Lessons from Greece

Over the past 4 years, I’ve been questioning the conventional wisdom that Greece’s debts were unpayable. In May 2017, after a sharp decline in Greek bond yields, I did a post at Econlog entitled:

Is the Greek public debt actually “unpayable”?

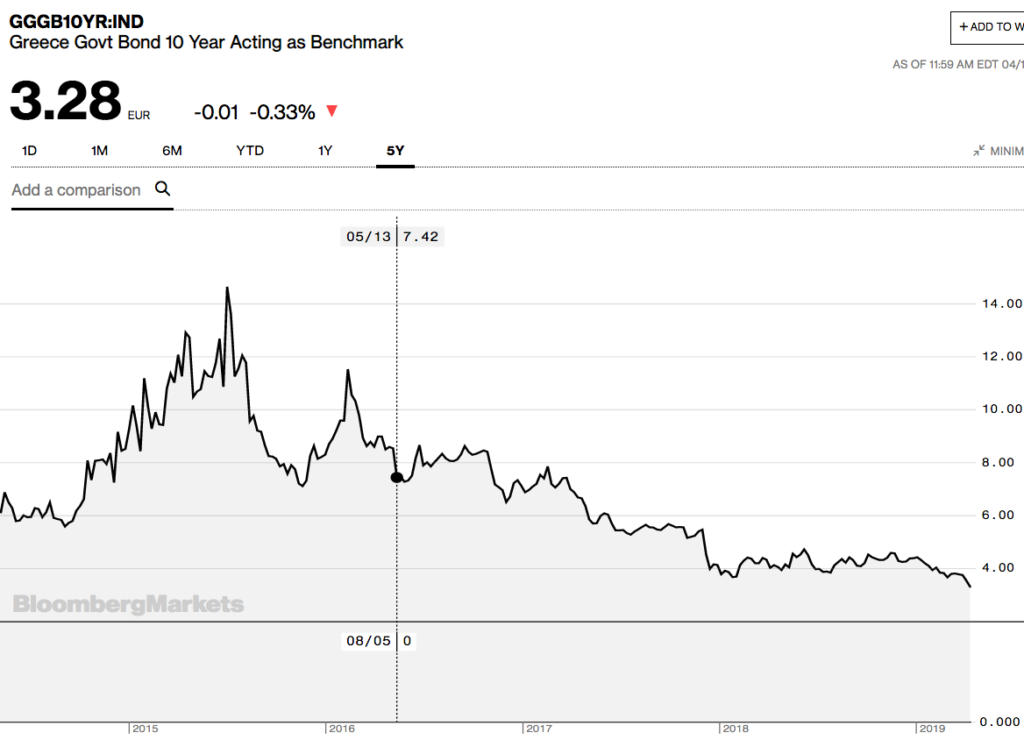

At the time, yields on Greek 10-year bonds had plunged to 7.4%. Today they are down below 3.3%:

Who knows, Greek bond yields might eventually fall below the yield on US Treasury bonds.

My argument was not that Greece was not at some risk of defaulting, rather that their national debt (roughly 180% of GDP) was certainly not “unpayable”. Whether bondholders actually got paid depended on whether the Greek public was willing to service the debt, or (as in 2012) whether they were unwilling to do so. Today it looks like the Greeks have stepped up to the plate and the public debt looks sustainable. Of course if there were another deep recession then things could change fast.

Bloomberg has a new piece pointing to lots of incorrect predictions from back in 2015:

Greece reached its bailout deal with European creditors in the summer of 2015 after some of the smartest people earlier that year predicted default and exit from the European Monetary Union.

Former U.S. Federal Reserve Chairman Alan Greenspan told the British Broadcasting Corp. then that it was “just a matter of time” before Greece abandoned the shared currency and the euro disintegrated. George Soros, the billionaire chairman of Soros Fund Management, said in an interview with Bloomberg Television a month later that “Greece is going down the drain.” Marcel Fratzcher, the Oxford- and Harvard-educated former head of policy analysis at the European Central Bank and president of the German Institute for Economic Research, went so far as to characterize Greece as a “political and economic catastrophe.” Amid predictions that Greece would abandon the euro and revert to the drachma in a desperate ploy to reassert control over its economic future, Fratzcher declared: “A Grexit is and remains the worst option for Greece. It is becoming more and more likely.”

There’s no shame in these false predictions, indeed I was not at all certain what Greece would end up doing. My point here is that it’s dangerous to predict economic crises. If the crisis were fairly certain to occur, it likely would have already happened. You can certainly observe that a given situation is very precarious, just as one might notice that a certain mountain road is susceptible to accidents. But just as it is difficult to predict that a specific auto will crash, it’s hard to predict which countries will default on their debt.

PS. Technically those predictions cited by Bloomberg were about leaving the euro. But a Grexit would have made default on Greek euro-denominated public debt virtually 100% certain. Indeed, claims that the Greek debt was unpayable continued long after 2015.

Tags:

15. April 2019 at 16:08

Remarkable: amazing what can happen under sustained pressure. Of course, Greece had a lot of bad policy to ditch.

The stability of the euro is clearly still very attractive, given that most people probably don’t connect the euro itself with the very high economic costs that its implementation (eventually) led to.

15. April 2019 at 22:18

Draghi deserves a lot of credit. It seems fashionable now to criticize the ECB’s QE and negative interest rates. However, Eurozone NGDP has gone up 2.5% a year since 2015. Greece would have certainly left with Trichet heading the ECB.

16. April 2019 at 02:23

Greece might have an easier time paying back debt if its GDP had not been shrunk by 25% in the Great Recession, never to recover.

https://fred.stlouisfed.org/series/CLVMNACSCAB1GQEL

One might also posit that Greece is an example that austerity and tight-money are not the prescription for economic growth, given certain structural impediments and institutional realities,

16. April 2019 at 03:05

The 25% decrease in GDP is really stark. But I don’t know how much of extra 2007 Greek GDP was really “production.” If Greece simply borrowed 1 million Euros and then paid a 1 million corrupt “consulting fee,” GDP would count that in the G component.

16. April 2019 at 09:12

The guy’s name is Fratzscher. And most of these examples by Bloomberg (if not all) are pretty bad, because what these guys said and did was not about predicting at all.

It was about painting a certain gloomy picture in order to achieve certain actions, goals and ideologies. In the case of Fratzscher Stone Age Keynesianism for example, and the communitization of all European debt. And I bet they were pretty successful with that.

16. April 2019 at 19:51

Benjamin, however the Greek experience doesn’t invalidate austerity. Merely tight money AND austerity (and perhaps Greek institutions..).

The market monetarists can tell you that adequate money (enough to keep nGDP on target trajectory) makes all the difference. Austerity or not is a supply side question. And so will have an impact on real growth, but not on whether they can pay nominal debts.

Given the weakness and inefficiency of the Greek public sector, austerity would have likely been the right way to go. Even relatively efficient America (relative to Greece at least) did well out of their austerity in early 2013.

18. April 2019 at 10:43

Didn’t Greece receive around three bailout packages with about 250 billions euros of tax payer money from other countries? And in the end, basically a guarantee that other EU countries will pay any bill, no matter the cost?

And wasn’t the repayment of debt partially suspended, deferred, or extended to infinity, with virtually zero interest?

All this makes complete defaulting and the prediction of it a bit hard, doesn’t it?