Megan Greene on NGDP (forecast) targeting

This FT article by Megan Greene is a sort of breakthrough:

If they are serious about achieving their mandates more effectively, the Fed and ECB should consider other strategies.

One has been circulating for decades: target the sum of inflation and total real output, or nominal gross domestic product. With NGDP targeting, a central bank automatically lowers rates as output falls, to push up inflation. That eases real debt burdens and lowers real interest rates, helping to generate growth. As output rises, rates adjust higher to bring inflation down and maintain the target.

A potential obstacle is that NGDP is reported quarterly, with a lag. But NGDP could be reported more frequently and accurately if the Fed treated it as a priority. The Fed could also target the forecast of NGDP instead, which is reported in the monthly blue-chip economic indicators survey of business economists.

There have been plenty of other pundits calling for NGDP targeting, but this is the first one I recall that advocated a “target the forecast” approach. If forecasts are useful in monetary policy (and they are) then we obviously need to create a market-based NGDP forecast. Hypermind has actually done so, but we need to create a much more liquid NGDP futures market.

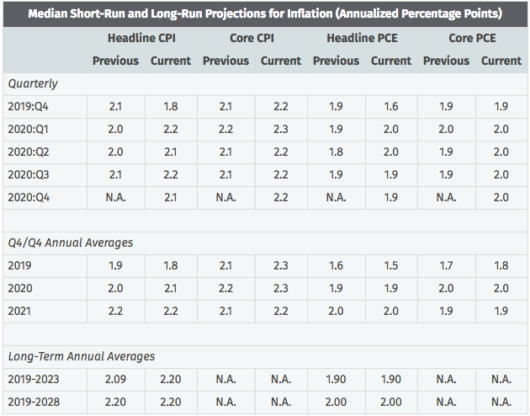

We cannot trust the consensus forecast of economists because they consistently forecast too high, just like the Fed itself:

It’s always around 1.9% to 2.0% in the out years—a major embarrassment for the profession. Trust markets, not economists.

PS. The 3-month/10-year Treasury spread recently inverted. As I pointed out a year ago, that doesn’t necessarily mean money is too tight or that a recession is imminent. But when combined with other indicators, it seems clear that money is currently a bit too tight.

Some of this relates to the coronavirus epidemic, which has a small chance of being a major problem for the global economy and a large chance of blowing over in a few months. The following analogy might be helpful:

Suppose you see a crazy guy load one bullet into the cylinder of a revolver. He puts the gun to his head and pulls the trigger. Nothing happens.

Would you say, “See, he made a wise decision, as nothing bad happened. He just had some fun playing Russian roulette.” Or would you say that even in retrospect his decision was foolish?

That’s sort of how I think about current Fed policy. I think there’s a 5/6 chance of no recession this year. But I still think it would be wise to cut the IOR rate, to further reduce that risk. I am disappointed by the Fed’s recent decision, and hope that they are monitoring events closely. There’s a real danger that they will fall behind the curve if the coronavirus crisis gets much worse. Indeed I think it likely they will fail to adopt a sufficiently expansionary policy in the event of a global pandemic.

If that happens, we can’t let them off the hook with excuses about unforeseen “shocks”. The markets are very clearly indicating RIGHT NOW that money is a bit too tight.

They’ve been warned. Fix it.

PS: I agree with this:

“The bond market is basically telling the Fed that it hasn’t done enough and will be called back to do more and that the longer they wait the more they will have to do,” said Michael Darda, market strategist at MKM Partners. “If the bond market thought Powell’s comments on wanting higher inflation were credible in his press conference, you wouldn’t have seen break-even inflation rates falling as they did.”

HT: David Beckworth

Tags:

30. January 2020 at 13:32

“I think there’s a 5/6 chance of no recession this year. But I still think it would be wise to cut the IOR rate, to further reduce that risk.”

Isn’t this inconsistent with NGDP targeting or PL targeting? These variables are below what they “should” be if the Fed were targeting them. So monetary policy is to restrictive even if there is no recession. The Fed is leaving the market uncertain about what its target is, it it actually HAS a target.

30. January 2020 at 13:39

I agree.

