Money is half of macro

Macro is basically composed of three fields:

1. Long run RGDP growth.

2. Nominal macro variables in the long run (P, NGDP, i, E, etc)

3. Business cycles.

Money is all of part two, and half of part three. That means monetary economics is half of macro. It’s also far and away the more interesting half. The real side is a long, boring and random list of factors that affect RGDP (capital, labor, technology, good governance, natural disasters, etc. Monetary economics is an interesting, counterintuitive and elegant structure that fits together wonderfully, using concepts like money neutrality and superneutrality to generate the QTM, the Fisher Effect, PPP and lots of other models filled with beautiful symmetries.

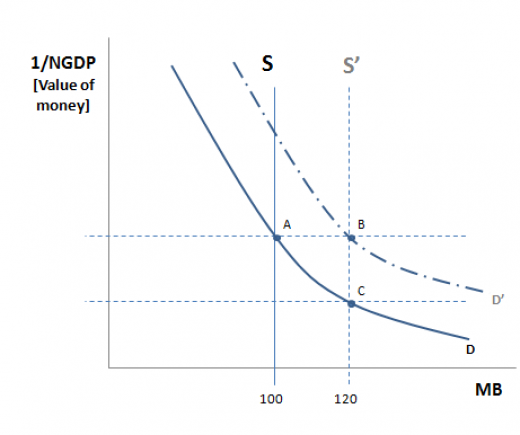

A work study student helped me create a couple of graphs that form my “model” of the macroeconomy. I’ll use them to explain a few issues. First a model of NGDP determination:

This is similar to the regular model of money supply and demand in Mankiw’s textbook, except that the value of money is defined as 1/NGDP, not 1/P. I.e., the value of money is defined as the share of NGDP that can be bought with a single dollar. As with the traditional model, the demand curve is a rectangular hyperbola. In this case the area of a rectangle under any given point on the demand curve is M* (1/NGDP), or M/NGDP, not M/P as on the traditional graph. Thus a given demand for money is defined as a given “Cambridge k” (which is the inverse of velocity.)

Market monetarists differ from traditional monetarists in that we see monetary policy as shifting both money supply and money demand. As in traditional monetarism, any one-time and permanent increase in the monetary base increases NGDP in proportion. That would be like a shift from point A to point C. (Note that 1/NGDP falls at point C, hence NGDP rises.) On the other hand setting a higher NGDP growth target would raise NGDP by reducing the demand for base money–shifting the demand curve to the left. Ditto for a lower IOR.

If NGDP is slow to adjust to a permanent rise in the base, interest rates may fall in the short run (the liquidity effect) and you initially go to point B as the lower interest rates cause the demand for money to rise. Then over time NGDP starts rising, and you gradually move from point B to point C. Actually that’s not quite right, as even in the very short run NGDP will respond somewhat to monetary stimulus. After all, some prices (like food, metals and crude oil) are highly flexible. So the short run equilibrium is actually slightly below point B. NGDP rises immediately, by a small amount.

If the monetary stimulus is not expected to be permanent then you will see interest rates fall and you would go to point B in the short run. That’s what happened in Japan between 2003 and 2006. Then in 2006 the MB was reduced by 20% and Japan went back toward point A.

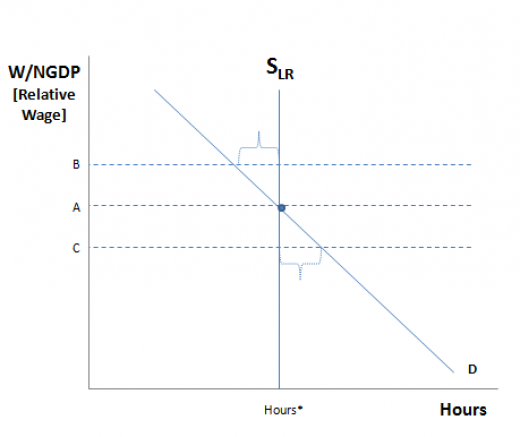

OK, so that’s my model for explaining one third of macro; inflation, NGDP, nominal interest rates, nominal exchange rates, etc. It’s a monetary model. Then we add the assumption that nominal wages are sticky in the short run:

This one is kind of tricky to explain. I’ve assumed the long run supply of labor is perfectly inelastic, but nothing of importance would change if you made it slightly positively sloped, or even backward bending. The key assumption here is that, unlike in the money market, we are usually not at equilibrium. Let’s start with the case where the Fed reduces NGDP unexpectedly, causing W/NGDP to rise unexpectedly to point B. We assume that employment is demand-determined when we are above equilibrium. Lots of people want to work at that wage, but employers determine how many actually get jobs. The gap between supply and demand is cyclical unemployment, which is currently about 2.6% in the US. The other 5.6% is the natural rate of unemployment, and occurs even if we are at an equilibrium relative wage rate. In terms of hours, unemployment is even higher, as many who want to work full time are working part time, or so discouraged they leave the labor force.

If monetary policy pushes NGDP above expectations (from when labor contracts were signed), then we have an overheating economy. In this case the actual level of excess hours worked is not necessarily equal to the gap between supply and demand, as there may be a labor shortage at point C. In that case the level of hours worked would lie somewhere between the supply and demand curve, but the qualitative results would be the same—too much employment. In a richer and more realistic model employment would depend on more than just unexpected NGDP shocks; because of money illusion workers may be reluctant to accept nominal wage cuts.

One problem with the preceding model is that it implies that equilibrium is “best” and that the public suffers if there is either too much employment or too little. And yet it doesn’t seem that way in the real world. It seems like boom periods are much better than recession periods. And they are! That’s because this simple model abstracts from all sorts of real world policy distortions. The vast majority of government intervention tends to discourage employment (minimum wages, marginal tax rates, welfare, unemployment comp., occupational licensing laws, etc, etc.) Thus when we are on the long run labor supply curve the level of hours worked is actually far too low, even in the US. It’s even worse in Europe, which explains why Europeans are less happy than Americans (see if that gets some comments.)

So there’s a reason why booms feel like good times, even though the simple model says we are working too much. The stickiness of wages temporarily pushes us toward the socially optimal level of hours worked. We produce more goodies, and collectively we consume more as well. We are happier. Alas, we can’t stay there, as wages adjust and we go back to the long run equilibrium. Even worse, attempts to use monetary policy to create booms tends to end up creating more business cycles, which makes people less happy. Better to do as the Aussies do and throw Schumpeter in the trash can. End business cycles with stable NGDP growth, or at least level targeting if there are unavoidable short term blips like 2009.

I agree with Matt Yglesias about 99% of the time on monetary policy. The one area I slightly disagree is that I think he’s too inclined to view the Great Moderation as being a period of excessively tight monetary policy. That might be slightly true, as inflation and NGDP growth did decline very gradually during that period. But the decline was so slight it doesn’t seem to me that it mattered much, until 2008. I wonder if he isn’t relying on his intuition that it’s better to err on the side of higher inflation. In the short run that’s true, but only because of all the other policy distortions. This is actually a very counterintuitive point, and is similar to a policy debate I occasionally have with Karl Smith. I insist that there is no first order income effect for tax changes, and hence that only the substitution effect matters. That means taxes unambiguously reduce hours worked. It’s really hard to see at the individual level, because the average American feels that higher taxes make him worse off, even as a first order effect. But that can’t be true, as the tax money is not just destroyed. Similarly, if wage stickiness is making you work harder than you’d prefer, it seems like it would be making you worse off. But what you don’t see is that the average person working harder also gives more tax money to the government, and that at least some of this money comes back to you (you the average American) in the form of Social Security, better schools for your kids, or better roads.

Booms feel good. It’s a nice example of the fallacy of composition.

