Market monetarism goes mainstream

Back in early 2009 two key market monetarist ideas were very much out on the fringe. One is the claim that the huge output gap was due to excessively tight money, caused by Fed incompetence. The second was the claim that interest rate targeting is fatally flawed, and is part of the problem. Consider this recent article written by Matt O’Brien at the Atlantic:

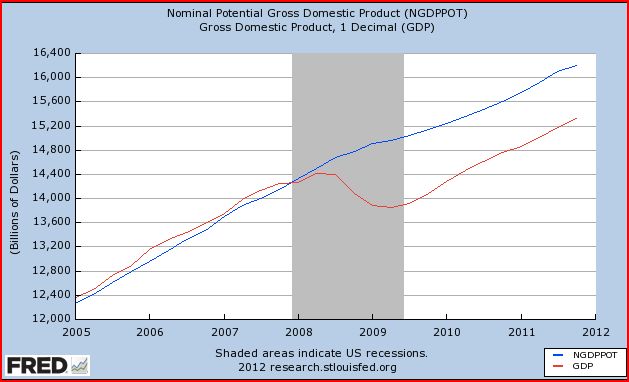

It got me thinking: How much is a good central banker worth? Consider this chart. The blue line shows where our economy could, and should, be if it had kept growing at its long-term trend since 2008. The red line shows where we actually are. The difference between the two is the so-called output gap. (Note: These dollar figures are not adjusted for inflation).

We’re in about a trillion-dollar hole. And that’s a trillion dollars every year. Even if we get “Morning in America: The Sequel” and the economy rapidly reverts to its long-term trend, we’ll forever be $4 trillion poorer than we would have otherwise been.

Let’s try a thought experiment. Say that Lars Svensson — one of the world’s top monetary economists and the current deputy governor of Sweden’s central bank, the Riksbank — could get our economy back to trend in half the time Ben Bernanke could. It’s actually plausible-ish. Like Bernanke, Svensson spent his academic career championing unconventional monetary policy as a “foolproof” way to escape a liquidity trap. (Coincidentally, they were colleagues at Princeton). But unlike Bernanke, Svensson’s Riksbank has been much more willing than Bernanke’s Fed to experiment with these kind of heterodox policies. Perhaps unsurprisingly, Sweden’s recovery has been the envy of the developed world. So I ask again: How much is a good central banker worth? Put simply, how much cash should we throw at Svensson to steal him away from Sweden?

That’s another way of asking how long it will take the economy to return to trend. Here’s where things get really depressing. According to Fed Vice Chair Janet Yellen, we won’t get back to full employment until after 2018. If we assume the output gap will steadily shrink until then, that leaves us with roughly another $4 trillion in lost income. Maybe more. If Svensson really could double our recovery speed, he’d be worth $2 trillion to us. Even if that’s being wildly optimistic, something on the order of hundreds of billions of dollars probably isn’t. Tell me that wouldn’t be worth paying Svensson a billion dollars a year. Maybe more.

Here’s what I said three years ago:

So let’s imagine an FOMC with the above 4 members [Bernanke, Svensson, Woodford, Krugman], plus a bunch of other distinguished monetary economists; say people like Mishkin, Mankiw, Rogoff, Hall, McCallum, James Hamilton, etc. I don’t want any inflation hawks or inflation doves; I want people who call for tight money when tight money is needed and easy money when easy money is needed. And most importantly, nobody who believes monetary policy is ineffective in a liquidity trap. (Yes, I’m talking about Janet Yellen.)

Here’s my hypothesis. A committee made up of these 10 people would have been far more likely to adopt a highly expansionary monetary policy once the scale of last fall’s crash became apparent. There’s enough intellectual firepower there to understand the threat of rapidly falling NGDP, and also the need for policy credibility. I think they would have been able to coalesce around something like the 3% inflation trajectory (level targeting) proposed by Mankiw in his blog.

Monetary policy is incredibly complex. You have to look at issues from a lot of different perspectives. My fear is that even fairly bright people may get stuck in an intellectual rut, looking at policy from just one perspective. Good isn’t good enough, bright isn’t bright enough, we need people who are extremely bright, but also have the kind of mind that allows them to see the problem from different angles.

And here’s another hypothesis. Monetary policy may be the only important policy area where this is true. In other areas like health care, we don’t let a bunch of “wise men” (and women) make important decisions, rather we let Congress and the President decide. (Go ahead, insert a joke here.) The Supreme Court might be the closest parallel, but a mistake by the Supreme Court generally won’t create a worldwide recession, or depression.

. . .

I don’t care how much is costs, even if we have to pay FOMC members a billion dollars a year, we will save much more money in the long run if we can get “strong” central bankers (pun intended) who have the vision to see what needs to be done, and who understand that effective policies require explicit target paths for macro aggregates.