30. January 2020 at 14:08

I wouldn’t look at the market today as a reason to cut right now. Partly due to tail risks of the corona virus. But also after a big up move in stocks theres likely a lot of sell equity buy bond rebalancings going on at the end of the month.

If this pricing would continue for another 2-3 weeks then it would be a good sign for a modest cut.

30. January 2020 at 14:17

The Fed INCREASED IOER to 1.60% yesterday. The 10-year Treasury closed at 1.57% today. How is this not exactly wrong?

30. January 2020 at 14:23

30-year TIPS yield now 0.30%, lower than it was in August.

Breakeven CPI expectations now ~1.7% across the curve.

So much market data vs. so many no skin in the game experts. Exasperating.

30. January 2020 at 16:09

The reduction in 10-year Treasury rates to below 1.6% on the coronavirus scare is another tell that the modern global economy retains an inclination to lower interest rates and lower inflation, even if we don’t know why.

Reducing interest on excess reserves is probably a small step in the right direction, as has been the several hundred billion dollars of quantitative-easing engaged in by the Federal Reserve in the past few months.

Still, it is difficult to force commercial banks to lend and quantitative easing results in the Federal Reserve buying assets on huge global capital markets, which may have but a small stimulative effect.

The IMF just released a report championing major global central banks for “synchronized” easing in 2019.

The IMF, I suspect, has the right perspective. We should be calling for all major central banks to engage in easing in light of the coronavirus, and a general tendency of the global economy to sync (sink) to lower interest rates, inflation and growth.

With globalized capital markets, and the fungibility of money, the actions of a lone central-bank must be considered in perspective. The Federal Reserve is jostling alongside the ECB, The People’s Bank of China, the bank of Japan, and even sometimes the Bank of England and the Swiss National Bank.

Most likely, direct fiscal stimulus or helicopter drops is also appropriate, for those wishing to stimulate an economy within national borders.

There is no sense in tweetybirding around when fighting back a recession.

30. January 2020 at 18:02

OT:

The notorious third world country that (severely) punishes defendants who do not tell the truth to law enforcement authorities. Who might that be?

https://reason.com/2020/01/30/michael-flynn-wants-to-withdraw-plea/

30. January 2020 at 19:12

Add on to Brian Donahue’s comments:

Not only is the average inflation target of 2% perennially undershot by the Fed, and not only are 10-year US Treasuries presently selling for 1.59%…but the US dollar has appreciated by about 25% against a mix of currencies since 2011.

https://fred.stlouisfed.org/series/TWEXBPA

So…by what measure do we say the Fed as been “easy,” in recent years, which is the routine and usual description given by the financial media? The Bank of Japan is beyond description, and expressions like “hyper-expansionist” are devised in a futile effort to convey BoJ laxity. (Japan is near deflation, btw).

Some of you guys on Social Security might remember when any rate of inflation under 4% was considered good enough…as during the Reagan Administration.

Or, in 1992, when Milton Friedman publicly chastised the Fed for being too tight (in a WSJ op-ed!)…while the CPI was at more than 3%.

The modern orthodox macroeconomics profession has made a fetish of low inflation, dressed up as prudence and gravitas.

One more recession, and we will see AOC in the White House (and deservedly so).

I would suggest printing money until the plates melt.

30. January 2020 at 23:03

The nice thing about macroeconomics is that no one is ever wrong.

China trade deficit has cost the US 3.7 million jobs this century, report says

From CNBC—

PUBLISHED THU, JAN 30 2020 12:15 PM EST

UPDATED THU, JAN 30 2020 3:19 PM EST

Jeff Cox

@JEFFCOXCNBCCOM

@JEFF.COX.7528

SHARE

KEY POINTS

“The U.S. has lost 3.7 million jobs as its trade deficit with China has continued to grow, according to the Economic Policy Institute.

Most of those losses came in the manufacturing and technology sectors.

EPI officials said the Trump administration is right to go after China but hasn’t been tough enough.”

So there you have it: Trump is not tough enough, but the Trump tariffs threaten to throw the global economy into another Great Depression.