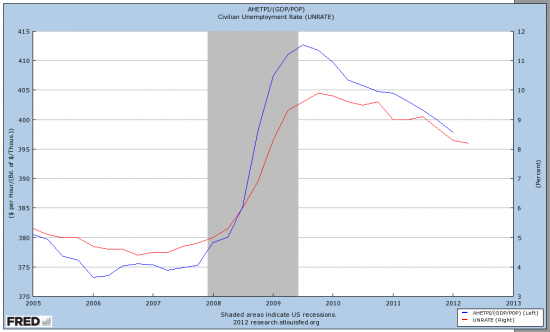

PS. Mark Sadowski sent me the following graph of unemployment (red) and nominal wages divided by per capita NGDP:

It breaks my heart to think about all the garbage we force our students to learn in macro. Is inflation good or bad for growth? They leave the course not having a clue. If only we’d teach a simple monetary model of NGDP determination, and then a simple W/NGDP model of business cycles, using the sticky wage assumption. They might actually be able to understand that model. Of course if our politicians understood the model then they never would have allowed the Fed and ECB to create the Great Recession. No more macro. Economics would become a one semester course, and we’d loose lots of teaching jobs.

PS. Matt Yglesias has a great post on why non-sticky wage models of unemployment (such as a loss of wealth) are a dead end. They can’t explain why people would work less:

It is both true that we are not as wealthy as we thought we were and that there’s a lot of joblessness in the United States, but I struggle to grasp a model in which the former causes the latter. Imagine a reverse situation. A town full of working class people sees its unemployment rate suddenly shoot up from 11 percent to 27 percent. Concurrently, it turns out that the town’s residents were much wealthier than they thought they were””each one of them actually had a check for $1 million sitting in their pockets. We might say it’s pretty clear what’s happened here. These folks are wealthier than they thought they were so they raised their reserve wage. But then suppose it turns out the checks were fraudulent and they all bounce. The reserve wage should fall and joblessness should decline. That it seems to me is the supply-side story about the relationship between wealth and employment.

Exactly.

Tags:

17. July 2012 at 07:03

“Macro” is a pseudo-science constructed to solve problem created by bad economics & bad government policies and programs, eg controls & interventions in the labor market, controls & interventions in the money & credit market, and pathological spending & finance on the part of government and quasi-government entities.

It doesn’t have to be that, but that is mostly what it is.

17. July 2012 at 07:05

Sincere question: why is the loss-of-perceived-wealth story mutually exclusive with sticky-wages? I would say both contribute to unemployment. Why am I wrong? Thanks,

17. July 2012 at 07:15

In the government sector the gov worker unions decide how many actually get jobs.

Example. The local teachers union runs & wins with its own slate of school board members — those members decide the trade off between compensation and number of teachers. In many places the choice has been to increase compensation, and to cut the number of teachers.

You see this also happening in other gov worker domains, police, fire, etc. Local pols elected by the union, choosing increased compensation and reduced number of folks on staff.

In the union sector, the union decides how many actually get jobs.

Macroeconomists since the time of Keynes have stepped forward and have advocated increasing the money supply and increasing government spending to “break” these “sticky” union wages, leading to ever accelerating race to keep ahead of the next union compensation demand.

Scott wrote,

“Lots of people want to work at that wage, but employers determine how many actually get jobs.”

17. July 2012 at 07:24

If you do not structure economic policy to NOT have sticky wages, you will have sticky wages.

But SINCE we CAN eliminate sticky wages without printing money, we have a moral obligation to do so.

AUCTION THE UNEMPLOYED and FORCE anyone on AID to be auctioned, and overnight we’ll not only employ everyone, we won’t have to owrry about pesky public employee unions.

Mine is the true path. Walk unto my light.

17. July 2012 at 07:26

Scott,

We’re not even sure MACRO exists.

I mean sure it appears to exist when we have a bunch of currencies partially controlled by govts.

But that isn’t a set on desirable conditions, and it certainly isn’t the predicted future.

17. July 2012 at 07:27

To dilute what your saying even further…

About 85% of macroeconomics boils down to 2 observations: productivity growth drives long run RGDP growth; MV=PY=NGDP. The remaining 15% is the half of business cycles that are not explained by nominal factors, and are basically coordination/heterogeneous expectations driven problems. In any case when you’ve solved 85% of a problem, what you have left isn’t much of a problem anymore.

Greg Ransom, as usual, libels Scott & MM in general by alleging a desire to ‘solve’ that 15% with top down controls, which is preposterous.

17. July 2012 at 07:35

Very nice post, only I think Nick Rowe has more believable explanation why booms feel so good. Actually it is the story that you seemed to find interesting at that time (see comments): http://worthwhile.typepad.com/worthwhile_canadian_initi/2010/11/excess-supply-under-monopolistic-competition.html

17. July 2012 at 07:36

It breaks my heart to think about all the garbage we force our students to learn in macro. Is inflation good or bad for growth? They leave the course not having a clue. If only we’d teach a simple monetary model of NGDP determination, and then a simple W/NGDP model of business cycles, using the sticky wage assumption. They might actually be able to understand that model. Of course if our politicians understood the model then they never would have allowed the Fed and ECB to create the Great Recession. No more macro. Economics would become a one semester course, and we’d loose lots of teaching jobs.

Your experience with a small private university is probably very different than mine as a student at a medium-sized public university. I went to maybe 15% of my classes after intermediate micro/macro, because I could see that all of the material was substantively the same after that. I don’t regret it in the slightest. This is hardly different that economics becoming a ‘one semester course.’ I only hope that other students come to the same conclusion before wasting their time doing problem sets with renamed variables and not absorbing the only observations that matter.

17. July 2012 at 07:45

I didn’t mention Scott. Scott is pretty much an outlier in the field of macro, ie when people talk about “macro” Scott isn’t the topic.

“Greg Ransom, as usual, libels Scott & MM in general by alleging a desire to ‘solve’ that 15% with top down controls, which is preposterous.”

17. July 2012 at 08:04

Scott writes,

Don’t worry Scott, in most countries a program in economics is primarily about accounting, and accounting is primarily about discretion. You’ll at least make it to retirement before computers replace those jobs.

17. July 2012 at 08:04

J.V. Dubois, I agree that Nick Rowe’s story is interesting. Empirically, stickiness in prices seems to be more relevant than in wages, since e.g. in internal devaluations, nominal wages fall more promptly than do nominal prices. Of course, this means that the real effects of NGDP shocks would look quite similar, even in the absence of all other policy distortions.

17. July 2012 at 08:06

If you read Freakonomics, it notes that “good schools” are not the result of better inputs especially greater expenditures. They are the result of good students & parents.

17. July 2012 at 08:13

I assume, Scott, that you meant that the real side is boring macroeconomics, because it’s a set of platitudes and things that aren’t easily modeled. For most people, however, the real side is by far the more interesting half. Technological advances, good governance, and natural disasters? Good god, man, those are the things that people can tell stories about. Even if it is more Freakanomics than Macroeconomics.

17. July 2012 at 08:17

It may not be a large first order effect, perhaps, but on average if the tax money is spent on less efficient things, then it might as well be destroyed. The reducto ad absurdum would be spending money on digging a big hole and then filling it up again. That can’t be the best use of money, hence something was destroyed. That would be one of those “boring” real side effects.

It’s possible that in some cases too there are real prisoner’s dilemmas and other cases where the tax money makes people better off on net. That is, naturally, what liberal and conservative and libertarian economists fight over.

17. July 2012 at 08:27

‘better schools for your kids, or better roads.’

More lavishly funded, yes. But, ‘better’?

‘…if our politicians understood the model then they never would have allowed the Fed and ECB to create the Great Recession.’

Oh, they understand the model, but it doesn’t incentivize them to act responsibly. Quite the opposite.

17. July 2012 at 08:36

Professor Sumner,

How do you know that the correlations between NGDP and unemployment/rGDP are not endogenous?

17. July 2012 at 08:39

Also, you argue that wages are determined by NGDP and not just by inflation. How did you come to this conclusions? Did you use empirical evidence, theory, intuition?

Also, you should consider having a smart grad student converting your model into math, at least for pure marketing purposes.

Best wishes.

17. July 2012 at 08:49

Money is related to all three points. Certain macroeconomics need to drop the unrealistic assumption of long-run money neutrality.

17. July 2012 at 08:54

Why don’t we assume that we can have booms without employees getting a raise?

