Nick Rowe on interest rates and monetary policy

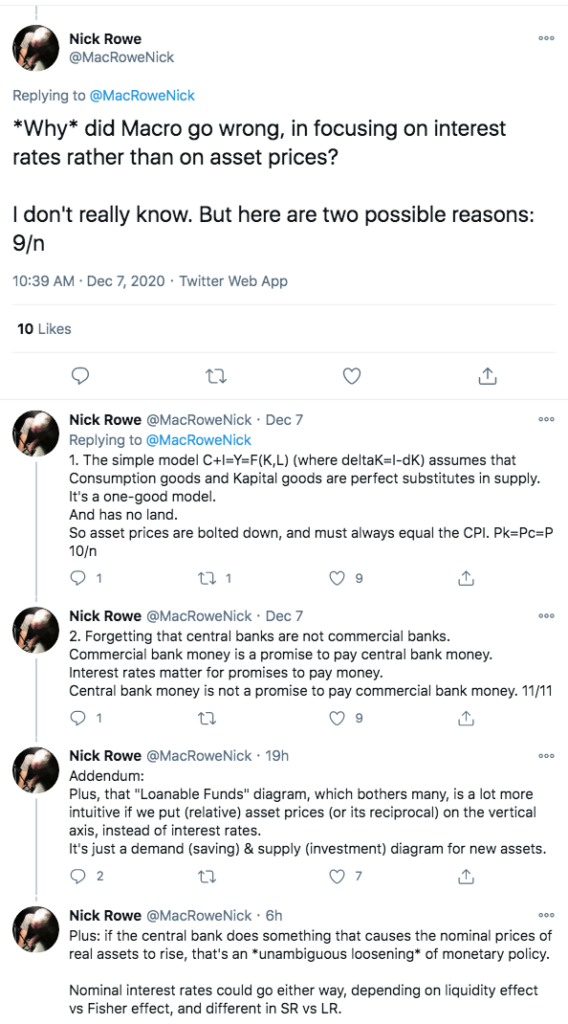

I recently published a 55-page Mercatus paper arguing that we should not equate interest rates and monetary policy. I’m not sure if anyone actually read the paper, but people do read Twitter. Thus I was glad to see these tweets from Nick Rowe:

Tags:

8. December 2020 at 11:43

The Fed has consistently targeted (rising) asset prices for at least ten years. The Fed doesn’t say it is targeting asset prices, but it obviously does. Rising stock prices lead us out of the great recession and rising asset prices have kept investors happy during the pandemic. So what’s Sumner complaining about? In a pinch, would the Fed go full Farmer and purchase stocks in order to support (targeted) stock prices? God help us.

8. December 2020 at 12:23

Rayward, Given how you’ve ignored all my previous replies, I think I’ve reached the point where I see no need to respond.

8. December 2020 at 13:14

Here are some facts—we currently have record low interest rates. People need a place to live. Many American cities have existing infrastructure to handle hundreds of thousands of more residents. If someone’s living expenses are low enough then higher wages are not necessary to have a decent quality of life. Affordable housing programs in expensive cities are suboptimal.

So instead of bickering about what effect low interest rates have…why wouldn’t the federal government just have a home ownership program that gives every American the opportunity to take out a $150k home loan with the government picking up the interest payments?? So the average median home price is $210k, by having a government program in which one can take out an interest free loan for a home prices below the median home price you are putting downward pressure on housing prices which would allow lower income Americans to take advantage of record low rates. Furthermore cities like St Louis could offer tax incentives to lure Americans to their city, so maybe these people wouldn’t pay property taxes for a year? Shouldn’t we want all Americans to ha d the opportunity to take advantage of record low interest rates and not just the wealthy with money for a down payment on an expensive home??

8. December 2020 at 13:39

sumner, I am reading your paper and it is very interesting but I will have to take issue with this,

“Thus in the mid-2000s, a rise in oil demand led to an increase in both oil consumption and oil production.”

When I look at global oil production I see a plateau in the mid-2000s. Also compare global oil production with global steel and copper production during the same period. I believe pretty much every other major global commodity would work in your sentence…except oil (and American natural gas). I personally have always found that a strange economic phenomenon.

Thus in the mid-2000s, a rise in _____ demand led to an increase in both ____. consumption and ____ production.

8. December 2020 at 13:48

I think the more interesting question is why did “macro” focus on interest rates rather than the price level and employment as the Fed’s mandate requires them to?