When I wrote that I never expected this sort of idea to go mainstream.

Nick Rowe sent me a recent Matt Yglesias post from Slate.com:

I say all this, I note, not to argue that we need to scrap paper money. The point is that it’s very bad for the Fed to have a policy rule [interest rate targeting] that breaks down in moments of severe crisis. It’s like having an umbrella that dissolves in water. We either need to run a background level of inflation that’s high enough to avoid zero bound episodes, or else shift the policy lever to something that’s not effected by these issues.

And here’s what I wrote a few days ago:

But interest rate targeting (which underlies all of New Keynesian economics) has been an unmitigated disaster for American workers. And given that rates are likely to frequently hit the zero bound in future recessions (as trend productivity growth and population growth both slow) NK policy will fail us again and again in future recessions, i.e. when we most need it to be effective. Our current monetary regime is roughly like a car with a steering wheel that works fine””except when driving on twisting mountain roads with no guard rail. (emphasis added.)

I like the steering wheel metaphor better, as I see the Fed steering the nominal economy.

In three years market monetarism has moved from the fringes to mainstream publications like The Atlantic and Slate.

PS. If this keeps up Lars Svensson’s going to start asking “where’s my billion dollars?” If the titans of finance deserve the big bucks for efficiently allocating capital, what about the people who actually steer the macroeconomy?

Tags:

20. April 2012 at 05:49

Trying to popularize the concepts you’ve promoted to get people to understand why nominal rates can be low while real interest rates are high.

The housing and mortgage markets are a perfect extreme example to illustrate the point.

This follow-up post leaves out one more conclusion, though… if we really want that trillion dollars, we should just make Scott Sumner the dictator of the FED and pay him a Billion dollars a year, right? 🙂

20. April 2012 at 06:06

Keep up the good work! This is worth fighting for.

20. April 2012 at 06:34

Yep. Just to be clear, the “[interest rate targeting]” bit in the MattY is what I inserted, but it’s clear from the context that that’s what he means.

20. April 2012 at 06:35

Nice, a billion dollars a year for Lars would mean almost a macro-level boost to the economy of Sweden. Lars would become a new Swedish export star besides brands like Volvo or Ericsson

20. April 2012 at 06:40

“We either need to run a background level of inflation that’s high enough to avoid zero bound episodes, or else shift the policy lever to something that’s not effected by these issues.”

The correct mindset is… right now we have very little inflation, and liberals are unhappy. They are losing.

So let’s switch to a low enough NGDPLT to continue the pressure on liberal constituencies.

Matt doesn’t want people to be unemployed, but we have to make him trade away unproductive overpaid public employee salaries, to solve for his problem.

He has to make a Sophie’s Choice.

Why can’t we finally make this clear??

20. April 2012 at 06:42

I’ll note, that the sooner we make Public Employees eat it we get the same kind of YoY future improvement that O’Brien mentions.

20. April 2012 at 06:48

Should we tie FOMC compensation to growth in the economy?

20. April 2012 at 06:57

Lest the central bank czars get swelled heads, they might also keep in mind that there are some of us who would fire them all and leave monetary policy to unregulated bankers operating in a free market.

20. April 2012 at 07:27

Perhaps in the future all monetary stimulus will come in the form of salaries paid to central bankers.

20. April 2012 at 07:34

Morgan – I enjoy your comments, and I agree with your goal of smaller government, but I think there’s a flaw in your reasoning.

“Matt doesn’t want people to be unemployed, but we have to make him trade away unproductive overpaid public employee salaries, to solve for his problem.”

If people like Matt, whom I assume you mean as a proxy for liberals, believe that NGDPLT will force them into this Sophie’s Choice, why would they ever support it in the first place? Wouldn’t they just continually advocate for abandoning NGDPLT? And if we can “force” them to accept NGDPT, why can’t we just force them to accept any other policies we like? It vaguely reminds me of how the gold bugs say that gold can “force” the government to live within its means. If we can force the government to do what we want, why not just force the government do to live within its means in the first place? If we can’t do that, what makes us think we can force the government to abide by any target – gold, NGDP, CPI, or anything else?.

I think you’re misunderstanding liberals. I don’t think they want bigger government as an end, they think of it as a means to the ends they seek, such as lower poverty, more stable economy, etc. And that is the real reason to favor NGDPLT. It is a better way to achieve the goals liberals want. By getting rid of nominal shocks, you dramatically reduce economic instability, and poverty. Obviously, that also reduces the demand for big government. So it’s a classic win/win, making liberals and conservatives happy. And that’s how we should promote it, not as an “us vs. them”.

20. April 2012 at 07:37

Morgan also seems to forget that not everyone who favors profligate government spending does so from the left.

