Money is still easy

These tweets from a few days ago caught my eye:

I think David is right. We do know why rate increases have failed to slow the economy, if “we” means market monetarists. But Weisenthal is right that the mainstream is puzzled by this fact.

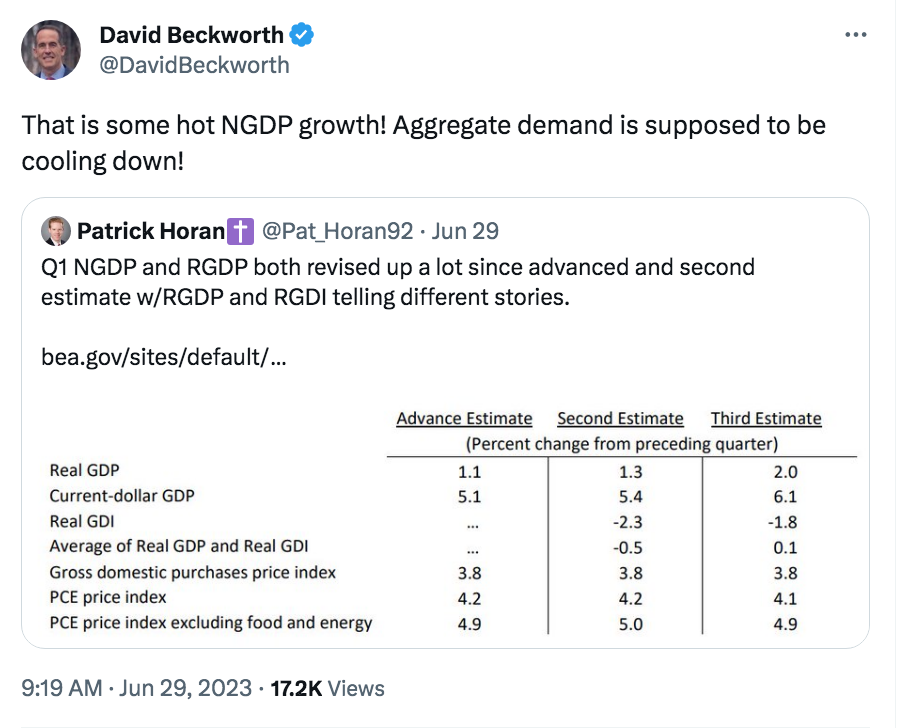

Actually, I’m still not sure that rates have “caught up” to the natural rate. A couple days later we saw these tweets:

So the 2023:Q1 NGDP slowdown mostly reflected bad initial data. That’s why I pay a lot of attention to high frequency labor market data, such as the payroll report. It often provides the best snapshot of the current state of the economy.

Of course this is all backward looking data, and its possible that NGDP growth will slow sharply going forward. But I recall people making that claim last year, and we now know that the doves of 2022 were wrong—policy was clearly too easy last year.

There’s no mystery here—easy money is generating fast NGDP growth, and that’s why core inflation remains stubbornly elevated.

Tags:

1. July 2023 at 10:33

The market expects rates to go down, so they don’t need adjust their behavior since the high interest rates are a temporary blip.

1. July 2023 at 11:06

Oh, fancy new layout for this crummy blog. Do they still let anyone post here? Hit Enter key and see…

SS: “We do know why rate increases have failed to slow the economy, if “we” means market monetarists” – oh, please do tell. You always seem to know why…after the fact.

1. July 2023 at 15:09

https://fred.stlouisfed.org/series/WRMFNS

Bank deposits flowing through the MMMFs increase the supply of loan funds, but not the supply of money (a velocity relationship).

The FT author gets this wrong:

https://www.ft.com/content/3b6bb3af-5568-4a72-86d9-833cad01a071?ftcamp=traffic/partner/feed_headline/us_yahoo/auddev

“Cash that flows into the government’s coffers to pay for new T-bills in effect leaves the banking system.”

Since C-19, there’s been an 18% drop in the “demand for money”, or gated deposits/transactions deposits. I.e., velocity has increased.

1. July 2023 at 15:26

A decrease in O/N RRP volumes increases liquidity when the award rate is lower than yields on T-bills.

https://fred.stlouisfed.org/series/RRPONTSYD/

https://www.richmondfed.org/publications/research/economic_brief/2021/eb_21-43

1. July 2023 at 15:45

Link: Daniel L. Thornton, May 12, 2022:

“However, on March 26, 2020, the Board of Governors reduced the reserve requirement on checkable deposits to zero. This action ended the Fed’s ability to control M1.”

