Keynesianism explained?

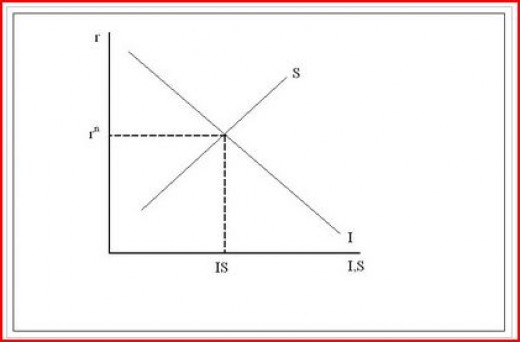

My previous post certainly led to some odd assertions about the relationship between saving and investment, so let me try again. The crux of the problem seems to be confusion over the so-called “paradox of thrift,” which is what happens when an attempt by the public to save more leads to no increase in saving, but rather a fall in income. Let’s try to explain that paradox with the traditional S & I diagram:

I don’t know how to draw graphs, so I “borrowed” this one from Bill Woolsey. You need to imagine what happens if the public wants to save more at each and every interest rate, perhaps because of more immigration from Asia.

Imagine the saving schedule shifting 1/4 inch to the right. Notice that interest rates fall and investment increases. However that may or may not be all that happens. Now let’s assume a monetary regime where lower interest rates lead to lower NGDP. One such regime is the gold standard, as Larry Summers of all people showed (with Robert Barsky.) I published a modest addition to that literature. You can view that as a fall in gold “velocity,” or equivalently a rise in the real demand for gold. Another such regime is interest rate pegging, where a shift right in the saving schedule forces the central bank to reduce M in order to keep rates from falling. Either way NGDP falls.

If prices are flexible that’s no big deal, the diagram above still shows the new equilibrium for real saving and real investment. But wages and prices aren’t flexible, they are sticky. So an increase in the saving schedule is a very big deal. It causes lower NGDP, which leads to lower RGDP and lots of unemployment. At least that’s what the Keynesians believe.

How do we show this on the diagram? The recession leads to a big drop in desired investment, because investment is a highly cyclical sector of the economy. The intuition is simple–you are far more likely to expand plant and equipment when the economy is booming, than when the economy is depressed. So let’s assume that the expectations of low NGDP and RGDP cause the investment schedule to shift left by 1/2 inch. Notice that interest rates fall still further. Also notice that the equilibrium of S and I is actually lower on the quantity axis, despite the increase in the S schedule. Why do I assume this result? Because during recessions investment usually falls along with interest rates, even as a share of GDP. Investment is very procyclical.

So that’s how I see the basic Keynesian model. Why did this model become much less popular after 1980? Partly because of a change in monetary regime. The Fed no longer pegged the price of gold or the interest rate, but rather the rate of inflation. Now an increase in the desire to save would not reduce NGDP (and hence inflation) because the Fed would offset any incipient fall in inflation with a more expansionary monetary policy. You might wonder if they could do so in time. But just the expectation that inflation would be targeted over the long run tended to anchor inflation expectations, and that kept NGDP growth pretty stable (until 2008.) A world of stable NGDP growth is a classical world, where saving is again a virtue and fiscal policy should promote efficiency, not stabilization.

Those who read this blog know that there is a dispute about which model best describes our current situation; which best describes current monetary policy. But I’ve already gone on too long, so let’s leave that debate for the comment section.

PS. I just read Nick Rowe’s new post, where he complains that saving is very misleading and should be eliminated from this discussion. I tend to agree, at least for business cycle analysis. (I think it’s fine to talk about saving in a classical context.) Instead of talking about people saving more, talk about the real problem, which is a greater demand for cash balances (i.e. money hoarding.) Or perhaps a fall in the supply of money that occurs as an interest rate pegging central bank responds to a rightward shift in the saving schedule. Talk about M and V, not S and I and T and G. M and V allow you to model changes in NGDP, or aggregate demand. The Keynesian entities would allow that too, if you knew the central bank reaction function. But you don’t and hence they are useless.

Tags:

11. January 2012 at 20:11

Here’s how Krugman handled it in 2009: http://krugman.blogs.nytimes.com/2009/07/07/the-paradox-of-thrift-for-real/

He has S an I as upward sloping curves, directly related to GDP. So, assume a fall in GDP, and you simply shift S up along an upward sloping investment curve.

Alternatively, assume a fall in MV, and you also have less S and I as all savings in an economic *system* is exhausted absent a decline in MV.

The Keynesians get to the paradox of thrift via the zero lower bound and a negative Wicksellian real rate. GDP/income must fall to equilibrate desired savings and intended investment.

11. January 2012 at 23:42

There’s nothing here that makes I = S an identity. It’s this S I think Nick is complaining about. I = S is only an identity through definition to make national accounts balance.

Your I-S chart treats I and S as having a simple intuitive relationship. This would seem to be more defensible if S were savings, which is not the same thing.

What people want is savings, not saving. ROI on saving is undefined.

