Y rate has slowed 5 out of 6 quarters to 4Q22’s 7%. The Q/Q rate hasn’t been as clean, but also has trended down, to 4Q22’s 7%. Not good enough, and they should have started acting 6-9 months earlier, but definitely tighter than before.

15. March 2023 at 12:59

@Larry

Larry this is gold. But why don’t you use serious economists like Summers, Krugman, Scott Sumner. I’m interested how well ChatGPT can imitate these individuals. Maybe I’ll do it myself when I have time and less work.

16. March 2023 at 09:11

Robert, You said:

“but definitely tighter than before.”

No, reread my post.

Everyone, My blogging on the banking crisis is over at Econlog, not here.

16. March 2023 at 13:58

I read it, I disagree. Are you defining tightness by tue natural rate of interest? Do you have evidence it’s now higher?

16. March 2023 at 19:15

Correct me if I’m wrong, but I don’t recall a lot of commentary from you about US political donations or the revolving door in Washington. A recent example of a scandal involving the latter is the case of Barney Frank:

“While Frank never officially registered as a lobbyist, he had publicly argued that Dodd-Frank’s $50bn threshold for triggering greater regulatory oversight was too low. Signature’s assets surpassed $50bn in 2019. By the end of 2022 it had more than $100bn in assets.”

Link:

https://www.ft.com/content/090e081f-35b3-484b-8095-c42a3c5e4259

I know that Milton Friedman was very, very concerned about allowing corporations to donate money to political campaigns, for example. What’s your view on legal political donations and revolving door relationships in the US? I consider it to be legalized bribery, and I’ve linked to many polls previously indicating that the Citizens United decision greatly undermined confidence in the legitimacy of the US political system among Americans.

16. March 2023 at 22:45

Forgive my ignorance Scott, but why do banks have such high demand for the lending facility right now? It was well understood for a long time that the fed was going to raise rates. Did the bank just run out of money? Is this lending they are doing stopping the progress they have been making on their goal of tightening money? Seems if their balance sheet grew by 300 billion that money is tight this month, but I’m expecting that I don’t understand something.

17. March 2023 at 06:16

I was quoting you here Scott 🙂

“If conservatives understood this then market monetarism would go from being a fringe movement eyed suspiciously by those on the right, to a position where we’d be headline speakers at CPAC.”

You COMPLAIN MM isn’t being taken seriously after nearly 20 years of you pitching it.

And I want you to be taken seriously.

Like I said, Trump broke your brain.

17. March 2023 at 12:07

Robert, I rely on NGDP growth to evaluate the stance of policy. The fact that it is so high implies the natural rate must be relatively high (compared to the policy rate.)

Michael, I’ve done many posts on how the unholy alliance of the banking industry and DC politicians has created our flawed banking system. (The vast majority are at Econlog.)

Stephen, I imagine there’s been some deposit outflow due to the recent banking problems.

Morgan, Yeah, I really blew it in 2016 when I claimed Trump was an authoritarian demagogue. It turned out that he has great respect for democracy. What a statesman!

20. March 2023 at 07:16

That doesn’t disagree with what I said. Yes, the natural rate is higher than the current rate, but that’s a different statement than if policy is tighter than it was 24 months ago. If NGDP had slowed from 9% to 7%, maybe you’re right, but it was 17% or 14% to 7%. You’re sounding like activists who rightly point out ongoing problems but that can’t admit that things are better than they used to be.

20. March 2023 at 08:17

Robert, You keep looking at growth rates, but that’s not enough. Levels also matter. Growth rates are getting better and levels are getting worse.

The net effect? Who knows?

21. March 2023 at 06:43

I definitely agree it’s not contractionary now. Seems very clearly less loose/tighter now.

This is a legit question, not a gotcha or anything like that, trying to understand better how you define things. If NGDP growth is 4-4.5% this year and next, and it looks like at that point that 2025 will again be around there, how would you characterize the tightness of policy? The level then would be higher than an ideal path from early 2021 would have had us, but growth would be stable at a good rate. I’m guessing that would be a good enough situation?

21. March 2023 at 09:59

Robert, That would be much better, but not quite “good enough.” It’s good enough when they do their job.

21. March 2023 at 14:38

Can you answer in a non-glib way? Maybe pretend my last sentence of my previous comment wasn’t there

24. March 2023 at 10:52

If they plan to level off, a rate of 3.5% to 4% would be better, given their 2% inflation target.

But if we could dial back the clock, they should have aimed for level targeting from the beginning. Now that they’ve lost credibility, things become much tougher.