31. January 2020 at 07:29

The coronavirus epidemic might be contained and passed in a few months, but I still think that there are political repercussions in China, and that the uncertainty over how Chinese politics changes reduces real growth in China (and the world) going forward. Whether or not Xi’s grip on power is weakened or strengthened, I would think that either mean it is more difficult to do business in China. Either Xi has more power, and uses it, or is weaker and is trying to find ways to use the state apparatus to bolster his power. Obviously not a good time to be making investments in China, and China is the world’s largest economy.

31. January 2020 at 08:33

To some degree, I feel like I am whistling past the graveyard in this comment on the flu virus. But, CDC says about 400k people already die from the flu annually. Yet we do nothing about this—-meaning quarantines etc. About .5 to 1% die from the flu, if they get it. The known numbers now are most certainly understated——my guess is maybe a factor of 10 or higher. Yet, it is still a drop in the bucket versus normal flu.So far, about 2-3% who have gotten this flu have died——but the guesstimates are that the long term number is lower. So, we take this seriously, as of course we should, because it is new, we have no vaccine and no “cure”, other than the body’s own defenses. That is as far as my brain can take this. This is not “Captain Trips” (The Stand), not yet at least. What we can do however, is jumpstart bad behavior due to fear——-assuming of course, this is containable. The

Re: the Fed——I am pretty sure they still look at their weird models, regardless of their feint toward markets

31. January 2020 at 08:34

Death rate above is global

31. January 2020 at 09:19

Sean, The Fed should adjust policy every single day.

31. January 2020 at 13:23

@Michael Rulle

What I don’t understand is why China has not taken more measures in recent years that are at least trying to prevent such new viruses: they still eat close to every species of animal there is, often almost every part of it. They keep them together in markets, alive. Hygiene is not very good. They live very close to or even right with the animals.

Probably one of the worst things are the markets: many different animal species, often living, in a very confined space, and then the slaughtering, selling, eating, pretty close together, and all this under suboptimal hygienic conditions.

Under such conditions it seems only a matter of time until China incubates a real mass killer virus.

Regions like Europe are not prepared for this. China can at least enforce radical quarantine measures (after they hatched their great super virus). The vast majority of European countries won’t be doing radical measures until it’s way too late. They are already breaking the recent quarantine and are flying their citizens out, directly from Wuhan.

If a super virus ever leaves China, then good night, and good luck, Europe (and quite some other parts of the world).

I hope China learns from this new virus. Of course it is hard to change your habits regarding markets, animal breeding, slaughtering and food. But if you look at what the communists in China have changed in the last 100 years (for better or worse), it is probably possible. Who else could do it but them?

31. January 2020 at 16:09

@Christian List

I get your point. A friend of mine, just today, discussed a trip she took to Burma/Myanmar and described the food conditions there. Burma is less than half as wealthy as China but described how food is bought and prepared. Little refrigeration leads to daily purchases and preparation etc. i.e. so-called wet food markets, which is cited as the reason in Wuhan also. But I really have no view on causes, don’t know enough. But I believe I have a decent sense of how authoritarian govts work and it is hard to trust China. My biggest concern is this is radically understated. But, our best guess, based on little but recent history is this will be contained and “objectively” will be not much worse or not worse at all than a normal flu season. But, because of uncertainty we will treat it more like a worst case scenario which we should. And we are behind the curve. So even if it is “not much” Scott’s 5/6th sounds right. But even if not much, we need to find out soon or those odds climb, let alone if it really is worse than we hope/think.

31. January 2020 at 17:00

Michael,

I also think that the current virus is not catastrophic. In my opinion it is worse than influenza and also deadlier, but it is probably not a super killer. However, it will be necessary to wait a few more days, because the majority of infected people in China have been infected just few days ago. And these people have the worst yet to come. Studies so far show that it takes on average about a week from the first symptoms to severe lung problems (The Lancet: Huang et al., 2020). This means that very soon thousands of Chinese patients will reach the point where it becomes clear whether their disease is mild or severe. Only then will we know whether the disease is worse than influenza or not.

Currently the mortality rate could be about 10%, which would be pretty high, and also with the reservation and on the assumption that the Chinese regime is open and honest and does not hide data. Fortunately, the Chinese regime is known for its openness and transparency.

My biggest concern at the moment is that this will continue to happen until a super killer is created, and that the vast majority of countries are not well prepared for such a situation. If this were a real killer virus, things could get out of hand pretty fast.

