Nick Rowe channels Robin Hanson (and John Cochrane)

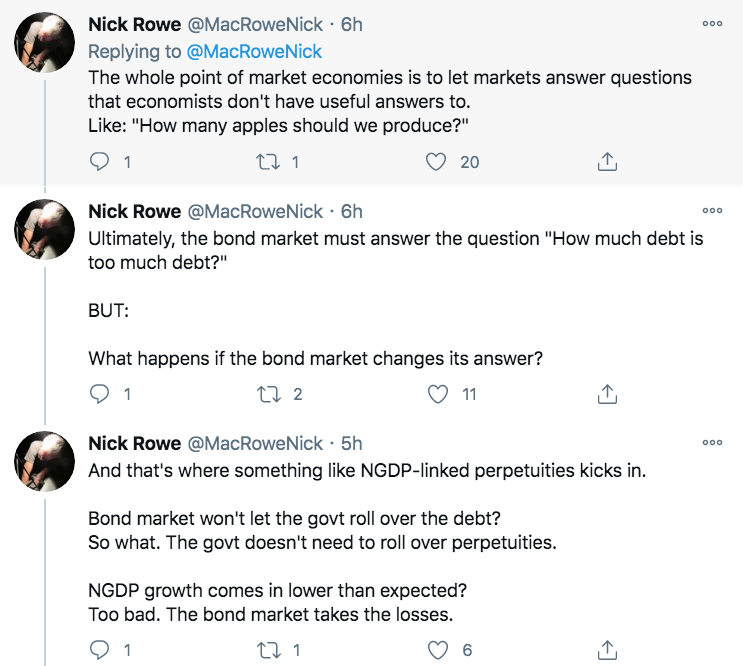

This is a great idea (he’s discussing government debt):

There is some risk that the government could change the way it computes NGDP. But there is also risk that the government changes the way it calculates the CPI, and that doesn’t stop people from buying TIPS.

Tags:

24. January 2021 at 12:45

Shiller has obviously been pushing for GDP growth-linked securities for a long time. I’ve long been a fan of the idea, especially in recent years, as it would make it easier to test my hypothesis that GDP growth should equal the rate of return on capital, and should perhaps also equal the nominal risk free interest rate.

More importantly, it would make NGDPLT easier.

24. January 2021 at 12:45

[…] Original Article […]

24. January 2021 at 14:47

I think it’s a good idea, but I think you can start with nominal perpetuities before moving to linkers.

24. January 2021 at 15:06

Argentina issued GDP-linked warrants as part of the deal to restructure debts in the wake of the 2001 bankruptcy.

There were some accusations in shenanigans along the way regarding the GDP calculation and whether the growth was sufficiently high to trigger the warrant.

24. January 2021 at 17:04

Total Govt debt, federal and states etc is about 35 trillion give or take. It’s really more but close enough. FRED says total financial and corporate debt is about 20 trillion which seems low to me. FRED says Total global debt is 277 trillion. So no one is “paying back” anything. But debt, revenues, equity values, and all continue to grow and have always grown. Equity value globally is about 80% of Debt. Give or take.

How much is too much? Have no idea. But we obviously have not reached it yet. But we have seen it be too much before when bankruptcies occur. So we know it can happen. Plus we also know that promises made about future payments (pensions, SS etc) can eventually get high enough we know that cannot technically ever be paid at some point, at least without inflation. But Scott, who might actually not be kidding, thinks TIPs buyers might be able to arb the problem for themselves by buying them.

I suppose that is possible at tiny amounts for short periods of time. But, I have come to believe that monetary policy can prevent inflation if done properly. At least I thought that was the topic of this blog. But at some point it can all break down—- just like we used to be taught.

At least corporations can create profits. Can Govts? I don’t think so. So it seems inevitable that we must periodically lower the rate of growth of Govt debt. But that is not happening anywhere.

24. January 2021 at 18:25

The rule of thumb is that there’s no market for something where there’s no societal demand for it. Call it short sighted, but that’s how markets work. For example, I value rewarding inventors more, but there’s no market for that, since historically, inventors invent for fame, for recognition, and non-monetary reasons, (a few bankrupt inventors as exceptions that prove the rule) so ergo there’s no market for rewarding inventors (not to mention inventions are non-rival goods and IP is not legally recognized, a sort of chicken-and-egg problem). Shiller lamented there’s no futures market for housing prices, and even invented the Case-Shiller index, but it went nowhere (no market for it). Sumner laments there’s no NGDP futures market, but the same reason applies: why do we need one? The market sees no need for one, markets assume money is short term neutral. No reason anymore than rewarding inventors, or having a housing index you can hedge.