17. July 2012 at 09:24

I think the wealth-based model of unemployment Cowen has in mind is a demand-side rather than supply-side phenomenon. Basically, people thought they were wealthier than they were. This caused them to consume more. Hence demand rose.

To take it a step further, one could consider that much of this excess consumption was financed by debt (mortgages, home equity loans, etc.), which tended to rise just enough to cancel out the perceived wealth increase (ie., people took out the increased home equity to finance consumption). So net-net, people did not end up feeling wealthier (and thus did not raise their reserve wages, which is why the impact on employment was positive), but they did consume more in the process.

17. July 2012 at 09:28

[…] Scott Sumner has just posted, “Money is half of macro” and the evidence shown here is consistent with that view. Monetary policy has been tight enough […]

17. July 2012 at 10:08

Money is all of part two, and half of part three. That means monetary economics is half of macro. It’s also far and away the more interesting half. The real side is a long, boring and random list of factors that affect RGDP (capital, labor, technology, good governance, natural disasters, etc. Monetary economics is an interesting, counterintuitive and elegant structure that fits together wonderfully, using concepts like money neutrality and superneutrality to generate the QTM, the Fisher Effect, PPP and lots of other models filled with beautiful symmetries.

This is quantophrenia gone haywire.

——————

Market monetarists differ from traditional monetarists in that we see monetary policy as shifting both money supply and money demand. As in traditional monetarism, any one-time and permanent increase in the monetary base increases NGDP in proportion.

Monetarists fail to grasp that non-market increases in the monetary base distort economic calculation, and thus requires ever accelerating inflation of M in order to avoid deflationary corrections.

A permanent increase in M cannot sustain a proportional NGDP. After the errors of the permanent M increase are exposed, NGDP will fall, despite the original continued increase in M.

The belief that NGDP rises in proportion to M, permanently, is a myth brought about by the incorrect epistemological tacit belief that human action is based on constant operation of causes, as if you can just continue to mislead people forever using the same tactic.

This is positivism gone haywire.

——————-

Better to do as the Aussies do and throw Schumpeter in the trash can. End business cycles with stable NGDP growth, or at least level targeting if there are unavoidable short term blips like 2009.

Stable NGDP growth comes at the cost of unstable money supply growth.

The instability of money supply is due to the fact that money ALSO serves as a storage of value but is artificially attacked anyway. Money is not only something that people spend. It is something they hold as well. Both holding and spending money are services money provides.

By forcing “spending” to grow at an arbitrary rate, central banks end up attacking the holding service of money. But the market overwhelms. You can only attack the holding of money for so long. At some point, the money supply will be rising so much so fast, that it loses its character as a tool of economic calculation. When that happens, and it could take a while (communism for example took over 80 years to crumble), then all those economists who said everyone is dead in the long run, all those economists who focused on the short term instead of doing what Hayek recommended which is to not engage in politics but rather educate people as to the long run effects, all those economists who quite narrow mindedly and with positivist fervor point to the recent history of a country that has had de facto NGDP targeting as “evidence” it is sustainable, all those economists who believe in socialism, even if only for something as seemingly innocuous as money production and interest rates(!), all these economists must accept that what they are doing is benefiting themselves while “the system” exists, and dooming the future to deal with the mess, and so will go down in the record books as unsightly men who had it all wrong.

As always, central economic planning minded people are ignoring the law of opportunity costs. To these people, as long as “spending” grows, as long as “output” grows, as long as “employment” grows, as long as these particular means to human ends grows by state power, we’re supposed to ignore everything else, even money itself.

This is technocratism gone haywire.

——————-

I insist that there is no first order income effect for tax changes, and hence that only the substitution effect matters. That means taxes unambiguously reduce hours worked. It’s really hard to see at the individual level, because the average American feels that higher taxes make him worse off, even as a first order effect. But that can’t be true, as the tax money is not just destroyed.

Sure, why not bring MMT insanity into this as well?

There is no such thing as “the average American.” There are only separate individual Americans. An individual who is taxed more cannot be claimed as being no worse off simply because the tax money is not destroyed and spent by the state on SWAT teams and drones. Goodness. It’s like if a thief robbed you on the street, you can’t complain your life is any worse off, because don’t worry, the money won’t be burned, it will “put back into circulation” and therefore it will benefit “the average American.” And we’re all the average aren’t we!

This is hypostatization gone haywire.

——————-

Mark Sadowski sent me the following graph of unemployment (red) and nominal wages divided by per capita NGDP

This is conflating correlation with causation gone haywire.

——————-

It breaks my heart to think about all the garbage we force our students to learn in macro.

Not all of us were convinced of that garbage, and fortunately, not all of us are convinced of this new market monetarist garbage being presenting as the next meal course.

What, do you actually believe that finally, after 2000 years of people trying, the final final final solution to macro has been found? “Target aggregate spending by inflating however much money is needed to coax people into behaving like robots!” Really? Talk about being exhausted and settling for anything that even looks like an oasis, even if it’s a dirty puddle in the back alley behind a strip club.

This is failing to look in the mirror gone haywire.

———————

People’s spending falls for the same reason employment falls after years of “stable” central bank inflation: The aggregate of what has been invested in is not physically sustainable in its current configuration.

When someone loses their job on the basis that they were lead into that job because of the Fed, and they spend less, which then leads to falling revenues elsewhere, which then leads to losses/unemployment at those other companies, which then leads to further declines in spending and still further losses/unemployment, and so on, such that “NGDP” falls from where the Fed put it prior, it is oh so tempting for those who don’t understand the market to believe that the unemployment and losses are caused by a “lack of aggregate demand”. It is so tempting because of a failure to extend one’s understanding beyond one’s own circumstances. They take the “people spending less on me is bad for me”, and they incorrectly infer the economy is a person and believe “people spending less in general is bad for people in general“, even if people spending less in general is a good thing that reverses the errors made because of previous Fed printing.

People spending less on you is their value judgments, given what you have invested in and produced, whatever it may be. Suppose your previous buyers would rather hold onto their money for longer because they would rather own more money than goods at the margin. How much time must pass before it is justified, and why is it justified at all, for violence backed money printing by counterfeiters in Washington to buy securities from their friends in Wall Street, so that hopefully, after they live a more lavish lifestyle, the money will eventually be spent and respent enough times to finally result in enough money in people’s hands such that they do buy your output?

What you don’t understand is that it is precisely the previous counterfeiting of money in Washington and the buying of securities that is the REASON why the general cascading decline of spending starting occurring in the first place. You know, the pre-2008 period and the 1920s period that you have thrown everything at the kitchen sink in trying to believe that the inflation was not a source of distorting calculation, because “price inflation was stable.”

Firms, or more accurately investments, are inter-connected. If one goes down because of lack of spending there, which then leads to a reduction of spending at other firms, this is the market process signalling that the investments made at these companies are not in proper real coordination. It isn’t a signal that counterfeiters have to spring into action to prevent the readjustment, such that if they don’t print money, then they “failed” to prevent the helpless, stupid, and ignorant people from killing themselves by their unnecessary, destructive, and evil reduction in spending relative to some unique past period, as if people are doomed to repeating their past actions ad infinitum.

This process of reduction of spending in one area followed by a reduction of spending elsewhere, and thus a cascading reduction in spending firm to firm, is the market process fixing, correcting, solving, the REAL SIDE errors that have been made by previous inflation. You know, what Sumner admits he finds “boring” and not worth looking at because it isn’t “elegant”…on paper. People hoard money not because they want higher cash balances with the same real investments. They are hoarding money because there is something wrong with the investments. For if the investments were correct, then people would have wanted the output of those investments rather than hoarding cash! It’s not like the Fed is burning piles of money. People are reducing their spending by choice. Of COURSE they would reduce spending by choice if they think there is something wrong with what money was previously spent on.

Is it really so hard to believe that investment choices in general would be bad? That not only can one individual make a bad investment choice, but two, three, ten, one hundred, one thousand, one hundred thousand, even tens of millions of individuals to have made bad investment choices?

