Nevermind

Before the election, I pointed out that the Chinese government was not holding down the value of its currency, indeed just the opposite. Here’s the FT:

“There aren’t going to be trade wars,” Wilbur Ross, the New York investor and Trump adviser, told US media last week.

Mr Ross argues that Mr Trump’s widely-quoted campaign threat to impose a 45 per cent tariff on Chinese imports — seized on by economists as the potential trigger for a trade war with Beijing — has been misunderstood and amounts only to negotiating tactics.

Such a figure would be dependent on a finding that China’s currency, the renminbi, was undervalued by 45 per cent, Mr Ross says. The International Monetary Fund has called the RMB fairly valued while US officials point out any recent intervention by Beijing in currency markets has been designed to slow a market-driven decline, arguably to the US’s benefit.

Good.

In other news:

A global bond market rout intensified on Monday while the dollar strengthened as investors bet that US president-elect Donald Trump’s mix of economic stimulus and protectionism will herald faster growth and the return of inflation.

Since Mr Trump’s surprise win in last week’s election, investors have begun to question long-held consensus forecasts for subdued inflation and mediocre growth that underpinned a rally in bonds over the summer. Yields on US, UK, German and Japanese government debt are now rising from record lows.“Markets are betting that Trump will implement much of his domestic agenda of a fiscal boost and deregulation while ditching most of his international agenda of protectionism and ‘America first’,” said Holger Schmieding, chief economist at Berenberg.

There are actually two questions here. Why did bond yields rise after Trump was elected, and what is the “new information” that caused much of the increase to occur in recent days, not immediately after the election (as the EMH might seem to predict). Is there any new information?

I’m not sure, but my best guess is that as Trump’s camp sends out signals that it will be more “supply-sider” and less “populist”, that boosts RGDP growth expectations, and hence bond yields. Fiscal stimulus may also play a role, but my hunch is that a big infrastructure program was already a given, and that the new information relates to the hints that the supply-siders are dominating the populists. (Or perhaps the populism was a scam from the beginning, a way to get downscale white votes: “There’s nothing wrong with Kansas that huge tax cuts for billionaire NYC property developers can’t fix.”)

The swamp will be drained, right into the pockets of Trump’s buddies.

PS. Now I’ll put on my “Colombo” raincoat. “There’s just one thing I don’t understand. If this was the plan all along, then why not just go with Jeb!, Ted, or Marco? Why did we need Trump? Is it nothing more than Trump’s ego? Nothing more than Trump deciding he’d win by running as a populist xenophobe, but then implementing Mitt Romney’s program afterwards?”

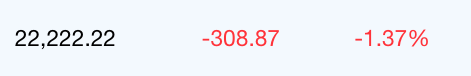

Update: Some commenters whined, “Sumner, you told us Trump wouldn’t win”, when I actually told them he had a 20% chance. Some people think 20% probability events never happen. I encourage all my commenters who complained to play Russian roulette. In any case, here’s the closing price at the Hong Kong Stock Exchange today, from Yahoo:

The odds of all 7 digits being identical are one in a million. Those sorts of coincidences happen thousands of times every day, all over the world. When you see an academic study that says a finding is significant at the 95% confidence level (one in twenty odds of being due to chance), you should make a mental note not to trust the finding, unless confirmed by multiple follow-up studies.

Update: Msgkings pointed out:

Wanna flip your lid some more? The actual closing yield on the 10-year UST today was 2.222% on the CBOE. Put that together with today’s Hong Kong close.

So that’s 11 digits, and a one in 10 billion odds of all digits being identical. That will happen again in those two markets in about another 28 million years. But will we still have the 10-year Treasury, 28 million years from now? How about NGDP targeting?

Tags:

14. November 2016 at 10:16

Swamp to be replaced with open sewer.

14. November 2016 at 10:30

I think the answer, broader than the appeal of fascism, was Trump’s authoritarian personality, which seem a contradiction. I think that even voters who oppose a particular strong leader respect, admire, and appreciate the strength.

Of course, Trump isn’t a strong leader, but he’s seen as such by many.

14. November 2016 at 10:33

10 yr yields

11/7 1.83

11/8 1.86

11/9 2.06

11/10 2.15

11/14 2.21

14. November 2016 at 10:34

Thanks Marcus.

14. November 2016 at 10:46

A big infrastructure program was hardly a given with the expectation of a Hillary victory with a Republican House.