8. December 2020 at 14:06

From 10 yrs ago:

“In any case, targeting the FF rate is of doubtful utility when the goal is to keep nominal expenditure on a stable growth path. Why? Because if nominal expenditures has been growing too slowly for some time (or even falling like it did recently), and AD is substantially below its “target path” (like it was in 2003 and even more so at present), having the Fed commit to falling, low or even “zero” short term rates is almost certainly not an appropriate approach.”

https://thefaintofheart.wordpress.com/2011/05/01/insisting-on-targeting-the-fed-funds-rate-can-be-bad-for-the-economys-health/

8. December 2020 at 14:48

What is your view on the MMT Job Guarantee? Rather than messing around with rates ban all bank lending except capital development lending (no mortgage lending only business), 0% overdrafts capital development lending agency business deliver state funds and monetarise debt. To counter deflationary effect of bank regulation introduce Job Guarantee auto stabilizer. Increases spending during recessions, decrease during booms. Guarantee every adult American a public sector job at minimum wage, job like any other job can be fired. Examples of JG Jobs: open source programming, social care, environmental work (e.g. stabilizing sand dunes), teacher assistants, musicians, community handyman, gardening in old people’s homes and mothering. End all poverty USA.

https://new-wayland.com/blog/the-mmt-approach-in-a-nutshell/

https://berniesanders.com/issues/jobs-for-all/

You SHOULD support Job Guarantee Scott, is ethical thing to do.

8. December 2020 at 14:50

Gene, I should have said 2002-06, as mid-2000s is kind of vague.

Marcus, Exactly.

8. December 2020 at 14:53

Macro went wrong because centralized planning doesn’t work.

Apparatchiks sitting in Washington have attempted to impose their will on the American businessman, while not knowing anything about running a business, the communities in which these businessmen live, or the individual positions of each.

As such, I call for these Fed apparatchiks to resign. I call for the abolishment of the Federal Reserve.

8. December 2020 at 15:08

sumner, I finally found an economist that shares some of my views about 2008. From Brookings in 2009:

“ABSTRACT This paper explores similarities and differences between the run-up of oil prices in 2007–08 and earlier oil price shocks, looking at what caused these price increases and what effects they had on the economy. Whereas previous oil price shocks were primarily caused by physical disruptions of supply, the price run-up of 2007–08 was caused by strong demand confronting stagnating world production. Although the causes were different, the consequences for the economy appear to have been similar to those observed in earlier episodes, with significant effects on consumption spending and purchases of domestic automobiles in particular. Absent those declines, it is unlikely that the period 2007Q4–2008Q3 would have been characterized as one of recession for the United States. This episode should thus be added to the list of U.S. recessions to which oil prices appear to have made a material contribution.”

https://www.brookings.edu/wp-content/uploads/2016/07/2009a_bpea_hamilton-1.pdf

8. December 2020 at 17:32

@Gene Jim Hamilton arrived at that conclusion much earlier (2009)

“Although the approaches are quite different, they all support a common conclusion: had there been no increase in oil prices between 2007:Q3 and 2008:Q2, the U.S. economy would not have been in a recession over the period 2007:Q4 through 2008:Q3.”

My conclusion differs:

https://thefaintofheart.wordpress.com/2012/02/10/by-blaming-oil-gas-prices-for-the-great-recession-rick-santorum-takes-the-heat-off-the-fed/

8. December 2020 at 21:13

Marcus, Santorum had the benefit of at one time representing PA in the Senate and so he understood how revolutionary fracking was early on and why a major problem of 2001-2008 had been solved. So because natural gas prices aren’t nearly as in one’s face as gasoline prices the average person might not have understood that the reason their good job was shipped to China and their electricity bill was expensive was due to natural gas price increases during the same period oil prices were increasing. I have a link to a quote from the CEO of XOM in 2007 saying America was about to become an LNG IMPORTER!?! So Fortune 500 CEOs and W Bush and Cheney were listening to Raymond and Tillerson telling them America would never have cheap natural gas again…and by 2010 fracking had proved economical and XOM was scrambling to buy XTO while missing out on fracking for oil!?! Tillerson and W Bush are the only Texans that couldn’t find oil in Texas!?!