In other words, the FED lost control of “MONEY DEMAND”.

2. July 2023 at 04:33

“Core inflation remains stubbornly elevated”

Hardly – it is just a lagged measure. Deflationary pressure in goods will pass to services which will reduce core inflation.

2. July 2023 at 06:49

The policy implication of your conclusion seems to be that monetary policy should be tightened further, which would presumably send the 5 year inflation breakeven further below target. Is that what you advocate doing?

When you initially saw inflation going above target during the pandemic recovery, and before the Fed explicitly confirmed that their inflation target was asymmetric, you wrote that inflation would need to be below target for a time, to end up with the mean of 2% over some period of time.

Obviously, this is mathematically true, ceteris paribus. But, what about in the case of an emerging permanently higher productivity growth rate? NGDP level targeting would suggest continuing getting NGDP growth back on the previous long-run trend line, but inflation targeting would allow for the higher RGDP growth rate.

2. July 2023 at 08:12

Ben, It’s not goods that matter, it’s wages.

Michael, A this point I’d be happy with just getting back to 2%—the Fed has admitted that FAIT was a farce.

I’m not sure the 5 year breakeven is below target–that takes a model.

2. July 2023 at 09:36

Last decade we mostly maintained government spending of a tad more than 20%. We are now running still >23%. Best I can do to explain this environment is those extra few % of government spending takes significant rate hikes to cancel out.

2. July 2023 at 15:33

Scott, do you have any guess for why stock prices fell, even if NGP did not slow its growth?

2. July 2023 at 16:28

Matthias, I suspect that higher interest rates were the main factor. Both components (inflation and real rates) can negative affect stocks when they rise.

The move toward economic nationalism also hurts stocks.

3. July 2023 at 04:19

Beckworth shouldn’t give Powell and “out” (neutral rate):

2021-01-01 11.7

2021-04-01 13.8

2021-07-01 9.0

2021-10-01 14.3

2022-01-01 6.6

2022-04-01 8.5

2022-07-01 7.7

2022-10-01 6.6

2023-01-01 6.1

Powell should either “fish or cut bait”.

4. July 2023 at 07:17

Money’s been easy since 1965:

https://fraser.stlouisfed.org/title/economic-quarterly-federal-reserve-bank-richmond-960/july-1968-37560/gold-cover-389271

6. July 2023 at 08:20

Scott, are you basing your easy money statement solely on the NGDP growth figures? What are your thoughts on the Divisia money aggregates that have been showing negative growth for the last 5 months? https://centerforfinancialstability.org/amfm/Divisia_May23.pdf

6. July 2023 at 21:24

KE, I don’t believe the divisia figures tell us much about the stance of monetary policy.

7. July 2023 at 08:16

Scott, why is that? Is it their methodology or is there a fundamental reason for you not to take that as an indicator?

7. July 2023 at 08:22

KE, When I’ve looked at various divisia indices, they doesn’t seem to provide a reliable forecasting tool for nominal GDP. We have better tools available.

9. July 2023 at 04:58

@Dr. Sumner, you wrote:

“I’d be happy with just getting back to 2%”

Perhaps in some sense that’s where we are. In the 8 months October 2022 to May 2023 inclusive the US headline PCE index increased at 3.5% annualized. However, as you noted about CPI at EconLog in January, I gather that the headline PCE index includes lagged housing data with a one third (32.9%) weight. It looks to me as though that may entirely account for the 1.5% “excess” annualized PCE inflation rate over those eight months.

9. July 2023 at 14:02

Brent, It’s important not just to exclude items that favor a particular point of view. We’d also want to exclude volatile food and energy, which have fallen since last year. In that case, inflation is still well above 2%.

This is why Powell looks at core inflation minus housing.

9. July 2023 at 17:02

@Dr. Sumner:

I’d only try to adjust the housing price component measurement to reflect current prices as opposed to reflecting lagged prices, not to exclude the housing price component. The food and energy prices are current prices.

As you wrote, “I’m not discounting rental inflation because it’s higher than average, I’m discounting it because it’s being measured with a long lag. It’s the spot rents that matter”

c.f. https://www.econlib.org/good-news-on-inflation-2/

10. July 2023 at 09:31

Yes, but what really matters is inflation going forward. Last July the CPI fell due to plunging oil prices—that meant nothing.

10. July 2023 at 09:56

@Dr. Sumner:

You wrote: “what really matters is inflation going forward”

I take the point that core inflation tends to be a better predictor of future inflation than headline inflation.

Thank you for kindly engaging!