Why is it that your typical macro-economist will blame an individual investors for bad investments, two individuals for bad investments, three, four, ten, and then fade out…but then when the magic word “RECESSION” is used, we’re supposed to ignore micro-economics, and instead of continuing on with the individual bad investment choice logic, they go upside down, black becomes white, and at some undefined switch over point, beyond which the magical “aggregates” reside, they blame the state for not printing enough money, or not spending enough money? Where the hell is the logical rigor in this? It’s nowhere to be seen! There is no systematic logical explanations for why we can accept the existence of individual bad investments, but not “many” bad individual investments.

By the logic of these macro blowhards, even if one single individual reduces their spending by $1.00 compared to yesterday, while everyone else spends a combined total of $0.50 more, then we’re supposed to believe “the economy” is “in recession”, and so the Fed, the Treasury, some mommy and daddy in government has to print and spend at least $0.50 today, so that we NEVER observe an aggregate fall in spending from one day to the next.

Macro-economics is a religion. It’s why violent force is the only way the believers can bring it to Earth.

While Sumner is shedding crocodile tears for the unemployed, he really doesn’t know how to help them, because his desire is to ensure total spending, not how investors and consumers coordinate themselves in real terms. He believes the coordination is automatic as long as total spending keeps rising. He doesn’t understand how investments become increasingly distorted over time, and become increasingly not in line with real consumer preferences, which requires ever more money printing to prevent real corrections. Australia’s M3 data bears this out for those of you who need pictures.

17. July 2012 at 10:22

Jonathan M.F. Catalán:

Money is related to all three points. Certain macroeconomics need to drop the unrealistic assumption of long-run money neutrality.

Agreed.

A neutral money is really a contradiction in terms.

The concept of money neutrality was derived from a philosophical movement in economics that saw a divorcing of economic phenomena from its human roots.

The real world of action, and of ceaseless change (which for some reason scares a good portion of intellectuals; my guess it is a carry over from their childhood where “stability” was instilled in them by constant habit parenting) is not compatible with a neutral money neutrality (and stability of purchasing power for that matter). A world characterized by the presuppositions of stable purchasing power and neutral money is a world without actors.

It’s economists, who study human actors, mimicking physicists, who study non-acting atoms and energy.

17. July 2012 at 10:24

Jon Talton of the Seattle Times is right less often than a stopped clock, but;

http://seattletimes.nwsource.com/html/soundeconomywithjontalton/2018706071_bernankes_job-crisis_failure.html

—————-quote—————–

The Bureau of Labor Statistics U-6 measure counts the “total unemployed, plus all marginally attached workers, plus total employed part time for economic reasons, as a percent of the civilian labor force plus all marginally attached workers.” Translation: This measure includes those working part-time when they want full-time employment, and the short-term discouraged workers. This broader measure stood at 14.9 percent in June. That’s pretty bad, Mr. Chairman.

Yet the official numbers, even U-6, have long been criticized for understating real unemployment, especially after a change in 1994 that narrowed the broader measure to only include short-term discouraged workers. That’s where Shadow Government Statistics comes in. This private firm includes the long-term discouraged who would like work but have stopped looking and the unemployment rate is 22.9 percent. Mr. Chairman, that’s Great Depression territory.

Bernanke’s line about the central bank “standing ready” is wearing thin amid this jobs crisis.

——————endquote—————

17. July 2012 at 10:46

Sonic. Less wealth makes people want to work harder.

Greg, If macro doesn’t exist, there’s nothing to discuss.

Morgan, It’s easier to build houses with roofs, than to stop it from raining. Wages are sticky—deal with it.

Cthorm, Not quite, because the business cycle is RGDP, not NGDP. You need a model linking the two. The equation of exchange is not such a model.

JV, But he still needs to explain employment. (Based on memory–I should reread it.)

Jon, Good point.

Wonks. I agree.

John Thacker. Yes, I definitely meant that. Real life is what drives the real economy, and that’s endlessly interesting. I meant within macro.

John and Patrick, I agree, but . . . There’s a back story to the tax debate. My opponents insist high taxes are good, because they don’t reduce work effort. But to claim they don’t reduce work effort thay have to show the money is wasted on filling holes, or unneeded spending in other areas. So it’s a pyrrhic victory.

JoeMac, It would take me 1000 hours to explain. Start by reading Friedman and Schwartz’s Monetary History, for evidence that exogenous monetary shocks have real effects. Sorry that I can’t say more . . . lack of time today.

You asked:

“Also, you argue that wages are determined by NGDP and not just by inflation. How did you come to this conclusions? Did you use empirical evidence, theory, intuition?”

All three.

You asked:

“Also, you should consider having a smart grad student converting your model into math, at least for pure marketing purposes.”

A few weeks back I did a post asking someone to help me construct a model. I explained exactly what I needed. No one helped me.

Jonathan, I see no reason to drop it.

O. nate, I believe he claims it’s distinct from AD.

Patrick, Thanks, although I have a hard time believing the 22% number; it’s bad, but it doesn’t seem like the Great Depression to me.

17. July 2012 at 11:08

Scott, re: JV: AIUI, some diseq. theorists (including IIRC Clower and Leijonhufvud) assume that labor demand is very inelastic in the short run, and is essentially driven by quantity adjustment in the goods market (caused by price stickiness). So we could have demand-driven unemployment given a moderate degree of wage stickiness or search frictions.

17. July 2012 at 11:15

Dr. Sumner,

Yes, less wealth makes people want to work harder. Are you saying this should (materially) un-stick wages? Because even if so, that would depend on the elasticity of the effect no? Perhaps it ‘makes people want to work harder’ but not enough to un-stick their wages enough to matter. So I still don’t see how these concepts are mutually-exclusive.

17. July 2012 at 11:16

One would hope at some point in the next decade enough country will adopt the concept that the value of NGDPLT will become so obvious a preference cascade will ensue.

17. July 2012 at 11:33

It seems that based on your first chart, the Fed’s “Operation Twist” is a reasonable way to try to produce the desired boost in NGDP. As you wrote, the reason that NGDP doesn’t immediately rise with a boost in MB is because the falling interest rate (caused by Fed open market operations) increases demand for money. The interest rate that is most relevant to monetary demand is the short-term rate, since short-term instruments are a better substitute for money than long-term ones. This naturally leads to the conclusion that the Fed should instead concentrate its purchases in the longer part of the curve, thereby increasing MB without increasing as much the demand for money.

17. July 2012 at 12:50

There’s no such thing as a modern economy without government involvement. The notion that there can be a large free market economy without a government making choices is absurd.

17. July 2012 at 12:52

Scott: You do not offer a good explanation either. You casually mention that even US has some deficiency of long erm labor supply supported by some stylized facts. To be honest, I myself do not know where the truth is. One of the problems I find is lack of good empirical studies.

For instance many people cite that Koreans and Singaporeans have large ammounts of hours worked, measured as hours worked divided by number of people employed compared to let’s say Norwegians. It must be about wellfare, marginal tax rates, minimum rate and all other government interference, right?. But then you can find out that Norwegians have the highest employment to population ration in the world – 79%, much higher then Korean 63%. This is caused by much higher women participation in labor force in Norway together with more frequent usage of part time work. So it is only logical that “average”, Norwegian work less hours then average Korean.

This is not my only and ultimate argument. But I feel very skeptical whenever I see somebody posting these strong claims how all these things MUST have this or that effect without having equally strong evidence to support these claims.

If you ask me, if I have some strong feeling without evidence that about this, then it is that labor supply seems to be pretty independent on many usual explanations. If you compare “average workers” across countries, regions and even across time, working in different regimes, under different tax systems and in different cultures and institutions etc. you will find a very strong clustering of work effort around 40 hours a week (discounting regimes with forced labor systems or where people need to work extremely hard just to have basic subsistence). What is my explanation? Maybe there could some “micro” foundation for this. People need to sleep, they need to eat, take care of their families and doing basic self-maintenance. They need to have time to regenerate their strengths both physically and mentally. Most people I know can work only so much until they lose focus and until they find out that there are rapid diminishing returns between hours worked and results from that work. And if they don’t, they are those lucky guys who find their work fun or even relaxing, but then this has nothing to do with usual culprits. That I think is a true constrain for labor supply.