20. April 2012 at 07:49

How much better a principled central banker who would not have let the economy get in a position to crash in the first place – what price Axel Weber? (And he’s not contracted to another central bank at the moment.)

20. April 2012 at 07:55

If the titans of finance deserve the big bucks for efficiently allocating capital, what about the people who actually steer the macroeconomy?

The “titans of finance” earn a hefty share of their keep by understanding central bank policy making. In a world where monetary policy is transparent, effective, and rule-based, passive diversified portfolios are really the best.

20. April 2012 at 08:24

We’re in about a trillion-dollar hole. And that’s a trillion dollars every year. Even if we get “Morning in America: The Sequel” and the economy rapidly reverts to its long-term trend, we’ll forever be $4 trillion poorer than we would have otherwise been.

This passage shows the writer is conflating wealth with riches. We are not $4 trillion “poorer”, as if we have less real wealth, there’s just 4 trillion fewer DOLLARS sloshing around the economy than there otherwise could have been.

Even market monetarists would be compelled to suspect that after 4 years, prices and wages should have adjusted to the new monetary conditions, and that if there was $4 trillion in new money printed, it wouldn’t create any more real wealth, it would just increase prices, and depending on how the inflation enters the economy, it will either add yet another level of malinvestment (if leaving the banking system through credit expansion), or make government even bigger (if the Fed buys treasury debt), or introduce even more moral hazard (if the Fed buys garbage securities).

It would be like believing, in the year 2012, that because the Fed was tight in the early 1930s that if they just printed today what they could have printed back then, that they can somehow erase the loss and increase real productivity to where it would have been had the Great Depression never happened.

Sure, we’re only talking about “only” 4 years ago, but I laugh when I contemplate the shelf life that “level” targeting clearly has. Suppose the Fed just continued to increase the rate of NGDP and not go back up to level, oh I don’t know, until the year 2020. Who in their right mind would say that should the Fed print the $4 trillion then, that they can reverse time, turn back the clock, and change the economy into one where they level targeted all along?

Keynesians and their circular logic flow of income doctrine is one thing, but this market monetarism “let’s change the past and thus the present, by printing money in the present” is downright hilarious.

20. April 2012 at 08:38

Rutgers’ Eugene White, in this paper;

http://www.nber.org/papers/w15573

says that bankers used to have to post bonds of up to 3 years salary, which would be forfeit if their banks failed. Maybe we should think about the incentives a little before we commit to a $ billion for the Central Banker.

20. April 2012 at 09:00

Excellent blogging.

To me, the logic of Market Monetarism is compelling.

The sniveling against it strikes me as peevish, partisan, territorial turfy, or bickering by Theo-Monetarists who want the first function of money to be a store of value–a death-trap for real economic growth (see David Hume).

To paraphrase Ben Franklin, “Who who seeks the security of price stability in exchange for economic prosperity will soon have neither.” In modern economies, I think this is true, and Japan is living proof. We are doing a Japan-lite.

Just to give you a headache: Iraqistan is a $4 trillion undertaking, and Scott Sumner says we just lost $4 trillion in real output due to Fed timidity and dithering.

Oh, well, out $8 trillion.

That is $24,000 for every man, woman and child in the USA. When a typical family of four sits down, $100k has been stripped out of their household in the last 10 years–on top of lost home equity.

Maybe intelligent central planning and supportive central bank is not the worst way to go.

20. April 2012 at 09:04

Negation of Ideology,

Oh I’m pretty sure you’ll see the real left fighting NGDPLT once they diarize their groupthink on the consequences.

I’m 100% sure they will lose.

Over at interfluidity (where I have been taunting Dan Kervick on his Job Guarantee) we’re seeing some of the admittance that Economics is a handmaiden of politics.

He’s thinking about the savers as a political force that stymie his side. The more that everyone keeps coming back to this conclusion, the closer we get to….

ACCEPTANCE is the hardest part to real compromise. There has to feel like there is no other way to get a better deal for the Dems.

After that, NGDPLT is simply honest.

There IS a Sophie’s Choice. Putting the unemployed to work REQUIRES removing Monetary Theory from the political bag of tricks.

To go a little Bart Simpson here:

NGDPLT is a CAP ON GROWTH

NGDPLT is a CAP ON GROWTH

NGDPLT is a CAP ON GROWTH

And the moment you frame it in your head this way, you see the outcomes clearly:

Govt. policy that is not productive sucks up part of the cap.

Main Street which pays attention to borrowing rates will see them go up in DIRECT immediate effect to a perception that govt. is eating up the cap.

Main Street will know that govt. being more productive lowers their rates.

I repeat: the more you cut govt. the more “monetary stimulus” the NGDPLT will reward Main Street with.