9. December 2020 at 03:07

“29:10 the central bank steps in goes to the

29:14 banks and purchases the non-performing

29:16 assets at face value and the problem is

29:19 solved there’s no cost and this is

29:20 exactly what Bernanke did that’s why in

29:24 September October 2008 the balance sheet

29:27 of the Federal Reserve Quadrupled in

29:29 one month . . . this doesn’t create inflation . . . ”

“that’s

66:17 what Bernanke did in September 2008 and

66:22 that is why bank credit creation

66:26 immediately recovered in the u.s. ”

https://www.youtube.com/watch?v=8FT-zyTX2nE&lc=z23dxvchbqzixx0rh04t1aokg5flnl0yyhzfwwshwgkubk0h00410.1540380500211044&feature=em-comments

9. December 2020 at 11:04

Kester, I definitely support a set of policies that allow anyone who wants to work to find a job. We were close in 2019, when firms were so desperate that even ex cons were being hired.

I’d prefer using the private sector, as they are more efficient. Replace the minimum wage with wage subsidies for lower wage workers, and target NGDP growth at 4% or 5% per year, level targeting.

It would also help to eliminate restrictive housing zoning, as this would boost construction jobs for people who don’t go to college. Deregulate infrastructure construction to make it cheaper, so we can build more infrastructure. Eliminate occupational licensing laws.

Gene and Marcus, Yes, Jim Hamilton has been writing papers on oil and the business cycle for decades.

10. December 2020 at 03:40

Hamilton was a firm peak oiler in the 2000’s, convinced that civilisation was about to fall due to lack of supply, a rather silly position to see now when the biggest question is whether oil demand has peaked forever. As I explained to him at the time the high prices were just a feature of demand suddenly increasing due to China industrialisation, their exponential growth in demand went (as exponential growth does) from completely insignificant to completely dominant in the space of a few years. Of course a temporary rise in prices was needed to stimulate more supply in that circumstances which took a few years. But that is history. The interesting thing now is when the exponential growth in solar power will start to become dominant, we are a few years off from that I think, but it is coming. The main impact on macroeconomics will be hard to estimate, certaintly will change trade balances, and put more pressure on the relationship between China (the main manufacturing country) and the West.

10. December 2020 at 09:53

Sumner’s right. It doesn’t take 55 pages to confirm that.

Read: Dr. Daniel L. Thornton, Vice President and Economic Adviser: Research Division, Federal Reserve Bank of St. Louis, Working Paper Series, “Monetary Policy: Why Money Matters and Interest Rates Don’t”

http://bit.ly/1OJ9jhU

10. December 2020 at 10:04

You have a lot of disinformation presented by the pundits:

“CHAIRMAN GREENSPAN. I must say that I have not changed my view that inflation is fundamentally a monetary phenomenon. But I am becoming far more skeptical that we can define a proxy that actually captures what money is, either in terms of transaction balances or those elements in the economic decision making process which represent money. We are struggling here. I think we have to be careful not to assume by definition that M1, M2, or M3 or anything is money. They are all proxies for the underlying conceptual variable that we all employ in our generic evaluation of the impact of money on the economy. Now, what this suggests to me is that money is hiding itself very well.”

People have a propensity to broadcast how stupid they are.

10. December 2020 at 10:16

At the height of the Doc.com stock market bubble, Federal Reserve Chairman Alan Greenspan initiated a “tight” monetary policy (for 31 out of 34 months).

Note: A “tight” money policy is defined as one where the rate-of-change in monetary flows (our means-of-payment money times its transactions rate of turnover) is no greater than 2% above the rate-of-change in the real output of goods and services.

Greenspan then wildly reversed his “tight” money policy (at that point Greenspan was well behind the employment curve), and reverted to a very “easy” monetary policy — for 20 consecutive months (i.e., despite 14 raises in the FFR (June 30, 2004 until January 31, 2006), – every single rate hike was “behind the inflationary curve”, behind Roc’s in long-term money flows). I.e., Greenspan NEVER tightened monetary policy.

And as soon as Bernanke was appointed to the Chairman of the Federal Reserve, he immediately initiated, his first “contractionary” money policy for 29 contiguous months (coinciding both with the end of the housing bubble, and the peak in the Case-Shiller’s National Housing Index in the 2nd qtr. of 2006 @ 189.93), or at first, sufficient to wring inflation out of the economy, but persisting until the economy plunged into an economic wide depression).

For > a 2 year period, Roc’s in M*Vt, proxy for inflation (for speculative assets), were NEGATIVE (less than zero!).*

Unfortunately, when long-term money flows peaked in July, which was reported with a lag on Aug 14, 2008 · when the government announced that the annual inflation rate surged to 5.6% in July – the highest point in 17 years; after July, both the Roc in short-term money flows and long-term monetary flows, simultaneously, fell off a high cliff (because of the lag effect of money flows).