17. July 2012 at 13:02

Morgan, It’s easier to build houses with roofs, than to stop it from raining. Wages are sticky””deal with it.

“Deal with it” is the result of someone whose entire theory rests on groundless assertions, and needs that assertion to be true to justify their theory, so it is associated with authority and intimidation so that questions are not asked and challenges are not raised.

Too bad I’m not one of those people…

Wages are sticky? Sticky from what standard? Do prices have to change every second of every day, in response to every change in nominal demand vis a vis real supply? Is that what the standard is? Or is the standard going to remain undefined, so that you can always blame unemployment on said sticky wages, and thus present inflation as the cure?

If the Fed prints $100 billion to buy treasuries from their banker friends, does the “sticky wage” idea mean that if the prices of the goods I sell do not increase by, say, [$100 billion/NGDP]%, that the prices of the goods I sell are “sticky”? How in the world can the prices of the goods I sell at the time the Fed inflates by $100 billion, rise in price even in principle? Wouldn’t my buyers have to have their incomes raised first before they can even afford to pay more? Wouldn’t TIME have to pass before the Fed’s inflation has passed between enough hands to result in my particular business experiencing an increase in nominal demand such that I can charge higher prices?

As with most socialist minded intellectuals, you are perceiving a “problem” that doesn’t even exist in a free market, and you are recommending a solution that is itself a major reason why you are observing what you are observing in the first place.

Is it some rite of passage or something?

Inflation (among other violence-based acts) influences wage earners and employers into making wage rates less flexible. People have become accustomed to expecting higher prices in the future due to inflation, and we’re supposed to believe that when wage rates don’t fall enough (due to people expecting higher prices in the future even if they fall in the short term) that this is the fault of the free market, and that it represents evidence for….a justification of inflation?

This is silly. It would be like hitting someone repeatedly in the stomach, and then when they develop a stomach ache, they say “See? The human body is weak and cannot be left alone! My actions are thus justified, for without me, his stomach pains would be even worse! Stop being an ideologue. Let’s work together. Let’s be pragmatic. Let’s try a come up with a different speed and rate that I can punch him at. For there is evidence a rate of X works. I saw it on UFC once. The people in the octagon are pretty fit, and they get punched all the time. Punching must be good for one’s health.”

17. July 2012 at 14:18

I don’t think Shedding Jobs or Cutting Pay is a good counter to Debt-Deflation. It will make the situation worse, if you follow Fisher’s Views. There is no Definite or Natural Point of Clearing in Debt-Deflation. That’s why you simply can’t ride it out. BTW, I think Schumpeter & Hayek came to agree with this.

In this Crisis, we’ve had something like Slow-Motion Debt-Deflation, which is harder to understand & read than a Debt-Deflationary Spiral, it seems. Some differences of opinion among commenters have to do with just this issue of whether we’ve been fighting a new form of Debt-Deflation or are back on track with the Clearing ( The Clearing being hindered by Structural Forces, say, as opposed to the effects of SM Debt-Deflation.).

17. July 2012 at 14:25

Deal with it.

ROFL

Scott, I have a workable politically viable plan which deeply weakens your Sticky Wages claim.

As such, before we should do Monetary Policy that accepts “rain” as fact, we have to admit it is mostly just piss from liberals.

We’ll see in November – you shouldn’t be banking your life’s work on Obama winning.

17. July 2012 at 14:27

Of course, I didn’t say that. You don’t get points for poor reading skills.

And of course, even if I had said that, your conclusion isn’t entailed.

Even if God did not exit, there would certainly still be much to discuss, such as the role of religion in this society or that.

What people believe creates phenomena to understand and explain.

Social science 101.

Scott,

“Greg, If macro doesn’t exist, there’s nothing to discuss.”

17. July 2012 at 14:46

“you shouldn’t be banking your life’s work on Obama winning.”

No, unless, Romney fails to release his tax returns.

17. July 2012 at 14:49

“Why don’t we assume that we can have booms without employees getting a raise?”

Morgan, I thought you were just against public employees ever getting raies, now you want to prevent private sector workers from ever getting raises either?

17. July 2012 at 15:13

Sax,

I consider it s boom when everyone gets Netflix and Skype.

I’ll consider it boom when every person has a quad core cell phone and a $20 wide band net connection, because they really wont have any excuse.

It won’t phase me that guys are working 12 hour days making the same basic wage, what I’m concerned about is dropping the price of digital everything.

Boob jobs, laser eye surgery, white teeth, fat reduction pills, these are the things that improves people’s lives.

17. July 2012 at 15:37

So you really do sing from the Rothbard hymnal? Say’s Law…

The forever lowering price. So you dream of a deflationary spiral?

17. July 2012 at 16:58

No Sax, it is my own.

There is no scarcity in the digital. And everyday more of what we call “quality of life” is digital.

There’s just not much real disparity in consumption. If you are fat, I don’t care if you eat crap, you are doing fine. If you have a two bedroom apartment for your family of 4-5 and A/C, and hot water, and broadband and 500 channels…

WE OWE YOU NOTHING.

Hell, with a prevalent Internet, I’ll force people to learn to cook and only provide them with staples – no food stamps.

YES there are guys doing menial labor, but that’s the punishment for bad parenting and bad state making of the forefathers.

BUT, we can make sure that all folks have this digital stuff for next to nothing.

And THAT will do more to improve their lives than 10M Sax’s feeling bad for them.

Only tech matters Sax, until you grasp that you are a rank amateur.

17. July 2012 at 18:17

anon, I’m not certain what to say about that. They are probably defining labor demand differently, I presume they don’t use W/NGDP.

Sonic, No, I don’t think it unsticks wages. Are you claiming a wealth shock impacts AD, and hence NGDP?

TallDave, I hope so.

O. nate, The key is whether the QE is expected to be permanent, at least in part. Otherwise it doesn’t have much affect, as D shifts right.

JV, Can you quote the exact passage you are referring to? I have trouble figuring out what you are disagreeing with from my post.

17. July 2012 at 18:27

I thought this was a great post that clearly stated your model. However I have a confusion.

The second chart you show (real wages/hours works) is used to demonstrate that if real wages increase due to a decline in NGDP then sticky wages will mean “involuntary employment”. It shows that very well.

However the chart seems to imply that if the demand curve shifts to the left then real wages would somehow adjust quickly and not be sticky at all. I guess I had assumed (until I read your post) that at least part of the current recession was indeed caused by the demand for labor curve shifting to the left and the supply curve being somewhat horizontal.

Am I mis-interpreting the chart ?

17. July 2012 at 18:40

I thought this was such an excellent post, why then is the quality of the comments so low? Maybe a colorful commentator’s presence has sullied this place. Scott, thank you for the clarity, reading this site has helped me ace my macro classes.

17. July 2012 at 18:49

As for why wages are sticky, they are based on contracts set in nominal terms (to take advantage of the enormous information and transaction cost advantages of money) where set rates are basic to the control/risk trade-off that is at the heart of the employment contract. Expecting employment contracts to act like commercial contracts in sharing risk is to mistake what makes an employment contract an employment contract (accepting direction traded-off against a floor under income risk) while expecting them to be on-going auctions undervalues existing employees as known quantities with firm-specific knowledge.

17. July 2012 at 22:01

[…] Source […]

18. July 2012 at 01:06

It seems strange to actually define the value of money as 1/NGDP. This implies that as the economy’s real income rises (but not the price level), I get poorer whilst holding the same amount of money.

The way I like to do it is simply think in terms of the Keynesian (or rather Hicksian) LM diagram, but remember that the interest rate is usually fixed by IS (a new money injection only briefly forces rates right down, then they come most of the way back up), so that there is a disequilibrium in LM – and then the excess cash balance mechanism takes over, which is what really drives income forward (assuming fixed P). This is in contrast to Keynesian textbooks where the interest rate goes all the way down with monetary stimulus, or IS shifts rightwards (instead of upwards) with fiscal stimulus, and then somehow planned expenditures exceed previous income, without saying anything about money balances. That might make a little sense if you’re talking about budget deficits at the ZLB (though even here it’s really drawing away demand for money) but it’s nonsense otherwise, making intelligent economists like Cochrane throw up their hands in exasperation.