Which means every single part of govt. is suddenly the 1993 discussion between Clinton and Greenspan. IF Clinton “invested” in blah blah, then rates were going to go up, if he didn’t Greenspan thought they stay down.

Clinton did the gut check and threw his promises overboard. Obama didn’t. There aren’t enough Obamas in America.

In fact, under NGDPLT Obama never gets to argue for “stimulus,” he’s left arguing literally that we shouldn’t make govt. more productive.

He can’t just point at the meek and say we must help them it since everyone knows it eats up the cap.

He’s pushed into a frame where what he’s doing is cap neutral.

So the bigger a believer he is in HELPING THE POOR the more likely he is to find the savings in public employee pay.

Sure, sure there may be slightly less defense spending, or less farm subsidies, and those are good things… but the REAL fatter calf to get gutted is making govt. productive.

Deflationary effects on Govt. happen until everyone feels like we are getting good value from govt.

20. April 2012 at 09:05

One more rant: Why not have central banker and staff pay keyed to real economic growth? How long do you think the pompous pettifogging and sanctimonious sermonettes about inflation would last?

20. April 2012 at 09:06

Major Freedom:

Okay we disagree about everything—-but would you agree that central bankers and staff should have pay tied to real economic growth?

20. April 2012 at 09:38

Benjamin Cole:

Okay we disagree about everything””-but would you agree that central bankers and staff should have pay tied to real economic growth?

Oh you mean if we’re living in a fantasy land?

OK, assuming we’re living in Fantasia, then I will still ask why should they even get a pay increase based on others producing more? Why should they get a free boost to their income if others produce more goods and services?

Counterfeiting/printing money isn’t a “service” central bankers provide. It’s just a power based mechanism by which they aggrandize themselves and their friends at the expense of everyone else who are forced by law into earning money because they are too weak to fight back.

If you asked me, their pay should be tied to the purchasing power of the toilet paper they print. Their pay decreases when the purchasing power of the toilet paper decreases. If price inflation is 2%, then they get a 2% real pay cut by having no change in their nominal income, and if price inflation is -2%, then they get a 2% real pay boost by having no change in their nominal income.

In other words, there should be an across the board nominal pay freeze.

Of course, since we’re not living in Fantasia, but Earth, where real people live, we’ll see central banker pay tied to productivity as soon as we see Pee-Wee Herman becoming President.

20. April 2012 at 09:52

What Scott doesn’t believe is real:

— inflation

What Scott does believe is real:

— the fantasy DGCPPOT curve, which exists only in the imagination of economists creating fantasy worlds premised on dubious pretend “science”

20. April 2012 at 09:55

“Why not have central banker and staff pay keyed to real economic growth?”

You could, although, as has been proposed for bankers’ bonuses, it would be wise to add some means of clawback to stop central bank governors using the short-term power of monetary policy to boost real activity just before they leave office. And if you did, I dare say that with real growth appropriately standardised for population growth and GDP calculation (especially quality adjustment), the Bundesbank staff would do rather well.

20. April 2012 at 09:55

Thomas, Actually, real rates are also quite low right now.

Thanks D. Gibson.

Nick, Thanks for clarifying that.

JV, Yes, that’s true.

Morgan, It’s not just liberals who are losing, America is losing.

Mike Sproul, You said;

Lest the central bank czars get swelled heads, they might also keep in mind that there are some of us who would fire them all and leave monetary policy to unregulated bankers operating in a free market.”

I’d rather leave it to unregulated NGDP futures traders. Let banker create deposits.

Rebeleconomist, You said;

“How much better a principled central banker who would not have let the economy get in a position to crash in the first place – what price Axel Weber?”

You keep the economy from being in a position to crash by doing level targeting. Does Weber favor level targeting?

Cthorm, Yes, but I’d say that’s only a modest percentage of what they do. Someone has to allocate capital. If not financiers, who?

MF, Yes, he exaggerates a bit.

Patrick. Yes, I did a post on that a couple months back, and endorsed the idea. You could probably find it with search.

Thanks Ben.

20. April 2012 at 09:57

Greg, Care to explain that acronym?

20. April 2012 at 10:01

Slate is a leftwing internet webzine edited by a lefty doofus who has earned her status as a laughing stock of the blogosphere.

The Atlantic is, what? Essentionally a blog hosting service, with it’s “biggest” blogger being a lunatic Palin birther with emotional issues.

Scott wrote:

“mainstream publications like The Atlantic and Slate”

Bury this with the dinosaurs: the idea of a “mainstream” publication in the age of the internet.

The Economist and the Wall Street Journal might still count. What else?