Of course, panic is not a good advisor, but I also read many articles in the media that are too mildly worded. I think the knowledgeable authorities want to calm people down and keep them calm, because they know fully well that even First world countries are not prepared for a serious killer virus.

The band on the Titanic can play their calming music, why not, if it calms the masses, but currently almost only the virus alone decides whether the situation will become more serious or not.

31. January 2020 at 18:18

PCE core posted at 1.7% YOY.

Take out housing costs, which are continuously and artificially inflated by restrictive property zoning, and you really don’t have much inflation in America.

So why do Federal Reserve Beige Books go into hysterical shrieks about dubious “worker shortages” but not bona fide “housing shortages”?

31. January 2020 at 20:30

@Christian List

What I have read, from an article on Stat by Helen Brantwell, is that the Chinese are a bit undersupplied with testing kits and so are only testing folks who already have pneumonia. Which if true, would mean that the number of mild cases is totally unknown, but likely some multiple of the number of confirmed cases. So the virus is probably a lot like the seasonal flu in terms of the severity of symptoms it causes (maybe a little bit worse, but basically not something that should worry a healthy, non-smoking adult).

Of course, something like 80% of men in China are smokers, which likely makes them a lot more susceptible to pneumonia caused by any type of pathogen, and the air quality in China is very poor as well, which doesn’t help anything. And winter is the worst time of year for air quality in China.

I think the impact of the new virus will be a large and permanent increase in pneumonia deaths throughout the world. Conceptually I think of it as taking the seasonal flu’s impact and doubling it, which is pretty bad, given that the seasonal flu kills hundreds of thousands of people each year.

But I don’t know how China’s leadership backs down the population from the fear that has spread and gets the country back to normal operations even if the virus turns out to be not all that different in terms of severity than the seasonal flu. And even if its fatality rate is similar to that of the flu, because it is new, it seems likely to infect more people than the seasonal flu usually does. So that means a lot of severe cases, and China, from what I have observed, doesn’t have the doctors, nurses, and facilities to deal with that kind of a surge in patients. Even in normal times, doctors in China are stretched thin seeing patients, which in a way is a good thing as it ensures that most people in China have access to basic medical care, even if they don’t have much money.

31. January 2020 at 22:39

@Burgos

I didn’t know Chinese people still smoke so much, thanks for the information. I think the new virus is well comparable to SARS, but unfortunately we have already exceeded the number of SARS cases. I think the Chinese are still one of the best peoples to get the situation under control. So on the one hand, it is “good” that the virus has broken out in China. On the other hand, one has to ask whether it is a coincidence that the virus originated there in the first place. Is it only statistical reasons, because it is such a big country, or are there other reasons (eating habits, hygiene behavior, animal farming, markets with living animals).

On the one hand, from a gustatory and environmental point of view, it is good that they often use all parts of an animal and slaughter the animals close to eating places. But from an infectiological-virological point of view it’s a nightmare.

The best case scenario now is that it becomes like SARS and disappears completely in 2-3 years. But how long before the next virus appears? And is this supposed to go on and on until a killer virus kills millions of people?

We should seriously consider whether we should fight influenza differently as well. Every single year new influenza viruses originate in Southeast Asia and then spread from there around the globe without changing significantly later. It’s always this region.

I find it fascinating that no one has yet tried to prevent its creation, considering that some experts say influenza kills about at least 500,000 people every single year.

One reservoir could be certain bird species. Okay, fine, identify the certain bird populations, then get rid of them all. Are the reservoirs mainly in people? All right, vaccinate them all. Is it certain habits? All right, then change the habits.

In a hopefully near future, people will scratch their heads and ask why, just a few years ago, 500,000 deaths per year and the risk of ever new killer viruses have been tolerated for so long.

1. February 2020 at 03:14

A market-based NGDP forecast or futures market seems like a great idea. Has anybody ever tried that? 😛

1. February 2020 at 06:36

JMCSF,

No, no central bank has actually declared they are level targeting NGDP growth, to my knowledge. While the idea of doing so seems so theoretically, it’s not even a perfect idea in the theory and may not work in reality. Paul Krugman and Joe Gagnon lay out reasons why NGDP level targeting may not be as effective in reality as on paper, but both have said it’s worth a try.