The advantage of looking at it my way is that it is a monetarist approach to ISLM, which allows me to both understand what you are talking about and what the Keynesians are talking about – and to see exactly where they are going wrong. (Amongst other things, when you understand that fiscal stimulus works by raising interest rates, you realise that the IS curve should really have a term in it for the interest-elasticity of saving.)

As for the rest of it, I find AD/AS (or rather, NE/RO) to work just fine in seeing how demand affects employment – that’s what I learned in school, and there’s nothing wrong with it (so long as you feel free to move ahead with your own intuition when the Keynesian teachers stop making sense).

“If the monetary stimulus is not expected to be permanent then you will see interest rates fall…”

Is that necessarily the case? Isn’t it also possible for nominal money demand to rise at the prevailing interest rate (i.e. straight hoarding, which I think you said explains much of the currently bloated base, in addition to IOR)?

“It’s really hard to see at the individual level, because the average American feels that higher taxes make him worse off, even as a first order effect. But that can’t be true, as the tax money is not just destroyed.

Surely what matters for the (behavioral) microeconomics here is whether people feel poorer. Shouldn’t we be looking at how much people choose to work as a function of how much they feel their tax dollars are being wasted?

Amen to your last paragraph. Though I’m not sure I agree that there’s not much more to macro than the money/business cycle stuff. The long run is precisely what interests me. International trade is fascinating, and economic growth… Read Why Nations Fail, if you haven’t already, it’s ****ing brilliant. They deserve a prize for that book. What an example of what economics is good for. Of course my definition of economics is pretty broad, just like Caplan.

Oh, and thanks for the repeated shout-outs to our country. Though I’m not sure we’re in such a welcoming mood to immigrants right now…

http://www.heraldsun.com.au/news/sri-lanka-nabs-20-alleged-asylum-seekers/story-e6frf7jo-1226426703259

http://www.theaustralian.com.au/national-affairs/immigration/in-the-real-world-people-die-in-the-queue/story-fn9hm1gu-1226427599742

http://www.abc.net.au/news/2012-07-08/gillard2c-greens-slam-abbott27s-asylum-seeker-response/4117370

http://www.safecom.org.au/images/huntemdown.jpg

18. July 2012 at 03:01

“Booms feel good. It’s a nice example of the fallacy of composition.”

Or as Mancur Olson would have called it, the “logic of collective action”.

18. July 2012 at 03:16

Scott: “The vast majority of government intervention tends to discourage employment (minimum wages, marginal tax rates, welfare, unemployment comp., occupational licensing laws, etc, etc.) Thus when we are on the long run labor supply curve the level of hours worked is actually far too low, even in the US. It’s even worse in Europe, which explains why Europeans are less happy than Americans (see if that gets some comments.)”

Actually I do not want to hijack the discussion in this (very good) post with this stuff. I don’t think that this even belongs here as my feeling is that this belongs to the “Long run GDP growth” category as it is described by you in your previous post. But what I said is true, I do not have strong feelings either way mostly because I have yet to see some comprehensive studies that would tackle these issues with honesty without ideological prejudices this or that way.

18. July 2012 at 04:31

“Are you claiming a wealth shock impacts AD, and hence NGDP?”

Probably a dead thread by now, but for the record I’m not claiming anything, I’m asking why you think a wealth shock and sticky-wages need be mutually exclusive (rather than complementary) explanations of unemployment, and trying to understand the relevance of the answer you gave. Because I do think both can play a role, though I admit I don’t know how to phrase that idea in “AD” style jargon.

18. July 2012 at 05:26

Scott,

As I have said before, the thing your model lacks is a clear explanation of the transmission mechanism for monetary policy. An increase in the supply of money does not directly increase spending (consumption and investment) on real goods and services. (As you have said, people hold the amount of money they require for spending… not the other way around). Rather monetary policy works indirectly through the price of financial assets.

For individuals and business there is a trade-off between holding financial assets and buying (consumption and investment) of real goods and services.

If the price of financial assets rises, individuals and businesses will spend more on real goods and services (higher NGDP). You can think of it as a preference curve for holding financial assets versus spending with the price of financial assets, p(FA) on the vertical axis and spending (investment plus consumption) on the horizontal axis.

The best way to think of the price of financial assets, p(FA), is 1/(1 + i(R)) where i(R) is the expected real risk adjusted IRR. (e.g. if the price of a security is 100, the future nominal payment is 105 and expected inflation is 3%, then the p(FA) is 100/(105/1.03) = 98.1%)

So monetary policy (OMP) has three effects.

1) It raises the current price of financial assets through a simple increase in demand (Fed buying).

2) It decreases the expected real value of the future income stream of financial assets because of inflation expectations. 1) and 2) combined and individually both increase p(FA) as I have defined it, and this causes a movement along the curve toward higher consumption and investment.

3) Because of expectations of higher NGDP, it causes a shift to the right in the preference curve for holding financial assets, i.e at the same p(FA) consumers and business will hold less financial assets and increase investment and consumption because of expected higher future income and expected higher returns on investments in real assets.

I’ve made it more complicated than it needs to be, but basically OMP drives down the expected return on financial assets by increasing the current price and reducing the inflation adjusted expected return. This makes businesses and individuals less willing to hold financial assets, which causes them to increase consumption and investment (spending). The resulting increase in NGDP absorbs the increase in the money supply, which occurred as a result of the OMP.

18. July 2012 at 05:34

Major_Freedom:

By the logic of these macro blowhards, even if one single individual reduces their spending by $1.00 compared to yesterday, while everyone else spends a combined total of $0.50 more, then we’re supposed to believe “the economy” is “in recession”, and so the Fed, the Treasury, some mommy and daddy in government has to print and spend at least $0.50 today, so that we NEVER observe an aggregate fall in spending from one day to the next.

You are just constructing straw man arguments. Macro isn’t concerned with individuals, only aggregates.

Macro-economics is a religion. It’s why violent force is the only way the believers can bring it to Earth.

How would Austrian economics be any different, or worse? I honestly do have this question. You have said in the past that you do not believe that experiments can help determine predictions of human behavior and action. Do you believe that any of the assumptions about humans that Austrian economics makes can be falsified? A belief system that declares things a priori, and refutes any experimentation to disprove, is a religion.

18. July 2012 at 05:36

Is it wages (money wages only) relative to NGDP that matter, or is it the nominal value of all compensation relative to NGDP?

18. July 2012 at 05:42

Saturos, how does your version of IS-LM compare to Nick Rowe’s upward-sloping medium-run IS curve? That seems fairly clear, even when considering that the IS-LM model itself is quite problematic.

18. July 2012 at 07:17

[…] reality; whoa, reality. You shouldn’t be headed that way, go here instead. Scott Summers agrees with every word, evidently with some enthusiasm…and I’m not sure how, let alone why. It’s like applauding Phlogiston theory, is […]

18. July 2012 at 07:41

You are just constructing straw man arguments. Macro isn’t concerned with individuals, only aggregates.

My example was an aggregate. Aggregates are outcomes of the totality of individuals. Ergo, if one individual brings about X, while everyone else brings about a collective Y, then this is by construction an example of an aggregate change.

Don’t let my use of “individual” mislead you. Yes, I know, it’s crazy to trace aggregates to their individualistic roots. It almost feels like bringing heaven down to Earth, doesn’t it? We can’t smear the sacred pure clean non-human aggregates with dirty individual human realities.

—————–

How would Austrian economics be any different, or worse?

Austrian economics is grounded in individual action. Austrian economics, specifically Misesean, only shows the praxeological foundations of economic principles. No individual can transcend these logical constraints because they are true for all actions, no matter if they are market oriented or central planning oriented.

I honestly do have this question. You have said in the past that you do not believe that experiments can help determine predictions of human behavior and action. Do you believe that any of the assumptions about humans that Austrian economics makes can be falsified? A belief system that declares things a priori, and refutes any experimentation to disprove, is a religion.