20. April 2012 at 10:05

MF:

“Even market monetarists would be compelled to suspect that after 4 years, prices and wages should have adjusted to the new monetary conditions,”

I’m not compelled to that suspicion. I think about reality and consider all of the things that have been taking place to prevent markets from clearing, among other barriers that are more natural. I actually think that the longer it takes for markets to clear, the more someone who is interested in how an economy actually recalculates would get the clue that adjustment to “the new monetary reality” is a very long and painful process. It’s worth considering what it is actually worth to society to have that process be the new “normal”.

And what exactly is a “malinvestment”? Doesn’t that require a value judgement for the future that can’t be made in the present? One also can’t stop people from doing with their money what they will, no matter how much cash is floating around. It seems like you prefer monetary freedom, until you don’t.

20. April 2012 at 10:08

DPG, It should be tied to how close they are to the NGDP target.

Matt, And monetary bloggers who were right all along should also get a cut.

20. April 2012 at 10:09

Greg, The WSJ has been awful on monetary policy–I’ll have a new post soon.

20. April 2012 at 10:26

Major Freedom-

They have enacted your plan, not in Fantasia, but in Japan.

They have had nominal deflation of 15 percent in last 20 years. Central bankers have gotten a good pay raise, as a result.

The only problem is that industrial production fell by 20 percent, real wages by 15 percent, property prices by 80 percent (and still falling) and equities by 75 percent.

The USA flourished in the same time frame, with moderate inflation.

You gotta go with what works, not monetary theologies.

20. April 2012 at 10:36

Bonnie:

“Even market monetarists would be compelled to suspect that after 4 years, prices and wages should have adjusted to the new monetary conditions,”

I’m not compelled to that suspicion.

Why, because when a person looks for a new job in 2012, they take into account the fact that the Fed didn’t print $1 trillion extra in 2008, and are waiting like eager beavers for it, and until then, are holding out for a wage higher than what employers are currently offering? Joe Blow in Detroit keeps up with NGDP?

I think about reality and consider all of the things that have been taking place to prevent markets from clearing, among other barriers that are more natural. I actually think that the longer it takes for markets to clear, the more someone who is interested in how an economy actually recalculates would get the clue that adjustment to “the new monetary reality” is a very long and painful process.

It is long and painful when it is hampered. What recalculation can take place in a real world economy with a central bank holding fed funds interest rate at zero, inflating M2 at near 10% YoY, a treasury incurring trillion dollar deficits, and spending trillions more, enforcing minimum wage laws, welfare, and failing to enforce basic accounting rules that have turned GAAP into a farce?

In order for market recalculation to take place, there has to be a market.

It’s long and painful when the Fed and Treasury attempt to stop it. The Treasury and Fed tried to stop it after 1929, and the result was the Great Depression. The Treasury and Fed tried to stop it after 2008, and the result is the Great Recession.

Pay no attention to the statist religion nutcases who are so dense that they believe it’s because the Fed and Treasury haven’t printed and spent enough. They would just as soon watch the world burn before they realize they are the ones burning it. Even if unemployment goes to 90% and the economy completely collapses because of their destruction, they’ll say it’s because they didn’t have enough control and there wasn’t enough of the poison they’re recommending. They’re intellectually bankrupt.

It’s worth considering what it is actually worth to society to have that process be the new “normal”.

You mean the new normal of inflation. Well, ask the millions who are unemployed because of it.

And what exactly is a “malinvestment”?

Should you really be engaging here if you need this explained?

Doesn’t that require a value judgement for the future that can’t be made in the present? One also can’t stop people from doing with their money what they will, no matter how much cash is floating around. It seems like you prefer monetary freedom, until you don’t.

Seems like you’d rather attack something you have in your mind, rather than what’s in front of you.

20. April 2012 at 11:15

Benjamin Cole:

They have enacted your plan, not in Fantasia, but in Japan.

They have had nominal deflation of 15 percent in last 20 years. Central bankers have gotten a good pay raise, as a result.

Nominal or real pay increase?

And what nominal deflation are you talking about? They’ve had 20 years of more or less stable prices.

The only problem is that industrial production fell by 20 percent, real wages by 15 percent, property prices by 80 percent (and still falling) and equities by 75 percent.

This is false. You’re not looking at the right data. Adjusted for PPP, real GDP per capita in Japan has steadily increased since at least 1980.

The USA flourished in the same time frame, with moderate inflation.

The US has had stagnant real wages.

You gotta go with what works, not monetary theologies.

OK, then I win.

20. April 2012 at 11:35

Ah yes;

http://www.themoneyillusion.com/?p=12671

I see I didn’t comment, so maybe that’s one post I missed. However, the paper you cite is a different one than I linked to–and also your link goes nowhere, it seems the paper has been removed. Same idea in both papers though.