There is also the possibility of a return to higher inflation. The 1970’s inflation started with Nixon and particularly Nixon’s pressure on Arthur Burns ahead of the 1972 election.

https://en.wikipedia.org/wiki/Arthur_F._Burns#Federal_Reserve_Chairman

I really have no earthly idea what Trump is going to do with the two open Fed board seats. He may appoint bankers who have his ear instead of economists. The new FOMC probably wouldn’t allow 4+% inflation, but Trump’s subtle pressure for growth could conceivably allow 2-3% inflation instead of 1-2%. If fiscal stimulus also raises rates, then there’s also less pressure for the Fed to raise rates when inflation ticks above 2%.

14. November 2016 at 10:52

It’s the same argument that creationists and apologists use in their “fine tuning” argument.

– Richard Feynman

14. November 2016 at 10:53

Matthew, I agree, I meant a give right after Trump won. My question is why did bond yields keep rising, as they rose only slightly immediately after the election, if at all.

Trump has no chance against Fedborg.

14. November 2016 at 11:14

“Trump has no chance against Fedborg.”

Wait until he appoints John Taylor as Fed Chair.

14. November 2016 at 11:41

Scott,

Is there any chance your perception of Trump’s character suffers from a bad case of confirmation bias? You looked for a monster and found one? If the wretched “promises” turn out to be more nuanced, and the folks that voted for him no worse the wear, will that persuade you that perhaps Trump is not as evil as you think? Why is Trump unique insofar as he ought to be judged by the very worst interpretations of the worst things that he’s said/done?

14. November 2016 at 12:14

Foosion, Taylor is no Arthur Burns. He has more than enough integrity to avoid being a puppet of Trump.

Mo, You said:

“Is there any chance your perception of Trump’s character suffers from a bad case of confirmation bias? You looked for a monster and found one?”

Yes there is. But . . . when I first heard about Trump I had a positive view of him. I only began to form a negative view when he started that birther thing. But even then I didn’t care much. it was the campaign that made me turn on him

You said:

“Why is Trump unique insofar as he ought to be judged by the very worst interpretations of the worst things that he’s said/done?”

It’s not that, it’s that almost everything he’s done in the past year has been awful. If he could have showed me something positive, I would have taken that into account. But what is one to think when faced with one awful thing after another. When I hear him talk it seems like almost nonstop lies and insults. I’ve never seen an America politician talk this way. Now you might say it’s just me. But others feel the same way—they also have never seen anyone like Trump.

I’d like to say “on the positive side . . . ” but what could I point to?

Now that doesn’t mean I’ll be biased; I’ve just done two posts praising his move away from stupid populist economics. If he does more of that, he’ll get more praise from me. I hope he’s a greater President than George Washington.

14. November 2016 at 12:49

Scott,

What gives you such confidence that Trump has “no chance against Fedborg”? To the degree he chooses to concentrate on monetary policy, it might not be in conventional ways.

Even conventionally, he can nominate members to the FOMC that he thinks will do his bidding, and what stops him from changing the Fed via the Congress?

Unconventionally, he can publicly demonize the Fed, which could bring about the typical nasty phone call and email attacks that will include antisemitic slurs, death threats, etc. He might openly talk about not reappointing certain members that don’t want to pop “bubbles” for example, or juice the economy if he thinks growth should be higher.

14. November 2016 at 12:50

Scott,

For that matter, he can even threaten to present a bill to Congress to radically, and likely, recklessly change the Fed.

Why am I wrong?

14. November 2016 at 12:53

Fair enough, but it seems that a lot of his offenses fall into the bucket of “doesn’t speak good.” That is, take him seriously, but not literally. If you consider how executives make decisions–they’re the “visionaries,” while the minions provide the details hashed out over an extended period of time while circumstances change, bargains are made and research brings more facts to light–his focus on goals without details could be regarded as more honest.

As for the indecent things that he’s said, I think some (but not all) lend themselves to more charitable interpretations. As for the others, they reflect an infinitesimal percentage of his collective words and given highly motivated sampling, it seems reasonable that they are not a representative sample. Plus, I think there is contrary evidence, including his recent statements and demeanor. He did appeal directly to Black communities (and was dismissed as disingenuous). Ivanka has twice made direct appeals to women (and was dismissed as disingenuous). He made a direct appeal to the LGBT community at the RNC (and was dismissed as disingenuous).