So….does that mean you are invoking a religion then? That assertion you made:

“A belief system that declares things a priori, and refutes any experimentation to disprove, is a religion.”

Is that something that is true and cannot ever be refuted? That is, is it an a priori statement? Or is it a falsifiable statement, in which case it would just be a hypothesis, and you would be logically compelled to admit that it could be wrong, and that you would have to engage me to see if that claim really does “pass the test” of falsification?

Is mathematics is a religion? Mathematics is a priori and not falsifiable. Is logic is a religion? Logic is also a priori and not falsifiable.

The rejection of falsificationism criteria does not necessarily imply the inquiry is religious. It could mean it, but not necessarily. Not in praxeology. Praxeology is to the field of action what Euclidean geometry is to the field of observations (non actions). Don’t look too much into this analogy, it is just a general way to understand it.

To answer your question, which I will in due course, I want to first ask you about the logical status of the falsification pronouncement. You seem to think that everything humans can come to know about reality, can come only via the falsification method of inquiry. Think only of in principle falsifiable hypotheses, then go out and make observations, then see if those observations are consistent with your hypothesis (confirmed), or inconsistent with your hypothesis (falsified). Every other statement is nothing but hot air, opinions, “religion”, etc.

I want to ask you, well, OK, then what of that falsification pronouncement itself? If you’re right about how knowledge is derived, then surely the falsification pronouncement itself has to be in principle falsifiable, or else it would be self-defeating. So what kind of a statement is it?

If it’s a falsifiable statement, that is, if it is a falsifiable statement concerning falsifiable statements, then it can only be considered a hypothesis, that might be wrong, in which case you would be logically obligated to hear alternatives for how knowledge about reality can be derived and not dismiss them all as “religion.”

If it’s not a falsifiable statement, that is, if it is saying something true about how knowledge about reality is acquired, then it becomes an a priori statement, the very kind you say is “religion.”

—————

So to answer your question, I have no worries in telling you that yes, Austrian propositions such as “humans act”, is non falsifiable. But it’s not religion. It is a self-evident truth. But not an immediately apparent one. It must be painstakingly borne out of self-reflective cognition. Humans act is an irrefutable proposition, because any attempt that is made to refute it, no matter how sophisticated or complex, those attempts at refutation will all be actions themselves. One cannot dispute action, without acting. Disputing, falsifying, observing, refuting, these are all actions. Action is presupposed in what I think is the subject matter of the science of economics. Austrian economics doesn’t say much, but what it says packs a wallop. Austrians are humble in holding that we cannot scientifically predict human actions based on constancy in relations. But they are far more ambitious in saying that the positivists are wrong, we can know certain categorical truths about reality a priori.

18. July 2012 at 08:07

“Austrians are humble in holding that we cannot scientifically predict human actions based on constancy in relations.”

humble, or rabid?

18. July 2012 at 08:30

dtoh, I think your model is very interesting. How does money fit in? Is it considered another FA? You’ve described one curve (the FA/real-spending preference curve), but for an equilibrium condition, don’t you need another curve to intersect it? What would the other curve be?

18. July 2012 at 09:03

I agree with Sonic, they’re not exclusive. So:

a) the wealth shock DOES reduce AD (and hence NGDP), whether or not wages are sticky, and

b) wages are sticky.

A 50 year old with $200 k of homeowner equity will spend a higher percentage of a $70k ($40k disposable) income than the same 52 year old, 2 years later (and closer to retirement) with $50 k of homeowner equity and a $71k ($40k disposable) income.

Given that the 50 year old had been EXPECTING to have such a good amount of equity in the upcoming retirement in 10-20 years, the loss of wealth will cause more devotion to saving and the reduced expectation on returns to saving will also cause more desire for both saving and especially safer saving.

A good amount of this effect is age dependent, while a good amount is independent.

“How much money does the 52 year old have?” depends on both income, consumption prices, and asset values.

Professor, I’m frustrated at not convincing you of the importance of the wealth effect, perhaps it’s too micro – individual based? Still, I heartily endorse your efforts to get NGDP targeting for the Fed. As both more rule oriented and more helpful than what they’ve been doing.

A good model of the economy will include all the most important variables which are changing and “driving”. Some real variables remain stable over long periods, so they are ignored in models covering those periods without invalidating the model. Yet, if such a variable (Median net worth, for instance; land value, perhaps) goes thru a rapid change, it drives results in such a way that NO model will be valid unless that variable is included with appropriate relations. One or another such “black swan” variables, missing in the model, dooms all econ models to fail when that variable temporarily drives the real economy.

[Like, I claim age adjusted Net Worth is now a big driver — but when house prices bottom, its rate of change will revert to being slowly positive and then, again, ignorable]

Finally, Money is far less than half of Macro — the importance of macro is because of government policy. Policy is made and has far more effects, including (and increasingly) regulations as well as taxes and gov’t spending, than mere monetary policy. And the differences in post WW II economic results of Texas and California, both under the same monetary policy of the USA, show how much more important these non-monetary policies are to the “macro” or aggregated sum of individual economic situations.

18. July 2012 at 09:13

Please compare Texas and CA:

1. Long run RGDP growth.

2. Nominal macro variables in the long run (P, NGDP, i, E, etc)

3. Business cycles.

Big big differences, same “monetary policy”.

18. July 2012 at 09:16

Tom bursts Scott’s bubble.

18. July 2012 at 09:32

anon, Nick Rowe argues that the IS should slope upwards as the marginal propensity to invest is often greater than the marginal propensity to save, so that interest rates rise with income. However the slope of the IS also depends on the interest elasticity of investment and (in my view) saving. So for instance I don’t think Rowe’s set-up can represent fiscal stimulus adequately. Does it shift his upward-sloping IS to the right or to the left? To the left, I suppose (or “upwards”)? So that when the Fed holds LM vertical, interest rates rise? But what if the Fed monetized the deficit instead? That’s supposed to raise income without raising rates. How do we represent that? Instead I prefer to show the “expectations effect” (or Chuck Norris effect, to use the beloved market-monetarist metaphor) as a forward shift of the IS curve. Nick allowed that representation too, if I recall.

Scott is right about people being misled by ISLM. However the solution is not to completely ignore the interest rate, as it does matter at times (at the ZLB, for instance), but rather to have a thorough understanding of monetarism in general and the excess cash balance in particular, so as to understand what fundamentally determines NGDP, but then to fit it into the ISLM framework as I do. Scott makes great “pragmatic” arguments, but I think Nick Rowe has him beat on the pure theory side. If he does ultimately write a market monetarist model he should get Nick to pitch in.

dtoh, you are ignoring the most direct mechanism – wealth effects. A helicopter drop of money raises wealth immediately. A swap of money for bonds when the interest rate is positive leads to portfolio rebalancing which drives asset prices upwards. Essentially the asset prices are rising to reflect higher permanent nominal income. You have it backwards – higher future NGDP drives up spending on current assets in response.

18. July 2012 at 09:41

Think of it this way. If money were the main store of value, then monetary policy would raise nominal wealth directly. If instead monetary policy works by making other stores of value scarce relative to money, then their nominal prices must rise, and the wealth effect is triggered that way. As I have said before, Keynesians focus far too much on interest rates as a constraint on spending, and not enough on permanent nominal income – despite the fact that the effect of money on interest rates is as Scott points out an epiphenomenon, and what really occurs in long run equilibrium is a simple scaling of nominal variables.

18. July 2012 at 10:01

anon, but I agree that a better understanding of IS-LM doesn’t help understanding what Scott talks about, it’s just useful when you’re reading Keynesians, and to see how their thinking fits within Market Monetarism.

18. July 2012 at 12:53

RJ:

“Austrians are humble in holding that we cannot scientifically predict human actions based on constancy in relations.”

humble, or rabid?

Rabid? So I assume by your puerile response that you do hold such constants exist? OK then, tell me just ONE such constancy in relations, and so so without contradicting yourself. I’ll give you a million dollars if you can.