What the one I linked to is about is the housing bubble of the 1920s and how it had very different results when it burst than the more recent one. What I find very amusing is that an implication is that the cause of the recent crisis is due to the existence of…Glass-Steagall!

Aka, the Banking Act of 1933, which replaced the bonding of managers and the double liability of shareholders with the FDIC. And, White points out that congress should have known better, as several states had experimented with deposit insurance, which experiments performed poorly.

Maybe if Gramm, Leach, Blilely had really repealed Glass-Steagall (rather than the two provisions dealing with affiliations between banks and investment houses which it did repeal) we’d have been spared all this misery.

20. April 2012 at 11:43

It’s a typo …

20. April 2012 at 11:50

Scott, NGDPPOT is make believe entity “plotted” on the graph you’ve posted above.

20. April 2012 at 11:56

Scott

I´m still (eagerly) waiting for my $ 1 billion!

http://www.themoneyillusion.com/?p=7473

20. April 2012 at 11:58

And yes, interest rate targeting can be bad for the economy´s health:

In any case, targeting the FF rate is of doubtful utility when the goal is to keep nominal expenditure on a stable growth path. Why? Because if nominal expenditures has been growing too slowly for some time (or even falling like it did recently), and AD is substantially below its “target path” (like it was in 2003 and even more so at present), having the Fed commit to falling, low or even “zero” short term rates is almost certainly not an appropriate approach.

http://thefaintofheart.wordpress.com/2011/05/01/insisting-on-targeting-the-fed-funds-rate-can-be-bad-for-the-economy%C2%B4s-health/

20. April 2012 at 12:01

@RebelEconomist: If anybody is willing to pay Axel Weber 1 billion of whatever to stay away from any central bank (or for that matter any member of the media, while we’re at it) I will happily contribute what I can. The guy would tank any economy while screaming INFLAAATIOOOON!!!!!

Ok, this may be OT but I really have to ask it: Prof Sumner says using interest rates as a monetary policy tool is flawed due to the ZLB, which is certainly true if one is restricted to short-term rates. However, if you look at longer-term rates (say, LIBOR) which, if I understand correctly, are the marginal cost of funding that banks take into account in their lending decisions, these are significantly higher than zero still today. One- to two year rates are currently at or above 1%, which if you think about (a) the Fed’s “promise” to keep rates at zero in the medium-term and (b) the notion that long-term rates are a market estimate of the future path of short-term rates, means (c) markets are telling the Fed, essentially, “Shut up and deliver the goods” (picture trader extending his middle finger towards Bernanke). Put another way, despite sitting on a trillion of excess reserves, banks are still lending to each other at these rates.

Couldn’t the Fed reduce long-term rates by lending long-term, like the ECB did with their 3-year LTRO ? Wouldn’t the latter be a more effective form of stimulus than QE, had it been extended for more than two quarters ?

Doesn’t compute, please explain. Thanks.

20. April 2012 at 12:50

And what exactly is a “malinvestment”?

yes, someone who says that needs to show me specifically: which houses/factories/oil rigs/etc should not have been built.

@Bonnie to your point it takes a long long time to reset (or devalue) nominal debt contracts. but it finally looks to be happening.

http://www.calculatedriskblog.com/2012/04/homeowner-financial-obligation-ratio.html

20. April 2012 at 12:53

oh, and I think this post could have been easily titled “whats old is whats new again.” many of these ideas i would have considered mainstream conventional wisdom 5 years ago. Sad, but it feels like a grand re-awakening.

20. April 2012 at 13:10

Here’s DeKrugman:

“I mean, what is the un-artificial, or if you prefer, “natural” rate of interest? As it turns out, there is actually a standard definition of the natural rate of interest, coming from Wicksell, and it’s basically defined on a PPE basis (that’s for proof of the pudding is in the eating). Roughly, the natural rate of interest is the rate that would lead to stable inflation at more or less full employment.

And we have low inflation with high unemployment, strongly suggesting that the natural rate of interest is below current levels, and that the key problem is the zero lower bound which keeps us from getting there. Under these circumstances, expansionary Fed policy isn’t some kind of giveway to the banks, it’s just an effort to give the economy what it needs.”

Here’s his mistake:

“Roughly, the natural rate of interest is the rate that would lead to stable inflation at more or less full employment.”

What he think we’re going to do is let the govt. make up and labor policies they like and THEN set “stable” inflation based on “more or less full employment”

That’s not what we’re going to do.

We’re going to set the NGDPLT and then watch the govt. have to keep altering their labor policies until we reach full employment.

If we don’t reach full employment, that a labor policy problem.

—-

WHY ISN’T that the clear line drawn in sand with DeKrugman?