Sad but true, markets are short-sighted. I once read the average ‘good product’ has a shelf life of about four years. If you can’t recoup your money in four years, it usually isn’t done. Maybe for long-term projects it might be 30 or even 50 years, but that’s stretching it and gets into government funded or operated enterprises.

24. January 2021 at 20:06

Ray, Do you even read? If not, why bother commenting?

24. January 2021 at 21:31

For the people out there who believe that money can only be precious metals Nick’s idea is pure sorcery. But, if I’ve been reading Sumner correctly for a few years, an NGDP linked perpetuity would be the perfect demonstration of a “guard rail” based monetary policy system.

Would such an instrument be a good investment if I were a vampire and wanted an inflation hedge with a 100 year window? Probably, and much easier to keep track off than chests of gold. Hell, even safer than real estate in Miami.

24. January 2021 at 23:27

David, for your hypothetical 100 year horizon, the bigger question would be whether the government in question will still be around in a century. Few countries have made it that long without a bankruptcy.

But otherwise, I agree.

I wonder whether there would be demand for private actors to create such perpetuities? I can see why bondholders might prefer bonds that automatically adjust coupons down when the economy is doing badly (and up in a boom). And investors could use them as a bet on the general state of the economy.

Add a clearing house perhaps to standardise the obligations, so you don’t have to worry about the issuer staying solvent,and you have a pretty decent instrument without any government being involved.

25. January 2021 at 00:25

David, such an instrument would be of great interest to endowments, pension funds, family offices, etc, not only vampires.

25. January 2021 at 00:54

“100 year horizon”?

‘We’ have ten years?

“ . . . our best estimate is that the net energy

33:33 per barrel available for the global

33:36 economy was about eight percent

33:38 and that in over the next few years it

33:42 will go down to zero percent

33:44 uh best estimate at the moment is that

33:46 actually the

33:47 per average barrel of sweet crude

33:51 uh we had the zero percent around 2022

33:56 but there are ways and means of

33:58 extending that so to be on the safe side

34:00 here on our diagram

34:02 we say that zero percent is definitely

34:05 around 2030 . . .

we

34:43 need net energy from oil and [if] it goes

34:46 down to zero

34:48 uh well we have collapsed not just

34:50 collapse of the oil industry

34:52 we have collapsed globally of the global

34:54 industrial civilization this is what we

34:56 are looking at at the moment . . . “

https://www.youtube.com/watch?v=BxinAu8ORxM&feature=emb_logo

25. January 2021 at 04:55

@Postkey

I have to admit, your format always makes me want to look at it—-but I have no idea what your clock like counter is supposed to do. I think you are saying we are running out of oil and we will collapse. It does seem like we eventually will run out of oil——which is not the same as running out of energy. Mankind keeps not disappearing, with progressively less periods of disaster/famine/pestilence, etc.. In fact, we seem to,be accelerating in our ability to survive—-even if we run out of oil. Eventually we will disappear——maybe suddenly or maybe gradually, but not due to running out of oil.

25. January 2021 at 05:37

The biggest morons in history are economists. But John Cochrane said: target sovereign spreads.

Albert Einstein said: “Compound interest is the eighth wonder of the world.”

It would seem that somewhere, somehow, if total net debt (not just Federal Debt) keeps rising faster than production (GDP), the burden of interest charges at some point now indefinite, and unknown, but nevertheless real, will become too great to carry.

It should be recalled that the charges on debt are related to a cumulative figure; and since the multiplier effects of debt expansion on income, the ingredient from which the charges must inevitably be paid, is a non-cumulative figure, it would seem that the time will inevitably arrive when further debt expansion is no longer a practical or possible expedient, either to provide full employment or to keep debt charges within tolerable limits.

25. January 2021 at 05:41

It is axiomatic. All monetary savings originate within the payment’s system. But commercial bank held savings (funds held beyond the income period in which received, income not spent) are stagnant, frozen until utilized (spent/invested).

The only way to activate monetary savings (bank held savings) is for their owners to invest/spend either directly or indirectly outside of the payment’s system, e.g., via a nonbank conduit.

Frictionless financial perpetual motion requires that, income not spent is reintroduced into the economy, completing the circuit income and transactions’ velocity of funds (*circular flow*), thereby sustaining and promoting economic momentum. The utilization of savings has a positive economic multiplier. Whereas bank-held savings contribute nothing at all to GDP.