18. July 2012 at 18:00

Scott, I’m having trouble figuring out the units in which you are measuring the real demand for money M*(1/NGDP). Doesn’t that give you dollars divided by dollar per year. Dollars cancel and so all you are left with is years. Am I missing something?

18. July 2012 at 18:01

Ron, I’m assuming nominal wages are sticky, regardless of the shock.

Lorenzo, But aren’t real contracts less risky?

Saturos, You said;

“It seems strange to actually define the value of money as 1/NGDP. This implies that as the economy’s real income rises (but not the price level), I get poorer whilst holding the same amount of money.”

Keep in mind that whenever I say NGDP, I mean NGDP per person. So if your cash holding is fixed, and NGDP per person goes up for any reason, then you are poorer. Poverty, as I’m sure you know, is a relative concept. People with low incomes in Switzerland are fabulously rich by historical standards, or Bangladeshi standards.

The rest of your post seems reasonable.

I agree that taxes can be wasted, and make people feel poorer. But that doesn’t seem to be the case in places like Europe, where the substitution effect clearly dominates. I make the “not wasted” assumption to give my opponents the best case for big government. If the money is wasted, then it’s a slam dunk that supply-siders are right—slash taxes.

Sonic, Perhaps a wealth shock could reduce AD (although I don’t agree.) But even so, that would reduce output unless wages were sticky.

dtoh, I have explained it many times, but you don’t seem to agree. It does not involve financial assets. In earlier centuries financial assets didn’t even exist, and more money was still able to boost NGDP. I am not claiming excess cash balances leads to more real spending, I’m claiming it leads to more nominal spending. Real spending does up if wages are sticky and output rises.

nwwhite, Both matter in different ways. It’s complicated.

Tom, I’ve done a number of posts explaining why Texas has a better economic model than California. But I don’t see how that has anything to do with my monetary analysis. If you think it does, then you’ve misunderstood my monetary model. It allows for regional differences based on supply side factors.

19. July 2012 at 04:42

Major_Freedom:

Don’t let my use of “individual” mislead you. Yes, I know, it’s crazy to trace aggregates to their individualistic roots. It almost feels like bringing heaven down to Earth, doesn’t it? We can’t smear the sacred pure clean non-human aggregates with dirty individual human realities.

Again, your standard is unrealistic. First, aggregates avoid the types of central planning that you so abhor. Second, you seem to suggest that any and all policies would have to benefit 100% of humans, lest the policy be unjust. If that is the case, there should be no state at all. But historically there seems to be greater tendency for humans to flourish within a state, so it seems dubious to abolish it.

So….does that mean you are invoking a religion then? That assertion you made:

“A belief system that declares things a priori, and refutes any experimentation to disprove, is a religion.”

Is that something that is true and cannot ever be refuted? That is, is it an a priori statement? Or is it a falsifiable statement, in which case it would just be a hypothesis, and you would be logically compelled to admit that it could be wrong, and that you would have to engage me to see if that claim really does “pass the test” of falsification?

I would argue that my statement actually is falsifiable. I’m sure if we thought hard about it, we could come up with a system of ideas that 1) declares things a priori and 2) refutes any experimentation to disprove. But my imagination seem short right now and I can’t think of one.

So to answer your question, I have no worries in telling you that yes, Austrian propositions such as “humans act”, is non falsifiable. But it’s not religion. It is a self-evident truth. But not an immediately apparent one. It must be painstakingly borne out of self-reflective cognition. Humans act is an irrefutable proposition, because any attempt that is made to refute it, no matter how sophisticated or complex, those attempts at refutation will all be actions themselves. One cannot dispute action, without acting. Disputing, falsifying, observing, refuting, these are all actions. Action is presupposed in what I think is the subject matter of the science of economics. Austrian economics doesn’t say much, but what it says packs a wallop. Austrians are humble in holding that we cannot scientifically predict human actions based on constancy in relations. But they are far more ambitious in saying that the positivists are wrong, we can know certain categorical truths about reality a priori.

So if two Austrians would disagree, how do they resolve the disagreement? Through attempts to disprove? You’ve already said that any disproof is an invalid exercise. They could argue about whether or not certain a priori assumptions exist. Or they could result to fisticuffs. (kidding)

It is the great weakness of the Austrian view that it does not permit falsification. And though you argue humility in not predicting human actions, the assumptions required seem too great. Humans internal mental state can be altered through application of different chemicals to the brain (anti-depressants, alcohol, etc) – wouldn’t this imply that there could also be unique chemical differences from the get-go as well? How can you make such great assumptions without being willing to accept the possibility of falsification?

-Jason

PS – with large datasets, aggregate human behavior begins to seem predictable, and we don’t even have to talk economics: http://www.latimes.com/news/science/la-sci-warfare-data-20120717,0,409336.story

19. July 2012 at 05:19

Scott,

I am not claiming excess cash balances leads to more real spending, I’m claiming it leads to more nominal spending.

It does, but not directly….only indirectly through the mechanism of higher financial asset prices. Previously I raised the example of your broker selling Treasuries you hold, closing your account, and delivering $100,000 in a briefcase to your doorstep. I think we agreed that you wouldn’t spend it but just put it back into another financial asset because there is no underlying change in your preference between holding financial assets and spending. OMP works because it impacts the price of financial assets and changes your preference toward more spending (consumption and investment).

In earlier centuries financial assets didn’t even exist, and more money was still able to boost NGDP.

But credit did exist and money can and did have a dual purpose (especially at the ZLB) where it serves both as MOE and a store of value (i.e financial asset). As I explained, the price of the asset has to take into account the expected real value of the income stream. Increasing the money supply creates an expectation of inflation which reduces the effective price of the financial asset per the definition which I have suggested. Printing money, therefore increase inflation expectations lowering the effective price of the asset, which causes a shift along the preference curve of holding financial assets versus spending on investment and consumption.

19. July 2012 at 05:25

Jason Odegaard:

Again, your standard is unrealistic. First, aggregates avoid the types of central planning that you so abhor.

How’s that?

Second, you seem to suggest that any and all policies would have to benefit 100% of humans, lest the policy be unjust. If that is the case, there should be no state at all.

Now you’re thinking.

But historically there seems to be greater tendency for humans to flourish within a state, so it seems dubious to abolish it.

I disagree. Somalia for example has done quite well since the collapse of the central state.

http://www.peterleeson.com/better_off_stateless.pdf

A belief system that declares things a priori, and refutes any experimentation to disprove, is a religion.

I would argue that my statement actually is falsifiable.

It had better be, huh? hehe

So if two Austrians would disagree, how do they resolve the disagreement? Through attempts to disprove? You’ve already said that any disproof is an invalid exercise.

Empirical disproof is invalid, but there can be logical disproof. If two Austrians disagree, then they can resolve their disagreement by either one correcting the other, or a third showing up to correct them both. But this is quite rare. In fact, I can’t think of a single disagreement among Austrians concerning the human action axiom and what, along with thymology, can be deduced. It’s their bread and butter.

They could argue about whether or not certain a priori assumptions exist. Or they could result to fisticuffs. (kidding)

Q: What do nuclear physicists do when they disagree? A: Nuclear war

Seriously, I have never read or even heard of an Austrian who disagrees with the truth of action.

It is the great weakness of the Austrian view that it does not permit falsification.

I think it is a great strength that they have found a priori true propositions. It’s quite a feat actually. Be advised that Austrians don’t hold ALL propositions as a priori. That would be absurd. No, they only hold that CERTAIN propositions are a priori, and these certain a priori propositions form the backbone of economics. That’s it. Everything else is a posteriori and empirical.

And though you argue humility in not predicting human actions, the assumptions required seem too great.

Humans act is too great an assumption? Seems quite modest to me. What is the standard by which you are judging the greatness of assumptions? Please don’t say falsifiability.

Humans internal mental state can be altered through application of different chemicals to the brain (anti-depressants, alcohol, etc) – wouldn’t this imply that there could also be unique chemical differences from the get-go as well?

Sure, but logically, the person will be either conscious or unconscious. Action can be sober, or drug induced. Someone can be clear headed, or a psychopath. The logical constraints of means, ends, profit, loss, these cannot be undone.