Money market and bank liquidity continued to evaporate despite the FOMC’s 7 reductions in the target FFR (which began on 9/18/07 until 4/30/08). Bernanke didn’t initiate an “easy” money policy, continuing to drain liquidity, despite Bear Sterns two hedge funds that collapsed on July 16, 2007, and immediately thereafter filed for bankruptcy protection on July 31, 2007 — as they had lost nearly all of their value.

Bernanke’s 29 contiguous months of a massive contraction of American Yale Professor Irving Fisher’s price level, the massive tightening of monetary conditions in the US. caused a sharp rise in E-$ money, in E-$ demand. Foreign central banks did not have direct access to dollar liquidity swaps from the Fed (as illustrated by the sharp drop in EUR/USD from close to 1.60 in July 2008 to 1.25 in early November 2008).

BuB didn’t even begin to try and ease monetary policy until Lehman Brothers later filed for bankruptcy protection (it was one the Federal Reserve Bank of New York’s primary dealers in the Treasury Market, disrupting the primary dealer system), on September 15, 2008. The next day AIG’s stock dropped 60%.

I.e., BuB maintained his “tight” money policy [i.e., credit easing, or mix of assets, not quantitative easing –injecting new money and excess reserves]. BuB literally didn’t ease monetary policy until March 2009 (when the rate-of-change in money flows finally reversed, when stocks turned).

The FOMC’s “tight” money policy was due to flawed Keynesian dogma (using interest rate manipulation as a monetary transmission mechanism), rather than by using open market operations of the buying type so as to expand legal reserves and the money stock — and thus counteract the surgically sharp fall in AD, esp. during the 4th qtr. of 2008.

On January 10, 2008 Federal Reserve Chairman Ben Bernanke pontificated: “The Federal Reserve is not forecasting a recession”.

Bernanke subsequently initiated the economy’s coup de grâce during July 2008 (his second ultra-contractionary money policy).

The 3rd contractionary policy was the introduction of the payment of interest on excess reserves, which destroyed non-bank lending/investing (the 1966 S&L credit crunch, where the term was first introduced, is the economic antecedent and paradigm).

Note aside: the 2 year rate-of-change, RoC in M*Vt (which the FED can control – i.e., the RoC in N-gDp), peaked in the 2nd qtr. of 2006 @ 12%. Bernanke let it fall to 8% by the 4th qtr. of 2007 (or by 33%). N-gDp fell to 6% in the 3rd qtr. of 2008 (another 25%). N-gDp then plummeted to a -2% in the 2nd qtr. of 2009 (another – 133%). That’s what created the cry, epitomized by Scott Sumner, for targeting N-gDp.

By withdrawing liquidity from the financial markets (draining legal reserves and the money stock), risk aversion was amplified, haircuts were increased, additional and/or a higher quality of collateral was required, liquidity mis-matches were magnified, funding sources dried up, long-term illiquid assets went on fire-sale, non-bank deposit runs developed (the ECB, which routinely conducts open-market operations “with more than 500 counterparties throughout the Euro Zone), withdrawal restrictions were imposed, forced liquidations lowered asset values, counterparties’ credit default risks mushroomed– all of which contributed a general crisis of confidence & frozen financial markets (regulatory malfeasance was a subordinate factor).

I.e., BuB turned Yale Professor Irving Fisher’s “price level”, or otherwise safe-assets, into impaired and unsaleable assets (i.e., upside down and under water).

I.e., Alan Greenspan didn’t start “easing” on January 3, 2000, when the FFR was first lowered by 1/2, to 6%. Greenspan didn’t change from a “tight” monetary policy, to an “easier” monetary policy, until after 11 reductions in the FFR, ending just before the reduction on November 6, 2002 @ 1 & 1/4% (approximately coinciding with the bottom in equity prices).

I.e., Greenspan was responsible for both high un-employment (June 2003, @ 6.3%), & high inflation (rampant real-estate and commodity speculation).

And BuB NEVER eased. BuB then relentlessly drove the economy into the ground, creating a protracted un-employment, & under-employment rate, nightmare.

10. December 2020 at 10:25

ChrisA, the leaders of XOM believed in “peak North American” energy production during that period. IIrc, XOM was the biggest and most profitable American corporation during that time. Once again, if you want to understand what happened from 2001-2008 line up charts showing production of every major global commodity including American natural gas production and what happened becomes very clear.