12. January 2012 at 01:26

Peter N: “There’s nothing here that makes I = S an identity.”

That’s an understatement. If I=S was an identity, there wouldn’t be two curves intersecting in a single point, there would be just one curve.

But if Scott can define saving as the resources put into investment projects then I suppose he can define an identity as an equation which holds for just one value of the variables. It’s the Humpty-Dumpty theory of meaning: words mean what I say they mean.

12. January 2012 at 05:04

1 – Probably, we should technically say that when savings (the curve) increases, the quantity of investment increases, but investment (the curve) does not change.

2 – Can you help me understand how hoarding fits into this? I reduce my consumption at every interest rate, so “savings” (Y-C) but that S curve really oughtn’t budge an inch. That or we need two assets, one that pays an interest rate i* determined by S and I and one that pays an interest rate 0 [or negative inflation] and is of infinite supply.

12. January 2012 at 05:29

Tommy, Actually the Keynesians don’t need the zero lower bound to get the paradox of thrift, just a non-responsive central bank, as I showed here. But Krugman’s post does point out something I missed, the lower income will also shift the saving schedule back to the left.

Peter, I think you don’t understand what Nick and I are trying to say. People get confused because their concept of saving (putting away some money) doesn’t always correspond to a change in national saving. Thus if I buy a stock from you, I save more and you save less. National saving is unchanged. National saving only changes when investment changes.

Kevin. So all the economics textbooks are wrong and you are right? I think you have a Nobel Prize coming. Consider this analogy. I claim that buyer gross expenditure equals seller gross revenue. Because they are two sides of the same transaction. I also claim that the desired expenditure is a downward sloping function of price, and desired sales are an upward sloping function of price. That’s basically what’s going on with S & I.

You said;

“But if Scott can define saving as the resources put into investment projects”

Yes and I define GDP as total final sales, and I define gross investment as new construction of capital goods, and I define the monetary base as cash plus reserves, and guess what, so does everyone else.

Derrill, Hoarding raises the issue of whether cash should be viewed as a capital good (like gold), or a government liability (like T-bills)

12. January 2012 at 06:03

I thought I was being reasonably clear. Saving is a poor choice of language. Its barbaric turning of a participle into a noun suits it. Saving is whatever its defined to be.

Savings are what people actually save. We call them savings banks not saving banks.

12. January 2012 at 06:03

Scott: “So all the economics textbooks are wrong and you are right?”

Krugman isn’t kidding is he? This pulling-rank thing seems to be part of the Chicago training. Find one textbook that agrees with you. Just one.

“That’s basically what’s going on with S & I.”

No, it isn’t. There’s a reason why you see equations like I=I(r,Y) and C=C(Y, M/P) in textbooks. The variables on the left are being defined as functions of the variables on the right.

Trust me on this. Samuelson, Tobin, Friedman, Krugman and a host of others agree with me.

“Peter, I think you don’t understand what Nick and I are trying to say.”

Have you considered the possibility that you are expressing yourself very badly? That’s just you BTW — Nick is doing fine. He’s got it right.

12. January 2012 at 06:45

You can certainly define saving any way you like, and your way agrees with how the US does its accounts.

However this does not prove that it is a useful concept in economics. You treat a lot of ideas as revealed truth.

There is a single stable equilibrium.

It’s reasonable to aggregate demand and capital, which requires a number of unreasonable assumptions like homothetic preferences.

These are theories or postulates. They can’t be proved and were disproved years ago. Many economists say the equivalent of “it works in practice, just not in theory, and by the way we can’t really prove it works in practice, but it makes the math tractable.”

And yes, I’m aware of the attempt to use game theory to salvage the situation.

12. January 2012 at 06:55

You wrote: “But just the expectation that inflation would be targeted over the long run tended to anchor inflation expectations, and that kept NGDP growth pretty stable (until 2008.)”

My question: Why did this mechanism break down in 2008? Could a permanent decline in households permanent income expectations (via a structural shock)have led them to reduce their demand for cash-on-hand? Or more broadly put, could the NGDP target have fallen in the last recession?

12. January 2012 at 07:09

Kevin you said “Scott: “So all the economics textbooks are wrong and you are right?”

Krugman isn’t kidding is he? This pulling-rank thing seems to be part of the Chicago training. Find one textbook that agrees with you. Just one.”

In answer to your challenge, I submit Macroeconomics by Krugman and Wells: “The savings-investment spending identity if a fact of accounting. By definition, savings equals investment spending for the economy as a whole.”

And is there anyone less self-aware than Paul when he talks about economists pulling rank or epistemic closure among freshwater economists?

I guess you can disagree with S=I, but don’t pretend like it’s something Scott just invented of the top of his head.

12. January 2012 at 07:53

Mike, I won’t go back over the weary trail which brought us to this. I hold (as does every textbook I’ve ever seen) that realized saving = realized investment. Yes, that’s an accounting identity. I(x)=S(z) where x and z represent whatever vectors of variables determine planned I and S, is not an accounting identity.

12. January 2012 at 12:22

Peter, I always thought saving was a verb and savings was a noun.