Why aren’t liberals and MMTers just TOLD by conservative econ bloggrs that the Fed will not be used to paper over labor policy favored by “buy votes” Democrats? That govt policy MUST BEND to monetary policy.

Can’t we just keep repeating that?

20. April 2012 at 13:22

dwb:

And what exactly is a “malinvestment”?

yes, someone who says that needs to show me specifically: which houses/factories/oil rigs/etc should not have been built.

They exist in projects that are unprofitable. It’s impossible to say exactly which ones are malinvestments and which are not, because there is only one data set.

20. April 2012 at 13:32

It’s impossible to say exactly which ones are malinvestments and which are not, because there is only one data set.

surely, in this land of 300 MM people and trillions in investment, we could find one example of malinvestment.

Hey i know one: spitznagel made money shorting the Fed. Betting against the fed and benefiting from 20 MM people unemployed certainly counts as malinvestment in my book. Now he doesn’t want it to wise up. I am a firm believer that people vote their pocketbooks. go figure: a hedge fund manager talking his book, imagine that. will wonders never cease.

20. April 2012 at 13:36

I mean, what is the un-artificial, or if you prefer, “natural” rate of interest? As it turns out, there is actually a standard definition of the natural rate of interest, coming from Wicksell, and it’s basically defined on a PPE basis (that’s for proof of the pudding is in the eating). Roughly, the natural rate of interest is the rate that would lead to stable inflation at more or less full employment.

The natural rate of interest is the difference between the nominal demand for output and the nominal demand for input factors. It is derived from the prevailing preference of present goods over future goods.

20. April 2012 at 15:28

[…] are two immediate inspirations for this post (consider it an extension of the previous one): (1) Scott Sumner’s recent post on market monetarism and (2) point 4 in a recent comment on this blog by Greg Ransom. Market […]

20. April 2012 at 22:15

Scott, you know you’re going to be properly famous eventually. I mean, you’re gonna be in the textbooks (and not just as a single footnote in Mankiw’s intermediate text).

21. April 2012 at 02:10

Glenn Stevens is really cheap, we only pay him $1m a year. Of course, he is the highest paid public servant in the country, by quite a lot.

21. April 2012 at 04:11

@Lorenzo

In fact, isn’t he the highest paid central banker in the world?

21. April 2012 at 04:48

Patrick, Yes, I recall White talking about the 1933 change—those are good points.

Greg, So you don’t believe NGDP can be measured?

Marcus, You and me both.

To, No, you should be looking at 2 and 3 year T-note yields, which are currently very low.

dwb, Even worse, which projects should not have been built even if the Fed had allowed NGDP to continue rising at 5% a year.

Saturo, Thanks, BTW I’m also in Bernanke’s textbook.

Lorenzo, Money well spent.

21. April 2012 at 10:44

” Even worse, which projects should not have been built even if the Fed had allowed NGDP to continue rising at 5% a year.”

.. due to monetary policy. of course, include tax subidies i could go on all day. but why spoil a nice summer day.

21. April 2012 at 11:19

Miswrote earlier badly enough in my earlier comment to post a correction:

Trying to popularize the concepts you’ve promoted to get people to understand why nominal rates can be low while real costs of borrowing are high.

Still not perfect, but that’s more what I was trying to say… argh…

21. April 2012 at 15:19

dwb:

“It’s impossible to say exactly which ones are malinvestments and which are not, because there is only one data set.”

surely, in this land of 300 MM people and trillions in investment, we could find one example of malinvestment.

Surely we cannot, because there is no way to discern from a single data set of history two separate categories of what would not have otherwise been started versus what would have been started anyway. We cannot observe the counter-factual world that would have otherwise existed.

If we had the technology where we can run reality experiments, where we can have two identical economies, with the only difference being one has inflation and one that does not have inflation, and we then observe which projects are different, which ones began because of the inflation and then busted, and which ones began without inflation and then busted anyway, and so on, tallying each difference, then we can do it.

But we don’t have that technology. The only thing we have is the single data set of history that has been affected by inflation. We cannot observe anything else.

So no, it’s not the case that “surely” we can identify a single example. We can’t. We can only use logic to know that they exist somewhere, someplace.

Economic science requires some imagination. One cannot only focus on observable data. One MUST include a mental component, a rational component, in one’s analysis.

21. April 2012 at 15:29

ssumner:

dwb, Even worse, which projects should not have been built even if the Fed had allowed NGDP to continue rising at 5% a year.

Whichever projects the consumer did not make profitable due to them not releasing the requisite real resources and labor to complete them, but were nominally profitable anyway solely because of the Fed’s monetary manipulation, and thus gave the illusion of adequate capital being available.