Is it the data or the model?

What if he actually has been the victim of relentless character attacks for the last year+? Considered in that light, his restraint is actually quite remarkable.

There is evidence to suggest that he’s made more good decisions than bad ones, even if he has made some bad ones. His ability to stay in the public eye and keep his brand valuable for so long is itself an accomplishment. I think you would agree that it’s harder to be a successful snake-oil salesman in the private market than in the public one, so maybe his success isn’t all or even mostly snake-oil?

14. November 2016 at 12:59

I would also suggest that the fact that “others have said so” could also cause you to (collectively) lower your guard.

14. November 2016 at 13:22

> Why did bond yields rise after Trump was elected, and what is the “new information” that caused much of the increase to occur in recent days, not immediately after the election (as the EMH might seem to predict). Is there any new information?

One explanation might also be lack of certain other signals that had a certain probability.

14. November 2016 at 14:37

Scott, Trump is nowhere near in as strong position as you assume. Try getting 50 senators to vote to manipulate the Fed. Lots of luck. You think people like McCain and Graham will play these games with Trump? Think again.

Mo, I’ve heard so many awful things from him, on so many topics, that I can’t just write it off as slips of the tongue. Saying we should ban Muslims is not a slip of the tongue. Ditto for stealing Iraq’s oil. And torture. And assassination. And 100s of other comments. And if he’s so dumb that he doesn’t even know he’s lying about almost everything he says, what does that tell us about his qualifications? And a visionary? He has no vision at all. Reagan had a vision.

Matthias, Yes, that’s possible.

14. November 2016 at 15:34

Wanna flip your lid some more? The actual closing yield on the 10-year UST today was 2.222% on the CBOE. Put that together with today’s Hong Kong close.

14. November 2016 at 17:16

Scott,

I’m going to stay on this side of the argument and hope I’m wrong. I expect the Republicans to fold like lawn chairs when it comes to most serious disagreements with Trump, if Trump decides to publically rail against them as he has in the past. Almost none of them showed courage during the election, so why would they start now?

Also, there may be enough kooks in tye Republican Party, and some perhaps in the Democratic Party also who might agree to certain changes he may want to make.

14. November 2016 at 18:49

msgkings. One in a billion, baby! I added an update.

Scott, Sorry, did McCain and Graham support him in the election? I must have missed that. Lots of Republicans opposed Trump, not a majority, but he can’t lose more than 2 on any vote. That’s not going to be easy. Remember that in 2001 Bush didn’t get the tax cut he wanted, because of GOP deserters.

Kooks? Sure, but there aren’t 50 in the senate, not even close.

14. November 2016 at 19:39

Scott,

McCain did support Trump until his own primary was over, and Graham initially supported Trump after his nomination, but withdrew the support shortly thereafter.

I don’t know what McCain and Graham think about monetary policy, so I don’t know how they’d respond to whatever Trump does.

While there might not be 50 kooks in the Senate(or these days,there might be), it’s not unimaginable that there are 50 or more who don’t know much about monetary policy and might have a misconception similar to Trump’s.

I think it’s safe to say, that especially lately, stranger things have happened.

15. November 2016 at 00:21

Maybe humans passed turing test tend to bid/offer price like 22222 or 27182

I will go out with umbrellas if I expect blood rain falls at 20% possibility.

MPT?

15. November 2016 at 00:36

This theory needs multiple research >Maybe humans passed turing test tend to bid/offer price like 22222 or 27182

15. November 2016 at 01:53

Well, the HSI was trading around 22,000 for a long time.

So, the odds yesterday of 22,222.22 were more like:

3×10 to the fourth, or one in 30,000.

I assume one in 3 odds for the third 2, which could have been a 1 or a 4. That is 22,1XXX.XX or 22.2XX.XX or 22.3XXX.XX were all reasonable prospects yesterday.

Yeah, I know, partypooper.

15. November 2016 at 06:47

Scott, Yes, strange things have happened. Maybe all 48 Dems will vote for it. But I’m not going to lose sleep over far fetched hypotheses.

You do know that Trump’s advisors are hard money types, don’t you? Is Trump even smart enough to question his advisors? Remember, this is a guy who thinks monetary policy is interest rates. He knows nothing about the implications of changing the 2% inflation target.

Ben, That doesn’t contradict my claim.