Unfortunately, most ideas in economics, like in any field, turn out to be wrong.

1. February 2020 at 06:42

I suspect an NGDP level target would be a big step forward, but I don’t think it will be the ultimate monetary policy for the remainder of time, and I also think credibility can still be a problem for an incompetent central bank such as virtually every country in the world has.

Better ways to conduct policy will be developed over time. Monetary policy understanding is still at a very, very crude stage, hence all the policy uncertainty.

1. February 2020 at 08:04

To give an example of how badly monetary policy is currently conceived, over the past few years I’ve had about 30 economists tell me that surely now, sticky wages have fully adjusted to the Great Recession shock. Many of them specialize in monetary policy. Yet, the US neutral interest rate was clearly rising until the trade wars began. The Fed was raising short-term rates, and growth wasn’t being particularly choked much worse than before the increases.

How high would rates have gone without some real shocks that the Fed under-responded to? No one knows for sure, but probably would have continued up. My model says they could have gone to about 5.5%, with little sustained increase in inflation.

My model might be wrong, but I think the conventional models I’ve seen are also wrong. There are parameters in them, for example, such as risk aversion and temporal discounting that don’t seem justified at the macro scale, and are even debatable on the micro scale.

The field appears to a mess, and perhaps my ideas are even worse, but at least I haven’t been surprised by low unemployment rate.

1. February 2020 at 13:39

@ Mike Sandifer

What do you think of Sumner’s insistence on targeting market forecasts? It seems that in an economy like that of the US, you are unlikely to get inflation without wage growth, and you are unlikely to get wage growth without very tight labor markets. So I am not sure how the markets get to a better forecast of the trade offs between unemployment and price stability than the economist. It isn’t like the participants in the markets have access to different information than the Fed, so I am wondering why the markets seem to end up with different predictions than the Fed.

1. February 2020 at 14:49

P Burgos,

I’ll answer as best I can, as a non-economist. In the short-run, inflation rises while nominal wages are sticky. This means real wages decrease. This is what allows more people to stay employed when monetary stimulus is supplied, wen real growth temporarily declines, for example.

In the longer-run, wages adjust upward more rapidly than sans the unexpected inflation increase, and so changes in the money supply are said to be neutral in the long run.

My limited understanding about the Fed is that they use their own internal forecasts, which are less predictive than even simple autoregression models. Their models are anything, but parsimonious.

Market forecasts are demonstrably better, not only given their forecasting record about future Fed action, as revealed in Fed Funds futures, for example, but also given the size of the typical market shock, and how few people are able to consistently out-predict broad, deep market price signals.

More fundamentally though, the Fed should target market forecasts, because it’s the markets they have to convince to have any influence at all. The markets are the Fed’s audience, and they should play that audience the way a comedian tries to play a crowd.

It’s not that particular market participants have more information than the Fed, though some may. It’s that each individual, following the contours of market incentives, comes together with others in networked fashion and then the network has more collective information than any single agent can obtain, much less process. Most of the information is implicit, but is summed up in abstract price signals.

1. February 2020 at 14:59

@P Burgos

The Fed cannot beat the market, at best it is as good as the market, in many other cases it falls far behind the market, as it did in 2008. Don’t give the Fed so much power. I think the market is far superior, you “just” have to make sure that there is no relevant manipulation.

I also think your focus on inflation and tradeoffs is not quite right, there seems to be a lot of misunderstanding by many people here. The Fed has to properly manage the market’s demand for money, but who could better determine the market’s demand for money than the market itself? Having a bureaucratic committee like the Fed interposed is a recipe for disaster.

As I said, if they are really good, they will meet market expectations (they can never be better), but unfortunately there will be many scenarios in which they are worse.

3. February 2020 at 10:36

An economist on Twitter was kind enough to correct me on whether wages had adjusted in the US since the Great Recession. Real wages, meaning wages/NGDP, are lower now than before the Great Recession.

https://fred.stlouisfed.org/graph/?g=q4v9

Interestingly, real wages were higher between the last two recessions than they are currently. Tight money?

So, if money has been tight since 2012, it has not been due to a lack of wage adjustment since the Great Recession, but perhaps NGDP should have been higher, nonetheless.