We have already passed the point where the problem of servicing the national debt can be solved without violating the principles of a free economy. That is to say for example, through a non-debilitating level of taxation rather than a confiscatory capital levee. Our economy will be forced into an increasingly totalitarian mold, and the freedoms which we are presumably arming to defend will be lost.

25. January 2021 at 10:08

One criticism is that extending maturity and building in an insurance component via the NGDP link are going to be costly, in two respects.

Many investors buy US treasuries because they have a guaranteed return and are relatively low vol, especially for terms shorter than 5-7 years. So you’d have to offer a lot more on your NGDP linked perpetuities than interest on your bonds, especially if you want to replace most of your outstanding debt with perpetuities.

Secondly, the NGDP perpetuity market would likely be more sensitive to sudden deteriorations in economic conditions. The government doesn’t need to rollover NGDP perpetuities, but in a state of perpetual high deficits it does need to issue new ones. Issuing $1,000B/yr worth of 5% perpetuities for a decade would be very painful on the federal budget.

–“David, such an instrument would be of great interest to endowments, pension funds, family offices, etc, not only vampires.”–

The duration on such a product would be extreme, and again there is the insurance component. Suppose rates rise 2% and NGDP growth falls 0.5% below expectations. You’d get something like a 50%+ capital loss on your perpetuity. Yes, there is some upside if NGDP performs better than expected, but if you have a pension fund with guaranteed liabilities, you should just use equities if you want to take on risks of this magnitude.

Overall, I have a better idea: eliminate the ongoing primary deficit for unemployment at 5%, target 0% inflation (whether directly or through 1.5-2% NGDP) so that treasury rates are zero to negative.

25. January 2021 at 13:52

Scott,

Three things.

1. I’ve been pushing this idea repeatedly since at least 2012 https://www.themoneyillusion.com/the-next-step/

2. If you think about it, Treasuries are already essentially perpetuities. Either investors (the market) will keep voluntarily rolling them over (continually extending the maturity) or Congress will pass a law putting a moratorium on principal repayment. Either way there is no expectation that principal will be redeemed in a time frame that affects the current price (NPV) of the notes.

3. Also the interest rate on the notes already does fluctuate with NGDP. Higher RGDP will result in higher real interest rates, and if inflation is higher, the market will require a higher nominal coupon. So in both these ways, rates on Treasuries will tend to track NGDP

25. January 2021 at 15:00

Justin, I’m certainly in favor of eliminating the primary deficit.

dtoh, Yes, I recall that now. Robert Shiller has also discussed the idea. Here I was focusing on the consol aspect of the plan.

In earlier discussion, I favored a NGDP futures contract over NGDP linked bonds for the purposes of monetary policy guidance, although obviously NGDP bonds would also be highly useful, and might be easier to implement, as you say.

This famous meme:

https://www.24a11y.com/2019/select-your-poison/why-not-both/

25. January 2021 at 16:02

https://www.youtube.com/watch?v=bYAiVNI82e8&feature=youtu.be

Steve Hanks on inflation. References Dr. William Barnett’s Divisia monetary aggregates. Of course, my #s are more accurate than Barnetts

25. January 2021 at 16:22

Scott,

Yes, if such a GDP growth instrument were produced, it’s quite possible a futures market would develop for it. There are Treasury futures, after all. May not even need subsidies.

If such a futures market existed, it really would be better than targeting the earnings yield of the stock market.

26. January 2021 at 06:36

S&P CoreLogic Case-Shiller index of property values)soared 9.08% YoY… the fastest pace since May 2014.

China would never permit a 7 million deficit in affordable housing.

26. January 2021 at 06:40

@Michael Sandifer

Monetary policy objectives should not be in terms of any particular rate or range of growth of N-gDp. Rather, policy should be formulated in terms of desired RoC’s (rates-of-change), in monetary flows relative to RoC’s in R-gDp;

RoC’s in money flows can be used to approximate N-gDp, which can then be used as a subset and proxy figure for RoC’s in all physical transactions P*T in early American Yale Professor Irving Fisher’s truistic “equation of exchange”. RoC’s in R-gDp have to be used, of course, as a policy standard;

Because of monopoly elements, and other structural defects, which raise costs, and prices, unnecessarily, and inhibit downward price flexibility in our markets, it is advisable to follow a monetary policy which will permit the RoC in money flows to exceed the RoC in R-gDp by c. 2 percentage points;

Monetary policy is not a cure-all, there are structural elements in our economy that preclude a zero rate of inflation. In other words, some inflation is inevitable given our present market structure and the commitment of the federal government to hold unemployment rates at tolerable levels;