Kevin, No reason to act insulting. You said:

“Find one textbook that agrees with you. Just one.”

I teach out of Mankiw, who calls S=I an “identity” on page 273 of Principles of Macroeconomics, 3rd edition. I’m sure there are many others.

Peter, You said;

“You treat a lot of ideas as revealed truth.”

Not S+I, I treat that like the definition it is.

I agree that you can write down investment functions, which depend on variables like the interest rate. I am talking about the quantiy saved, and quantity invested, with are identical.

anon, The problem was the opposite, demand for cash increased in late 2008, especially if you count ERs as “cash.”

Thanks Mike.

Kevin, Mike just provided an exact quotation that shows you are wrong, time to admit it perhaps? BTW, I have been talking about realized investment throughout all my recent posts, unless I specifically refer to an investment or saving “schedule.” Obviously schedules just intersect at one point.

12. January 2012 at 12:24

Derill:

If you decide to purchase less bonds and hold more money, then the “S” curve doesn’t shift.

If, on the other hand, you choose to consume less out of current income and hold more money, it shifts to the right.

Now, if you had instead chose to consume less out of current income and purchased bonds, this would tend to raise bond prices and lower the market interest rate.

The fact that saving by holding more money does not directly result in some process that brings down the market interest rate is a problem. The curve shifts to the right and crosses the investment curve at a lower interest rate and a higher amount saved and amount invested. But, there is no obvious market process by which the interest rate on the market falls. If it doesn falls and remains at the initial level, then saving is greater than investment. If we start with total spending on output and the full employment level, there is less spending. Less consumption and no more investment. If bonds had been purchased, then the market interest rate would fall, which would result in more consumption (other people saving a bit less) and more investment (firms buying more capital goods. Total spending is unchanged.

If you save by accumulating money, and someone, say banks, create new money and lend it out, and do that in a quantity that matches the added money you choose to hold, then their additional lending would tend to lower the market interest rate–exactly as if you had purchased bonds.

The market monetarist position would be that this is exactly what should happen. The quantity of money should rise to match the increase in the demand to hold money leaving total spending in equilibrium.

12. January 2012 at 14:59

“Obviously schedules just intersect at one point.”

Fine. We agree.

12. January 2012 at 15:19

Actually, I should clarify that: if two schedules intersect at just one point, then we are not entitled to describe that intersection as an identity. If I=S is an identity then I>S and I<S are both logically impossible. Disequilibrium is not logically impossible. (I presume Mankiw is referring to accounting, not economics, on the page you mention.)

If you disagree with that then we don't really agree, but maybe best to let it go. All the best.

12. January 2012 at 15:28

Bill:

“f you save by accumulating money, and someone, say banks, create new money and lend it out, and do that in a quantity that matches the added money you choose to hold, then their additional lending would tend to lower the market interest rate-exactly as if you had purchased bonds.”

Banks creation of money is certainly important to the whole picture, but I can’t see why it should exactly offset the money I choose to hold.

In the good old days when banks made money from lending deposits and the Fed set a multiplier that actually had teeth, you can make a reasonable case for this. However banks now make money in other ways, and deposits aren’t as important. Also the Fed no longer has a direct restraint on bank money creation through a deposit multiplier. Banks can lend up to the point their VAR equals the allowed level as determined still by Basel 2 (I believe we’ve delayed going to 2.5).

Since anything not on their balance sheets has 0 VAR the banks have a strong incentive to securitize their lending, so that they can do more. And, since AAA assets are accounted as riskless, they have an incentive to turn trash into gold by financial engineering and rating agency blessing of the results (and we know who pays the rating agencies).

So real investment can exceed savings, since it includes money created by lending. Consumer spending also includes borrowing. The S = I approach is defined to be correct accounting, but it obscures the most interesting part of the process – creation of money.

Of course, the Fed’s aggregates are antique, but maybe the new Divisia ones will give us some insight into money that was formerly invisible.

Try a FRED plot of GDP – year over year change in consumer debt. The result is surprising.

13. January 2012 at 06:21

Kevin, This all started with my critique of Wren-Lewis, who was talking about actual quantities, not schedules. If you were thinking in terms of schedules, then we agree.

13. January 2012 at 08:27

Scott, That’s a relief. However I think you’re misreading Wren-Lewis. He wrote: “If you spend X at time t to build a bridge, aggregate demand increases by X at time t.” Surely aggregate demand has to be a schedule?

Having said that though, I don’t think I agree with him either; he says that Lucas and Cochrane are making the same mistake, but actually they are discussing different measures: bridge building (Lucas) and cash transfers (Cochrane). Perhaps the upshot is the same but I’m not convinced. Nobody knows for sure what either of them were trying to say, so it’s a stretch to claim that they made the same mistake.

14. January 2012 at 07:48

Kevin, I think Cochrane divided the normal deficit financed fiscal stimulus into two parts, deficits, which Ricardian equivalence takes care of, and a balanced budget stimulus, which he suggested is unlikely to work.