For example, the Fed pulled the fed funds rate down to less than 2% soon after the nasdaq correction. It did this by inflating bank reserves. Those reserves served as the fuel to pull down interest rates of all maturities and types, notably mortgage rates. If consumers saved more in real terms, to make available the requisite complimentary resources and labor to complete the real estate projects, then interest rates would have come down naturally. But because the Fed pulled interest rates down artificially, real estate projects that should not have been started, due to lack of real savings and capital, were started anyway. People who could not have otherwise afforded homes, bought homes with the cheap money.

Regardless of what was happening to NGDP at the time, an unsustainable bubble was forming, and many Austrians, as early as 2002, and all throughout the 2000s up until the collapse, were warning of it.

22. April 2012 at 07:48

Thomas, There are actually two issues. Risk free costs of borrowing are low, even in real terms. But other costs may be high, as lenders have tightened standards sharply.

MF, No, the Fed didn’t cut rates in late 2007 and early 2008, it slowed the rate at which the market was cutting rates.

22. April 2012 at 08:23

@MF,

actually your argument pertains to the relative price of rental properties vs owner occupied housing. People need to live somewhere (the population is increasing exponentially at about 1.5%/yr) – So it is not the case that we did not need the houses. The rental market is doing quite well. And actually, we built more than 1 MM new owner occupied ones in the last 4 years.

It is the case that due to stupid lending standards (not interest rates) the relative price between rentals and owner-occupied was distorted (due to financing costs). The houses that were build are being sucked up, in many cases by the rental market.

22. April 2012 at 09:21

actually your argument pertains to the relative price of rental properties vs owner occupied housing. People need to live somewhere (the population is increasing exponentially at about 1.5%/yr) – So it is not the case that we did not need the houses.

That’s not right, because not everyone who needs a place to live has to live in their own house. There are other forms of residency, such as apartments, and sharing homes with other family members.

It is the case that due to stupid lending standards (not interest rates) the relative price between rentals and owner-occupied was distorted (due to financing costs).

The “stupid” lending standards were encouraged and exacerbated about by artificially low interest rates.

22. April 2012 at 09:56

@MF,

if what you were saying were true we should be in the midst of the biggest housing boom of the century, since mortgage rates are the lowest on record.

please respond by demonstrating your own igorance of the housing market, disregarding empirical data, and/or through repetition of discredited ideas. Please also be sure to contradict yourself and bring up irrelevant points.

22. April 2012 at 11:26

dwb:

if what you were saying were true we should be in the midst of the biggest housing boom of the century, since mortgage rates are the lowest on record.

No, that actually does not follow. The theory that low interest rates was necessary for the housing boom is not an argument of the form “If interest rates are X, then housing is Y.” It’s not a constant relation.

The theory that artificially low interest rates create bubbles is a theory that contains the important provision that we cannot predict which market the boom will be concentrated, if it is going to be concentrated in a specific market at all. It is always different, because not only does technology and resource usage change, but humans change their knowledge and their preferences as well.

The only thing the theory states is that artificially low interest rates generate economic discoordination between investors and consumers. What specific form this discoordination takes isn’t constant over time.

Thus, the currently low interest rates that exist is generating discoordination in as of yet unknown ways. We will see where the malinvestments are by which markets bust in the future.

My guess is that artificially low interest rates are currently generating a sovereign debt bubble, although since the housing market as stabilized, instead of collapsing further, my guess is also that there is also still a residual housing bubble that was never fully corrected.

please respond by demonstrating your own igorance of the housing market, disregarding empirical data, and/or through repetition of discredited ideas. Please also be sure to contradict yourself and bring up irrelevant points.

And be like you? No thanks. I’d rather be right.

22. April 2012 at 12:28

@mf

there have been innumerable experiments with money in the last, say 350 yrs. if you can name 3 out of the ordinary (not metal or paper) examples that were legal tender, ill take you off ignore. it has to has been sactioned by a sovereign (“legal tender”).

22. April 2012 at 12:40

there have been innumerable experiments with money in the last, say 350 yrs.

Experiments? Conducted by who? I just want to use my own money, and I want other individuals to use their own money, and not be subjected to any “system” that is viewed as sacred and inviolable.

if you can name 3 out of the ordinary (not metal or paper) examples that were legal tender, ill take you off ignore. it has to has been sactioned by a sovereign (“legal tender”).

You had me on ignore? Doesn’t look like it from your actions.

I’m not interested in being quizzed by someone who doesn’t understand money, who doesn’t understand the effects of fiat money, and who doesn’t even understand what it is I am arguing.

I am not arguing that I want to force you to use gold, or to force you into any “system”. I am, fundamentally, arguing that I do not consent to, nor do I respect, the religion of state money that you are seeking to convince me, and/or impose on me by way of state power, as if I am to yield to ANY “system” that is not my own, out of some twisted sense of “duty”.